How Technology Powers Specialty Insurance Products

The insurance industry is under increasing pressure to innovate faster than ever. Customer expectations are evolving rapidly. They demand digital experiences that are seamless, personalized, and immediate. At the same time, emerging risks, niche markets, and new data sources are opening the door to more targeted and unconventional insurance offerings.

Innovative insurers are no longer relying solely on traditional products. Instead, they are looking for the agility to quickly launch, test and scale new ideas. That’s where specialty insurance products come in.

Contents

- What is Specialty Insurance?

- Why Specialized Insurance Matters to Customers

- Benefits of Specialty Insurance

- The Challenges of Specialized Insurance Products

- How the Right Technology Can Help

- How to Choose the Right Technology for Specialized Insurance Products?

- Insurtech Platform for Specialty Products

These niche offerings are a powerful way to differentiate, meet specific customer needs, and address underserved market segments. But building and supporting modern insurance systems requires a technology foundation that can keep pace. And that’s the challenge we’ll talk about today.

What is Specialty Insurance?

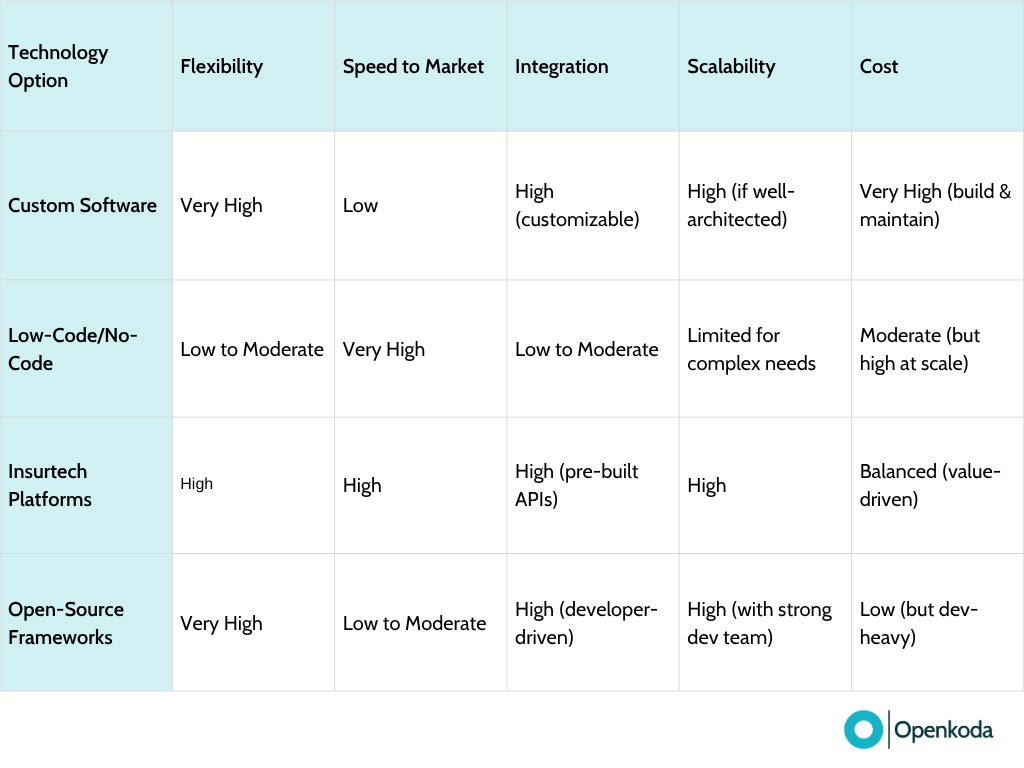

Specialty insurance is coverage designed for risks that don’t fit into standard insurance policies.

It helps protect businesses or individuals with unique needs – like those in construction, aviation, marine, events, or professional services. These are often higher-risk or more complex situations that require customized solutions.

For insurers, offering specialty insurance is a way to reach niche markets, handle unusual risks, and provide more flexible, expert-driven coverage options.

