Innovative Insurance Products to Introduce in 2025

As customer expectations evolve, insurance companies are turning to modern technology to keep up.

With advancements like insurtech platforms and generative AI, investing in innovative products is more promising than ever.

Let’s take a look at the most exciting innovative insurance products to introduce this year.

The Need For Innovation in The Insurance Sector in 2025

In 2025 insurance industry is under pressure to improve its operating model, offerings, experiences, and financial performance.

While these challenges aren’t new, emerging technologies are accelerating transformation for established players and lowering entry barriers for new competitors.

As a result, innovation—once a rather fringe activity in the insurance sector—is quickly becoming critical to their success.

“Insurance organizations are focusing innovation efforts on product development.” – Accenture, Illuminating Insurance Innovation

Recently, the focus of insurance innovation has shifted toward product development.

In 2019, product-related innovations accounted for 18% of all program launches submitted to the Qorus Innovation in Insurance Awards. By 2023, this figure had tripled to 57%, surpassing Marketing & Distribution (15%) and Claims Management (13%).

“Although it is complicated, those who develop specialized products and insure new risks—through careful risk selection coupled with the right capabilities—may capitalize on industry needs and unlock profitable coverage.” – McKinsey Global Insurance Report 2025

While most insurers have had the capital to fund innovation, high interest rates, and persistent inflation may curb investment.

This underscores the need for more efficient ways to deliver innovation to customers.

“I would say that the predominant driver in the market right now is cost cutting. There is a pressing need for insurers to contain costs, also through the use of AI, as much as possible to avoid being overwhelmed by inflation.” – Insurance Industry Expert requesting anonymity

Want to accelerate your insurance innovation? Book your personalized demo to see how Openkoda helps you launch and scale innovative products in weeks.

Are Investments in Innovative Insurance Products Worth it?

The numbers speak for themselves – insurance innovators are consistently outperforming their competitors.

