Policy Management Software Guide

Efficient policy administration is at the core of every successful insurance operation.

The right policy management software helps insurers handle the entire policy lifecycle with accuracy, speed, and compliance.

This guide walks through the essentials, from key features to choosing the best approach for your business.

Policy Management Software: Definition and Key Aspects

Policy management software is the backbone of modern insurance operations.

At its core, it’s a centralized system designed to handle the entire lifecycle of an insurance policy – from initial issuance to renewal or cancellation.

It acts as a central location for all policy data, documents, and processes, enabling insurers to deliver accurate, compliant, and timely services to policyholders.

In practical terms, a policy management system (PMS) ensures that all policy-related activities – underwriting, endorsements, premium billing, claims linkage, compliance tracking, and customer communication – are streamlined and connected.

This reduces manual work, minimizes errors, and creates a single source of truth for the business, especially compared to old, unoptimized legacy systems, and Excel sheets – a way that a surprising amount of insurers still run their business still in 2025.

From an industry perspective, the key aspects of effective policy management software include:

- Lifecycle Coverage – Managing policies from quote to bind, mid-term adjustments, and renewals without system handovers.

- Regulatory Compliance – Built-in tools for staying compliant with regional and global insurance regulations, supported by automated compliance tracking to reduce the risk of fines or disputes.

- Risk Management – Providing the data visibility and workflows needed to identify, assess, and mitigate potential risks across the policy lifecycle.

- Data Accuracy and Accessibility – Real-time access to up-to-date policy information for both internal teams and customers.

- Operational Efficiency – Automation of repetitive tasks, such as the approval process for policy changes, helping insurers reduce administrative overhead and improve turnaround times.

- Customer Experience – Enabling faster responses, clearer documentation, and self-service options for policyholders.

For insurers, brokers, and MGAs, the value of a PMS lies not only in operational control but also in its ability to integrate with other systems – CRM, claims management, payment gateways, or analytics tools – creating a connected ecosystem that supports both strategic decision-making and day-to-day execution.

Policy Management Software Key Features

While every insurer’s needs will vary depending on product lines, distribution channels, and operational scale, there are core capabilities that any robust policy management system should offer.

These features ensure that policies are issued, maintained, and serviced efficiently, while keeping risk under control and maintaining full regulatory compliance.

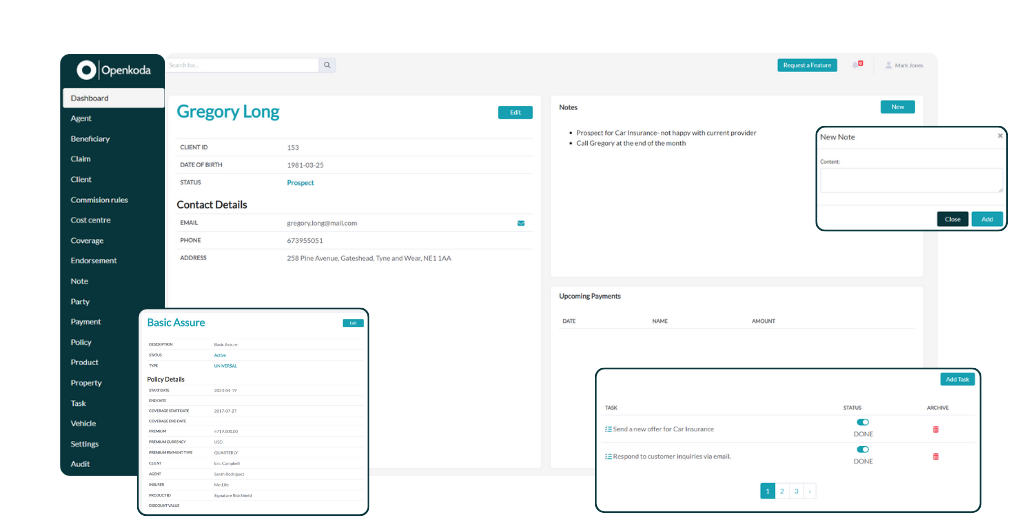

Core Policy Document Management

A strong policy management system provides a structured way to store, organize, and retrieve all policy-related documents in one central location.

This includes policy schedules, endorsements, renewal notices, and communication records.

Advanced systems also support version control, ensuring users always have access to the latest approved document while retaining an auditable history of changes.

Customer & Account Management

This module links policy data with customer profiles, giving underwriters, agents, and service teams a complete view of the insured’s history.

From basic contact details to full coverage portfolios, it helps the entire organization deliver consistent service, improve retention, and spot opportunities for cross-sell or upsell.

Analytics & Reporting

Built-in analytics capabilities allow insurers to track key metrics such as premium growth, lapse rates, and claims ratios.

Increasingly, insurers are adopting AI-powered tools to enhance this process – for example, Reporting AI by Openkoda uses large language model (LLM) technology to generate SQL queries for tailored reports without manual data mining.

This not only accelerates decision-making but also makes advanced analytics accessible to non-technical team members.

