Best Policy Management Software Systems in 2026

Finding the right policy management software can make a significant difference in how efficiently an insurance company operates.

For insurers, MGAs, and insurtechs acts as a central hub that ensures policies are created, approved, distributed, and monitored with accuracy and transparency.

Modern platforms integrate with core insurance systems, automate routine tasks, and keep all stakeholders working from a single source of truth.

In this article, we look at six of the best solutions available in 2026, each with unique strengths to fit different organizational needs.

Choosing Your New Policy Management Software: Practical Guide

Managing insurance policies has come a long way in the last decade.

Not too long ago, many insurers, MGAs, and insurtech startups relied on scattered Excel sheets, outdated databases, and manual workflows to track policies. This approach made it difficult to maintain accuracy, enforce compliance, and respond quickly to changes in regulations or customer needs.

Today, policy management software replaces that chaos with a single, centralized system that connects seamlessly with other tools and platforms.

Policy Management Software: Definition

At its core, policy management software is designed to support the entire policy management lifecycle — from policy creation and drafting, through the approval process, to publication, version control, and ongoing monitoring. This ensures that every stakeholder, from underwriting teams to compliance officers, works from the same source of truth.

The benefits go beyond just storing documents.

The right policy management tool gives organizations the ability to enforce governance standards, reduce operational risk, and automate repetitive administrative tasks.

With everything managed in one place, policy updates become faster, auditing is easier, and integration with claims systems, CRM platforms, and analytics tools happens without friction.

In short, a modern policy management system is a backbone for operational efficiency and compliance in insurance organizations, ensuring that policies are created, reviewed, approved, and maintained in a structured, traceable way.

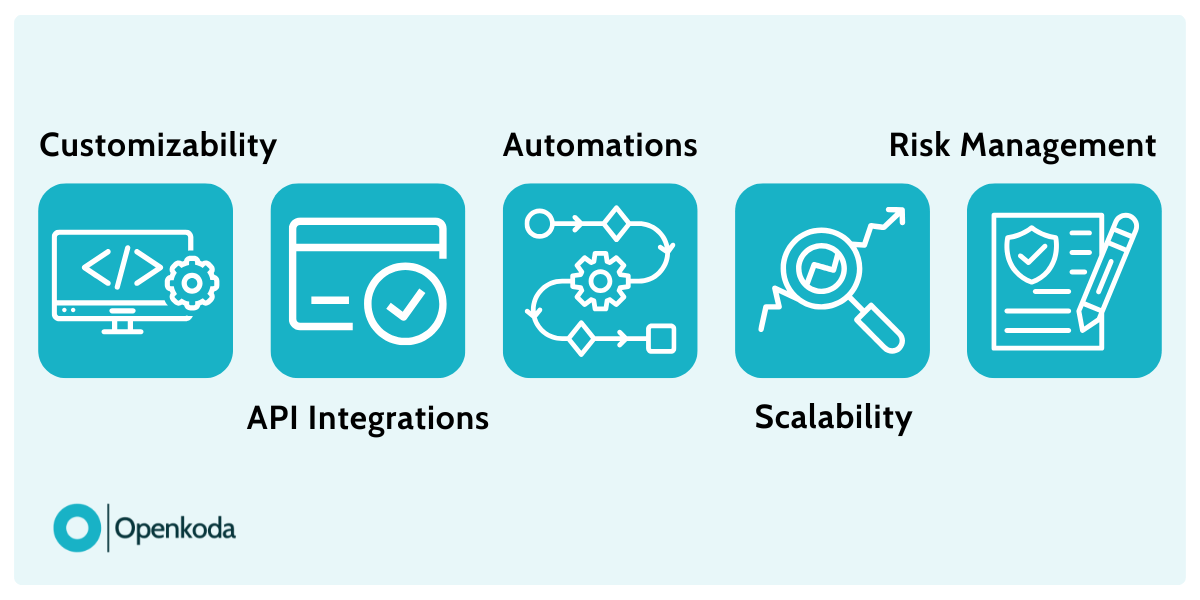

Key Features of Policy Management Systems

While every insurer or MGA has its own operational priorities, most modern platforms share a set of core capabilities that make them effective. A well-designed system not only stores and organizes documents but also actively supports risk management, streamlines policy and procedure management, and keeps teams on top of compliance tracking. Here are six key features to look for when evaluating solutions:

- Customizability – The ability to adapt workflows, templates, and approval chains to match your organization’s processes. This ensures that the system fits your business model rather than forcing you into a rigid, one-size-fits-all structure.

- API Integrations – Robust integration options that connect your policy management software with claims processing, CRM platforms, analytics tools, and other core insurance systems. APIs make it possible to share data instantly and eliminate double entry.

