How to Build Insurance Application Faster

Insurers need to be able to innovate faster.

They shouldn’t be forced to navigate cumbersome, legacy systems that impede rapid deployment and adaptation.

Luckily, there’s an alternative.

Meet Openkoda – a cutting-edge platform that transforms insurance application development. Let’s discover how your company can move from idea to ready insurance product up to 60% faster without sacrificing software quality.

Key Takeaways

- Custom insurance applications are designed to align with unique operational needs, driving competitive differentiation and scalability.

- Traditional insurance app development is complex; modern platforms like Openkoda accelerate the process and reduce time-to-market.

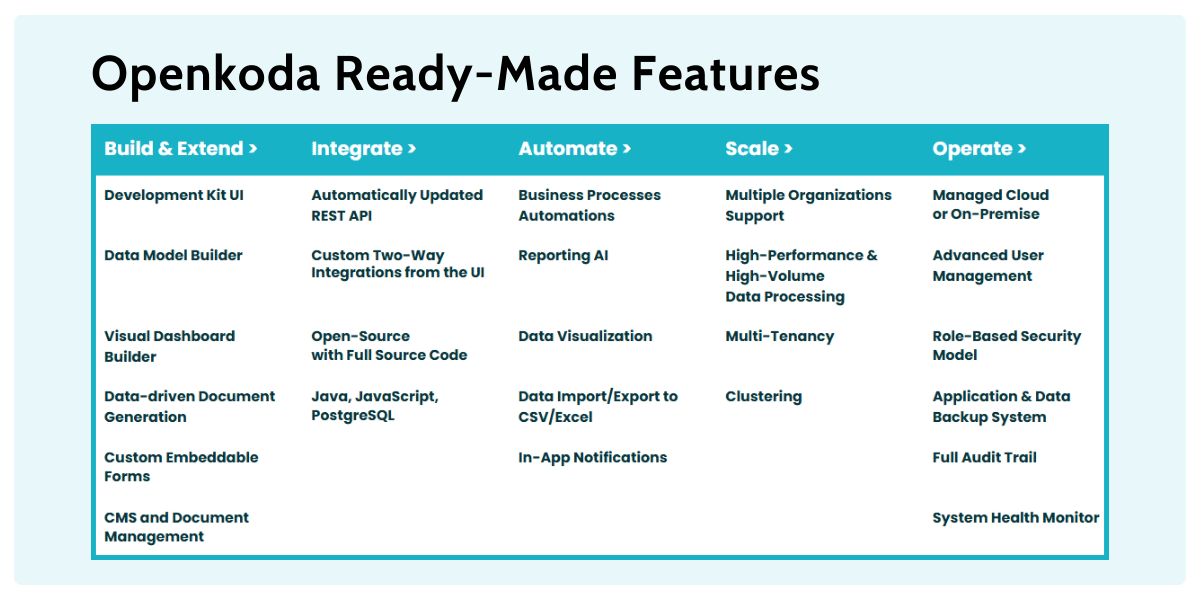

- Leveraging ready-made functionalities—such as app templates, dashboard builders, AI reporting, and automated document generation—can speed u

Insurance Application Development: Smarter Approach

In 2025, significant segments of the insurance sector are still struggling with incomplete digital transformation.

Legacy systems, cumbersome processes and high development costs have left many insurers looking for cost-effective alternatives to the traditional custom software development model.

This environment demands a smarter approach – one that not only accelerates innovation, but also closely aligns with evolving business needs and market pressures.

Custom Insurance Applications: The Basics

Unlike off-the-shelf solutions, a custom insurance application is built to address your organization’s unique challenges and opportunities.

Every feature and function is purposefully designed to align with your business objectives, ensuring a solution that truly reflects your vision.

So, why invest in custom software instead of a ready-made option?

Here are three key reasons:

- Automating Underwriting Processes: Automating risk assessment and decision-making workflows.

- Enhancing Customer Engagement: Offering personalized digital interfaces for policy management and claims processing.

- Integrating Legacy Systems: Bridging gaps between existing platforms and modern cloud-based solutions.

Ultimately, the decision to go custom is driven by a commitment to innovation and excellence.

