Complete Guide to Insurance Agency Management System (AMS)

Choosing the right tools is critical for insurance agencies looking to stay competitive in a fast-changing market.

At the center of this toolkit are Agency Management Systems (AMS) – platforms that help agencies streamline operations, improve client relationships, and manage policies with greater efficiency.

In this guide, we’ll explore what an AMS is, why it matters, and how the best agency management systems support both everyday tasks and long-term growth.

What is an Agency Management System?

Agency Management Software AMS is the software designed to handle the day-to-day tasks that keep an agency running – organizing client data, managing policies, processing claims, and streamlining communication with both carriers and customers.

Think of it as a central hub where all the essential information and processes converge.

For insurance agencies, time and accuracy are everything.

Unlike generic CRM or ERP systems, insurance agency software is built specifically for the needs of the insurance sector.

That means it doesn’t just track clients – it understands policy renewals, commission structures, underwriting workflows, and the compliance requirements unique to the industry. In other words, it is tailored to the data types and workflows of the industry.

It is also worth mentioning that in 2025, modern AMS platforms often go beyond simple record-keeping.

They integrate with carriers, offer customer self-service options, and automate repetitive insurance agents tasks like document generation or reminders for policy renewals.

By consolidating all these functions into one place, an AMS reduces operational silos and gives agencies a single source of truth.

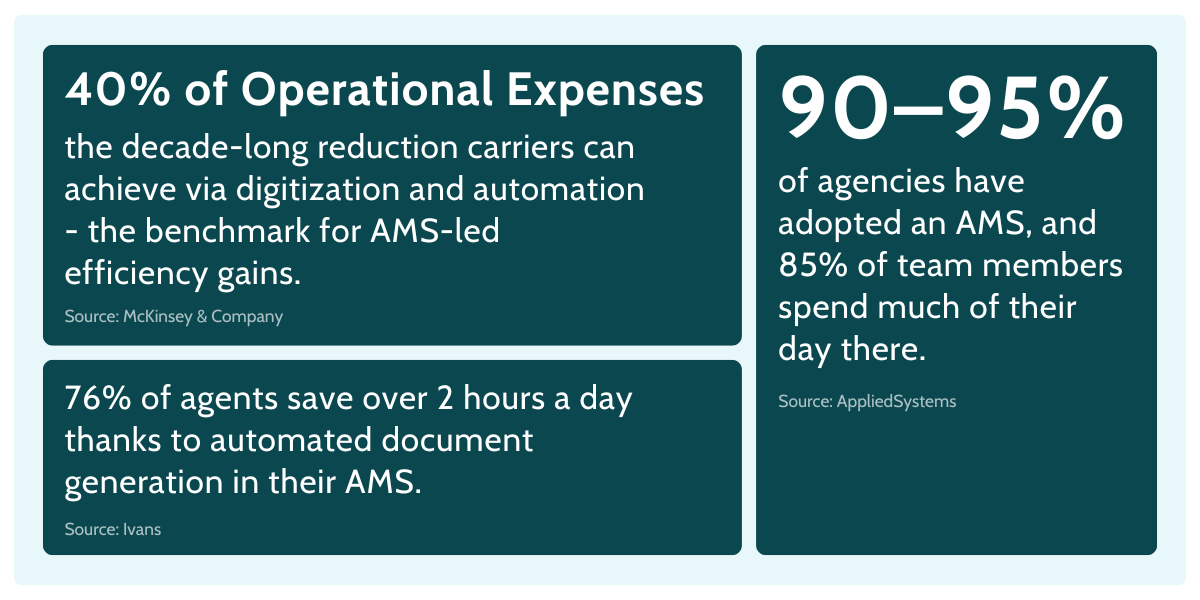

Insurance Agency Management Software: Key Trends and Statistics

For most independent agencies, and the carriers that depend on them, an Agency Management System (AMS) is the key operating system of the business – its software core.

