How to Automate Payment Reminders: The Insurer’s Guide

Manually tracking late payments is not only time-consuming – it often leads to unnecessary policy cancellations and operational inefficiencies. That is why today, automation is a necessity for modern insurers. By sending timely, personalized payment reminders, you can significantly reduce missed premiums while improving the overall client experience. And the best part? Implementing such workflows can be fast, seamless, and completely customized to your needs.

In this article, we’ll look at the key benefits of automation, the importance of customizable policy management systems, and how insurtech platforms enable insurers to build and deploy flexible workflows without deep development resources.

In the second half, we’ll guide you through a hands-on tutorial on setting up automated payment reminder emails using Openkoda.

Why Automations Are Essential for Policy Management

By replacing manual tasks with automated workflows, insurance providers can enhance the customer experience, reduce operational overhead, and improve key business outcomes like premium collection and policy retention.

Below, there are some of the most impactful automation use cases in the insurance industry, along with real-world examples.

Each of these automation workflows plays a role in improving efficiency and delivering a more responsive and personalized experience to policyholders.

Automated Payment Reminders

Sending reminders before and after a premium due date can significantly reduce missed payments. Automated and personalized email ensure that policyholders are always informed, without the need for manual follow-ups.

Example: A customer receives a friendly reminder email seven days before their auto policy premium is due, with a direct link to make the payment online.

Policy Renewal Notifications

When policies are nearing expiration, automated policy renewal emails help maintain continuity of coverage. These reminders not only reduce churn but also give your clients time to review or update their policies.

Example: A life insurance client receives a renewal notification one month before the policy expiration, with options to renew or speak to an agent.

Claim Status Updates

Keeping customers informed throughout the claims process is critical. Automation allows insurers to send real-time updates as claims move through different stages.

Example: After submitting a home insurance claim, a customer receives automatic updates each time the claim status changes, such as when it’s being reviewed, approved, or paid.

Quote Follow-Ups

Leads that receive a quote but don’t convert right away can be nurtured through automated follow-up sequences. These timely messages help increase conversion rates.

Example: A prospective client receives a personalized email two days after requesting a health insurance quote, reminding them of their options and inviting them to finalize the purchase.

Onboarding and Welcome Sequences

Automating the onboarding process for new policyholders ensures they receive essential information without delay. This creates a smooth start to the customer journey. Beyond onboarding, insurers can continue to foster relationships with personalized, automated touché, like birthday greetings.

Example: A new policyholder is automatically sent a welcome email series that includes their policy documents, billing schedule, and key contact information.

When to Use Automations in Policy Management Software

Automation delivers the best results when it’s supported by a flexible, adaptable policy management system. Because insurance operations often involve different product lines, customer segments, and compliance rules, your insurance system should allow you to easily adapt the way you do business without being limited by rigid software.

A modern platform should offer more than just basic policy storage. It needs to support automation, provide real-time AI-based analytics, allow for unlimited customization and personalization, and make integration with external tools easy and reliable.

Here’s what a customizable policy management system can help you achieve:

Tailor Reminders to Specific Scenario

With a modern policy management system, you can set up different reminder schedules based on policy type and client preferences. For example, auto policyholders might receive a final overdue notice three days after the due date, while life policyholders might be notified well in advance of upcoming renewals. Each workflow can be fine-tuned and customized.

Adjust Workflows For Different Client Types

Enterprise clients and individual policyholders require different workflows and communication styles. With advanced policy management software, you can configure customized processes for each group-adapting message tone, timing, and approval steps as needed.

For example, policyholders can receive personalized reminders and renewal notices, while agents supporting those clients can be automatically assigned follow-up tasks or alerted to policy changes in real time.

Track Payments and Automate Follow-Ups

With real-time payment tracking, you always know where things stand. If a payment is missed, the system can automatically send a reminder to the customer, alert the agent, and start any follow-up steps you’ve set up. This keeps everyone informed and helps you avoid delays or cash flow issues.

