MGA Insurance Software Guide (2026): Faster Product Launch

The past few years have brought significant market changes that challenge how MGAs operate.

Many existing systems weren’t built with the flexibility needed to support today’s pace of product development and integration demands.

For P&C MGAs, choosing the right policy management software is now a critical step in staying competitive and delivering value to both carriers and customers.

MGAs 101: The Need For a Specialized Approach

Unlike traditional insurers, MGAs operate under delegated authority from carriers, giving them the power to manage entire insurance lifecycle: underwrite, price, and manage policies for niche products.

Because of that they often focus on the specialty insurance market – anything from cyber liability to pet insurance – where flexibility and speed are crucial.

Off-the-shelf policy administration system built for general insurance industry often don’t fit the unique way MGAs operate.

If your products aren’t “one-size-fits-all,” and your software shouldn’t be either.

You need tools that support the essentials – policy issuance, endorsements, renewals, claims management – but also let you innovate, configure quickly, integrate with partners and eventually enable true business growth.

The bottom line: MGAs thrive when their technology enables them to act quickly, respond to market gaps, and deliver highly customized insurance offerings.

What Features Does MGA Systems Need?

MGAs operate in a very different way than traditional leading insurers.

They often deal with unique insurance products that can’t be handled effectively by generic, one-size-fits-all tools.

That’s why MGA systems need to be more than just standard claims and policy management software.

The right setup combines document management, seamless integrations, and flexible customization so your team can focus on growth instead of fighting with outdated tools.

Integration with Carriers

Because your authority comes from carriers, your MGA system needs to sync seamlessly with theirs.

But the scope of integration doesn’t stop there.

A modern MGA system should also connect with third-party software – think accounting tools for premium reconciliation or compliance reporting. It should even reach into external data enrichment services.

For example, pulling vehicle information automatically by VIN number, or using geospatial data about land plots for property underwriting.

These integrations turn your platform into a comprehensive solution, reducing errors, saving time, and giving underwriters and agents the accurate context they need to price and manage policies effectively.

This is why robust integration is one of the most important features an MGA system can have – it’s what enables your business to operate with the same efficiency and precision as larger insurers, without the overhead of legacy systems.

Customizability of the Software

For MGAs focused on specialty lines of business, rigid, one-size-fits-all software quickly becomes a bottleneck.

Your platform must adapt to your underwriting workflows, rating logic, and document processes – not the other way around.

Configurable rules, automated renewals, and tailored workflows for each niche product line are essential to support scalable growth instead of slowing it down.

Tailored Dashboards

Finally, you need visibility.

Tailored dashboards allow your team to track performance, monitor claims, and identify opportunities in real time.

Instead of drowning in raw data, your MGA system should translate numbers into actionable insights.

Whether you’re an underwriter, agent, or operations manager, the dashboard should give each role exactly what they need to make better decisions, faster.

Here also customizability is key – it’s important to tailor your agent portal screens so that each user sees only the most relevant information and tools.

[Read also: Top 5 Insurance Core Systems in 2026]

