Understanding Automated Underwriting System

Making the right call on a loan or insurance policy used to take days of back‑and‑forth email.

Today, customers expect an answer while they’re still on the screen.

Automated underwriting tools are how carriers and banks meet that demand.

Contents

Introduction to Automated Underwriting: How to Speed Up Manual Underwriting Processes

Underwriting is the silent core of every insurance carrier.

It determines whether the organization will write profitable business or slowly accumulate hidden risk.

Yet much of today’s underwriting still runs on e‑mail threads, desktop spreadsheets and lengthy referral chains.

The result?

Cycle times measured in days (sometimes weeks), inconsistent decisions, and a frustrating experience for both distribution partners and end customers.

What if those friction points could be removed without sacrificing control?

That is the promise of an Automated Underwriting System (AUS).

At its core, an Automated Underwriting System (AUS) is designed to streamline and partially or fully digitize the decision-making process.

Whether it’s personal lines, commercial policies, or even parametric coverage, automation is changing how insurers evaluate applications in a big way. It allows carriers to respond faster, underwrite more consistently, and scale without proportionally increasing operational costs.

Why does speed matter?

These days policyholders can abandon applications at the first sign of friction, and competitors with faster quote‑to‑bind workflows gradually capture market share.

Shaving even a single day off the decision window can add measurable premium and lift conversion rates, particularly in small commercial and personal lines where margins are thin and volumes are high.

In this article we will unpack how automated underwriting engines actually work, why rapid development cycles have become possible, and which business outcomes executives should expect.

How Does Automated Underwriting System Work

Automated underwriting systems (AUS) operate at the intersection of data, rules, and decision intelligence. Their primary function is to assess risk and make underwriting decisions: making credit risk assessments, improving the loan process, and enhancing decision accuracy.

But what actually happens under the hood?

At a high level, the process begins when an application is submitted—either by an agent, broker, or directly by the customer.

The process starts with applicant data, and lots of it.

Application answers arrive through APIs, but also through OCR on scanned forms or RPA wrappers around legacy terminal interfaces (often referred to as ‘green‑screen terminals’) —whatever keeps the submission flowing. An enrichment engine then pulls in third‑party signals: credit bands, telematics pings, IoT sensor streams, geospatial hazards, payroll data, you name it.

This customer data is normalized, evaluated, and fed into a set of predefined business rules and scoring models.

These calculation rules, crafted by actuaries, underwriters, and product teams, reflect the carrier’s risk appetite, underwriting guidelines, and regulatory constraints, and can be adjusted if the risk profile changes.

The system then outputs two figures executives care about: expected loss ratio and probability to bind.

Ultimately, the power of automated underwriting lies in its ability to replicate expert-level decisioning at scale, while preserving auditability, transparency, and control.

[Read also: Innovative Insurance Products to Introduce in 2025]

Automated Underwriting Systems: Fast Development and Deployment

Ask any chief underwriter what slows their team down and you’ll hear something along the lines of: “The tool doesn’t match our workflow.”

Every carrier has its own rating factors, referral trees, data providers and tolerance for risk.

Force‑fitting those nuances into a generic platform only shifts the bottleneck from spreadsheets to makeshift work‑arounds.

