How Embedded Insurance Enables Personalized Protection

The world of insurance is changing as it has to adapt to the changing trends of everyday life and different demands of each generation.

And one of the critical elements that answers the needs of insurance customers is embedded insurance. This seamless and personalized form of insurance is integrated directly into everyday transactions – from booking flights to buying electronics, customers can now add tailored insurance with the click of a button, making the process faster, easier and more relevant than ever.

As consumer demand shifts toward personalized, hassle-free solutions, embedded insurance is emerging as an industry game-changer.

Contents

- Personalization Era in Insurance Industry: Embedded Insurance

- Insights of Embedded Insurance Market in 2024

- How Embedded Insurance Uses Data to Deliver Personalized Insurance Experience

- From Traditional to Modern & Personalized Insurance

- How Embedded Insurance is Used in Everyday Life

- Benefits of Personalized Embedded Insurance for Customers, Insurers, and Businesses

- How to introduce embedded insurance?

- New Opprtunity

Personalization Era in Insurance Industry: Embedded Insurance

Embedded insurance is a cutting-edge model designed to meet the evolving expectations of today’s consumers. People have become accustomed to personalized experiences around them, from platforms like Spotify and Netflix, and demand the same level of customization and convenience in every aspect of their lives – including insurance.

They expect a quick, hassle-free process without the burden of wading through lengthy paperwork. They want instant, customized solutions that fit seamlessly into their daily routines.

Technology is the key to delivering this.

With data generated from connected devices, insurers can offer hyper-personalized insurance products that align perfectly with each individual’s unique needs and behaviors.

From wearable devices to smart home systems, these insights enable insurers to create customized coverage, ensuring relevance and efficiency.

The future of insurance lies in personalization, and companies must embrace this shift to stay ahead. It’s no longer just about offering coverage—it’s about delivering the right coverage, instantly and effortlessly.

Insights of Embedded Insurance Market in 2024

The rapid growth of embedded insurance is fueled primarily by changing consumer behavior seeking for personalized offers and the digitization of industries.

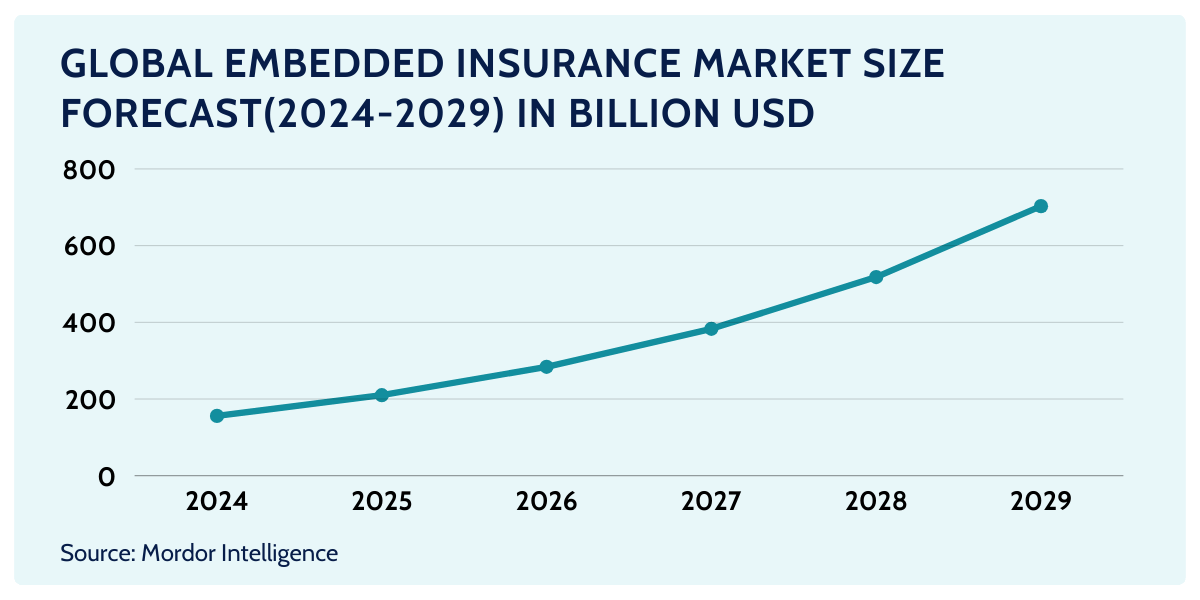

The global embedded insurance market is projected to reach approximately $700 billion in gross written premiums (GWP) by 2030, more than six times its current size. By 2033, it is projected to account for 15% of global GWP, reaching approximately $1.1 trillion, up from its current 3-5%.

