Best Strategy for Reducing Insurance Product Development Time and Cost

When it comes to developing innovative insurance products, traditional development cycles are no longer sustainable – insurers need faster, more agile solutions to bring innovative products to market without compromising security, compliance or scalability.

That’s where modern insurance development platforms like Openkoda come in.

Thanks to a myriad of pre-built features and a highly customizable core, such an approach can significantly improve the efficiency and reduce the cost of insurance product development.

The State of Insurance 2025: Key Trends and Statistics

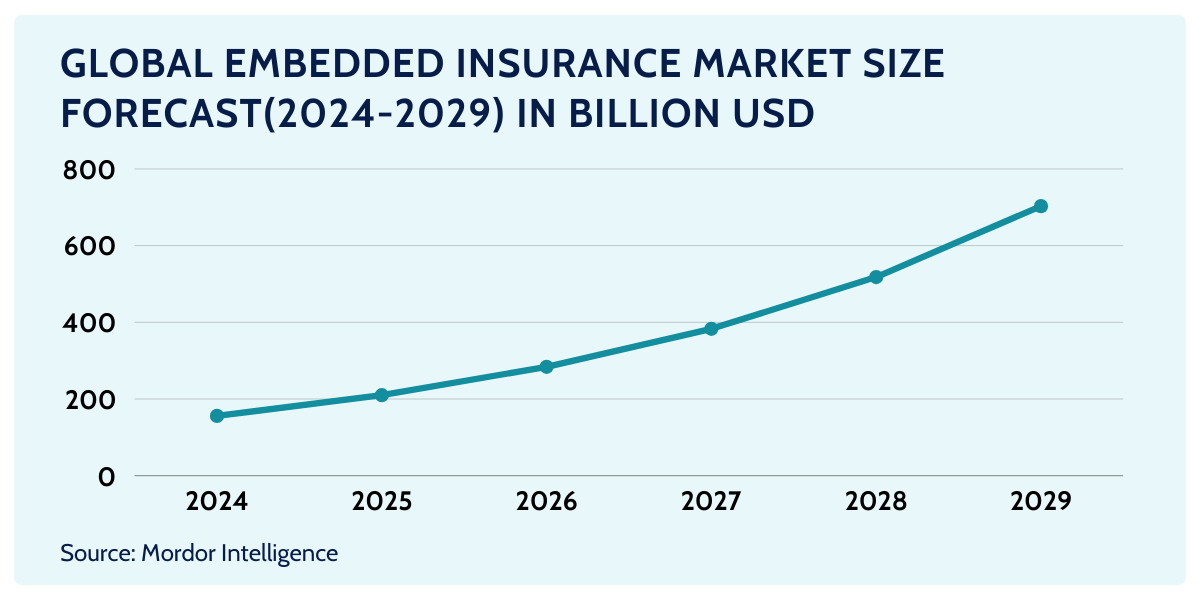

Global insurtech funding reached $4.25 billion in 2024, reflecting the industry’s push toward automation, AI-driven decision-making, and seamless digital experiences.

The insurance software market, valued at $16 billion in 2023, is projected to hit $23.7 billion by 2030, signaling growing demand for scalable, technology-first solutions.

AI is at the center of this transformation.

According to latest research 77% of senior insurance executives are now in some stage of AI adoption, a 16% increase from last year, with investments in generative AI expected to surge by over 300% by 2025.

Insurers who leverage AI-driven underwriting, claims automation, and customer engagement are already seeing tangible benefits—14% higher customer retention rates and a 48% increase in Net Promoter Scores (NPS).

To stay competitive, your business needs to be smart about how it uses its resources.

How do you do that?

Let’s take a step back and discuss the key ingredients of any successful innovative insurance product.

Building Innovative Insurance Products: What You Need?

So you want to launch a brand new insurance product.

What do you need?

There are two main ingredients: the idea and the technology.

The former is the key concept responsible for creating value for your customers, while the latter is the tool that makes it happen.

Both are critical and must work together to achieve satisfactory results and the desired ROI.

The Idea

A great insurance product idea typically stems from industry shifts, changing consumer expectations, and emerging risks.

It often capitalizes on major trends, such as personalization, AI data analytics, real-time underwriting, or risk prevention rather than compensation.