A few examples include:

- Insurance policies tailored for amateur athletes, offering coverage for sports-related injuries during training or competitions.

- Aviation insurance with dynamic pricing, where telemetry data from aircraft systems is used in real time to assess risk and adjust premiums accordingly.

- Property insurance in natural catastrophe-prone regions, such as tornado zones in the Midwest or earthquake-prone areas.

- Highly customized celebrity insurance, such as vocal cord coverage for professional singers or performance cancellation insurance for touring artists.

Specialty insurance products often require:

- advanced risk modeling,

- additional data collection,

- and more complex underwriting workflows.

They’re not something that can be easily managed by traditional insurance systems.

Why Specialized Insurance Matters to Customers

The appeal of specialized insurance lies in its ability to deliver exactly what the client needs, even the most specific requirements.

For many policyholders, this means more accurate pricing, personalized approach, and more relevant protection.

For example, physically active individuals can benefit from life or health insurance policies that offer lower premiums based on their healthy lifestyle.

In high-risk areas where standard policies are unavailable or prohibitively expensive, specialized coverage may be the only realistic option.

Benefits of Specialty Insurance

- Greater availability – These products make coverage accessible to niche segments that are often excluded from mainstream offerings.

- Better risk segmentation – By leveraging additional data and more granular criteria, insurers can reduce overall risk exposure.

- Smaller protection gaps – With more tailored coverage options, insurers can reduce the so-called “insurance gap,” extending protection to those who need it most.

- Lower premiums for the right segments – Thanks to better risk modeling, insurers can offer competitive pricing to well-defined customer groups, improving both affordability and uptake.

The Challenges of Specialized Insurance Products

- Lack of off-the-shelf solutions – Niche products often require custom workflows and features, which can’t be delivered using standard insurance software.

- Non-traditional distribution channels – Specialized products may be sold via partners, embedded in other services, or delivered through digital ecosystems that don’t fit typical agent models.

- Higher cost of implementation – Because of their complexity and smaller target audiences, each specialized product tends to carry a higher cost per launch compared to mass-market policies.

These challenges can be addressed with the right technology strategy, and later in this article, we’ll guide you through it. But first, keep in mind that the process can be complex, so here’s what you need to know to be well prepared.

How the Right Technology Can Help

Specialized insurance products often require non-standard processes, custom logic, and flexible user flows.

These are things that can’t be delivered using typical off-the-shelf policy administration systems.

Some of the most common obstacles include:

- Choosing the right technology stack – Insurers struggle to find a solution that’s flexible enough to handle complex use cases today, but also scalable and future-proof.

- High cost of prototyping – Testing new ideas often demands significant development time and resources, making it harder to innovate quickly or explore new niches.

- Scaling challenges – A solution that works well for a pilot program may collapse under the weight of increased volume or additional product lines.

- Integration headaches – Specialized products often need to connect with third-party tools, data providers, or insurtech platforms. Seamless integration becomes critical for maintaining a smooth user experience and operational efficiency.

While working closely with insurance companies of all sizes, we’ve heard a recurring set of concerns. These are not just technical complaints, but strategic pain points that directly impact business outcomes.

Here are some of the most common ones:

“Our implementation budget was exceeded several times over, and product sales didn’t even come close to covering the costs.”

“We built the product using a low-code platform with all the required features, but when we tested it on real-world data – like policies covering hundreds of properties with 2,000 attributes – the performance was unacceptable.”

“The SaaS solution works well for our P&C line, but the billing module doesn’t meet our needs – and the vendor has no plans to improve it.”

“We want to make our system available to other partners, but the SaaS platform doesn’t support setting up separate organizations.”

How to Choose the Right Technology for Specialized Insurance Products?

