7 Step Checklist for Insurance MGA Software Modernization

The insurance market is evolving rapidly, driven by market changes that are reshaping how specialty insurance is designed, distributed, and managed.

As MGAs respond to evolving needs around speed, flexibility, and scale, technology is becoming a critical factor in enabling MGAs to compete effectively.

This article explores how modern MGA systems can support growth, differentiation, and long-term success in an increasingly complex insurance landscape.

Contents

- The Basics: What Are MGAs and Why They Thrive in Specialty Lines

- Key Considerations for MGA Software Modernization

- Step #1: Define Your Modernization Vision and Goals

- Step #2: Audit Legacy Systems and Pain Points

- Step #3: Ensure Integration Capabilities

- Step #4: Prioritize Flexibility and Customization

- Step #5: Choose the Right Platform (Core Platform vs. Greenfield Build)

- Step #6: Leverage a Modern Core Platform

- Step #7: Plan for Data, Analytics, and AI Enablement

- Step #8: Mind the Change Management

The Basics: What Are MGAs and Why They Thrive in Specialty Lines

Managing General Agents (MGAs) are specialized insurance intermediaries that operate with delegated underwriting authority from insurance carriers.

Unlike a traditional insurer that carries risk on its balance sheet or a broker who simply facilitates sales, an MGA can price, underwrite, bind, and service policies within agreed limits on the carrier’s behalf, leveraging third-party data providers.

In essence, MGAs act as an agile extension of insurers – designing and running insurance programs in targeted niches while the carrier provides the capital and oversight. This unique position blends the market knowledge and distribution of an agency with certain underwriting capabilities of a carrier.

One key difference is agility.

MGAs today can move with speed and make decisions faster than even the leading insurers.

Freed from some of the legacy bureaucracy and IT constraints of big carriers, MGAs are able to respond quickly to market gaps and innovate with specialized products. They excel in specialty lines – niche or complex risks that standard insurers might overlook or struggle to serve. MGAs are valued for their deep specialization in niche and complicated risks, a core competency that many traditional carriers may lack internally.

For example, MGAs often focus on areas like cyber liability, marine cargo, pet insurance, excess & surplus lines, or other emerging risks where tailored underwriting and speed-to-market are crucial.

MGA Growth: Outpacing the Traditional P&C Market

It’s no surprise, then, that MGAs have become a rapidly growing force in the insurance industry. In the U.S. alone, the MGA market accounts for over $110 billion in premium and has basically doubled in the last five years, far outpacing the growth of the broader P&C market.

There are now more than 1,100 MGAs and program administrators in the U.S., with similarly strong growth in the UK and Europe.

Technology has made it easier than ever to launch these MGA ventures, which brings us to why modernizing an MGA’s software systems is so critical in today’s landscape.

Why Modernization Is Critical for MGAs

Technology and agile MGA systems are a foundational driver of competitiveness and growth for MGAs.

The MGA market’s rapid expansion and specialization mean that those operating on outdated systems face significant disadvantages. Many older MGAs rely on a patchwork of legacy policy admin systems, spreadsheets, and manual workflows. This limits their ability to leverage expanding data and advanced analytics, which are increasingly essential for innovative underwriting and pricing.

On the flip side, the business impact of modernization is tangible. MGAs that invest in replacing legacy core systems and prioritizing innovation report significantly higher growth – between 1.16× to 1.98× higher growth rates than those who do not make those tech investments.

In other words, there’s a clear correlation between a strong, modern technology foundation and long-term success for MGAs.