It is the uniqueness of your idea – coupled with the technological precision of a bespoke application – that can deliver truly unique value.

There’s just one caveat.

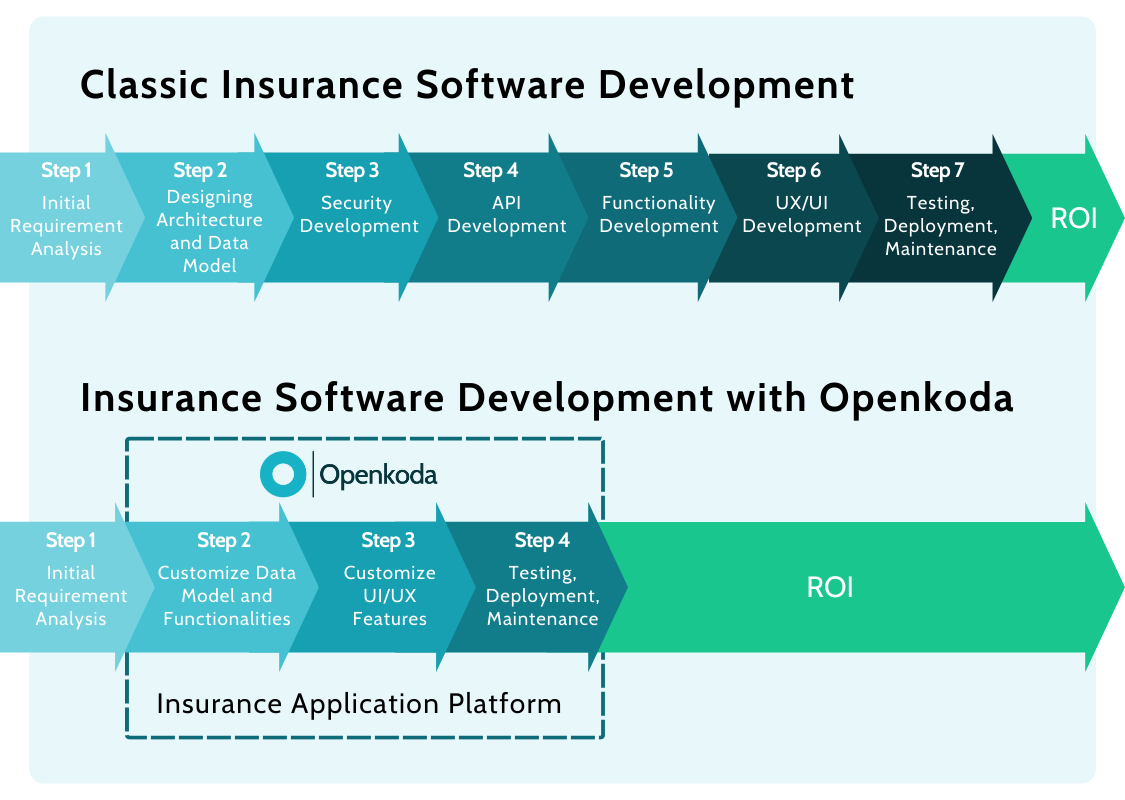

The traditional journey from idea to working product is long and arduous. Let’s take a quick look at how this process usually plays out to better understand how platforms like Openkoda put it into overdrive.

