Accelerating Insurance Digital Transformation: 2026 Outlook

The insurance industry is changing faster than ever, shaped by an increasingly digital world and shifting customer expectations.

What worked even a few years ago is no longer enough to stay competitive or relevant.

Let’s take a clear look at how digital transformation is reshaping insurance – and where leaders should focus next.

Understanding Digital Transformation in Insurance

What Is Digital Transformation in Insurance?

These days, digital transformation in insurance goes far beyond moving paper forms to PDFs or launching a customer portal.

Those sorts of initiatives could have been considered innovative ten years ago, but in 2026, insurers need to move further.

At its core, it’s about rethinking how insurance products are developed, delivered, and serviced—leveraging modern technology to drive operational efficiency, create value for customers, and unlock new business models.

It encompasses everything from automating underwriting processes and implementing AI-based fraud detection, to offering usage-based insurance via connected devices.

It also includes foundational shifts: integrating legacy systems with cloud platforms, adopting APIs for more agile partnerships, and developing scalable software architectures that allow insurers to iterate quickly.

But here’s the key takeaway: digital transformation is not a one-off initiative.

It’s an ongoing strategy – a fundamental reshaping of how insurers operate and compete in a connected, fast-moving world, with a great vision to support it.

The Drivers of Change in the Insurance Sector

The push toward transformation and new technologies isn’t happening in a vacuum.

Several converging factors are pressuring insurance companies to evolve.

First, the traditional operating models are reaching their limits.

Legacy systems are expensive to maintain, difficult to adapt, and slow to integrate with new tools. They hinder innovation, particularly when insurers want to experiment with specialized insurance products or embedded models.

Second, regulatory landscapes are evolving. Governments and regulators are introducing requirements that demand more transparency, real-time reporting, and better risk modeling—demands that are nearly impossible to meet without digital infrastructures.

Third, insurtechs and digital-native startups are raising customer expectations.

These players offer sleek, intuitive experiences with flexible policies and rapid service. Traditional insurers must respond or risk losing relevance.

Lastly, there’s pressure from within.

Many forward-thinking C-level executives now understand that embracing digital transformation is not just about efficiency—it’s about growth, resilience, and being able to offer differentiated value.

The Demand for Digital Solutions is Growing

Insurance companies are actively seeking solutions that allow them to innovate faster and serve customers better.

This is particularly true in segments that rely on complex or highly specialized products—where agility and configurability are key. Here, a clear shift toward digitalization is underway: 89% of companies have already adopted or plan to adopt a digital-first business strategy.

Looking ahead, 74% of insurance executives worldwide have identified digital transformation and technology adoption as their top strategic priorities—ranking it above other major concerns like ESG initiatives and talent acquisition.

[Read also: Insurance Industry and Insurtech Trends for 2026]

Customers are Looking for Digital Channels

But the main reason for the push towards digital transformation and why insurers need to take it seriously is changing consumer behaviors.

People now expect the same level of digital convenience from their insurer as they get from their bank or their favorite e-commerce platform.

This means modern mobile apps, self-service portals, real-time policy management and updates, and fast, transparent claims handling.

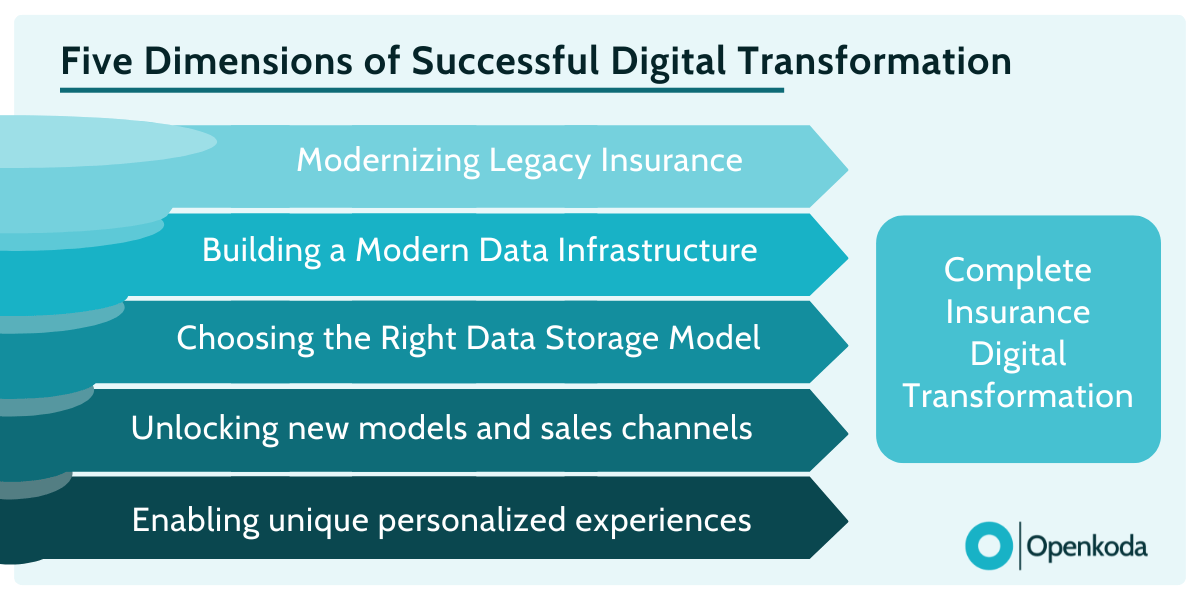

Five Dimensions of Successful Digital Transformation

In which sectors and areas of their internal operations should insurers invest to achieve the best return on their digital transformation efforts?

