Claims Routing Tool: Buyers Guide

Claims routing has been and stil is most decisive element of modern claims operations.

As insurers scale, diversify products, and digitize customer journeys, the way claims are routed often determines speed, cost, and customer satisfaction.

This guide looks at how a claims routing tool fits into today’s claims platforms and why it matters across the entire claims lifecycle.

Claims Routing Software: General Definition

Claims processing software is a broad category of systems designed to manage, automate, and oversee claims operations from first notice of loss through settlement and closure.

It supports everything that happens after customers submit claims – intake, validation, assessment, payment, reporting, and communication – often across multiple internal teams and external systems.

Within that broader category, claims routing is usually the most critical and foundational capability. While claims processing software defines what activities exist in the process, the claims routing tool determines how claims actually flow. Routing decides where a claim goes first, who handles it next, and how it moves as new information becomes available. Without effective routing, even the most advanced claims platforms struggle to deliver speed or consistency.

In practice, most modern claims processing software includes some form of routing.

The difference lies in how advanced it is.

Simpler systems rely on static rules or manual assignment, which quickly breaks down at scale while more mature platforms treat routing as a living decision layer – adjusting dynamically based on policy details, claim complexity, fraud indicators, workload distribution, or regulatory requirements.

This is where operational efficiency is either gained or lost.

From the policyholder’s perspective, this complexity stays hidden – customers submit claims electronically and expect timely updates on claim status.

Behind the scenes, however, routing logic governs how smoothly a claim moves across the entire claims lifecycle. For insurers modernizing their claims operations, routing is no longer a supporting feature – it is the backbone that holds the process together and determines whether digital claims delivery actually works.

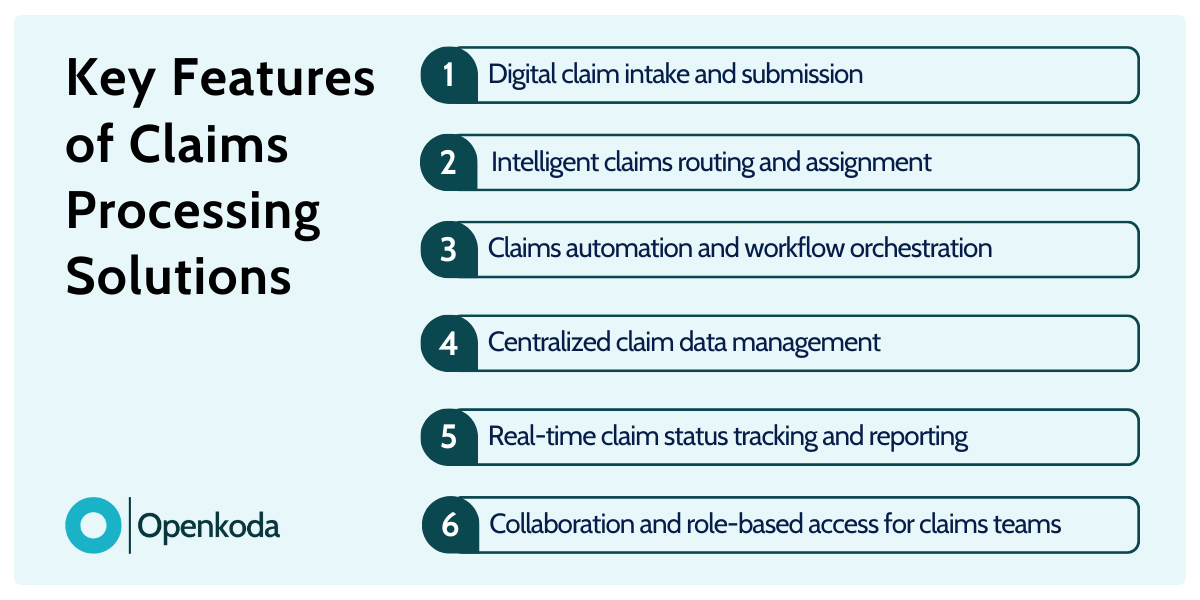

Key Features of Claims Processing Solutions

Once the role of claims routing is clear, the next step is understanding what actually separates modern claims management software from legacy systems.

in 2026 claims platforms are operational hubs designed to support speed, accuracy, and collaboration across claims teams – they need to perform.

