Marine Cargo Insurance

Global trade moves at an extraordinary pace, and every shipment introduces new risks to valuable goods. Marine cargo insurance helps businesses protect these goods while they travel across oceans, ports, and inland connections.

For cargo owners whose business operations depend on stable, predictable logistics, having the right protection in place is essential for continuity and risk management across the entire supply chain.

Marine Cargo Insurance Explained

Marine cargo insurance is a type of coverage designed to protect goods in transit against physical loss or damage.

It applies to shipments moving by sea, air, or land, and ensures that businesses aren’t left exposed when something goes wrong during transport. Whether a company ships machinery, electronics, textiles, or raw materials, this coverage helps keep their cargo insurance needs aligned with real-world trade risks.

A marine insurance policy typically responds to events such as accidents at sea, water damage, theft, fire, or handling issues during loading and unloading. While freight forwarders can assist with arranging coverage, it is ultimately the cargo owner’s responsibility to ensure that a marine insurance policy is properly selected and matches the value, nature, and route of the shipment. In short, this form of marine insurance provides a financial safety net that stabilizes operations and strengthens the overall logistics strategy.

Who is Ocean Cargo Insurance Right For?

Marine cargo insurance is suitable for virtually any business moving goods internationally or domestically, regardless of industry or shipment size.

Manufacturers shipping components overseas, distributors replenishing stock, and e-commerce sellers sending products worldwide all benefit from comprehensive protection.

It’s also relevant for companies working through a freight forwarder or logistics partner.

What Marine Cargo Insurance Covers

While specific protections vary by policy, marine cargo insurance commonly includes:

- Physical loss or damage to goods during transit

- Loss caused by natural disasters, accidents, or vessel issues

- Theft, pilferage, and non-delivery

- Damage occurring during loading, unloading, or temporary storage

- General Average contributions (when all parties share losses after a maritime emergency)

Coverage can be tailored to the cargo type, transportation route, and trade terms, ensuring the policy reflects real-world cargo insurance needs.

Costs of a General Average Incident

When a vessel encounters an emergency – such as a fire or grounding – the captain may sacrifice cargo or incur extraordinary expenses to save the voyage.

Under maritime law, all stakeholders must contribute to these losses. For cargo owners, this can mean significant, unexpected costs unless they are protected by appropriate marine insurance that covers General Average contributions.

Types of Cargo Insurance

Marine cargo insurance policies come in several forms, each designed to protect goods from different types of risk during sea voyages and inland transit.

Because every shipment, route, and cargo type carries unique exposures, businesses often combine multiple forms of marine insurance to create a protection strategy that prevents unexpected financial loss and strengthens operational resilience.

ICC (A) – All Risks

ICC (A) provides the broadest form of marine insurance coverage.

It protects cargo against most fortuitous events, except for specific exclusions outlined in the marine insurance policy. This typically includes damage from accidents, weather events, mishandling, theft, and even concealed damage discovered after delivery.

Although “all risks” does not mean “every possible scenario,” it remains the most comprehensive option for preventing total loss or partial damage.

ICC (B) – Named Perils

ICC (B) offers a mid-tier level of coverage, insuring shipments against specific listed dangers.

These can include events like fire, explosion, vessel grounding, collision, and discharge at a port of distress. While more limited than ICC (A), this form of marine insurance still provides solid protection for cargo owners who want targeted coverage without the cost of broader policies.

ICC (C) – Basic Coverage

ICC (C) is the most limited of the Institute Cargo Clauses.

Coverage is restricted to major incidents such as fire, collision, or total loss of the vessel. It does not include many of the broader protections found in ICC (A) or ICC (B).

This option is typically selected for low-value goods or cargoes with very minimal risk exposure.

Single Voyage Policy

A single voyage policy is a one-time marine insurance policy that covers a specific shipment from origin to destination.

It’s well-suited for companies that ship goods infrequently or handle unusual one-off consignments. Protection applies only for the duration of that specific journey.

Open Policy / Open Coverage

Open cargo policies are continuous, automatically covering all shipments that fall within agreed parameters.

They work well for businesses that ship regularly and need uninterrupted coverage without arranging insurance for each individual consignment.

In many cases, insurers may also include elements of marine liability insurance, depending on the exposures involved, so cargo owners are protected if disputes arise regarding actual fault, damage, or negligence.

