Best Guidewire Alternatives: Openkoda vs. Guidewire

Insurance industry – often associated with outdated software and processes – is now under growing pressure to modernize.

Today’s market trends demand faster product launches, real-time customer experiences, and systems that can adapt quickly to change.

Platforms like Guidewire, along with emerging alternatives such as Openkoda, are giving insurers the tools to break free from legacy limitations, modernize their core systems, and innovate at the pace the market now expects.

Customers Expect Instant, Digital Experiences: insurance Industry Must Keep Up

Your policyholders (and the agents who serve them) now judge an insurer by whether they can get a quote on a phone in seconds, upload accident photos from the roadside, or tweak coverages on a Saturday night.

Suite vendors such as Guidewire have responded by baking ready-made web and mobile “Digital” modules into their core platform, so carriers can launch omnichannel experiences without building every screen from scratch.

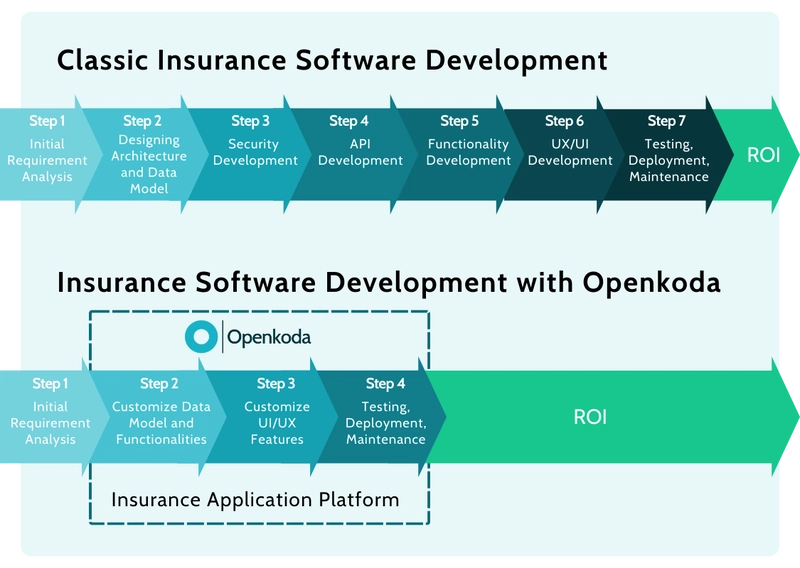

Speed-to-Market Now Trumps the Old Build-vs-Buy Debate

The insurance industry used to face a straightforward choice: build a custom system in-house or buy an off-the-shelf core solution.

Today, that debate feels outdated.

What insurers really need is speed-to-market – the ability to launch new products quickly, adapt to changing customer behavior, and stay ahead of compliance and regulatory shifts without months of development time.

Legacy Cores Can’t Keep Up

Many established insurers still run billions in premium through COBOL or AS/400 systems.

They’re rigid, expensive to modify, and slow to scale. Integrations often require workarounds. Even small changes can take weeks or months.

For insurers who want to experiment with innovative insurance products, test new distribution channels, or deliver personalized experiences — legacy systems are a serious bottleneck.

While established platforms like Guidewire have made strides in modernization, they still carry the weight of their legacy architecture.

Customization is possible, but often complex and costly. And in a world where product iteration needs to happen in days, not quarters, that’s a problem.

Building Custom Insurance Software Faster: Openkoda vs. Guidewire

This is where Openkoda offers a new alternative.

It’s a platform purpose-built to combine the flexibility of custom development with the speed and scalability of low-code frameworks – without the vendor lock-in offering a .

- Guidewire delivers an integrated, feature-rich P&C suite. You get deep insurance functionality out of the box, plus a marketplace of 430+ pre-built integrations—but you stay within a proprietary framework.

- Openkoda offers an open-source canvas. You start lighter, compose exactly the capabilities you need, and keep the keys to every line of code.

Both aim to accelerate product innovation; they simply differ in how much is ready-made versus how much freedom the carrier wants.

Both Systems at a Glance

Now that we’ve established how speed, flexibility, and digital agility have become critical for insurers, it’s time to take a closer look at how the tools themselves stack up.

Guidewire at a glance

Guidewire InsuranceSuite is a battle-tested core system for P&C carriers, unifying policy administration, billing and claims into a single, cloud-ready suite.

Its strength lies in breadth – deep insurance functionality, regular ISO updates, and a marketplace that now tops 500 connectors – backed by predictable release cycles and a large pool of certified partners.