According to Swiss Re, in certain P&C markets this would likely be nearer 30% of the total, taking share in particular from tied insurance agents and branch channels.

We are witnessing a significant trend in the insurance industry.

This opens up huge opportunities for companies, as embedded insurance not only enhances the customer experience, but also allows insurers to access a wider market through digital platforms.

With 94% of insurance executives viewing embedded insurance as critical to future strategies, the industry is clearly betting on this model to redefine how insurance is bought and sold, moving away from traditional distribution methods and aligning with modern consumer expectations.

One key factor driving the rise of embedded insurance is its ability to offer hyper-personalization. This new model is tailored to the evolving needs of customers who demand personalized, quick, and easy insurance solutions and offerings.

Today, we’ll dive into the role personalization plays in this shift.

How Embedded Insurance Uses Data to Deliver Personalized Insurance Experience

Data drives embedded insurance, helping customers get personalized offers and relevant coverage in real time.

By using data from different sources, insurers make the process as easy as one more click when buying a product. It’s quick, convenient, and tailored to each person’s needs, fitting naturally into everyday activities.

For insurers, it also means better pricing and risk assessment, while offering customers the right coverage at the right time, improving their overall experience.

How Data is Collected

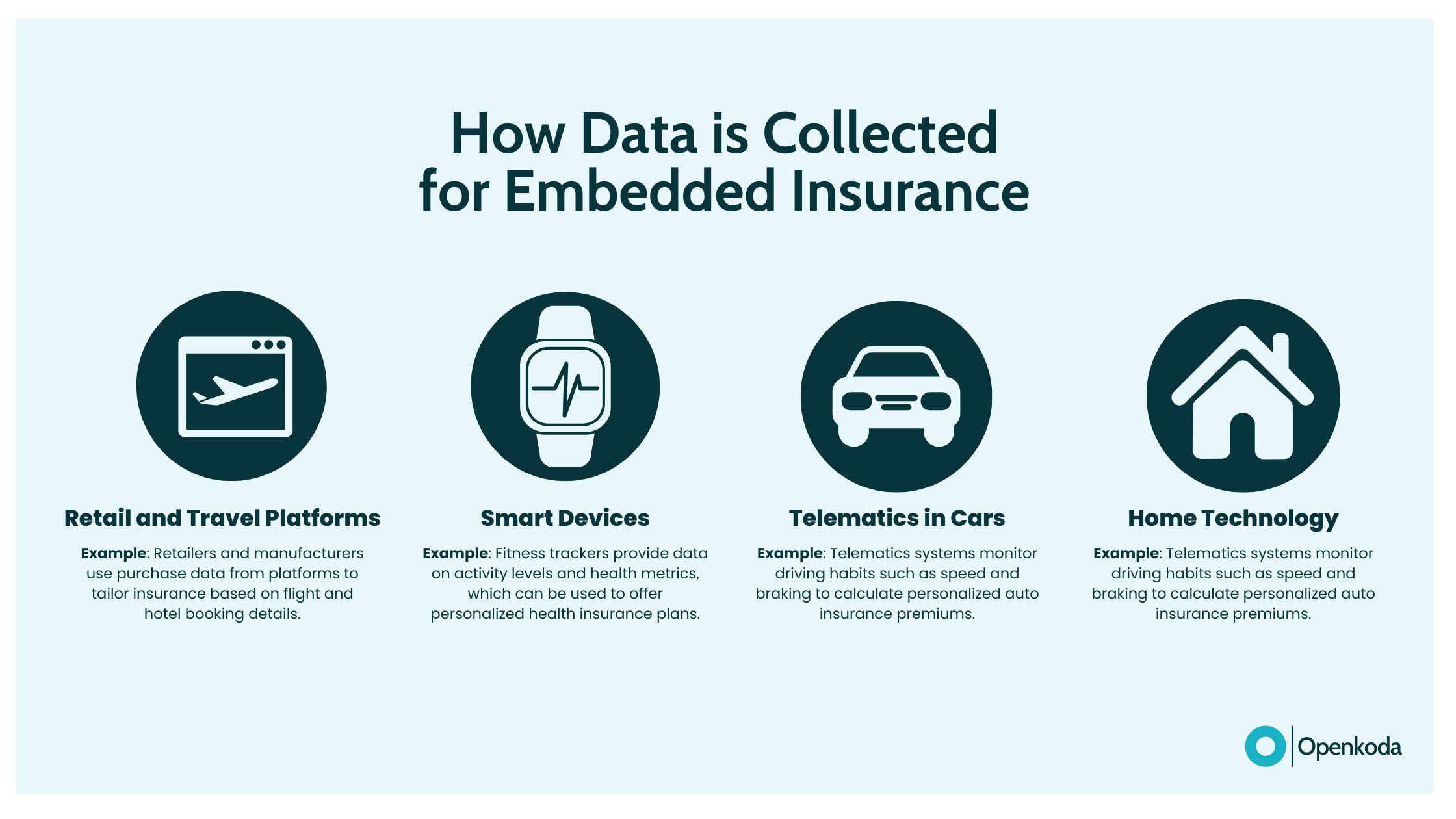

Data for embedded insurance is collected from various modern devices and platforms to offer personalized coverage. This could be, for example:

- Retailers and manufacturers leverage first-party data from purchases and third-party sources to tailor insurance products to customer needs. For example, Allianz partners with e-commerce platforms like Traveloka and Booking.com to offer travel insurance at the point of purchase. They use purchase data (flight tickets, hotel bookings) to personalize coverage, offering insurance tailored to the customer’s travel itinerary, such as flight delay or baggage loss protection.