By 2025, adoption of agency management systems is nearly universal.

In the U.S., more than 9 out of 10 independent agencies report using an AMS. Even among smaller agencies, the Big “I” Agency Universe Study shows penetration rates above 80%.

So, how do agencies actually use these systems in practice?

Most rely on the AMS for their core day-to-day tasks. Around 70 percent use it for eDocs and messages, more than 65 percent for billing and claims inquiries, roughly 60 percent for endorsements, and between 50 and 67 percent for quote bridging across both Personal and Commercial Lines.

Another clear trend is the growing importance of integrations.

In 2025, no AMS can stand on its own. Agencies increasingly depend on connected tools that plug into the system and extend its functionality. E-signature solutions are used by about 71 percent of agencies, personal-lines rating platforms by 57 percent, and integrated texting tools by 31 percent, according to Catalyit’s 2024 research.

These figures highlight a broader reality: modern insurance agency management system has become a connected hub that anchors the agency’s wider digital ecosystem – if you are still not using one your are missing

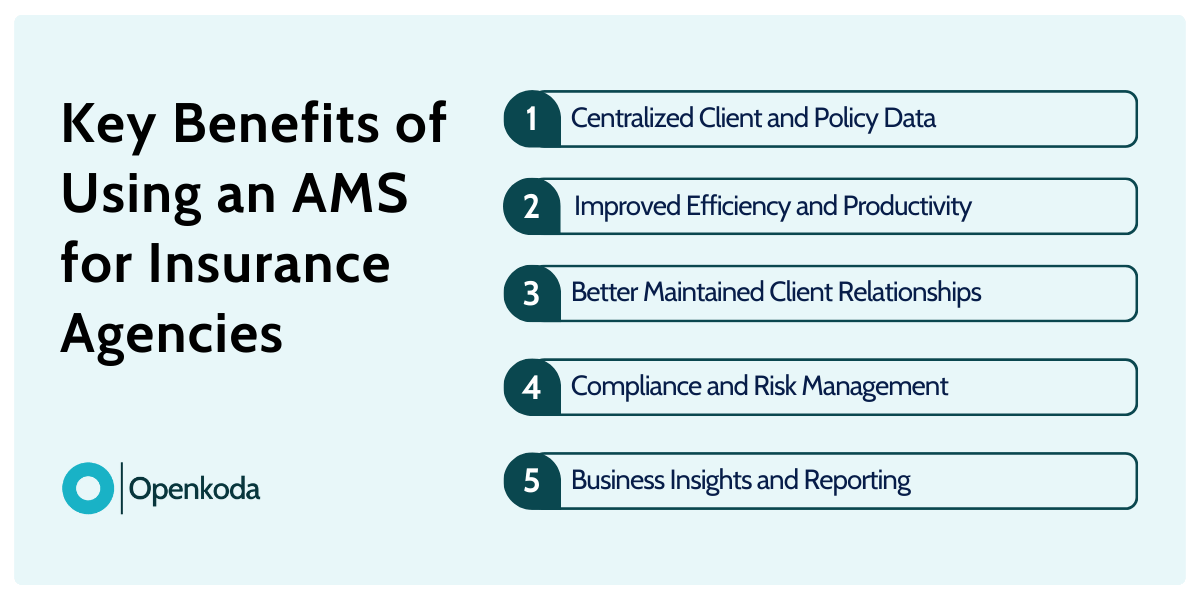

Key Benefits of Using an AMS for Insurance Agencies

Implementing an Agency Management System can completely reshape how an agency operates.

Instead of juggling multiple disconnected tools and manual spreadsheets, everything lives in a single, organized environment.

Benefits of such move will be visible in virtually all aspects of daily work of your insurance agents and agency principals as well.

Below we’ve picked some of the key benefits.

Centralized Client and Policy Data

An important element of any good AMS is policy management software.

It keeps all client information, policy details, and communication history in one place.