The key features below are commonly found in mature claims processing solutions, but the way they are implemented can vary significantly between platforms. Together, they shape how efficiently insurers can handle claim details, automate decisions, and deliver consistent outcomes.

- Digital claim intake and submission – Enables customers and partners to submit claims through web forms, portals, or APIs. Reducing manual data entry at this stage improves data accuracy and shortens the time to first action.

- Intelligent claims routing and assignment – Automatically distributes claims based on predefined rules, workload, expertise, or claim complexity. This ensures claims teams focus on the right cases at the right time instead of manually triaging queues.

- Claims automation and workflow orchestration – Automates repetitive tasks such as validations, document checks, notifications, and status updates. Well-designed claims automation reduces handling time while keeping humans in control of critical decisions.

- Centralized claim data management – Consolidates all claim details, documents, and communication in one place. This creates a single source of truth and makes handovers between adjusters or departments far less painful.

- Real-time claim status tracking and reporting – Provides visibility into claim progress for both internal teams and customers. Transparent status tracking improves customer trust and helps managers identify bottlenecks early.

- Collaboration and role-based access for claims teams – Supports different roles such as adjusters, supervisors, fraud analysts, and external partners. Clear access rules protect sensitive data while enabling faster collaboration.

Individually, these features are valuable.

Combined, they define how scalable and resilient a claims platform really is.

As claim volumes grow and customer expectations rise, insurers increasingly judge claims processing software not by how many features it has, but by how smoothly those features work together in daily operations.

[Read also: How to Streamline Claims Processing with a Customizable Claims Management Dashboard]

10 Best Claims Processing Tools in 2026

With core features and routing capabilities in mind, it’s easier to evaluate real-world solutions.

The best tools in 2026 are not necessarily those with the longest feature lists, but those that handle claims routing well under pressure—especially when insurers must process high volumes, manage complex claims, and integrate smoothly with existing systems across insurance operations.

Below is a representative mix of enterprise platforms, modular solutions, and insurer-built systems that stand out today.

- Blue Shield of California Claims Platform – Blue Shield of California has invested heavily in an internal claims platform optimized for medical claims at scale. Its strength lies in advanced claims routing, strong data validation, and the ability to process complex claims while maintaining detailed audit trails. Blue Shield of California uses automation to route claims based on provider type, policy rules, and risk signals. The platform also integrates tightly with billing systems, enabling faster reconciliation and fewer downstream errors. As a result, Blue Shield of California can submit claims and adjudicate them efficiently across large member populations.

- Openkoda (Claims Routing Module) – Openkoda approaches claims routing as a configurable module within its broader core suite. Rather than forcing insurers into rigid workflows, it allows teams to define custom routing rules, decision logic, and workflow automation tailored to their products. This is especially valuable when handling complex claims or when claims data must be enriched from multiple existing systems. Openkoda is often used to build claims processing layers that sit cleanly alongside legacy platforms.

- Duck Creek Claims – Duck Creek Claims is a widely adopted enterprise solution known for deep configuration options and strong support for end-to-end processing claims. It offers mature workflow automation, configurable claims routing, and robust audit trails, making it suitable for regulated lines of business. Integration with policy and billing systems is a key strength.

- Guidewire ClaimCenter – A long-standing enterprise platform used by large carriers worldwide. It supports advanced claims routing, complex workflows, and strong governance features. ClaimCenter is particularly effective in environments with high transaction volumes and strict compliance requirements.

- Salesforce Insurance Claims Management – Built on the Salesforce platform, this solution emphasizes flexibility and rapid customization. It supports digital intake, claims routing rules, and strong visibility into claims data, making it attractive for insurers modernizing customer-facing processes.

- Sapiens ClaimsPro – Designed for multi-line insurers, ClaimsPro focuses on automation, configurable workflows, and integration with core insurance operations. It handles both simple and complex claims well, with strong reporting and controls.

- Majesco Claims – A cloud-native platform offering workflow automation, configurable claims routing, and analytics-driven insights. Majesco is often chosen by insurers looking to modernize without completely replacing existing systems.

- Pegasystems Claims for Insurance – Pega’s strength lies in decisioning and process orchestration. Its claims routing capabilities are tightly coupled with business rules and case management, enabling adaptive handling of exceptions and complex scenarios.

