Top 10 P&C Insurance Software Vendors in 2026

The insurance industry is standing at a crossroads where decades-old systems meet a new era of digital possibility – and the winners will be the companies that modernize with intention.

As P&C insurers push for faster product launches, smarter claims handling, and more connected customer experiences, the software vendors powering this transformation are becoming as strategically important as the products insurers sell.

In this article, we explore the top P&C insurance software vendors shaping 2026, and what makes each one worth watching in a market that’s evolving faster than ever.

State of Insurance Industry in 2026

As we enter 2026, the global property and casualty insurance industry stands on solid yet challenging ground. Recent data shows the global P&C market has doubled over the past two decades and is now estimated at roughly USD 2.4 trillion. (FortuneBusinessInsights)

Growth continues – from USD 1.88 trillion in 2024 to a projected expansion beyond USD 2.57 trillion by 2032. (SwissRE)

Behind this growth lie powerful macro trends: increasing asset values worldwide (real estate, vehicles, infrastructure), heightened risk awareness among individuals and businesses, and a rising tide of climate, liability and specialty risks – all driving demand for well-structured non-life insurance coverage.

Moreover, P&C insurers are increasingly seeking growth not just through scale, but through product innovation, specialty lines and flexible coverage models that match evolving customer needs — from climate-linked risks to new liability or asset classes.

These dynamics create a compelling imperative: to manage growth, risk and complexity effectively, insurers must modernize their insurance core systems – especially in policy administration, underwriting and claims management.

Legacy platforms, often rigid and outdated, simply can’t keep up with the velocity, variety and regulatory demands of 2026’s P&C landscape.

Why Insurance Carriers Need Modern Systems

Many P&C carriers still rely heavily on legacy systems that were built decades ago.

These monolithic platforms often lack flexibility: they are hard to customize, difficult to integrate with modern data sources, and inefficient when it comes to supporting product innovation.

For an industry grappling with accelerating product complexity and evolving customer expectations, such limitations are unsustainable.

Modern systems – with modular architecture, API-first design, and cloud-native scalability — enable insurers to respond rapidly to market changes.

They allow for seamless integration with data analytics, IoT feeds, real-time underwriting engines, and third-party services (e.g., weather data, telematics, risk scoring). This connectivity is critical for maintaining performance and agility.

How to Develop Innovative Insurance Products Faster

Think back to how new insurance products were traditionally launched: endless requirements meetings, often hard-coded logic buried deep in monolithic systems, slow release cycles, manual testing, and the constant fear that one change would break everything else.

For many carriers, this meant innovation moved at a glacial pace.

But the landscape has shifted.

Modern insurance core platforms – API-first, configurable, modular – have rewritten what’s possible. Suddenly, the idea of launching a new P&C insurance product in weeks instead of months became feasible.

It’s real, operational, happening across the market.

This tTechnology is no longer just supporting the insurance lifecycle but rather it’s enabling insurers to create never-before-seen insurance solutions and respond to emerging risks in real time.

The vendors featured in the next section represent this new era of agility, customization, and innovation.

Best Insurance Software Vendors on The Market

Below is a curated list of the Top 10 software vendors shaping the P&C insurance industry in 2026.

These vendors have demonstrated leadership in modern policy administration, claims management, product innovation and enterprise-grade scalability — attributes increasingly vital for growth in a dynamic insurance landscape.

