Insurance Industry and Insurtech Trends for 2026

At the start of 2026, the insurance industry is adjusting to a new mix of pressures and opportunities—from shifting interest rates to rising loss volatility and faster digital expectations across the insurance sector.

The most important insurtech trends this year are about building practical capabilities that improve speed, relevance, and trust.

Ultimately, the winners will be the organizations that translate innovation into measurable customer satisfaction – not in pilots, but in everyday underwriting, servicing, and claims.

Contents

- State of Insurance Industry in 2026: “Selectively Softer,” But Nobody’s Relaxing

- The trends to watch in 2026

- Trend 1: Embedded insurance becomes the default distribution layer

- Trend 2: Generative AI moves from “Inspiring Demos” to Targeted Automation

- Trend 3: Parametric Insurance Grows Up: Fast Payouts For a World With a Widening Protection Gap

- Trend 4: Digital Twins Shift Insurance From Paying Claims to Preventing Loss

- Trend 5: Exploring Specialty Insurance Lines: Niche Products Become a Growth Engine

State of Insurance Industry in 2026: “Selectively Softer,” But Nobody’s Relaxing

If you talk to insurance industry leaders in January 2026, you’ll hear a familiar mix of confidence and caution.

On one hand, global supervisors and industry bodies are calling the sector broadly stable going into 2026, with solid capital positions and profitability holding up even amid macro uncertainty.

On the other hand, risk is getting less predictable – and the industry knows it.

Two signals set the tone right now:

- Reinsurance is loosening (in places). Multiple market updates around the January 1 renewals describe abundant capacity and continuing price reductions/greater flexibility across many programs—helpful breathing room for cedants after a tough stretch.

- Climate losses are still relentlessly high. Swiss Re Institute data reported by Reuters points to another year above the $100B insured-loss mark globally—yet again. That reality keeps boards focused on exposure, accumulation, and protection gaps even if pricing momentum cools.

- Capital markets are quietly “refilling the tank.” Record catastrophe-bond momentum is keeping alternative capital front-and-center—and that extra risk-bearing capacity is one reason the reinsurance conversation feels less constrained than it did a year or two ago.

- AI is shifting from innovation story to governance story. Regulators are hardening expectations around model controls, transparency, and discrimination risk (with insurance-specific frameworks already expanding in some jurisdictions), while the liability market experiments with exclusions and tighter wording around AI-related errors. Translation: adoption is accelerating – but so are guardrails.

The Trends to Watch in 2026

The insurance market isn’t being reshaped by one “big thing.”

It’s a set of shifts that reinforce each other: distribution moving into digital ecosystems, operations becoming more automated, and products becoming more responsive to real-time data.

Let’s go one by one – starting with embedded insurance.