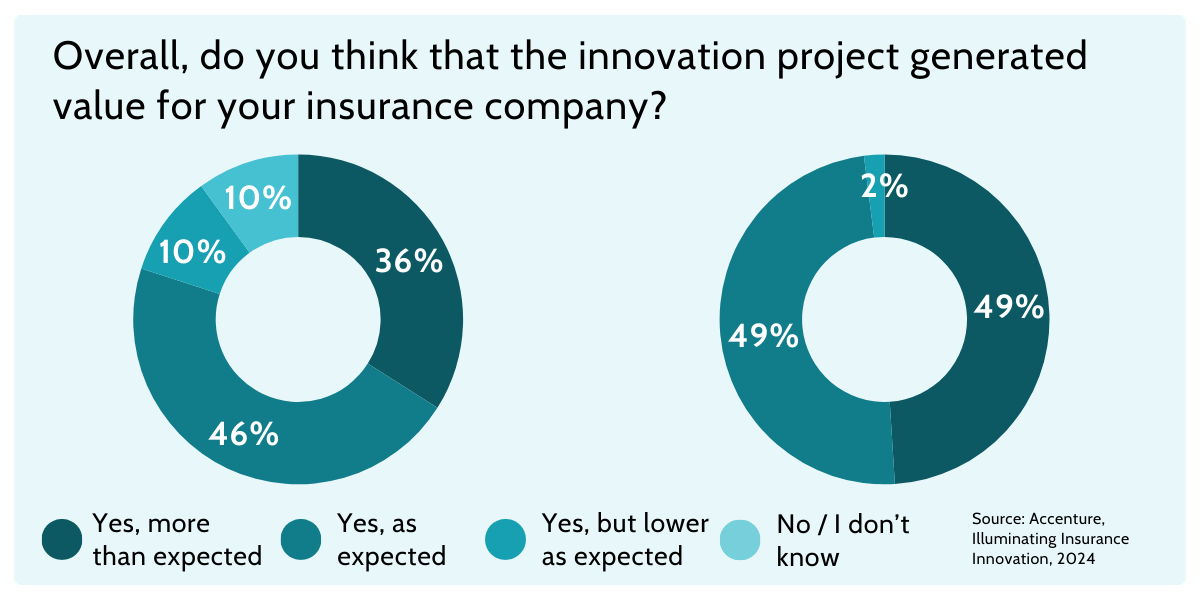

In fact, according to Accenture research, 80% of respondents reported that their innovations met or exceeded expected financial outcomes. When considering non-financial goals—such as customer engagement, satisfaction, brand strength, and employee loyalty—that number rises to an impressive 98%.

So, why do some companies continuously drive innovation while others struggle to keep up?

The key lies in a deliberate, sustained strategy and a culture that encourages disruption, rewards innovation, and provides the right enablers. Two critical factors stand out in sustaining long-term value: an Innovation Mindset and an idea for an innovative insurance product.

Let’s focus on the latter and explore key areas where insurers can begin introducing innovative tech solutions to gain a competitive edge.

Embedded Insurance

Let’s first tackle one of the key trends in the insurance sector in 2025.

Embedded insurance—offered at the point of sale for a product or service—is not a new concept. Electronics retailers have long bundled warranty coverage, and banks have distributed life insurance products.

However, embedded insurance is evolving beyond these traditional models.

Industries like telecommunications and retail are integrating insurance into broader ecosystems of services and products, seamlessly linking coverage to original purchases.

By eliminating friction in the buying process and embedding insurance into existing customer journeys, this model significantly increases accessibility and expands market reach. As more businesses adopt protection-as-a-service, embedded insurance is becoming a key driver in reshaping insurance distribution.

