10 Examples of Successful Embedded Insurance Products and Applications

From travel platforms that provide instant travel insurance to fintech apps that offer tailored insurance for high-value purchases, embedded insurance is reshaping the way consumers interact with protection products, making coverage more accessible and seamlessly integrated into everyday transactions.

Let’s explore 10 successful embedded insurance products and applications that are leading the way in this rapidly growing market.

Embedded Insurance: Next Big Thing in The Industry

Embedded insurance refers to the seamless integration of insurance products into the purchase journey of other goods or services, allowing consumers to purchase coverage directly at the point of sale.

This insurance-as-a-service model is one of the hottest insurance industry trends in 2024, as it can create new revenue streams for businesses while closing the protection gap for consumers – a win-win scenario for both parties.

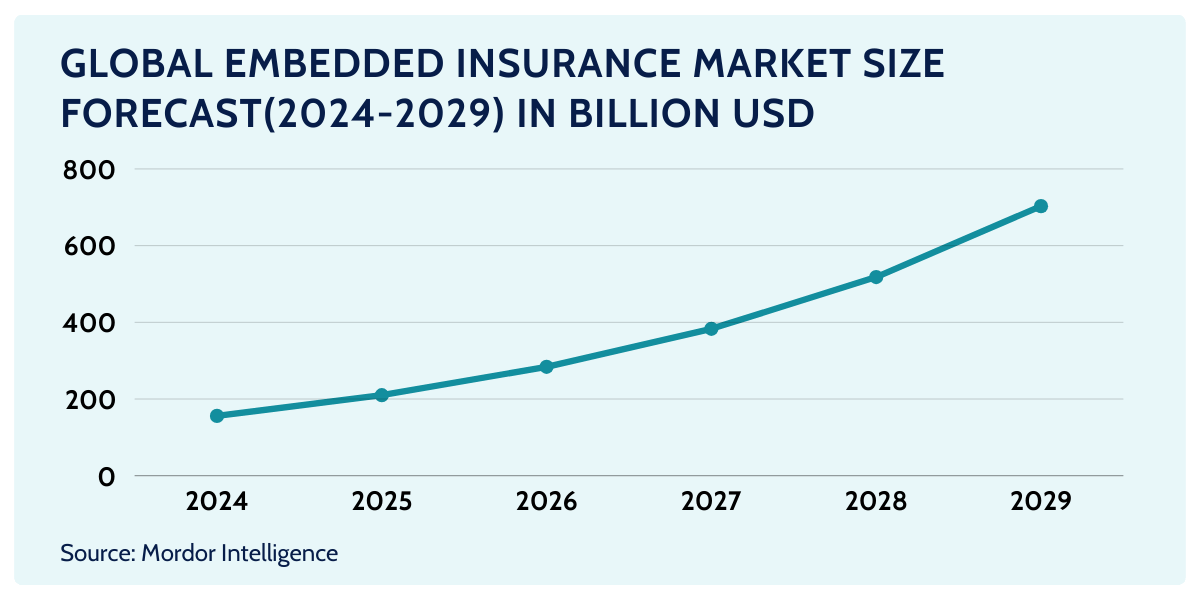

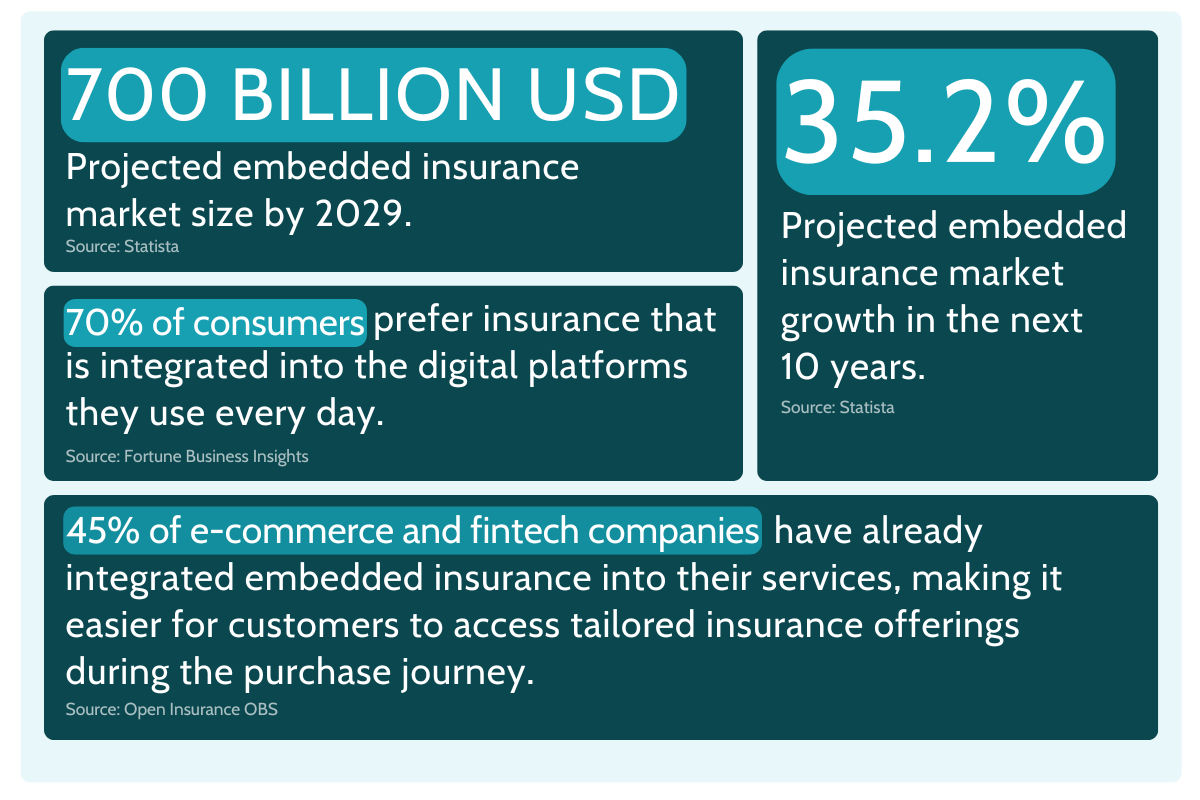

In 2024, the market is projected to reach approximately $156.06 billion in gross written premiums and grow at a compound annual growth rate (CAGR) of 35.14% to reach approximately $703.44 billion by 2029.

By 2026, embedded insurance will account for 15% of the total insurance market, making it by far the fastest growing insurance distribution channel.

This shift is largely driven by changing consumer behavior.

By 2024, it is estimated that 70% of consumers prefer insurance that is integrated into the digital platforms they use every day.

The rapid growth of the embedded insurance market is further fueled by advances in technology and increased cross-industry collaboration.

Around 60% of insurance providers are investing in new technologies to offer more personalized, on-demand insurance solutions to meet the evolving needs of consumers.

In addition, 45% of e-commerce and fintech companies have already integrated embedded insurance into their services, making it easier for customers to access tailored insurance offerings during the purchase journey.

Want to see how embedded insuance could work for your insurance platform? Schedule a personalize demo with our experts.

Where Embedded Insurance Makes a Difference: Five Touchpoints for Personalized Insurance Coverage

By embedding insurance at multiple touchpoints, your company can improve customer satisfaction, add value, and increase revenue.

Here are five popular places within your online we where you can effectively embed insurance products to provide personalized protection.