Quoting & Underwriting

By automating the review process for applications, eligibility checks, and pricing, a policy management system accelerates time-to-quote and reduces manual errors. Underwriters can focus on complex cases while standard risks move quickly through automated insurance workflows.

Payments & Billing

Integrated payments and billing functionality ensure accurate premium collection and reduce administrative overhead. Features like automated reminders, flexible billing schedules, and reconciliation tools keep the process efficient and transparent for the entire organization.

Audit Trails and Version Control

For compliance and governance, an audit trail records every change made to a policy — who made it, when, and why.

This supports the review process during audits and gives full visibility into the policy’s history.

API Integrations

No piece of insurance software lives on its own.

In practice, it’s part of a network of systems – claims management, CRMs, accounting tools, rating engines, customer portals – that need to “talk” to each other efficiently.

Modern policy management solutions use API integrations to connect these systems, ensuring smooth data exchange, eliminating duplicate entry, and keeping all teams aligned through one central location for reliable, up-to-date information.

Policy Management Software: Custom vs. Off-the-shelf

Choosing the right approach to policy management technology is all about balancing cost, speed to market, flexibility, and long-term control.

Insurers typically have three main options: ready-made solutions, fully custom software, or modern insurtech platforms that blend the best of both worlds.

Ready-made solutions: Pros and Cons

Ready-made policy management software comes pre-built with core features, allowing insurers to get up and running quickly.

It’s a popular choice for smaller organizations or those with less complex product lines.

Pros:

- Fast deployment and minimal setup time

- Lower upfront cost compared to custom builds

- Vendor maintenance, updates, and support included

- Proven reliability from existing user base

Cons:

- Limited flexibility for unique workflows

- Potential vendor lock-in and dependency on roadmap

- Integration challenges with niche or legacy systems

Custom Insurance Software Development: Personalized Approach at Immense Cost

On the other side of the spectrum, we’ve got custom policy isurance software development.

A custom-built policy management application is tailored exactly to your products, workflows, and compliance requirements. It can be designed to fit the way your entire organization works, from underwriting to claims linkage.

However, this precision comes with trade-offs: development can take many months (or years) and requires significant financial investment, as well as ongoing resources for updates, security, and maintenance.

