Insurance is one of the foundational elements of modern societies, supporting progress and helping humanity move forward with greater security.

Although the insurance market has traditionally been slow to adapt to change, the AI revolution and the expectations of a younger, tech-savvy customer base are accelerating the need for digital transformation in the insurance industry.

Let’s look at five of the most influential trends in the insurance industry that aim to better position the market for the needs of the next quarter of the 21st century.

Contents

- Insurance Sector Outlook

- Trend #1: Embedded Insurance: Seamless Coverage Integration at The Point of Sale

- Trend #2: Artificial Intelligence Entering the Insurance Industry

- Trend #3: Accelerating Insurance Product Innovation

- Trend #4: Climate Resilience Coverage and Adaptation Incentives

- Trend #5: Proactive Risk Management through Predictive Analytics

- How Your Insurance Business Can Prepare for The Future: Tips from Experts

Insurance Sector Outlook

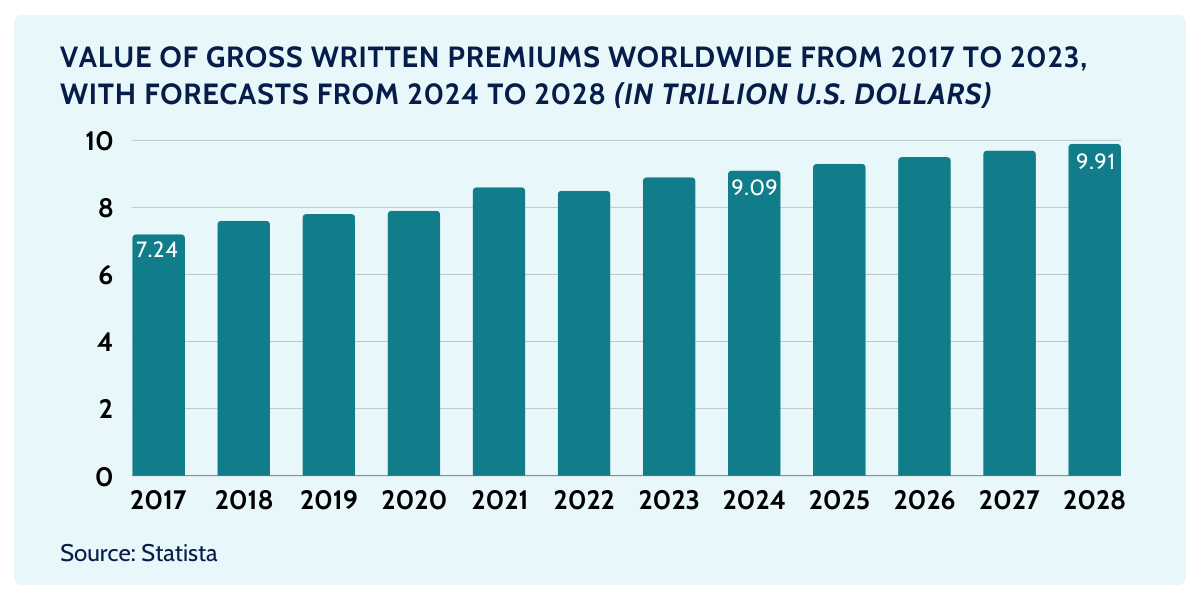

The global insurance market in 2024 is valued at around $7.79 trillion, with expectations to grow to $10.29 trillion by 2033, reflecting a compound annual growth rate (CAGR) of 7.2% between 2024 and 2033.

According to Deloitte, the U.S. non-life (P&C) insurance sector posted a $9.3 billion underwriting gain in the first quarter of 2024, marking a substantial recovery from the $8.5 billion loss experienced in the same quarter of the previous year.

This improvement was supported by a 7.4% growth in net premiums and a 2.2% decline in incurred losses and loss-adjustment expenses. The combined ratio for the industry also improved to 94.2% year-over-year, driven by multiple rate hikes in the personal lines sector, which surpassed claims costs.