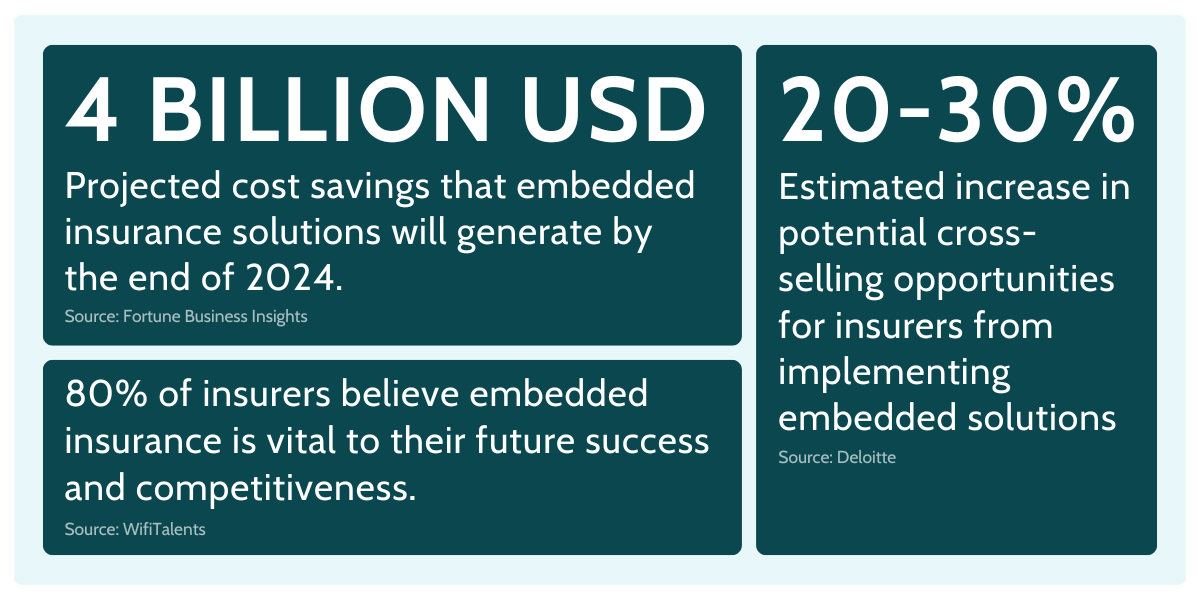

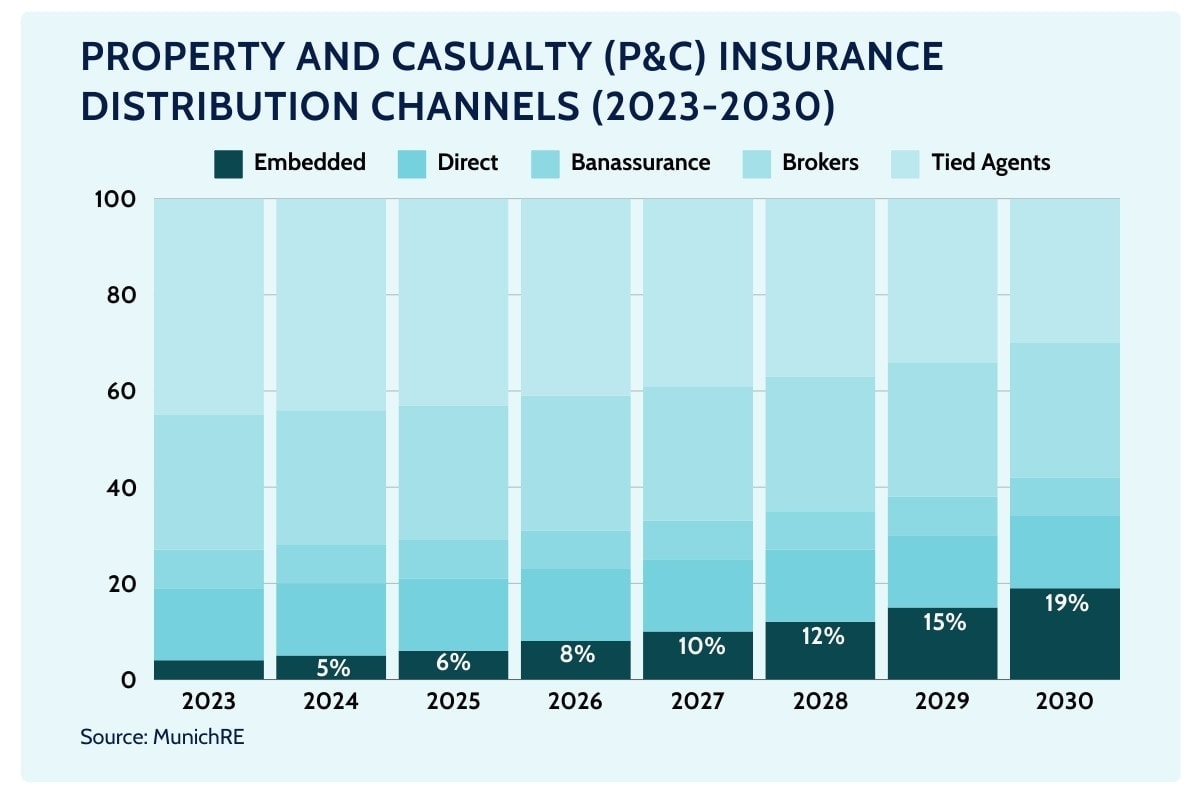

With this growing momentum, analysts predict a major shift in the market. By 2033, embedded insurance is expected to make up 15% of global GWP (~$1.1 trillion), up from 3-5% today. It represents the largest forecasted market-share growth percentage-wise, underscoring the transformative impact of this trend.

An Example of an Innovative Embedded Insurance Product: Parametric Travel Insurance

One of the most compelling examples of embedded insurance innovation is parametric travel insurance.

Unlike traditional travel insurance, which requires a claims process that can be cumbersome and time-consuming, parametric insurance automates payouts based on predefined conditions.