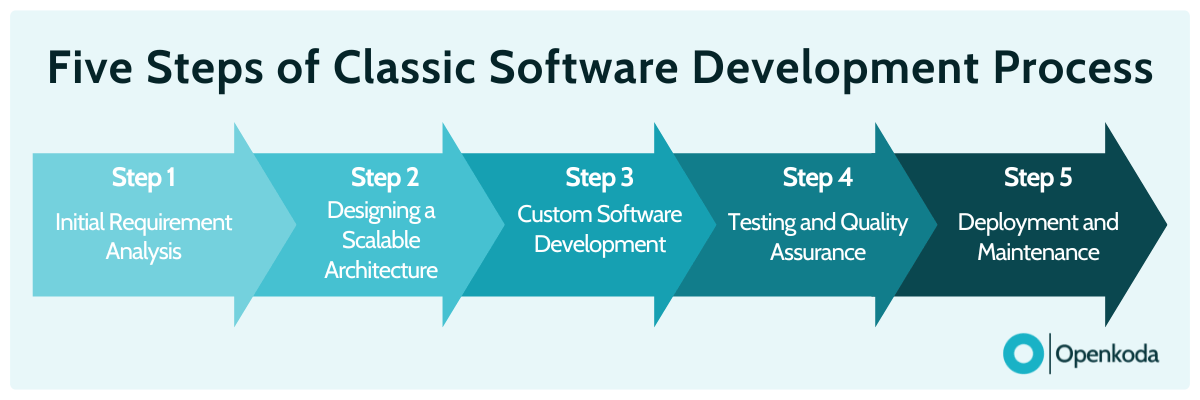

Classic Insurance App Development Process

Traditional custom insurance software development is a methodical, resource-intensive journey that requires a deep understanding of both the technical intricacies and the strict regulatory environment unique to the insurance industry.

While the thoroughness of this process ensures reliability and compliance, it also results in long development cycles and significant resource commitments.

- Phase 1: Requirements Analysis: Capture business objectives and regulatory mandates.

- Phase 2: System Design: Define architectural blueprint and API integration framework.

- Phase 3: Development: Build bespoke software components aligned with industry specifics.

- Phase 4: Testing & Quality Assurance Verify functionality, performance, and compliance rigorously.

- Phase 5: Deployment & Maintenance Roll out the system with ongoing monitoring and updates.

Each phase is critical to the overall success of the project.

Requirements analysis lays the groundwork by matching technical capabilities with your idea for a new insurance application that could enhance our internal operations or serve external users.

The development phase is characterised by iterative coding and integration, where specialist expertise is essential to manage the inherent complexities.

Finally, deployment and maintenance underscore the need for continuous monitoring and iterative improvements to keep pace with evolving regulations and market dynamics.

This whole process is undoubtedly comprehensive, and when carried out by professionals experienced in the nuances of the insurance industry, it yields positive results, but it is extremely time and resource-consuming.

Let’s consider an alternative – a way to build quality insurance software faster and more efficiently than ever before.

Faster Approach Using Openkoda Platform

Enter Openkoda – a transformative solution designed to accelerate the development of insurance software.

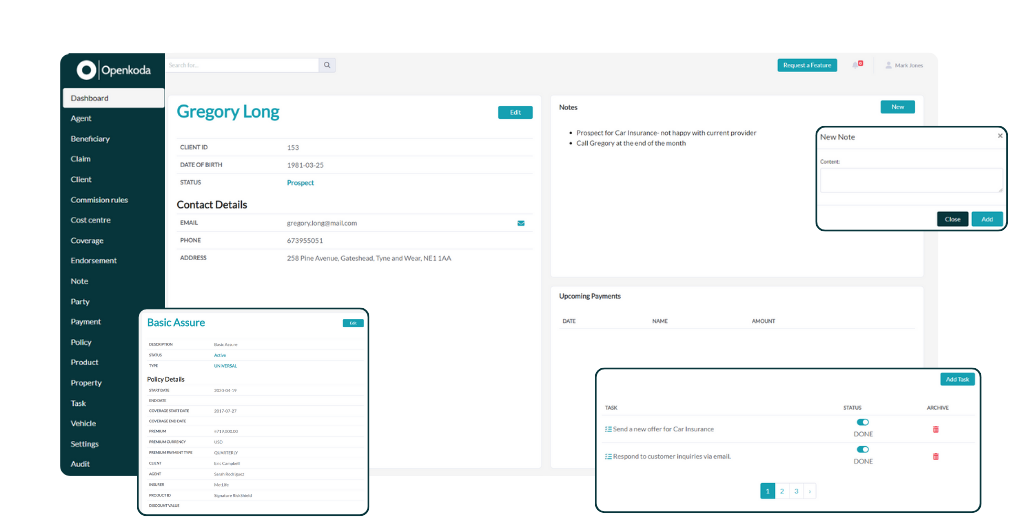

The platform uses a modular architecture and pre-built components to significantly reduce development time, while maintaining the flexibility to customise key functionality without major backlog delays.