- Insurity Claims Suite – Popular in specialty and commercial lines, Insurity provides configurable workflows, strong data validation, and integration capabilities. It supports efficient processing claims while maintaining transparency across teams.

- BriteCore Claims – A lighter-weight, cloud-based option aimed at regional and niche insurers. It offers straightforward claims routing, digital intake, and solid workflow automation without the overhead of large enterprise platforms.

What becomes clear across these examples is that claims routing is the real differentiator.

Whether built internally like at Blue Shield of California or delivered as a configurable module like Openkoda, routing quality directly affects speed, accuracy, and scalability.

[Read also: How to Build a Custom Claims Management Application Faster: Step-by-Step Guide]

Customized Claims Routing Tool: Optimal Approach for Faster Deployment

As insurers look to modernize the claims process, many discover that off-the-shelf solutions only go so far. While standard platforms cover common scenarios, real-world claims rarely follow a single, predictable path. Different products, regions, and risk profiles introduce variation across the claims lifecycle, from the moment customers submit claims to the final settlement.

A configurable routing layer allows insurers to adapt workflows to their business model instead of reshaping operations around rigid software logic. This is especially important for organizations handling multiple lines of insurance, where a travel claim, a property loss, and a specialty liability case should never follow the same path – even if they start in the same intake channel.

A modern, customizable routing tool typically sits on top of a flexible workflow engine.

This engine defines how claims move between steps, teams, and systems, using business rules rather than hard-coded logic. Insurers can adjust routing criteria based on claim value, complexity, customer segment, or external signals, while keeping core key features such as auditability and compliance intact. The result is faster decision-making without sacrificing control.

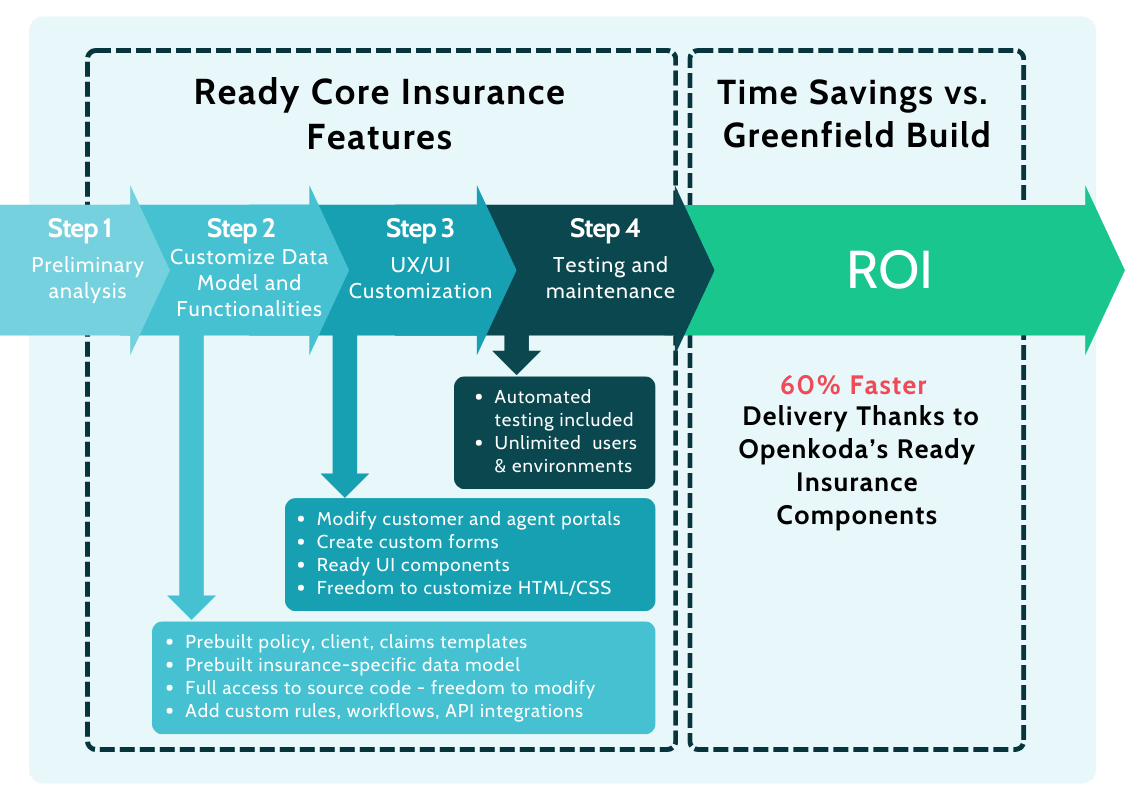

Open, modular platforms like Openkoda illustrate this approach well.