For instance, a travel platform offering embedded parametric insurance can automatically compensate travelers when a flight is delayed beyond a set threshold—without requiring them to file a claim.

The system detects the delay through real-time data sources, triggers an immediate payout to the traveler’s account, and ensures a hassle-free experience.

According to industry reports, the embedded insurance market is expected to grow at a double-digit CAGR in the coming years, driven by partnerships between insurers and digital platforms.

While distribution will not change overnight, competition is expected to intensify—with implications for carriers.

Custom Claims Management Apps

Claims management is often seen as the “moment of truth” for policyholders, making it a critical factor in customer retention.

A smooth, transparent process builds trust and strengthens loyalty, while a frustrating experience—delayed payments, underpayments, or overly complex procedures—can drive customers away and hinder business growth.

This is why innovation in claims management presents a major opportunity for insurers.

The challenge?

Standing out in a crowded field of existing solutions.

Custom-built claims management apps empower insurers to integrate CX-driven features that enhance efficiency and customer experience, such as:

- AI-Driven Claim Automation – Leveraging artificial intelligence and machine learning to assess, approve, or flag claims automatically, ensuring fast, accurate settlements.

- Real-Time Communication – Enabling direct, instant interactions with adjusters, chatbots, or virtual assistants for 24/7 claim updates.

- Personalization – Utilizing customer data to offer tailored claim experiences, real-time tracking, and individualized guidance.

Data-Driven Claims Management

can leverage data from IoT-connected devices—such as wearables, smart homes, vehicles, or telematics systems, and use artificial intelligence technology to make the most of it.Looking at claims management from another angle—data streams—reveals even more innovation potential.

The effect?

Policyholders receive tailored claims experiences—predictive notifications, instant decisions, proactive financial advice, and empathetic, human-like interactions.

Standard, off-the-shelf software often limits flexibility due to rigid frameworks and vendor dependencies.

In contrast, custom claims management apps can harness data from IoT-connected devices—such as wearables, smart home systems, vehicles, and telematics—to instantly verify claims, trigger alerts, and proactively manage risk exposure.

While many of these capabilities are still emerging, they hold immense potential for the future of insurance. However, before implementing these advanced features, insurers must first establish a solid foundation.

Laying the Groundwork for Innovation

To bring cutting-edge features to life, insurers must cover the essentials: role-based security, dashboards, database setup, and integrations with external services. These foundational elements take time to build, often delaying the release of truly innovative functionalities.

If you’re looking to accelerate your return on investment (ROI) and build your custom insurance application faster, check out this demo on how to set up a claims management prototype in minutes:

Custom Policy Management Software

Policy management systems are the backbone of any insurance business model, handling product definitions, policy administration, customer lifecycle events, and regulatory compliance.

While mature, off-the-shelf solutions exist, insurers and insurtech startups are increasingly recognizing the strategic advantage of custom-built policy management software. A tailored system enables differentiation, fosters innovation, and provides a competitive edge.

So, how can you make your policy management system stand out?

Two key approaches drive success: Tailored Approach and Rapid Product Innovation.

Tailored Approach

Standard policy management systems effectively handle basic administrative tasks, but custom-built solutions are designed to meet the specific needs of niche markets or individual insurers, unlocking greater efficiency.

Let’s take a look at an example.

A Look at Health Insurance

Health insurance presents unique operational complexities, strict regulatory requirements, and intricate workflows.

A sector-specific policy management system can significantly enhance efficiency, accuracy, and customer satisfaction.

A specialized data model can accommodate complex policy structures, including co-pays, deductibles, out-of-pocket maximums, exclusions, wellness programs, and chronic illness coverages, ensuring precise coverage management. Advanced automation can streamline claims processing by instantly assessing medical necessity, policy coverage, and fraud potential, reducing manual workload and improving accuracy.

On the customer side, a well-designed client portal can offer real-time access to policy details, claims tracking, preventive care reminders, and telehealth integration.