Build your MGA Faster and Smarter

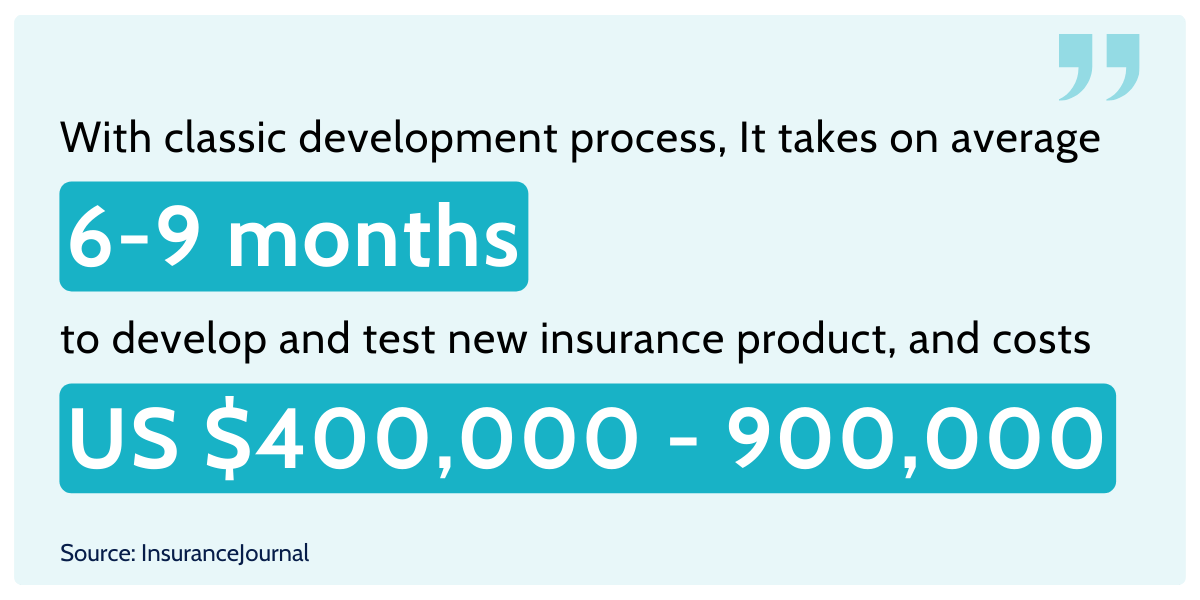

Traditional software development for MGAs often feels cumbersome, expensive, and time-consuming.

Too much time goes into plumbing that doesn’t create competitive value—authentication, role-based access, dashboards, baseline data models, and boilerplate integrations—before you even touch product rules or UX.

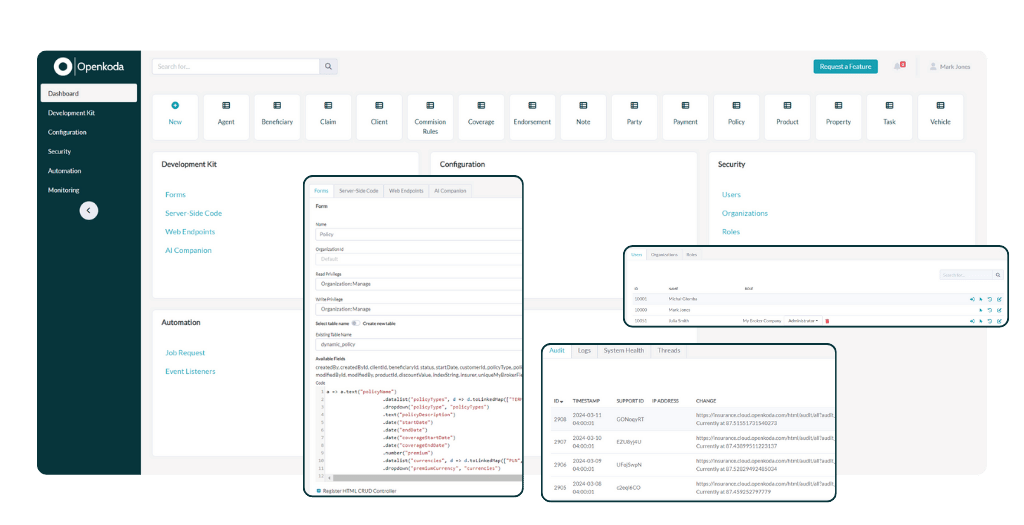

There’s a better route: modern insurtech platforms like Openkoda ship the undifferentiated heavy lifting so your team can focus on the parts that move the needle – underwriting logic, distribution flows, and partner integrations.

Why It Works for Your Business

Openkoda’s core value for MGAs is speed without giving up control.

It is a robust platform that combines production-ready insurance templates with an open-source foundation (Java/Spring Boot) so you can deliver non-standard, specialized applications that go far beyond a PoC and stand up to scale in production.

Teams keep full code ownership and avoid vendor lock-in, which matters when your product evolves every quarter.

In practice, organizations report cutting build time by up to 60% compared to traditional from-scratch projects – because the essentials are already there.

These benefits come down to a few core principles that define how Openkoda helps MGAs build and scale smarter.

