Insurance Legacy Systems Modernization: Winning Strategy

Many insurers dread the process of updating and modifying their legacy software architecture.

Nevertheless, insurance legacy system transformation is an essential but often challenging initiative for insurers seeking efficiency, agility, and long-term competitiveness.

Let’s explore some proven strategies, core principles, and common obstacles insurers encounter when modernizing outdated systems.

Why Modernize Insurance?

Current customer sentiment clearly shows a desire for affordable products and a hassle-free experience with prompt service delivery.

However, most insurers struggle to fulfil this expectation because of the limitations of their outdated legacy systems and infrastructure.

The answer lies in modernizing legacy systems in the insurance industry.

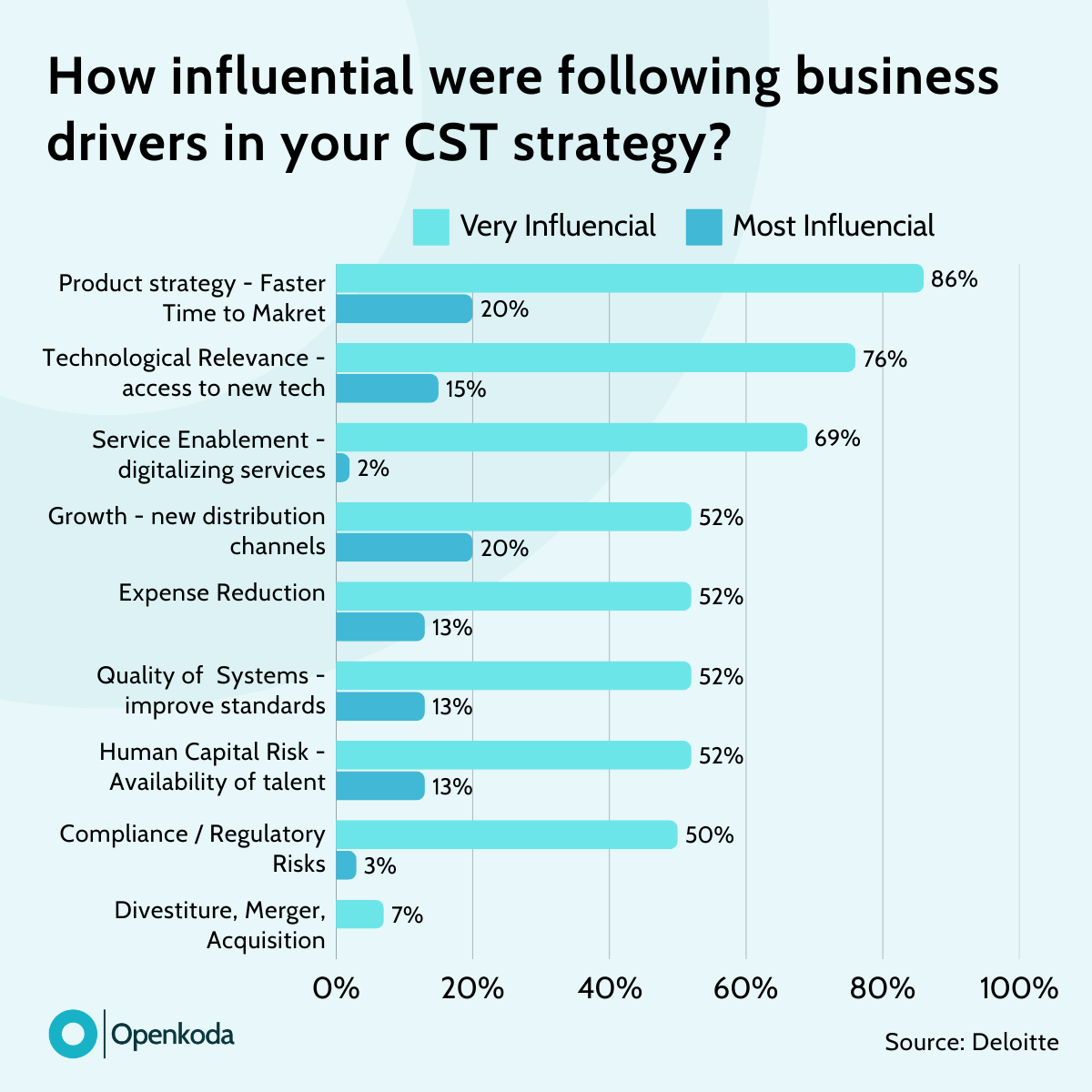

According to Deloitte, the highest rated business driver was product strategy and objectives.

Eighty-six percent of the respondents are looking to launch insurance products to market rapidly while simultaneously modifying product attributes as they refine the offering.

Two-thirds of the responses indicated technological relevance as the second most selected business driver.

Legacy solutions lack flexibility and carry a significant technology debt due to dated languages, databases, architectures, and a limited supply of aging baby-boomer programmers.

When asked which factor was the single most influential business driver, one in five respondents chose product speed to market/policy volume growth.

Insurance legacy system transformation is seen by industry veterans as a somewhat risky but strategic move aimed at both improving current operational efficiency as well as prospects for future expansion and driving innovation.