There are five general dimensions to consider – but which should take priority depends on each insurer’s specific situation.

The key takeaway is that these dimensions rarely operate in isolation.

In most cases, all areas require attention and investment to ensure a successful transformation.

Modernizing Legacy Insurance Software Infrastructure

First, we need to address legacy insurance software.

Most established insurers still rely heavily on legacy core systems – rigid, monolithic platforms that are deeply embedded in underwriting, claims, and policy administration processes. From our experience, we noticed that this problem is much more common than many people might suspect.

While these systems are stable, they weren’t designed for the speed and flexibility that today’s marketplace demands.

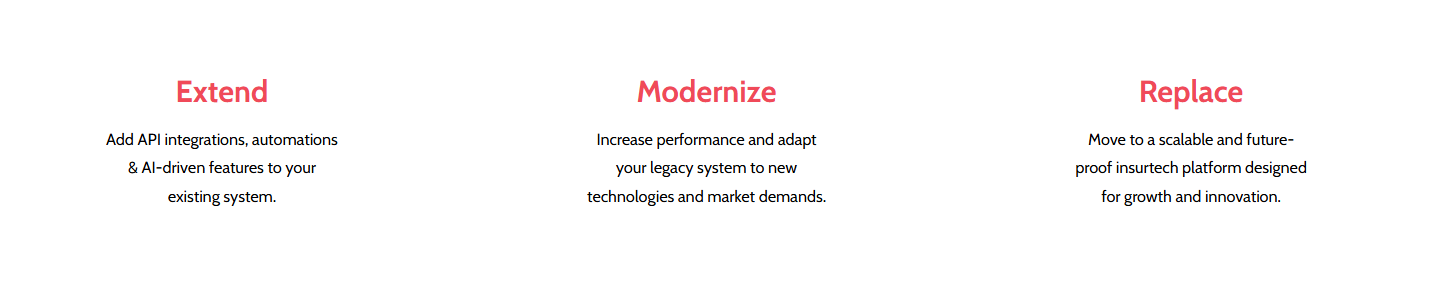

Insurance software modernization doesn’t have to mean ripping everything out.

An incremental approach-such as building API layers around core systems, gradually decoupling services, or leveraging middleware-allows insurers to innovate on top of existing infrastructure without risking operational disruption.

Building a Modern Data Infrastructure to Support Real-Time Decisions

Data is the backbone of digital transformation—but only if it’s accurate, accessible, and actionable.

A key enabler here is multitenancy—especially in platforms serving multiple insurance lines or partner programs.

A multitenant architecture allows insurance professionals to manage separate data environments for each entity or client while maintaining centralized control and scalability. Combined with streaming data pipelines, AI-ready analytics engines, and strict data governance models, this approach supports both agility and compliance.

Cloud vs On-Premise: Choosing the Right Model for Long-Term Flexibility

While cloud infrastructure offers clear advantages—faster deployments, seamless scalability, and reduced maintenance—it’s not always the default answer in insurance. In certain regulated markets, especially where data sovereignty or auditability is a concern, on-premise deployment is still a legal or practical requirement.

In addition, the economics of the cloud must be carefully considered. As cloud costs continue to rise and usage scales, exuberant pricing models can begin to undermine the long-term ROI of cloud-native solutions.

For insurers with predictable workloads and in-house IT capacity, on-premises or hybrid models can provide greater cost control and regulatory clarity.

Unlocking new business models and sales channels

With the right tech stack, insurers can tap into emerging opportunities such as embedded insurance, usage-based products, digital affinity programs, and dynamic bundling. These models allow insurance to be sold as a service, integrated into everyday transactions and platforms—from booking engines to subscription services.

Achieving this, however, requires a flexible application core—one that can easily adapt to different product configurations, APIs, and front-end experiences. Insurers with composable systems are able to experiment, partner, and pivot quickly, unlocking distribution channels that would be out of reach with a rigid, traditional platform.

Personalizing experiences

Last but not least, there’s the aspect of improving personalization.

The key thing to remember here is that true personalization goes beyond marketing automation – the thing most people associate with that ever-popular term.

True personalization should touch pricing models, product design, and real-time engagement – the more, the better.

For insurers, this means having the right data flows, decision engines, and feedback loops in place. A digitally transformed organization can deliver contextual, meaningful experiences while gathering the insights needed to constantly refine them.

[Read also: Top 10 Insurance Software Development Companies in 2026]

Key Benefits of Insurance Digital Transformation to Your Business

When implemented with clear objectives and the right technology partners, insurance digital transformation delivers measurable business value across the insurance value chain.

At least that’s the goal; if it doesn’t deliver value, don’t call it digital transformation.

Here are some of the key benefits it brings to modern insurers.