- Insurance Automations – Built-in tools that automate repetitive tasks like policy renewal notifications, compliance reminders, and document version control. This reduces human error and frees staff to focus on more strategic work.

- Scalability with Multitenancy – The capability to support multiple business units, regions, or brands within a single platform while maintaining secure separation of data. This is critical for insurers operating across diverse markets.

- Compliance Tracking – Features that monitor policy status, highlight overdue reviews, and log approval history. This makes audits far easier and ensures regulatory standards are met at all times.

- Risk Management Tools – Capabilities that identify, assess, and monitor risks associated with policy changes or procedural updates, helping insurers maintain strong governance and avoid operational blind spots.

Best Policy management Software Systems

The market in 2025 offers a wide range of platforms, from specialized insurance-focused solutions to more general enterprise policy and procedure management tools. Each comes with its own strengths, from advanced automation capabilities to deep integration options and industry-specific compliance features.

Below, we’ve highlighted six standout systems that cover a variety of use cases for insurers, MGAs, and insurtech companies.

Openkoda Policy Management Software

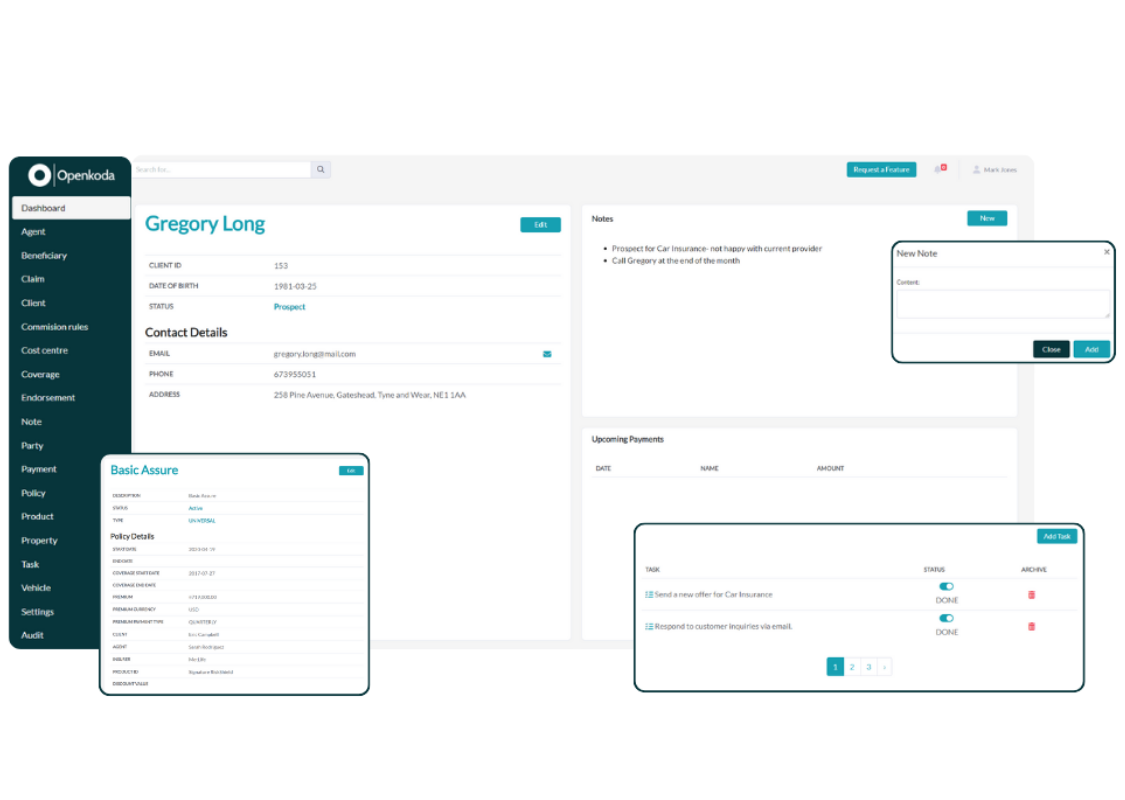

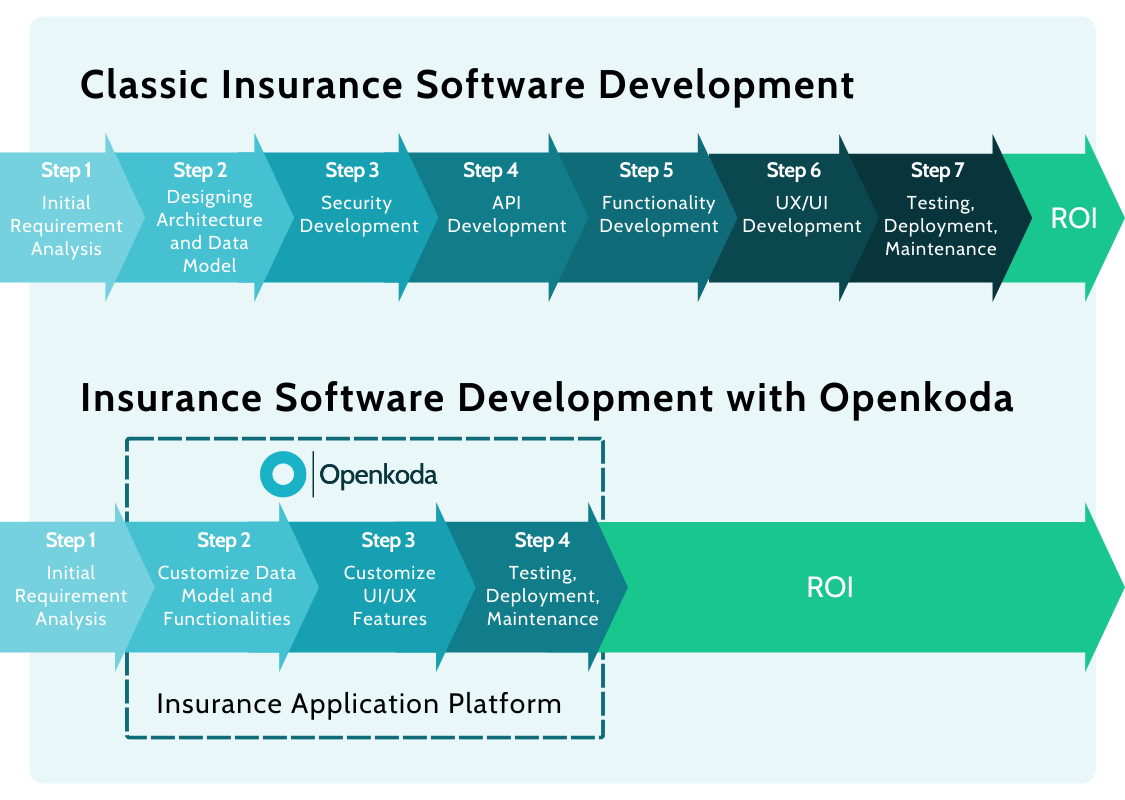

Openkoda is a robust insurtech platform crafted for rapid development of insurance applications.

It includes a powerful policy management component within a modular, template-driven architecture – giving insurers, MGAs, agents, and insurtechs the flexibility to pick and extend exactly what they need. You retain full code ownership, and the system can be deployed either in the cloud or on-premise – a capability that few platforms offer.

With Openkoda, you’re not just using a static product.

Its open-source foundation means you can tailor the entire policy approvals workflow, central document storage, and policy-handling logic across your entire organization.

Policy management is also not the only application template on the platform.

There are also components for embedded insurance, claims management, underwriter dashboards, AI-driven reporting, and automation – all customizable and easily integrated through REST APIs or webhooks.