But key thing to remember is that each insurance company situation is different.

So what’s the bottom line?

A winning strategy insurance software modernization program must ensure that business strategies and objectives align with and drive the direction of planned initiatives.

For example, an insurer aiming to expand into the digital-first market must ensure that its software modernization efforts prioritize self-service portals, and API-driven integrations with digital distribution channels.

Without this alignment, even the most advanced technology upgrades risk failing to deliver real business value.

Three Major Issues Facing Legacy Insurance Software

Apart from looking into the future, one of the key drivers for insurance industry to modernize its software foundation is the fact that it can no longer support ongoing operations.

Even though many companies still believe in the “if it ain’t broke don’t fix it approach” legacy systems often cause significant cost and operational overruns forcing the management to invest in modernization sooner or later.

Increased Cost of Policy Management and Customer Acquisition

Legacy insurance software increases the cost of policy management and customer acquisition because it requires frequent and costly maintenance, relies heavily on manual processes, struggles with integrating modern technologies, and offers a poor customer experience.

These factors result in inefficiencies, higher operational expenses, and more resources spent acquiring and retaining customers.

Just how big of a problem is it?

According to the latest data, insurers allocate roughly 70% of their IT budgets solely to maintaining outdated systems, leading to escalating policy management and customer acquisition costs.

