Innovative Personalized Insurance Explained

Personalization is transforming insurance, with AI, data analytics, and IoT enabling tailored coverage based on individual lifestyles and risks. This shift boosts customer satisfaction with more relevant, dynamic solutions. Now is the time for the insurance industry to personalize, modernize and embrace these technologies to stay competitive.

What is Personalization in Insurance?

Personalized insurance is about creating coverage that is tailored to each individual’s unique needs, preferences and lifestyle, rather than relying on a generic, one-size-fits-all model.

In the past, insurance policies were designed to be broad and standardized, but this approach no longer meets the expectations of today’s customers. People want policies that reflect their specific situations and lifestyle. Technology and data now play a key role in this shift.

By collecting and analyzing real-time information, insurers can offer customized solutions that are better suited to each person’s risks and circumstances, resulting in more relevant coverage and a better overall experience.

The Growing Demand for Personalized Insurance: Market Trends

The demand for personalized insurance continues to grow, driven by advances in technology and changing consumer expectations.

The insurance market is undergoing significant changes due to generational shifts. Economic uncertainty, climate change, and technological advancements have changed consumer priorities. According to Accenture, as Millennials enter their peak insurance-buying years and Generation Z enters the market, demand for personalized, digital-first solutions is on the rise. Gallup poll reveals that Millennials are nearly twice as likely as older generations to be “actively disengaged” with their insurance providers. These generations prioritize seamless, tailored experiences and are reshaping the insurance landscape to meet their expectations for convenience and customization.

This shift has led to one of the biggest trends in the insurance industry today: hyper-personalization through technology. Advances in data analytics, AI, and IoT are allowing insurers to offer customized policies that are tailored to an individual’s behavior and risk profile. This is the trend we’ll be focusing on the most in this article

The importance of personalization is also evident in the growing popularity of service-led offerings, which are expected to account for 33% of premium insurance volumes by 2024. This shift reflects the increasing demand for seamless digital experiences, as consumers prioritize convenience and customization, rather than traditional product-led approaches.

Changing consumer behavior and the digitization of industries are accelerating the growth of embedded insurance personalization in 2024. EY estimates that 30% of all insurance transactions could be conducted through embedded channels by 2028. The ability to purchase insurance with a single click, alongside goods and services, offers a highly efficient way to personalize offerings, leveraging real-time data and AI for tailored, seamless coverage options.

Key Technologies Enabling Insurance Personalization

AI and Machine Learning

Advancements in AI have surged, particularly with the rise of generative AI, which is projected to have a market potential of $15 billion in the insurance and finance sectors by 2025.

Research from WorldMetrics indicates that 67% of insurance companies have already integrated AI into their operations. Additionally, it is estimated that 95% of customer interactions in the insurance industry will be facilitated by AI.

AI is transforming the insurance industry by automating key insurance processes such as:

- underwriting

- pricing

- predictive analytics and risk management

- claims fraud detection

- faster claims resolution

- data-driven product innovation

- regulatory compliance and risk monitoring

- AI in embedded insurance

All these advancements result in more efficient and accurate insurance decision-making. AI helps streamline operations and enhance customer experiences by offering personalized, dynamic solutions, while also ensuring regulatory compliance and reducing operational risk.

AI also plays an important role in personalizing customer service. This is achieved through chatbots and virtual assistants, which provide 24/7 support, answer queries, and resolve issues quickly. These technologies enhance customer interactions by offering instant, personalized assistance while freeing human agents to handle more complex tasks.

Data Analytics

Data analytics plays a critical role in enabling personalization in the insurance industry, helping companies process vast amounts of customer data to deliver tailored products and services.

Insurers are using advanced data analytics techniques, such as machine learning and predictive analytics, which utilize historical and real-time data, including customer behavior, preferences, and risk profiles, to forecast future trends. This allows insurers to anticipate customer needs and emerging risks.