The Necessity for Customization

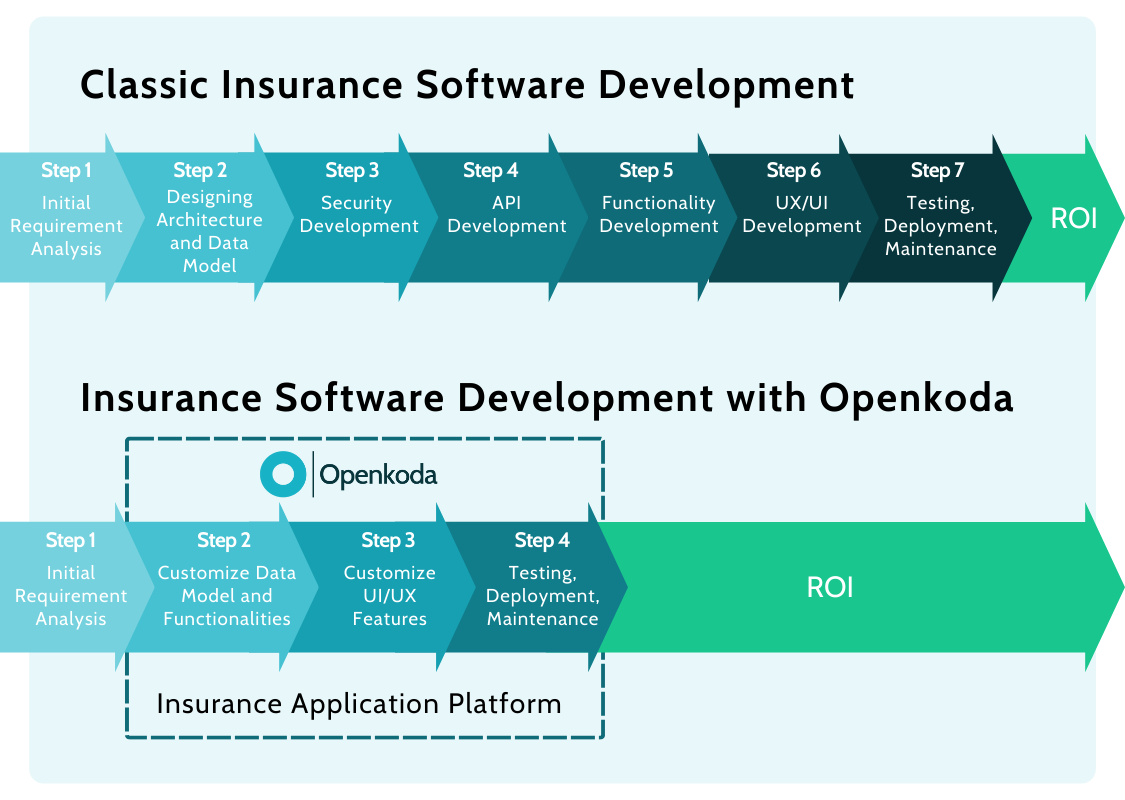

Historically, tailoring a system to that degree meant a multi‑year core‑replacement project. Today the bar is higher: markets move faster, product cycles are shorter, and capacity providers expect instant MI.

If your digital roadmap still measures releases in quarters, you are already losing ground.

