Best MGA Insurance Software Systems in 2026

Managing General Agents have quietly become some of the most innovative players in today’s insurance landscape — but only when their tech keeps up.

Generic tools rarely work, which is why purpose-built mga systems are getting so much attention in 2026.

In this article we’ll look at why MGAs need something different and which platforms are actually worth shortlisting.

MGAs are not just “small insurers”

Managing General Agents sit in a strange, busy crossroads of the insurance industry.

They look a bit like insurers, because they underwrite and manage parts of the insurance lifecycle. They look a bit like insurance agencies, because they work with brokers and distribution partners. But in reality they’re a third thing: an MGA operates on delegated authority and has to prove to the capacity provider that every decision was made inside that authority.

That single fact changes how their tech should look.

Plain “policy admin” software often isn’t enough and why purpose-built mga systems are getting so much attention. An MGA has to receive submissions from different channels, rate them, sometimes enrich them with third party data providers, bind, produce documents, and then send clean data back to the carrier.

So when we talk about the “best MGA insurance software systems in 2026,” we’re in fact looking for tools that understand this middle position.

Why MGA Operations Require a Custom Approach

Here’s the core problem: an MGA is judged not only by growth, but by how clean its data and processes are. Every quote, every endorsement, every bordereau can be audited. That means your mga systems must make compliance the default, not an afterthought.

On top of that, MGAs launch products fast. New niche in commercial, new partner, new state — the business can’t wait six months for IT.

So the right mga software must be highly configurable or even developer-friendly, so that product people can change rating, forms, or distribution rules without blowing up the whole stack.

Integrations are another big one.

MGAs don’t live in isolation; they constantly push and pull data with carriers, TPAs, accounting tools, and those third-party data providers that enrich risks.

A solid MGA insurance software has to be connectable by exposing APIs and webhooks, letting you plug the MGA into the wider insurance industry ecosystem.

How to Evaluate MGA Software in 2025

Choosing software is where MGAs usually slow down – not because they don’t know what they want, but because the insurance landscape keeps shifting under their feet.

So before we look at actual platforms, it helps to agree on what “good” looks like in 2025. Below is a quick, working checklist you can use to compare different mga systems and spot which ones are really built for delegated authority and which ones are just repackaged agency tools.

- Speed-to-product – Can you spin up or tweak a program without a six-month project? Modern mga software should let you configure products, rating, and workflows fast, so you can capture opportunities before competitors do.

- Operational efficiency – The system should remove manual steps, reduce rekeying, and automate documents/bordereaux. That’s how MGAs control operational costs while still growing headcount slowly.

- Delegated authority controls & compliance – Built-in rules, audit trails, and permissioning so you can show carriers exactly how a quote or endorsement was made.

- Openness & seamless connectivity – APIs, webhooks, and prebuilt connectors to talk to carriers, TPAs, data sources, and other external systems. Without this, even the best mga systems end up as islands.

- Data & innovative solutions layer – Support for enrichment, underwriting assistance, or analytics so you can actually use data from third parties, not just store it.

- Total cost of ownership – Clear pricing and the ability to customize without constant vendor change requests; in other words, mga software that stays affordable as you scale.

Best MGA Insurance Software Systems in 2026

By this point it should be clear that MGAs can’t just grab any off-the-shelf tool and hope for the best.

The mga systems that will actually matter in 2025 are the ones that boost operational efficiency while still letting you move fast, plug into partners, and prove every underwriting decision.

Below we’ll walk through the key platforms, starting with the one that’s deliberately built to be open and developer-friendly.

Guidewire

Guidewire sits at the other end of the spectrum: enterprise-grade mga system for MGAs that are either part of larger insurance groups or expect very fast mga growth.

You get the reliability, security and process depth you’d expect from a carrier platform, but with tooling that can be tailored to delegated authority. It’s not the lightest option, but it’s a strong answer when carriers demand mature controls and clean integrations.