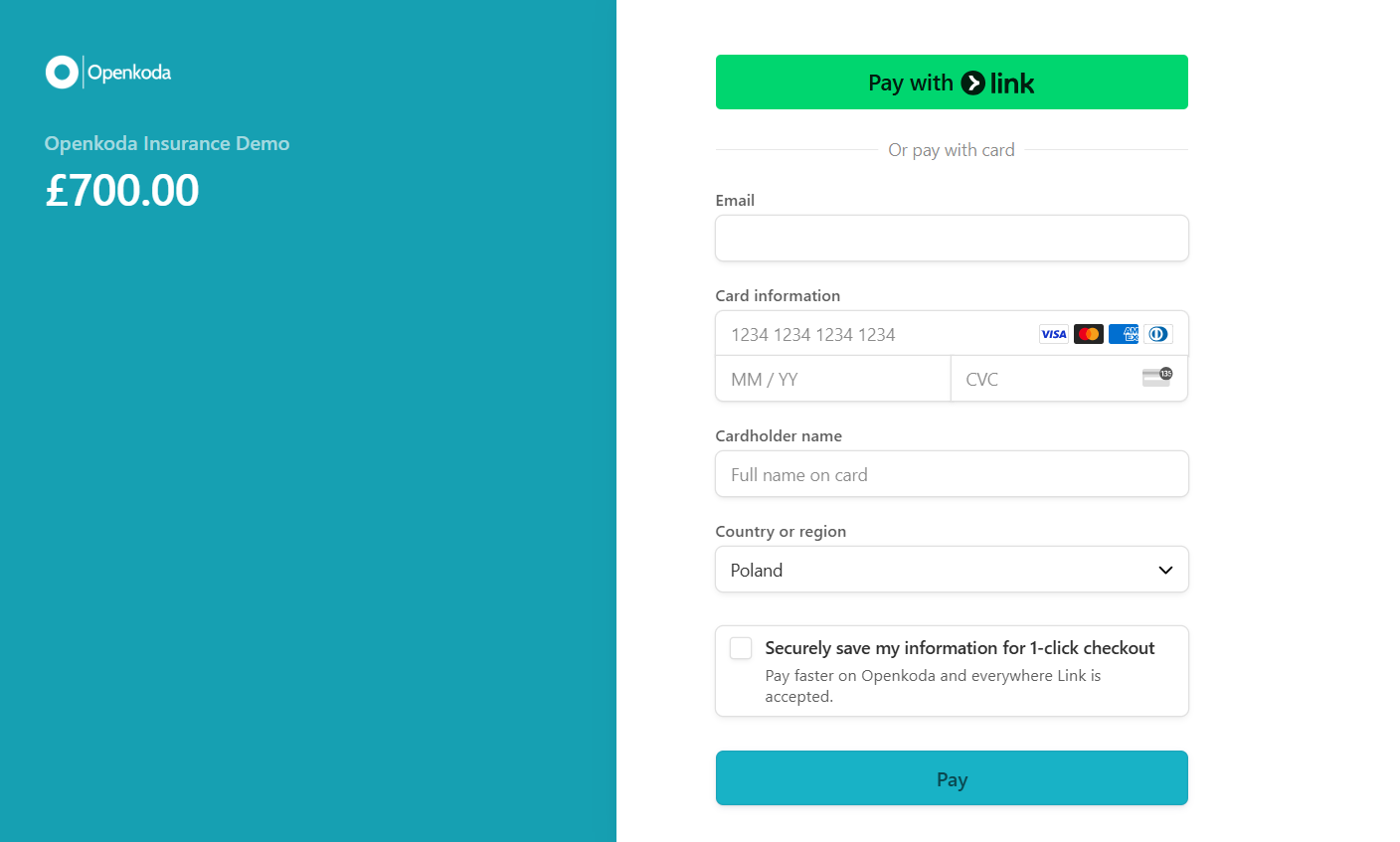

Connect with the Tools you Already Use

Choose the policy management system that makes it easy to integrate with the tools your team already relies on (like for payments, communication, or task management). You should be able to quickly connect platforms like Stripe, Slack, Trello, or your own custom solutions through API integrations, so everything works smoothly together without extra effort.

Manage and Create Documents Faster

Create, update and manage insurance documents using smart templates tailored to your organization’s needs. The system automatically fills in client and policy data, helping you generate accurate documents of different types. This not only saves time, but also reduces the risk of manual errors. Learn how to do it here: How to Generate Insurance Documents with Customizable Templates.

Create Branded Client Portals

Give customers access to their policy details, payment status, and communication history through secure, custom client portals. These can be tailored to your brand and user needs, improving transparency and reducing service requests.

Step-by-Step Guide: How to Send Automated Payment Reminder Emails Using Openkoda

In the previous sections, we explored the benefits of automation in insurance operations, from improving communication to reducing late payments. Now let’s take a closer look at how you can put this into practice.

In the step-by-step guide below, you’ll learn how to set up a specific automation using Openkoda: automated payment reminder emails. Follow the steps or watch a video tutorial:

This workflow helps you stay on top of overdue payments by sending timely, personalized messages to your clients. It keeps your customers informed and ensures your business continues to run efficiently.