- Wearable Devices such as smartwatches and fitness trackers provide health-related data like activity levels and heart rates. The Vitality company in the UK offers health insurance linked to data from such trackers. By monitoring daily activity levels, such as steps or workouts, they provide rewards or reduced premiums to customers who maintain healthy lifestyles.

- Telematics in cars monitor driving behaviors. This real-time driving data is used for example by Tesla that offers embedded auto insurance to its car owners. The data is collected through its in-built telematics system and includes metrics like driving speed, acceleration, braking habits, and autopilot usage. This allows Tesla to offer personalized insurance premiums based on the driver’s actual behavior, rewarding safe drivers with lower costs.

- Smart Home Devices can be used by insurers to collect data like security systems, smoke detectors, or leak sensors. A smart thermostat, for instance, might provide insights into energy usage, or a smart door lock could show how secure a home is. This data helps homeowners’ insurance providers offer tailored policies based on actual home conditions and security levels.

How Data is Used

Once collected, data serves a crucial role in personalizing insurance products and enabling real-time risk assessment and dynamic pricing. Here’s how:

- Personalization: By analyzing data from wearables, driving patterns, or home devices, insurers can offer customized insurance policies that align with individual needs and behaviors. It ensures more relevant coverage.

- Real-Time Risk Assessment: Data allows insurers to continuously assess risks in real time. For instance, driving data can adjust auto insurance premiums based on actual driving behavior, rewarding safe drivers with lower rates. Similarly, smart home data can adjust homeowners’ insurance based on real-time safety conditions in the home.

- Dynamic Pricing: Data allows insurers to implement pricing that changes dynamically, based on real-time behavior rather than static factors like age or location. This ensures more accurate pricing, better alignment with customer lifestyles, and a higher level of satisfaction.

Data Privacy is a Key to Building Trust in Embedded Insurance

In embedded insurance, protecting customer data and following the rules are key. While following privacy laws and having clear policies is important, building trust with customers requires more.