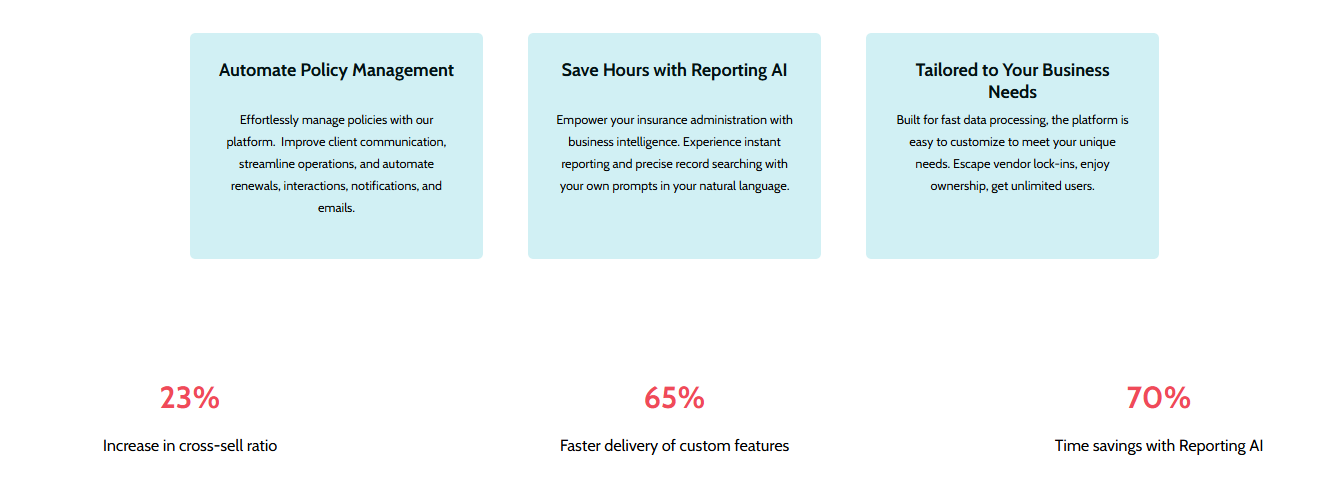

Streamline Client Communication

The way insurers communicate with clients has changed. Customers now expect interactions to be consistent, timely, and accessible across multiple touchpoints—email, chat, apps, and even voice.

Digital transformation enables insurers to centralize these communication channels, automate follow-ups, and personalize messaging at scale, especially considering how powerful LLMs have become in customer service.

The result?

A smoother experience for the client and better operational visibility for your teams.

Improve Processes

Operational inefficiencies are often hidden in routine processes—claims handling, policy administration, and document verification.

These are precisely the areas where automation delivers the most impact.

With digital workflows and intelligent rules engines, insurers can reduce friction, cut down on manual processes, and improve accuracy.

It’s not just about doing things faster—it’s about making the process smarter.

