Custom Insurance Software Development: Streamlining Processes for Faster Deployment

Custom insurance software development offers insurers the opportunity to transform their operations with tailored solutions.

By leveraging advanced technologies and customized functionality, insurers can streamline processes, improve customer experience, and accelerate deployment.

But how can insurers do this without breaking the bank?

The answer is modern development platforms like Openkoda. It’s a way to achieve cost-effective custom development while maintaining full flexibility and control over the end product.

Contents

- Importance of Modern Software Solutions for Insurance Companies and Insurtechs

- Classic Custom Insurance Development Process

- An Alternative Approach: Leveraging Openkoda for Quicker Development and Deployment

- Key Types Of Custom Insurance Software Solutions

- Why Going Custom is Worth It: Key Benefits of Custom Insurance Software Solutions to Companies

- Cost of Custom Insurance Software

- How to Choose the Right Insurance Software Development Company

- Final Word

Importance of Modern Software Solutions for Insurance Companies and Insurtechs

The insurance industry is under pressure to adapt to changing regulations, rising customer expectations, and a constant demand for efficiency.

The answer?

High-quality software solutions. These modern systems are essential for driving innovation, managing risk, and delivering personalized, streamlined customer experiences.

What is the role of software in insurance?

Software has become a key driver of value in the insurance industry, revolutionizing how companies operate, engage with customers, and manage data.

For insurers, software solutions simplify traditionally complex and highly regulated processes such as underwriting, claims processing, risk assessment, and customer service.

By automating routine tasks, software improves accuracy, reduces human error, and frees up employees to focus on strategic activities that require human insight.

Moreover, advanced software integrates technologies like insurance artificial intelligence, machine learning, and predictive analytics. These tools enable insurers to analyze vast amounts of data, gaining a deeper understanding of customer behavior, preferences, and risk profiles.

Such data-driven insights pave the way for more personalized offerings, optimized pricing models, and effective fraud detection—boosting profitability while strengthening customer relationships.

Ultimately, robust software solutions act as the engine powering smarter, more adaptable, and responsive insurance operations.

What software should an insurance company need?

Insurance companies require a range of software tools to address their diverse operational and strategic needs.

At a foundational level, a core insurance management system is essential, covering customer relationship management (CRM), policy administration, claims management, and billing. These core systems serve as the backbone for managing day-to-day processes, maintaining accurate records, and ensuring regulatory compliance.

There are essential systems that are foundational across the industry.

Claims management software, for example, is crucial to handling claims efficiently, ensuring that customers receive prompt service and minimizing potential errors or delays.

A policy administration system helps insurers manage the entire policy lifecycle, from quote issuance to renewal, allowing for seamless operations and effective tracking of customer journeys.

However, the types of systems depend on the type of company niche it operates within.

For example, a large, established insurance company may need an advanced enterprise resource planning (ERP) system to manage its extensive operations with a large suite of supporting apps, while a smaller insurtech startup might focus only on implementing a scalable cloud-based claims management solution.

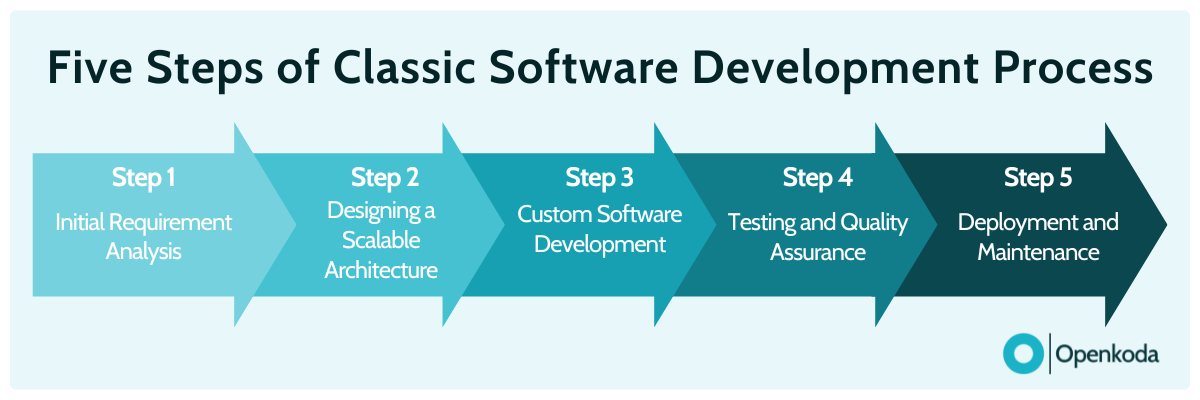

Classic Custom Insurance Development Process

So you’ve decided to take advantage of professional insurance software development services.