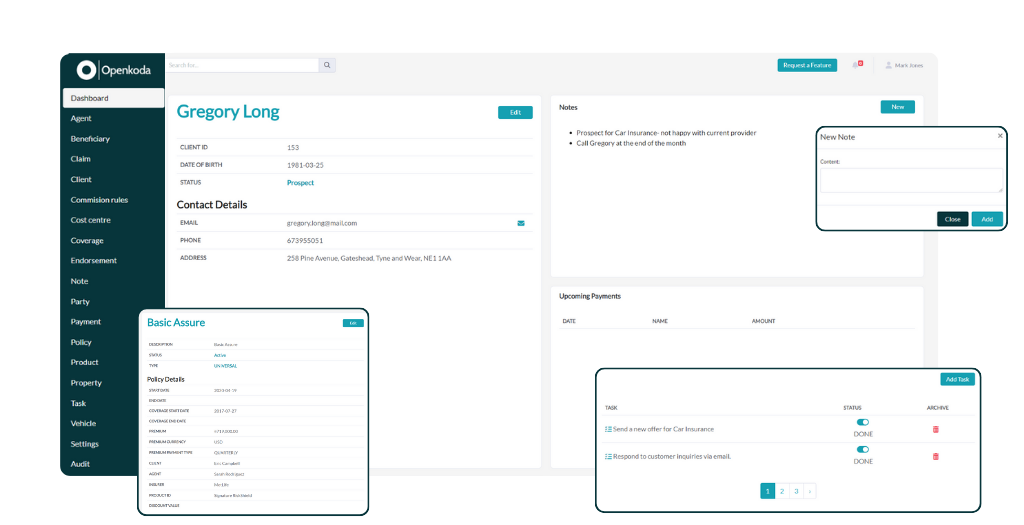

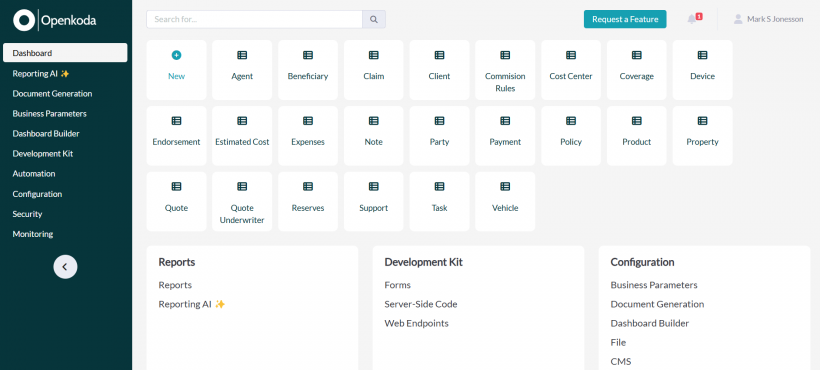

However, in 2025 platforms like Openkoda are revolutionizing the way insurers build custom insurance apps by offering pre-built components that serve as building blocks for creating tailored underwriting dashboards.

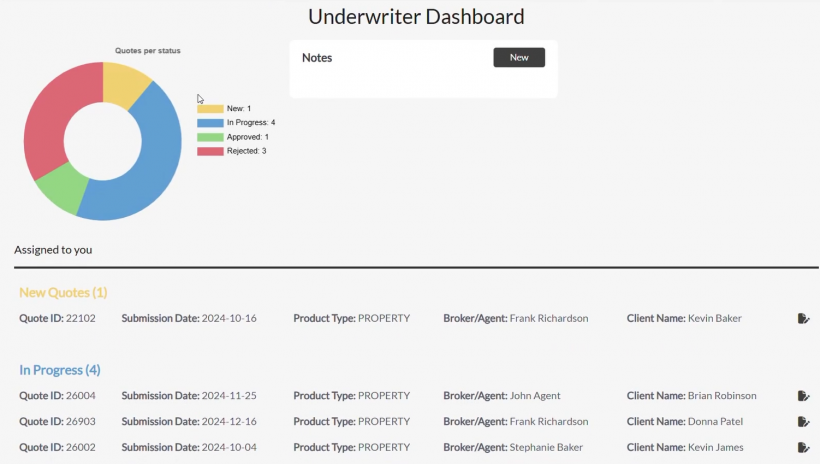

Openkoda provides a robust foundation that includes essential features such as:

- Dashboard Builder: A drag-and-drop interface that allows for the creation of custom dashboards using pre-built widgets, enabling underwriters to visualize and interact with data effectively.

- Visual Data Model Builder: This tool facilitates the customization of data models, allowing insurers to define and manage the specific data structures required for their underwriting processes.

- Automated Underwriting Dashboard: A customizable tool designed to streamline and automate the insurance underwriting process, centralizing necessary data and workflows for efficient risk assessment and decision-making.