Time-consuming insurance product development

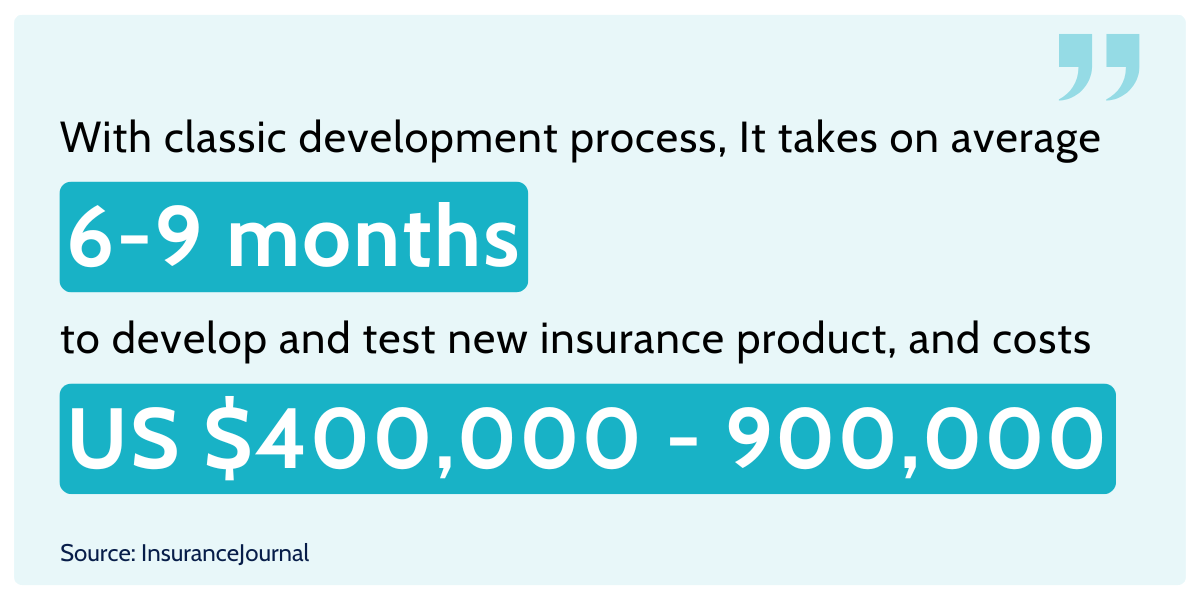

Insurance firms launching new products encounter significant delays due to manual configurations across interconnected legacy systems.

The average development cycle extends 6-9 months, costing US$400,000–900,000 per product, severely constraining innovation and market responsiveness.

But increased cost isn’t all.

When insurance companies want to update or modify premium calculation logic, adjust pricing strategies, or introduce new product features, these legacy systems often require complex, manual coding efforts.

Since older systems weren’t designed for quick or easy adjustments, even small changes can necessitate lengthy development cycles, extensive testing, and specialized technical expertise.

Limited capability to integrate with existing systems

Legacy systems, often built on proprietary technology, face severe integration limitations, hindering seamless connections with digital ecosystems.

Due to their outdated architectures, these older platforms frequently lack modern APIs or standardized interfaces, making integration with newer tools—such as CRM platforms, automation software, or third-party data providers—difficult or even impossible.

As a result, insurers may encounter significant technical challenges, requiring custom-built integrations that are costly, complex, and fragile.

Pain-Points in Today’s Insurance Operations

We’ve discussed the technical limitations of legacy systems within the insurance industry.

To craft a winning strategy for insurance legacy system transformation we must also explore four key areas of insurance operations where outdated systems might really hinder the operational efficiency.

These are the key areas in which upgrading your outdated system can improve the business efficiency in the most profound way.

Underwriting

Legacy underwriting platforms often suffer from fragmented data structures and limited automation capabilities.

Underwriters working with outdated software typically face data silos, making it cumbersome to gather a holistic view of client risk profiles and history.

This leads to inconsistent underwriting decisions, reduced speed, and missed opportunities for accurately segmenting risks.

For instance, when insurers attempt to integrate external data sources (IoT sensors, telematics, social media analytics) into older systems, they frequently encounter compatibility issues or manual workarounds that significantly delay underwriting cycles and degrade data integrity.

Actuarial

In actuarial operations, legacy systems make report preparation particularly cumbersome because actuaries must manually fetch, consolidate, and validate data from multiple, disconnected systems.

This manual data handling process is not only time-consuming but also prone to errors or data omissions, directly affecting the accuracy and timeliness of critical financial or risk assessment reports.

Why is it so problematic? It’s because such processes can be done in 1/10 of the time with modern systems especially with the usage of generative AI technology.

Openkoda reporting AI functionality, for example, accelerates report preparation by enabling users to generate SQL queries through natural language prompts, eliminating the need for technical SQL expertise.

This functionality operates entirely within the system (only the database schema is shared with OpenAI API), ensuring that sensitive client data remains secure and is not shared externally.

Payment & Collection

Legacy insurance platforms commonly lack integration with modern payment solutions, complicating premium collection and reconciliation processes.

With modern systems, insurers can just divert users to a dedicated section of their client portal with an integrated Stripe payment gateway and streamline the whole process for improved customer satisfaction.

In complex legacy systems without automated payment capabilities, staff may spend unnecessary amounts of time manually verifying payments, following up on missed transactions, and resolving discrepancies.

