Data-driven insurance offers new opportunities for personalized services and efficient risk management. But the journey is not without its challenges.

Let’s explore how your company can leverage customer data to gain an unparalleled competitive advantage.

Data: The Most Valuable Asset of Insurance Companies

Data has always been a cornerstone of the insurance industry, providing the foundation for assessing risk, pricing, and understanding customer needs.

But for an insurance company to differentiate itself from the competition, it needs to make the most of all the data it has.

Customer data, in particular, plays a critical role in driving value.

It gives insurers the ability to assess risk with precision, deliver tailored coverage, and anticipate customer needs more effectively than ever before.

This is the basic concept behind the data-driven insurance strategy – effectively using data from all possible sources to optimize customer premiums and value.

From demographics and lifestyle preferences to behavioral patterns and transaction histories, data allows insurers to build a more complete picture of their customers, enabling both risk mitigation and personalization.

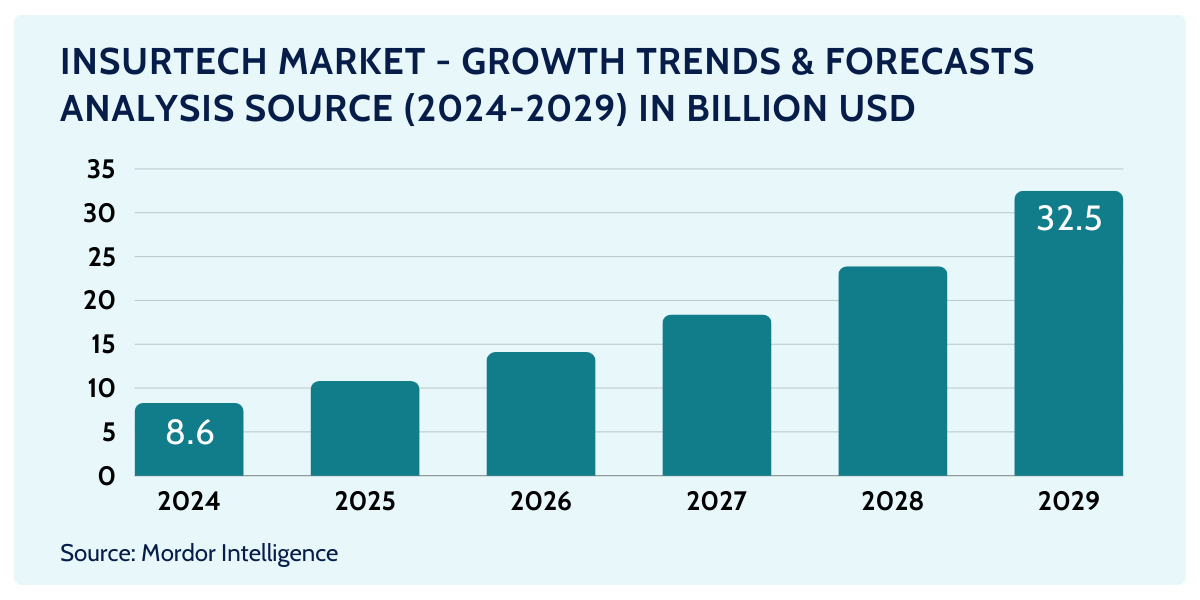

The broader insurance industry has already embraced this trend.

According to recent data, up to 86% of insurers are working to implement AI-driven insurance analytics mechanisms for better predictive capabilities and improved big data reporting.

But to be successful, you need best-in-class insurance software that enables advanced data analytics.

Common Issues of Data-Driven Insurance

But making a software system truly fit into a data-driven insurance strategy is far from easy.

From our experience developing data-driven software for the insurance industry, we’ve identified three common pain points related to data collection, processing, and security.

Let’s take a closer look at them, because only by knowing what issues to expect can you properly prepare.

Issue #1: Data Collection

The first hurdle is data collection.

Gathering customer data can be a daunting task, especially when you consider the variety of sources from which it comes. Whether it’s traditional forms, digital applications, IoT devices, or social media, the volume and variety of data can be overwhelming.

Sourcing, transforming, and serving data are key components of this data-driven journey in commercial lines.

Integrating location, financial, and government data is extremely challenging, but when done right, it has the potential to open up new dimensions for insurers to fully understand and assess risk.

This issue is also closely related to software performance.

The data collected must be real-time or near real-time to support responsive, predictive modeling, putting pressure on systems to ensure fast, high-quality data ingestion.

Issue #2: Data Processing

Once data is collected, the challenge shifts to processing it in a way that extracts actionable insights while managing complexity.

The challenge is to design a system that can handle this additional data input, this ever-growing amount of data.