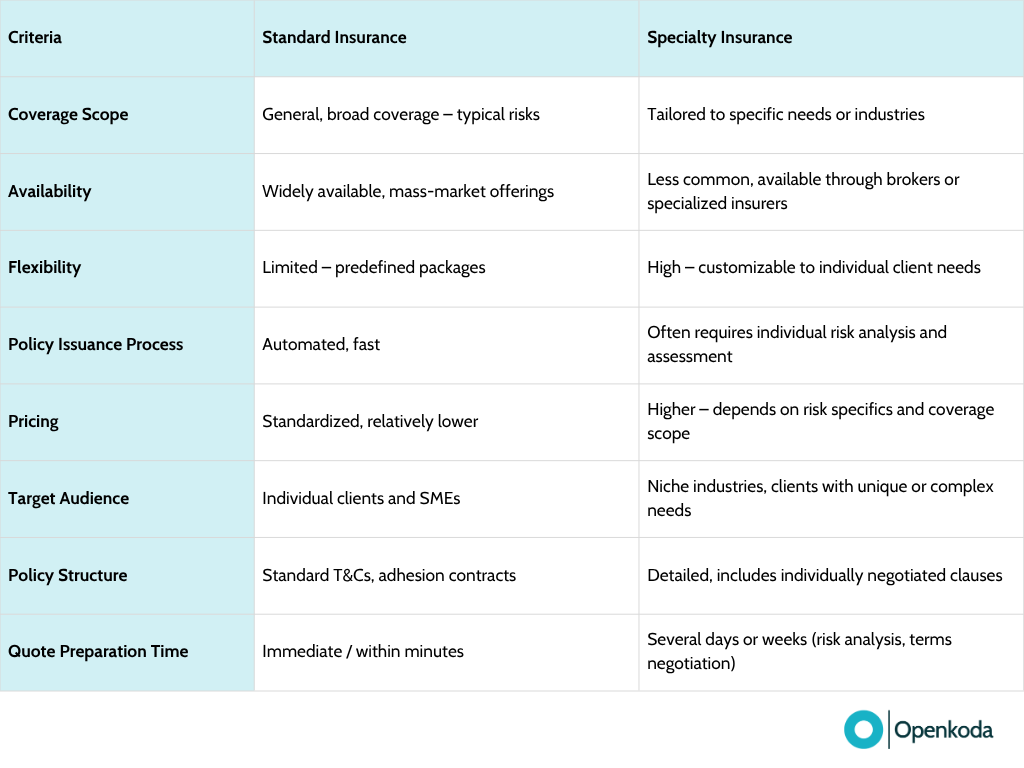

Today’s insurers have a few broad categories of tools they can choose from:

- Custom software offers maximum flexibility. Every process can be tailored to the insurer’s needs, but it is time-consuming, expensive, and often requires ongoing maintenance from in-house teams or external vendors.

- Low-code or no-code platforms promise rapid deployment, and it’s easy to use by non-technical users. They’re great for getting something off the ground quickly, but often struggle with edge cases, complex workflows or integration-heavy environments.

- Insurtech platforms offer pre-built modules for underwriting, policy management, and claims, positioning themselves somewhere between custom-built solutions and low-code platforms.

- Open-source frameworks give insurers full control and the ability to innovate freely, but they require strong technical expertise and often lack the ready-to-use insurance components that speed up development.

Each option has its trade-offs. The key is aligning the tech stack with your business strategy. Are you just validating an idea? Are you planning for long-term scale? Or do you need a solution that’s easy to resell or white-label to partners?