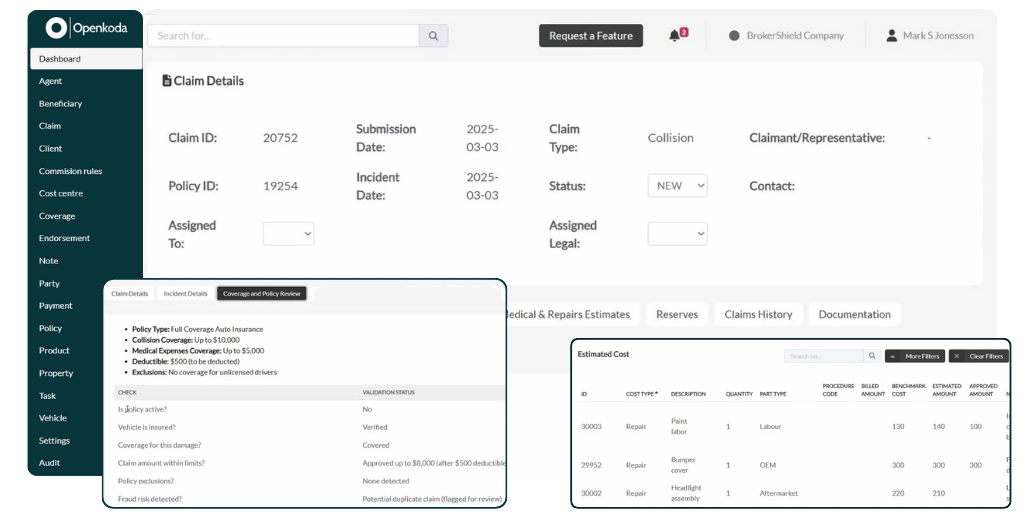

Pre‑built Insurance Templates

Openkoda includes domain-specific starting points – policy management, claims management, embedded insurance, underwriting dashboards, and more – all wired up with core data models and workflows.

Faster Time to Market

In ample real-world cases, insurers and p&c MGAs have launched new, innovative insurance products up to 60% faster than traditional development approaches allowed.

Customizable, Open‑Source Foundation

Built with Java, JavaScript, Spring Boot, and PostgreSQL, Openkoda lets your team tweak UI, logic, and data models freely – and directly access the codebase whenever needed. This flexibility ensures your system aligns with the unique demands of your distribution channels.

Full Ownership, No Vendor Lock‑In

The open‑source MIT license means you won’t be tied to a vendor’s roadmap or pricing model. You decide what you build and when.

Seamless Connectivity

Openkoda’s integration-ready architecture and rich set of APIs make it easy to connect with carrier systems, broker portals, payment gateways, rating engines, and third-party data providers.

MGAs can orchestrate end-to-end workflows across their whole ecosystem without brittle point integrations, keeping data in sync and reducing manual rekeying.

How This Plays Out in Practice

If you’ve ever gone down the traditional path of custom insurance software development, you know how slow it feels.

Before your team can even begin working on the parts that make your MGA unique, weeks or months are spent setting up the basics: authentication, role permissions, dashboards, database models, and reporting.

Openkoda changes that approach.

While not being a holistic solution for MGAs if such a thing is even possible), it does offer an enterprise-ready foundation for any business application.

Instead of starting from a blank page, you begin with production-ready insurance templates for policies, claims, or embedded distribution flows. These templates already include the foundation most MGAs need – data models, workflows, reporting, and user roles – so the development team (your in house or dedicated Openkoda specialist) can jump straight into the business logic that differentiates you.

But that leaves one important question: if costs are such an important factor, why not just buy an out-of-the-box policy/claims system?

For specialized P&C insurance products, those platforms can be rigid: you move fast only until you hit their configuration ceiling.

Pure custom builds give you flexibility but burn time and budget on infrastructure.

That’s why Openkoda sits in the middle ground – a comprehensive, production-ready base you can tailor deeply, with the speed of a platform and the control of custom code.

Value of Modern Custom MGA Software System

No matter if you are running an established MGA and decide to go for modernization of your legacy insurance software, or just starting a new business – choosing a modern, scalable and customizable platform will create benefits throught your entire value chain.

First of all, many P&C MGAs, still struggle with the amount of manual paper work – reconciling data with carriers, handling settlements, or managing reporting across multiple disconnected tools.

These inefficiencies, slowly increase the overall operational costs, eat up resources and slow down your ability to focus on what matters: building new products and growing your business.

The real cost of outdated system often shows up as missed opportunities.

If your system makes it hard to design or test new insurance products, you’re always a step behind competitors who can. That’s where a comprehensive solution tailored to P&C MGAs changes the game.

With a modern custom platform, you can reduce manual processes, collaborate more effectively with carriers, and build integrations that keep your data flowing smoothly.

More importantly, you gain the flexibility to launch new offerings quickly, test them in the market, and adapt based on results.

This agility not only supports better customer service but also creates the conditions for sustainable, profitable growth.

[Read also: Best Guidewire Alternatives in 2026: Openkoda vs. Guidewire]

Closing Thoughts

The insurance landscape is evolving quickly, and these days the technology is acentral to how P&C MGAs compete and grow.

Modern policy management systems give you the flexibility to design products, streamline workflows, and achieve real operational efficiency.

For P&C MGAs that want to stay ahead, the right custom software can be the difference between keeping pace with the market and setting the pace.