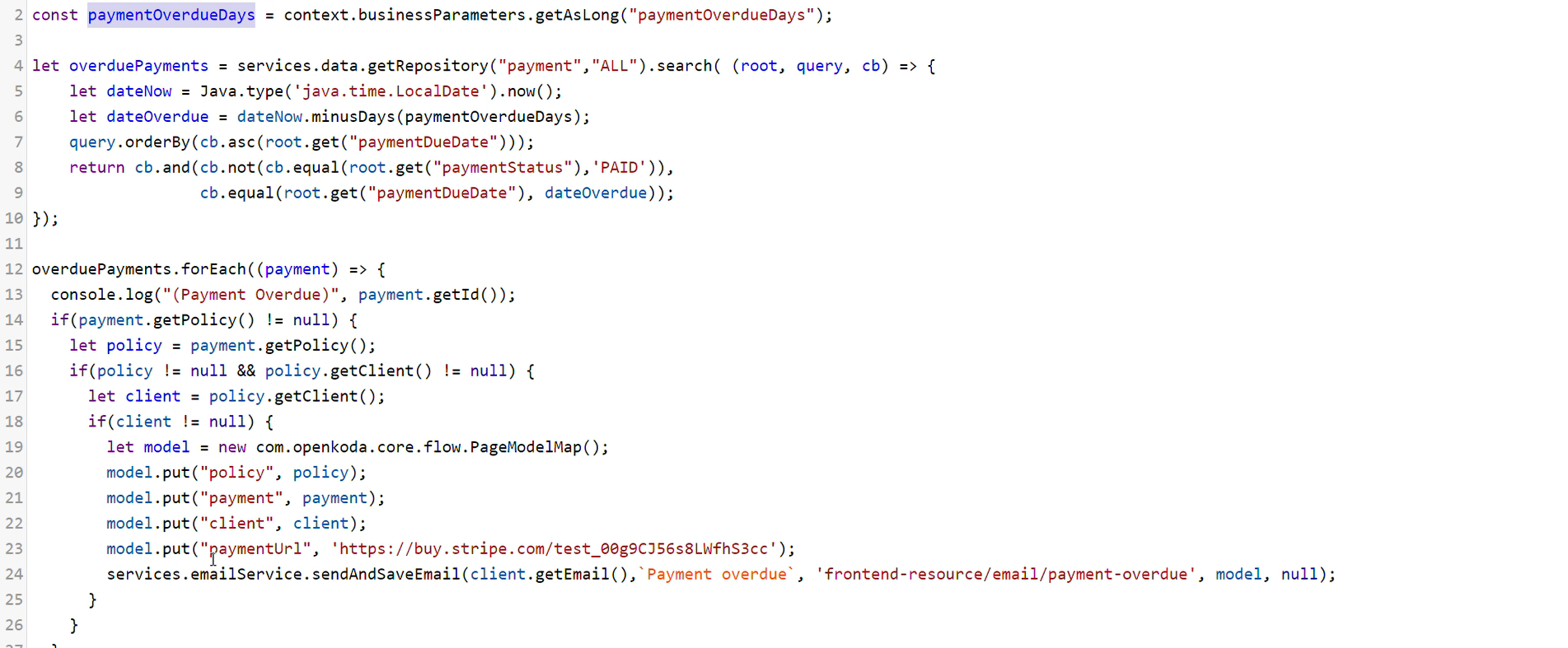

Step 1: Define When a Reminder Should Be Sent

Start by specifying which policies should trigger a reminder.

In this case, we want the system to automatically send an email when a payment is overdue by one day.

Openkoda allows you to create custom server-side logic that checks policy status and payment dates to determine when a reminder should be sent.

You can easily configure this logic using Openkoda’s automation tools, so the system scans all policies and selects only those with overdue payments based on your defined rules.

Let’s learn how to do it.

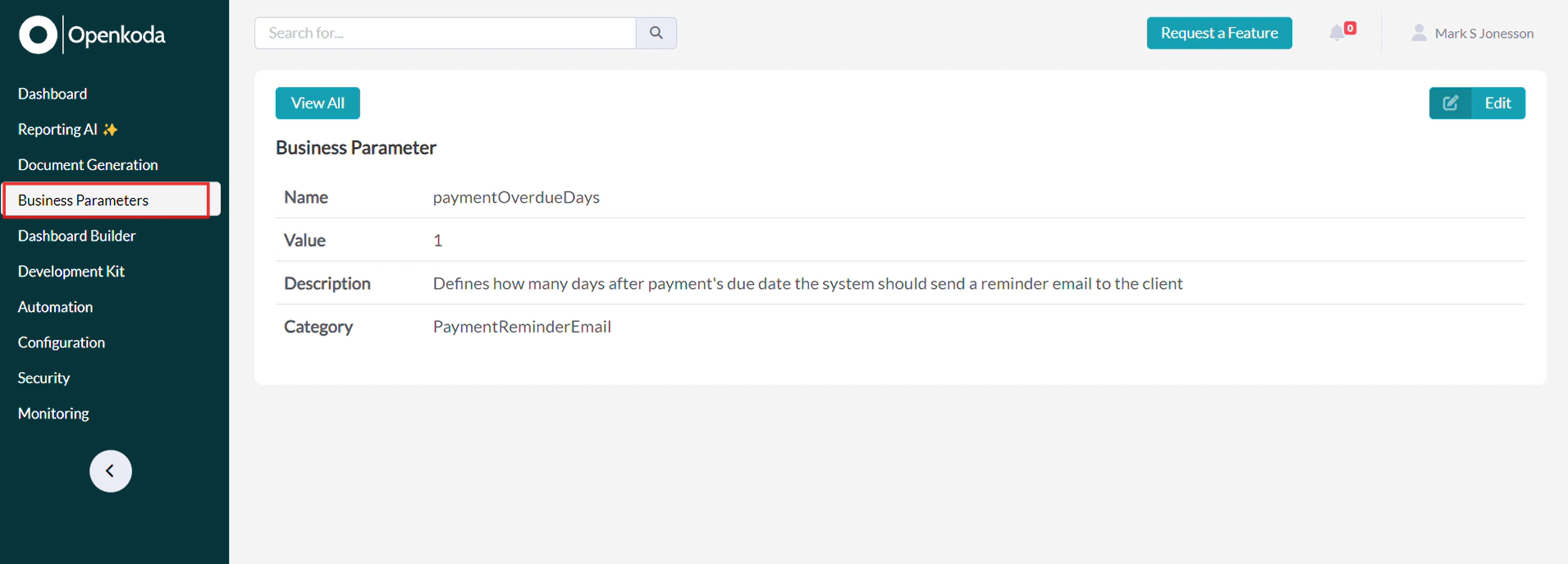

Step 2: Configure Business Parameters

Go to the Business Parameters section in Openkoda and look for the parameter called “Payment Overdue Days.”

