The insurance industry is undergoing a digital transformation, driven by the need for more accurate risk assessment, improved customer experience, and operational efficiency.

AI-driven analytics is increasingly at the forefront of this transformation, offering advanced capabilities that go beyond traditional methods.

Let’s see how, even now, in 2024, AI can be used by insurance companies to make their data analysis faster, better and smarter.

The Role of AI in Modern Insurance Data Analytics

Data analytics in insurance has always been a key element of the industry—analyzing historical data to make predictions and assess risk. Without it, any insurance company would quickly go out of business due to inefficiencies.

AI changes that by turning its capabilities up to eleven.

AI is redefining data analytics in the insurance sector by enabling more dynamic, real-time and data-rich insights faster than ever before.

Insurers no longer rely solely on historical data; AI enables them to consider a myriad of variables in real time, drawing from sources such as IoT devices, social media, and other contextual data sets.

In claims processing, AI has significantly improved speed and accuracy. Automation and natural language processing have shortened cycle times and reduced human error, allowing insurers to focus more on customer-centric services.

This AI transformation is particularly evident in underwriting, where AI models are making risk assessments more precise and personalized, leading to better pricing strategies and improved profitability.

AI in Insurance Analytics: Statistics and Insights

In 2024, the value AI brings to the insurance industry is already substantial.

AI is expected to save the industry $390 billion by 2030, with projections suggesting it will generate $1.3 trillion in value by 2035. Adoption has surged, growing by 25% in the past year, and 84% of insurance executives believe AI will transform the industry within the next three years.

AI is now integrated into more functions within insurance software.

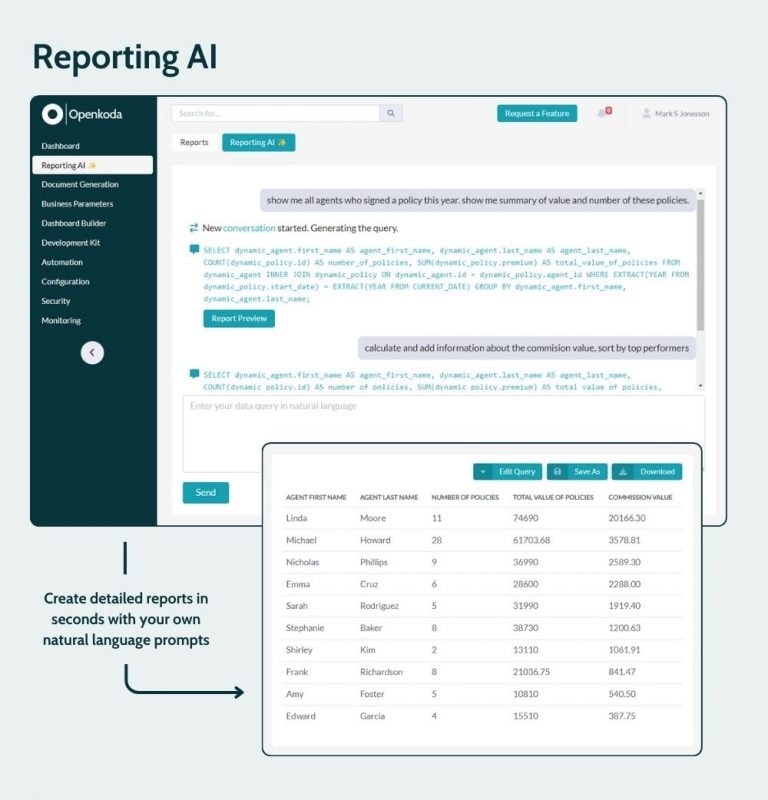

A prime example is Openkoda’s Reporting AI, which illustrates how AI-driven solutions are already reshaping insurance analytics today.

When Insurance Analytics Meets AI: Openkoda Reporting AI

What’s the most time-consuming activity for a data analyst?

In many cases, it is the process of creating SQL queries when preparing reports, which can sometimes take days or even weeks.

Openkoda’s Reporting AI functionality is designed to make data reporting and querying easier by allowing users to create SQL queries using natural language prompts.

This feature removes the need for technical SQL expertise, enabling non-technical users to access complex insights and generate reports based on their requirements.

Reporting AI, included in the latest release of Openkoda 2.0, works by translating your natural language queries into SQL commands using the latest LMM models.

If you know SQL, you can iteratively adjust your queries to refine results, allowing for flexible and precise data exploration, but no SQL knowledge is required to use this functionality.

Once generated, your reports can be saved for periodic execution or exported to formats such as Excel for sharing across teams, making it easy to distribute insights without repeated manual effort.

The impact?

The time required to produce insurance reports can be reduced by up to 90%.

Improving Data Analytics with Customizable Insurance Management Software

Reporting AI is one of the best AI reporting tools tailored specifically to the insurance industry, representing the value of generative AI in automating some of the seemingly inconspicuous, yet time-consuming tasks