Beyond just identifying new risks to insure, innovation can come from how insurance is sold, who it is sold to, and what technology is used to deliver it.

Expanding Sales Channels: Selling Insurance in New Ways

Innovative insurance products don’t always have to reinvent coverage itself; sometimes, the real breakthrough is in how insurance is distributed.

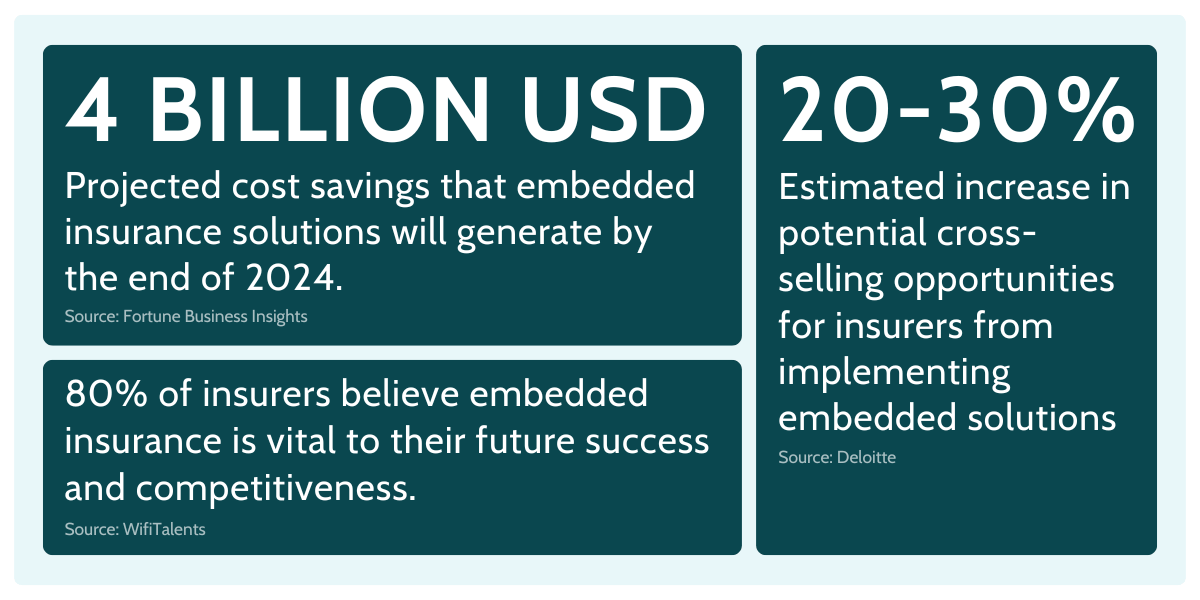

One of the most impactful distribution trends today is embedded insurance—integrating coverage seamlessly into third-party transactions.

This allows customers to purchase insurance as part of an existing buying journey, such as:

- Travel platforms offering trip protection at checkout

- E-commerce stores bundling extended warranties

- Ride-sharing or car rental apps providing usage-based coverage

Leveraging New Technologies to Enhance Insurance Products

Your idea might also entail usage of some breakthrough tech – such as AI that is ever so popular in 2025.

But remember that the key to an innovative insurance product is not just using AI but integrating it in ways that enhance efficiency, personalization, and customer experience.

From enhanced AI analytics to convenient chatbots and personalization engines – in insurance industry there are plenty of areas where artificial intelligence can be introduced in smart way.

The result?

Faster, smarter, and more adaptive insurance products that align with modern customer expectations.

Tapping Into New Demographics and Changing Consumer Needs

Focusing on new demographics can transform an existing product into a compelling new offering.

Millennials and Generation Y are already a significant target segment for insurers, but Zoomers (Gen Z) are quickly emerging as the next major consumer group.

By the end of 2018, 14% of young adults in the U.S. remained uninsured, highlighting a gap in coverage that insurers can address.

Developing innovative products that cater to these needs—such as flexible, AI-powered coverage options with real-time adjustments—can help insurance companies tap into this growing market.

The Technology

While a strong idea provides direction, the right technology determines whether it can scale and succeed.