Key Considerations for MGA Software Modernization

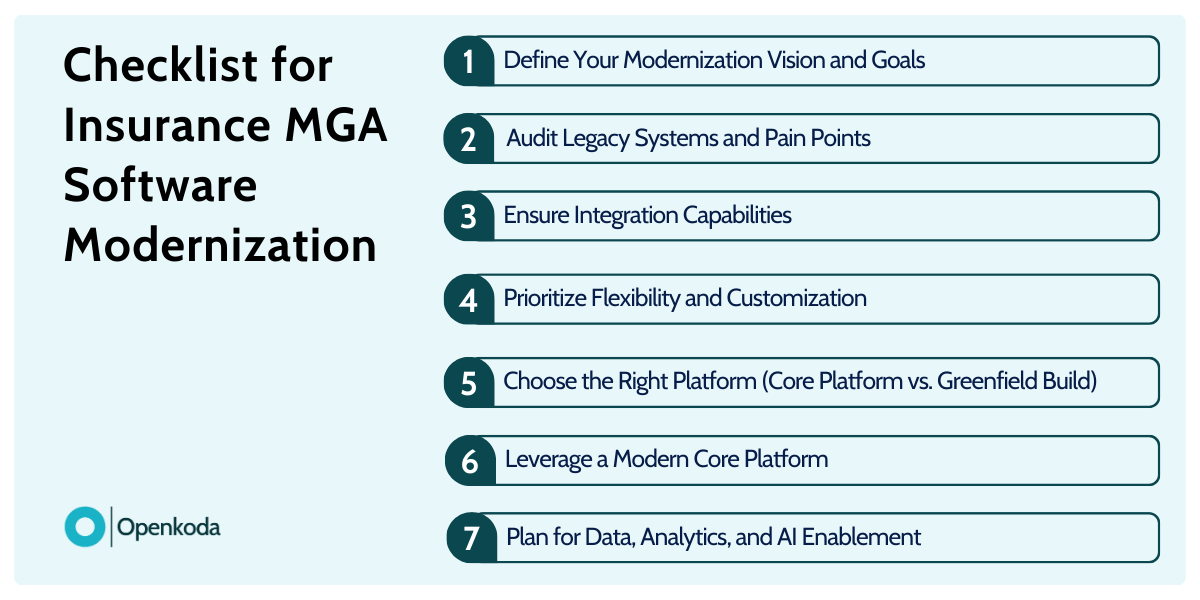

When launching a modernization process for your MGA’s software, it helps to approach it as a step-by-step checklist.

Here are the key things to remember and evaluate:

Step #1: Define Your Modernization Vision and Goals

Start with a clear articulation of why you are modernizing and what success looks like.

Tie the technology upgrade directly to your business objectives and long-term growth plans.

For many MGAs, this means the ability to move faster into new markets, experiment with new insurance products, or support higher transaction volumes without adding operational complexity. Others may focus on improving pricing accuracy, enabling better data-driven underwriting, or delivering a more seamless digital experience for agents and partners

For example, if rapid market entry is a priority, your platform must support flexible product configuration and seamless connectivity with carriers, data providers, and distribution partners. If scale is the goal, the system should handle growth without forcing fundamental changes to how your MGA operates.

[Read also: Insurance Legacy Systems Modernization: Winning Strategy]

Step #2: Audit Legacy Systems and Pain Points

Take stock of your current systems, processes, and data flows.

Identify what’s holding you back.

Many MGAs find that legacy MGA systems involve a lot of manual work and workarounds – for instance, re-keying data into multiple systems, reconciling reports with carriers by hand, or using spreadsheets for lack of better tools.

Pinpoint these pain points and inefficiencies. This audit will highlight where modernization can have the biggest impact (such as eliminating duplicate data entry, reducing paper processes, or speeding up quote-to-bind cycle time). It also helps prevent simply “paving the cow path” – you want to redesign processes for efficiency, not just convert old flaws into a new system.

Step #3: Ensure Integration Capabilities

Integration with carrier systems and third-party partners should be a top priority in any MGA platform modernization. Since your authority (and much of your data) comes from carriers, your system must sync seamlessly with theirs.

Modern MGAs also connect with a wide array of external services – from premium finance and accounting systems to compliance databases and data enrichment APIs (for example, pulling vehicle details by VIN or using geospatial data for property underwriting).

As you modernize, evaluate the system’s ability to connect easily (via REST/GraphQL APIs, webhooks, etc.) to your ecosystem. The goal is an integrated digital backbone where data flows freely across your MGA, carriers, brokers, and service providers – no more brittle point-to-point integrations or silos that require manual intervention.