By simplifying the often complicated healthcare-related processes, insurers can improve engagement and provide policyholders with greater transparency and support.

And health insurance is just one example.

Highly specialized insurance solutions can enhance efficiency and innovation across various sectors.

From usage-based auto insurance to cyber insurance offerings – custom policy management application can accommodate all data models no matter how complex and nuanced.

Rapid Product Innovation

Insurance needs to innovate faster.

New concepts like on-demand insurance, embedded auto insurance, and cyber insurance are unlocking fresh revenue streams. However, companies must be able to test, refine, and launch innovative products quickly to stay ahead.

A custom-built policy management system designed for rapid adjustments in business rules, pricing logic, and compliance parameters enables insurers to introduce new products without long development cycles or costly downtime.

How Does This Process Work?

Let’s see how easy and fast it is to set up and deploy an innovative insurance product when you start with a solid application core using the Openkoda platform:

- Skip the Heavy Development Phase – Start smart with a ready made application template instead of committing to full-scale insurance software development.

- Launch a Prototype in Real Market Conditions – Test new policy structures with real customers in controlled environments.

- Experiment with Sales Channels and Customer Journeys – Find the most effective ways to distribute and market policies.

- Optimize Based on Real Feedback – Adjust business rules and user experience in response to customer insights.

- Scale & Customize – Once validated, expand and refine the product for wider adoption.

A flexible, custom-built policy management system ensures insurers don’t just meet today’s demands—they stay agile, innovative, and future-proof in an evolving industry.

Insurance AI-Driven Analytics and Reports

Artificial intelligence has become a game-changer in the insurance industry, transforming everything from claims automation and personalized offerings to fraud detection and customer service.