This means that if you cannot find your best policy management system within the ready-made suites, you can make one yourself with Openkoda – and it will truly be yours.

Pros

- Highly customizable, open‑source architecture: Allows you to adapt workflows, UI, and logic while ensuring full ownership and avoiding vendor lock-in.

- Flexible deployment: Supports both managed cloud and on-premise installations — a rare advantage in the market.

- Modular templates for insurance apps: Comes with off-the-shelf policy‑management, claims, reporting, and embedded insurance modules that accelerate development.

- Strong integration and automation capabilities: Offers APIs, webhook support, automated document generation, insurance dashboards, approval flows, and AI-powered reporting tools.

Cons

- Some technical skills needed for deep customization – While the platform’s open-source nature allows for extensive flexibility, making advanced changes may require familiarity with its tech stack (Java, JavaScript, PostgreSQL). However, the Openkoda team can handle tailoring and implementation if you prefer not to manage it in-house.

- More setup than a basic SaaS – Openkoda offers far greater flexibility than most ready-made tools, but this also means a bit more initial configuration to match your workflows. Once set up, it runs just as smoothly as any fully managed system.

PowerDMS

PowerDMS is a cloud-based policy, training, and accreditation management platform that allows organizations to develop, review, approve, and distribute critical documentation all from a centralized system.

Originally built for public safety and healthcare sectors, PowerDMS now serves over 4000 public and private entities, offering a consolidated ecosystem for policy approval, training tracking, and compliance workflows for insurers and healthcare facilities.

Pros

- Centralized repository with workflows – Draft, route, approve, and distribute policies with version control and audit trails.

- Integrated policy, training, and accreditation – Syncs updates across policies, training requirements, and standards.

- Mobile access with e-signatures – Staff can review and sign documents on any device.

Cons

- No built-in content creation – Policies must be authored separately or adapted from templates.

- Initial learning curve – Requires some training to set up workflows effectively.

