Policy Administration Software (AMS): Complete Guide

Policy administration sits at the very heart of modern insurance operations.

As products become more personalized and customers expect instant, digital interactions, insurers can no longer rely on fragmented or manual processes.

Policy administration software brings structure, speed, and real-time control to the full policy lifecycle, from new business to renewal and beyond.

What is Policy Administration Software? General Overview

Policy administration software, often referred to as PAS, is a core insurance system designed to manage the entire lifecycle of an insurance policy.

That lifecycle typically starts with policy issuance and continues through endorsements, renewals, cancellations, and policy termination. In practical terms, PAS is the system of record for all policy information within an insurance organization.

At its core, policy administration software centralizes data and processes that were once scattered across spreadsheets, legacy tools, and manual workflows.

It ensures that policy details, coverage terms, pricing rules, and customer data are consistent, auditable, and available in real time. This is especially critical in insurance, where accuracy, compliance, and speed directly affect both operational efficiency and customer trust.

Modern PAS solutions go far beyond basic record-keeping.

They support digital distribution models, self service for customers and agents, and seamless collaboration between underwriting, operations, and customer support teams.

When implemented well, policy administration becomes an enabler of growth rather than a bottleneck, allowing insurers to launch new products faster, adapt to regulatory changes, and respond instantly to customer needs.

Policy Administration Software (PAS) – Key Functionalities

While implementations differ across insurers and product lines, most policy administration systems share a common functional foundation.

Below are the key capabilities that define a robust PAS in today’s insurance landscape.

- Policy Lifecycle Management: PAS manages every stage of a policy, from new business and policy issuance through mid-term changes and renewals. All actions are logged and versioned, ensuring a complete and transparent policy history.

- Product and Coverage Configuration: Insurers can define insurance products, coverage options, limits, and exclusions without hardcoding business logic. This flexibility is essential for quickly adapting offerings to market demand or regulatory changes.

- Endorsements and Policy Changes: Real-time policy administration allows insurers to apply endorsements, amendments, and coverage adjustments instantly. Updated policy information is immediately available to internal teams and, where applicable, to customers via self service portals.

- Rating and Premium Calculation: PAS integrates rating rules and pricing logic to calculate premiums consistently and accurately. This ensures that changes in risk factors or coverage are reflected in real time across all active policies.

- Document Generation and Policy Communication: Policy documents, schedules, and confirmations are generated automatically based on current policy data. This reduces manual effort, minimizes errors, and ensures that customers always receive up-to-date insurance documentation.

Together, these functionalities form the operational backbone of policy administration.

They allow insurers to scale efficiently, maintain compliance, and deliver a smoother experience to both internal users and policyholders.

[Read also: Best Policy Management Software Systems in 2026]

What to Look for in an Insurance Policy Administration Solution?

Choosing the right policy administration software is a strategic decision, not just a technical one.

The platform you select will directly shape how fast you launch products, how efficiently teams work, and how well you support customer service across the policy lifecycle.

- Configurability without complexity: Strong product configuration capabilities allow business teams to adjust coverages, rules, and pricing without constant IT involvement. This is essential for modern, fast-moving insurance products.

- Scalability and performance: Policy administration must scale smoothly with growing volumes of policies, users, and transactions, without performance degradation or architectural rewrites.

- Integration readiness: A PAS should function as part of a broader insurance platform, integrating easily with claims systems, billing, CRM, data warehouses, and external services.

- User experience and productivity: Intuitive workflows directly impact customer service quality. If internal users struggle with the system, policyholders will feel it too.

Common Challenges with Policy Administration Systems

Many of the challenges insurers face today are not caused by policy administration itself, but by outdated PAS software that no longer aligns with how modern insurance operates.

Legacy policy administration systems were built for a different era, and carriers now feel the strain as expectations around speed, flexibility and digital access continue to rise.

Integration Issues

A frequent pain point in insurance policy administration is limited integration capability.