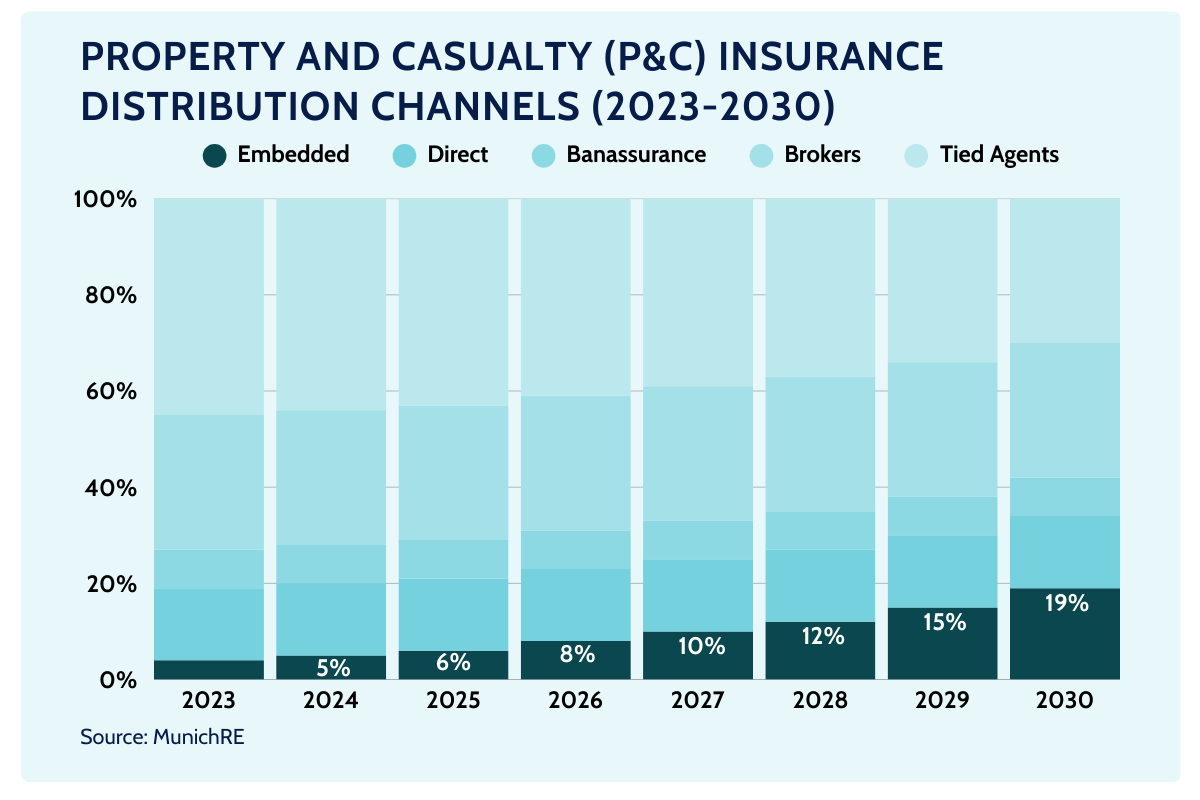

Trend 1: Embedded insurance becomes the default distribution layer

Embedded insurance is no longer going to be just a simple “insurance at checkout.”

In 2026, it’s better described as embedded insurance products delivered inside someone else’s customer journey – a car purchase, a flight booking, an ecommerce order, or a SaaS onboarding flow across the wider insurance sector.