If customers know how their data is used, they feel secure. If you explain data protection and why you need personal information, customers will feel confident. Treat customers well and they’ll trust you. This will make customers more loyal to your brand and help your business succeed.

From Traditional to Modern & Personalized Insurance

Picture this: You drive occasionally—maybe just on weekends—yet you’re paying the same insurance premium as someone who drives daily.

That’s the reality with traditional insurance.

It’s one-size-fits-all, based on general factors like age or location, and while it’s reliable, it comes with high costs and limited flexibility. You’re often paying for coverage you barely use.

Now, imagine that your insurance adapts to your actual driving habits.

This is how usage-based insurance (UBI) works. With UBI, your car insurance adjusts based on things like mileage, driving behavior, and even the time of day you travel. If you’re a safe driver who doesn’t drive often, you could end up paying significantly less. Tesla does this already, using data from your car to assess how you drive. Safe drivers can enjoy lower premiums because the insurance is tied to their real-world behavior.

There is also another model that allows for hyper-personalization and even bigger flexibility: pay-per-use insurance. Instead of paying for a set amount of coverage, you only pay when you actually use the product or service. Let’s say you don’t drive your car during the week because you use public transport. With pay-per-mile or pay-per-day insurance, you only pay for the actual distance you drive or the days you use your vehicle.

What role does embedded insurance play here?

Embedded insurance streamlines the process of getting the right coverage at the right time.

For example, when renting a car through a car-sharing app, embedded insurance offers a seamless option to add pay-per-mile coverage with just a click. There’s no need to hold a full-year policy for something you use occasionally—you only pay when you actually drive.

Additionally, with the power of AI, insurers can quickly gather all this the necessary data from users to tailor coverage to their specific needs. In minutes, AI could prompt relevant questions, allowing insurers to calculate the appropriate insurance model, price, premium, and warranties based on individual factors.

How Embedded Insurance is Used in Everyday Life

Let’s explore how embedded insurance seamlessly integrates into our daily lives, making things easier and more convenient than ever. These examples highlight just how close this innovative solution is to us and the ways it simplifies various aspects of life.

Ecommerce

Imagine you’re shopping online for a new smartphone.

You’re about to hit “checkout” when a simple option pops up – add insurance for just a few extra dollars. With one click, you’ve protected your new device without having to search for third-party providers or read complicated policies.

This is a perfect example of how embedded insurance simplifies the buying process. It’s fast, convenient, and fits seamlessly into your existing transaction.

Travel

You book a vacation rental, and when you confirm your booking, you’re presented with a travel insurance quote tailored to your specific trip. No more scrolling through endless policy options or worrying about whether you’ve chosen the right coverage.

Embedded insurance takes the guesswork out of the equation and offers you the personalized policy right when you need it.

To see how you can easily and efficiently set up and deploy embeddable insurance forms tailored to the travel industry check out this demo.

Healthcare

The digitalization of the healthcare industry has opened up new opportunities for patients to benefit from personalized embedded insurance.

For instance, telehealth platforms can collect data about your health during virtual consultations. Based on this information, you can be offered a customized health insurance rider that covers follow-up visits to specialists or necessary lab tests.

This makes ongoing care not only more convenient, but also more affordable, as the insurance is tailored to your specific healthcare needs and integrated directly into the platform’s services.

Real estate

Embedded insurance could be offered to home buyers when securing a mortgage. As part of the closing process, you might be asked to add a home insurance policy that is automatically tied to your mortgage payments.

This ensures that your property is protected from the moment you move in, without the hassle of researching different insurers or managing multiple payments.

Benefits of Personalized Embedded Insurance for Customers, Insurers, and Businesses

Improved customer experience

One of the most significant benefits of personalized embedded insurance is an improved customer experience.

Traditional insurance models, especially for products like life insurance, have historically involved complex jargon, lengthy paperwork, and a time-consuming process.

For many, this complexity has discouraged people from purchasing insurance altogether. Embedded insurance changes that by seamlessly integrating insurance options into everyday transactions, whether you’re renting a car, booking a flight, or buying electronics.

Affordability and accessibility

One of the most transformative aspects of embedded insurance is its ability to make coverage both affordable and accessible to a wider range of consumers.