It must be built on a technological foundation that ensures scalability, efficiency, and adaptability.

The right tech stack defines whether a product can meet the demands of modern consumers, integrate seamlessly with existing ecosystems, and evolve with market trends.

But here’s where the first major challenges emerge: time and cost.

The Hidden Complexity of Insurance Product Development

Insurance products are inherently complex. Unlike standard SaaS applications, they must accommodate risk modeling, underwriting automation, claims processing, compliance adherence, fraud detection, and real-time data flows—all while ensuring an intuitive user experience.

The layers of functionality required make development a resource-intensive process, where missteps in technology choices can lead to costly rewrites, operational inefficiencies, and delayed go-to-market timelines.

[Read also:

Leveraging Insurance Software Development Platforms For Faster Deployment

So you ware looking for a way to overcome this issues and develop and launch new insurance products faster and more efficiently.

What are your options?

To overcome these challenges, insurance business and insurtechs are increasingly leveraging rapid software development platforms, open-source frameworks, and modular API-driven architectures.

Platforms like Openkoda provide a way to accelerate development of digital solutions while maintaining full flexibility—reducing build time by up to 60% without sacrificing scalability or compliance.

But wait, that seems to good to be true.

Can you really cut the time of insurance product development by that much and end up with a quality insurance software?

Let’s take a closer look and compare these two approaches.

