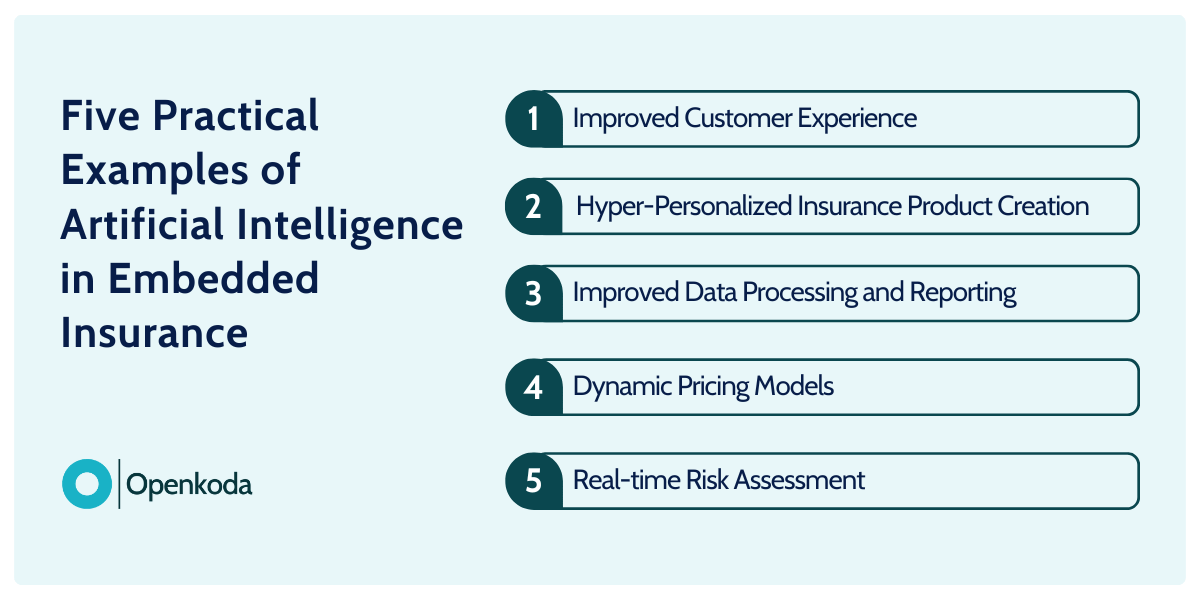

5 Practical Examples of AI in Embedded Insurance

We are living in the AI era, where technology is rapidly reshaping entire industries, including insurance.

Embedded insurance in particular, when powered by AI, offers immense potential for transforming how customers interact with and receive coverage.

In this article, we explore five practical examples of how AI can help insurance providers deliver smarter, faster, and more personalized experiences.