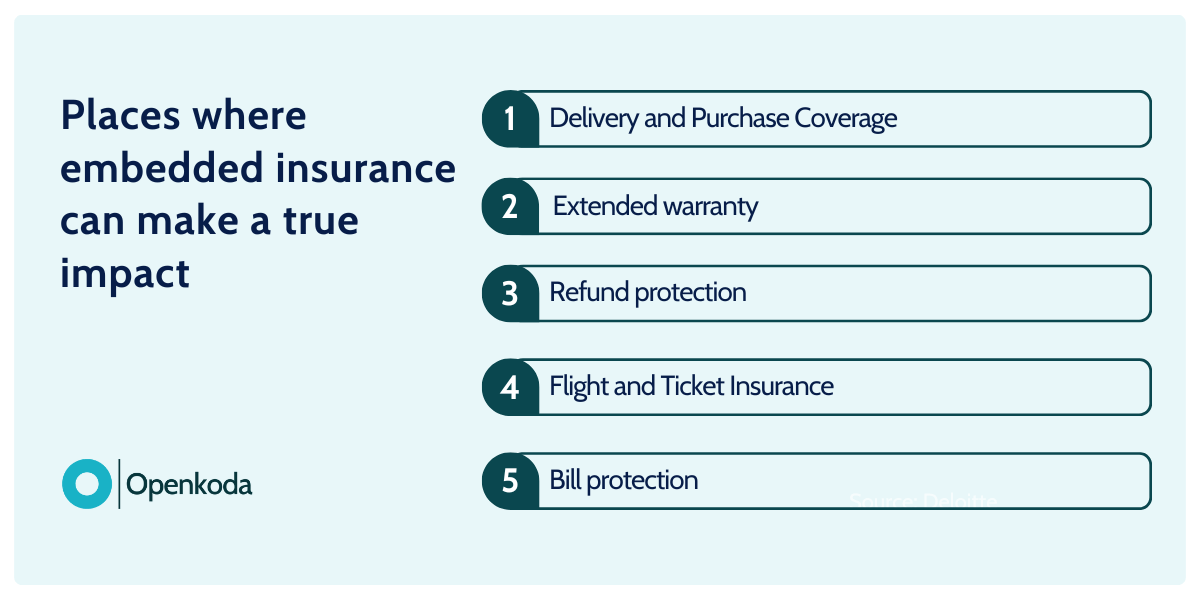

Delivery and purchase coverage

First, we need to talk about purchase and delivery insurance: the classic approach to embedded insurance.

By embedding insurance at the point of sale, retailers can protect their customers against risks such as theft, loss, or damage in transit.

This insurance builds customer confidence and makes them feel more secure about their purchases, especially when they are buying fragile, high-value items such as furniture or kitchen appliances.

Recent studies show that 65% of online shoppers are more likely to complete a purchase if they know that shipping insurance is included.

Extended warranty

Another area where you can introduce embedded insurance solutions into your business is by offering extended warranties.

Instead of dealing with additional paperwork or separate processes, customers can opt for extended coverage with the click of a button.

The benefits that embedded insurance offers are clear: extended warranties help extend the life of products and provide peace of mind, all while increasing customer satisfaction and loyalty.

[Read also: Top Insurance Agency Growth Strategies]

Refund protection

Refund protection is invaluable for customers who shop online or book services.

It provides financial protection when plans change unexpectedly, such as when an event is canceled or an item needs to be returned. By embedding refund protection at the checkout, businesses can reduce the stress and friction associated with cancellations.

Flight and ticket insurance

No one wants to miss that vacation flight or that concert they have been waiting for.

Unfortunately, life is unpredictable and often gets in the way.

That’s why travel and ticket insurance is so important to many people. By leveraging embedded insurance solutions, you can reduce the perceived risks associated with travel or event attendance and increase overall sales.

Bill protection

Let’s also focus on something more innovative: bill protection.

From an economic standpoint, the last few years have been incredibly turbulent, and many people have faced problems with their monthly bills and payments.

This is where bill protection comes in.

This product, which is tied to personal risk rather than customer spending, provides financial security to customers in the event of temporary inability to work due to illness, accident, job loss or hospitalization.

With built-in bill protection, many recurring expenses and personal bills paid through the user’s account are covered.

Curious how this works in your insurance system? Schedule a personalized walkthrough of the Openkoda insurtech platform.

Embedded Insurance Done Right: Ten Inspiring Real-life Life Partnerships

Now that we know where to introduce embedded insurance, let’s take a look at how the biggest brands in various industries have done it in the past and discover some interesting and highly successful examples of embedded insurance products.