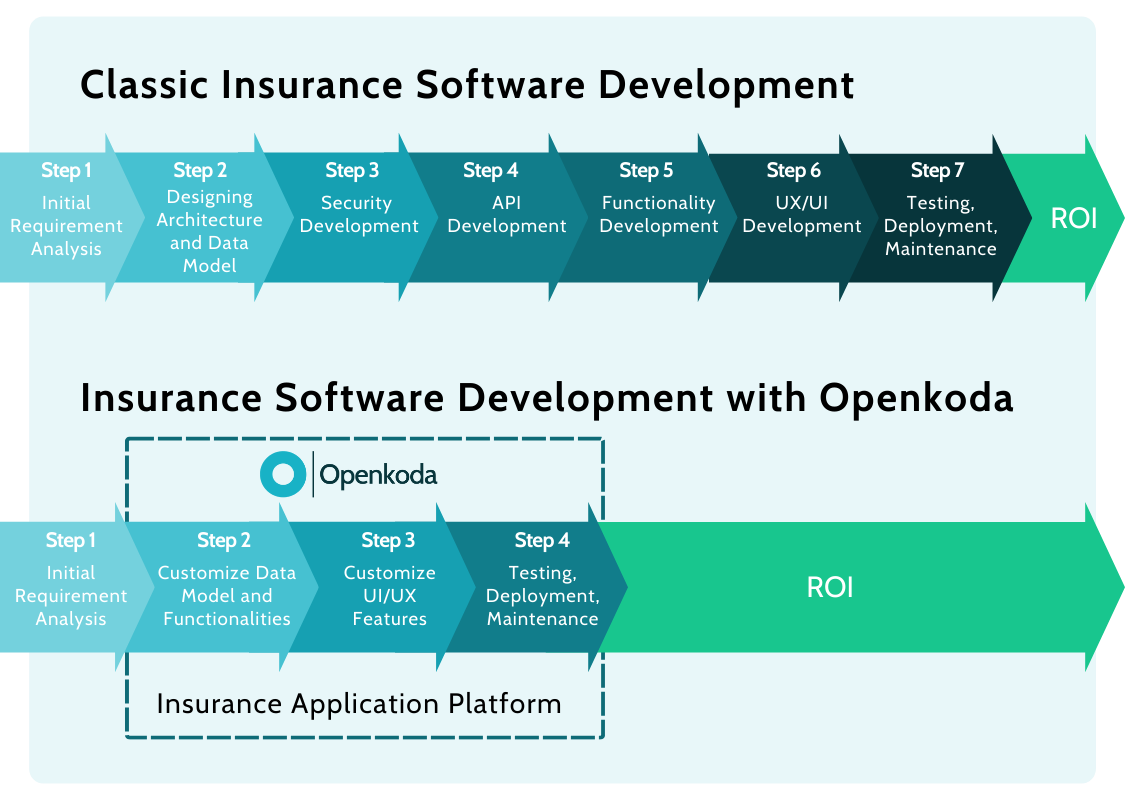

Classic Insurance Product Development

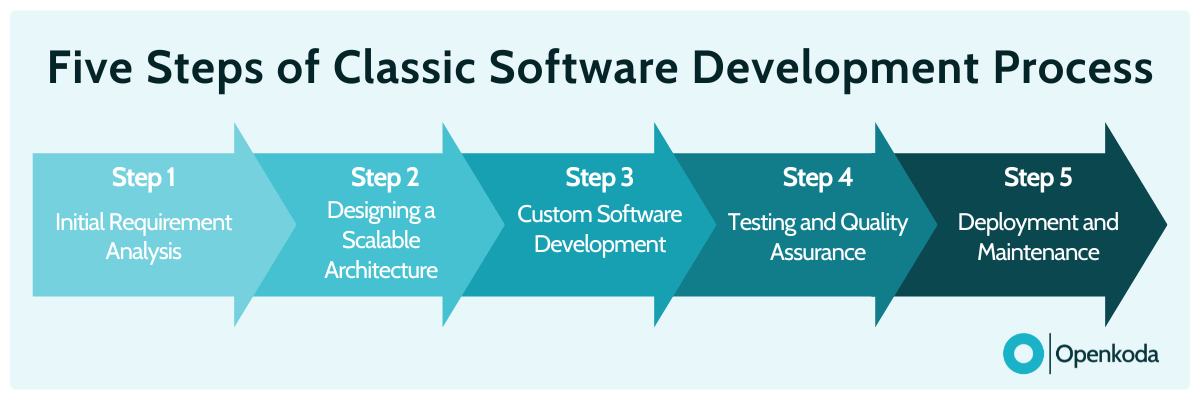

Developing an insurance product from scratch is a complex and resource-intensive journey.

It requires multiple teams working in sync over 12 to 24 months, balancing regulatory compliance, security, and technological scalability.

This is how usually this process plays out:

- Phase 1: Discovery & Requirements Gathering (1-3 Months) – Insurers conduct market research, regulatory analysis, and define core functionalities. Missteps here lead to costly delays later.

- Phase 2: Core Development (3-6 Months) – Developers design and build policy, claims, and underwriting systems, ensuring integrations with legacy infrastructure and third-party services.

- Phase 3: Compliance & Security Implementation (2-4 Months) – Ensuring compliance with GDPR, CCPA, IFRS 17, and data security requirements adds legal reviews, security layers, and fraud detection mechanisms.

- Phase 4: Frontend Development & Customer Experience Design (2-4 Months) – Creating customer portals, agent dashboards, and API integrations to ensure a smooth experience across multiple digital channels.

- Phase 5: Testing, Iteration & Optimization (3-6 Months) – Comprehensive testing, performance tuning, and compliance validation. Unexpected integration failures often lead to costly rework.

This slow, expensive approach delays go-to-market strategies and makes rapid innovation nearly impossible.

Let’s now see how you can conduct insurance software development process in smarter way.

Insurance Product Development with Openkoda

Instead of starting from scratch, Openkoda provides a foundation that eliminates the heaviest lifting in insurance software development. Instead of spending months building core functionalities, insurers can configure, customize, and deploy products in a fraction of the time.

– ready to use and easy to configurable insurance specific features

– use foundation to avoid building from scratch

– skip the heavy development phase

Imagine you’re launching an on-demand parametric insurance product for travel delays.

With a traditional approach, you’d spend months designing the policy system, building claims automation, and integrating payment gateways.

With Openkoda, you:

- Start with a configurable policy and claims application template instead of coding it from scratch.

- Leverage built-in automation to trigger instant payouts based on real-time flight data.

- Use Openkoda’s API connectors to integrate with airline databases and payment providers in days, not months.

- Deploy a customer-facing portal with pre-built templates adjusted for insurance workflows, skipping frontend development delays.

Instead of 12+ months, your custom application is ready for market in 3-6 months—fully compliant, secure, and scalable.

But that’s not all.

The application you build with Openkoda is highly customizable and adaptable.