This parameter lets you define how many days after a missed payment the system should trigger the reminder.

For example, if it’s set to “1,” Openkoda will send an email reminder exactly one day after the due date.

These parameters can be managed by business users without writing a single line of code, making updates quick and accessible.

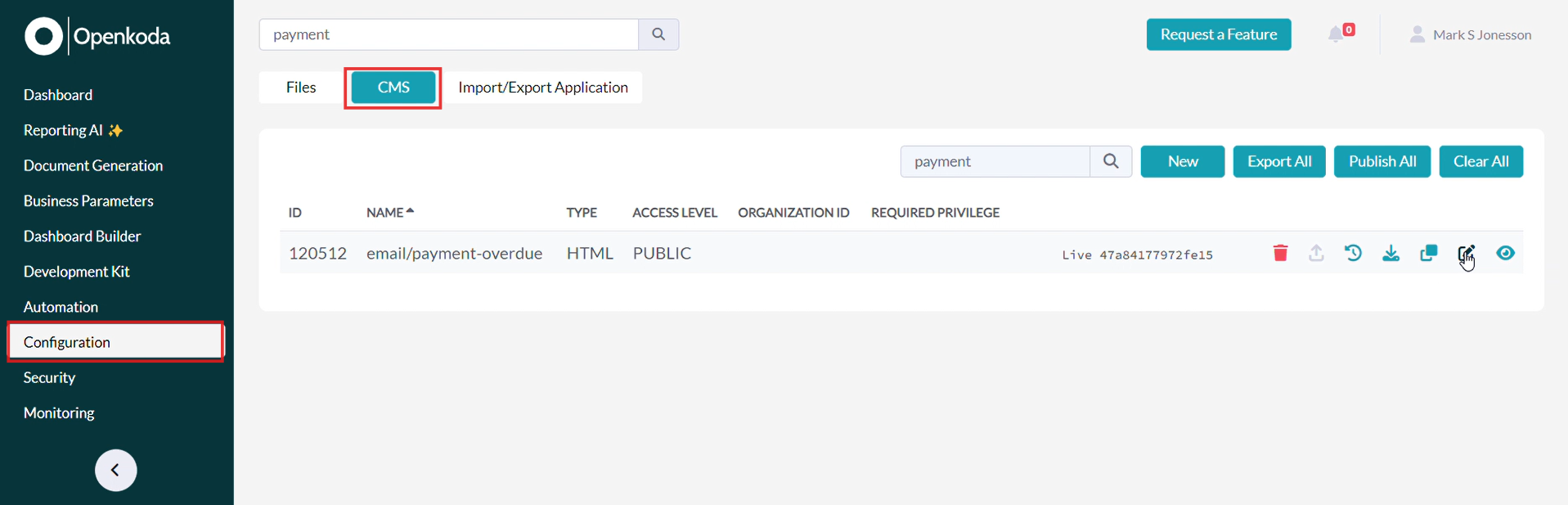

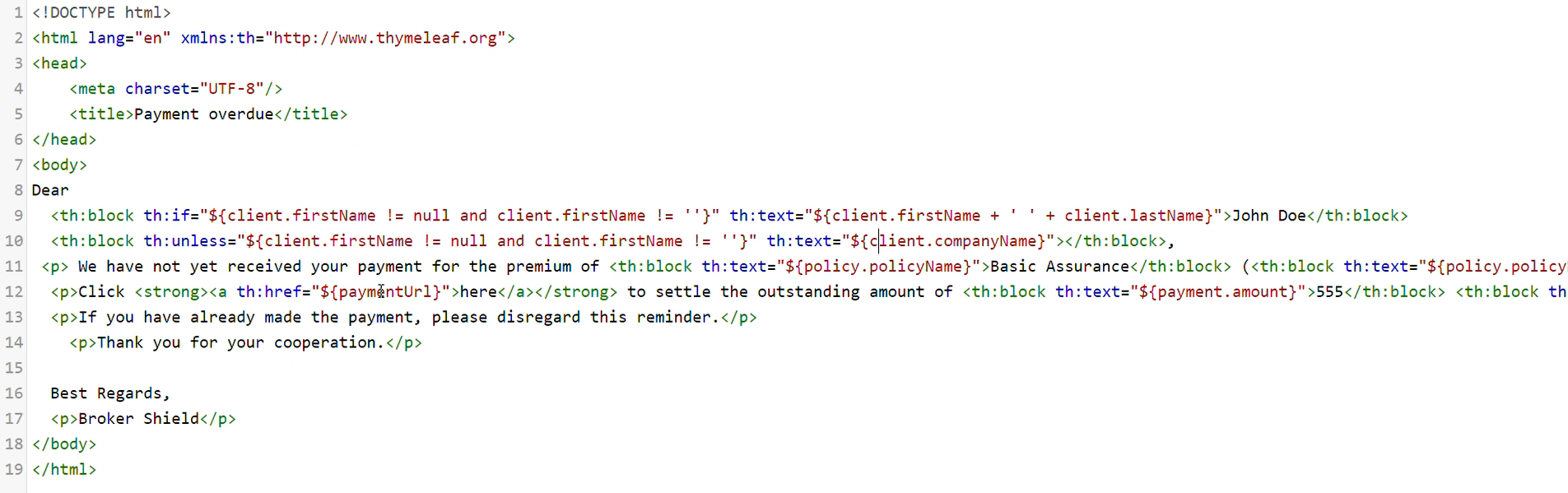

Step 3: Customize the Email Template

Now it’s time to personalize the reminder email.

