Top 5 Embedded Insurance Providers in 2025

Instead of dealing with separate policies and endless forms, embedded insurance software seamlessly integrates with everyday purchases, making coverage almost effortless.

If you’re curious about who will lead this transformation in 2025, here are the top five vendors setting new standards.

Embedded Insurance: Brand New Way of Offering Insurance Products

Embedded Insurance is an innovative approach that seamlessly integrates insurance coverage into the purchase of products or services with embedded insurance forms, enhancing the existing customer journey and providing a unique value proposition to users at checkout.

How does it work in practice?

For example, when a customer purchases a new smartphone, they can be offered device protection or extended warranty insurance as part of the checkout process. This integration makes the insurance purchase feel like a natural part of the product purchase, rather than an afterthought.

This innovative way of simplifying the insurance value chain is rapidly gaining traction.

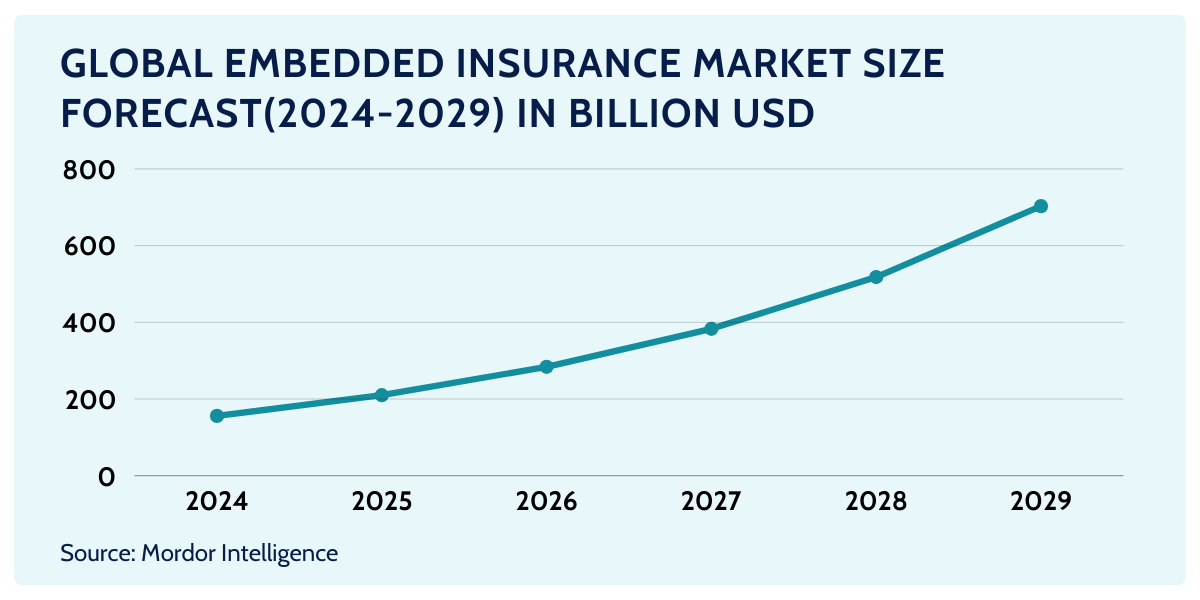

The market is expected to reach over $150 billion by 2024 and grow to $700 billion by 2029, with a compound annual growth rate (CAGR) of over 30%.

As you may have guessed, this rapid growth is being driven by the convenience and relevance that embedded insurance trend offers, which has resonated strongly with consumers, but also by the increasing role of younger generations such as Millennials and Gen Z.

As noted in Aperture’s Embedded Insurance 2.0 report, more than $5 trillion could be distributed globally by non-insurance companies through embedded capabilities in less than 10 years, representing 16% of projected global insurance spend – up from just 1% in 2022.

That’s why many companies are increasingly investing in embedded insurance software as a critical component of their digital transformation strategies, and yours should, too.