What can you look forward to?

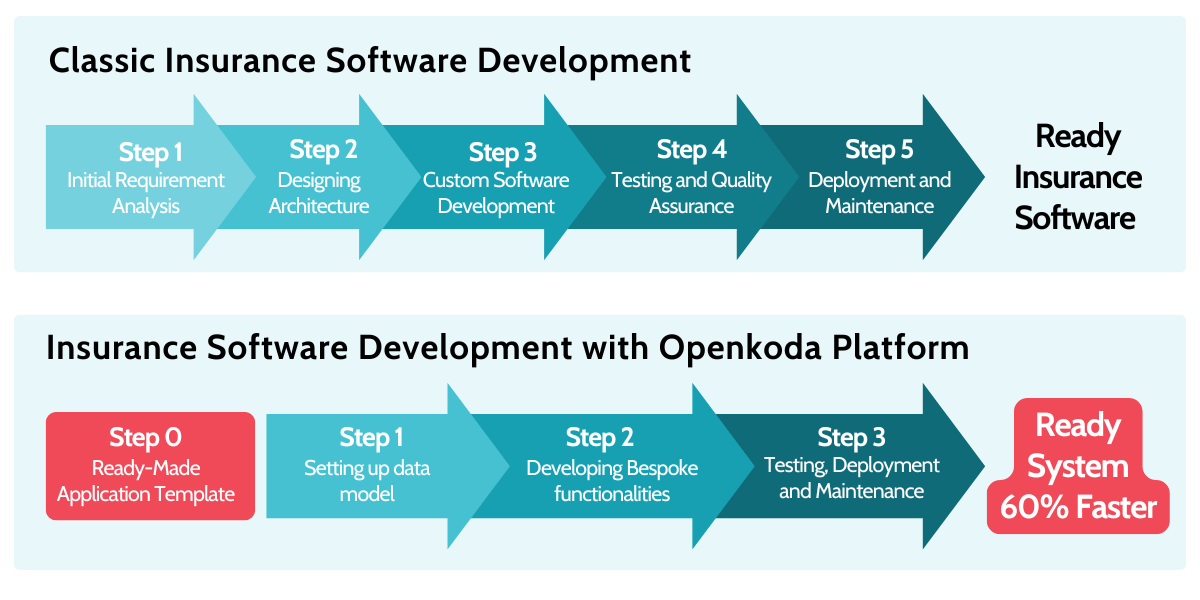

Let’s divide the entire process of insurance software development into five key phases.

Step #1: Initial Requirement Analysis

The first step is to gather detailed information about your needs as an insurer.

In this phase, you and your stakeholders—such as business leaders, IT teams, and end-users—work together to define the project’s scope, identify core functionalities, and prioritize features.

To clarify your objectives, ask yourself:

- What are our main pain points in current processes that we want to solve?

- What do we envision as the primary function of this software—improving policy management, automating claims, enhancing customer experience, or all of the above?

- What regulatory requirements must we account for from the start?

- How will the software need to adapt in the future as we expand or diversify our offerings?

This analysis is crucial in ensuring that the software addresses the unique challenges and opportunities of the company, from regulatory compliance to customer-specific demands.

Step #2: Designing a Scalable Architecture

Your insurance software needs to adapt to changing market demands, regulatory updates, and technological advancements.

Choosing the right tech stack, data handling methods, and service structure is critical, as these decisions will impact your system’s longevity and maintainability.

Building the solution involves selecting the best tech stack, defining data models, and creating a flexible framework that can scale with your business.

This is where approaches like microservices architecture, multitenancy and RESTful APIs can make a real difference, allowing individual components to evolve independently.

Step #3: Custom Software Development

Then comes the brunt of project development itself.

Developing core functionality in a modular, insurance-specific system is both time-consuming and technically complex.

