Parametric Insurance

Parametric insurance is becoming one of the most talked-about innovations in modern risk management.

It offers a fresh way to handle physical risks that are becoming more frequent and more severe.

And because it responds quickly and transparently, many organizations now use a parametric insurance policy to fill stubborn coverage gaps left by traditional products.

Parametric Insurance: Definition

A parametric insurance policy is a type of alternative risk transfer solution that pays out when a predefined event threshold is met – not when the insurer adjusts an actual loss.

Unlike traditional insurance, a parametric policy doesn’t require damage inspections, long investigations, or proof of the actual loss sustained.

Instead, it is triggered by objective data such as wind speed, rainfall level, earthquake magnitude, or temperature readings. This makes it a fast, efficient tool for organizations exposed to large-scale, hard-to-predict physical risks.

How Does Parametric Insurance Work?

Parametric insurance works by linking the payout directly to a measurable event.

Once the trigger level, say, a Category 4 hurricane with wind speeds above 130 mph, is confirmed by an independent data source, the payment is issued automatically.

For example, a hotel chain located in coastal regions may use a parametric insurance policy that activates when hurricane wind speeds exceed a certain threshold. Even if the property suffers only minimal damage, the immediate payout helps them manage operational disruption, emergency staffing, or evacuation expenses far faster than a traditional claim process would allow.

Real-World Applications of Parametric Insurance Coverage

Parametric insurance coverage can be applied across many industries, especially those facing weather-driven volatility or operational interruption.

It’s particularly valuable where traditional products struggle to quantify losses or verify them quickly.

- Agriculture: Triggered by rainfall shortages or heat stress, helping farmers manage drought-related revenue loss.

- Renewable Energy: Activated by wind variability or low solar irradiance affecting production levels.

- Travel & Hospitality: Providing payouts when seismic events, storms, or airport disruptions impact bookings or occupancy.

Traditional Insurance vs. Parametric Insurance

As climate change accelerates and weather-related risks become harder to forecast, the differences between traditional insurance and parametric insurance have become increasingly important.

Many businesses now face climate risks that cause widespread disruption long before a physical loss can even be assessed. In these situations, traditional indemnity policies may respond slowly or may not respond at all, creating gaps that parametric insurance offers to close with speed, transparency, and predefined triggers.

Key Differences

- Loss Assessment

- Traditional insurance: Pays based on verified damage and loss adjustment.

- Parametric insurance: Pays based on objective triggers—such as wind speed, temperature, or rainfall—regardless of the final loss amount.

- Speed of Payouts

- Traditional insurance: Often slow due to inspections and lengthy investigation.

- Parametric insurance: Extremely fast, sometimes within days, which is crucial during escalating climate risks.

- Handling Climate Risks

- Traditional indemnity policies: Struggle when climate disasters create widespread, hard-to-measure losses.

- Parametric insurance: Designed to respond cleanly to weather-related risks and systemic events.

- Basis Risk

- Traditional insurance: Lower basis risk but slower and more complex.

- Parametric insurance: Higher potential basis risk, but significantly faster and more predictable.

- Coverage Structure

- Traditional insurance: Focuses on reimbursement for actual physical loss.

- Parametric insurance offers: Liquidity triggered by measurable environmental parameters—ideal for modern climate risks.

Key Benefits of Parametric Insurance

For risk managers navigating increasingly unpredictable natural disasters and natural catastrophes, parametric insurance has become a powerful complement to traditional policies.

While the traditional market still plays a crucial role in providing broad coverage for the actual damage incurred, the parametric model adds something different: speed, liquidity, and the ability to act the moment an event occurs.

This makes it especially valuable for any business exposed to climate volatility, operational disruption, or fragile cross-border operations.

Here are the key benefits:

- Faster Disaster Response

Immediate payouts help a policyholder mobilize resources early, improving disaster response and reducing downtime. - Liquidity When It Matters Most

Payments arrive quickly after the trigger is met, giving businesses the cash flow they need before the full extent of damage is known. - Stronger Climate Resilience

Ideal for climate-sensitive sectors, parametrics strengthen climate resilience by providing a predictable financial buffer against extreme events. - Support for Supply Chain Disruptions

When supply chain disruptions follow storms, floods, or other environmental triggers, parametric payouts can help stabilize operations more quickly than traditional products. - Complements Traditional Policies

Works alongside indemnity coverage to fill gaps, especially in situations where assessing the true damage incurred can take weeks or months. - Clear, Transparent Triggers

Because payouts are tied to measurable data, both the insurer and the policyholder know exactly what activates the policy and when.

Parametric Insurance Solutions

Building effective parametric solutions requires far more than a simple trigger-and-payout structure.

These specialty insurance products depend on high-quality, reliable data, well-designed parametric triggers, and flexible calculation logic that can interpret complex environmental or operational signals.

Because every business faces different exposures—wind speed, rainfall levels, seismic activity, or temperature anomalies—the underlying setup must be tailored with precision.

Even a small mismatch between the trigger and the actual operational impact can make a parametric product less useful than intended.

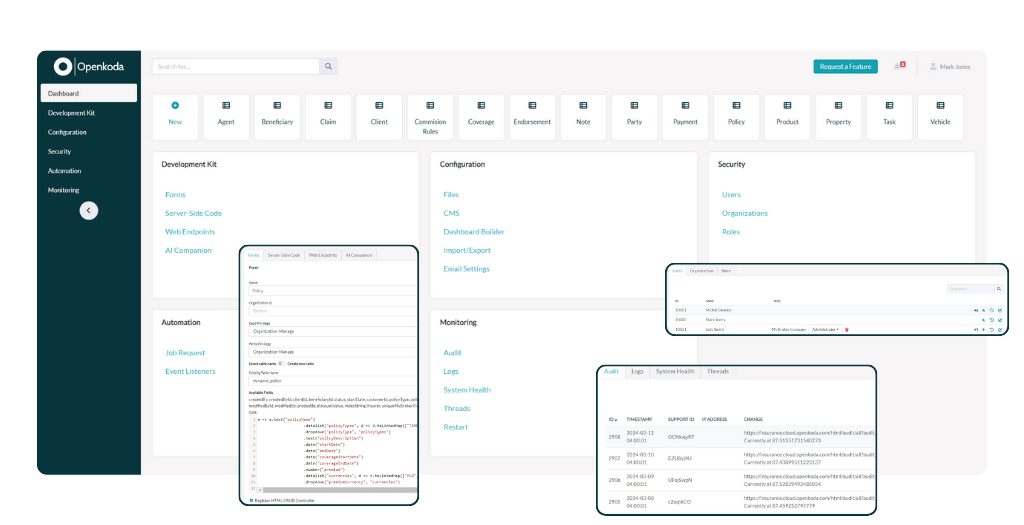

With Openkoda, insurers and MGAs can build parametric solutions that connect directly to trusted data sources, automate event detection, and configure parametric triggers exactly as the business requires.

Everything – from data ingestion to payout calculations – can be customized without locking the organization into rigid vendor constraints.

Openkoda’s architecture makes it possible to adapt quickly as exposures evolve, expand to new data providers, or refine trigger thresholds to better reflect real operational risks.

This level of flexibility is essential for insurers delivering modern parametric products that must perform consistently in a world where environmental volatility is becoming the norm.

Closing Thoughts

Parametric insurance is no longer a niche concept – it’s becoming a critical tool for organizations facing fast-moving environmental and operational risks.

Its ability to deliver transparent, data-driven payouts gives businesses the agility they need when traditional processes slow them down.

As climate pressures intensify, the combination of well-designed parametric models and flexible technology platforms will shape a more resilient future for insurers and their customers alike.