Closing the Protection Gap

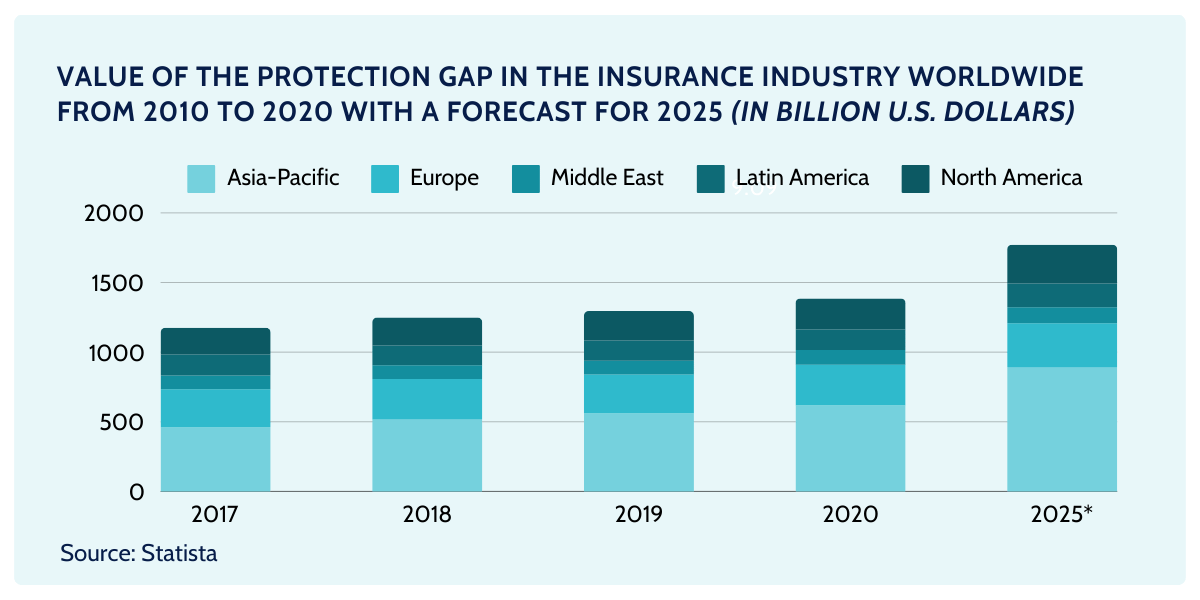

A major challenge for the modern insurance industry is the growing protection gap—the difference between the insurance coverage that is needed and what is actually purchased—which stood at $1.4 trillion in 2020.

According to PwC’s analysis, this gap could rise to $1.86 trillion by 2025, with the Asia-Pacific region contributing nearly half of all uninsured risk.

What does this imply?

For insurers, it represents a significant opportunity to expand their market and close the protection gap through innovative products and services. It also underscores the need for insurers to adapt and evolve to effectively reach underinsured customers and offer them appropriate coverage solutions.

Trend #1: Embedded Insurance: Seamless Coverage Integration at The Point of Sale

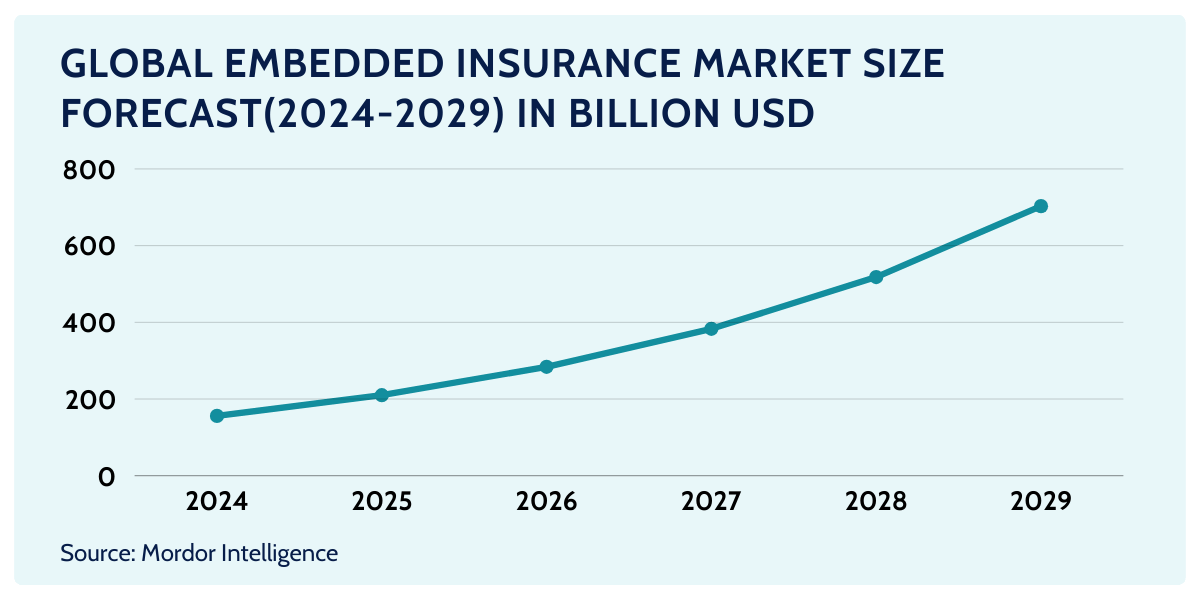

Embedded insurance is rapidly becoming one of the most transformative trends in the insurance industry.

