Top 10 Best Insurance Policy Administration Software

Choosing the right insurance policy software is a strategic decision that directly impacts how quickly insurers can innovate, scale, and respond to customer expectations.

With legacy platforms struggling to keep pace with modern policy management needs, insurers are increasingly looking for flexible, future-ready solutions that support growth rather than limit it.

In this article, we explore the top insurance policy software options on the market and what makes them stand out in today’s highly competitive insurance landscape.

Contents

Why Insurers Need Modern Policy Administration Software?

For most insurers in 2026, the policy administration system has become the operational backbone of the entire insurance lifecycle.

From quote to bind, endorsement to renewal, modern policy management must keep up with changing customer expectations, evolving products, and increasingly complex regulations.

Legacy tools that once “did the job” now slow teams down, limit innovation, and create friction where speed and flexibility are expected.

Today’s customers judge insurers by the same standards they apply to digital banks or e-commerce platforms. They expect a seamless customer experience, intuitive self service options, and instant responses – not days of waiting for manual updates.

A modern policy administration system enables real time changes to an insurance policy, transparent communication, and user friendly portals for both customers and agents. Whether it’s updating coverage, issuing endorsements, or checking policy status, everything needs to be fast, consistent, and accessible.

From an operational perspective, modern platforms also unlock efficiencies that are impossible with fragmented systems. Advanced policy management solutions support:

- streamlined agency management across multiple distribution channels

- automation of complex workflows, especially critical in p&c insurance

- consistent data across underwriting, billing, and claims

- faster product launches without heavy IT dependency

This is particularly important for insurers operating in competitive lines like p&c insurance, where speed-to-market and pricing agility can define success. A flexible policy administration system allows insurers to adapt products, rules, and pricing models without rebuilding core infrastructure every time the market shifts.

Ultimately, modern policy administration software is more about control than just the tech itself.

Control over products, processes, and the end-to-end customer experience.

Insurers that invest in scalable, real time, and user friendly policy management platforms are better positioned to grow, innovate, and respond to market demands without being held back by their own systems.

Best Insurance Policy Administration Software on The Market in 2026

In 2026 there are plenty of policy administration systems designed to meet the needs of different niches and business models – from global carriers to MGAs and specialty lines.

Whether you’re focused on p&c insurance, life and annuity, or hybrid products, the right policy management solution can transform operations and customer experience.

Below, we explore some of the best insurance policy administration software on the market in 2026, highlighting their strengths and ideal use cases.

Guidewire PolicyCenter

General Overview

Guidewire PolicyCenter is an industry-leading policy administration system for p&c insurance that helps property and casualty insurers manage the entire policy lifecycle from quote to renewal.

It is known for high configurability and robust functionality, enabling carriers to launch new products in weeks and adapt quickly to market changes.

Ideal For

Medium to large P&C insurance carriers that require a comprehensive, scalable PAS.

Guidewire is frequently chosen by Tier-1 insurers worldwide for personal, commercial, and specialty lines due to its rich features and track record. It’s best for organizations that need enterprise-grade performance, extensive out-of-the-box content (ISO product models, etc.), and the ability to handle high volumes of policies and transactions.

Key Features

- End-to-end policy lifecycle (quote → renewal)

- Advanced underwriting and risk analytics

- No-code product configuration

- Open APIs and InsuranceSuite integration

Openkoda Policy Management

General Overview

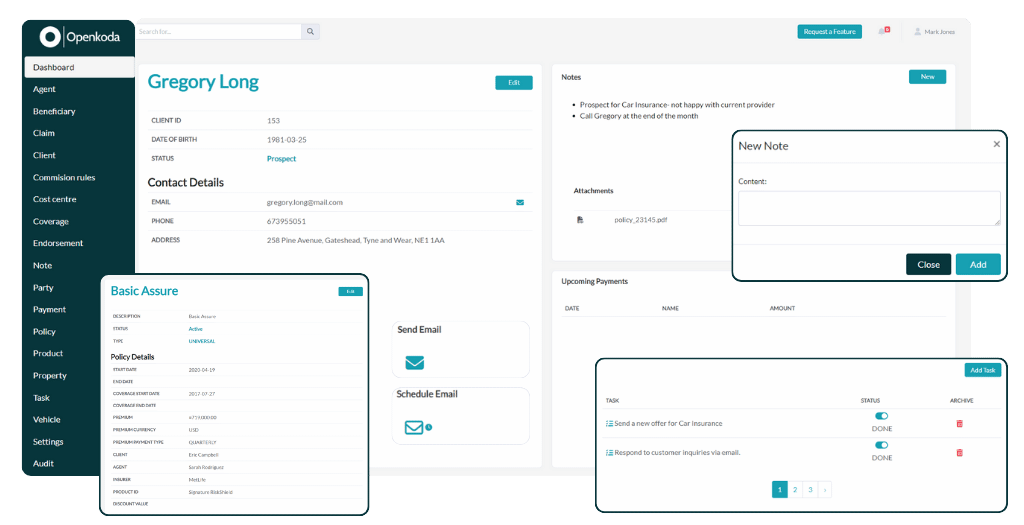

Openkoda is an modular insurance application platform that includes robust, production-ready modules for policy administration and claims management, designed to help insurers build and evolve specialized insurance systems significantly faster than starting from scratch.