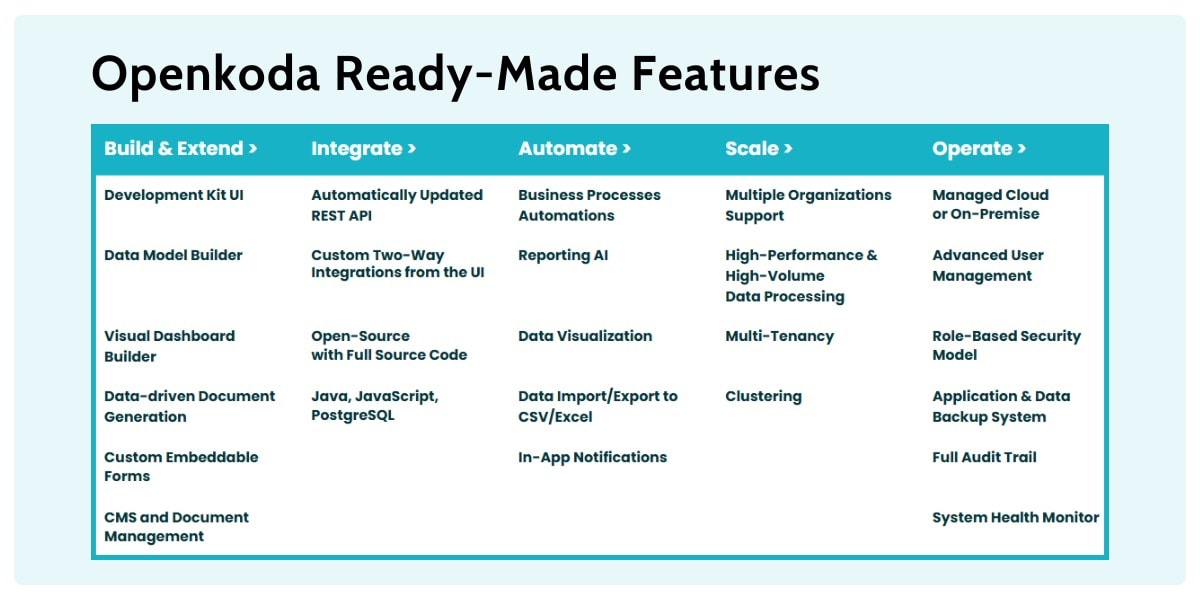

Openkoda at a glance

Openkoda takes the opposite tack: it is an MIT-licensed, open-source application platform that lets insurers stitch together bespoke products fast and still keep every line of code.

Lightweight Java/JavaScript foundations, one-line Docker deploys, and premade functionalities shorten the leap from idea to MVP, while modular templates for policy, claims or embedded insurance jump-start domain work.

| Aspect | Openkoda (Open-Source Insurtech Platform) | Guidewire (InsuranceSuite Platform) |

|---|---|---|

| Use Cases | Custom insurance apps, claims systems, portals, embedded insurance; also applicable in finance, real estate, healthcare, and travel. | Core P&C insurance systems – policy, billing, claims. Not used outside insurance. |

| Platform Philosophy | Open-source platform for full customization and ownership. | Proprietary suite with built-in best practices and standardized workflows. |

| Flexibility | Fully customizable at any level (data, logic, UI); requires developer input. | Highly configurable but within vendor-defined limits; uses Gosu language for extensions. |

| Deployment Options | Self-hosted, public cloud, hybrid; full code and data ownership; vendor-neutral infrastructure. | Vendor-managed cloud (AWS) or on-prem; cloud favored for updates and modern tooling. |

| Target Market | Insurance innovators, insurtechs, tech-savvy SMBs, and enterprises needing custom apps or on-prem control. | Medium to large P&C insurers seeking proven, full-featured systems with vendor support. |

| Integration | REST/GraphQL APIs, webhooks, open-code connectors (Java/JS); no vendor lock-in; full integration freedom. | REST/SOAP APIs, event messaging, Camel-based flows; large marketplace with 400+ insurance-specific integrations. |

| Vendor Ecosystem | Growing open-source community, but limited formal marketplace. | Extensive partner ecosystem and certified System Integrators. |

| AI & Automation | Natural language reports, event scheduling, PDF generation, process automation built-in. | Built-in AI for fraud detection, risk scoring; robust automation in underwriting and claims. |

| User Interface | Custom UI tools (HTML/CSS), visual data model and dashboard builders. | Predefined user interfaces, digital engagement modules (Jutro) for web/mobile portals. |

| Licensing & Costs | MIT license core; cost-effective, no user-based licensing; one-time fees for enterprise edition. | License-based with subscription or enterprise pricing; significant investment for implementation and customization. |

Openkoda vs Guidewire: Deep-Dive Comparison

Use-Case Focus & Industry Fit

Guidewire

Guidewire aims squarely at property-and-casualty carriers that want every core process—policy, billing, claims management, customer relationship management —delivered in one insurance-specific box and backed by a large ecosystem of partners

Openkoda

Openkoda ships with robust software foundation for both insurance carriers and general agents – pre-built data models for policy management, claims management, embedded insurance products, and even underwriting dashboards – wrapped into open-source application templates that insurers can freely modify using popular technologies and connect to all of their existing legacy systems using API integrations.