Claims Processing

Legacy claims processing systems typically lack flexibility, automation, and advanced decision-support mechanisms needed for modern insurance operations.

Insurers using these outdated solutions frequently encounter bottlenecks stemming from manual reviews, paper-based workflows, and isolated document generation systems.

For instance, outdated claims systems often provide limited or no integration with advanced fraud detection technologies, predictive analytics, or intelligent triage engines.

As a result, claims handlers are burdened with repetitive tasks, reducing productivity and significantly increasing cycle times.

The takeaway is simple: in claims processing systems, flexibility is key.

Upgrading to modern claims processing technology allows insurers to deliver enhanced customer service, maintain operational efficiency, and gain a competitive advantage.

Three Core Principles of Openkoda Insurance Software Modernization

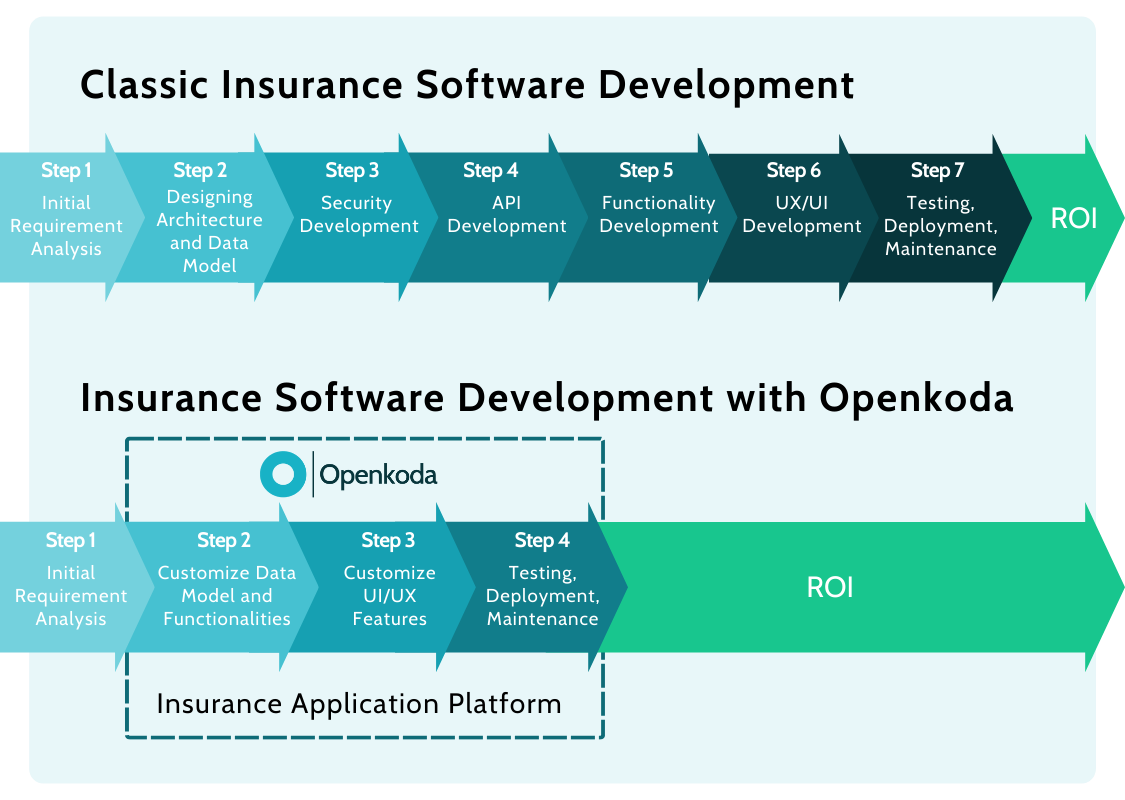

To succeed, insurers require a clear, proven approach that simplifies complex modernization efforts.

At Openkoda, our software modernization strategy is built around three core principles: Extend, Modernize, and Replace.