Unlike out-of-the-box solutions, custom software development involves writing and testing each module independently, while ensuring seamless interaction between components.

For example, modules for underwriting, policy issuance, and claims automation must be self-sufficient yet interoperable.

The key to success is working in short development cycles and using agile methodology to keep track of project progress.

Step #4: Testing and Quality Assurance

Testing is a crucial and time-intensive phase in developing your insurance software, going beyond standard quality assurance.

At this stage, you’ll conduct thorough functional, performance, and compliance testing to ensure every module is accurate, resilient, and reliable in real-world conditions.

Because insurance data is highly sensitive and subject to strict regulations, testing must cover a wide range of scenarios to confirm how the system handles edge cases and safeguards against data breaches.

Step #5: Deployment and Maintenance

At last, there’s software deployment.

It is usually a gradual and ongoing process. A careful deployment plan is essential to ensure minimal disruption, especially when integrating with legacy systems or external platforms.

Even with CI/CD pipelines to expedite updates, each deployment step involves precise coordination, thorough verification, and real-time monitoring.

An Alternative Approach: Leveraging Openkoda for Quicker Development and Deployment

So that’s, in a nutshell, how a classic custom insurance software development works.

Unfortunately, this approach can be both time-consuming and expensive.

Openkoda offers a powerful alternative for insurers seeking a more efficient way to develop and deploy custom insurance solutions.

With its flexible and scalable framework, Openkoda 2.0 allows insurers to build custom applications faster without sacrificing quality or functionality.

By leveraging pre-built modules and components, it minimizes the need for extensive coding from scratch, significantly accelerating the entire development process.

Openkoda can reduce the time and costs of insurance software development by up to 60%.

How does it achieve this?

The key lies in eliminating the need to start from scratch when building custom insurance solutions. Openkoda offers insurers a ready-to-use foundation that can be tailored to meet their specific business needs.

Let’s say you want to build custom claims management software.

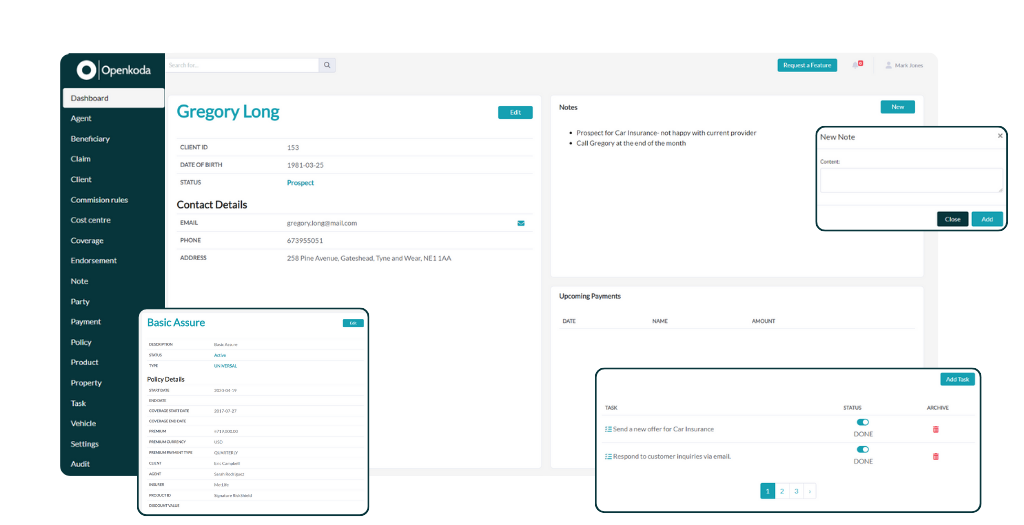

With Openkoda, you gain access to a claims management software template that includes all the essential functionalities such systems require, such as role-based privileges, authentication, dashboards, automation, an admin panel, and much more.

These foundational features typically take significant time and effort to develop from scratch, but with the Openkoda platform, they’re already pre-built for you.

You can use this robust foundation to easily extend, integrate, and customize your application, transforming it into your own unique insurance solution without limitations and vendor lock-in.

This allows you to focus on the features that provide the most value to your organization.

Additionally, you won’t need to deal with proprietary technologies or programming languages.