How does it work? Take the claims management process as an example.

Traditionally, developing a robust claims management system involves extensive custom coding, intricate integration work, and protracted development cycles.

With Openkoda, insurers can deploy a fully integrated claims management application template that comes equipped with a ready-made insurance-specific data model and plenty of features.

This approach not only accelerates time-to-market but also guarantees that the system is scalable and efficient from day one.

Openkoda offers custom insurance app development services provided by a dedicated team of seasoned professionals.

This expert development team not only leverages the robust capabilities of the Openkoda platform but also brings deep industry knowledge and technical expertise to the table.

They guide clients through every phase of the process—from designing and developing to deploying new insurance applications—ensuring that even the most innovative solutions are delivered faster and more efficiently than the competition.

One of the key advantages of the Openkoda platform is its adaptability.

All calculation rules, risk assessments, and internal logic are built to be easily reconfigured.

This means that as market conditions evolve or regulatory requirements change, modifications can be implemented swiftly—without the need for extensive rework or prolonged project backlogs.

Key technical features of Openkoda include:

- Modular Architecture: This facilitates plug-and-play integration of various insurance components.

- Pre-integrated Compliance Modules: Streamlines adherence to regulatory standards.

- Customizable Business Rules Engine: This allows dynamic adjustments to underwriting and claims calculations.

- Real-time Analytics Dashboard: Offers immediate insights into operational performance.

- Cloud-native Scalability: Ensures that the platform can grow alongside your business needs.

By harnessing a suit of ready-made features, pre-built templates, and the expertise of the Openkoda development team, insurers can achieve rapid market entry while maintaining the flexibility to continuously enhance their applications.

Have a Game-Changer Insurance App Idea? Build It with Openkoda!

Groundbreaking ideas for custom applications can redefine how insurance business engage with clients and manage operations.

Unique concepts—ranging from leveraging AI for personalized risk analysis to integrating real-time data streams—offer distinct value that traditional off-the-shelf systems simply cannot match.

Openkoda enables innovators to translate these concepts into robust, agile solutions that stand apart in terms of functionality, scalability, and efficiency.

Insurance Policy Management Application Development

With over 80% of insurance providers grappling with slow manual processes, potential revenue loss and declining customer satisfaction have become critical challenges.

Implementing an effective Insurance Policy Management System is essential to streamline operations and enhance overall service delivery.

Such systems are designed to transform outdated, labor-intensive procedures into efficient, automated workflows, ensuring that agencies can focus on strategic growth rather than routine administration.

A modern policy management solution not only accelerates core processes but also provides a comprehensive suite of tools that significantly enhance operational efficiency.

Do you have your own idea for a functionality that can transform the policy management process?

Check out this quick demo to learn how you can build a policy management application prototype in just a couple of minutes using the Openkoda Platform:

Key Openkoda Functionalities

- Policy Management App Template: A ready-to-use framework that accelerates deployment and ensures consistency across policy-related operations.

- Dashboard Builder: Customizable dashboards that offer real-time insights into policy performance and key metrics.

- Reporting AI: Advanced analytics that automate the creation of detailed reports, helping to uncover trends and inform decision-making.

- In-App Notifications: Timely alerts that keep users informed of critical updates and policy changes.

- Data-driven PDF, Word, and Excel Document Generation: Automated document creation that ensures consistency and accuracy in policy documentation.

- Automatically Updated REST API: Seamless integration capabilities that keep the system current and interoperable with other platforms.

Claims Management Application Development

Custom claims management applications simplify the claims process from initiation to resolution.

Such systems have been around for a long time, but that doesn’t mean there’s no room for innovation.

According to the latest data, insurance automation in claims processing reduces time by 30-50%, resulting in cost savings of 25-30% for the insurance industry. AI-driven insurance claims processing can improve fraud detection rates by 30% and reduce manual workload by 40%. 60% of insurance companies have either adopted or plan to adopt AI-powered claims management by 2025.

These stats show that a custom claims management app with integrated AI functionalities and advanced automation holds great potential for success on insurtech market.

Custom claims management insurance apps can reduce processing times, ensure consistent compliance with regulatory standards, and enhance customer satisfaction through real-time status updates.