Each principle addresses specific challenges related to legacy software, enabling insurers to enhance their technology capabilities, streamline processes, and optimize resources.

When crafting a successful insurance legacy system transformation strategy, consider which parts of your software architecture need extension, modernization, or complete replacement.

Should you focus equally on extending and modernizing, or would incremental replacement of an entire system be more effective?

A balanced approach ensures smooth transitions, minimizes disruption, maximizes ROI, and prepares insurers for current and future market demands.

Extend

The “Extend” principle recognizes that sometimes insurers must retain certain legacy systems because they handle critical operations or store vital data.

Rather than immediately replacing these systems, Openkoda enables insurers to seamlessly extend their existing software through APIs, advanced integrations, and modular applications.

This approach allows insurers to preserve valuable core functions while adding innovative capabilities such as embedded insurance forms, customizable claims management, or AI-driven reporting functionalities.

Modernize

Modernizing existing software involves incremental improvements that refresh and upgrade critical parts of the legacy system without fully replacing it.

Techniques include re-platforming, refactoring code, migrating to cloud infrastructures, and containerizing applications.

Openkoda’s modular architecture facilitates gradual modernization, enabling insurers to integrate new functionalities into their legacy software environments while significantly boosting software performance.

Replace

The “Replace” principle acknowledges scenarios where legacy software has become too costly, inflexible, or inefficient to support the insurer’s long-term business goals.

In such cases, Openkoda provides insurers a powerful foundation for fully replacing outdated software with modern, flexible, and scalable solutions.

Openkoda’s open architecture, standard programming languages, and built-in functionalities allow insurers to rapidly build highly customized, cloud-native applications tailored specifically to their business requirements.

By fully replacing legacy systems with Openkoda, insurers eliminate recurring issues like vendor lock-in, cumbersome updates, and restrictive licensing, positioning themselves to swiftly innovate, scale effortlessly, and effectively future-proof their business.

Common Challenges of Insurance Legacy System Modernization and How to Solve Them

While applying the core principles of Extend, Modernize, and Replace, is key for strategic planning, insurance companies must also navigate several common challenges.

Understanding these hurdles early in the process allows insurers to effectively plan, mitigate risks, and ensure smooth transitions.

Below are the most frequent challenges insurance companies face during legacy system modernization, along with insights on managing and overcoming them successfully:

- Complex Data Migration: Insurers often find themselves struggling with outdated databases, fragmented customer data storage, and inconsistent formats that lead to data integrity issues and operational delays. Implement incremental, phased migration strategies combined with data cleansing and validation processes.

- Business Continuity Risks: Any disruption to critical systems—such as policy management, underwriting, or claims processing—can negatively impact customer experience and revenue streams. Carefully plan and execute modernization projects in stages, ensuring critical business processes have backup plans or redundancies in place.

- High Initial Costs: Focus on building a clear business case highlighting the long-term return on investment (ROI) of modernization. Consider incremental modernization or phased implementations to distribute costs over time and showcase early benefits.

- Resistance to Change: Internal resistance, often due to comfort with existing systems or fear of disruption, can slow or hinder modernization efforts.

- Integration Issues: Achieving seamless interoperability between legacy systems and modern technologies or third-party solutions can be technically demanding. Legacy systems often lack standardized APIs, modern integration capabilities, or sufficient documentation, complicating integration efforts. Prioritize adopting flexible, open-platform solutions like Openkoda that easily integrate with existing systems and third-party applications.

[Read also: Best Strategy for Reducing Insurance Product Development Time and Cost]

Why Choose Openkoda to Modernize Your Insurance Legacy Software?

When starting a transformation project for your insurance legacy system, you have plenty of options on the table. You could delegate tasks to your internal IT team or outsource insurance software development to a custom software company.

However, if you’re aiming for the ideal balance of speed, cost efficiency, and high-quality software, partnering with Openkoda is your best option.