By 2033, it is projected to account for 15% of global gross written premiums (GWP), approximately $1.1 trillion, up from just 3-5% today.

At its core, embedded insurance seamlessly integrates coverage into the purchase process of products and services.

For example, imagine booking a vacation and being offered travel insurance as a simple, one-click add-on, or purchasing a high-end smartphone with device protection automatically included. That’s the essence of embedding insurance products into the customer purchase journey.

Why is this approach a part of so many business strategies within the insurance industry?

For one, it tackles the common pain point of complexity in purchasing insurance.

Traditional insurance processes can be cumbersome, often requiring extensive paperwork, research, and decision-making.

In contrast, embedded insurance makes coverage easily accessible, offering it as a seamless extension of an existing transaction.

The challenge lies in introducing it in a smart and efficient way.

That’s where Openkoda’s embedded insurance software comes in.

With this platform, you can develop and deploy your own embedded insurance solutions faster and more efficiently.

Openkoda allows you to embed simple, customizable forms directly into your site without any hassle.

The entire solution is white-label, so you can tailor it precisely to your site’s style and the products you’re selling. Premiums are automatically calculated in the background based on your rules or the insurer’s API for each client.

The biggest advantage of this approach?

Openkoda’s flexibility.

Since embedded insurance is an evolving trend, if you decide in a few months that you need additional functionalities or changes to how premiums are calculated, you can easily implement them without fearing vendor lock in. This ensures that your embedded insurance solution can be personalized and is future-proof for years to come.

Check out this quick demo to see just how quickly you can set up embeddable insurance forms in Openkoda, that you can easily integrate with any site you want.

Trend #2: Artificial Intelligence Entering the Insurance Industry

The AI revolution is here to stay, and many insurance leaders are exploring the best ways to integrate generative AI within their business processes—often with mixed results.

The challenge lies in determining where exactly AI can improve business efficiency without sacrificing the quality of provided services.

Despite this, AI adoption in insurance has already grown by 25% in the past year, and its potential for future growth is immense, with insurance AI projected to generate $1.3 trillion in value for the industry by 2035.

According to a June 2024 survey by the Deloitte Center for Financial Services, 76% of surveyed U.S. insurance carriers reported implementing generative AI capabilities in at least one business function. Furthermore, 84% of these executives believe AI will revolutionize the insurance industry within the next three years.

So, where exactly can AI find its place in the software environment of an insurance company?

Let’s explore a few examples.

Hyper-Personalization Through Advanced AI and IoT

One key area where AI is making a big impact in insurance is personalization.

By using real-time data from IoT devices—such as smart home sensors, wearable health trackers, or connected cars—insurers can now offer highly personalized policies that adapt to individual customer needs.

For instance, Tesla’s IoT technology, as well as other auto insurers, allows it to adjust auto insurance premiums based on real-time driving behavior, rewarding safer drivers as well as offering usage based insurance. Similarly, John Hancock uses data from wearable health trackers to promote healthy lifestyles with rewards and personalized coverage.

AI helps analyze behavioral data, enabling insurers to tailor coverage and insurance premiums to each policyholder’s unique lifestyle and risks unlocking a complete data-driven insurance strategy.

Advanced AI-Enabled Analytics

AI-enabled insurance analytics are another significant advancement influencing your insurance business.

With AI-driven algorithms, your company can analyze large volumes of structured and unstructured data to detect patterns, predict risks, and process claims more efficiently.

For example, machine learning models can identify fraud signals during claims processing, helping insurers save millions on potentially fraudulent payouts.

There are also insurance software systems that can significantly speed up the report creation process.

Take Openkoda for example, which includes Reporting AI—a functionality that lets you generate complex SQL queries using nothing but natural language prompts. Just write what data you want to compare, and it will generate SQL code for you.

All this is done while only sharing the data types from the database schema—ensuring that sensitive information stays within your system.

What to Watch

To prepare for the AI era, it’s essential for you to embrace data literacy and invest in understanding AI’s applications in insurance.

You need to develop a solid grasp of how AI is transforming customer interactions, underwriting, claims management, and fraud detection to stay ahead of the curve.

It’s also important to consider partnering with tech innovators to seamlessly integrate AI solutions and keep up with the latest advancements.

[Read also: Top 5 Embedded Insurance Providers in 2024]

Trend #3: Accelerating Insurance Product Innovation

In 2025, insurers will continue to develop innovative insurance products tailored to specific groups.