It combines an insurance-ready foundation (security, workflows, integrations, portals, reporting) with template modules for core insurance operations – so teams can move from concept to product launches with far less overhead, while keeping full code ownership and avoiding vendor lock-in. Openkoda can run as a managed cloud service or be self-hosted, which is particularly valuable for organizations with strict compliance, deployment, or data residency requirements.

Ideal For

Openkoda is ideal for mid-to-large insurers and MGAs, especially those operating in specialty lines or working with unusual, non-standard insurance products.

It is well suited for organizations that need fast time to market, frequent product changes, and the ability to support complex new business and claims management processes without being constrained by a vendor’s configuration limits. Insurers with strong technical teams or strategic technology partners benefit most from Openkoda’s extensibility and long-term flexibility.

Key Features

- Policy administration module: Core policy lifecycle templates (issue, endorse, renew, cancel) ready to extend

- Claims management module: Configurable claims workflows, statuses, and servicing logic

- Rapid product launches: Template-based foundation accelerates time to market

- Unlimited customization: Specialty logic built on top with no functional constraints

- Open-source core: Full code ownership, no vendor lock-in

- Modular architecture: Use only needed components (policy, claims, embedded insurance)

- Reporting AI: Natural-language insights into operational data

- Document generation: Policy and claims documents with custom templates

- Workflow & role management: Configurable processes and role-based access

- API-first design: Easy integration with portals, partners, and external systems

Duck Creek Policy

General Overview

Duck Creek Policy is a core policy administration solution known for its agility and breadth in the property & casualty space. It provides an end-to-end lifecycle platform to quote, issue, and manage policies across personal, commercial, and specialty lines.

Duck Creek’s modern cloud-native design (via Duck Creek OnDemand SaaS) allows insurers to innovate rapidly and scale globally while maintaining precision and control in underwriting and servicing.

Ideal For

Duck Creek Policy is best suited for mid-size to large insurers that require a proven, enterprise-grade PAS, particularly in the P&C segment.

Many Tier-1 carriers globally use Duck Creek for its rich functionality and cloud delivery — for example, it handles high-volume auto and property books with ease. It’s also suitable for insurers operating in multiple regions, as it comes with extensive pre-built content (ISO lines, bureau content) and multi-country support.

Key Features

- Low-code product and rule configuration

- Built-in rating engine and forms management

- Extensive API ecosystem (2000+ APIs)

- Automated, omnichannel policy processing

[Read

Majesco Policy

General Overview

Majesco Policy is a component of Majesco’s cloud-native insurance platform, offering policy administration solutions for both Property & Casualty (P&C) and Life & Annuities (L&A) insurers.

Majesco’s system is designed to provide agility, innovation, and speed, enabling insurers to configure products easily and bring new offerings to market quickly. It unifies policy processing with analytics and a rich marketplace of integrations to support end-to-end insurance operations.

Ideal For

Majesco Policy is a good fit for insurers of all sizes across P&C and L&A sectors who seek a modern, cloud-based core system. It’s used by both P&C carriers (for personal and commercial lines) and life/health insurers, as well as MGAs and insurance administrators. Mid-tier insurance companies benefit from Majesco’s robust functionality without the footprint of heavier legacy systems, while larger insurers appreciate its cloud scalability and the breadth of industry support.

Key Features

- Cloud-native, microservices architecture

- Rapid product configuration with templates

- AI-driven automation for underwriting and renewals

- Omnichannel portals for agents and customers

EIS Policy Management

General Overview

EIS PolicyCore is the policy administration module of the EIS Suite, a cloud-native, API-driven core insurance system.

EIS (Excellence in Insurance Software) provides a unified platform for policy, billing, claims, and customer management, enabling insurers to operate with the agility of a tech company.

Ideal For

EIS PolicyCore is often chosen by small to mid-sized insurers and innovative carriers aiming to modernize their core systems.

It’s well-suited for insurers that want a cloud-based solution with a faster implementation timeline than some larger suites. P&C insurers with a focus on digital capabilities, as well as group/life insurers (EIS has customers in benefits insurance), can leverage PolicyCore’s flexibility.