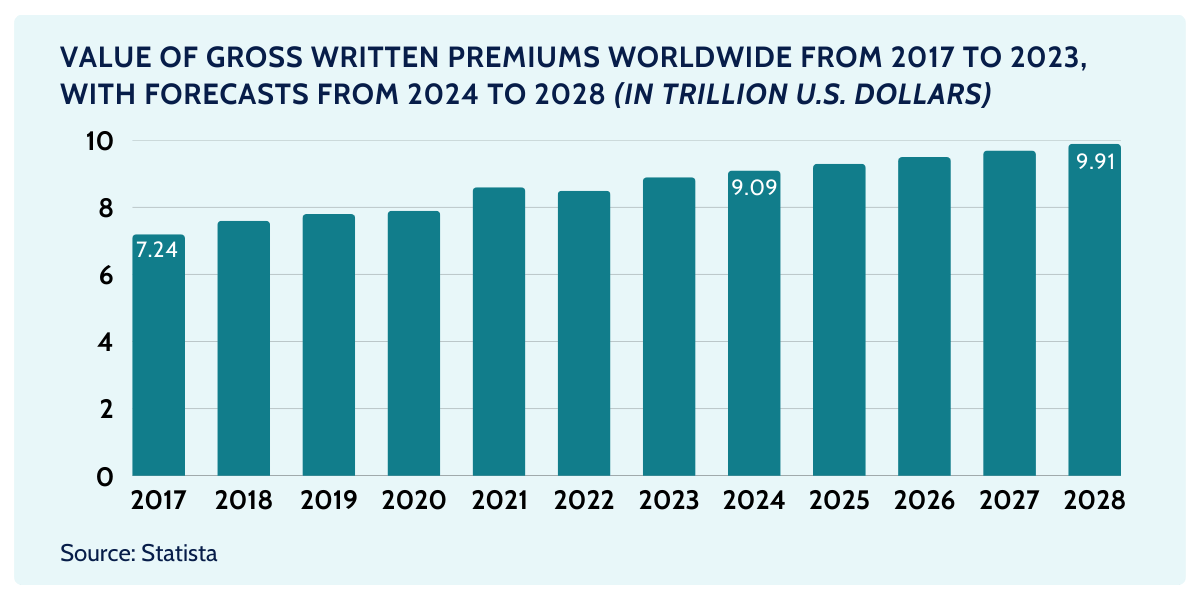

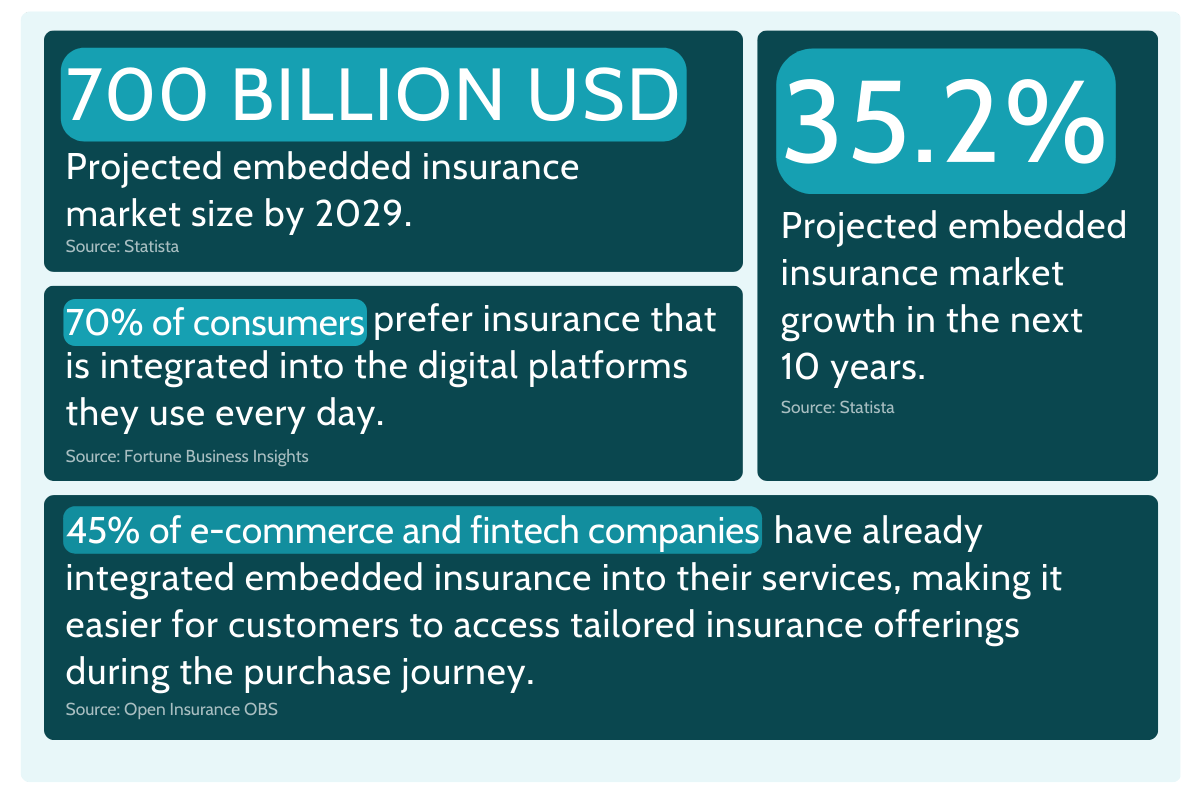

Analysts see it scaling fast, with projections reaching hundreds of billions in gross written premiums globally by 2030.

Fortune Business Insights projects the global market to grow from $176.35B in 2026 to $1,464.42B by 2034 (a dramatic scale-up over the decade) (FortuneBusinessInsights). On the demand side, J.D. Power survey data reported by Investopedia found 37% of Americans would consider buying embedded auto insurance, rising to 47% among Millennials and Gen Z—a strong signal that point-of-sale coverage is becoming a preferred path for younger buyers. (Investopedia)

We’ve compiled all of the recent insights and data regarding the embedded channel in this latest overview: Embedded Insurance Statistics and Market Dynamics (2026).