Agents no longer need to dig through emails, shared drives, or paper files to find a piece of information.

With everything centralized, agencies reduce duplication, avoid mistakes, and have a complete view of their customer relationships.

Improved Efficiency and Productivity

By automating repetitive tasks – like generating renewal notices, producing policy documents, or syncing data with carriers – an AMS frees up valuable time.

Agents spend less effort on administrative work and more on building relationships and growing the book of business.

Better Maintained Client Relationships

Clients today expect quick answers and seamless service.

With an AMS, independent insurance agents can instantly pull up policy details, track claims, or process changes during a single call.

Some systems even provide customer portals, where clients can self-service basic tasks, further improving satisfaction and loyalty and building client relationships that can last.

Compliance and Risk Management

Regulation is and always been a major factor in the insurance industry.

AMS platforms help independent agencies stay compliant by keeping thorough records, managing document retention, and ensuring data security.

This reduces the risk of penalties while also building trust with carriers and customers.

Business Insights and Reporting

Most modern AMS solutions come with built-in reporting and analytics.

Agencies can track performance metrics, monitor revenue streams, identify which lines of business are most profitable and make data driven decisions. These insights support better strategic decision-making and long-term planning.

How Management Systems Improve Day-to-Day Operations

For many agencies, the real impact of an agency management system shows up in the small, everyday tasks.

Think about a typical morning at a mid-sized insurance agency.

Agents start by checking upcoming policy renewals. Instead of flipping through spreadsheets or email threads, they open the AMS dashboard, which immediately highlights all renewals due this week. Automated reminders are already sent to clients, so the agent can focus on follow-up conversations rather than chasing deadlines.

When a client calls with a question about their coverage, the agent can pull up the entire account history in seconds.

All policy details, past claims, and communication logs are stored in one place. This not only saves time but also strengthens client relationships, because the client feels recognized and well-served instead of being asked to repeat their history.

The same applies to document management. Certificates of insurance, policy documents, and claims forms are automatically generated and stored in the system.

Independent agents no longer waste hours searching shared drives or re-creating documents from scratch. Instead, everything is neatly organized, secure, and easy to share with clients or carriers.

By reducing administrative friction, an agency management system allows teams to spend more time on revenue-generating activities and less time on clerical work. This balance is what makes agencies more efficient, responsive, and competitive in a digital-first insurance market.

Features to Look for In Your Future Agency Management System

Not every agency management system is created equal.

The right platform should support your current needs while also giving you room to grow as your agency evolves. When evaluating options, it’s worth paying attention to the core features that make daily operations smoother and long-term growth more achievable.

Here are some of the most important features to look for:

Policy Management

At the heart of any agency management system is strong policy management.

This means tracking policies from quote to renewal, managing endorsements, and ensuring clients always have up-to-date documents.

Claims Management

A built-in claims workflow ensures faster response times, better transparency for clients, and less manual tasks. This also supports compliance and reduces operational risk.

CRM Functionalities

An AMS should also function as a mini-CRM, centralizing client data and supporting client communications. From call notes to renewal reminders, everything should be accessible in one place to strengthen relationships.

Sales Pipeline Management & Automation

Many systems now include sales pipeline management and sales automation features. These help agents follow leads, track opportunities, and convert prospects into policyholders more effectively.

Document Management

Secure storage and quick retrieval of certificates, policies, and compliance documents are essential. Proper document management ensures smoother business processes and keeps everything audit-ready.

Customizability and Scalability

Agencies grow and change.

A future-ready agency management system should be flexible enough to adapt workflows, eaisly modify business rulkes, add features, and scale with the team without forcing costly migrations.

Common Problems With Agency Management Software

While the advantages are clear, not every agency management software solution fits the needs of modern insurance agencies. Choosing the wrong tool can actually slow operations down instead of improving them.

One of the biggest issues agencies face is vendor lock-in. Many platforms limit flexibility, making it difficult—or extremely costly—to migrate data, integrate new tools, or switch providers. This leaves agencies stuck with a system that no longer serves their needs.