By collecting data from various sources, such as social media, IoT devices, or past claims, insurers can identify patterns and trends that help them predict individual needs.

This allows them to offer personalized policies, dynamic pricing, and recommendations, ultimately improving customer satisfaction and loyalty.

Telematics and IoT

Telematics and IoT are transformative technologies that enable real-time data collection and analysis.

Through IoT devices such as connected cars, wearable fitness trackers, or smart home sensors, insurers can collect data on driving habits, health metrics, or home safety.

Telematics, particularly in auto insurance, tracks driving behaviors such as speed, braking, and mileage. With this data, insurers can offer usage- or behavior-based insurance policies that provide personalized premiums and coverage.

By continuously monitoring these metrics, insurers can tailor their offerings to individual lifestyles and needs. This makes insurance more relevant and cost-effective for each customer.

Open-Source Insurance Platforms

One of the key technologies driving personalization in the insurance industry is open-source insurance application platforms. Tools such as Openkoda enable insurers to rapidly develop their own custom software and insurance products, offering complete flexibility and customization to meet the specific needs of the insurance industry.

This enables companies to respond more effectively to market demands and develop solutions that are directly tailored to their customers.

With Openkoda features, insurers can leverage AI-powered reporting, build robust claims and policy management systems, and seamlessly integrate embedded insurance solutions. The open-source nature of the platform means there is no vendor lock-in, allowing companies to innovate and refine their offerings without restriction.

This adaptability helps deliver hyper-personalized products and services, significantly improving customer experience and satisfaction.

Check out this demo to see how you can quickly set up a personalized insurance policy dashboard using Openkoda Platform.

Recommendation Engines

AI-powered recommendation engines can tailor coverage by analyzing vast amounts of data, such as customer preferences, claims history, and current market trends.

This allows insurers to offer customized insurance products and pricing models.

For example, recommendation systems can help identify trends to tailor future coverage or more accurately predict risk. This allows insurers to create hyper-personalized policies that meet specific individual needs, which in turn increases customer satisfaction and loyalty.

[Read also: Digital Transformation in Insurance Industry]

How to Personalize the Insurance Experience

Now, let’s look at different ways to make insurance more personal using the technology we’ve talked about earlier in this article.

Each method is shown with examples to show how it can help customers and meet their needs better.

Personalized Quotes

Insurers can offer personalized quotes by using individual data to provide more accurate and tailored pricing. Several factors come into play when customizing insurance quotes, such as age, location, health, and driving history.

To illustrate personalized pricing, imagine two drivers, Sam and Alex.

Alex, 25, lives in a low-crime suburb, drives a reliable sedan, and has a clean driving record. Taylor, 45, lives in a busy city, drives a sports car, and has had two minor accidents. Because of these differences, Alex would likely get a lower insurance quote, benefiting from a safer location and driving history. Meanwhile, Taylor’s premiums would be higher due to the higher risk factors of urban environment, accident record, and vehicle type.

This personalized approach helps insurers reflect each individual’s risk more accurately and transparently.

Embedded Insurance

Embedded insurance integrates coverage seamlessly into other products or services at the point of sale, offering a convenient and highly personalized experience. For example, when purchasing a smartphone on platforms like Amazon, customers can be offered insurance for their device as part of the checkout process, eliminating the need to search for separate coverage.

With data from connected devices and purchase behaviors, insurers can refine this embedded insurance personalization further by tailoring products to align with each individual’s specific needs and risk profile. This ensures customers receive relevant, targeted coverage without the hassle of shopping for it independently.

Tailored Insurance Offers

Insurance companies also personalize the experience by offering tailored insurance plans to meet specific needs.

For example, families in high-risk areas that are prone to flooding or earthquakes can receive specialized coverage to protect against these threats. This ensures that they are properly covered for the risks they face.

In addition to basic policies, insurers offer riders and recommendations, such as extended liability or coverage for high-value items like jewelry.

This personalization approach focuses on more than just price, providing customers with comprehensive protection that fits their unique lifestyle and needs.