What’s driving it is simple: convenience.

Customers don’t want a separate search, quote, and purchase process when the need is obvious in the moment. And platforms like marketplaces and retailers want a cleaner experience plus new revenue streams. For many insurance companies, that means treating embedded as a core channel strategy – and using data analytics to understand which touchpoints convert, which coverages attach, and where customers drop off.

What embedded looks like when it’s done well

From the outside, the experience is quick: one or two clicks, minimal friction, clear value.

But behind the scenes, embedded models only work when insurers can support fast, reliable decisions and adapt insurance products to different partner journeys – often using machine learning to speed up eligibility checks, pricing, and routing.

- Fast pricing and eligibility checks (often in seconds, not minutes)

- Digital underwriting workflows that don’t break when data is incomplete or messy

- A claims experience that matches the promise (simple, trackable, fast communication)

- Partner-friendly integration (stable APIs, versioning, monitoring, SLAs)

[Read also: Embedded Car Insurance: How to Build It?]

The part many teams underestimate: customizability (especially for specialty lines)

Embedded distribution tends to start with simple products – travel, gadget, basic auto add-ons – because they’re easier to standardize. But in 2026, growth increasingly depends on bringing specialty and niche coverage into embedded channels too, as the insurance industry responds to a more fragmented and demanding insurance landscape.

Specialty lines don’t fit neatly into a generic “quote widget.”

They often require:

- more detailed underwriting questions,

- custom documents and endorsements,

- broker or partner-specific rules,

- different compliance constraints by market,

- and non-standard pricing logic.

That’s why the real enabler is customizability: the ability to adapt the quote/bind flow, data capture, underwriting rules, and integrations to each partner journey without rebuilding everything from scratch.

In practical terms, if the embedded experience can’t be tailored, the channel stays limited to simple products—and specialty remains stuck in slower, higher-friction distribution, even as the broader insurance business pushes for digital growth.

