Life Insurance Policy Administration Software Guide

The insurance industry is in the middle of a profound digital transformation, and life insurers are feeling it from every angle.

Customer expectations are rising, products are becoming more complex, and regulators are demanding greater transparency in near real time.

In this environment, modern policy administration systems play a crutial role as most foundational piece of software a life insurer can have.

Why Life Insurance Companies Need Good Policy Administration Software?

At its core, life insurance policy administration software is the system that manages a policy throughout its entire lifecycle – from new business and underwriting, through premium collection and servicing, all the way to claims and maturity.

For life and annuity carriers, this lifecycle can span decades, making stability, flexibility, and data integrity absolutely critical.

Historically, many life insurers relied on legacy systems built years ago for a narrower product set and a slower market. These systems struggle to support today’s realities: frequent product changes, hybrid insurance products, omnichannel distribution, and customer expectations shaped by digital-first industries. As a result, insurers often face long product launch cycles, manual workarounds, and limited visibility into policy data.

A well-designed policy management software changes that dynamic.

It enables speed to market by allowing insurers to configure and launch new life and annuity products faster, without rewriting core logic every time. Product rules, pricing elements, and policy terms can be modeled more flexibly, supporting innovation without introducing operational risk.

Equally important is the role these systems play in customer experience. Modern platforms support self-service capabilities for policyholders and agents alike – such as policy changes, beneficiary updates, or premium inquiries – reducing operational costs while improving satisfaction. For internal teams, real-time access to accurate policy data supports better decision-making and smoother collaboration across underwriting, operations, and finance.

Key Features of Life Insurance Policy Administration Software

Modern insurance policy administration software sits at the center of life insurers’ operations, connecting products, processes, people, and data.

Unlike older policy administration tools that focused mainly on record-keeping, today’s systems are designed to actively support growth, efficiency, and better customer service. They must handle complex life annuity products while remaining flexible enough to adapt as insurance strategies evolve.

Below are the core features that define effective policy administration software for life insurance companies:

- End-to-end policy lifecycle management: Support for the full policy administration process – from quote and automated underwriting, through policy issuance, servicing, and claims. This ensures consistency and control across all insurance operations.

- Product configuration for life and annuity insurance: Flexible product engines that allow insurers to define and modify life annuity products without heavy development. Coverage options, riders, pricing logic, and eligibility rules can be managed through configuration rather than code.

- Real-time policy data access: Centralized, accurate data available in real time across departments. This improves operational efficiency, enables faster decision-making, and reduces errors caused by manual data reconciliation.

- Automated underwriting and rule-based processing: Built-in underwriting rules and workflow automation reduce manual effort, speed up new policy issuance, and improve risk consistency across insurance portfolios.

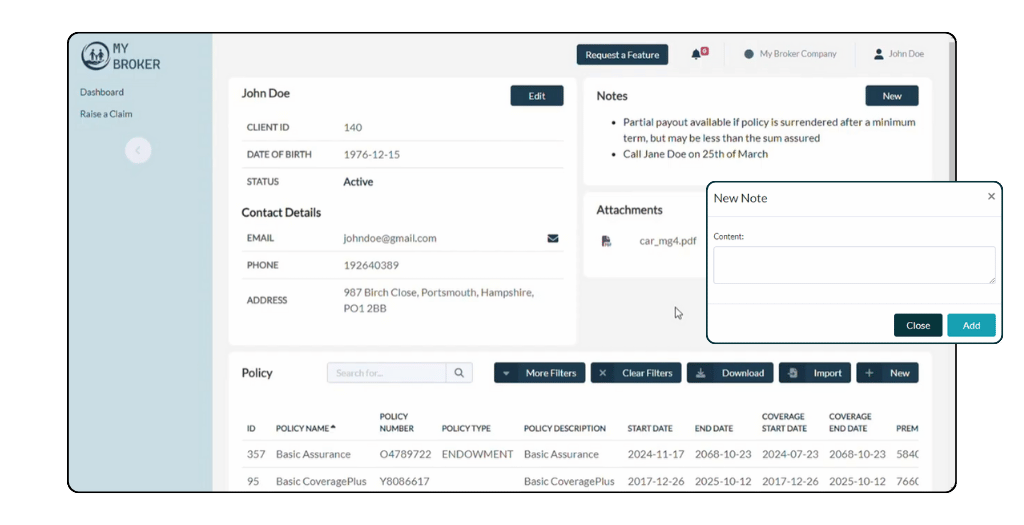

- Customer service and self-service capabilities: Tools for agents, customer service teams, and policyholders to view and update policy information, process changes, and handle inquiries efficiently—significantly improving customer service quality.

- Integration and scalability: Open APIs and integration capabilities that allow the policy administration system to connect seamlessly with billing, claims, CRM, analytics, and external data sources, supporting long-term scalability as insurance operations grow.

Together, these features turn policy administration from a passive system of record into an active operational backbone – one that supports modern insurance models, improves responsiveness, and prepares life insurers for continuous change.

[Read also: Top 10 Best Insurance Policy Administration Software]

Life Insurance Policy Administration Systems: Custom vs. Out-of-the-box

Choosing the right policy administration system (PAS) is one of the most consequential technology decisions a life insurance company can make. It shapes how efficiently the business operates today—and how well it adapts to tomorrow’s digital transformation.