The Openkoda platform is built on a widely-used open-source technology stack, making it accessible to any developer familiar with Java-based programming.

Openkoda aims to modernize legacy insurance systems by providing a scalable and extendable framework upon which insurers can build their brand-new tailored software architecture for maximized efficiency.

Sounds interesting?

Key Types Of Custom Insurance Software Solutions

To better understand the scope of insurance software development services, let’s explore the key systems an insurance business might want to develop.

We’ll also look at the foundation Openkoda provides for each of them.

Claims Management Software

Claims management software is a critical component of the insurance ecosystem.

It enables insurers to handle claims efficiently, from initial notification to settlement. The software automates the claims process, ensuring accurate data collection, timely communication and proper assessment of claims.

This reduces administrative burden and helps minimize errors, ultimately leading to faster resolution times and improved customer satisfaction.

For the vast majority of insurance companies, efficient claims management is critical because it has a direct impact on the customer experience and operational costs.

An insurance company that operates in unique niches, such as insuring rare collectibles (e.g., vintage cars or fine art), may opt for custom claims management software to handle highly specialized workflows, such as detailed appraisal integrations or niche-specific risk assessments, that are not supported by generic solutions.

Check out this demo to see how you can build your own claims management system in a matter of minutes leveraging ready-made functionalities and insurance-specific data model.

Ready-made features in Openkoda Platform

- Customizable Dashboards

- Configurable Claims submission forms,

- Document Generator,

- External and Internal automatic notifications,

- Automatic Payment Reminders,

- Events Automatization.

What you might want to add

- Personalized recommendation system for claims resolution,

- Automatic claim assessment,

- Rest API integrations with any automated claim assessment tools (AI), and Image/Video Recognition tools

Insurance Policy Management Software

Insurance policy management software is a type of document management software designed to manage the entire lifecycle of an insurance policy, from quoting to renewal and cancellation.

Compared to claims management software, which focuses on efficiently handling claims from initiation to resolution, insurance policy management software is designed to manage the entire lifecycle of an insurance policy and is a much more comprehensive solution when it comes to handling insurance processes.

This software centralizes policy information and provides insurers with a single view of customer data, policy status, and related documentation.

Ready-made features in Openkoda Platform

- Policy Lifecycle Support,

- Customizable premium calculations,

- Customizable Policy Dashboards,

- Automatization for renewals,

- Multiple Insurance Organizations Support,

- Customizable User Permissions,

- Payment reminders,

- Custom Notifications,

- Automated document generation,

- Reporting AI for easy access to busines insights.

What you might want to add

- Easy integrations with Insurers,

- Personal recommentaion for quoting/cross selling

[Learn how to build custom policy management application in 5 minutes using Openkoda]

Custom Embedded Insurance Software

Custom embedded insurance software integrates insurance products into third-party platforms, creating a more seamless experience for consumers.

Judging by recent examples, embedded insurance is a hot trend in the industry today because it allows insurers to be present at the point of sale, making coverage options readily available when customers need them most.

The idea behind embedded insurance is to remove friction and create a more convenient, integrated customer journey. By embedding insurance offerings directly into other services – such as e-commerce platforms or travel booking sites – insurers can reach customers at the point of need.

This type of software requires flexibility and strong API integration capabilities to connect with multiple partners.

For insurers, embedded insurance opens new distribution channels, increases customer convenience, and drives higher conversion rates by meeting customers where they are on their digital journey.

Openkoda can significantly speed up the deployment of embedded insurance solutions. To see how take a look at this demo in which we create and set up easy embeddable forms for car insurance company.

Ready-made features in Openkoda Platform

- Customizable and easily embeddable forms,

- White label customization,

- Policy Management Tools for managing policy and sales,

- Easy integration with payment solutions,

- Easy integration with e-commerce.

What you might want to add

- AI-enabled insurance personalization functionalities

Custom Underwriting Software

Custom underwriting software uses data analytics, AI, and machine learning to assess risk and make informed underwriting decisions.

By automating parts of the underwriting process, this software can improve accuracy, reduce manual tasks, and ensure consistency in risk assessments.

Insurers benefit from faster underwriting decisions, better risk management, and reduced processing times.