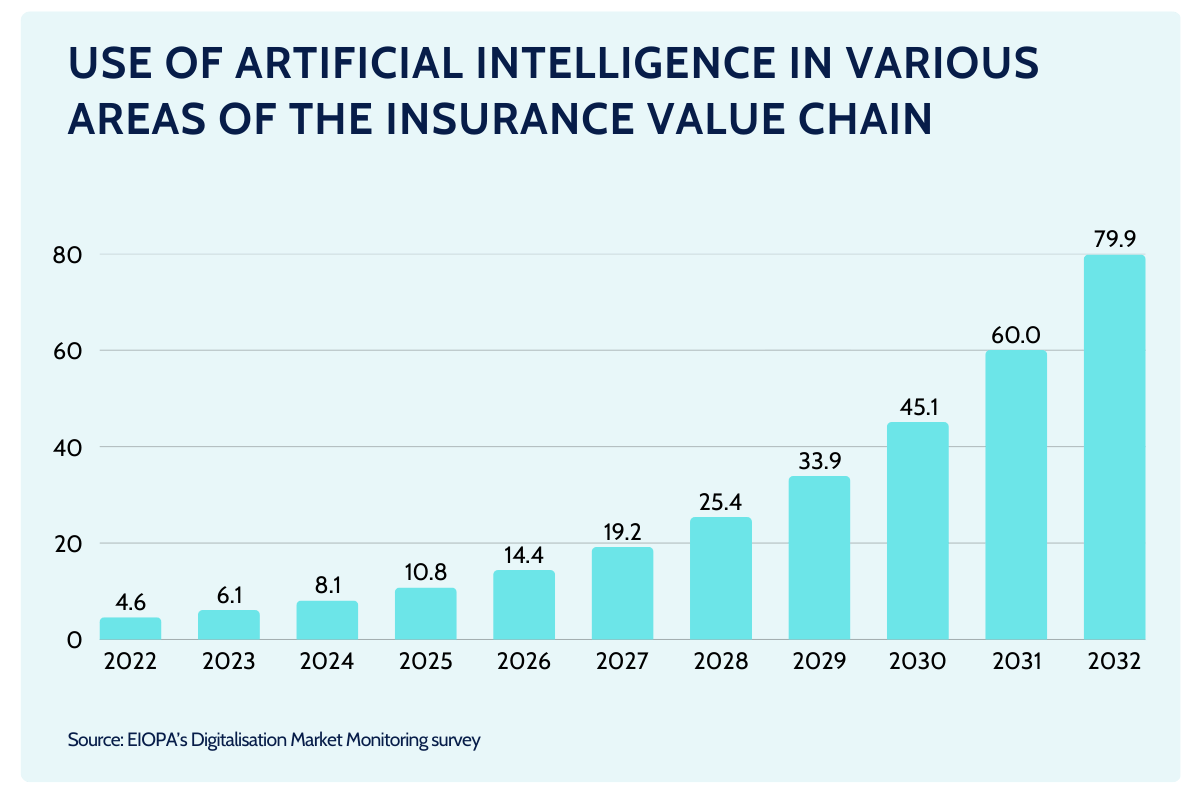

Trend 2: Generative AI moves from “Inspiring Demos” to Targeted Automation

Generative AI is now firmly on insurers’ 2026 roadmaps—but adoption looks more mature than the hype suggests.

According to latest research, nearly 90% of insurers are evaluating GenAI, and 55% say they’ve already implemented it in core functions like claims, underwriting, and customer experience.

For more stats regarding the growing usage of generative AI in the insurance sector, head on to our comprehensive summary here: AI in Insurance Industry: Statistics, Trends, Adoption, and Investments (2026)

The three patterns that keep showing up (where GenAI actually delivers)

- AI for throughput (more work per expert): In underwriting, GenAI is being used to read and summarize unstructured submissions (broker packs, medical reports, building plans), so underwriters spend less time extracting facts and more time on judgment.

- AI for consistency (better, clearer communication at scale): Claims is where the “small task automation” story is most tangible. The research notes Allstate uses OpenAI’s GPT models to draft nearly all claims-related emails – supporting 23,000 claims reps handling about 50,000 customer communications a day. Humans review, but they’re no longer writing from scratch, and Allstate reported clearer messages and faster cycle times.

- AI for signal detection (find what humans miss): Swiss Re’s ClaimsGenAI example is a good illustration of GenAI used as an analyst, not an adjuster: it reads large commercial claim files, flags anomalies (fraud/subrogation/recovery opportunities), and then routes to humans for decisions. In its first year, it flagged 1,000+ potential irregularities and uncovered additional recoveries that weren’t spotted manually.

The uncomfortable part: a lot of pilots didn’t survive contact with reality

Here’s the tension insurance leaders are working through in early 2026: the tech is real, but scaling it is hard across the insurance industry – including the life insurance industry, where complexity, regulation, and long-tail servicing make “pilot to production” especially unforgiving.

Recent industry estimates suggest a meaningful share of GenAI initiatives are being abandoned after proof-of-concept – Gartner projected at least 30% of GenAI projects would be abandoned after POC by the end of 2025.

And beyond GenAI specifically, Gartner has also warned that through 2026, organizations may abandon 60% of AI projects that aren’t supported by “AI-ready data.”

A common failure mode is not “bad prompts.”

It’s strategy – and, just as often, a missing data strategy.

Many companies tried to introduce GenAI across wide workflows – multiple departments, many use cases, unclear ownership – without the foundational governance, quality, and accessibility needed for AI to work reliably.

[Read also: Top 10 AI Reporting Tools in 2025]

A better 2026 approach: pick the task, not the department

The practical alternative is narrower and more effective:

- Choose one specific, time-consuming, repetitive task (e.g., “summarize submissions into a structured risk memo,” “draft claims emails,” “extract key fields from PDFs,” “triage FNOL into queues”).

- Define what ‘good’ looks like (quality checks, turnaround time, error thresholds, and who signs off).

