Mutual Insurance Software: Boosting Efficiency and Transparency

Mutual insurers face unique challenges – from state-specific regulations to insuring specialized assets – and many are still held back by outdated legacy systems.

Modern technology offers a way forward, giving them flexible software options to streamline operations and serve members better.

Let’s explore why upgrading matters and highlight the platforms worth considering.

Why Mutual Insurers Need Modern Software Solutions

Mutual insurers are unique entities in the insurance landscape.

Unlike stock companies driven by shareholders, mutuals are owned by their policyholders.

It’s an approach that has stood the test of time – some mutual insurers have been around for more than a century – but in today’s digital-first world, tradition alone isn’t enough.

First digitalization challenge lies in the very nature of mutual insurance.

These companies often operate under state-specific regulations that require precise compliance and reporting. On top of that, mutuals frequently insure highly specialized risks — anything from local businesses to farm equipment or niche property types.

This diversity makes operations more complex and demands systems that can adapt to very particular product designs and compliance frameworks.

Unfortunately, many mutuals still rely on outdated technology stacks, legacy core systems, or, in some cases, even spreadsheets patched together to handle day-to-day operations.

Why is it such a serious issue?

Let’s take a closer look.

Why Mutual Insurance Companies Struggle with Legacy Systems

The legacy technology problem in the mutual insurance sector runs deeper than just “old software.”

Many of these systems were built decades ago, designed for a time when member expectations were simpler and regulatory demands were less dynamic. Today, those same platforms act more like anchors than engines of growth.

One of the biggest issues is rigidity.

Legacy systems often lack the flexibility to adapt to new products, updated regulations, or changing market conditions. Even something as straightforward as launching a new coverage option can require months of custom coding and testing.

Maintenance is another pain point. Supporting outdated systems usually involves high operational costs – not just in licensing, but also in specialized IT staff who know how to keep them running.

In some cases, insurers are stuck with software that only a handful of people in the organization know how to operate.

Key Software Systems Mutual Insurers Need

If legacy systems are the problem, then modern, well-designed software is the solution.

Each area of the insurance value chain can benefit from digital transformation.

Let’s look at the core systems that can make the biggest difference when it comes to smooth insurance legacy system modernization.

Policy Administration Systems

At the heart of every insurer is the policy administration system.

But for mutual insurers, policy administration is rarely straightforward.

Unlike large national carriers within broader insurance industry with standardized products, mutuals often operate under unique, state-specific laws and must design policies that reflect those local requirements.

On top of that, they frequently insure specialized assets – from farm equipment and agricultural property to niche community businesses – that don’t always fit neatly into a standard policy template.

A modern insurance policy management software helps reduce errors, improves document management and complience, and shortens the time it takes to bring new offerings to market.

Key features to look for in a policy management software include:

- Customizability – the ability to adapt policies to unique regulations and unusual types of insured assets.

- Scalability – systems should grow as the mutual expands into new products, regions, or membership bases.

- Freedom of deployment – whether cloud-based, on-premise, or hybrid, insurers need the choice to deploy systems in a way that fits their IT and compliance strategies.