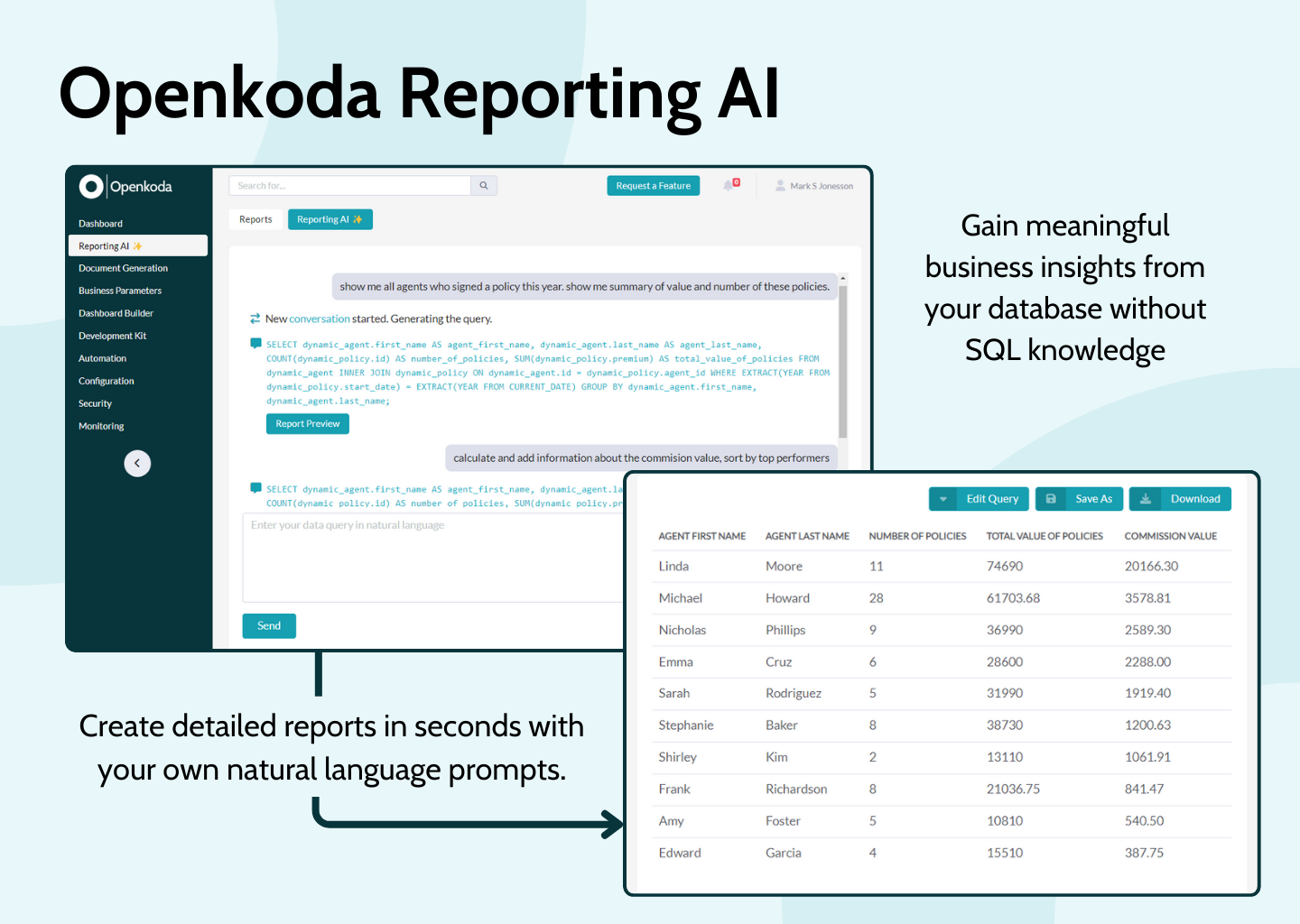

One particularly promising application is AI-driven analytics and automated report generation.

Traditionally, insurance professionals spend countless hours manually analyzing vast datasets to produce meaningful reports. Today, AI—especially generative AI models—can automate complex analytical tasks, drastically reducing the time and effort required.

For instance, generative AI can translate natural language prompts into precise SQL queries, allowing insurers to generate reports and analytics simply by describing what they need.

Instead of manually coding complex database queries, analysts can quickly retrieve claims frequencies, loss ratios, customer churn predictions, and other critical insights.

This streamlined process not only accelerates decision-making but also frees analysts to focus on interpreting results and making strategic recommendations, rather than spending valuable time managing raw data.

Personalized Insurance Products

A major trend reshaping the insurance industry is the rise of personalized insurance products.

Today’s customers expect tailored solutions that align with their unique needs, lifestyles, and risk profiles.

By leveraging data from IoT devices, wearables, and behavioral analytics, insurers can create policies based on actual risk factors rather than broad assumptions.

For example, telematics-based auto insurance adjusts premiums in real time based on driving habits, rewarding safer drivers with lower rates. Similarly, health insurance providers can offer customized plans based on activity levels and wellness data, encouraging proactive health management.

While some consumers may have concerns about sharing personal data, the demand for innovative, data-driven insurance products continues to grow, highlighting their vast potential.

As personalization advances, insurers that embrace these solutions will gain a significant competitive edge, delivering more relevant, customer-centric offerings.

[Read also: Top 10 Insurance Software Development Companies in 2025]

Insurtech Platforms to Launch Your Own Insurance Products

Insurers and insurtech startups face immense pressure to launch innovative insurance products and digital experiences without delays, as even minor setbacks can lead to lost opportunities and competitive disadvantages.