- Keep humans in the loop where decisions carry risk (coverage, liability, adverse actions, disputed claims).

It’s worth stating plainly: replacing humans entirely won’t work in most insurance workflows – not because AI lacks value, but because insurance decisions are contextual, regulated, and high-stakes.

The strongest implementations use GenAI to remove repetitive work, so experienced teams can focus their judgment on the decisions that truly require it.

Trend 3: Parametric Insurance Grows Up: Fast Payouts For a World With a Widening Protection Gap

Parametric insurance is moving from “interesting niche” to a practical tool insurers can deploy at scale—especially for climate-driven volatility, agriculture, travel disruption, and energy production.

The idea is simple: instead of adjusting loss, the policy pays when a measurable trigger is hit (rainfall below a threshold, wind speed, flood depth, flight delay length).

A couple numbers make the case for why this matters in 2026:

- The protection gap is still huge. Swiss Re’s sigma data for 2024 puts global economic losses from disasters at $318B, with 57% uninsured—a protection gap of $181B.

- Parametric is small, but scaling fast. The research cites a global parametric market of ~$15B (2023), projected to grow at 11%+ CAGR (compound annual growth rate) through 2032.

Real-life Example of How Parametric Insurance Changes Customer Expectations

One of the most useful ways to understand parametric is to look at payout speed.

Recent research highlights FloodFlash, which uses an IoT sensor at the insured property and triggers payout when water reaches a defined depth. In one case, the sensor tripped at 9:40am and the payout was in the client’s bank by 1:30pm – 3 hours 50 minutes end-to-end.

A likely 2026 pattern is hybrid design: a quick parametric amount for immediate needs (cash flow, evacuation, emergency repairs) plus traditional cover for full restoration.

Trend 4: Digital Twins Shift Insurance From Paying Claims to Preventing Loss

A digital twin is a dynamic, data-driven virtual model of a real-world object, system, or process. It stays connected to the real thing through data (often from sensors, operational systems, and external sources), so it can be used to monitor what’s happening now and simulate what could happen next—before decisions are made in the real world.

Digital twins are moving into insurance industry conversations in a more serious way in 2026—showing up alongside other insurtech trends that are shifting from experimentation to deployment.

The first wave is internal. AIG’s leadership has described building a “digital twin of our business,” mapping key data, processes, and interdependencies so teams can test the impact of changes before they happen – like how a surge in claims affects operations, or how a tweak in underwriting rules changes outcomes. For insurance executives, the appeal is simple: you can stress-test decisions in a sandbox before you pay for them in production.

Then there’s the risk-side application, where this becomes more than operational efficiency. Swiss Re’s work with Microsoft on “Risk Digital Twins” is positioned as a way to simulate complex scenarios – natural catastrophes, supply chain disruptions, even pandemics – and understand portfolio impacts before losses happen. That kind of forward-looking modeling strengthens risk management and can translate into real levers: more accurate pricing, tighter accumulation control, and ultimately better-aligned insurance premiums.

And sometimes it’s very concrete.

Recent research describes a vessel’s digital twin ingesting IoT sensor data and weather inputs, detecting extreme stress from an incoming storm early enough to support a route change that avoids damage in the first place.

That same logic extends beyond marine: life insurance companies can apply “twin-like” models to operational and policyholder ecosystems – using integrated data to anticipate lapses, service bottlenecks, or fraud signals earlier. In a market where differentiation is hard, the insurers who operationalize these simulations as decision systems can turn them into a durable competitive advantage.

Trend 5: Exploring Specialty Insurance Lines: Niche Products Become a Growth Engine

Specialty insurance used to be framed as “non-standard risks.”

In 2026, it’s increasingly where demand is most predictable: new technologies, new liabilities, and fast-changing operating environments are pushing buyers toward coverage that simply doesn’t fit a one-size-fits-all policy.

The growth signals are hard to ignore. Market estimates put the global specialty insurance market at about $101B in 2024, with forecasts projecting it could more than double by 2032 (depending on definition and scope).