Usage-Based Insurance (UBI)

In Usage-based insurance (UBI) your insurance premium is determined by factors such as how much you drive, your driving habits, and even the time of day you drive.

For example, Tesla uses data from its vehicles to assess each driver’s behavior. A safe driver who doesn’t drive frequently could pay less because the insurance is tailored to their actual usage and risk. The more carefully you drive and the fewer miles you cover, the lower your premium may be.

Similarly, pay-per-use insurance goes a step further by offering even more flexibility. Instead of a fixed premium, you pay only when you use the service.

For instance, if you rely on public transport during the week and drive only occasionally, you could opt for pay-per-mile or pay-per-day insurance. This way, you only pay for the coverage you need when you drive, making it highly personalized and cost-effective.

On-Demand Insurance

On-demand insurance offers allows customers to activate short-term cover only when they need it. This flexibility is ideal for situations such as travel or car rental insurance, where coverage is only needed for a specific period or event. For example, travellers can use apps such as Trov to instantly activate cover for the duration of their trip and deactivate it when they return, ensuring they only pay for what they use.

Personalized Application Interface

Personalizing the insurance experience involves leveraging technology to create personalized interfaces that align with an organization’s brand and cater to individual user needs. Platforms like Openkoda enable insurers to customize their software interfaces, ensuring consistency with their brand identity and enhancing user engagement. This level of personalization not only reinforces trust but also streamlines operations, providing a seamless connection between the brand and its users.

Benefits of Personalization for Insurers and Consumers

We’ve already touched on the individual benefits of various personalized solutions insurers can offer, such as AI-powered tools, embedded insurance products, and usage-based policies. Now, let’s bring it all together and explore the overall advantages of personalization for both insurers and their clients.

Increased Revenue and Sales for Insurers

Personalisation offers insurers the opportunity to better understand customer needs and preferences. By using data-driven insights, insurers can offer tailored products and services that resonate with consumers.

As a result, insurers see an increase in conversion rates, cross-sell opportunities and customer retention, leading to increased revenue and long-term business growth.

Streamlined Operations and More Efficient Customer Service

With AI and automation powering personalised solutions, insurers can streamline their operations by reducing manual tasks such as underwriting or claims processing. The result is faster decision-making and more efficient customer service.

Insurers can focus their resources on strategic growth while providing a seamless experience for consumers, even in complex processes such as claims management.

Higher Consumer Satisfaction and Engagement

Consumers today expect more than just insurance products – they want proactive services and relevant, timely communications.

Personalised policies, usage-based insurance (UBI) and telematics-based offerings help insurers engage customers in ways that meet their individual needs. This leads to higher satisfaction, more positive interactions and greater loyalty from policyholders.

New Sales Channels (e.g., Embedded Insurance)

Personalisation allows insurers to tap into new distribution channels, particularly through embedded insurance. By integrating insurance products directly into key touch points, such as e-commerce platforms or travel booking sites, insurers can reach consumers when they need protection most.

This creates new opportunities for growth without relying on traditional distribution models. Learn more about why embedded insurance has become a hot topic in the industry.

Flexibility for Consumers with Coverage That Adapts to Their Lifestyle

In a world where customer needs are rapidly evolving, offering flexibility is key. Personalisation gives consumers the power to choose policies that fit their lifestyle – whether it’s on-demand insurance for short-term needs or usage-based policies that adjust based on driving habits or activity. This flexibility increases customer satisfaction and ensures that insurance remains relevant as their circumstances change.

By embracing personalisation, insurers not only improve the customer experience, but also their operational efficiency and competitiveness in an evolving marketplace.

Challenges in Insurance Personalization

Data Privacy Issues

Personalization requires vast amounts of personal data, which must comply with regulations like GDPR and HIPAA. Insurers must safeguard data while maintaining compliance to avoid legal and reputational risks. Additionally, over-personalization can feel invasive, so finding the right balance is crucial to avoid overwhelming users.