Open the CMS module in Openkoda and locate the “Payment Overdue” email template.

This template is fully customizable. You can edit the content, adjust the layout, and define placeholders that automatically pull client and policy details from your system.

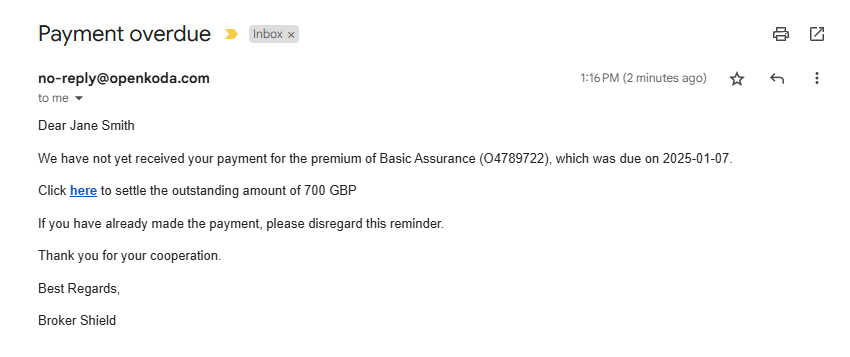

Each email can include:

- Client or company name

- Policy name and number

- Overdue date and amount

- A direct payment link

This ensures that every message is tailored and informative, helping clients take action quickly while maintaining a professional tone.