Tesla

One of the best and most innovative ways to integrate embedded insurance into a product offering is Tesla.

Available directly to Tesla vehicle owners through the Tesla app, Tesla Insurance uses real-time driving data from the cars to adjust premiums based on individual driving behavior. This approach is powered by Tesla’s “Safety Score” system, which tracks various metrics such as harsh braking, aggressive turning, and unsafe following distances. Its also one of the key examples of how AI in the insurance industry can be used to optimize premiums dynamically.

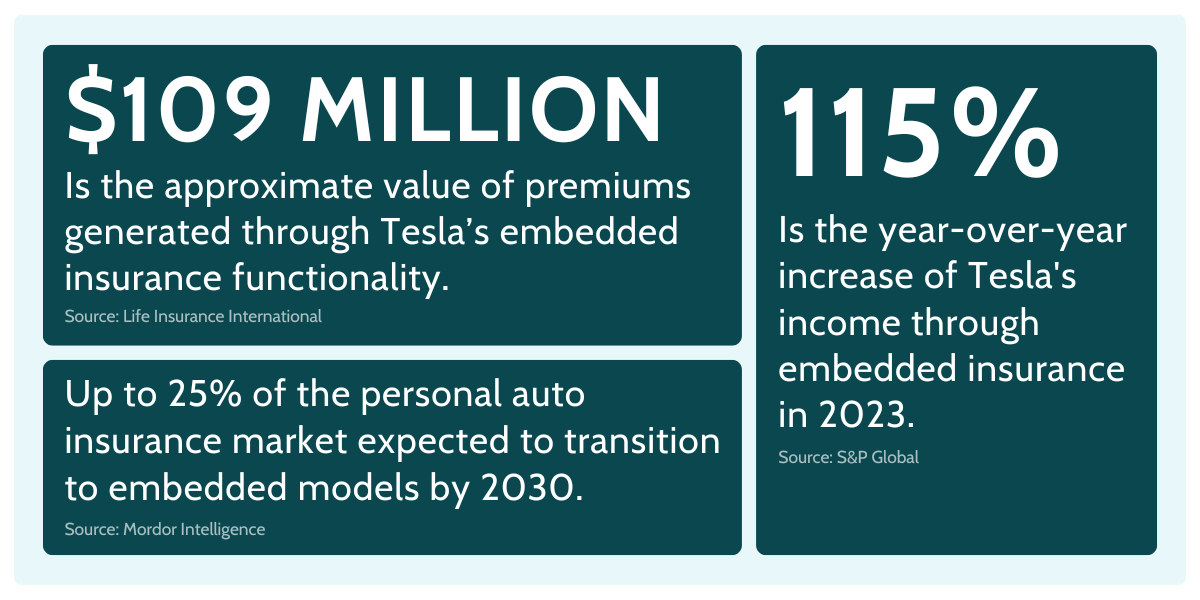

In 2023, Tesla’s insurance premiums grew significantly, with written premiums reaching $109.9 million, up significantly from $12.7 million the previous year. This year promises to be even more profitable for Tesla’s embedded insurance division.

Rivian

Following in Tesla’s footsteps, Rivian Insurance, the insurance agency associated with electric vehicle manufacturer Rivian, has expanded its embedded insurance services.

The company has added Progressive to its list of appointed insurers, joining Nationwide and Cincinnati Insurance.

This integrated car insurance model covers not only the vehicle itself, but also Rivian-branded accessories, making it especially attractive to owners of Rivian’s R1T and R1S models.

Stellantis

In 2024, Stellantis, another automotive company that owns brands such as Chrysler, Dodge, Jeep, Ram, Fiat and Alfa Romeo, has partnered with insurtech company Bolt to deploy its own embedded insurance functionality.

Through this collaboration, Stellantis customers will be able to purchase auto insurance using Bolt’s innovative solutions. This service will be accessible through Stellantis’ websites and mobile apps, offering a range of insurance products from multiple insurers.

In addition to simplifying the customer experience, the program also includes accident management solutions and aims to meet modern customer demands for choice and convenience.