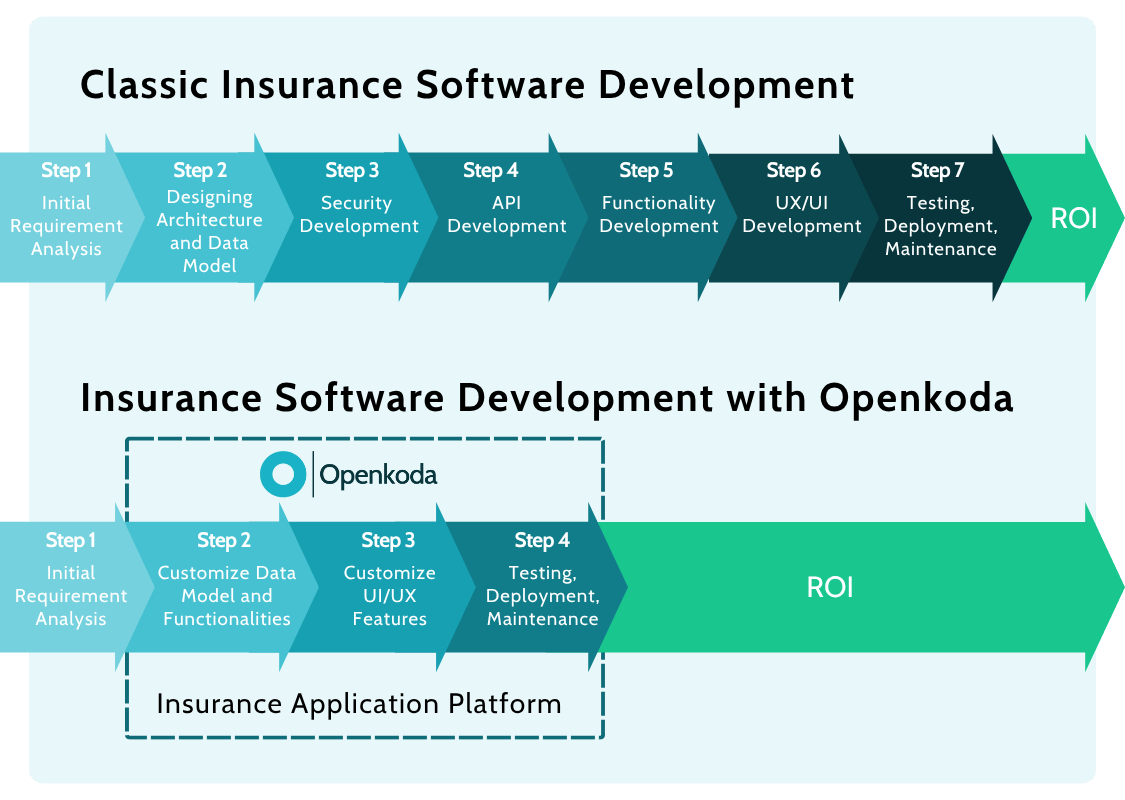

Broadly speaking, insurers face two paths: building a fully custom system from scratch or adopting an out-of-the-box platform and tailoring it to their needs.

Custom Insurance Policy Administration Systems promise a perfect fit for the insurer’s products, workflows, and regulatory environment. In life insurance, where product structures can be highly specialized, this level of control is attractive—especially for complex new business models or niche offerings.

In practice, however, custom development comes with significant trade-offs. Building enterprise-grade insurance software from scratch requires substantial investment, long delivery timelines, and ongoing maintenance capacity.

Out-of-the-box policy management software systems offer a different value proposition.

Traditionally, these solutions traded flexibility for speed, forcing insurers to adapt their processes to the software rather than the other way around. That model is increasingly outdated.

Insurance Core Platforms Explained: Enchancing Insurance Policy Administration Software Development

Modern insurance platforms, such as Openkoda, represent a more balanced approach.

Instead of delivering a rigid, closed system, the platform provides a production-ready PAS module for life insurance. Insurers start with a semi-finished application that already supports core policy administration processes, including new business handling, product setup, and servicing.

From there, they extend and adapt the system by adding specialized functionality tailored to their exact workflows.

This approach combines the strengths of both worlds.

Insurers gain faster time to value and reduced risk, while retaining the flexibility to build differentiated insurance solutions on top of a solid, extensible platform. With guidance from experienced Openkoda developers, customization becomes a controlled, iterative process—not a multi-year reinvention of the wheel.

Insurance Core Platform vs Greenfield Projects: Cost Comparision

From a cost perspective, the difference between a greenfield PAS and a platform-based approach is substantial.

Building a single, fully custom policy administration system for life insurance often requires years of development, a large internal team, and a long-term maintenance budget. The result may fit specific insurance products well, but the financial and operational risk is high—especially if business priorities shift.

A greenfield life insurance PAS typically costs €3–6 million to design, build, test, and deploy, with timelines of 24–36 months. Ongoing maintenance, regulatory updates, and enhancements can easily add 15–25% of the initial cost per year.

By contrast, using an insurance core platform like Openkoda significantly lowers the entry barrier.

A platform-based approach using an insurance core platform like Openkoda usually starts in the range of €300,000–€800,000, depending on the scope of customization and number of insurance products.

Initial rollout can take 4–6 months, with incremental extensions delivered as the business evolves – without rebuilding the core PAS.

Instead of funding a full build from scratch, insurers start with a ready-to-use PAS that already supports core policy administration systems. Investment is focused on extending and configuring digital solutions that directly support the business, not rebuilding standard functionality.

Closing Thoughts

For life insurers navigating digital transformation, modern policy administration systems in 2026 are seen as strategic assets.

The right technology choice can determine how quickly financial services organizations adapt to new products, regulations, and customer expectations.

In an increasingly competitive market, flexible and scalable policy administration is becoming a clear differentiator rather than a back-office necessity.