Step 4: Automate the Sending Process

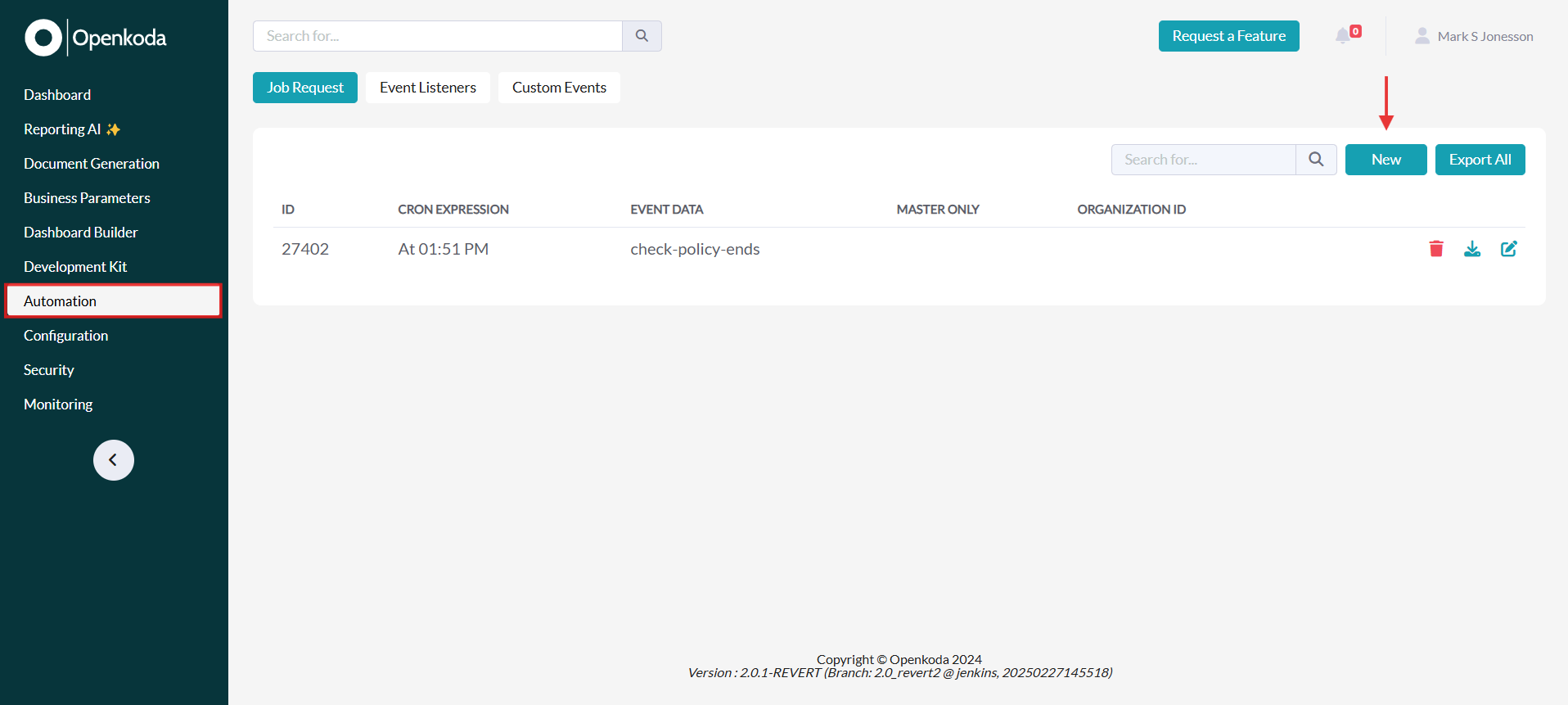

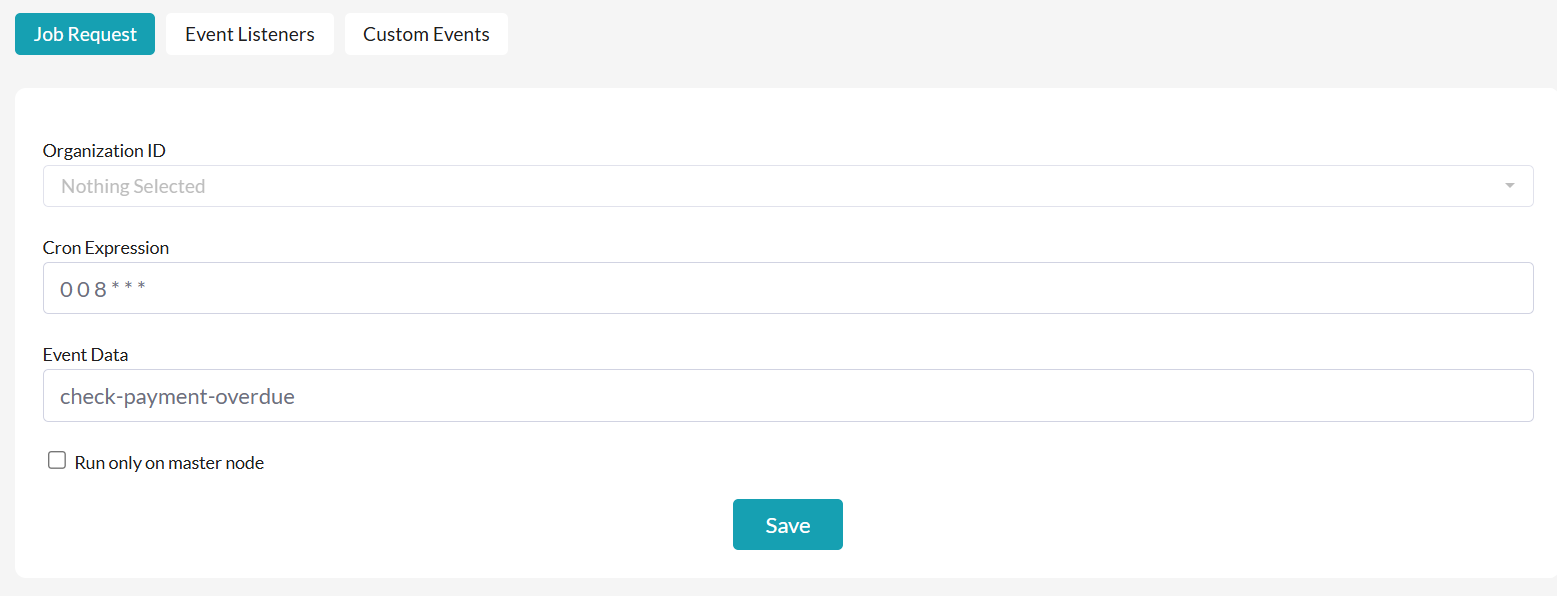

To automate daily reminders, go to Job Requests and create a new scheduled job.

For example, set it to run every day at 8:00 AM.

This job will scan all active policies every 24 hours, identify any that are overdue based on your parameters, and automatically trigger the appropriate email.

Once configured, this process runs in the background with no manual work required from your team.