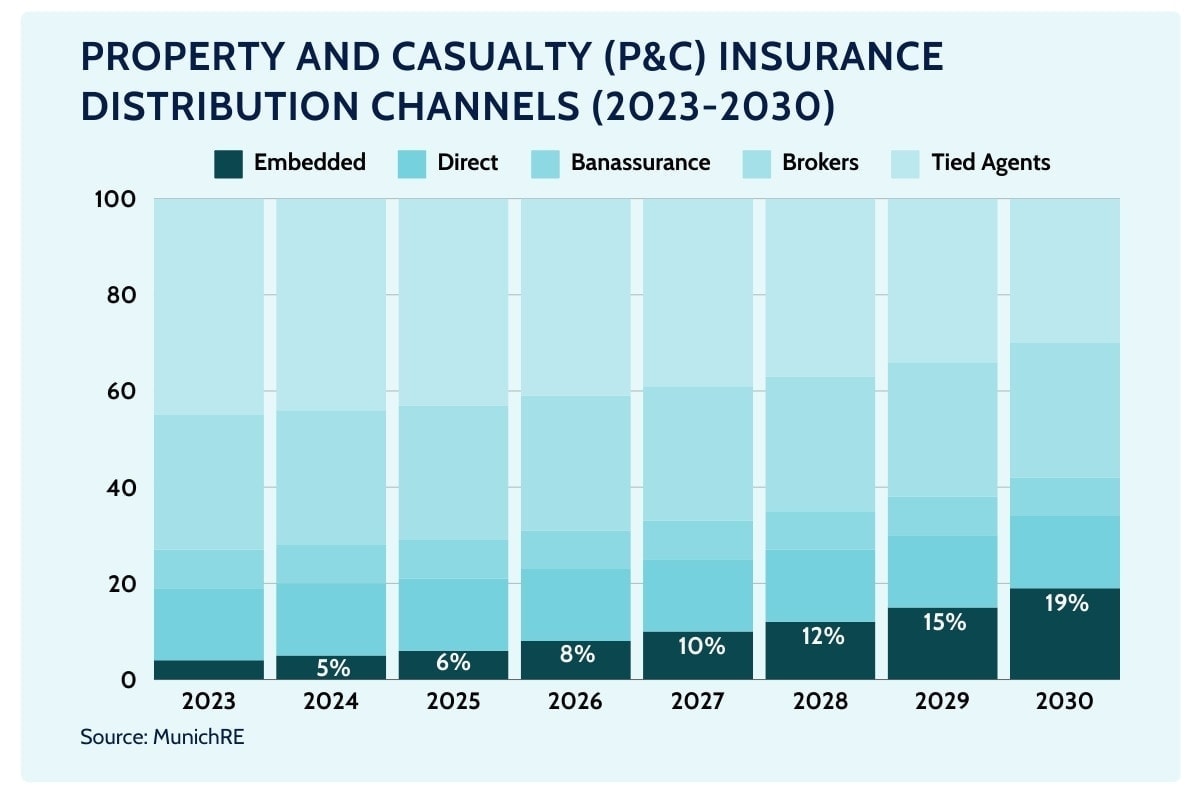

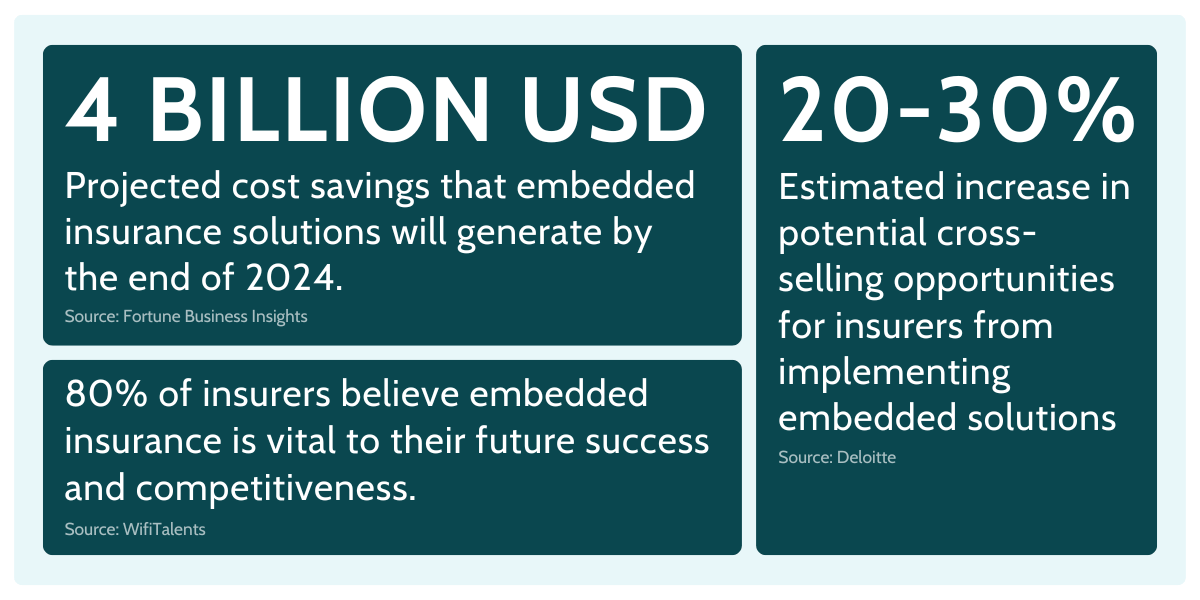

Exploring New Distribution Channels

One of the most transformative aspects of going digital is the ability to reimagine distribution.

Traditional models—built around agents, brokers, and direct sales—are giving way to integrated, real-time channels that allow insurers to offer insurance products exactly when and where customers need them.

Embedded insurance is a leading example of this shift.

Instead of forcing the customer to seek out coverage separately, insurers can now embed their products directly within non-insurance platforms—such as travel booking sites, e-commerce checkouts, mobility apps, or fintech services. It’s insurance without the friction.

The numbers speak for themselves: according to the Open and Embedded Insurance 2024 Insight Report, embedded insurance is on track to account for 15% of global gross written premiums (GWP) by 2033, representing an estimated $1.1 trillion—up from just 3–5% today.

And it’s not just about reach; it’s also about cost efficiency. In the UK, embedded insurance partnerships have demonstrated the potential to reduce customer acquisition costs by up to 75%, from £200 to £50 per policy.

Introduce Personalized Insurance Offerings

In 2026 policyholders expect more than one-size-fits-all coverage.

They want insurance that adapts to their lifestyle, needs, and risk profile—and they want it instantly.

By leveraging AI, behavioral data, and modular product design, insurers can deliver hyper-personalized offerings, such as dynamic pricing, usage-based coverage, or on-demand micro-policies. Personalization isn’t just a trend—it’s a driver of loyalty and long-term growth.

[Read also: Best Low Code Platforms For The Insurance Industry in 2026]

Better Security and Compliance

Insurance companies handle highly sensitive data, from personal health records and financial details to biometric identifiers and behavioral insights. The stakes are high, and so are the expectations from regulators and customers alike.

Digital transformation offers an opportunity to build robust security and compliance frameworks directly into the architecture of your systems—rather than layering them on as an afterthought.

Compliance also becomes significantly easier to manage.

With digital workflows and auditable event trails, insurers can automatically log user actions, enforce internal approval chains, and maintain full transparency over sensitive processes such as claims adjustments or policy cancellations. This not only supports internal governance but also makes external audits faster and more reliable.

More importantly, frameworks like GDPR, Solvency II, and IFRS 17 require insurers to maintain strict control over how customer data is processed, stored, and reported. Digital transformation platforms help achieve this by centralizing data flows and standardizing how information is collected and shared across systems—eliminating silos and reducing human error.