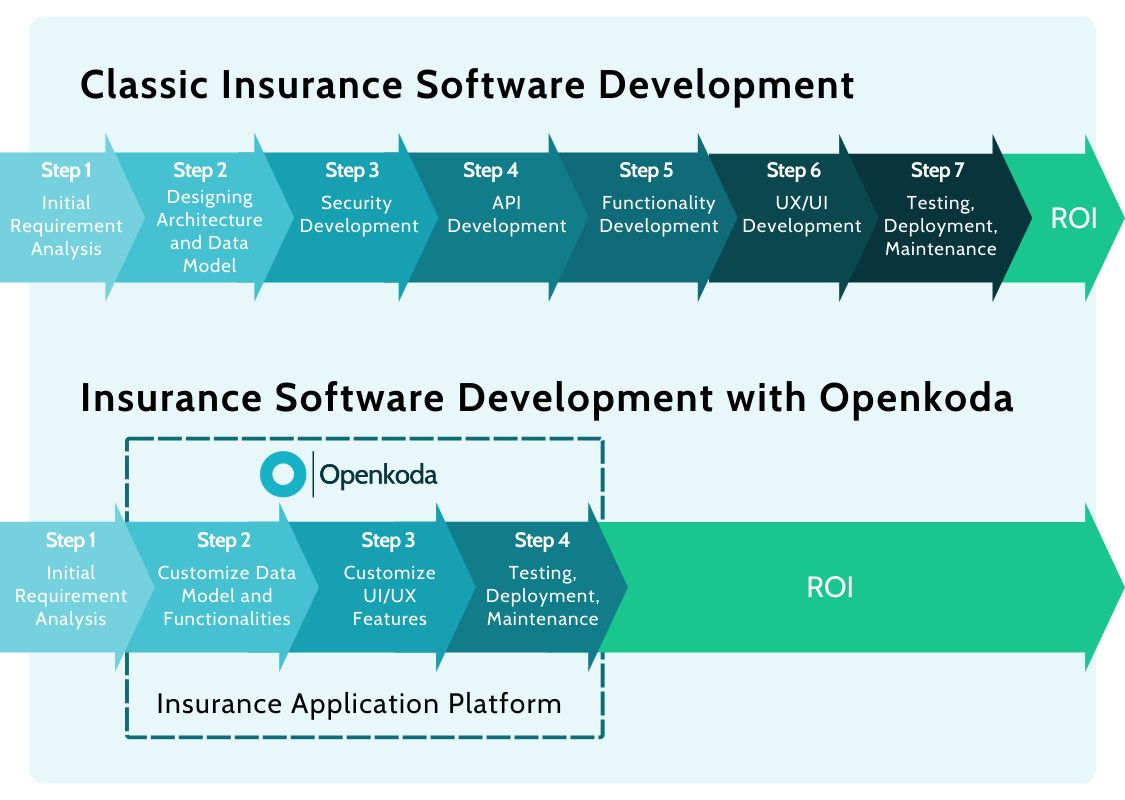

Middle Ground: Modern Insurtech Platforms

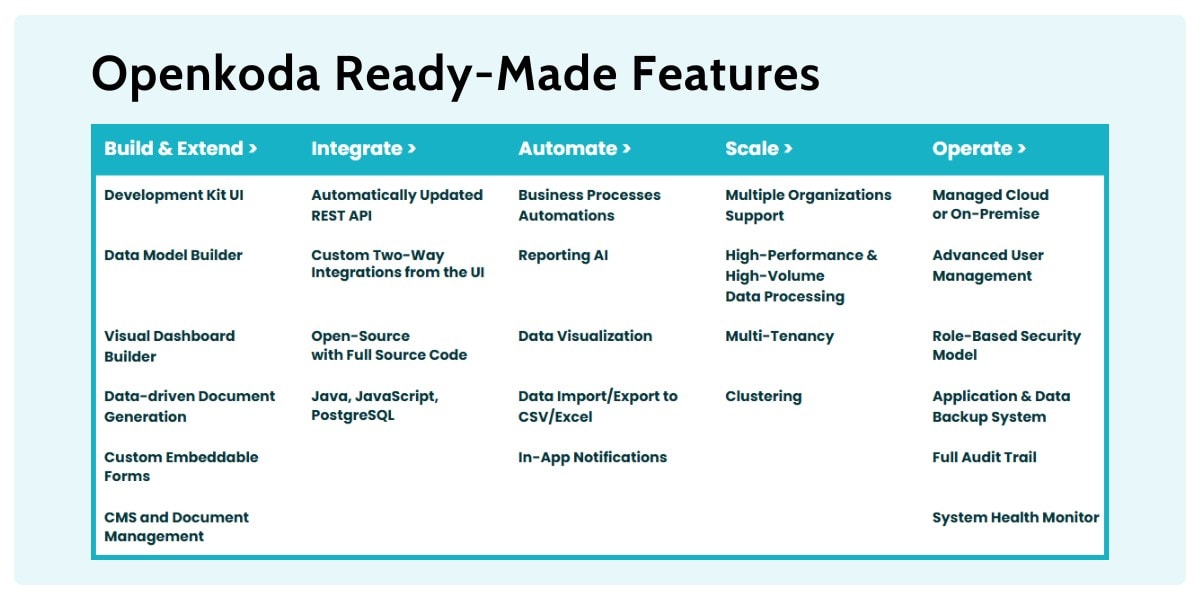

Modern insurtech platforms, such as Openkoda, offer a compelling alternative to the two extremes of ready-made and fully custom software.

They are built to launch quickly while still allowing insurers to shape the system to their exact requirements over time but up to 60% faster compared with greenfield development.

Instead of starting from scratch, you get a functional policy management environment from day one, complete with essential capabilities like document handling, quoting, billing, and analytics – all designed to be extended and reconfigured without costly rebuilds.

Unlike rigid off-the-shelf products, these systems are designed to evolve, supporting new distribution channels, product variations, or regulatory changes without forcing a complete technology overhaul.

Another significant advantage is control.

With platforms like Openkoda, insurers don’t just rent software – they gain full access to their own codebase.

It means that their software is truly theirs, build upon a popular enterprise-grade tech stack, they can customize it, deploy and do with it whatever they want – there’s no such option with ready made SaaS policy management application.

In short, modern insurtech platforms combine the speed to market of ready-made solutions with the customization and ownership benefits of custom development.

They offer a practical, scalable approach to building a robust policy management system without sacrificing agility or long-term control.

How to Choose the Right Policy Management Software

Selecting the best policy management software is not just about picking the system with the most features – it’s about ensuring the technology aligns with your current operations and can grow with your business.

The insurance market is dynamic, with changing customer expectations, evolving regulatory demands, and constant product innovation.

The software you choose should be able to keep pace with all of that.

When evaluating options, pay particular attention to these three factors:

- Customizability – Every insurer has unique workflows, product rules, and compliance requirements. A good policy management system should let you adapt forms, processes, and integrations without waiting on the vendor for every change. This flexibility ensures the platform can keep up with evolving products and distribution models while providing accessible policies to your agents.

- Scalability – Your chosen system should be able to handle growth – whether that means adding new product lines, onboarding more users, or integrating with additional systems. Scalable multi-tenant architecture prevents costly system replacements down the line and supports long-term business expansion.

- Key Functionalities – While bells and whistles can be appealing, the foundation matters most. Look for strong capabilities in areas like document management, quoting and underwriting dashboards, billing, compliance tracking, and analytics. Having these essentials in place ensures your core operations run smoothly before you layer on more advanced features.

Closing Thoughts

A well-chosen policy management system streamlines everything from policy creation to renewals, ensuring accurate data and smooth workflows.

With easy access to key information across teams, insurers can respond faster to market changes and customer needs.

The right platform acts as a foundation for long-term operational efficiency and growth.