Step 5: See It in Action

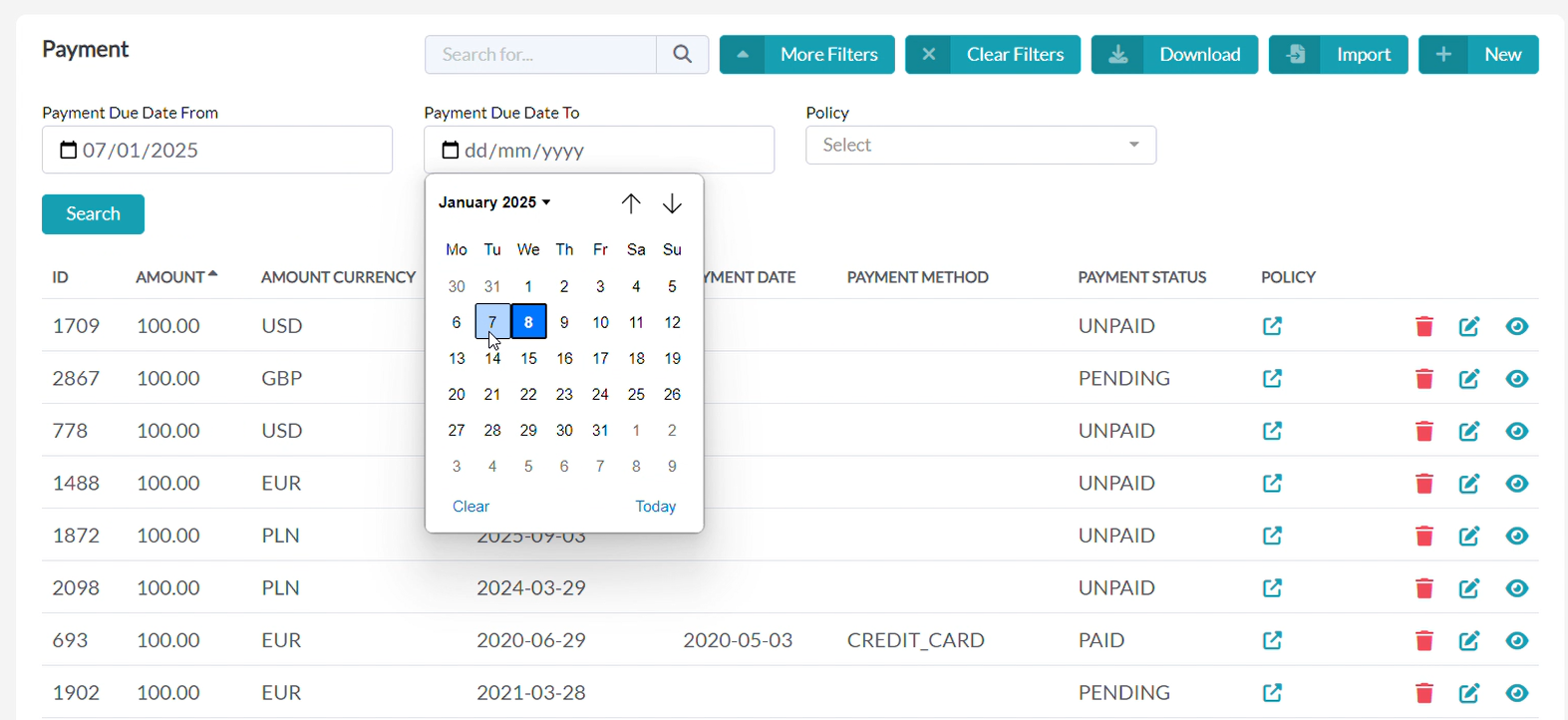

To verify everything is working as expected, you can check your payment list in Openkoda and find overdue ones.

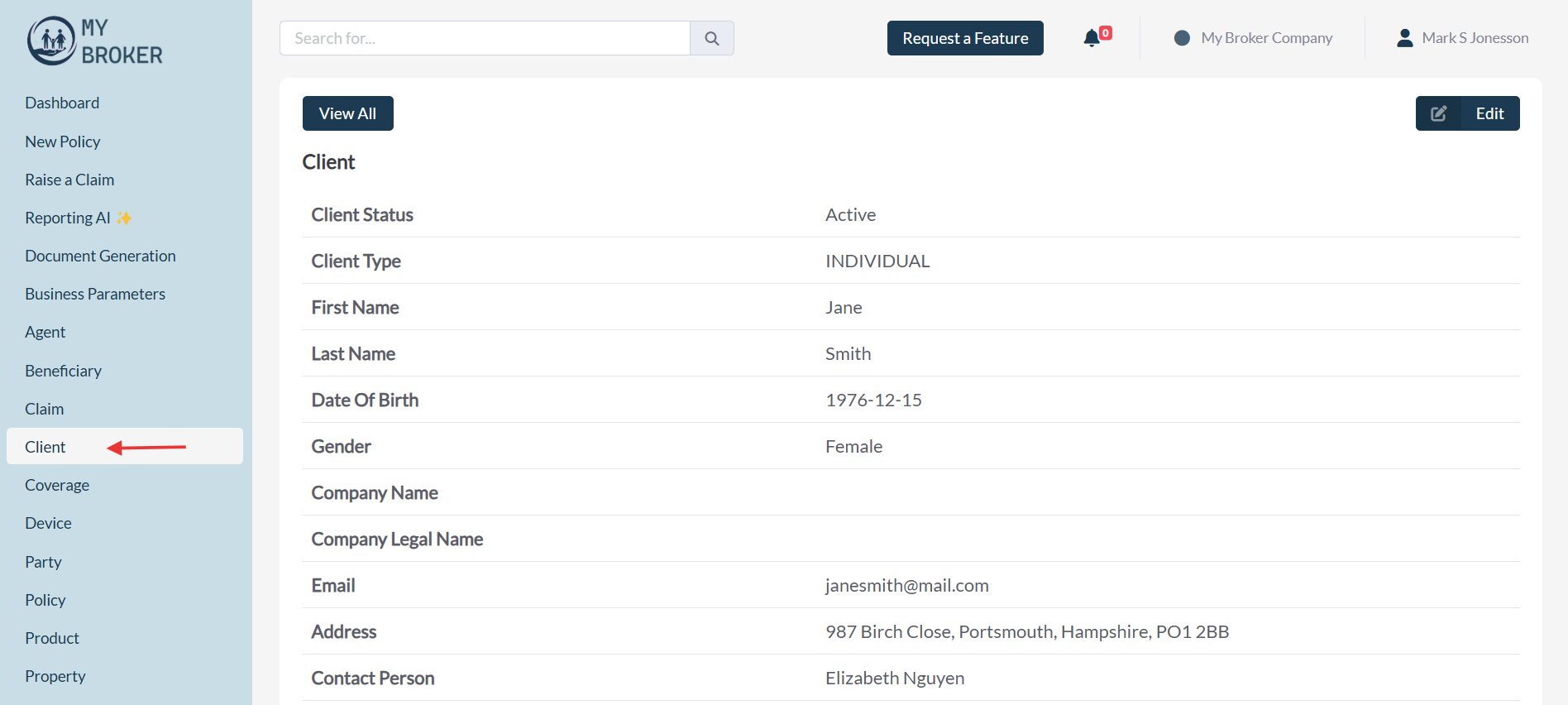

Let’s say a policy belonging to Jane Smith has a due date of January 7, 2025, and today is January 8, 2025.