Insurtech Platform for Specialty Products

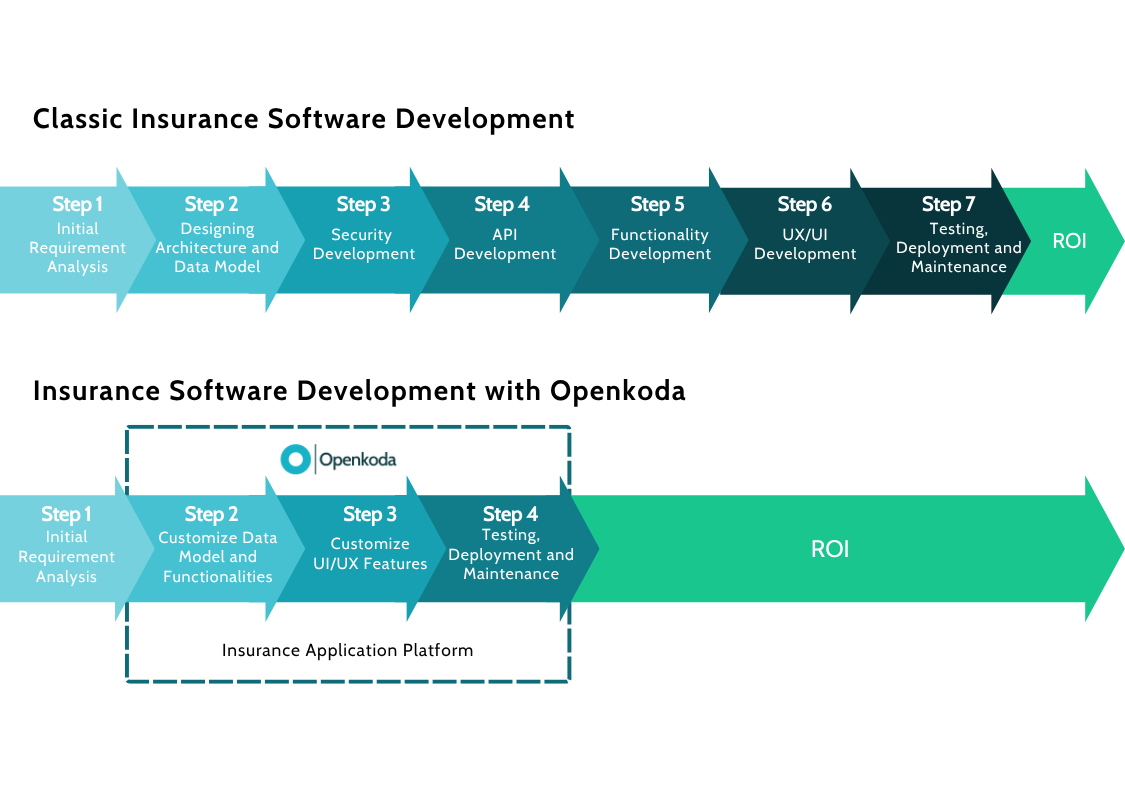

The Openkoda insurance platform was built to solve exactly these kinds of challenges.

Developed by engineers with deep experience in insurance, fintech, and enterprise-grade systems, it offers a hybrid approach, giving insurers the best of both worlds.

The platform combines the flexibility of custom development with the speed of pre-built components.

It includes ready-to-use modules specifically designed for the insurance industry, such as:

- Underwriting rules and automation workflows

- Policy lifecycle management

- Claims processing and customer service tools

- Document management and automatic document generation tools

This setup enables insurers to prototype and iterate on new products far more quickly than with traditional software development.

Whether you’re testing a new idea or launching a niche insurance offering at scale, Openkoda helps you stay agile without sacrificing control.

Insurers and insurtechs have already used Openkoda to power a variety of innovative solutions, including:

- Embedded insurance models – companies have been able to integrate insurance offerings directly into the purchase journey of other products – such as consumer electronics, airline tickets, or equipment rentals. This allows customers to add relevant coverage at the right moment, without the need to visit separate platforms or fill out extensive forms.

- AI-driven chatbots – By building intelligent virtual assistants on top of Openkoda, insurers have streamlined customer support and automated key steps in the claims process. These bots can answer policy-related questions, guide users through filing a claim, and even escalate complex cases to human agents when necessary, saving their valuable time and resources.