If you need to modify pricing algorithms, risk assessment calculations, or claims logic, it can be done without complex redevelopment.

Want to test new sales channels, such as embedded insurance distribution through travel booking platforms?

Openkoda’s modular architecture makes these adjustments fast and efficient, allowing insurers to iterate and expand their product offerings seamlessly.

With Openkoda, you don’t just build faster – you gain long-term agility, ensuring that your custom insurance solution remains adaptable as market needs evolve.

If your 2025 strategy includes words like “innovation,” “technology,” and “agility,” then Openkoda is the platform for your business.

To see Openkoda’s full capabilities in speeding up insurance product development check out this comprehensive demo:

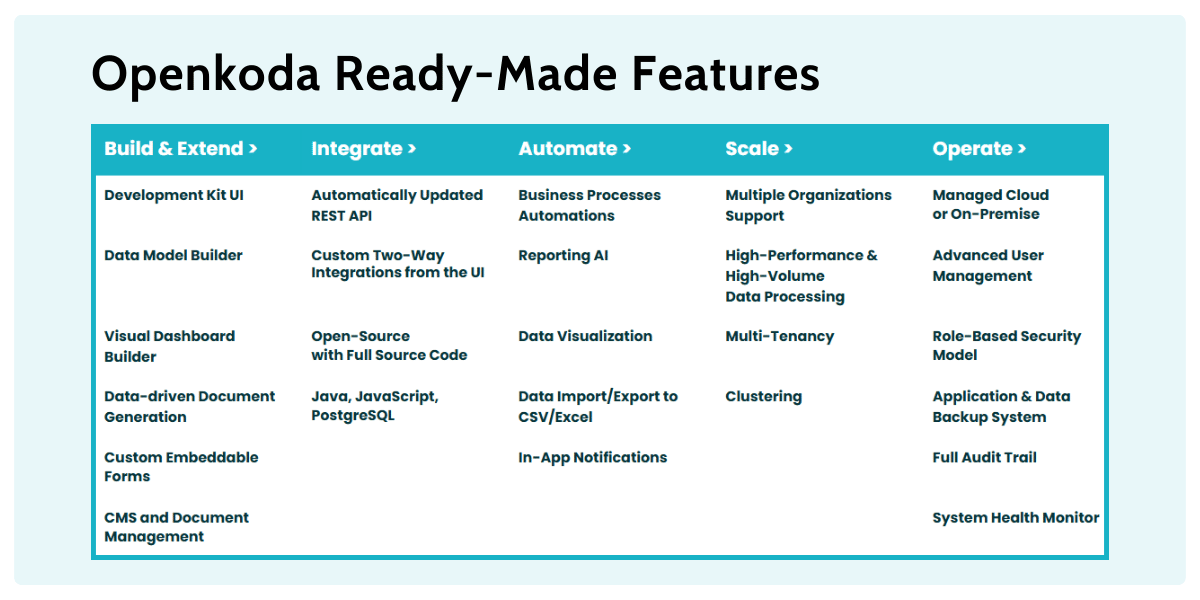

Openkoda Ready-Made Features

So how does the process of insurance product development using Openkoda looks like?

Openkoda offers a comprehensive suite of out-of-the-box features designed to significantly reduce development time, lower costs, and improve operational efficiency.

Here’s a brief rundown:

- Development Kit UI – Accelerates UI development for insurance platforms.

- Data Model Builder – Enables quick structuring of insurance data.

- Visual Dashboard Builder – Helps insurers create real-time insights, analytics, policy, and underwriting dashboards.

- Automatically Updated REST API – Simplifies integration with external insurance systems.

- Custom Two-Way Integrations from the UI – Enables flexible data exchange with third-party services.

- Data Visualization – Enhances decision-making with clear, interactive reports.

- Data Import/Export to CSV/Excel – Facilitates smooth data migration and AI reporting.

- Multi-Tenancy – Enables insurers to serve multiple customer segments efficiently.

- Automation – let you set up automated insurance policy renewal reminders.

- Embeddable Insurance Forms – Enables you to explore new sales channels with embedded insurance for device protection, travel insurance or car coverage.

- Clustering – Ensures reliability and scalability for insurance applications.