The upside is that Guidewire supports complex lines, multiple stakeholders and large volumes — so when more business starts flowing in, the platform doesn’t fall over. Used well, it can still deliver speed to market through configuration and accelerators, especially if your MGA wants to align with carrier standards from day one.

Openkoda

Openkoda positions itself as a core platform designed for MGAs, supporting underwriting, policy administration, billing, and claims within carrier-defined rules. It offers a high level of customizability and extensibility, enabling rapid development and scaling of specialty insurance products without getting trapped in a vendor black box.

It comes with production-ready application modules for policy administration, claims management , and even an agent portal, but the main idea is different from classic MGA insurance software suit: you retain complete code ownership and gives you complete freedom to customize the application the way you want.

That makes it ideal when you’re trying to replace parts of legacy systems, stand up entirely new systems, or just push speed to market on a new product line.

Because it’s to flexible and build with API-first integration in mind, MGAs can integrate carriers, data sources, or portals on their own timeline instead of waiting for a release cycle.

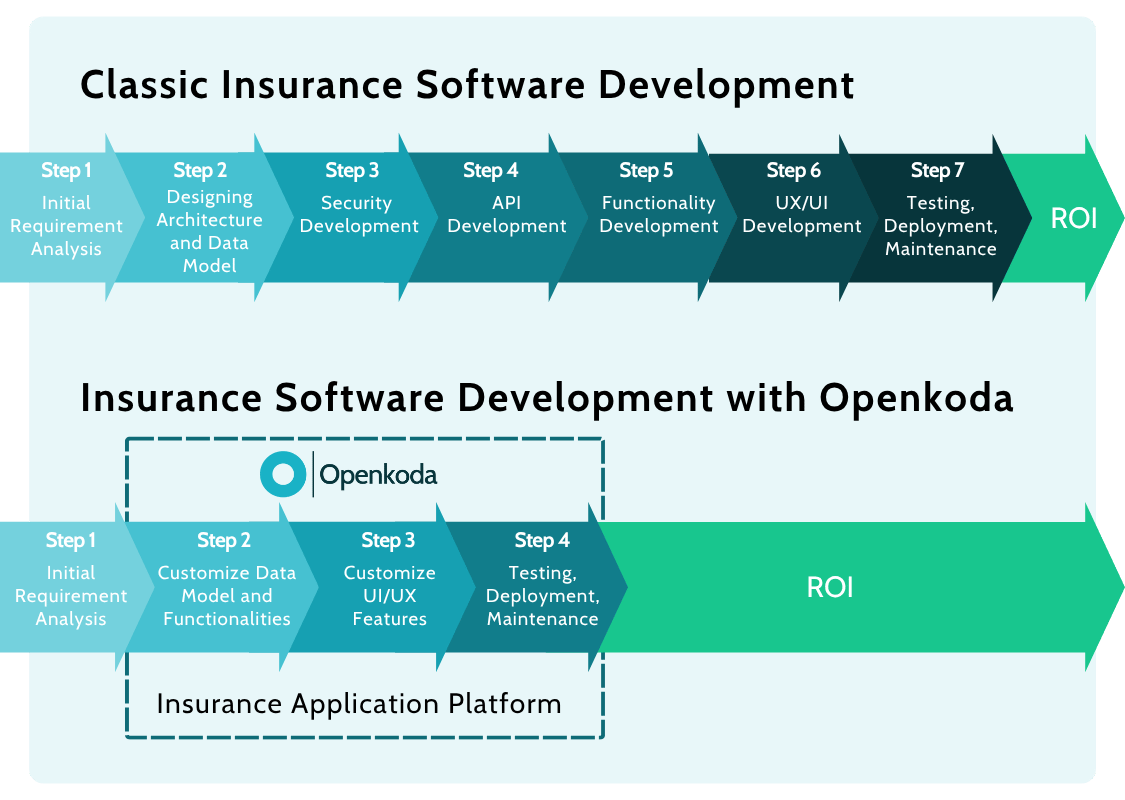

How would building software openkoda look like in practice?