Another common problem is user-based pricing.

As an agency grows and hires new agents and insurance professionals, costs can skyrocket. What looked affordable for a team of five becomes much less attractive for a team of fifty. This kind of pricing structure punishes business growth rather than supporting it.

Scalability is another concern. Some solutions work well for smaller firms but quickly run into performance or customization limitations as business expands. Agencies that adopt these tools often find themselves searching for a replacement system just a few years later.

These challenges highlight why it’s important to carefully evaluate any agency management system before committing. The wrong choice can lead to unnecessary costs, wasted time, and operational frustration.

[Read also: Top 6 Best Policy Management Software Systems on The Market in 2025]

Agency Management System: Customizing Your Own Bespoke Platform

The downsides of traditional systems – like vendor lock-in, user-based pricing, and limited scalability – push many agencies to consider building their own platform.

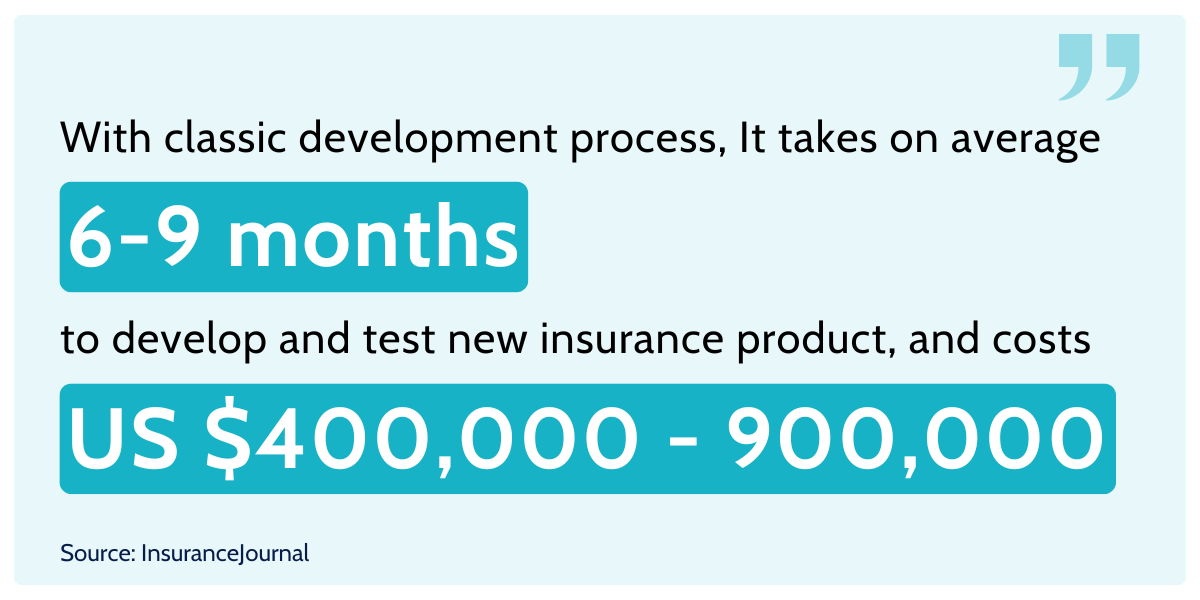

A bespoke solution means owning the code, setting your own rules, and shaping the system around your business instead of the other way around, but are undeniably extremely pricey when you consider just how long the whole development process usually takes.

This is where modern development approaches, like Openkoda, make a real difference.

Creating Your Own Agency Management Experience with Openkoda

So what’s the Openkoda’s secret?