Step #4: Prioritize Flexibility and Customization

In the specialty lines arena, one-size-fits-all software quickly becomes a bottleneck – especially as MGAs scale and their operating models become more complex.

MGAs thrive by being different – your products and workflows won’t look like a standard personal auto insurer’s. Therefore, ensure that any new system is highly configurable and customizable. Your platform should adapt to your underwriting workflows, rating logic, unique coverage terms, and document requirements – not the other way around.

The modern system must support these variations easily.

If a platform is too rigid – allowing only cookie-cutter products – it will hinder your growth in specialty markets. A modern system must allow you to configure underwriting workflows, rating logic, unique coverage terms, document templates, and approval paths without excessive custom development.

This is essential not only to launch insurance products faster, but also to continuously refine them as market conditions change and stay . When MGA systems are flexible by design, product teams can iterate quickly without waiting on long development cycles, directly improving operational efficiency.

Flexibility should also extend to the user experience. Underwriters, brokers, operations teams, and management all interact with systems differently.

Being able to customize dashboards, workflows, and portals ensures that each role sees relevant information and actions at the right moment. This clarity supports faster, better-informed decisions — and ultimately helps MGAs scale without losing control of their operations.

Step #5: Choose the Right Platform (Core Platform vs. Greenfield Build)

One of the most critical decisions is how to modernize your core system.