Reduce Costs

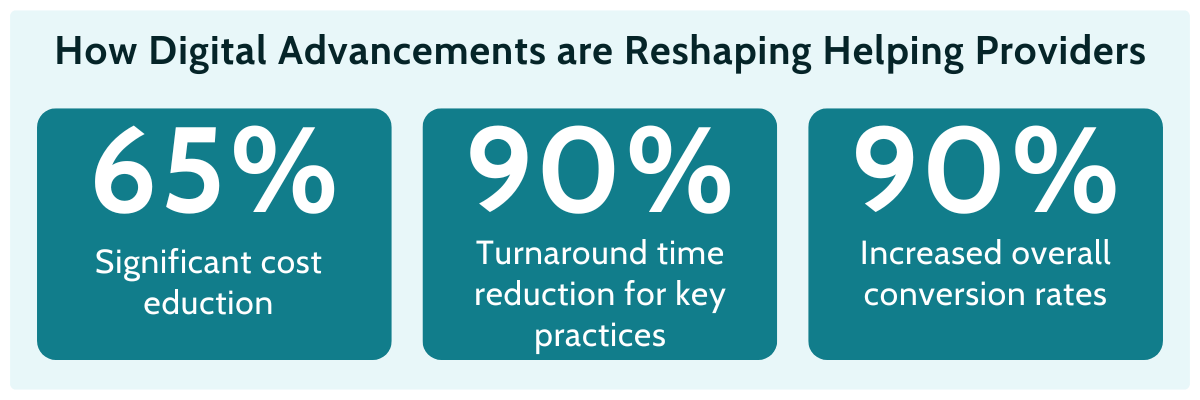

Cost reduction remains a strong incentive for many digital transformation initiatives in the insurance industry.

By automating repetitive tasks, migrating to cloud infrastructure, and enabling self-service tools for customers, insurers can dramatically reduce their operational costs.

But it’s important to remember that it’s not just about cutting costs.

It’s about reallocating resources to innovation, customer experience, and growth initiatives-the cost savings are more a byproduct of improved productivity and team performance. It shouldn’t be your primary goal to invest in more innovative digital tools solely for the sake of cost-cutting.

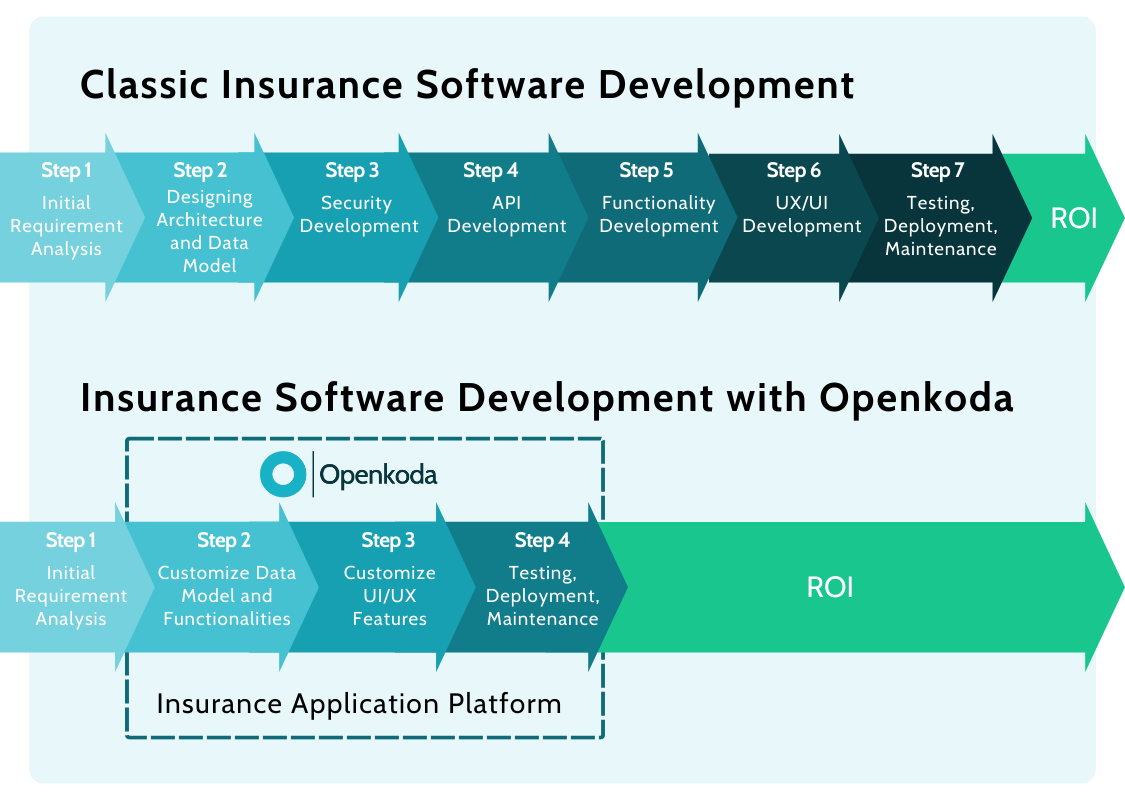

Faster Time to Market

Time is a competitive advantage.

When insurers identify a new opportunity—be it a market segment, product category, or distribution partner—they need to move fast. Traditional core systems often stand in the way, requiring months of development and integration before a product can go live.