In the U.S., surplus lines – a major channel for specialty and hard-to-place risks – also continues to expand: one industry report shows $81B in surplus lines premium reported to stamping offices for 2024 (+12.1% YoY).

AM Best separately reported nearly $130B in U.S. surplus lines direct premiums written, up 12.3% YoY, marking multiple consecutive years of double-digit growth.

A few examples that keep gaining momentum in 2026:

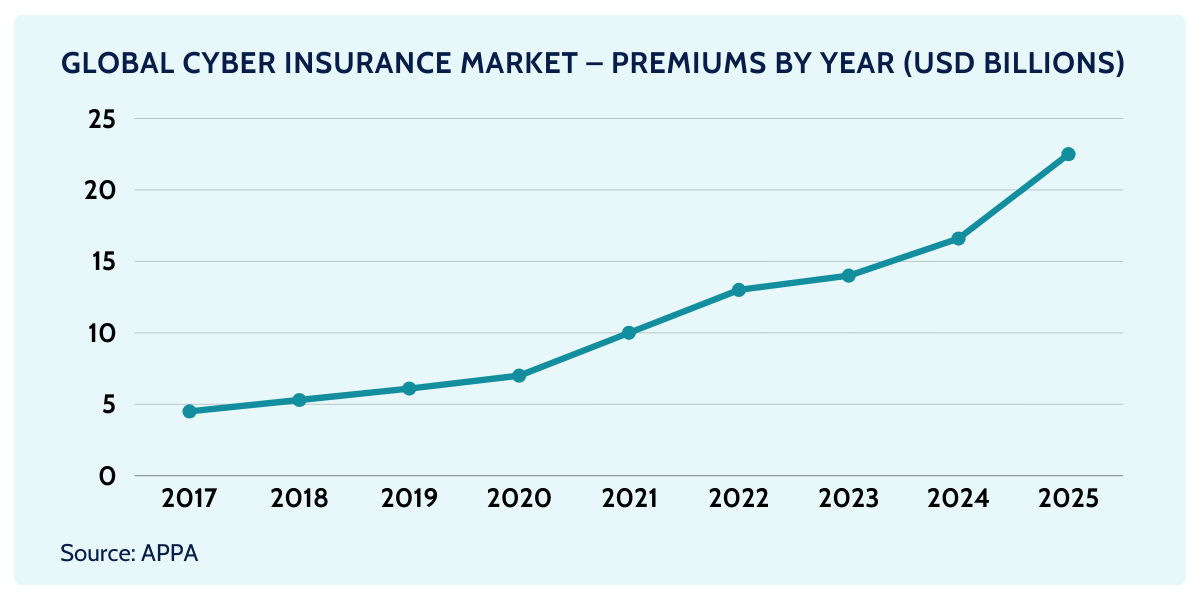

Cyber risk is the obvious one.

Swiss Re projected global cyber risk premiums of $15.6B for full-year 2025, while noting growth expectations have moderated versus earlier hype—partly because systemic cyber events are difficult to model and price.

Then there are specialty pockets shaped by geopolitics and supply chains: political violence, terrorism, trade disruption, and kidnap & ransom.

And specialty isn’t only about scary headlines.

It’s also about innovation-driven industries: renewable energy performance risks, life sciences clinical trial liabilities, product recall, tech E&O, media liability, marine/aviation, space-related risks, and emerging mobility.

Specialty growth has a technical constraint: complexity.

Specialty products often require custom underwriting rules, nuanced questionnaires, bespoke endorsements, partner-specific workflows, and non-standard claims processes.

That’s why the next phase of specialty is all about building the capability to design, develop, and deploy insurance products repeatedly – without each launch turning into a bespoke IT project.