Older policy administration systems were designed as closed tools, making it difficult to connect them with claims platforms, billing engines, data analytics, or external services. As a result, carriers often rely on custom interfaces or manual data transfers.

Lack of Flexibility

Many insurance legacy systems offer a fixed set of features with minimal room for adaptation.

Adjusting product logic, launching new insurance offerings, or changing policy rules often requires vendor involvement or costly development cycles.

For carriers, this rigidity makes it harder to respond to market changes and forces business teams to work around system limitations rather than with them.

Outdated UI

Outdated user interfaces remain a surprisingly common issue in policy administration systems.

Complex screens, non-intuitive workflows, and poor usability slow down daily operations and increase error rates. When internal teams struggle with their tools, service quality suffers.

[Read also: Complete Guide to Insurance Agency Management System (AMS)]

Policy Administration Software: Custom vs. Out-of-the-Box Solution

When modernizing insurance policy administration, companies typically face a familiar dilemma.

Should they buy an off-the-shelf policy administration system in a subscription model, or invest in building a fully custom solution from scratch?

Increasingly, insurers are discovering a third path: leveraging a core platform that accelerates development while preserving flexibility.

Traditional out-of-the-box policy administration software promises fast implementation but often comes with rigid processes, limited customization, and long-term vendor lock-in. Fully custom systems, on the other hand, offer maximum control but require significant time, budget, and ongoing maintenance.

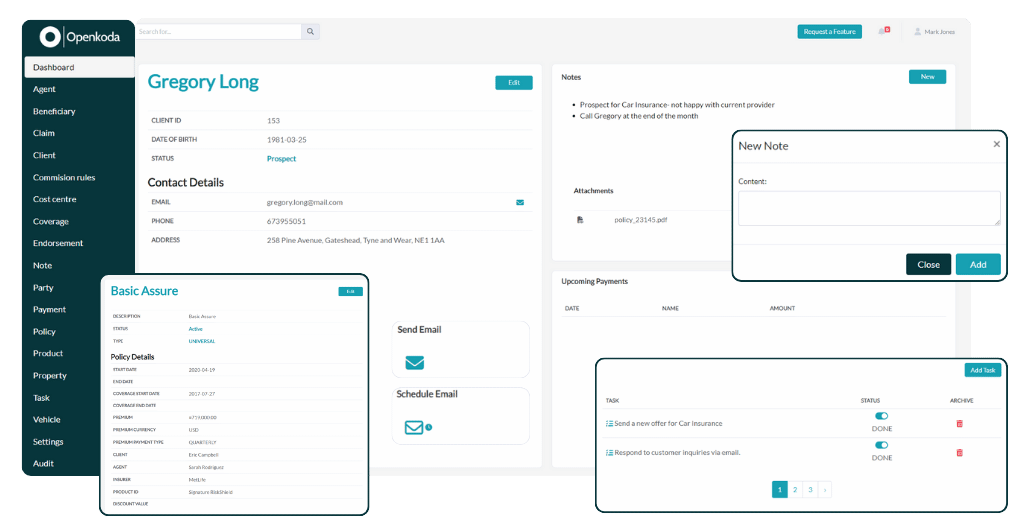

This is where platforms like Openkoda change the equation.