Architecture & Technology Stack

Guidewire

Guidewire InsuranceSuite is written in Java but exposes most configuration through Gosu, its own statically-typed language that compiles to JVM Deployments now default to Guidewire Cloud – built on AWS – yet the underlying apps remain single-tenant per carrier for isolation.

Openkoda

Openkoda sticks to vanilla Java + JavaScript, runs on PostgreSQL or any compatible database, and ships as a one-line Docker image; multi-tenant or single-tenant is your choice.

Source code is MIT-licensed and lives on GitHub, so teams can fork, inspect, or extend every layer.

After insurers or brokers modify their apps they retain full code ownership and can do with it whatever they want.

Feature Breadth & Depth

Guidewire

Out of the box, Guidewire delivers rich insurance functions for P&C insurance operations – rating engines tied to ISO content, statutory reports, subrogation workflows, catastrophe coding, payment plans, and more—refined across hundreds of live carriers.

Openkoda

Openkoda’s approach is lighter: you assemble features from modular templates (policy, claims, embedded insurance) and augment them with built-in insurance low-code tools such as a data-model builder, workflow engine, and AI Reporting tool.

Depth is whatever you code or import, but the platform makes that act of coding fast.

Deployment Flexibility

Guidewire

Guidewire supports two main footprints: its fully managed SaaS (Guidewire Cloud) or a self-managed install for carriers that still keep workloads on-prem. Either way, release cadence is vendor-controlled, and upgrades are orchestrated project events.

Openkoda

Openkoda is cloud-agnostic: run it on AWS, Azure, GCP, your own Kubernetes cluster, or even a laptop—just change the Docker target. Teams decide when to cut new releases or freeze versions.

Integration & Ecosystem

Guidewire

Guidewire’s Marketplace boasts 430-plus pre-built apps and connectors covering payments, geospatial data, fraud, AI, and more.

This ecosystem, plus a deep PartnerConnect network, lets carriers plug in third-party capabilities with minimal custom code.

Openkoda

Openkoda auto-generates secure REST and GraphQL endpoints for every entity it hosts, giving instant read/write access to policy, claims, billing, and any custom objects you add.

That means you can wire the platform into existing PAS, CRM, DMS, data warehouses—or any other legacy stack—without touching the old codebase.

And if a decades-old system has no API at all, developers can drop in a lightweight Java/Spring Boot adapter or file-exchange script and still achieve two-way, real-time data sync.

Implementation Effort & Skill Sets

Guidewire

A Guidewire configuration and extension work relies heavily on Gosu, a proprietary, statically-typed language unique to the platform.

Developers typically need vendor-led training and certification courses before they can touch production code, and most large implementations are staffed with specialist System Integrators who already live in the Guidewire ecosystem.

Openkoda

The platform is built entirely on mainstream Java/JavaScript, so any competent enterprise-Java team can spin it up; there’s no proprietary language or “special sauce” to master.

Core insurance templates (policy, claims, embedded products) and common software services – authentication, workflow, reporting—ship ready-made, which means developers focus almost exclusively on business-specific features rather than plumbing.

For carriers that want extra help, the vendor itself offers custom insurance software development services on top of the open-source codebase, acting as an extension of the client’s team.

When to Choose Which?

When it comes to enterprise software, especially in the insurance sector, the decision-making process is never simple. Requirements range from strict regulatory compliance to lightning-fast product launches and seamless integrations with legacy systems.

Guidewire often feels like the obvious choice because it delivers a fully integrated, end-to-end P&C suite with decades of domain depth, hundreds of pre-built connectors, and a large pool of certified implementation partners.

If you are a mid- to large-tier carrier that values a proven roadmap, predictable upgrades, and an ecosystem you can hire for tomorrow, Guidewire will tick most of your boxes.

But before you settle on the most popular option out there let’s consider its competitors.

Openkoda, by contrast, is tailored to insurers who need freedom as much as functionality.

The platform is designed for various sectors within the insurance industry such as insurance carriers of different kind (especially niche and specialized vendors), general agents, and brokers.

Because it runs on mainstream Java/JavaScript and generates universal REST/GraphQL APIs, any competent development team can own it without vendor lock-in.

The rule of thumb is simple: the more specialized or fast-moving your business model, the more you’ll gain from building a custom system on Openkoda.

Bottom Line

Pick Guidewire for breadth and maturity; pick Openkoda for agility, code ownership, and tailor-made differentiation.

Whichever path you take, ensure the platform aligns with your release cadence, talent strategy, and appetite for ongoing change—because in modern insurance, change is the only constant.