In an industry where accurate risk assessment is fundamental, custom underwriting software enables insurance companies to improve their pricing models and more effectively mitigate potential losses.

Ready-made features in Openkoda Platform

- Login portal,

- Underwriting Dashboards,

- Reporting AI,

- Role-based security,

- Multitenant software architecture,

- Open source technology.

What you might want to add

- AI-Powered Risk Profiling and Scoring

- Behavioral Analytics Integration

- Custom Insurance Automations

- Digital Twin Simulations

- Predictive Portfolio Optimization

Custom Insurance CRM Software

Customer relationship management (CRM) software is essential to building and maintaining strong relationships with policyholders.

Custom insurance CRM systems are tailored to the specific needs of insurers, allowing them to manage customer interactions, improve insurance operations, track leads, and personalize communications.

A well-designed CRM system helps insurers understand customer preferences, anticipate their needs, and deliver targeted marketing campaigns.

Effective CRM systems are critical to fostering customer loyalty, improving service quality, and driving business growth by providing actionable insights into customer behavior.

Ready-made features in Openkoda Platform

- Role-Based Security Model,

- Reporting AI,

- Multi-organization support,

- Data visualization functionalities,

- In-App Notifications,

- Personalized Customer Portals,

- Data-driven PDF, Word and Excel Document Generation,

- Multitenant database architecture for better scalability,

- Custom Integrations using REST API.

What you might want to add

- AI-Driven Lead Scoring and Routing,

- Multi-Channel Customer Interaction Hub,

- IoT-Driven Insights,

- Gamified Customer Engagement,

- Predictive Customer Retention Tools.

[Read also: 5 Practical Examples of AI in Embedded Insurance]

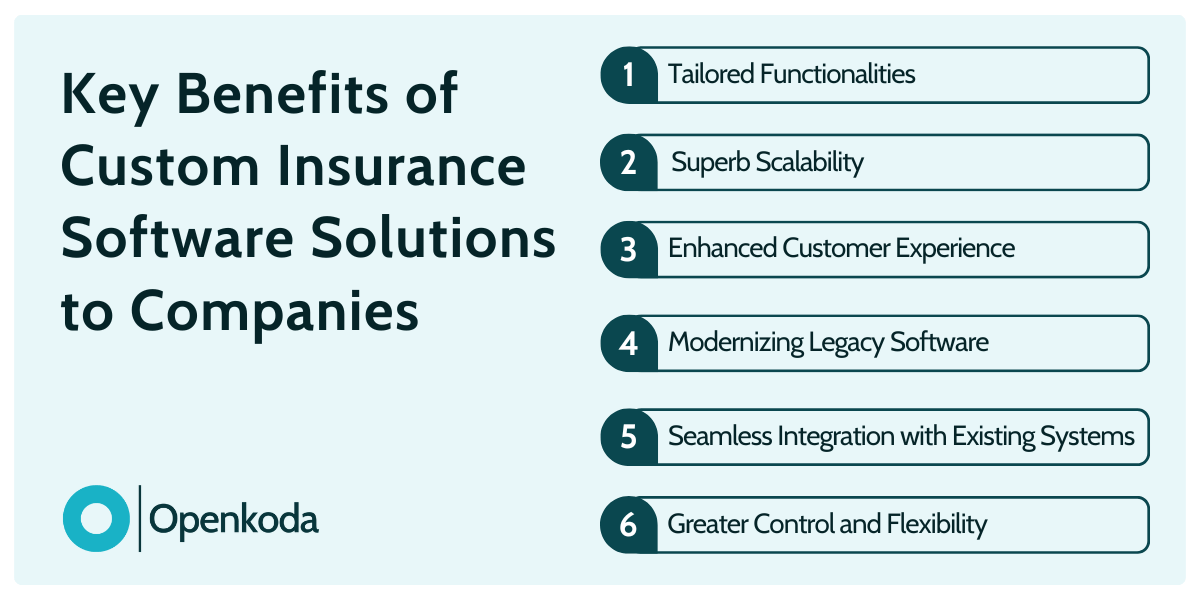

Why Going Custom is Worth It: Key Benefits of Custom Insurance Software Solutions to Companies

In the fast-changing and digitalizing insurance industry, one-size-fits-all solutions often fall short.