Embedded Insurance Revolution: New Approach to Insurance

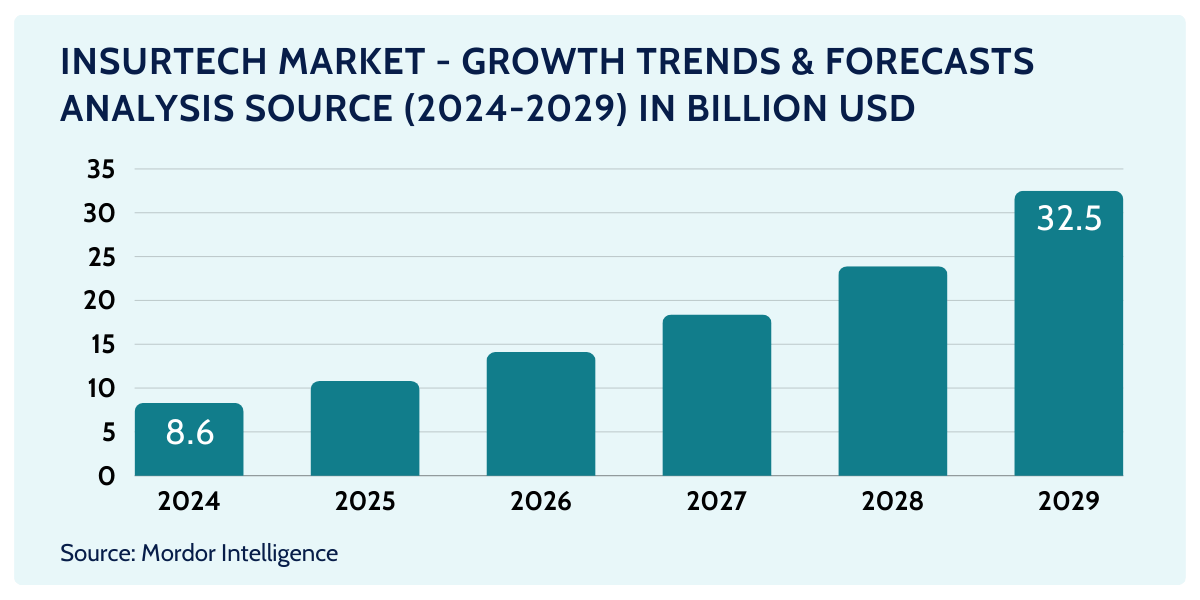

The insurtech market is witnessing significant developments in 2024, driven by digital innovation and a focus on personalized, customer-centric solutions in the insurance industry.

The global insurtech market is expected to grow from $8.63 billion in 2024 to $32.47 billion by 2029, with a compound annual growth rate (CAGR) of 30.34%.

With global protection gap projected to reach USD 1.89 trillion by 2025 there is a lot of room for insurance companies to search for new, innovative ways of offering insurance products to potential clients and that’s exactly what embedded insurance aims to accomplish.

Embedded insurance is at the forefront of this evolution, offering tailored cover at the point of sale or service.

A key driver in this area is the integration of artificial intelligence (AI) with embedded insurance.

AI enables insurers to offer hyper-personalised products by analysing vast amounts of data, assessing risks more accurately and optimising claims processes in real time.

Embedded insurance has gained momentum across various sectors, including e-commerce, travel and fintech, offering insurance coverage within existing user experiences.