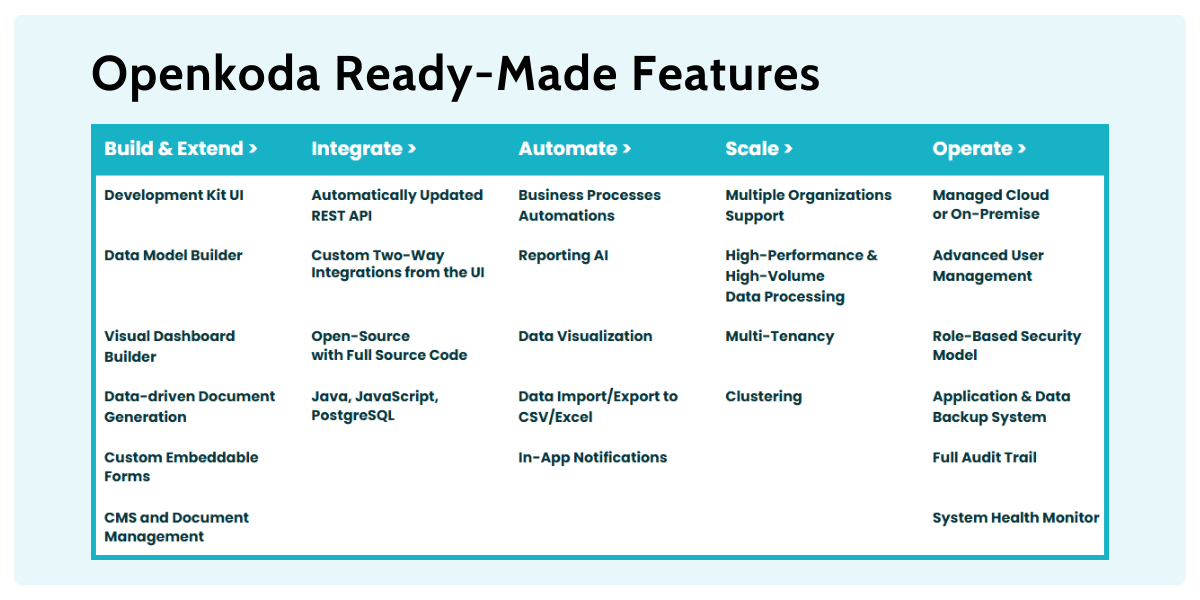

This is where platforms like Openkoda become really impactful.

Built with speed and flexibility in mind, Openkoda provides ready-made components, customizable templates, and modular building blocks tailored to insurance workflows. Whether you’re launching a new claims experience, configuring a travel insurance quote form, or embedding a product into a partner’s app, Openkoda helps teams move from concept to deployment in weeks—not quarters.

In short, it helps insurers launch faster, iterate more confidently, and remain agile in an industry where being early to market can be the difference between leading and lagging behind.

Improved System Scalability

Finally, digital transformation lays the groundwork for long-term scalability.

Legacy systems often struggle under this weight.

They were built for stability, not adaptability.

As insurers grow—whether organically, through M&A, or by entering new markets—these older systems can quickly become bottlenecks. Maintenance costs rise, technical debt accumulates, and insurance innovation slows to a crawl.

But scalability isn’t just about infrastructure. It’s also about how quickly a business can adapt its digital ecosystem to evolving needs.

For example, Openkoda supports scalability at both the system and product levels. Its modular architecture allows insurers to add new features or lines of business incrementally, without affecting core operations.

Need to roll out a new claim process flow? Or launch a white-labeled client portal for a new affinity partner? These can be built and deployed independently using Openkoda’s reusable components and microservice-ready approach.

[Read also: 7 Key Insurtech Trends For 2026]

Many Insurers Are Still Struggling With Proper Digitalization

Despite the clear strategic and operational benefits of digital transformation, the path forward isn’t always smooth.

For many insurers, progress is incremental at best-and stalled at worst.

While digital leaders are reaping the rewards of agility and customer centricity, a significant portion of the industry is still grappling with the realities of change.

Why?

Because successful transformation requires more than technology.

It requires alignment across systems, people, culture, and compliance. Here are four of the most persistent barriers preventing insurers from realizing their digital potential.

Organizational and Cultural Resistance

challenges long-standing workflows, alters reporting lines, and disrupts how decisions are made.

In organizations where change management is weak or where leadership isn’t fully aligned, resistance can quietly stall progress—despite investment in tools or external consultants.

Every level of your organization must understand why and how changes and investments in new digital tools are being made.

Legacy IT Systems and Integration Complexity

We’ve already touched on the need to modernize legacy systems-but it’s worth emphasizing how challenging this can be in practice.

Many insurers operate on platforms that were never designed to interface with modern APIs, real-time data processing, or cloud-native applications. These systems may use outdated languages, lack documentation, and carry years of business logic that’s deeply intertwined with core operations.

Even simple integrations-such as connecting a claims engine to a customer portal-can turn into months-long projects fraught with risk and exceptions.

Talent Gaps and Skill Shortages

Talent is a two-sided challenge in insurance digitalization.

On one hand, many insurers struggle to find professionals who understand outdated programming languages, middleware platforms, and homegrown systems that are still running critical processes. These legacy skill sets are increasingly rare, and losing internal expertise—through retirement or attrition—poses a serious operational risk.

On the other hand, even when organizations commit to transformation, they often face a second hurdle: finding software development partners who genuinely understand the insurance industry.

Generic IT providers may bring technical skills, but without deep knowledge of insurance data models, policy lifecycles, and compliance requirements, the risk of project failure increases dramatically.

Regulatory and Compliance Concerns

Insurance is one of the most heavily regulated industries in the world—and for good reason. But that also means every step of digitalization must be vetted against local and international standards, from GDPR and PCI-DSS to Solvency II, IFRS 17, and various national insurance authorities.