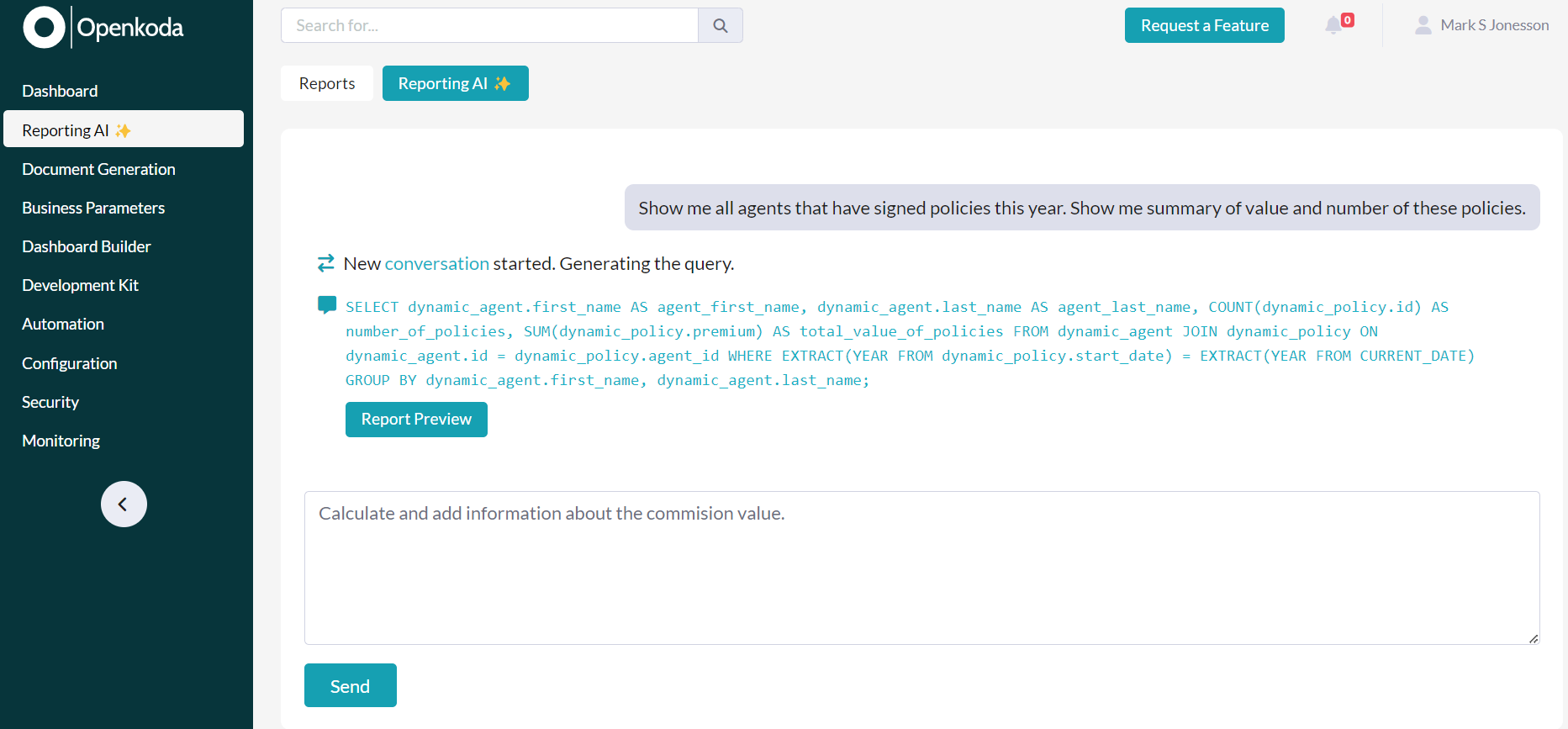

- Conversational analytics – Openkoda enables business users – especially those without technical backgrounds – to explore and analyze data using natural language with the Reporting AI tool. Instead of writing SQL queries or relying on data teams, a user can simply type a question like, “Which policies are due for renewal next month?” and receive an immediate, accurate response. This empowers teams to make data-driven decisions faster and more independently.

Specialized Insurance Products

Specialized insurance products offer a way to stand out in a crowded market, serve underrepresented segments, and unlock new revenue streams. But none of that is possible without the right technology foundation.

In today’s environment, technology needs to do more than just keep up, it should enable innovation. With platforms like Openkoda, insurers can take bold steps into new markets, launch specialty insurance products with lower risk, and deliver real value to customers faster than ever before.