As the market continues to evolve, the right embedded insurance software can ensure your company is well-positioned to capitalize on new opportunities and deliver differentiated services that meet modern customer expectations.

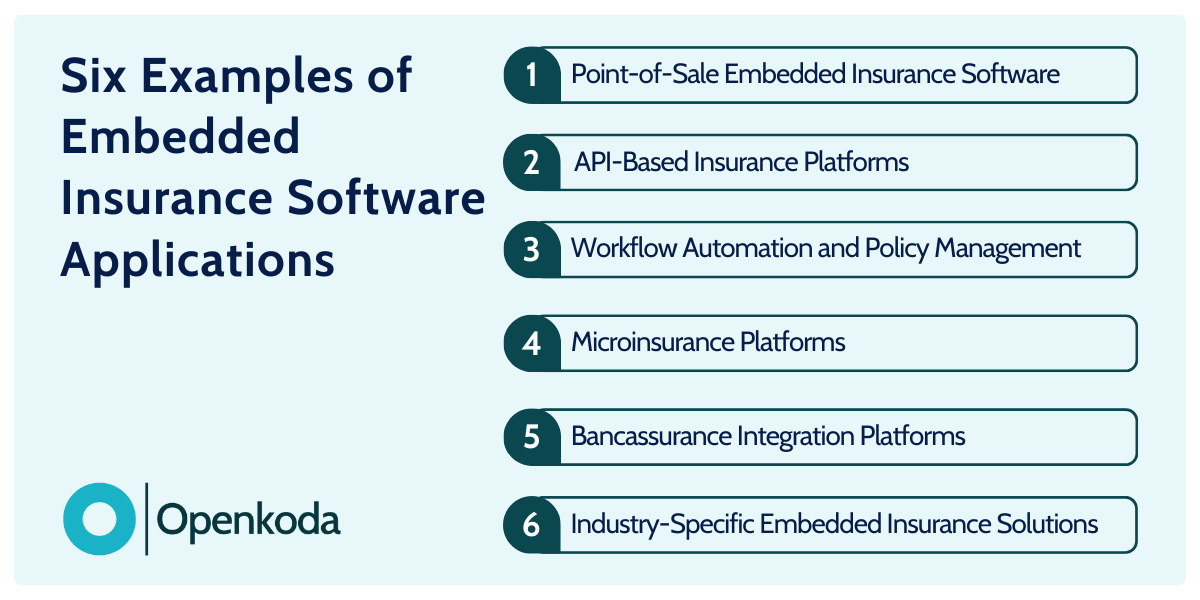

Key types of Embedded Insurance Software

Embedded insurance software comes in several forms, each tailored to seamlessly integrate insurance products into other ecosystems such as e-commerce, travel booking systems, financial services, and more.

Here are the main types:

- Point-of-Sale Embedded Insurance Software – They integrate point-of-purchase insurance offerings commonly used by eCommerce platforms and travel websites to offer relevant insurance during transactions (e.g., flight cancellation insurance or gadget protection).

- API-Based Insurance Platforms – These systems provide easy integration via APIs, allowing third-party apps or platforms to embed insurance services directly, offering flexibility without building the infrastructure themselves.

- Workflow Automation and Policy Management Systems – Manages the entire insurance process, from quote generation to claims, reducing friction and integrating smoothly into existing business workflows with features like automated underwriting and customer communication.

- Microinsurance Platforms – Focuses on embedding affordable, bite-sized insurance solutions for specific events, such as a single trip or short-term coverage, often integrated into mobile apps and digital services.

- Bancassurance Integration Platforms – Allows banks and financial institutions to embed insurance products as part of their services, streamlining coverage offerings like mortgage or personal loan insurance, enhancing cross-selling opportunities.

- Industry-Specific Embedded Insurance Solutions – Tailored to specific industries, such as: travel insurance integration, ecommerce product insurance, Cyber insurance, mobility & ride-sharing coverage.