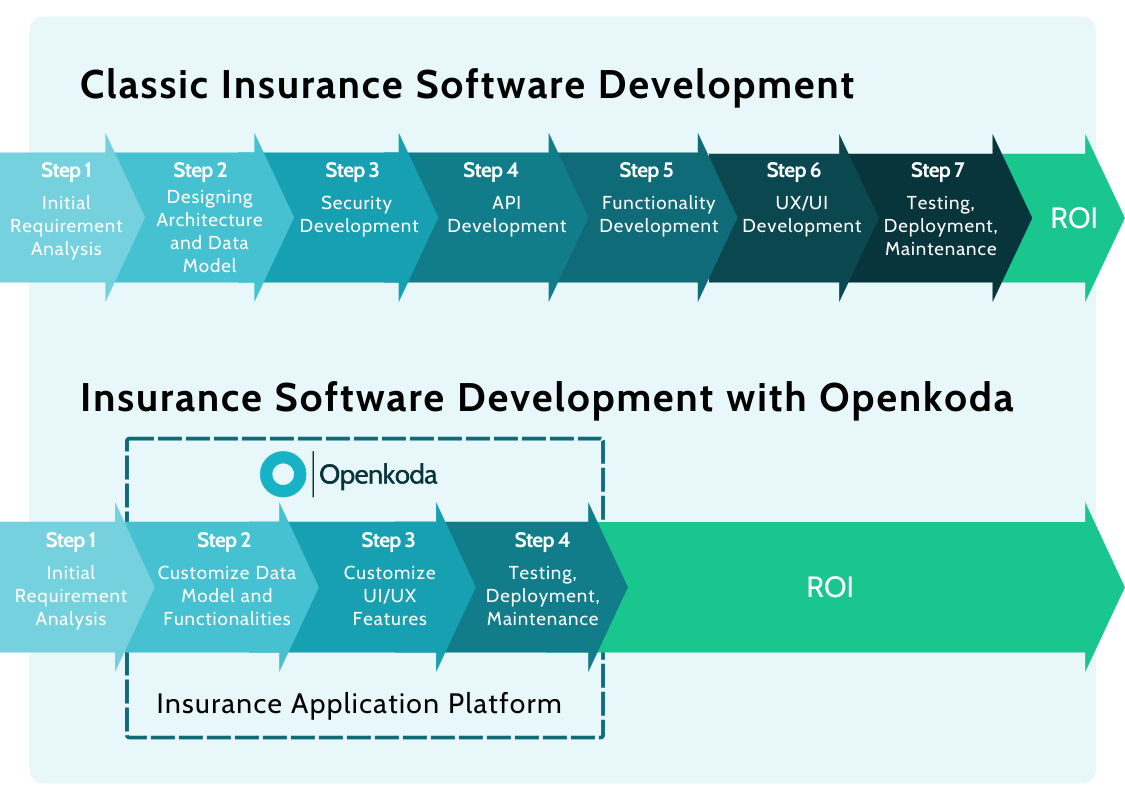

Traditionally, building a new insurance application from the ground up meant investing significant resources into long development cycles, extensive testing, and costly revisions—ultimately slowing down product launches and delaying ROI.

Insurtech platforms like Openkoda directly address this challenge by eliminating the need to reinvent the wheel. By leveraging a comprehensive set of pre-built features, insurers can drastically shorten their time-to-market, thus accelerating innovation and reducing risks.

Curious how much faster you can go from idea to market-ready product? Book your personalized demo and we’ll walk you through a live example of a new insurance product built on Openkoda.

Accelerated Development and Faster ROI

Openkoda’s platform is designed to reduce development time by up to 60%, enabling companies to launch new, specialty insurance products in weeks rather than months.

This rapid development cycle allows businesses to start generating revenue sooner, thereby achieving ROI much earlier than traditional development approaches.