Openkoda is a powerful insurtech platform specifically designed to help insurance companies and startups build and scale modern systems—without the risk of vendor lock-in.

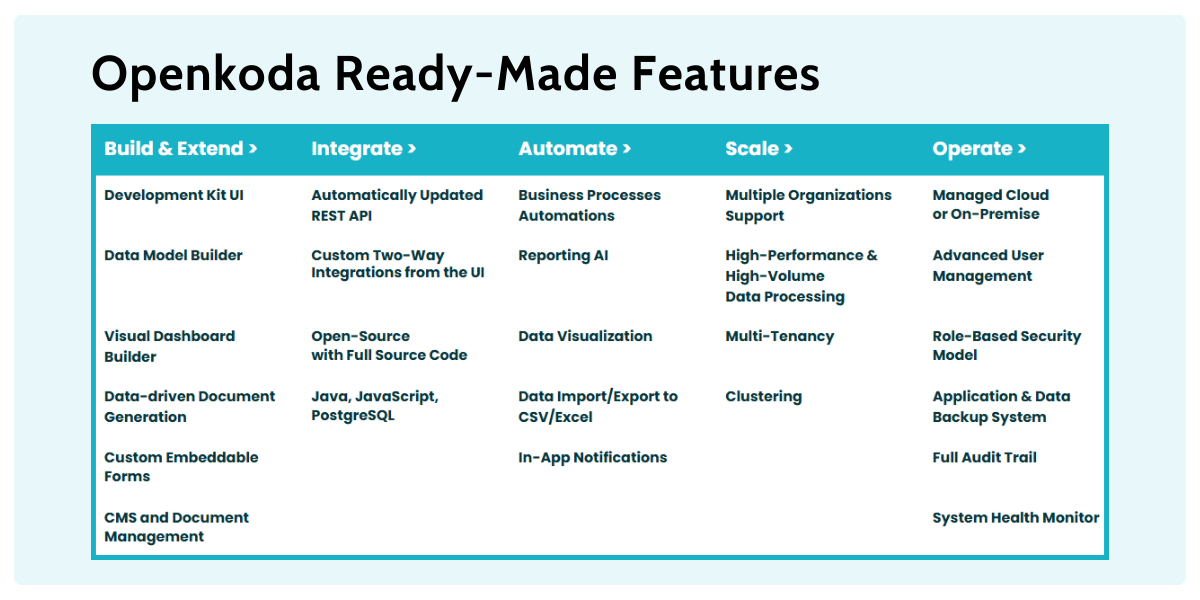

With our ready-to-use templates and a highly customizable foundation, Openkoda significantly reduces development time, enabling your team to focus more on innovation, optimization, and driving business growth.

But Openkoda is more than just a platform.

Our dedicated team of experienced developers ensures you fully leverage all platform capabilities, providing personalized support tailored to your unique business needs, acting as guides through the entire process of legacy insurance software modernization.

Key benefits of choosing Openkoda include:

- Proven Insurtech Expertise – A specialized platform built for modern insurance technology tailored to the needs of the insurance sector.

- Speed & Flexibility – Faster insurance software development thanks to built-in insurance-specific features.

- Cost-Effective – Usage-based pricing without per-user fees, maximizing your return on investment and reducing long-term expenses and operational costs.

- Tailored to Your Needs – Easily configurable and extendable at any point to match evolving requirements.

- Automations – Openkoda includes many automated processes such as email and notifications sender as well as ability to quickly create custom automation logic

- Seamless Integration – Connect effortlessly with legacy systems and APIs.

- Cloud-Ready & Scalable – Future-proof your infrastructure with modern architecture.

Your Bottom Line: Path for Succesful Modernization of Legacy Insurance Systems

Legacy system modernization demands strategic decision-making, thoughtful planning, and a reliable partner that understands the nuances of insurance operations to ensure smooth digital transformation.

With Openkoda, insurers receive a modern, flexible solution tailored specifically to their unique requirements, ultimately driving innovation, efficiency, and sustained competitive advantage.