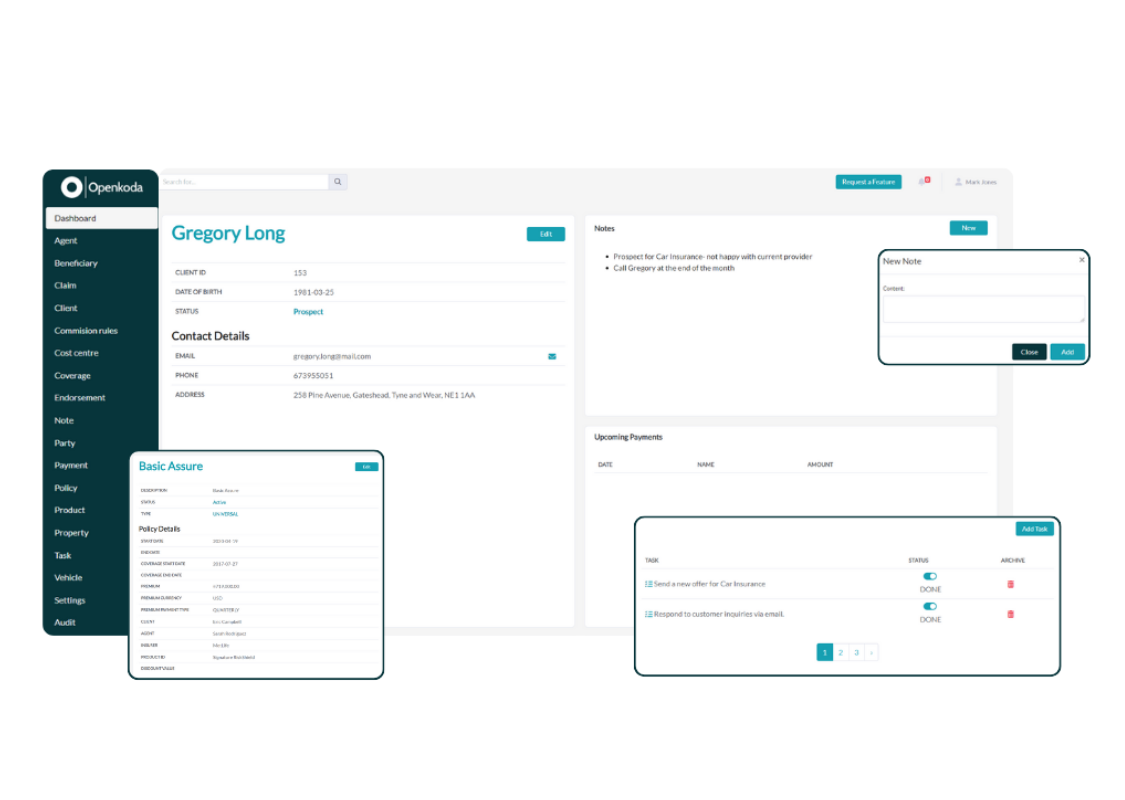

The platform provides ready-to-use components that cover the most critical areas of insurance operations.

Out of the box, you can quickly set up policy management, embedded insurance and claims management modules, giving your agency the backbone of a functional AMS right from the start.

These can then be customized to reflect your unique business processes, commission structures, or innovative insurance products.

There are alse plenty of key backend features such as multi-tenancy, role-based security, reporting, audit trails, and insurance API integrations that come pre-integrated, offering the scaffolding necessary for a fully-functional AMS straightaway.

Beyond core functionality, Openkoda is designed for scalability and freedom.

Since it’s open-source, you own the code and can adapt it as your business evolves—without vendor lock-in or hidden user fees.

This means your AMS grows with your agency, not against it.