A well-designed claims solution mitigates errors and facilitates seamless communication across multiple stakeholders.

Key Openkoda Functionalities

- Ready-made Claims Management Insurance App Template: Jumpstart your project with a pre-configured solution designed to cover core claims processes.

- Role-based Security: Ensure that sensitive data is accessible only to authorized personnel, reinforcing data integrity and compliance.

- Custom Privileges: Define and manage access levels tailored to your organizational structure and regulatory needs.

- Visual Data Model Builder: Simplify the creation and management of data models to quickly adapt to evolving claims processes.

Underwriting Dashboard Development

Underwriting is the backbone of insurance operations, and a robust underwriting dashboard is essential for enhancing risk assessment and decision-making efficiency.

A custom underwriting dashboard insurance app can offer your business and your clients a centralized view of risk profiles, enabling more informed decision-making. It can also incorporate advanced analytics, real-time data visualization, and automated risk assessment tools.

This empowers your underwriters to quickly identify trends, manage risk exposures, and adjust policies proactively based on actionable insights.

Key Openkoda Functionalities

- Real-time Analytics Tools: Deliver continuous monitoring and instant data updates for timely decision-making.

- Customizable Data Visualization Modules: Enable tailored dashboard views that reflect unique business requirements and risk profiles.

- Dynamic Business Rules Engine: Automatically adjusts underwriting criteria and risk thresholds based on real-time data inputs.

- Integrated Reporting Capabilities: Streamline regulatory reporting and performance tracking with automated insights.

Custom Embedded Insurance App

Embedded insurance is emerging as one of the most compelling trends in the insurance industry, offering a strategic avenue for insurers to diversify their sales channels and appeal to a younger, digitally-savvy customer base.

It works by integrating insurance offerings directly into the customer’s purchase journey, whether on a digital platform or in a physical retail environment.

By 2033, embedded insurance is expected to make up 15% of global GWP (~$1.1 trillion), up from 3-5% today. Offering embedded insurance can raise purchase intent by 25%. These stats underscore the potential within this unique insurance sales channel.

With Openkoda, creating custom embedded insurance app solutions becomes a streamlined process.

The platform’s embeddable insurance forms allow insurers to integrate insurance offerings directly into a wide range of digital platforms—be it an e-commerce site, a travel booking portal, or a mobile insurance app.

Check out this demo to see how you can customize your own embeddable car insurance form within Openkoda platform:

Key Openkoda Functionalities:

- Embeddable Insurance Forms:

- API-driven Integration: Enables smooth embedding of insurance forms within third-party platforms.

- Customizable Front-End Modules: Tailors the user interface to match the look and feel of existing digital experiences.

- Dynamic Business Rules Engine: Allows real-time adjustments to underwriting criteria and pricing models.

Launch & Scale Insurance Products Faster, Without Risk

Smart insurance providers seek innovative insurance products to unlock alternative revenue streams.

This requires rapid setup and real-world testing.

Openkoda’s agile approach enables iterative development, allowing continuous refinement based on market feedback.

Its flexibility is a key advantage, facilitating quick adjustments to underlying logic and seamless adaptation across multiple sales channels.

Key Openkoda Functionalities

- Flexible business rules engine for quick adjustments

- Agile module configuration and deployment tools

[Read also: Top 10 Insurance Software Development Companies in 2025]

Bottom Line: Faster Insurance Application Development

Custom insurance app development could empower organizations to streamline core processes, enhance customer engagement, and launch truly innovative insurance products in an industry where there’s still a massive need for digital transformation.

While traditional insurance product development methods can deliver top-notch insurance applications tailored to the needs of a single company, they often involve lengthy, resource-intensive cycles.

A custom approach driven by modern platforms like Openkoda, on the other hand, delivers agility and efficiency that the custom software development market needs so badly.

By harnessing ready-to-use templates, advanced analytics, and automated document generation, insurers can transition from manual, error-prone workflows to dynamic, data-driven operations.

Ultimately, embracing faster, custom development is not just about keeping pace with change; it’s about setting a new standard for service, performance, and strategic growth in the insurance industry.