- Role-Based Security Model – Strengthens compliance and data protection in insurance workflows even when managing multiple insurance organizations.

- Application & Data Backup System – Ensures business continuity in case of failures.

- Full Audit Trail – Helps insurers maintain transparency and regulatory compliance.

These features are a common denominator of all enterprise-class insurance applications, which means you need to develop them regardless of the value they add to your innovative insurance products.

With them ready to go, you can jump right into prototyping.

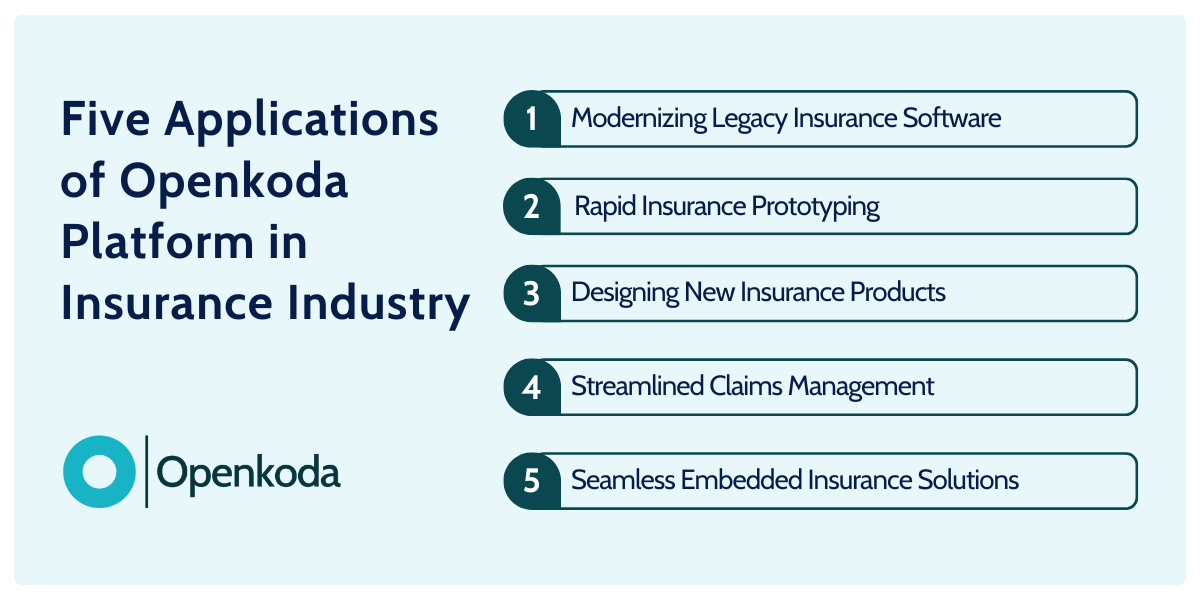

Best Openkoda Use Cases

Openkoda is built to address some of the biggest challenges in insurance software development, making it an ideal solution for companies looking to innovate, scale, and modernize their insurance operations.

For those focused on innovation, Openkoda simplifies the creation and launch of insurance products with built-in features for flexible pricing models, automated underwriting, and seamless policy customization.

The platform also supports the rapid development of new distribution channels, enabling insurance agents to embed their offerings into third-party platforms, e-commerce sites, and partner ecosystems with minimal integration effort.

Finally, Openkoda is excellent for companies looking to replace legacy systems. Its modular architecture and rich API integrations make it easy to connect with external and back-office systems, ensuring a smooth transition to new insurance processes without the risks and delays of full-scale system overhauls.

Your Bottom Line: Faster Deployment Without Compromising Quality

Traditional insurance software development is slow, expensive, and resource-intensive, making it difficult to adapt to market changes and customer expectations.

With Openkoda, insurers cut development time by up to 60% without sacrificing scalability, compliance, or performance.

Instead of building complex systems from scratch, they leverage a pre-configured, highly adaptable platform that accelerates product launches, simplifies integrations with existing insurance operations, and ensures future-proof flexibility.

Whether you’re developing innovative insurance products, optimizing claims management or policy management, expanding distribution channels, or modernizing legacy systems, Openkoda enables you to move faster, smarter, and more efficiently—without compromising on quality or compliance.