This makes digital transformation especially complex. Every tool introduced, every system updated, and every insurance API integration deployed must come with built-in safeguards—security, traceability, access control, and reporting.

Case Studies and Real-World Examples

Building Custom Claims Management Software in Minutes with Rapid Software Development Platform

One of the most resource-intensive areas of insurance operations is claims management.

From initial submission to validation and resolution, the claims process often involves multiple departments, disparate systems, and significant manual intervention.

This process can be particularly challenging for insurers operating in niche markets, where out-of-the-box solutions are often unable to handle complex data types and processes.

In these cases, a bespoke approach is the only viable option.

Typically this process takes months of meticulous planning, development, and testing and costs tens or even hundreds of thousands of dollars, but what if there was a way to speed up this process by up to 60% and have a working prototype in minutes?

It seems impossible, but with Insurtech development platforms like Openkoda, it’s entirely possible.

Using such a tool, the usual process starts with an intuitive setup of your claims data model.

Fields such as claim number, status (e.g., approved, denied, in process), claim description, and policy reference can be added with a few clicks.

You don’t need a team of engineers – it’s designed to be fast and intuitive.

Once your core structure is in place, Openkoda lets you design the front-end experience just as quickly.

Want a custom dashboard that shows key metrics and recent claim statuses at a glance for improved data analytics? You’ve got it. Need to add filters so teams can quickly drill down to specific cases? A couple of clicks, and it’s live.

While speed is a headline feature, it’s the long-term flexibility that makes this approach truly stand out. The platform is designed to scale as your business evolves.

As claims volumes increase or your workflows grow more complex, you can easily:

- Automate repetitive tasks using custom logic and workflow triggers

- Assign role-based permissions to protect sensitive data and support regulatory compliance

- Integrate with external tools (payment providers, policy systems, fraud detection engines) via open APIs

- Attach supporting documents to claim records, ensuring everything is in one place

- Export and import large datasets as needed for analysis or migration

What’s the key value to the insurance company?

You can have a working MVP of a custom claims management application in minutes rather than weeks which can then be easily customized further as the need arises.

[Read also: How to Automate Insurance Policy Renewal Reminders?]

Creating Embeddedable Insurance Forms for Auto Insurance Company

We’ve already touched on embedded insurance as one of the emerging trends reshaping the insurance industry — and with good reason.

It’s a smarter, more contextual way of reaching customers, right at the point where insurance decisions make the most sense.

The best part?

With Openkoda, launching embedded solutions is not only incredibly fast but also easy to integrate with any insurance platform or e-commerce site.

[Read also: Best Strategy for Reducing Insurance Product Development Time and Cost]

Embedded Where It Matters Most

Let’s take a closer look at how it works in practice, using auto insurance as a prime example.

Car insurance is a natural fit for embedded distribution.

Think about the customer journey: someone buying a car online, visiting a dealership website, or even browsing financing options is already primed to consider coverage. Offering a tailored quote right there, as part of that journey, eliminates friction — and dramatically increases the likelihood of conversion.

From Zero to Embedded in Minutes

Here’s how easy it is to go from idea to working prototype:

- Step #1: Build a Smart Quote Form: Use Openkoda’s built-in tools to create a responsive form that collects all the necessary info — vehicle registration, model, insurance type, and more. You can design the fields to adapt based on the user’s input, keeping things simple and relevant.

- Step #2: Configure Real-Time Pricing Logic: Add business logic that dynamically calculates the premium. This can be as straightforward or as advanced as you need — from flat rates to formulas pulling in external risk data or discount schemes.

- Step #3: Embed Anywhere: Once ready, the form can be dropped directly into any website or partner platform. Whether it’s a dealership site, car loan portal, or automotive app, the integration is seamless and user-friendly.

- Step #4: Customize, Extend, Repeat: As with all Openkoda components, everything is fully customizable. If you need new API integrations with underwriting engines or multi-language support you can do it easily and efficiently thanks to the extensible core.

Implementing a Dynamic Pricing & Real-Time Premium Calculation in Insurance Systems

Launching an innovative insurance product is rarely a one-and-done effort. From pilot phase to post-launch, insurers are constantly tweaking: pricing formulas, discount rules, eligibility criteria, and more. Maybe you’re responding to market feedback, optimizing for profitability, or adapting to partner requirements.

Static systems just don’t cut it anymore. If every change requires a development sprint, or worse — a full system deployment — your time-to-market and responsiveness are gone.

Dynamic pricing solves this. It gives product teams, actuaries, and business owners the ability to modify rules in real-time, without touching core code. It’s what turns an insurance product from a rigid offering into a living, evolving business asset.

How Openkoda Makes It Simple

With Openkoda, implementing dynamic pricing is much faster — even for non-technical users.

The platform lets you build custom pricing logic using straightforward, readable code snippets that can be updated, tested, and deployed on the go.

Here’s what that looks like in practice:

- Custom Pricing Logic

Create and manage pricing rules in a dedicated logic editor. Whether you need to calculate premiums based on age, location, car type, or claims history, you can define it all in a clear and transparent way. - Business-Friendly Editing

Need to adjust the formula for a specific campaign or launch a time-based discount? You don’t have to redeploy the app. Just update the rule and it goes live instantly. - Scenario Testing and Experimentation

Want to try out multiple pricing strategies to see what converts best? Openkoda allows you to run A/B tests or region-specific pricing variations without any major restructuring. - Integrate External Data Sources

Pull in real-time data like weather, traffic, or credit scores to influence pricing dynamically — giving you even more control over risk and profitability.