Custom software gives your business a competitive edge by tailoring systems to your unique needs.

Here are the key benefits of choosing custom insurance software solutions:

Tailored Functionalities

Custom software lets insurers design features and functionalities tailored to their unique business challenges.

Unlike off-the-shelf solutions, custom systems can be precisely aligned with your company’s specific requirements, leading to more efficient operations and a higher return on investment. Custom insurance software is unfortunately very costly to develop and takes a lot of time and effort.

But there’s another option—a middle ground.

The Openkoda insurance software development platform gives you the best of both worlds. It combines the cost efficiency of ready-made systems with the customizability and code ownership of fully bespoke solutions.

Superb Scalability

As insurance companies grow, so do their software needs.

Custom software solutions are built for scalability, enabling your system to expand with your business without major rework or the limitations of legacy systems.

This means you can easily add new features, integrate with additional systems, or manage larger data volumes as your needs evolve.

Enhanced Customer Experience

Custom solutions empower insurers to deliver seamless and personalized customer journeys.

With systems like claims management software, customer portals, and policy management tools, you can leverage your data to the fullest, reduce response times, and offer tailored products that meet each customer’s unique needs.

Modernizing Legacy Software

Custom insurance software development modernizes legacy systems in the insurance industry by addressing specific business needs, enabling seamless integration with modern technologies, and enhancing scalability and adaptability.

Openkoda goes a step further by offering an open-source enterprise platform that accelerates the development of modern insurance applications, empowering companies to update their legacy systems with greater efficiency.

With Openkoda, insurance companies can streamline the launch of new insurance products and distribution channels, ensuring a smooth transition from outdated systems to cutting-edge solutions.

Seamless Integration with Existing Systems

Integration is crucial for insurance companies, especially larger ones.

Custom software can be built to seamlessly integrate with your existing systems, minimizing disruptions and creating a unified IT ecosystem.

This ensures that all parts of your business work together efficiently.

Greater Control and Flexibility

With custom software, insurers have full control over their system’s features, updates, and modifications. This level of control ensures that the software evolves based on the business’s changing needs, without being dependent on third-party vendors or dealing with licensing restrictions.

Competitive Advantage

Custom insurance solutions allow companies to stand out in a competitive marketplace.

By developing unique features and offering superior service through tailored systems, insurers can differentiate themselves from competitors and build strong, lasting customer relationships.

Enhanced Security

The insurance industry handles highly sensitive customer data, making security an absolute priority.

Custom software provides insurers with the ability to implement tailored security protocols designed to address their specific needs. This includes features such as advanced encryption, secure authentication methods, and regular security updates to protect against evolving threats.

By designing solutions that align with both internal policies and regulatory requirements, insurers can significantly reduce the risk of data breaches, safeguard customer trust, and ensure compliance with industry standards.

[Read also: Digital Transformation in Insurance Industry: Key Strategies & Trends]