The system automatically detects this overdue status, uses the configured template to generate a personalized email, and sends it out.

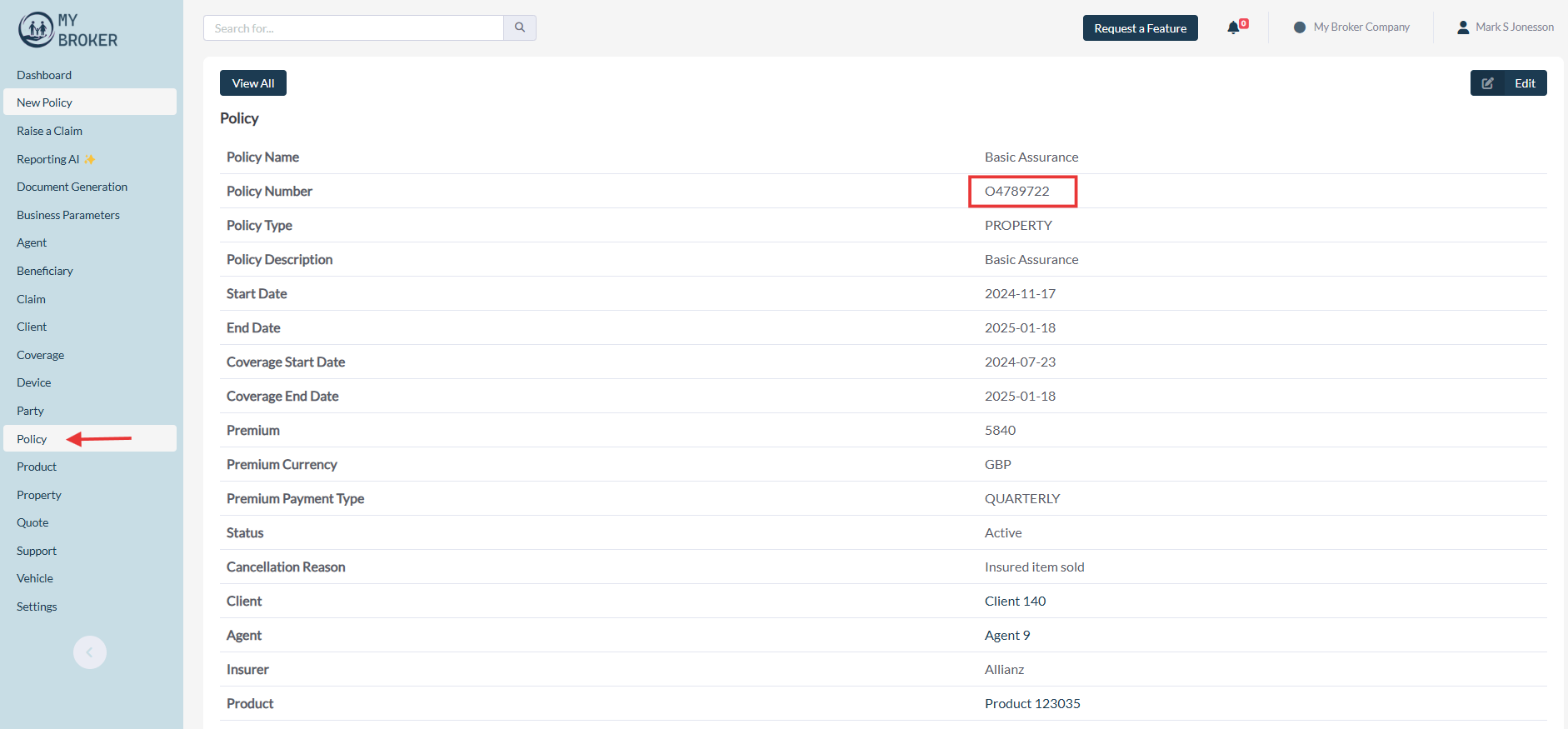

Let’s check the policy’s details:

The system automatically pulls this data and fills it into the email and add a direct payment link.

Keep Client Relationships Strong with Automations

Automating payment reminders is just one example of how modern, flexible policy management software with automations built-in can simplify operations and strengthen client relationships. With the right tools in place, insurers can save time, reduce risk, and deliver a better experience to both policyholders and agents. If you’re ready to explore how automation can work for your insurance business, schedule a personal demo with us.

Related Posts

- How to Automate Insurance Policy Renewal Reminders?

- Step-by-Step Guide to Creating a Custom Insurance Business Dashboard

- How to Personalize Your Openkoda Interface to Match Your Brand

- How to Create Custom Notifications for Your Application

- How to Manage User Roles and Create Custom Permissions in Your Application