Instead of delivering a fixed claims process, Openkoda enables insurers to configure their own routing rules, escalation paths, and exceptions.

Claims teams can evolve workflows over time, respond to regulatory changes, and optimize handling for different products – all without rebuilding the system. This flexibility directly reduces operational costs while improving responsiveness.

Customizability in insurance software plays a central role in enhancing customer satisfaction and productivity.

Faster triage, fewer handoffs, and clearer communication lead to smoother journeys across the claims lifecycle.

For insurers, this means lower friction, better outcomes, and a platform that grows with the business rather than holding it back.

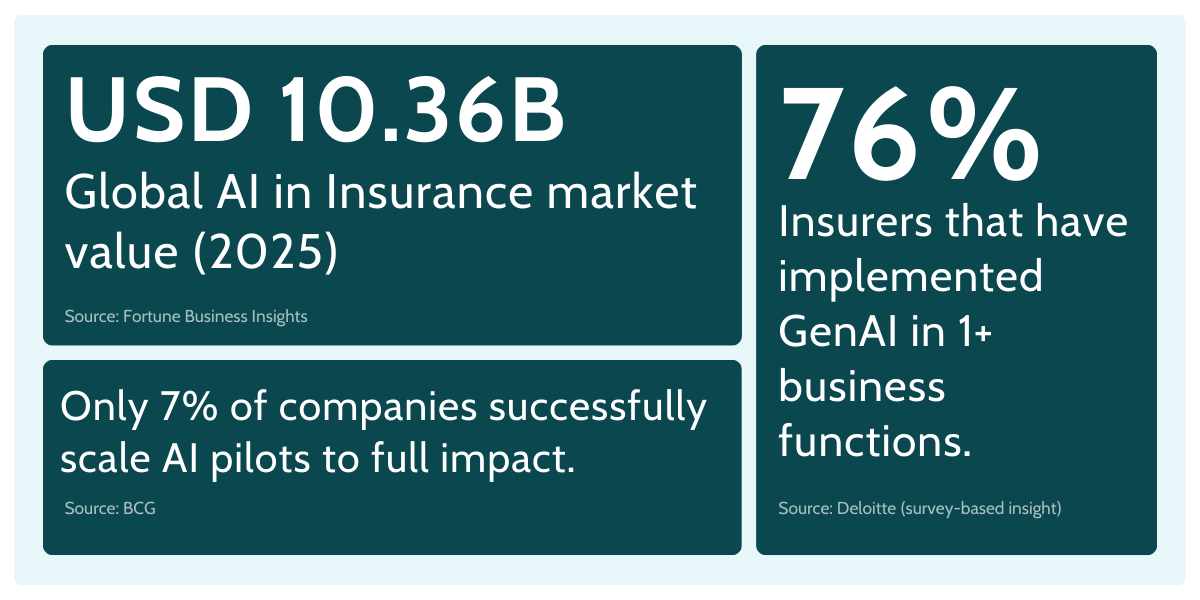

Future of Claims Processing Software: Usage Generative AI For Faster Routing

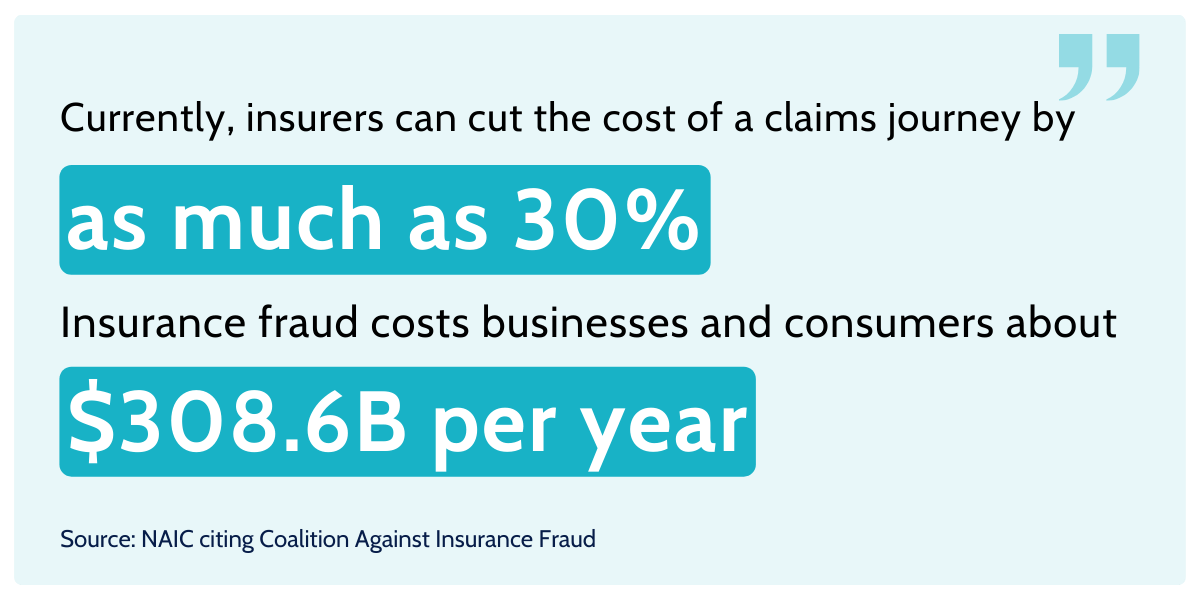

If you look at the key features insurers prioritize today – speed, consistency, regulatory compliance, and better customer experience – generative AI is starting to show up as a practical enhancer, not a magic replacement.

The goal isn’t to remove people from the loop.

It’s to take the friction out of manual processes that slow down triage, inflate operational costs, and frustrate customers in digital channels.

The reality is that claims work is packed with repetitive tasks: reading first notice of loss narratives, extracting claim details from emails, classifying documents, checking completeness, spotting inconsistencies, summarizing histories, and drafting updates. And a lot of that information arrives as unstructured data – notes, PDFs, images, attachments, and free-text descriptions. Some industry sources estimate claims data is overwhelmingly unstructured (one commonly cited figure is as high as 97%).

That’s exactly where gen AI can help: turning messy inputs into usable signals fast.

Here’s what “AI-enhanced routing” looks like in a mature claims setup:

- Smarter triage and routing recommendations: Gen AI can interpret intake narratives, summarize context, and propose the right queue or handling path—especially for complex claims—while a workflow engine enforces rules and approvals. In one example cited by McKinsey, Aviva deployed many AI models in claims, reporting improvements including faster liability assessment for complex cases and better routing accuracy (and even fewer complaints).

- Better data validation at intake: Instead of bouncing claims back and forth, gen AI can flag missing fields, contradictions, and likely next-required documents—before the claim hits a human’s desk. That lifts data accuracy and shortens cycle times without compromising controls.

- Fraud detection support, not “fraud verdicts”: Machine learning and predictive models can surface suspicious patterns (provider history, claim velocity, text anomalies), while gen AI explains the “why” in plain language and assembles a review pack. Final decisions still belong to trained experts.

A particularly interesting direction is AI agents – not in the sci-fi sense, but as structured assistants that can complete bounded tasks: request missing documents, prepare claim summaries, or pre-fill case notes across systems. Deloitte has predicted growing enterprise adoption of AI agents among organizations using gen AI.

The catch is obvious: claims is a high-stakes domain. If you’re serious about regulatory compliance, you need guardrails – clear permissioning, audit trails, explainability, and human sign-off for critical decisions.

And that’s the point to underline: gen AI should enhance claims teams, not replace them.

Even as digital transformation accelerates, claims adjusters and domain experts are, for now, irreplaceable – because judgment, negotiation, empathy, and accountability don’t automate cleanly.

The winning model is “human-led, AI-accelerated”: let AI handle the heavy lifting of triage prep and information synthesis, and let humans own the decision-making that actually matters.