- Variable pricing – Costs depend on user count and selected modules.

Guidewire Policy Center

Guidewire PolicyCenter is a cornerstone of Guidewire’s broader InsuranceSuite – it’s not a standalone product, but rather a key module within a holistic suite designed for property and casualty insurers.

As a policy management software embedded in this ecosystem, it supports the full policy lifecycle – from product design, quoting, underwriting, and issuance to endorsements, renewals, and even cancellations – while helping you efficiently maintain compliance and engage relevant employees through modern, streamlined workflows.

Pros

- Comprehensive lifecycle support – Tackles the full spectrum of policy processes under one roof: quoting, underwriting, issuance, renewals, and more, with automation and real-time updates.

- Deep configurability paired with insurance context – Built-in tools and the Advanced Product Designer make tailoring workflows, rules, and products intuitive—without needing code-heavy customization.

- Proven performance across large insurers – Users praise it as “best in class,” especially for its out-of-the-box features, integration capabilities, and developer tooling.

Cons

- Complex for specialized processes – While highly customizable, its core architecture may pose challenges when molding it to fit extremely niche or unique workflows without significant configuration.

- Implementation demands time and coordination – Rolling out Guidewire PolicyCenter usually involves significant setup process: lengthy planning, stakeholder alignment, Data migration, and training across underwriting, IT, and compliance teams – making the journey slightly longer.

- High dependency on cloud performance – Some users have noted occasional lag in the cloud environment, especially when handling large volumes or simultaneous data inputs.

LogicGate

LogicGate’s Risk Cloud is a cloud-native GRC (Governance, Risk, and Compliance) platform with a strong policy management software module built right in.

Its Policy & Procedure Management application centralizes and automates policy creation, review, approval, and version control.

You can craft policy workflows and manage governance from a shared repository – even bringing in Spark AI for draft generation – while ensuring the right policies reach relevant employees and that attestations are clearly tracked.

Pros

- Full lifecycle automation – From drafting to review, approval, and acknowledgment tracking—all in one platform with built-in audit trails.

- AI-assisted drafting & version control – Spark AI can help generate policy drafts; version history and updates are tracked automatically.

- Compliance dashboards & control mapping – Easily link policies to control frameworks, identify compliance gaps, and view reports on acknowledgments and revision status.

Cons

- Cost may scale with scope – Pricing depends on the number of Power User licenses, applications chosen, and any implementation services needed—so the platform can be a significant investment as you unlock more capabilities.

- Broad GRC scope may feel heavyweight – If you only need basic policy tracking, this full-stack GRC solution may offer more functionality than necessary, potentially complicating adoption

ConvergePoint

ConvergePoint delivers a cloud-based system that slots neatly into your existing Microsoft 365 SharePoint environment.

It’s designed for the entire lifecycle of the policy document – from drafting and review to approval, publication, and acknowledgement.

Built with robust integrations (Microsoft Word, Outlook, Teams, Active Directory), it’s particularly well-suited for insurers aiming to enforce compliance standards with minimal fuss. The platform lets you track progress with real‑time dashboards and audit trails, all within tools your team already uses.

Pros

- Embedded in Microsoft 365 SharePoint – Installs quickly as an App, using familiar tools (Microsoft Office, Outlook, Teams) for drafting, approvals, and notification workflows in a single centralized hub.

- Full lifecycle support with real-time tracking – Manages drafting, approvals, publishing, version control, attestations—and helps you track progress via dashboards and reports.

- Strong compliance readiness – Offers policy certification/acknowledgement tools, audit trails, metadata-driven search, and automated alerts to meet compliance standards.

Cons

- Dependent on SharePoint availability and setup – As a SharePoint‑based solution, it works best in environments already using Microsoft 365. Non-SharePoint organizations might need more setup or support.

- Customization tied to SharePoint structure – Tailoring metadata or templates to niche insurance workflows may require SharePoint expertise or additional consulting.

MetricStream Policy and Procedure Management

MetricStream is a leading enterprise GRC platform with a dedicated module for insurance policy management.

It’s designed to streamline the creation, review, approval, and distribution of policies within large, regulated organizations.

The system supports linking policies to risks, controls, and audits, ensuring governance is consistent and traceable.

Pros

- Centralized and integrated – All policies are stored in a single repository with tools to monitor their status, review cycles, and governance links.

- Strong compliance alignment – Connects policies with relevant regulatory requirements and risk controls to maintain governance and readiness for audits.

- Automation and AI features – Streamlines version control, approval workflows, and document updates while offering AI-assisted drafting and search.

Cons

- Implementation complexity – Large-scale deployment can require significant planning, configuration, and technical expertise.

- High cost – The platform’s enterprise pricing may be prohibitive for smaller organizations.

- Learning curve – Its breadth of features can take time for teams to fully master.