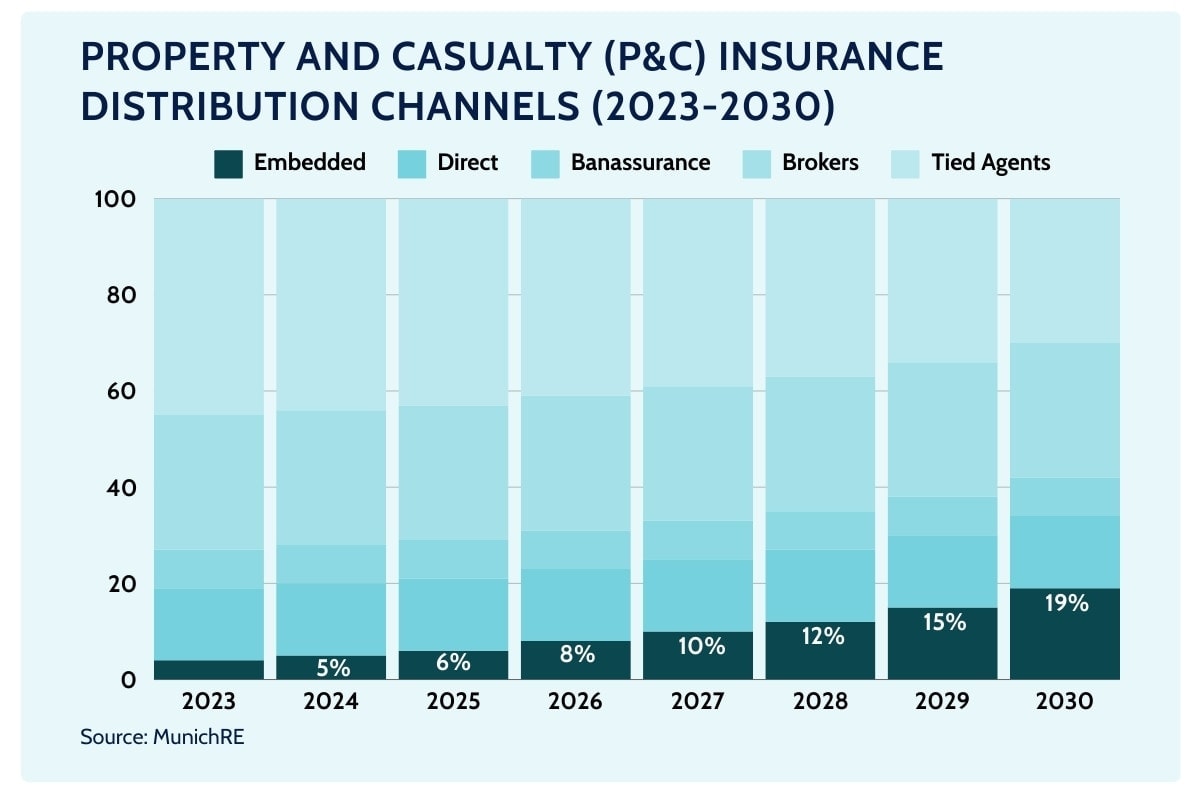

The embedded insurance market is experiencing significant growth with 30% of all insurance transactions expected to be embedded by the end of the decade. All of this reflects a major shift in the way insurance is delivered.

Impact of IoT and AI on Embedded Insurance: Five Practical Examples

The main objective behind AI in embedded insurance is pretty straightforward: make your organization more effective while optimizing operational costs.

As Ericson Chan, group chief information and digital officer at Zurich put it “Artificial intelligence (AI) can make many aspects of embedded insurance “more productive”.

From enhancing the customer journey with advanced personalization to simplifying the claim settlement process through advanced analytics, AI can greatly improve the efficiency of embedded insurance solutions and position your system at the forefront of innovation.

Let’s take a look at five examples of how artificial intelligence is improving the insurance industry. And what lessons you can apply to your own business.

Example #1: Improved Customer Experience

Generative AI can significantly enhance embedded insurance products by personalising and streamlining the customer experience.

For example, embedded insurance offerings powered by GenAI could provide your customers with advice that alerts them to dangers in specific destinations they may not have considered.

Such a system can analyse real-time travel data and then recommend safer destinations based on individual preferences, making insurance coverage more relevant.

Joe Mason, Global Head of Product Management and Innovation at Allianz Partners, says: “If we can get customers to go to places where they are more likely to be safe, that’s good for business and fewer people will get hurt.”

It can also simplify traditionally dense policy documents, offering concise, understandable summaries that reduce customer friction and improve clarity.

When it comes to the embedded insurance forms themselves, AI can automatically customize them based on training data, tailoring fields to each user’s specific needs, providing real-time chat support, eliminating unnecessary steps, and ensuring a smooth, hassle-free process.

These improvements lead to higher satisfaction and engagement with insurance products.

Example #2: Hyper-Personalized Insurance Product Creation

Insurance companies are often struggling to adapt to changing customer preferences due to outdated technology that makes it difficult to offer real-time, personalized insurance products.

Embedded insurance offers a solution by moving away from the traditional “one-size-fits-all” model and instead providing coverage tailored to individual needs.

IoT devices play a key role in this by collecting customer data and providing insights into user behavior and environments, allowing insurers to design highly customized products.

In the travel insurance industry, for example, generative AI can create policies based on real-time factors such as the traveler’s destination, weather conditions, and personal profile, ensuring coverage is a perfect fit and helping to drive efficiency and customer loyalty.