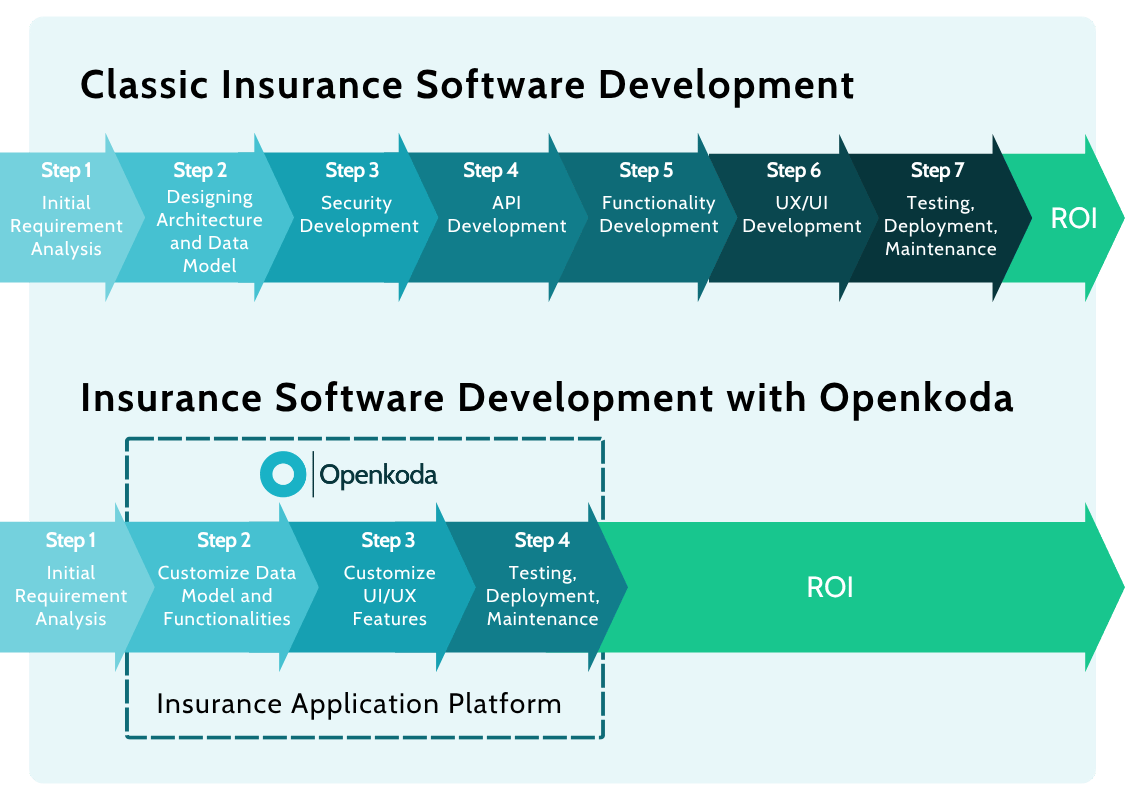

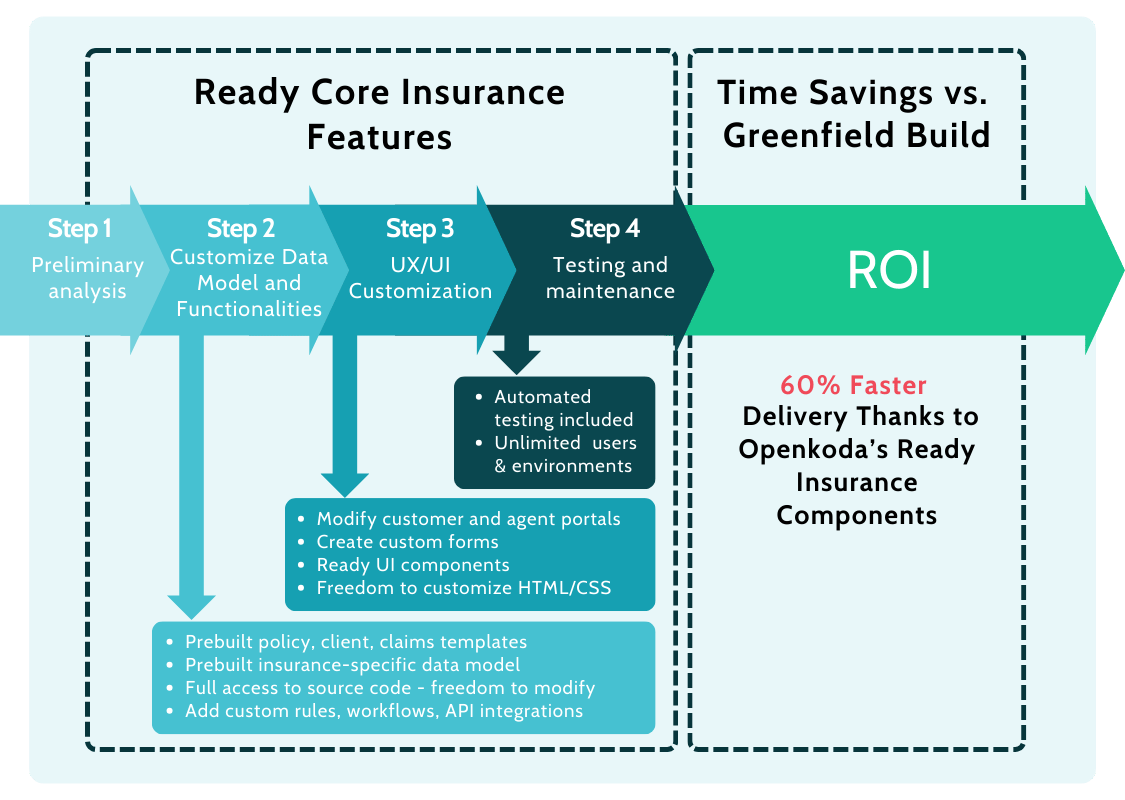

Broadly, MGAs have two paths: build a completely new system from scratch (greenfield) or adopt a modern core insurance platform as a foundation and customize it. It’s important to understand the trade-offs. Building from scratch can seem appealing (“total freedom!”), but in reality a blank page is slow and costly.

You would need to reinvent everything – data models, policy admin modules, claims, billing, integrations – and handle all the plumbing (authentication, user roles, basic UI) before delivering any business value.

Industry studies find that a full in-house build often takes 24–36 months for a multi-line insurer, which could be 2–3 years before your first customer sees value.

Meanwhile, a modern core platform comes with the essential components ready-made: a policy administration module, claims handling, rating engine, billing, user management, and more – all tested and proven.