In short: if you’re building or scaling modern insurance products, dynamic pricing becomes essential. And with Openkoda, you get that flexibility without sacrificing control, security, or speed.

The Future of Insurance in the Digital Age

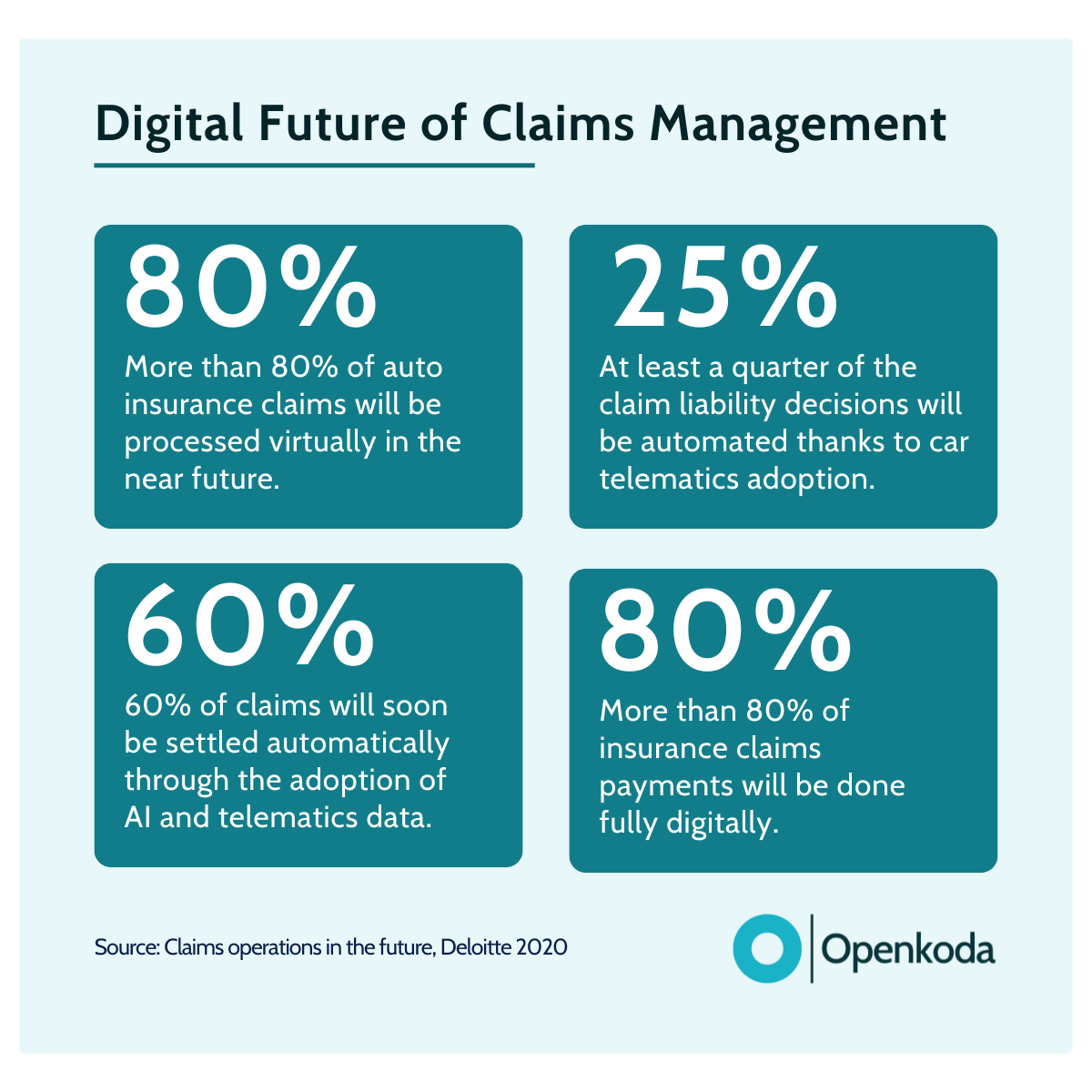

With incredible growth in digital platforms and artificial intelligence, the insurance sector is standing at a major inflection point.

As of today 67% of insurance firms are significantly accelerating their digital transformation initiatives, it’s increasingly clear that those who still rely on legacy systems might get left behind very rapidly.

What matters now is the ability to execute this transformation with a proper and clear vision.

In the coming years, one of the defining factors of competitiveness will be personalization.

According to industry projections, by 2026, nearly half of all insurers will differentiate primarily on their ability to deliver hyper-personalized products and services delivered at the most convenient touchpoints.

Of course, artificial intelligence will continue to expand its role in insurance technology.

Already, 79% of insurance executives expect AI to fundamentally change how they acquire customer insights and engage across the policy lifecycle.

Most forward-thinking carriers won’t stop at AI chatbots or intelligent routing.

They’ll apply machine learning in underwriting, claims triage, fraud detection, and even dynamic product creation—streamlining decision-making while elevating precision.

Digital Transformation in Insurance Industry: Closing Thoughts

Digital transformation is no longer optional—it’s the foundation for future-ready insurance organizations.

As technology reshapes customer expectations, product delivery, and operational models, insurers must move from incremental improvements to holistic reinvention.

Those who act decisively today will define the market standards of tomorrow.