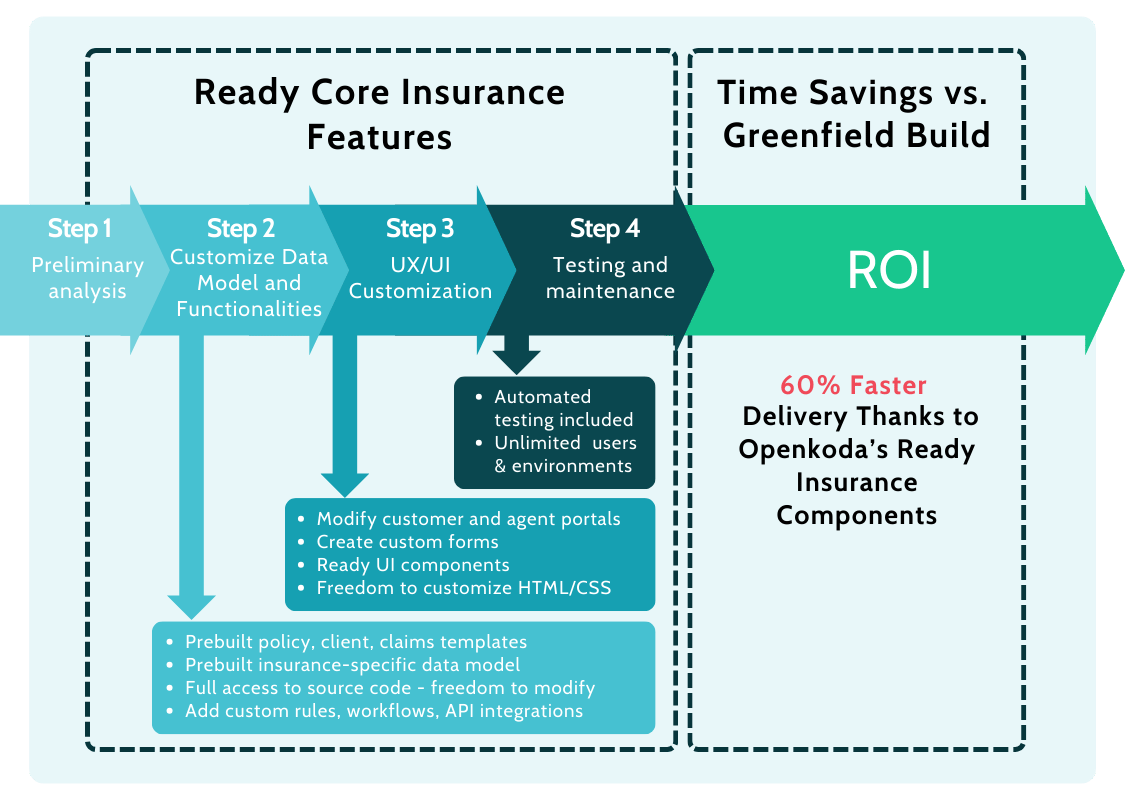

This is where platforms like Openkoda matter.

Specialty lines typically demand constant change: new clauses, shifting eligibility rules, updated risk questions, fresh integrations with broker portals or data providers, and different document templates depending on segment or jurisdiction.

If every change requires a long backlog cycle in a monolithic core system, specialty becomes slow and expensive – exactly the opposite of what the market is rewarding in 2026.

Openkoda supports a more modular approach: insurers can build and evolve specialty products as configurable workflows and components, rather than hard-coded one-offs.

That makes it easier to:

- Model specialty underwriting workflows that reflect real-world complexity (including manual review steps where needed), without losing automation.

- Create custom quote and bind journeys for different partners or distribution channels – especially important when embedding specialty coverage.

- Generate and manage documents dynamically, using templates that can be adjusted per product, client segment, or regulatory requirement.

- Integrate cleanly with the rest of the stack – policy management, claims management, payment providers, KYC, fraud tools, data sources – without reinventing the wheel every time.

[Read also: Top 10 P&C Insurance Software Vendors in 2026]

Closing Thoughts

Taken together, these trends point to a simple reality: the insurance sector is becoming more embedded, more automated, and more specialized at the same time.

The insurance industry will get the most value from insurtech trends when technology is applied with focus – improving real workflows and outcomes instead of trying to transform everything at once.

And in an environment shaped by interest rates and tighter customer expectations, customer satisfaction will increasingly be the clearest indicator of whether these shifts are working.