As consumer needs evolve, insurance companies are focusing on niche products that address unique demands.

Here are three examples of such insurance product innovations just hitting the market:

On-the-spot coverage for Gig workers

Gig workers often face challenges securing coverage due to irregular income and work schedules.

To address this, insurers are creating on-the-spot coverage options, offering protection on a per-task or per-hour basis. This allows rideshare drivers or freelance couriers to access affordable insurance during work hours, without the burden of traditional policies.

The takeaway?

In 2025, the popularity of per-usage insurance products will continue to grow and play a significant role in the market.

Mental Health Insurance

Mental health is becoming a crucial aspect of overall well-being, and insurers are responding by offering dedicated mental health coverage.

These policies cover therapy sessions, counseling, and digital mental health tools. By providing specialized coverage, insurers are making mental wellness more accessible while recognizing its growing importance. This shift not only helps individuals receive needed care but also reduces the stigma around mental health issues.

If your company specializes in healthcare insurance, this niche is worth watching in the coming year.

Cyber Insurance

As cyber threats grow more sophisticated, both individuals and businesses face increasing risks of digital attacks.

In 2023, the global average cost of a data breach reached $4.45 million, highlighting the financial dangers posed by cyber incidents.

As an insurer, you can respond by offering cyber insurance products that protect against data breaches, ransomware, and other cybercrimes. These policies provide your clients with financial support in the event of an attack, along with resources for recovery and prevention.

Cyber insurance is quickly becoming essential for businesses, helping them safeguard digital assets and maintain trust with their customers. According to Statista, the global cyber insurance market is projected to reach $22.5 billion by 2025.

Trend #4: Climate Resilience Coverage and Adaptation Incentives

By Q3 2024, for the first time in six years, worldwide insured losses from natural catastrophes exceeded US$100 billion.

The growing threat of natural disasters was highlighted by Hurricane Milton, which hit the southeastern United States in October, causing widespread damage with estimated losses exceeding $15 billion.

These alarming figures indicate that climate-related events will likely continue increasing in frequency and severity in 2025, making climate resilience a critical focus for insurance offerings.

To encourage policyholders to take proactive steps to mitigate risk and minimize potential losses, insurers are offering discounts or premium reductions for climate-resilient upgrades.

Homeowners who invested in such upgrades—encouraged by their insurers—experienced significantly less damage compared to those who hadn’t. Insurers who incentivized these measures saw fewer claims and reduced losses, demonstrating the effectiveness of climate adaptation incentives.

Trend #5: Proactive Risk Management through Predictive Analytics

Last but certainly not least, let’s talk about proactive risk management through predictive analytics.

This emerging trend in the insurance industry allows carriers to anticipate and mitigate risks before they occur. By leveraging advanced data analytics and machine learning models, your company can shift from a reactive approach—where claims are managed after an incident—to a proactive strategy focused on prevention.

How does this approach work in practice?

For instance, insurers can use predictive models to assess the likelihood of natural disasters, identify customers at higher health risks, or anticipate potential fraudulent activities.

By understanding these risks in advance, you can take steps to minimize losses, such as issuing early warnings to policyholders, recommending preventive actions, or adjusting underwriting criteria.

How Your Insurance Business Can Prepare for The Future: Tips from Experts

As the insurance industry evolves, it is essential to stay ahead of the curve by adapting to new trends and technologies. Here are some expert tips on how your insurance business can prepare for the future:

- Develop digital networks and ecosystems: You need to engage in a broader network of digital players, including tech partners and data providers, to offer a full suite of services such as embedded insurance. By establishing strong partnerships, you can create synergies that improve operational efficiency and open new opportunities for innovation.

- Gather customer insights: To leverage what modern digital platforms have to offer dive deep into customer data to build a robust understanding of their behaviors, preferences, and needs. This insight is crucial for crafting personalized solutions that meet customer expectations.

- Develop innovative insurance products that cater to the digital landscape: Focus on building innovative insurance products tailored for a digital-first audience. This includes flexible offerings like on-demand insurance, which meets the need for immediacy, and usage-based policies that appeal to customers looking for customizable and cost-effective options. In 2024 there are many options on the table and in the coming years they will take a significant percentage of the entire insurance market.

- Rethink your distribution channels: To stay ahead, rethink how you get your products to customers. Invest in digital distribution channels such as mobile apps, online platforms, and direct digital marketing strategies or even custom insurance software such as embedded systems. Collaborate with insurtech firms to enhance your technological capabilities and ensure a more seamless customer experience, ultimately increasing market penetration.