To accomplish this, insurers are using a mix of traditional batch processing and more dynamic stream processing systems to ensure that time-sensitive data remains relevant and actionable.

In addition, data processing pipelines must be highly scalable to handle fluctuations in data volume without compromising performance and data quality. Multi-tenant databases provide a clean approach to scalable, data-driven insurance software.

Your software architecture must be prepared to connect internal data in databases to this constant flow of data from multiple sources.

It’s a matter of properly ordering, processing, and managing the data coming in and going out.

Issue #3: Safety and Trust

Having access to all the details about a customer’s behavior and preferences is great, but it certainly raises major security concerns.

After all, wouldn’t you be concerned if you knew your insurer was actively collecting data ranging from personal health records and financial information to real-time data from IoT devices and telematics?

That’s why security and trust are paramount in data-driven insurance.

Customers need to feel confident that their personal information is being handled securely. Any breach or misuse can undermine trust and have a lasting impact on an insurance brand.

In the UK and the EU, personal data should be well protected, as GDPR is a powerful regulation and the Information Commissioner (ICO) has extensive powers. It’s imperative that insurance professionals are confident in the strict data protection regulations so as not to hinder customer satisfaction in the future.

That’s why it’s important to have a data governance framework in place to identify who within the organization has access to certain data, and limit it to the absolute minimum required for their job.

The AI Revolution: Transforming Insurance Data Processing in the Next Decade

As we’ve noted before, a data-driven approach for insurance sector requires top-notch software systems that include advanced analytics supported by AI technology.

A good data-driven insurance solution should combine scalable databases, a customizable framework, and perhaps most importantly these days, smart artificial intelligence capabilities.

Let’s take a look at one framework that combines them all: Openkoda Insurance Software