Tesla’s Insurance: Perfect Coverage Personalization

When it comes to mixing AI with IoT devices to deliver hyper-personalized, embedded insurance products, there’s no better example of such a deployment than Tesla.

Tesla Insurance combines AI and data from IoT devices – namely, the vehicles themselves – to offer dynamic, personalized insurance policies.

Tesla vehicles are equipped with advanced sensors and on-board diagnostics that collect real-time data on driver behavior, speed, road conditions, and more.

This data is used directly to calculate a driver’s risk profile, which in turn adjusts their insurance premium on a monthly basis.

This results in a highly customized and fair pricing model based on how safely each individual drives, rather than broad demographic factors such as age or location.

In recent years, Tesla’s insurance business has grown rapidly.

In 2023, Tesla Insurance’s direct written premiums soared to $517.6 million, more than doubling from the previous year.

The insurance company continues to expand, offering coverage in multiple U.S. states and becoming a significant player in the auto insurance market.

Example #3: Improved Data Processing and Reporting

Systems connected to embedded insurance forms can revolutionize data processing and reporting by incorporating AI to analyze vast amounts of data more efficiently.

How does this work in practice?

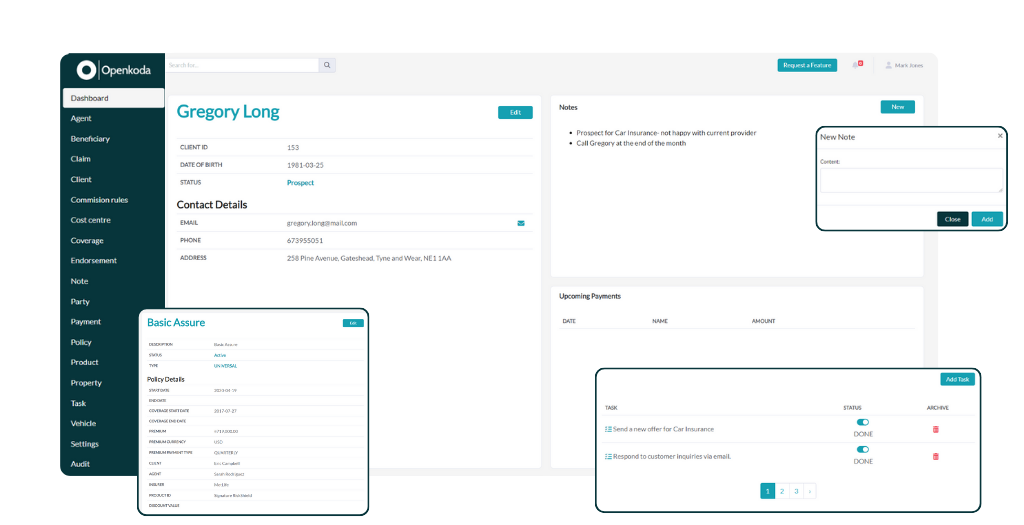

For instance, Openkoda, an open-source platform for embedded insurance solutions, offers advanced AI-powered reporting tools.

With Reporting AI, you can easily generate complex SQL queries using natural language prompts.

Simply write a description of a table you need and the LLM system will generate a ready SQL query for you.

This feature allows you to access data from embedded insurance forms, so you can quickly analyze metrics such as customer engagement, form completion rates, or the effectiveness of different policy options.

By integrating such advanced data analysis and reporting tools into your embedded insurance forms, you can improve reporting accuracy and gain actionable insights into the performance of your insurance products, ultimately improving customer satisfaction and business results.

Example #4: Dynamic Pricing Models

AI-powered dynamic pricing models in embedded insurance enable insurers to calculate premiums in real time and tailor them to individual user profiles and changing circumstances.

These models evaluate data from multiple sources, such as user behavior, environmental factors, and market trends, enabling more accurate and personalized pricing.