Consider building new policy administration system to automate processes and modernize your legacy stack – you start from the openkoda base modules (users, roles, product setup, workflows), then add your specific logic for quoting, binding and reporting, and finally connect it to existing carrier or bordereaux flows.

If you don’t have your own team of developers, don’t worry – openkoda also offers custom insurance software development services, so you can keep the project moving and launch new insurance products without losing the “we own the code” advantage.

Genasys

Genasys is a good fit for MGAs that want a ready, productized mga system rather than building everything from scratch. It’s built around delegated authority, rating and policy workflows, so you can get to speed to market without hiring a big internal tech team.

Because it’s designed for insurers and MGAs, you get portals, documents and reporting out of the box — which means you can handle more business with the same people.

Where Genasys helps most is predictable, scalable growth.

As your MGA insurance software starts serving more brokers and more programs, you don’t want to rework the core every three months. Genasys gives you structure, consistent processes and decent customer experience for partners, so ops don’t become a bottleneck. For MGAs that are still standardizing their insurance products, it’s often the safest “start here” option.

SANDIS

SANDIS is interesting when MGAs want to move fast into new markets without rebuilding the same plumbing over and over.

It’s very much an “enable distribution quickly” mga system — turn your existing rating or even Excel models into real products, expose them to brokers, manage multi-level commissions, and keep the data tidy. That’s useful when MGAs need to scale without exploding back-office work. Because SANDIS focuses on distribution management and policy flows, it supports the full quote to bind path and basic policy issuance, so you can react to market changes faster than with heavier systems.

For MGAs that care about onboarding partners in weeks, not quarters, it’s a pragmatic, enable-the-business-first option.

Expert Insured

Expert Insured takes a more automation-heavy approach: it’s built to enable MGAs that already have volume and now want machines to do more of the work.

You get policy admin, billing, renewals, and reporting in one mga system, plus workflow intelligence that speeds up underwriting and triage — helpful when you’re evaluating lots of submissions and need better risk selection to protect loss ratios. Because it streamlines quote to bind and policy issuance, MGAs can serve brokers faster and open space for mgas scale into new lines or territories.

It’s not trying to be flashy; it’s trying to keep the moving parts in one place so you can enter new markets without stitching five tools together.

[Read also: 2026 Cyber Insurance Statistics and Trends]

| System | Speed to product / speed to market | Delegated authority & compliance | Openness / integrations |

|---|---|---|---|

| Openkoda | ⭐⭐⭐⭐ – fast, especially if you reuse base modules | ⭐⭐⭐⭐ – can be easily tailored to MGA program rules | ⭐⭐⭐⭐ – API-first, easy to extend, good for replacing legacy |

| Genasys | ⭐⭐⭐ – quicker than classic carrier stacks | ⭐⭐⭐⭐ – built with MGAs in mind | ⭐⭐⭐ – solid, more packaged |

| Guidewire | ⭐⭐ – good with accelerators, but heavier | ⭐⭐⭐⭐ – strong governance, carrier-grade | ⭐⭐⭐ – integrates well in enterprise setups |

| SANDIS | ⭐⭐⭐⭐ – very good when launching new products/partners | ⭐⭐ – enough for mildly delegated setups | ⭐⭐⭐ – built to connect distribution and policy flows |

| Expert Insured | ⭐⭐⭐ – good once workflows are defined | ⭐⭐⭐⭐ – strong on guided workflows and audit trails | ⭐⭐⭐ – integrates to keep quote–bind–issue in one place |

Conclusion

MGAs win when they can adapt quickly to evolving needs — new products, new partners, new reporting asks from carriers.

That’s only realistic if you pick the right technology that seamlessly integrates with the rest of your stack instead of creating yet another silo. Start from the operating model you want, then choose the system that removes the most friction on the way there.