Marine Cargo Insurance Contract Requirements

Entering into a marine cargo insurance contract involves more than simply selecting a preferred coverage type.

To properly insure goods from the moment they leave the warehouse to their final destination, cargo owners must understand the obligations, documents, and responsibilities that define how cargo insurance policies work in practice.

These requirements help ensure that the insurer, the carrier, and the policyholder all have clarity on what is protected, under which conditions, and who is responsible at each stage of the journey.

A standard cargo insurance contract typically specifies:

- What is being insured – including cargo type, packaging, and declared value.

- Where and when coverage applies – from initial pickup to transit legs, storage points, and final delivery.

- Which external causes are covered – such as weather events, accidents, handling issues, or unforeseen disruptions during transport.

- Obligations of the cargo owner – such as proper packaging, timely contact with insurers after a loss, and accurate documentation.

- Responsibilities of the carrier – including handling standards and liability limitations that may apply under shipping conventions.

Because marine transport involves multiple touchpoints and handovers, the contract must clearly indicate when risk transfers between the shipper, the carrier, and the insurer.

This is especially important when goods move through multiple modes of transport—by truck, port terminal, and ship – before reaching their final destination.

Finally, marine cargo insurance contracts often require prompt reporting if damage is discovered, even if it results from external causes that were not immediately visible.

This includes cases of hidden or delayed damage that only appear after unstuffing the container. Adhering to these requirements ensures that claims are processed smoothly and that the protection purchased through cargo insurance remains fully effective when it matters most.

Software For Specialty marine Cargo Insurance

Marine cargo is a complex, highly specialized line, and supporting it effectively often requires more than generic tools.

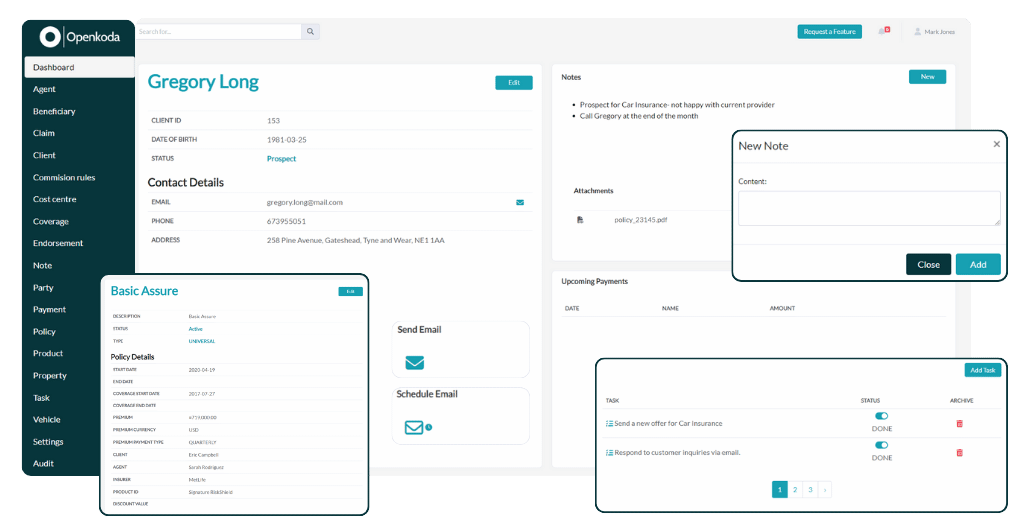

Specialty insurers frequently turn to flexible solutions that can adapt to the nuances of routing, valuation, documentation, and multi-modal risk. Modern insurance solutions in this space must handle complex clauses, global trade workflows, and real-time visibility needs.

Because of this, many carriers and MGAs rely on custom insurance software that allow them to model intricate coverage terms, automate underwriting steps, and streamline claims tied to international shipping events.

Insurance Core Platforms like Openkoda play a valuable role here, offering a core insurance framework for building tailored systems quickly – especially in niche specialty markets such as marine, where precision and adaptability are critical.

Closing Thoughts

Marine cargo insurance plays a crucial role in protecting goods as they move through complex global supply chains.

With the right coverage and systems in place, cargo owners can minimize uncertainty and keep their operations resilient.

As trade evolves, so too must the tools and solutions insurers use to support it – making flexibility, clarity, and modern technology more important than ever.