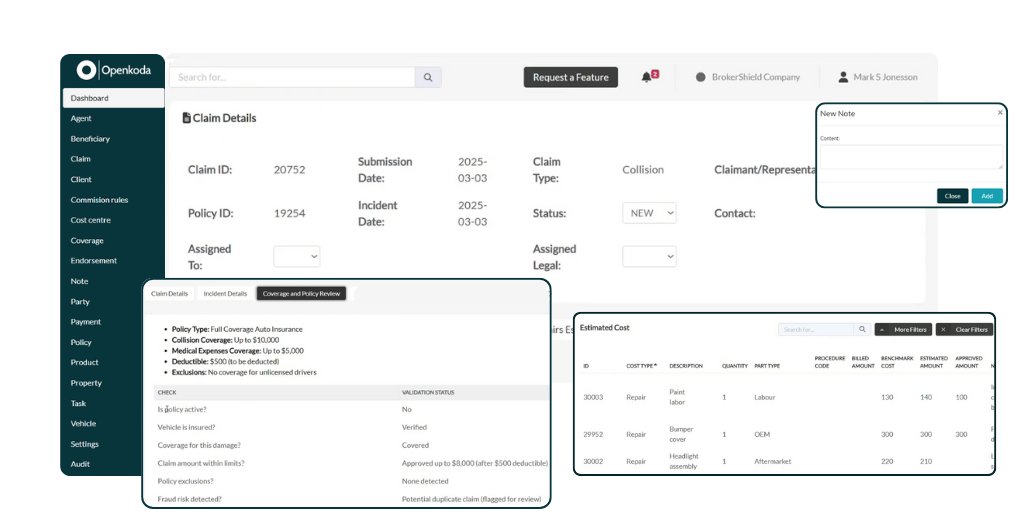

Claims Management Software

In mutual insurance, the claims process carries even more weight than in other segments of the industry.

Because policyholders are also members and owners, handling claims fairly and transparently is at the very heart of the mutual model.

This is where modern claims management systems make a difference.

They not only streamline standard workflows but also provide the flexibility mutuals need to adapt processes to unique member and asset types.

By reducing paperwork, automating repetitive tasks, and improving communication, these systems allow claims teams to focus on what really matters: serving members in their moment of need.

Billing and Payment Platforms

Billing might seem like a back-office task, but for members, it’s often one of the most visible interactions with their insurer.

Modern billing platforms allow for flexible payment options, automated reminders, and transparent reporting. For mutuals, offering simple and convenient payment methods — from direct debit to mobile wallets — is a way to strengthen member satisfaction and reduce churn.

Customer Portal

Mutual insurance is built on close relationships with members.

Digital insurance client portals bring that philosophy into the modern era by providing 24/7 access to policy information, claims status, billing, and communication tools.

A well-designed portal can reduce the load on call centers while empowering members to manage their own policies with self service features.

Reporting and Analytics Tools

Data is one of the most valuable assets an insurer has, yet legacy systems often keep it locked in silos.

Advanced analytics tools consolidate information across claims, policies, billing, and member interactions.

For mutual insurers, this means better insights into member behavior, more accurate risk assessments, and the ability to detect patterns early – whether it’s fraud or emerging coverage needs.

The Benefits of Modern Mutual Insurance Software

Adopting modern software systems goes further than just going for more innovative tech stack.

For mutual insurance agencies, it’s about unlocking capabilities that align with their mission: serving members more efficiently, transparently, and fairly.

Once outdated systems are replaced with flexible, integrated platforms, the impact is felt across the entire organization.

Here are the most important benefits mutual insurers can expect:

- Greater operational efficiency – streamlined processes reduce manual work, errors, and costs.

- Enhanced member experience – faster claims management, flexible billing, and self-service portals improve satisfaction and trust.

- Faster product innovation – mutuals can launch new products or adapt existing ones more quickly to meet evolving needs.

- Improved compliance and transparency – modern systems keep pace with regulatory requirements and provide clear audit trails.

- Data-driven decision making – advanced reporting and analytics help insurers understand risk, anticipate trends, and make smarter strategic choices.

Top Mutual Insurance Software Platforms to Consider

The market for insurance software is broad, but not every platform might fit the unique needs of mutual insurers.

Below are four notable software platforms that mutual insurers can consider — each with different strengths and approaches to modernizing policy, claims, billing, and member engagement.