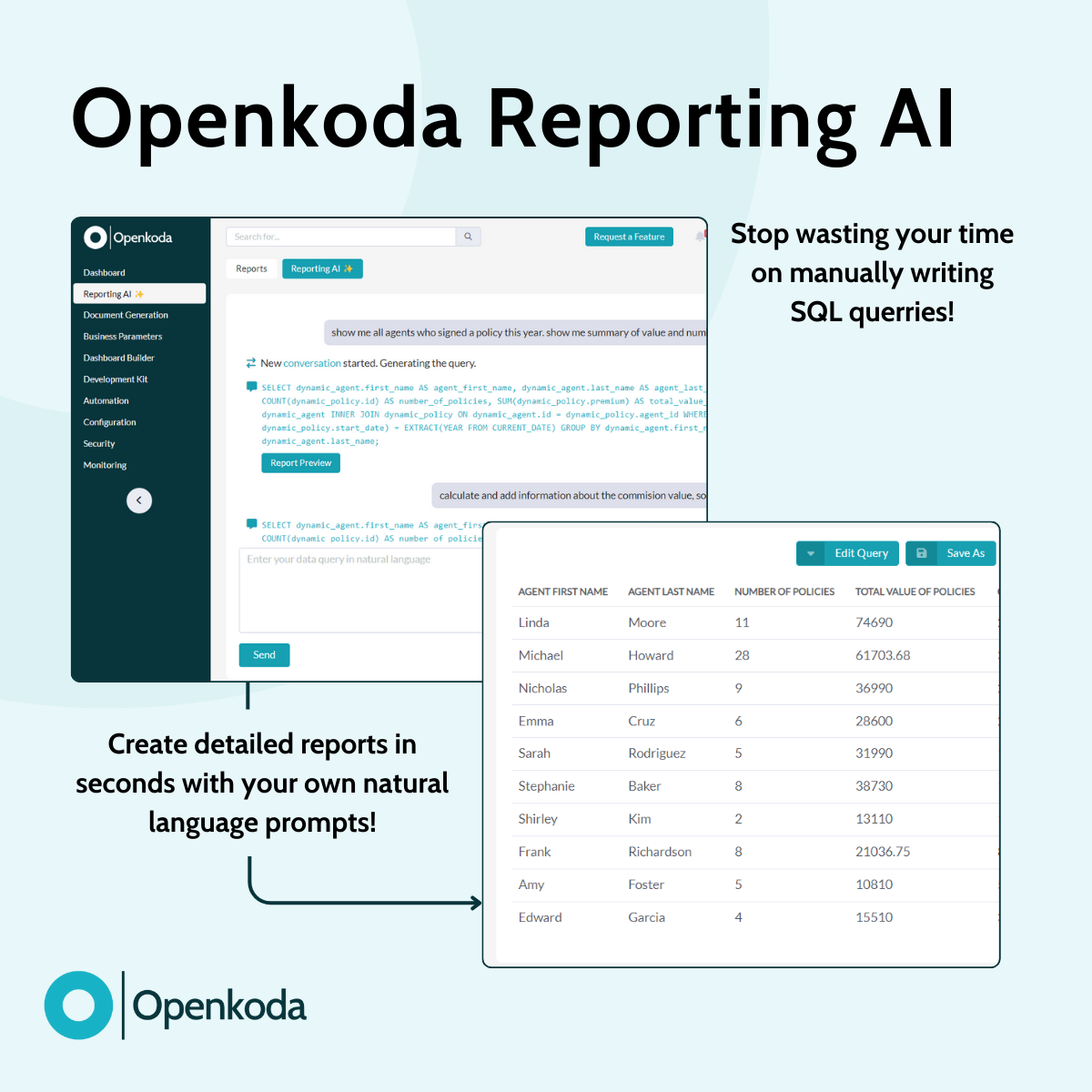

- Reporting AI: An AI-powered system that enables natural language queries, allowing underwriters to generate reports and extract insights without the need for complex SQL queries.

- Role-Based Access Control: Ensures that sensitive underwriting data is accessible only to authorized personnel, maintaining data security and compliance.

Embracing Flexibility and Scalability

Openkoda’s platform is designed with flexibility and scalability in mind. Its open-source nature and modular architecture allow insurers to build insurance applications faster and scale their systems as their business needs evolve.

This approach also reflects a broader industry trend: insurers are modernizing their legacy insurance software on a large scale and moving away from obsolete monolithic architectures.

The pressure to bring niche insurance products to market quickly and to respond to shifting customer expectations has made speed and adaptability a strategic priority.

To see how you can create your own custom underwriting dashboard and customize it check out this short demo:

https://www.youtube.com/watch?v=duOiz335BU8

Key Benefits

As discussed earlier, platforms like Openkoda allow insurers to develop tailored systems rapidly.

But what does this translate to in real-world outcomes?

Now let’s zoom out and quantify the upside once those dashboards are live in production.

Automated Loan Underwriting

In the lending industry, speed, accuracy, and consistency in decision-making are essential.

Automated underwriting systems play a key role in evaluating a borrower’s credit risk with greater precision and speed than manual methods.

By instantly pulling data from credit reporting agencies and assessing an applicant’s credit report, income details, and historical behavior, the system can generate a decision or risk score within seconds.

Faster Lending Process

Speed is money when a bank or insurer fights to keep an applicant from shopping around.

An AUS collapses the loan approval process from days to minutes by clearing the low‑risk tier without waiting for human underwriters.

A smart queue then flags only edge cases for a loan officer review, breaking the legacy pattern where every file waited in the same pile.