Skyscanner

The COVID-19 pandemic canceled many people’s travel plans.

To ensure travelers can recoup the cost of their tickets, many companies in the industry, like Skyscanner, have ventured into the embedded insurance sector.

By partnering with insurance providers, Skyscanner integrates insurance offers directly into the flight and travel booking process.

Travelers are very interested in this aspect of the booking process. A survey conducted by Cover Genius found that 42% of US travelers would consider switching to another travel insurance provider due to dissatisfaction with their coverage and claims process.

HK Express

Airlines themselves are also looking to introduce embedded insurance.

In June, AXA Hong Kong and Macau, a unit of AXA France, announced an exclusive alliance with HK Express to offer travel insurance to the airline’s customers.

Through this partnership, passengers can easily secure insurance coverage with a simple “one-click” option when booking flights on the HK Express website.

The HK Express Travel Insurance, a bespoke product from AXA, is designed to enhance the travel experience by providing up to HK$500,000 ($65,000) of medical cover and up to HK$6,000 of baggage and personal effects cover, which doubles to HK$12,000 for travel to Japan.

Airbnb

Airbnb uses embedded insurance through its AirCover program, which automatically protects both guests and hosts.

This embedded insurance provides substantial coverage at no additional cost and is designed to address potential issues during a stay.

For guests, AirCover provides assistance in situations such as host cancellations, inability to check-in, inaccurate listings, or safety concerns.

For hosts, AirCover provides more comprehensive protection. It includes up to $3 million in damage protection, $1 million in liability coverage, and protection for valuables such as vehicles or boats parked at the property.

Zillow

Real estate is another area where we work closely with the insurance industry on embedded solutions.

Zillow has integrated embedded insurance capabilities into its platform to provide homebuyers with critical information about potential risks and the insurance implications of those risks.

This integration focuses primarily on climate-related risks such as flooding, wildfires, and extreme weather.

With over 85% of flood-prone homes now including insurance recommendations, this tool ensures that buyers are aware of the potential additional costs associated with insurance when purchasing homes in high-risk areas.

FirstVet

For many people, their pets are true members of the family.

To meet the needs of these beloved companions, FirstVet has integrated insurance into its telehealth platform, making it easier for pet owners to protect their pets with the right coverage. Through this collaboration, FirstVet users in the U.S. will have access to multiple pet insurance options directly within the app.

FirstVet’s growing platform, which hosts more than 50,000 consultations per month and serves more than one million users worldwide, is now a one-stop destination for both veterinary care and pet insurance solutions.

EventPipe

For many people, attending events is one of their favorite pastimes, but plans can often be unpredictable. EventPipe has addressed this by embedding insurance into its event accommodation management software.

This collaboration introduces Booking Protection, a feature designed to provide event attendees with financial peace of mind by offering quick refunds through a self-service process within 72 hours, while giving event organizers real-time insight to quickly resell refunded rooms.

Oscar Health

Last but not least, we’ve got an example of a healthcare company in the form of Oscar Health, whose embedded insurance model integrates technology to make healthcare more accessible and personalized.

Through its platform, Oscar enables members to engage with healthcare in a streamlined way, offering tools to track symptoms, schedule virtual consultations, and receive personalized care recommendations.

[Read also: Digital Transformation in Insurance Industry: Key Strategies & Trends]

How to Implement an Embedded Insurance Solution in an Insurance System

Curious how embedded insurance works in the real world? Watch this short video to see how Openkoda integrates embeddable insurance forms into an automotive platform.

Like what you see? Book your personalized demo.

Deploying Your Own Embedded Insurance Solution

Using Openkoda for developing embedded insurance solutions you can build and custom insurance software systems with greater speed and flexibility.

Its open-source platform reduces development time by up to 60%, enabling rapid deployment of insurance systems that seamlessly integrate with different platforms, such as e-commerce or travel booking sites.

You retain full ownership of the code, there are no proprietary languages involved, no vendor lock in, and you have the flexibility to select your own hosting solution or opt for our managed cloud services.