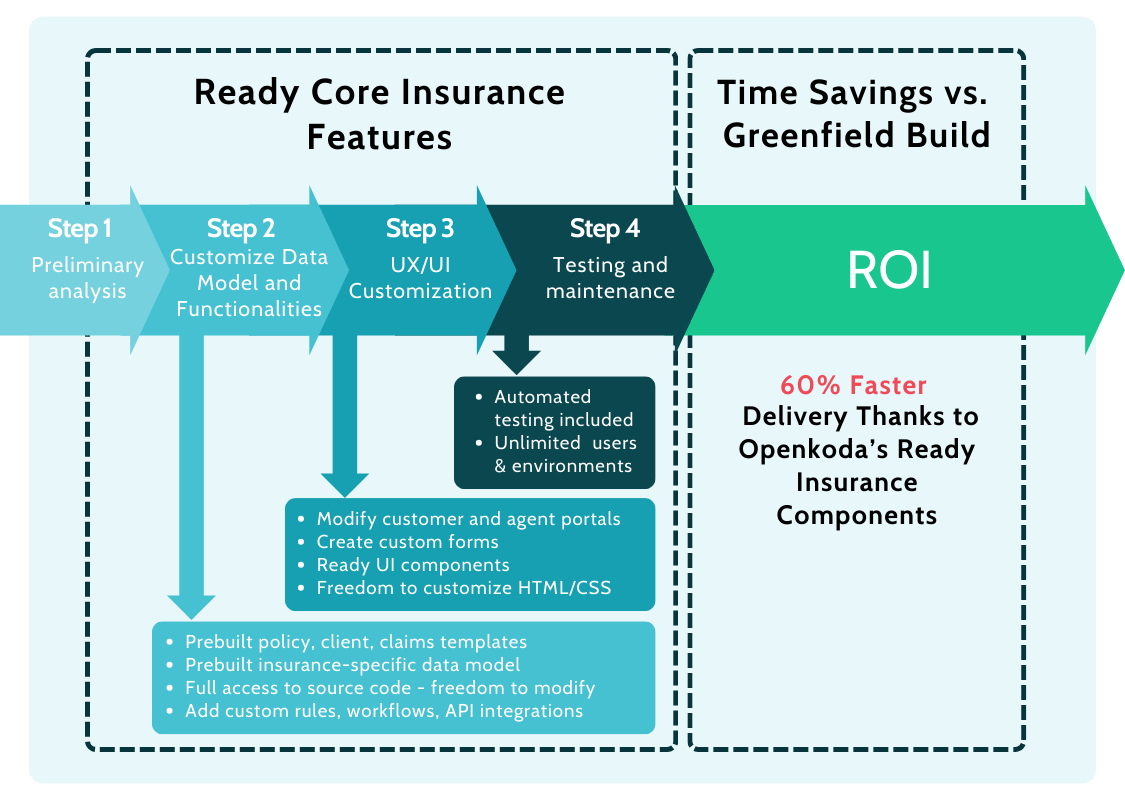

Developing Policy Administration Software 60% Faster

Openkoda provides a ready-made application template for insurance policy administration, combined with an insurance-ready data model and cloud native architecture.

Instead of starting from zero, insurers build on a proven foundation and tailor it to their exact business needs. The result is faster speed to market without sacrificing ownership or flexibility across the full policy life cycle.

From the perspective of insurance policy administration, key Openkoda capabilities include:

- Prebuilt policy administration framework

A structured starting point covering core policy administration systems logic, reducing early-stage development effort. - Flexible product and policy configuration

Business rules, products, and workflows can be adjusted without fighting platform constraints. - Cloud based and cloud native architecture

Designed for scalability, performance, and seamless deployment in modern cloud environments. - Full integration readiness

Open APIs make it easy to connect policy administration with claims, billing, analytics, and external services. - Code ownership and extensibility

Insurers retain full control over the codebase, enabling long-term evolution without vendor dependency.

From a cost and timeline perspective, the difference is significant.

A greenfield insurance policy management software often takes years to build and requires a large, permanent development team. Using Openkoda, insurers can launch core insurance policy administration functionality much faster – up to 60% faster, then evolve it iteratively as innovative insurance products are introduced and overall markets change.

There is also a fundamental pricing distinction.

Many policy administration software vendors charge per user or per transaction, which becomes expensive as organizations scale. Openkoda’s model is based on code ownership, not user-based fees. For insurers planning long-term growth, this approach offers far greater predictability and control over total cost of ownership.

Closing Thoughts

Modern policy administration software serves as a strategic asset for insurers.

Systems that support rapid new business onboarding and flexible product configuration enable companies to respond faster to market change and customer expectations. In the long run, insurers that treat policy administration as a core capability, not a constraint, are better positioned to grow, adapt, and innovate.