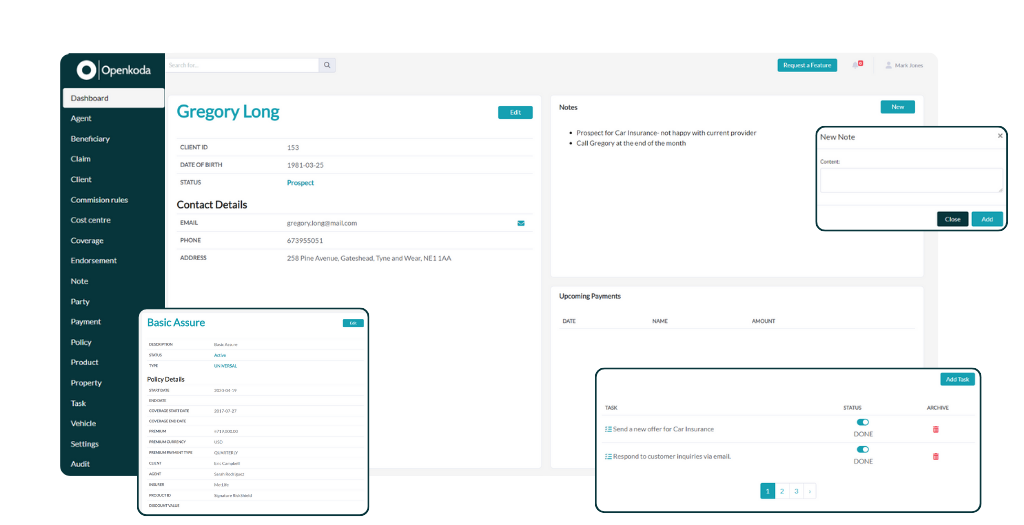

Openkoda 2.0 empowers your insurance business by providing an open-source enterprise platform designed to accelerate the custom insurance software development process according to regulatory compliance standards and without vendor lock in.

With new application templates tailored for embedded insurance, risk assessment, and policy and claims management, you can quickly prototype and deploy customized solutions that meet your specific needs.

Sound interesting?

How Modern Data Analytics Impacts The Insurance Industry

However, reporting AI is just one example of the many potential uses of AI in insurance data analytics.

The impact of modern data analytics on the insurance industry is much broader, so let’s take a look at what the future of insurance analytics might hold.

Dynamic Insurance Pricing

For once, we’ve got AI-powered dynamic pricing.

It’s a powerful example of how artificial intelligence (AI) is finding its place in insurance analytics, enabling real-time responsiveness to changes in customer data and risk factors.

By integrating information from IoT devices, such as vehicle telematics or wearable health monitors, an insurance company can tailor policies to more accurately reflect individual behaviors and risks.

This approach not only enables you to provide more accurate and personalized pricing, but also opens up new opportunities for customer satisfaction.

By offering rates that better reflect individual risk profiles, AI-driven dynamic pricing helps you attract low-risk customers with competitive rates, potentially increasing retention and lowering loss ratios for insurers.

The automotive industry is a prime example of this use of AI in insurance, with many embedded IoT devices enabling classic and embedded insurance providers to collect real-time data that informs personalized insurance pricing models, giving them a competitive advantage when it comes to premiums.

This data enables usage-based insurance (UBI), where premiums are dynamically adjusted based on how, when, and where the vehicle is driven.

Predictive Analytics

Predictive analytics is one of the most powerful ways AI is impacting the insurance industry.

By analyzing large volumes of historical and real-time data and customer behavior, predictive analytics tools enable insurers to anticipate customer needs and respond proactively, whether it’s through personalized offers or risk-based pricing.

What would this look like in practice?

Consider a scenario where the insurer’s analytics system identifies a policyholder whose data shows a decrease in physical activity and higher-than-average stress indicators. The predictive model flags this as a potential health risk, prompting the insurer to offer targeted support, such as access to virtual wellness programs or discounted gym memberships.

This personalized, data-driven approach could benefit both insurers and customers.

[Read also: How Embedded Insurance Enables Personalized Protection]

Claims Processing Automation

AI-driven claims automation is transforming the traditional claims management process, which often involves manual review and lengthy paperwork.

By automating routine tasks with claims management application, insurers can process claims far more efficiently than with traditional manual methods.

AI-powered insurance analytics tools handle complex data inputs, analyzing data from images, policy records, and documents to determine claim eligibility and potential risks.

For example, advanced AI models use computer vision to assess vehicle damage from submitted photos, while machine learning algorithms look for patterns that may indicate fraud.

Fraudulent Claims Prediction and Modeling

Finally, there’s fraudulent claims modeling-a critical application of AI that significantly improves insurance analytics by identifying suspicious claims early in the process.

AI-driven predictive modeling uses machine learning algorithms to scan large volumes of claims data for patterns commonly associated with fraud.

For example, AI systems can analyze and detect fraud factors such as the timing of the claim, its frequency, and inconsistencies in the claimant’s statements.

With these insights, insurers can prioritize claims that are likely to be fraudulent for further review, allowing investigators to focus on the highest risk cases rather than manually sifting through every claim.

[Read also: 5 Key Insurance Industry Trends for 2025]

The Competitive Edge of AI-Driven Analytics

AI-driven analytics is revolutionizing the insurance industry, offering your business a strong competitive edge through streamlined processes, cost savings, and an innovative approach to classic insurance processes.

As a quick recap, here’s how AI in insurance analytics is reshaping key areas:

- Fraud Mitigation: AI can reduce fraud-related costs by 30% by identifying suspicious claims early, allowing insurers to prevent fraudulent activities and avoid associated financial losses.

- Operating Expenses: With automation of repetitive tasks like data entry and claims processing, enabling insurers to allocate resources to more complex tasks.

- Efficiency and Speed in Claims Management: Automated claims handling speeds up processing times, allowing for quicker resolutions. This streamlined workflow enhances efficiency and provides a smoother experience for customers.

- Improved Underwriting Accuracy: AI is expected to improve underwriting accuracy and speed for 88% of insurers, as it analyzes vast datasets to make data-driven, precise risk assessments, reducing errors and refining policy pricing.