Key Features

- Multi-line, full policy lifecycle management

- No/low-code product factory (Product Studio)

- Embedded rating and real-time analytics

- API-first integration with external systems

BriteCore

General Overview

BriteCore is a cloud-native core insurance platform tailored primarily to property and casualty insurers. It delivers a full-featured policy administration system alongside modules for billing and claims, all unified in one system

BriteCore emphasizes ease of product configuration and the ability for non-technical users to manage rates and rules, enabling carriers to rapidly introduce new products or make updates. The system includes self-service portals for agents and policyholders, providing a modern, digital experience out of the box.

Ideal For

BriteCore is well-suited for mid-size carriers, regional insurers, and fast-growing MGAs in the P&C sector. Over 100 insurers (including many mutuals and smaller companies in North America) use BriteCore. It’s an attractive option for organizations that want a modern system without the high overhead of the largest vendors.

Key Features

- Unified policy, billing, and claims platform

- Low-code rate, rule, and form configuration

- Built-in agent portals and insurance broker portal

- Standard reporting and analytics tools

- Insurance rating engine

Insly

General Overview

Insly is a cloud-based insurance software platform offering full-cycle policy administration with a strong focus on MGAs, brokers, and small insurers. Launched in 2014, Insly provides a low-code/no-code environment for designing insurance products, along with modules for quote distribution, policy management, billing, accounting, and claims handling.

It’s essentially a one-stop solution for managing the insurance business of an MGA or digital insurer, enabling quick launch of new products and automation of back-office processes.

Ideal For

Insly is ideal for Managing General Agents (MGAs), insurance brokers, and small insurance companies or captives. It’s built around the needs of MGAs and intermediaries – for example, it supports lines of business spanning personal and commercial lines (from motor and property to niche products like aviation or D&O, as their case studies show).

Insurtech startups looking to enter the market quickly with a new product often choose Insly for its quick setup and low upfront cost approach.

Key Features

- No-code product builder for fast launches

- Multi-channel distribution and CRM

- Integrated accounting and compliance reporting for ACORD form

- Built-in claims management module

Quick Silver Systems

Quick Silver Systems offers the Mercury Platform, a state-of-the-art 100% web-based policy and claims administration system built by insurance industry professionals for P&C insurance companies.

Mercury provides a comprehensive, centralized system to handle every aspect of the policy lifecycle with speed and efficiency. From initial quote and underwriting to policy issuance, mid-term changes, and renewals, the platform streamlines operations through intuitive interfaces and automated workflows.

Ideal For

Mercury is geared toward P&C insurers and MGAs looking for a robust yet cost-effective core system. It is particularly attractive to small and mid-sized carriers, regional insurers, mutuals, captives, and startup insurance programs. Quick Silver’s client base and marketing indicate they serve companies writing anywhere from under $1M in premium up to around $200M+ in premium.

Key Features

- Combined policy and claims administration

- Highly configurable workflows and underwriting rules

- Built-in document management and notifications

- Real-time dashboards and regulatory compliance reporting

FINEOS Policy

General Overview

FINEOS Policy is a purpose-built policy administration system for the Life, Accident & Health insurance industry, especially targeting the Employee Benefits and group insurance market. It manages the full policy lifecycle at both the group (employer) level and member (individual insured) level, which is essential for benefits and group voluntary products.

As part of the FINEOS AdminSuite, it seamlessly connects with FINEOS modules for billing, claims, absence management, and others to provide a holistic core platform for L&A carriers.

Ideal For

FINEOS Policy is tailored for large and mid-sized life, accident, and health insurers, particularly those in the group and employee benefits space. In fact, FINEOS is used by 7 of the 10 largest group life and health carriers in the US, and by major insurers in markets like Australia.

It’s an excellent choice for carriers offering group life, disability, supplemental health (critical illness, accident), dental/vision, and similar products, as well as individual life or annuities in some cases.

FINEOS pricing can start in the range of $500–$1,000 (likely per module or user per month).

Key Features

- Group and member-level policy management

- Workflow automation with full version control

- API-based integration with third party service providers

- Pre-built templates for life & benefits products

Collaborus Cloud

General Overview

Collaborus Cloud is a global, insurance distribution and policy administration platform developed by eBaoTech (Shanghai, China) based on cloud native architecture.

It is a full lifecycle system with a specialty in digital insurance distribution – enabling insurers and underwriting agencies (MGAs) to digitize products and externalize them to various channels. Collaborus Cloud handles everything from initial lead and quote through policy issuance and servicing, with tools to streamline interactions between internal staff, brokers/agents, and even consumers in real-time.

Ideal For

Collaborus Cloud is ideal for insurers, MGAs, and insurance innovators who prioritize digital distribution and partner integration. It’s particularly popular among underwriting agencies, brokers with binder authority, and insurers launching new digital channels. For example, insurers that want to quickly enable brokers or affinity partners to sell their products online can use Collaborus as a ready-made solution.

Key Features

- Digital distribution and channel management

- Role-based portals for insurers, brokers, customers

- Product externalization via APIs (embedded insurance)

- Automated policy processing and bordereau reporting