Insurance Needs to Innovate Faster. Openkoda Makes It Happen. It is a powerful insurtech platform that helps insurance companies and insurtech startups build and scale modern systems — without vendor lock-in. – Michał Głomba Openkoda CEO

Openkoda’s Ready-Made Features

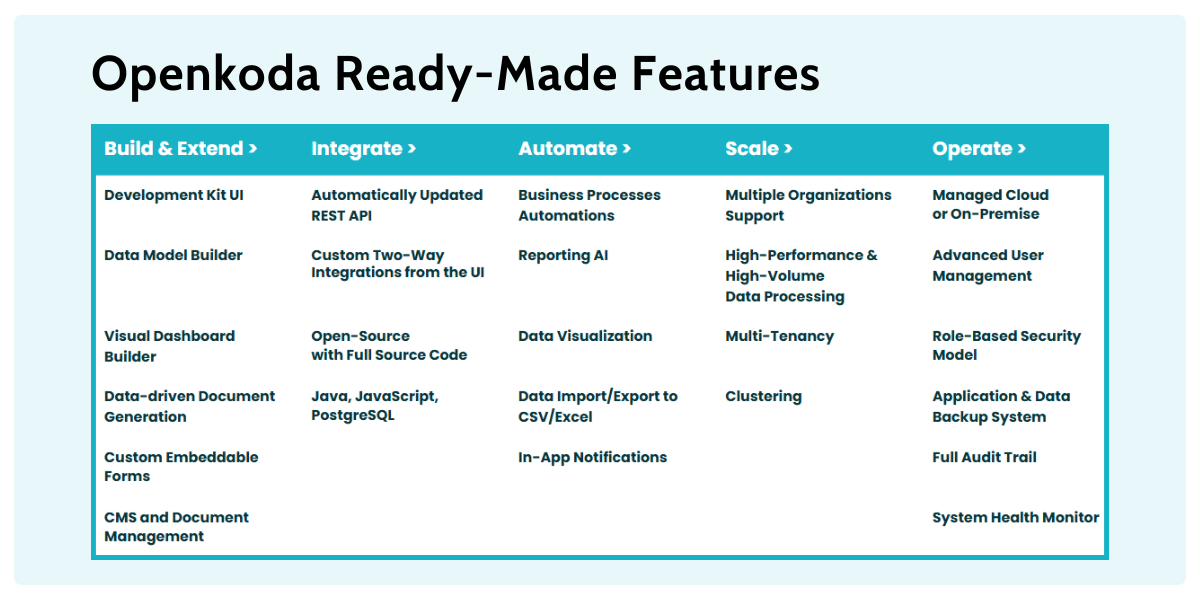

Openkoda offers a comprehensive suite of features that facilitate rapid development and customization:

- Enterprise Application Foundation: Includes authentication, user management, multitenancy, and an admin dashboard.

- Industry-Specific Application Templates: Provides pre-built templates tailored for various insurance applications, such as policy management and claims management.

- Visual Data Model Builder: Allows for easy customization of data models and views through a user-friendly interface.

- Dashboard Builder: Enables the creation of custom dashboards using pre-built widgets and a drag-and-drop editor.

- Automatically Updated REST API: Facilitates seamless integration with other applications through secure APIs.

- Custom Integrations: Supports extensions using open-source technologies like Java, JavaScript, and PostgreSQL.

- AI-Powered Reporting: Utilizes natural language processing to generate reports and query data effortlessly.

Example: Building a Custom Policy Management Application with Openkoda

What does working with Openkoda look like?

Imagine you want to create an innovative, customized policy management application.

Rather than starting from scratch, your development team can use Openkoda’s visual data model builder to quickly define essential policy forms, including fields like policy numbers, agent details, and coverage specifics. These forms can be easily tailored using intuitive drag-and-drop tools.

Core functionalities, such as data validation, personalized dashboards, and automated client notifications, can also be swiftly configured. This significantly reduces the time spent on manual coding and testing.

The result?

You can launch a functional minimum viable product within days, shortening your entire development cycle to just weeks instead of months.

Leveraging platforms like Openkoda is rapidly becoming standard practice for innovative insurance and insurtech companies aiming to adapt swiftly to emerging risks and meet customer expectations in 2025.

Want to test how that works for your business? Book your personalized demo and let us show you a real-world product prototype built in days.