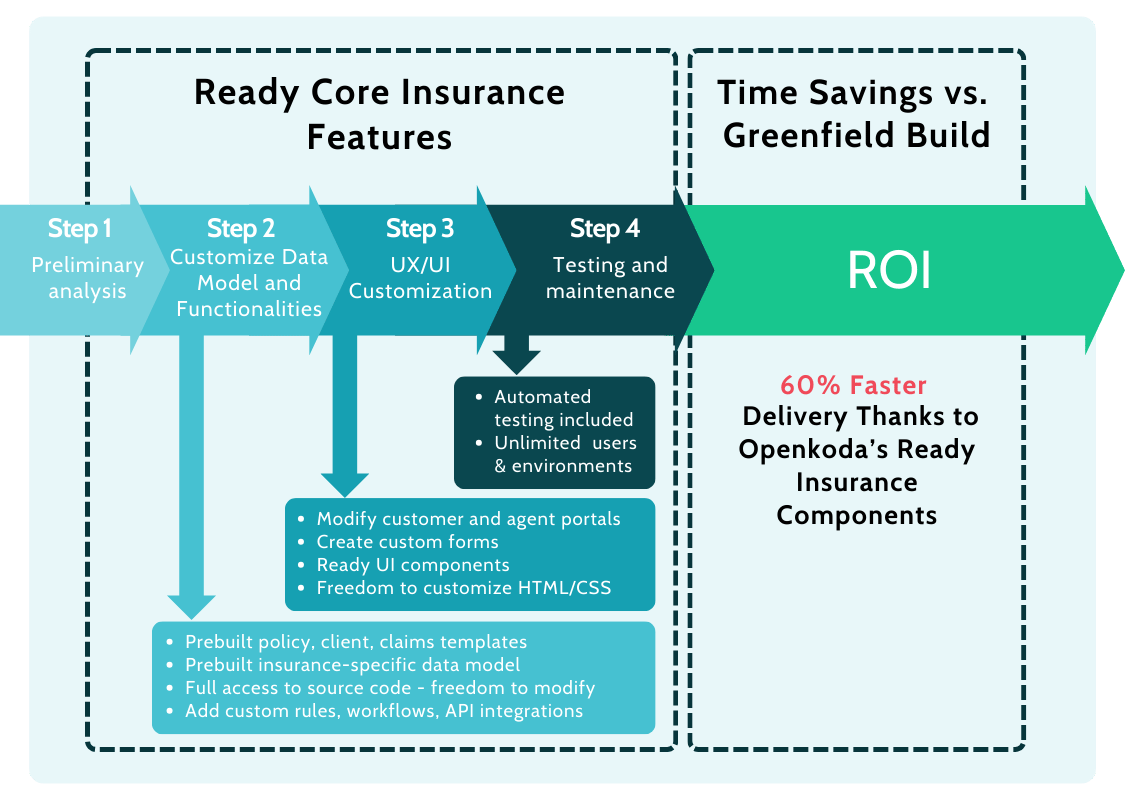

Openkoda

Openkoda has quickly become one of the most compelling alternatives to traditional P&C core systems – especially for insurers and managing general agents (MGAs) that need full control over their technology without sacrificing speed.

Unlike many established platforms, Openkoda is built for organizations that want to shape their software around their business, not the other way around.

Its architecture gives insurance businesses the freedom to design, extend, and operate their systems exactly as they need —-whether they’re modernizing legacy insurance software, streamlining claims management, or building entirely new digital products.

Carriers can treat it as a ready-to-use foundation while maintaining complete code ownership, enabling teams to adjust workflows, set up custom business rules data structures, underwriting rules, and integrations without fighting vendor constraints.

It supports both cloud and on-premise deployments — a major advantage for insurers with strict security, regulatory, or regional hosting requirements.

Key strengths of Openkoda

- Unparalleled customizability — insurers can tailor the system end-to-end, from policy logic to claims workflows, without relying on vendor roadmaps.

- Complete code ownership — full access to the codebase ensures long-term flexibility, transparency, and no risk of vendor lock-in.

- Flexible deployment (cloud + on-premise) — ideal for insurers requiring tight data governance or hybrid environments.

- Easy integration with all supporting systems — API-ready architecture connects seamlessly with rating engines, payment providers, CRM platforms, document generators, and more.

- No user-based pricing — insurers and MGAs can scale operations, launch portals, and grow internal teams without incremental licensing costs.

Guidewire

Guidewire remains one of the most recognized platforms in the insurance industry, trusted by large P&C carriers for its mature, enterprise-grade capabilities.

Designed as an all-in-one system, it brings policy administration, billing, and claims together under one unified architecture – a major advantage for insurers prioritizing operational consistency and long-term stability.

Key strengths of Guidewire

- Comprehensive, all-in-one system — integrates policy administration, billing, and claims into a single cohesive platform.

- Advanced business intelligence tools — supports data-driven decision-making across underwriting, operations, and claims.

- Broad industry adoption — widely used by major carriers with a strong global user community and partner network.

[Read more: Best Guidewire Alternatives: Openkoda vs. Guidewire]

Duck Creek

Duck Creek has become a go-to choice for insurers seeking modern, cloud-first insurance technology that accelerates digital transformation.

Its modular platform supports policy, billing, and claims while giving carriers the flexibility to roll out updates and new products at a faster pace. Insurers often choose Duck Creek for its strong configuration capabilities and its ability to improve both internal operations and customer experiences.

Well suited for organizations focused on future-ready insurance solutions, Duck Creek helps drive business growth by enabling faster delivery cycles and more responsive digital interactions.

Key strengths of Duck Creek

- Cloud-native insurance technology — designed for rapid deployment and continuous upgrades.

- Enhanced customer experiences — supports seamless digital interactions across the entire insurance lifecycle.

- Accelerates digital transformation — enables carriers to modernize without rebuilding everything from scratch.

Britecore

BriteCore is a cloud-native insurance software platform built specifically for P&C insurers and MGAs that want strong digital capabilities without the heavy footprint of traditional legacy suites.

Delivered as SaaS on AWS, it brings policy management, billing, claims, analytics, and portals into one unified environment, helping insurers streamline operations and unlock cost savings while modernizing the policyholder experience.