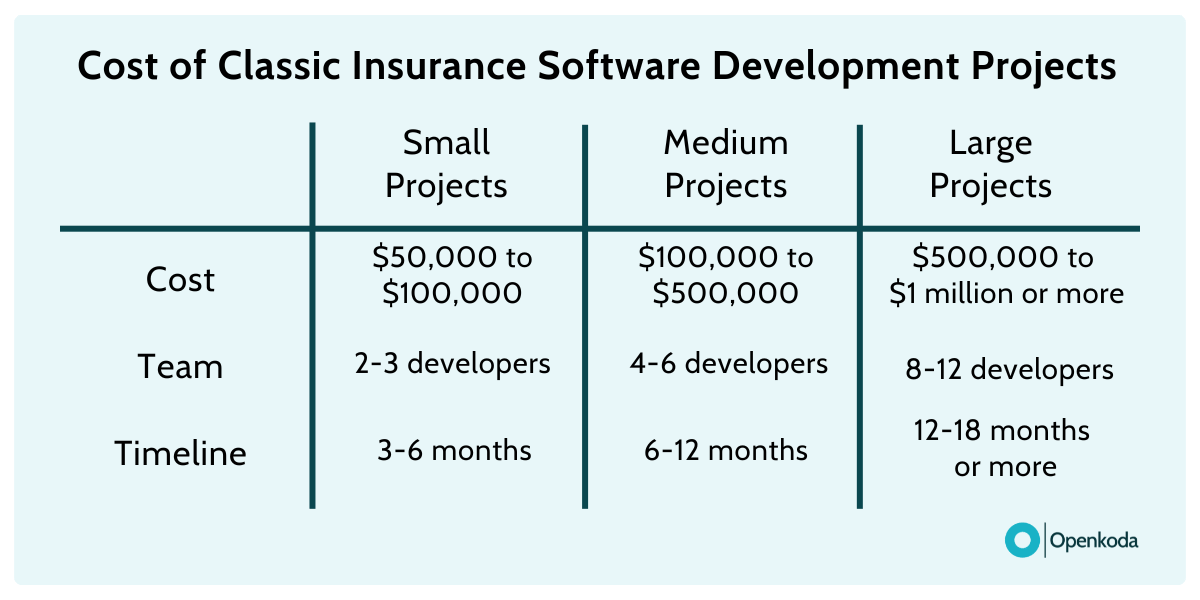

Cost of Custom Insurance Software

If you choose to work with an insurance software development company, the cost of creating custom insurance software can vary significantly based on the project’s scope, features, and complexity.

Key factors influencing these costs include:

- Scope and Complexity: The more complex the software, the higher the cost. Features like AI integration, data analytics, or advanced automation require additional development effort.

- Technology Stack: The choice of technologies—such as programming languages, frameworks, and third-party services—affects the overall cost. The question also remains wether the project will include insurance mobile app development or just a native web app.

- Team Size and Expertise: The number of developers, designers, and QA specialists involved, as well as their level of expertise, directly impacts the cost.

- Development Timeframe: Tight deadlines may require more resources, such as additional developers, which increases the cost.

Small Projects

- Cost: $50,000 to $100,000

- Team: 2-3 developers,

- Timeline: 3-6 months

Medium-Sized Projects

- Cost: $100,000 to $500,000

- Team: 4-6 software developers, designer, QA specialists, project manager

- Timeline: 6-12 months

Large-Scale Projects

- Cost: $500,000 to $1 million or more

- Team: 8-12 software developers, multiple designers, 2 QA specialists, 1 project manager, additional business analyst

- Timeline: 12-18 months or more

This might seem costly at first glance.

However, Openkoda’s greatest strength lies in improving efficiency, which also means significantly reducing the costs of custom insurance software development.

Thanks to its pre-built templates designed specifically for the insurance industry—covering features like policy management, claims processing, and compliance modules—you can cut development time and costs by up to 60%.

For larger, more complex projects, this can translate into savings of tens of thousands of dollars in the long run.

But that’s not all.

Let’s say that you opt to base your insurance system on Salesforce architecture.

Monthly subscription and maintenance costs can accumulate over time, especially as more users join your organization.

With a custom system built on Openkoda, this risk is completely eliminated.

There’s no user-based pricing, so you avoid hefty licensing fees. Additionally, you can deploy your app either on-premises or in the cloud—whichever option best suits your organization.

How to Choose the Right Insurance Software Development Company

Selecting the right partner for your insurance software development is critical to ensuring the success of your project.

A great starting point is Clutch, a platform that provides verified reviews and ratings of top software development companies.

Look for firms with experience in the insurance industry, a strong portfolio of relevant projects, and positive client testimonials.

Consider their technical expertise, especially in areas such as regulatory compliance, scalability, and integration with third-party services that are critical to insurance software. In addition, evaluate their approach to communication and project management to ensure a smooth collaboration.

If you decide to build your system with Openkoda, we can further simplify the process.

Our development team specializes in customizing and extending Openkoda’s robust foundation into a full-fledged insurance application tailored to your business needs.

This approach not only accelerates development, but also ensures a cost-effective solution that meets the unique requirements of the insurance market.

With our expertise, you can quickly transform Openkoda’s powerful framework into a customized, enterprise-class application.

Final Word

Custom insurance software solutions provide insurers with the flexibility and functionality needed to stay competitive in today’s marketplace.

However, the cost and time associated with development can be a significant barrier.

Platforms like Openkoda offer a great way to reduce costs and speed up the development process, making custom insurance solutions more accessible to a wider range of companies.