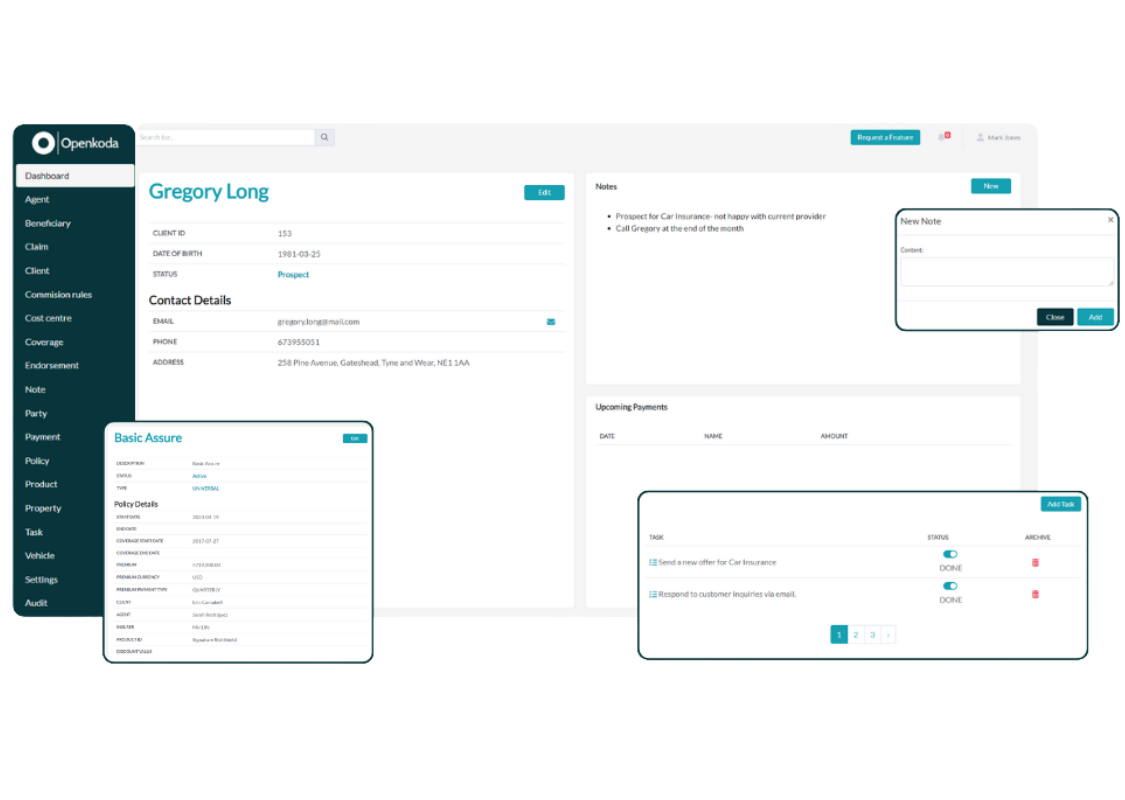

Openkoda

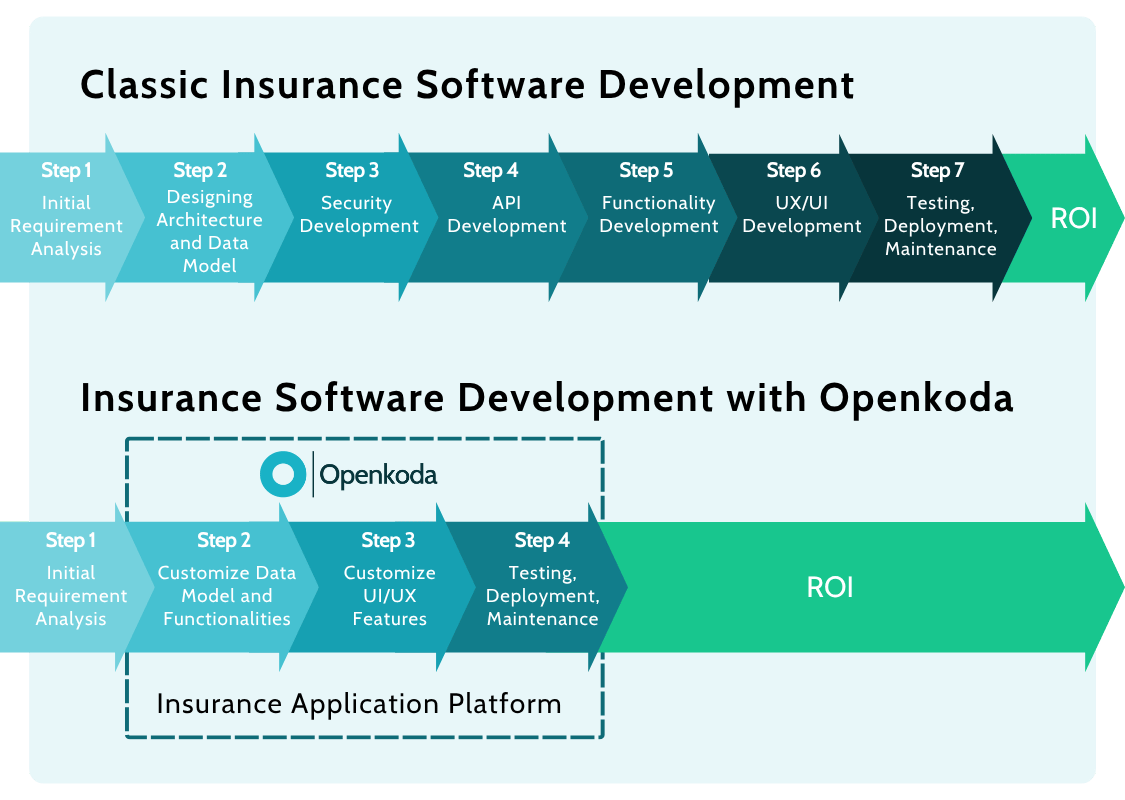

For mutual insurance carriers that need modern systems without giving up their independence, Openkoda offers a refreshing alternative.

It’s an open-source platform designed to help insurers build, customize, and scale insurance software applications faster.

What sets Openkoda apart from other core insurance systems it its flexibility and customizability.

Openkoda makes it possible to adapt software to the very specific needs of mutual insurers instead of forcing them into rigid, predefined workflows.

Another key aspect is code ownership.

Unlike other platforms, apps built upon Openkoda belong to you and don’t force you to stay with one vendor forever.

Key strengths of Openkoda for mutual insurers include:

- Rapid development of custom insurance applications.

- Full control over deployment and integration.

- Lower total cost of ownership thanks to open-source foundations.

- Features like claims management, policy administration, and AI reporting available out of the box, yet fully adaptable.

Guidewire

Guidewire is a well-established core insurance platform offering policy, claims, and billing solutions at an enterprise scale.

For mutual insurers, it supports key business values like transparency and operational efficiency, while its broad functionality can help drive business growth through improved processes and digital capabilities.

The platform also opens up business opportunities by enabling integrations with third-party tools, analytics, and new distribution models.

However, its scope and complexity often make it better suited for larger mutuals with the resources to manage a comprehensive system.

[Read also: Best Guidewire Alternatives in 2025: Openkoda vs. Guidewire]