Its configurable policy administration and low-code product tools make it easier to roll out new offerings and adjust existing ones, while agent and policyholder portals support self-service and reduce manual work.

Key strengths of BriteCore

- Modern cloud-native insurance software — unified core for policy management, billing, claims, and rating designed for P&C insurers and MGAs.

- Digital capabilities and portals — configurable agent and policyholder portals that support self-service, improve experience, and reduce service overhead.

- Low-code configuration for faster change — tools and templates that shorten time-to-market and support ongoing product tweaks with less IT effort.

[Read more: Best MGA Insurance Software Systems in 2025]

Sapiens

Sapiens is a long-established player in the insurance software space, offering end-to-end digital technology for P&C carriers across the globe.

Its P&C software portfolio — including CoreSuite, IDITSuite and Stingray — is designed to modernize core P&C systems while giving insurers flexible deployment options and strong digital capabilities.

Key strengths of Sapiens

- Mature P&C systems portfolio — CoreSuite, IDITSuite and Stingray provide comprehensive P&C software for core policy, billing and claims.

- Built-in intelligent analytics — solutions like IntelligencePro deliver dashboards, reports and advanced analytics tailored to P&C operations.

- Strong digital technology offering — CustomerConnect portals and digital components support agents, brokers and policyholders across channels.

Applied Systems

Applied Systems is a leading P&C software vendor focused on independent agencies and brokerages, best known for its Applied Epic platform. Positioned at the center of the insurance industry’s distribution ecosystem, Applied provides tools that help agencies automate operations, connect with carriers, and manage the full client lifecycle in one place.

Its solutions are particularly attractive to program administrators and brokers who need strong connectivity, robust workflows, and consolidated views of their book of business.

Key strengths of Applied Systems

- Established P&C software vendor — widely adopted agency and brokerage management systems used across major markets.

- Strong fit for program administrators and brokers — tools optimized for multi-line, multi-location operations and complex commercial business.

- Integrated, all-in-one management — centralizes client, policy, billing, and document data for better control across the distribution chain.

Majesco

Majesco positions itself as a pretty solid provider of P&C software systems, with a strong focus on intelligent, cloud-native cores and rich digital engagement.

Its P&C Intelligent Core Suite connects policy, billing, and claims on a single platform, enhanced by embedded analytics and GenAI tools like Majesco Copilot to improve underwriting, service, and operations.

Key strengths of Majesco

- Modern P&C software systems — cloud-native core for policy, billing, and claims, designed to support personal, commercial, and specialty lines.

- Strong digital engagement — pre-integrated digital solutions (e.g., Customer360, Agent360) to enhance customer and distributor experiences.

Insurity

Insurity is a long-standing provider of cloud-based P&C insurance software, focused on delivering configurable, end-to-end platforms for insurers, MGAs, and program administrators.

Its p&c insurance software systems cover policy, billing, claims, underwriting, and advanced analytics, with a strong emphasis on cloud deployment and scalability.

Key strengths of Insurity

- Cloud-first p&c insurance software — end-to-end platform for policy, billing, and claims with a strong track record in large, complex organizations.

- Configurable p&c insurance software systems — tools that allow insurers to tailor products, workflows, and rating with a focus on speed and agility.

- Broad market presence — trusted by 22 of the top 25 P&C carriers and 7 of the top 10 U.S. MGAs, reinforcing its relevance across the insurance industry.

[Read more: Top 6 Best Policy Management Software Systems on The Market]

Insly

Insly is a cloud-based p&c insurance software platform used by insurers, MGAs, and brokers to digitize everyday insurance operations. The company focuses on delivering modular tools that support the full product and policy lifecycle – from product design and distribution to accounting, reporting, and claims.

Key strengths of Insly

- Cloud-based p&c insurance software — designed as a modular, SaaS platform covering product builder, distribution, accounting, reporting, and claims management.

- Strong focus on MGAs and intermediaries — widely used by MGAs and brokers, with features tailored to their processes and reporting needs.

- Support for core processes — tools for policy management, claims handling, invoicing, and business intelligence on one platform.

Vertafore

Vertafore is a well-known provider of P&C insurance software, especially on the agency and MGA side of the market. Its portfolio includes products like AMS360, QQCatalyst, and ImageRight, which are designed to bring policy, accounting, documents, and workflows into a single application for day-to-day operations.

The company focuses on helping agencies and MGAs deliver more modern experiences to their clients while managing P&C insurance products more efficiently in the background. With growing use of embedded AI and automation, Vertafore aims to reduce manual work and improve consistency across communications and servicing.

Key strengths of Vertafore

- Established P&C insurance software provider — long history in the insurance industry with a broad user base among agencies and MGAs.

- Single application focus for agencies — solutions like AMS360 centralize policy, billing, reporting, and client data in one system to streamline operations.