This can shave years off the timeline. In fact, insurers report 40–60% faster development cycles with configurable platforms versus greenfield builds.

Some modern platforms even allow you to prototype a new product in weeks, iterate in days, and deploy in a few months – not years.

For most MGAs, leveraging a core insurance platform is the smarter approach to modernization. It dramatically lowers your time to market and helps achieve ROI faster by eliminating the need to build common features from zero.

[Readl also: Innovative Insurance Products to Introduce in 2026]

Step #6: Leverage a Modern Core Platform

Choosing your next platform should involve evaluating factors like vendor lock-in, customizability, and cost structure.

Can the platform support scalable growth without driving up operational costs? Can it integrate smoothly with external systems, from carriers’ policy administration systems to payments, data providers, and distribution partners? And most importantly, can your team adapt quickly when market conditions or product strategies change?

For example, Openkoda is a next-generation insurance platform designed with MGAs’ needs in mind. Its core value is delivering speed without giving up control.

Openkoda ships with pre-built insurance templates for policy management, claims management, and embedded insurance use cases, giving MGAs a solid starting point instead of a blank slate.

At the same time, it’s not a rigid black box. The platform is built to be extended and customized, making it easier to launch differentiated insurance products without fighting against the underlying technology.

A key advantage is how Openkoda approaches integration.

MGAs rarely operate in isolation – they rely on a growing ecosystem of carriers, MGA systems, brokers, and third-party services. With a rich set of APIs and a modular architecture, Openkoda simplifies connectivity with external systems, whether you’re plugging into underwriting engines, document generation tools, or analytics platforms.

This flexibility is critical for insurance agencies and MGAs that need to evolve their tech stack incrementally rather than rip and replace everything at once.

From an operational perspective, Openkoda helps keep costs predictable.

Its approach avoids per-user pricing traps and supports unlimited internal users, which is particularly valuable as your team expands or as you roll out new tools like an agent portal.

Finally, Openkoda is designed for change.

Whether you’re launching a niche product, expanding into a new distribution channel, developing a new underwriting platform, or refining your policy management system to meet regulatory or carrier-specific requirements, the platform gives your team the ability to move fast without accumulating technical debt.

For MGAs focused on innovative solutions rather than maintaining brittle systems, that combination of flexibility, control, and speed can make a measurable difference.

Step #7: Plan for Data, Analytics, and AI Enablement

Modernizing your core system is also an opportunity to upgrade how you use data. Ensure the new platform has strong data management and reporting capabilities. Real-time dashboards and built-in BI tools can replace the old routine of exporting data to spreadsheets.

Your goal should be a single source of truth for policy, claims, and financial data, accessible on-demand for analysis.

This not only improves decision-making but also makes regulatory compliance (stat reporting, audits) much easier. Additionally, consider how the platform leverages emerging tech like AI and machine learning. Many modern core systems are embedding AI for things like intelligent triage of submissions, automated fraud detection, or even generative AI to auto-complete forms.

As an MGA, you want the ability to plug into such innovations over time. Even if AI is not on your immediate roadmap, choosing a platform with an API-first, cloud-native architecture will make it easier to integrate new tools down the line.

Step #8: Mind the Change Management

Finally, remember that modernization is not only about technology – it’s also about people and processes as well.

As you implement a new core platform, invest in training your team and possibly your distribution partners (agents/brokers) on the new system’s workflows. Plan a phased rollout or a parallel run if needed to ensure business continuity.

It helps to designate internal “champions” who understand the new platform well and can support others.

Additionally, engage with carrier partners early about any new data exchange formats or portal changes to keep everyone in sync.

Conclusion: Modernize to Accelerate and Differentiate

Embarking on a core system modernization is a substantial undertaking for any MGA, but it’s a move that pays off across the entire value chain.

By choosing a modern, scalable, and customizable platform as the foundation, MGAs can eliminate manual inefficiencies, collaborate more effectively with carrier partners, and unlock the agility to launch new specialty products quickly as opportunities arise.