Human underwriters are still involved, especially in edge cases or higher-risk scenarios, but their role shifts from processing all loan applications to oversight over the automated process, focusing on quality assurance and complex decision-making where experience and judgment matter most.

Enhanced Risk Management

Automated systems make it easier to track, audit, and refine risk models over time. Because every decision is data-driven and logged, insurers and lenders can perform retrospective analysis to identify trends or anomalies in borrower behavior.

Moreover, built-in alerts and scoring mechanisms can flag potentially fraudulent or high-risk applications early in the process—before resources are spent on deeper underwriting or loan origination.

Enhanced Compliance and Auditability

Each automated decision carries a machine‑readable explanation: which rule fired, which model scored the risk, who overrode it, and why.

When regulators or reinsurers knock, compliance teams can export a complete audit file in seconds instead of stitching one together from e‑mail trails. Fines avoided and reputation protected, both hard to see in a spreadsheet, but painfully obvious in hindsight.

Scalable Operating Model

By automating routine underwriting tasks, organizations free up skilled personnel to focus on strategic initiatives or more complex cases.

This optimization leads to cost savings, higher employee satisfaction, and the ability to scale operations without a linear increase in staffing.

In sectors like consumer lending or insurtech-driven microinsurance, where volume is high and margins are tight, operational efficiency is not just a bonus—it’s a requirement for viability.

[Read also: How Technology Powers Specialty Insurance Products]

Challenges and Limitations

While automated underwriting systems offer undeniable advantages in speed, scalability, and consistency, they are not without challenges. For insurers and lenders considering or already implementing such systems, it’s essential to understand the practical limitations and risks involved.

Insurance automation is a powerful tool—but like all tools, it must be used thoughtfully and with clear boundaries.

Some of the most pressing challenges include:

- Fragmented Data Supply Chain – Underwriters and loan officers alike still contend with missing or inconsistent data: small‑business payrolls that lag by a quarter, vehicle telematics with gaps, or credit reporting agencies that return thin files

- Regulatory Patchwork Complexity – A carrier writing personal auto across U.S. states navigates 50 DOI rulebooks; a lender scaling across EU markets faces both national prudential rules and the upcoming EU AI Act. Harmonising model documentation and version control across jurisdictions diverts scarce actuarial and compliance resources.

- Legacy Systems and Technical Debt – Many insurers still run 20‑year‑old policy‑admin systems. Real‑time APIs and event streams collide with nightly batch windows, forcing expensive middleware or manual bridges that erode the latency gains automation promises.

- Over-Automation & Exception Risk – If automated thresholds are set too aggressively, important outliers can slip through unchecked—or worse, be automatically rejected without a way to appeal, undermining customer trust and missing out on profitable niche opportunities. To prevent this, implement continuous sampling and regular manual back-testing as critical safeguards.

- Cybersecurity & Data Privacy – Centralizing detailed client information and policy management in a single decision hub increases the impact of any potential breach. Mitigating this risk requires strong encryption, a zero-trust architecture, and secure-by-design integrations with third parties, which inevitably raises costs and extends deployment timelines.

Future Developments: Will Human Underwriters be Replaced by AI?

Will the algorithm finally replace the underwriter?

The short answer is no, at least not any time soon.

AI reporting tools are already parsing submissions, merging an applicant’s credit report with telematics, satellite imagery and unstructured notes, then drafting the coverage rationale or loan memorandum in seconds.

McKinsey estimates the productivity prize at nearly $1 trillion a year for global banking and several hundred billion for insurance once AI is scaled across front‑ and back‑office decision flows.

Deloitte’s 2025 survey of U.S. carriers shows three‑quarters have a generative‑AI pilot in underwriting, yet nearly all retain mandatory human sign‑off loops to satisfy board‑level risk appetites and growing regulatory scrutiny.

Supervisors are heading the same way: the IAIS draft Application Paper on AI supervision and state rules such as New York DFS Circular 7 explicitly require a human‑in‑the‑loop for high‑impact decisions.

The emerging consensus is therefore augmentation, not replacement: algorithms will handle 80‑90 % of routine submissions, surface anomalies and explain their reasoning, while seasoned underwriters and credit officers concentrate on edge cases, portfolio steering and ethical governance.

In that world, AI doesn’t replace the human but rather it elevates them.