Insly

Insly is a cloud-based low-code insurance software platform designed primarily for brokers, MGAs, and smaller insurance companies.

Compared to other core insurance systems its strength lies in simplicity and speed: insurers can set up policy administration, billing, and claims workflows quickly without heavy IT involvement.

For mutual insurers, Insly offers an accessible way to digitize core processes and reduce reliance on spreadsheets or outdated legacy tools. As a SaaS solution, it provides regular updates, lower upfront costs, and straightforward scalability, making it a good fit for organizations that want agility without managing complex infrastructure.

Sapnies

Sapnies is an insurance platform focused on policy and claims management, offering tools to support day-to-day operations for insurers of various sizes.

It emphasizes usability and process efficiency, helping insurers handle member data, claims workflows, and compliance requirements in a more streamlined way.

For mutual insurers, Sapnies can provide a structured framework for managing specialized and innovative insurance products and ensuring regulatory alignment, particularly in environments with complex local rules. Its features aim to simplify administration and improve overall transparency in member interactions.

Closing Thoughts

Modern software gives mutual insurers the tools they need to turn tradition into a competitive advantage.

By replacing legacy systems with flexible, member-focused platforms, they can improve operations, adapt to complex regulations, and drive innovation.

Most importantly, these upgrades strengthen trust and boost customer satisfaction, ensuring mutuals remain relevant in a rapidly changing insurance landscape.