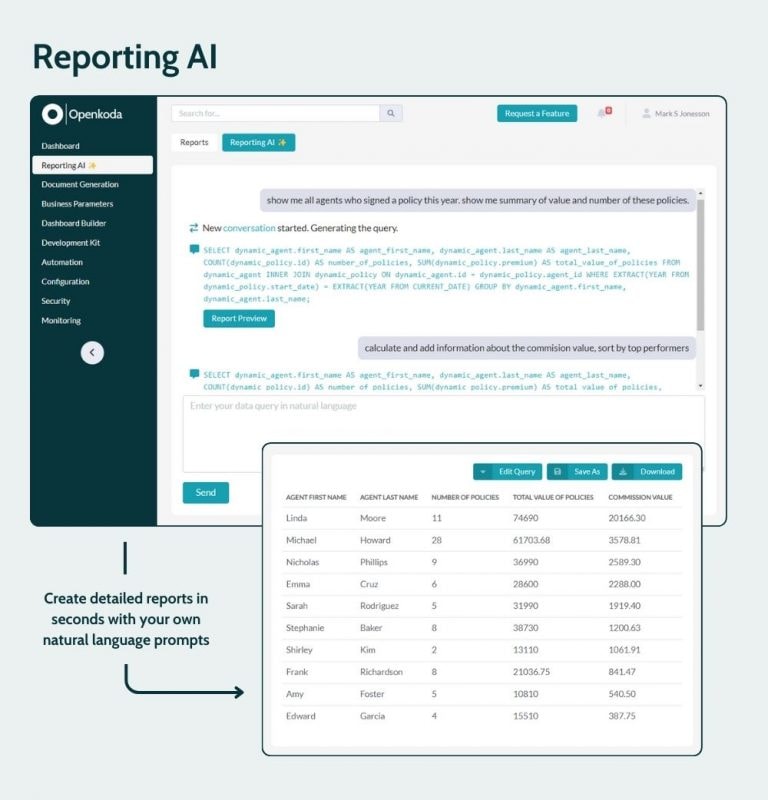

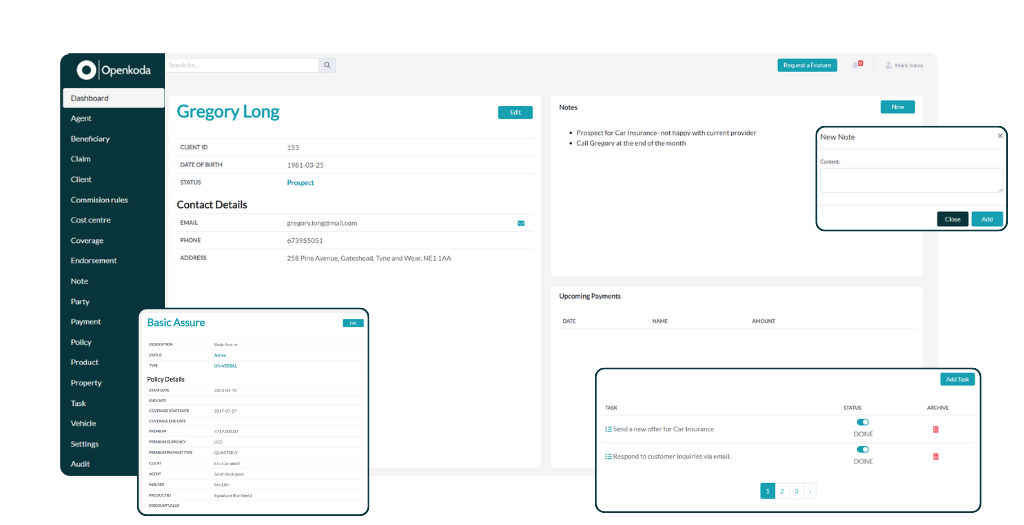

Openkoda is an open-source application platform designed to accelerate the development of custom solutions for embedded insurance and insurance underwriting processes by integrating Generative AI and pre-built templates.

A key feature of Openkoda is its Reporting AI tool, which allows you to generate detailed reports using natural language queries.

This means you can ask questions about your business data in everyday language, and the AI will generate the necessary reports in seconds. This functionality eliminates the need for external reporting tools or manual database queries, streamlining your data analysis process.

Openkoda’s platform is designed to be flexible and highly customizable, allowing you to greatly speed up the custom insurance development process and quickly deploy systems that are tailored to your business.

This customization enhances every part of your insurance underwriting process, from insurance claims data collection to personalized product offerings.

If you want to build custom insurance software for data management integrated with advanced predictive analytics, Openkoda 2.0 is the perfect starting point for your project.

Data-Driven Insurance: Your Strategy and Benefits

Let’s do a quick recap and cover key strategies for leveraging a data-driven approach within the insurance market and what you can gain from it.

Key Strategies for Data-Driven Insurance

To leverage data-driven insurance, you first need a good strategy.

Based on our experience, we’ve identified five key touchpoints you need to consider:

Strategy #1: Leverage Predictive Analytics

Predictive analytics uses historical data, machine learning models, and statistical algorithms to predict future events.

By using predictive analytics, insurers can anticipate customer needs, identify emerging risks, and proactively tailor their product offerings.

Strategy #2: Ensure Data Quality Management

Data accuracy and consistency are critical to the success of any data-driven initiative.

Your organization must implement robust data quality management practices to verify, cleanse, and maintain your data assets.

Strategy #3: Adopt Cloud-Based Data Storage Solutions

Cloud-based insurance solutions like Openkoda provide a scalable and secure approach to managing large volumes of data.

Cloud technology allows insurers to store, process and access data seamlessly, enabling better data integration and collaboration across business units. By adopting a cloud-based infrastructure, insurers can benefit from cost savings, increased data processing speed, and reduced reliance on outdated legacy systems.

Strategy #4: Prioritize Cybersecurity

With increasing reliance on digital channels and cloud-based systems, cybersecurity has become a critical priority for data-driven insurers.

Protecting customer data from breaches and cyberattacks is essential to maintaining trust and complying with regulatory standards.

Strategy #5: Develop a Customer-Centric Approach

Focus on what your customers need and want.

A customer-centric approach means using data insights to improve the customer journey and deliver tailored services.

Use your data analytics to understand individual needs, preferences, and behaviors to personalize insurance products and improve customer engagement.

This demo is a great presentation of how you can easily and efficiently deploy a custom policy management system to keep track of your client’s policies, have access to insightful analytics, and set up smart notifications. These sorts of systems are the core of any data-driven insurance strategy.

Benefits of a Data-Driven Approach

What can you gain by adopting these strategies?

A data-driven approach to insurance can deliver many benefits beyond operational efficiency and cost savings.

Here are five key examples:

- Improved Risk Assessment: By gaining valuable insights from large datasets, insurers can more accurately assess risks and offer competitive pricing.

- Personalized Customer Experiences: Data allows insurers to offer tailored coverage options that align closely with individual needs, enhancing customer satisfaction.

- Enhanced Fraud Detection: Advanced data analytics help identify patterns of fraudulent behavior, minimizing financial losses.

- Operational Efficiency: Automated data processing and analysis reduce the workload on staff, improving efficiency and enabling faster decision-making.

- Customer Retention and Loyalty: Personalized insurance products and proactive service increase customer loyalty, helping insurers retain valuable clients.

Building a Future-Ready Insurance Company

Data-driven strategies are shaping the future of insurance by enabling companies to respond faster, provide better service, and create personalized experiences.

As competition in the insurance industry intensifies, the ability to effectively leverage data and follow the latest insurance industry trends will be key to staying ahead.

Insurers that embrace these strategies will be well-positioned to deliver superior value, build lasting customer relationships, and drive sustainable growth in a rapidly evolving marketplace.