Leading Providers of Custom Embedded Insurance Software in 2025

With various embedded insurance products on the market, it’s good to familiarize yourself with the most popular options to make the most informed decision about what to choose for your business.

Let’s take a closer look at five of the most popular and influential embedded insurance applications and products providers in 2025:

Openkoda

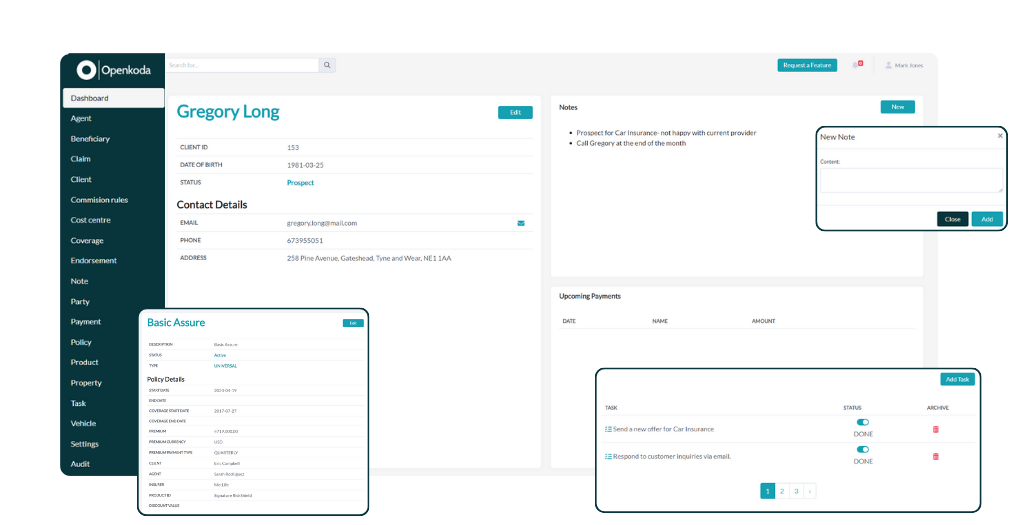

Openkoda is an open-source platform designed for faster insurance application development.

With Openkoda, building a custom embedded insurance system becomes much faster, reducing development time and costs by 60% and enabling faster time to market.

The platform provides all core functionality from the start, eliminating the need to start from scratch, and the system can be easily extended and customized without limitations (no proprietary programming languages).

The system allows you to create various plugins for a range of digital platforms, including e-commerce product insurance, travel insurance, mobility and finance.

Being open-source, Openkoda’s technology ensures that there is no vendor lock-in.

The code is entirely yours, with no proprietary language restrictions, giving you the freedom to choose your own hosting solution or use Openkoda’s managed cloud services.

What They Offer

- Rapid Development: Openkoda accelerates development by 60%, allowing businesses to bring embedded insurance products to market much faster thanks to included pre-built templates and out-of-the-box features.

- Open-Source and No Vendor Lock-In: Since Openkoda is open-source, businesses retain full control of their code, preventing vendor lock-in. You can host the solution on your own infrastructure or opt for managed cloud services, giving you maximum flexibility.

- Customizable and Scalable: Openkoda’s platform is fully customizable and supports extensive integrations with third-party systems, enabling businesses to tailor their insurance offerings to specific needs and scale as their business grows.

- Seamless Integration: The platform is designed to seamlessly integrate with existing e-commerce, finance, travel, or other digital platforms. This simplifies adding insurance options directly within the customer’s purchase journey.

- Advanced Reporting and Automation: Openkoda includes AI-driven reporting and process automation, allowing businesses to generate insightful reports and automate routine tasks, such as sending reminders or managing contracts.

Cover Genius

Cover Genius is a leading embedded insurance provider focused on delivering customized insurance solutions through a variety of digital platforms.

The company partners with businesses in industries such as retail, travel and financial services, enabling them to offer insurance directly to customers at the point of sale.

Known for its global reach, Cover Genius operates in over 60 countries, delivering localized, compliant insurance products that enhance the customer experience by providing seamless and relevant coverage options.