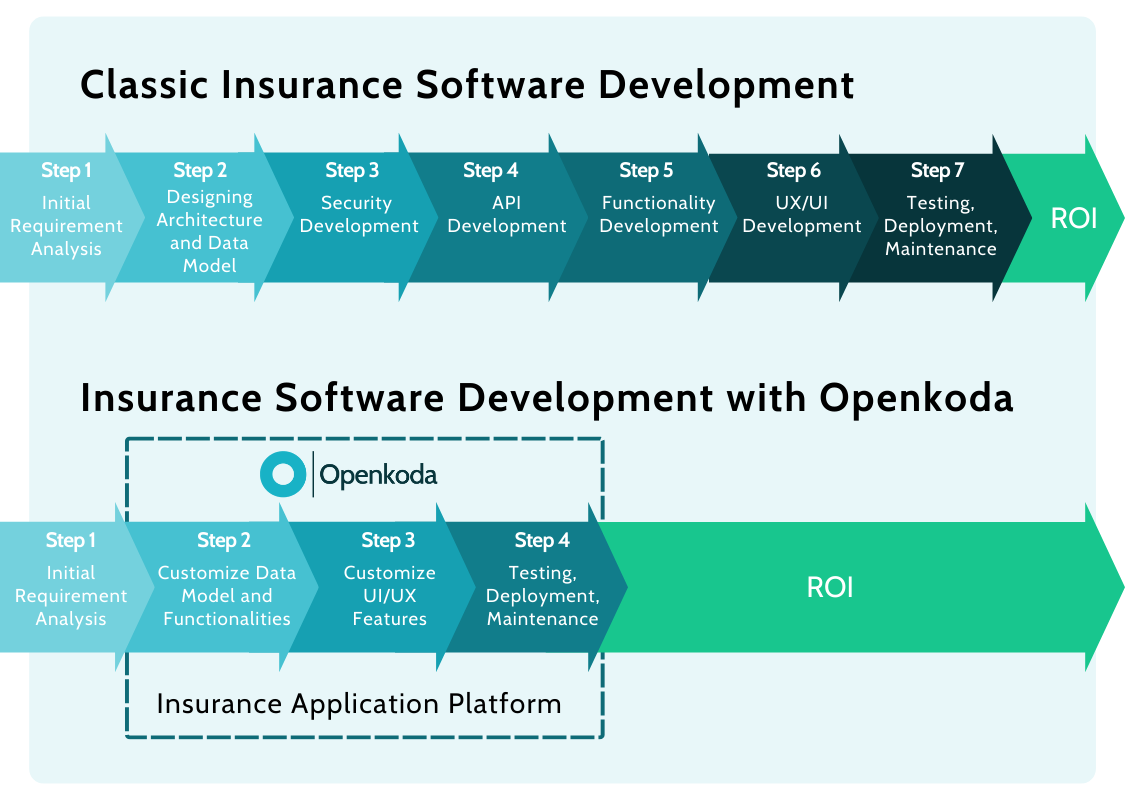

Openkoda Platform vs. Traditional Custom Development: Approach Comparison

While custom solutions offer unparalleled flexibility and tailored functionalities, we must address the elephant in the room: time and cost.

When starting from scratch, developers would spend months designing the basic structures typical of software solutions, such as authentication, user management, reporting AI modules and document handling.

Only once these foundations were in place could they start developing insurance-specific features such as policy tracking, commission management and claims workflows.

Openkoda changes this approach.

Instead of reinventing the wheel, it gives agencies a ready-made foundation with many of these core elements already built in.

User management, reporting, dashboards, and even preconfigured modules for policy and claims management software are available out of the box. That means development time is cut drastically, allowing teams to focus directly on the features that matter most to their business.

The difference is not just speed but also flexibility.

With Openkoda, you can develop a working AMS prototype in weeks, refine it as you go, and scale it to enterprise-level operations—all while maintaining ownership of the code.

[Read also: 6 Best Claims Management Software Solutions in 2025]

Closing Thoughts

Insurance agencies face growing pressure to work faster, stay compliant, and deliver better client experiences.

An agency management system – especially one tailored with tools like Openkoda – can provide real benefits business by bringing efficiency, flexibility, and control to daily operations.

The agencies that invest in adaptable systems today will be better prepared to meet tomorrow’s challenges.