Traditional insurance policies can often feel out of reach due to high premiums, complicated application processes, or lack of transparency.

Embedded insurance breaks down these barriers by integrating personalized coverage directly into everyday transactions and purchases, offering more manageable pricing structures and simplifying the process of obtaining protection.

Easy-to-use interfaces and one-click insurance options

Embedded insurance platforms prioritize user experience (UX) and user interface (UI) design to provide a smooth and personalized process.

With easy-to-use interfaces and one-click insurance options, customers can instantly access tailored coverage without having to navigate through multiple steps or complex terms and conditions.

Simplicity is key – users can review basic coverage information, check claim status and complete transactions in a matter of moments, as in the examples mentioned earlier.

Simplicity and transparency

Embedded personalized insurance solutions provide customers with simplified access to coverage details, such as policy inclusions and exclusions, claim status, and renewal information.

In the past, traditional policies often left customers confused, but the transparent design of embedded insurance ensures that users can understand their coverage at a glance. This increases customer confidence and loyalty because they feel in control of their protection.

Business and Insurer Advantages of Personalized Approach

For Insurers

Better risk assessment through real-time data

Insurers can instantly access real-time data during transactions, such as the type of product or service being purchased, usage duration, and customer behavior.

This allows for more accurate risk assessments, leading to tailored premiums and reduced exposure to losses.

For example, when a customer rents a car, insurers can adjust coverage based on vehicle type and driving history, ensuring more precise risk management.

Increased customer loyalty due to personalized offers

By embedding insurance into everyday purchases and offering coverage that matches customers’ specific needs, insurers build stronger relationships.

Personalized insurance offers, whether it’s travel insurance for frequent flyers or device protection for electronics buyers, create a sense of trust and value. Customers appreciate the convenience and relevance, which boosts loyalty and encourages repeat business.

[Read also: How Technology Powers Specialty Insurance Products]

For Businesses Offering Embedded Insurance

New revenue streams and cross-selling opportunities

For businesses, offering personalized embedded insurance unlocks new revenue streams and cross-selling opportunities.

By integrating insurance options directly into the purchasing process, companies can generate additional income with minimal effort, such as offering device protection alongside electronics or travel insurance with flight bookings.

This approach makes it easy to upsell related services that are relevant to the customer’s purchase.

Improving customer experience and loyalty

Embedding insurance enhances the overall experience of the customer journey. This personalization fosters trust, making customers feel valued and more likely to remain loyal to the brand.

How to introduce embedded insurance?

Implementing embedded insurance product requires a collaborative approach between insurers and technology companies.

For insurers, the key to success is finding the right technology partner – one that can seamlessly integrate embedded insurance solutions into their business model.

On the other hand, technology companies should recognize the growing demand for embedded insurance and begin to develop dedicated platforms that are easy for insurers and businesses to integrate.

These platforms must prioritize flexibility, customization options, and real-time data processing to enable hyper-personalized insurance experiences.

By focusing on these areas, technology companies can create new revenue streams while helping insurers meet the demands of a rapidly changing market.

Check this tutorial to learn how to build an embeddable quote form with Openkoda.

Openkoda is a practical choice for building custom insurance software solutions, especially for embedded insurance forms, because it allows businesses to customize and integrate insurance features directly into their products or services quickly. The platform’s open-source nature gives you full control over the system, without being tied to a specific vendor.

It also provides ready-to-use components dedicated to insurance businesses that simplify the development process, saving time while offering the flexibility to adapt to your specific needs. Learn more about the platform.

New Opportunity

Embedded insurance represents a new opportunity for insurers. Real-time data from platforms and devices enables better risk assessment and dynamic pricing, while building customer loyalty with offers tailored to individual needs. On the business side, companies are tapping into new revenue streams and cross-selling opportunities to improve the overall customer experience.

With these opportunities come challenges – companies must address privacy concerns, ensure regulatory compliance, and maintain transparency to build customer trust.

But the benefits are clear: embedded insurance is reshaping the future of how insurance is bought and sold, offering a win-win for customers seeking simplicity, personalization and affordability, and for companies and insurers looking to innovate.