Implementation Costs

Building personalized systems requires substantial investment in technology, such as AI, telematics, and data analytics. For many insurers, these high costs can be a barrier, especially for smaller firms. In this regard, it is recommended to use open-source solutions to avoid vendor lock-in and additional costs.

Data Accuracy and Quality

Personalization depends on accurate data. Poor-quality or incomplete data can lead to inaccurate recommendations and pricing errors, affecting customer satisfaction and profitability.

Integration with Legacy Systems

Many insurers rely on outdated systems not designed for modern personalization. A potential solution is to build innovative, personalized products using open-source insurance platforms. These platforms can help insurers streamline development, accelerate implementation, and simplify integration, while also offering the flexibility needed to create custom solutions.

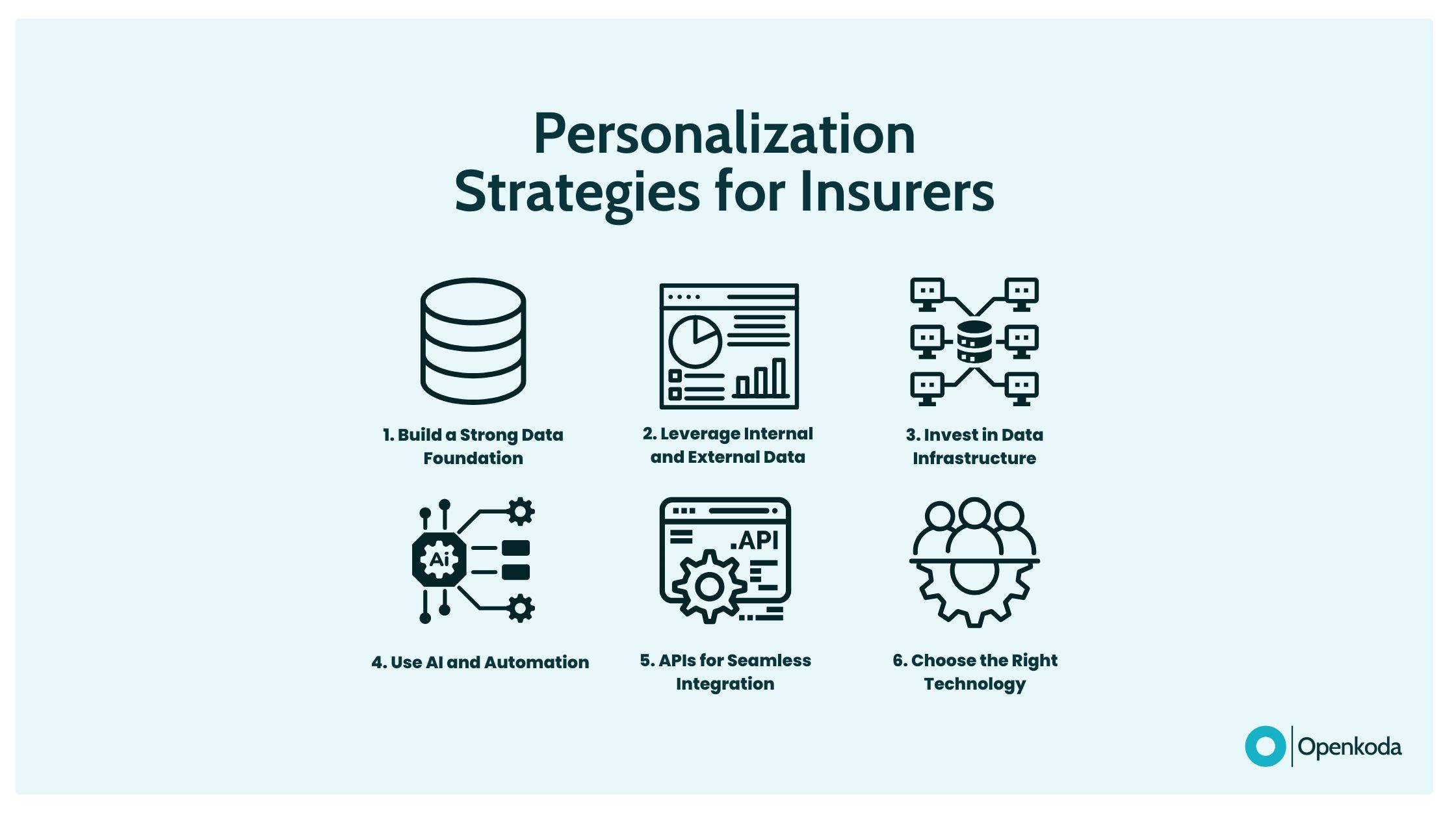

Personalization Strategies for Insurers

To implement effective personalization strategies, insurers need to blend cutting-edge technologies with smart data-driven approaches.

Here’s how to plan the personalization strategy:

1. Build a Strong Data Foundation

A skilled data engineering team is the backbone of personalization efforts. They’ll set up connections to diverse data sources like mobile devices, IoT devices, and telematics devices, which capture real-time customer data.

2. Leverage Internal and External Data

To fully capitalize on personalization, insurers need to explore and leverage both internal and external customer data. Internal data may include previous policyholder interactions, claims history, and customer feedback, while external sources could come from market trends, social media, or third-party vendors. By gathering a broad spectrum of data, insurers can develop a comprehensive understanding of their customers.

3. Invest in Data Infrastructure

Building a strong technical foundation is critical for advanced analytics. Insurers must invest in data infrastructure to ensure they can process and analyze vast amounts of customer information efficiently. The right infrastructure enables real-time data analysis, turning raw data into actionable insights that support personalized offerings.

4. Use AI and Automation

AI and automation play a critical role in analyzing massive amounts of customer data efficiently. With automatic data preparation, insurers can gather insights without manual effort, saving time and allowing for quick decision-making.