What They Offer

- Global Availability: Operates in over 60 countries, offering insurance that fits local rules and needs.

- XCover Platform: Easy-to-use platform that lets businesses add insurance directly into their systems.

- API Integration: Flexible API allows businesses to quickly embed insurance without disrupting their operations.

- Custom Insurance: Tailored insurance options, helping businesses offer exactly what their customers need.

Qover

Qover is a major player in the embedded insurance market, providing flexible, scalable solutions for companies looking to integrate insurance into their customer journeys.

Headquartered in Belgium, Qover partners with a wide range of industries, including fintech, automotive and gig economy platforms, enabling them to offer customized insurance products directly through their platforms.

The company’s API-driven platform enables seamless integration for insurance distributors, providing coverage in multiple countries while ensuring compliance with local regulations.

What They Offer

- API-Driven Integration: Offers a simple API that makes it easy for businesses to embed insurance into their platforms.

- Customizable Insurance: Provides flexible, modular insurance options that can be tailored to different business needs.

- Quick Launch: Qover’s system allows businesses to rapidly implement insurance offerings with minimal disruption to their operations.

- Enhanced User Experience: Offers insurance directly within customer journeys, improving convenience and increasing the likelihood of purchase.

Tigerlab

Tigerlab is an innovative insurance software provider that delivers end-to-end, cloud-based solutions for insurers, brokers, and managing general agents (MGAs).

Its flexible, API-driven platform enables companies to manage the entire insurance lifecycle, from policy issuance to claims processing, all within a customizable, scalable system.

Tigerlab’s software is designed to seamlessly integrate embedded insurance offerings, allowing partners to offer customized insurance fueling digital transformation in insurance industry.

What They Offer

- API-Driven Flexibility: Tigerlab’s platform is designed to easily integrate with third-party systems, allowing businesses to embed insurance seamlessly into their workflows.

- Plug-and-Play Integration: The platform supports easy implementation, particularly suited for embedding insurance into online sales, such as e-commerce, where insurance can be added with a single click during checkout.

- Enhanced Data Management: The platform includes real-time data analytics, which helps businesses track customer behavior, improve decision-making, and optimize insurance offerings through continuous data analysis.

[Read also: Top Insurance Agency Growth Strategies]

Bsurance

Bsurance is a digital insurance provider specializing in customizable embedded insurance solutions for businesses.

Through its cloud-based platform, Bsurance connects insurers with various partners, enabling the seamless integration of insurance products directly at the point of sale, improving both profit margins and customer satisfaction.

The company serves a wide range of industries, including retail, financial services and mobility, providing real-time, personalized insurance coverage to end users.

What They Offer

- Real-Time Integration: Bsurance allows businesses to embed insurance directly at the point of sale (POS), offering coverage when it’s most relevant to customers, enhancing convenience and customer experience.

- Customizable Digital Platform: The platform is highly customizable, allowing businesses to offer personalized insurance products that fit various industries, including automotive, consumer goods, and health sectors.

- B2B2C Focus: Bsurance operates as a B2B2C service, helping businesses offer white-label insurance solutions seamlessly to end customers. This approach helps boost customer confidence and loyalty while opening up new revenue streams for businesses.

[Read also: 5 Practical Examples of AI in Embedded Insurance]

How Can Your Company Benefit from Embedded Insurance?

Embedded insurance offers significant financial and strategic benefits that go far beyond improving the customer experience.

In the UK, embedded insurance partnerships can reduce customer acquisition costs by 75%, from £200 to £50 per customer.

This cost reduction results from streamlining the sales process by embedding insurance directly into the product, eliminating the need for costly advertising campaigns.

In addition, embedded insurance has been shown to increase purchase intent by 25%, increasing sales and adding value to the original product.

If you are looking for ways to unlock the potential of embedded insurance, Openkoda offers a clean alternative for developing and deploying insurance software quickly and efficiently.