Why does it matter?

Compared to traditional insurance models, dynamic pricing models can significantly improve the way travel insurance is offered.

Your company could adjust a traveler’s premium based on factors such as the risk level of the destination (e.g., weather conditions, political stability), the traveler’s itinerary (e.g., adventure sports or business travel), and personal data such as age or travel history.

If someone visits a high-risk country during hurricane season, the AI systems can increase the premium accordingly, while a traveler going to a safer, more stable destination would receive a lower premium.

This real-time responsiveness ensures that pricing is fair, risk-adjusted, and tailored to each individual’s circumstances.

By integrating such AI-driven systems, you can offer more competitive pricing while ensuring profitability because they have real-time data to back up their calculations.

Example #5: Real-time Risk Assessment

Real-time risk assessment is another key area where AI is enhancing embedded insurance, thanks to IoT devices and intelligent data analytics.

By leveraging data from IoT devices like wearables, smart home sensors, or connected vehicles, insurers can continuously monitor risks as they evolve, enabling more accurate and timely adjustments to coverage.

In health insurance, for example, wearables such as fitness trackers or heart rate monitors can provide real-time insights into a person’s health, allowing insurers to dynamically assess the risk of illness or injury.

With this data, insurers can offer proactive coverage updates or personalized advice that reduces the likelihood of a claim, ultimately benefiting both the customer and the insurer.

In auto insurance, as in the Tesla example we’ve already explored, connected cars equipped with sensors can monitor driving behavior, road conditions, and even external factors such as weather or traffic.

By integrating real-time data from IoT devices and analyzing it using advanced AI models, you can offer your customers more dynamic, personalized, and responsive embedded insurance products.

[Read also: Embedded Insurance: Key Statistics, Trends and Forecasts]

Risks and Challenges of Embedded Insurance AI

AI is transforming embedded insurance by making it more efficient and personalized, but it’s not without its challenges. Here are some of the key risks that need careful consideration:

- Data Privacy Concerns: AI relies on vast amounts of personal data to make accurate predictions and recommendations. This means insurers need to collect and process sensitive customer information, raising concerns about how this data is stored, shared, and protected. Any missteps in data handling could lead to significant breaches of privacy, resulting in a loss of customer trust and potential legal consequences.

- Algorithmic Bias: There is a risk of bias in AI models, which could result in unfair outcomes or discrimination if data is not balanced or representative. Be aware of that when fine tuning your algorithms.

- Transparency and Trust: The “black box” nature of some AI systems can make it challenging to explain why specific decisions are made. For instance, if a claim is denied or a premium is set at a particular rate, customers may struggle to understand the reasoning behind these outcomes.

- Cybersecurity Risks: The more data AI systems handle, the greater the potential vulnerability to cyber-attacks, threatening both customer data and trust. To mitigate these risks, you need to implement robust cybersecurity protocols, including multi-factor authentication, regular security audits, and up-to-date encryption methods.

- Over-Reliance on Automation: Automated processes can lead to oversights or errors, especially in unique or complex claims where human judgment is crucial. To mitigate this risk, you should adopt a hybrid approach that combines AI-driven automation with human oversight. In that way you remain present at the wheel, while AI will work in the background improving your business efficiency.

[Read also: Digital Transformation in Insurance Industry: Key Strategies & Trends]

Deploy Your Own AI-Enabled Embedded Insurance

With Openkoda, a platform for custom insurance software development, you can build and deploy your own AI-enabled embedded insurance system in a streamlined and cost-effective way.

Openkoda is an open source platform that accelerates development by providing pre-built functionality and essential components, reducing time to market by up to 60%.

It allows you to customise your own insurance forms and embed them into your site quickly and efficiently, regardless of the system or architecture it is built on.

It also includes smart features such as AI reporting and the flexibility to choose your own hosting, ensuring no vendor lock-in and complete ownership of the code.