5. APIs for Seamless Integration

APIs ensure insurers can provide real-time solutions, like instant policy updates or real-time claim tracking, making the customer experience smoother and more interactive.

6. Choose the Right Technology

Implementing all the previous steps becomes much easier with the right technology. Open-source platforms like Openkoda provide the flexibility to build custom solutions, allowing insurers to seamlessly integrate these capabilities, innovate faster, and deliver personalized services without being restricted by a single vendor.

To truly succeed in delivering a personalized insurance experience, insurers should consider building their own custom solutions. Using an open-source platform provides the flexibility to create customized products that perfectly fit your business strategy and your customers’ needs.

Why this matters? Insurers need to be agile, able to adapt to rapidly changing market demands and evolving customer expectations.

Open-source insurance platform enable faster product development, and also ensures that insurers can deliver highly personalized services that keep customers engaged and satisfied.

New Opportunity

Personalization is reshaping the insurance industry by providing tailored, dynamic coverage that meets individual needs. As technology advances, the future of insurance will rely heavily on hyper-personalization, driven by AI, IoT, and data analytics. However, to succeed in this evolving landscape, insurers must balance personalization with ethical data usage, ensuring transparency, privacy, and compliance to maintain customer trust while delivering innovative, personalized services.

Related Posts

- How Technology Powers Specialty Insurance Products

- How to Automate Insurance Policy Renewal Reminders?

- Embedded Car Insurance: How to Build It?

- How to Easily Manage Multiple Insurance Organizations in One Platform

- How to Implement a Dynamic Pricing & Real-Time Premium Calculation in Insurance Systems

Contents

- What is Personalization in Insurance?

- The Growing Demand for Personalized Insurance: Market Trends

- Key Technologies Enabling Insurance Personalization

- How to Personalize the Insurance Experience

- Benefits of Personalization for Insurers and Consumers

- Challenges in Insurance Personalization

- Personalization Strategies for Insurers

- New Opportunity