Top Insurance Agency Growth Strategies

In today’s fast-paced insurance landscape, standing out isn’t just about offering more – it’s about offering the right mix.

Imagine your agency as the ultimate safety net, where clients can find tailored solutions for every aspect of their lives, all under one roof. By expanding your product range, you’re not just meeting diverse needs – you’re transforming your agency into an indispensable partner in your clients’ lives. This smart approach is essential for thriving in a market where client loyalty is the new currency.

Ready to make your agency the go-to destination for comprehensive coverage? Let’s go.

1. Diversify the insurance products you offer

Expanding the range of insurance products you provide is a fundamental aspect of cultivating a successful insurance agency.

By broadening your spectrum of offerings, you can address a more diverse array of client requirements, which in turn enhances both customer loyalty and their lifetime value to your business.

Imagine delivering every kind of insurance solution that your clients may need (from health coverage to custom policies) all from one source. This approach not only streamlines their experience, but also strengthens their bond with your independent insurance agencies, contributing positively to the growth of your overall insurance enterprise.

The right insurance software can make this possible.

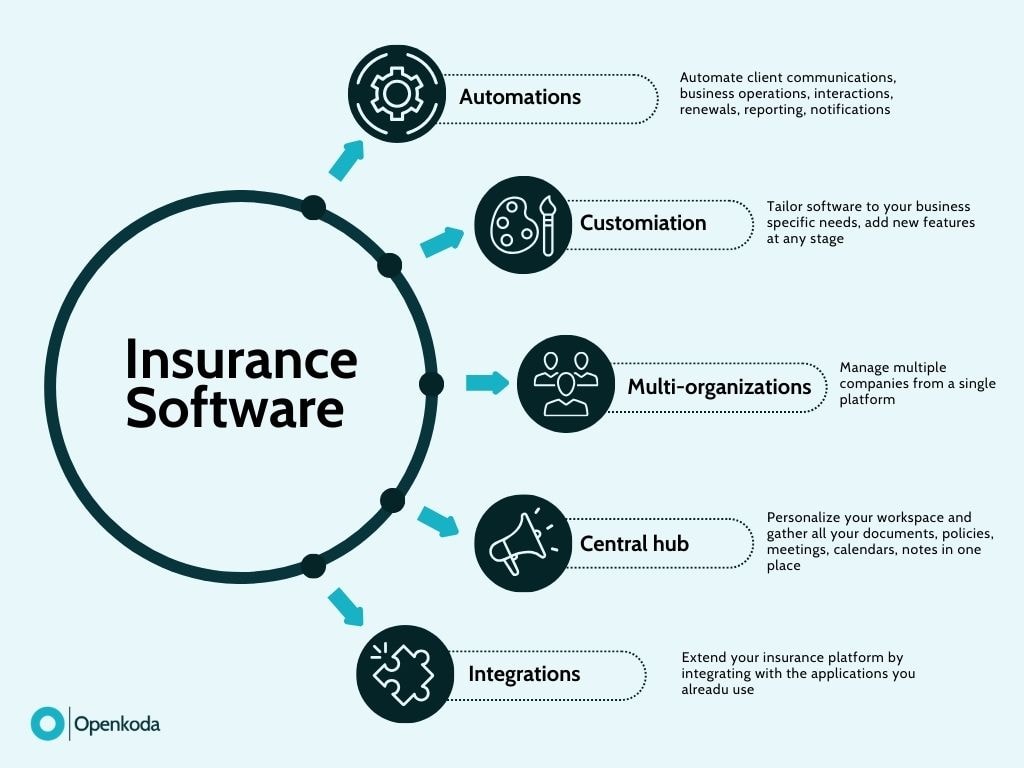

As you can see on the graph, the right insurance management platform centralizes all types operations, supports various non and embedded insurance products, automates routine tasks, streamlines quoting and billing, ensures compliance, and automates client communication.

Also, this type of software unifies operations, enhances client relationships, and drives business growth.

Apart from that, remember about a comprehensive portfolio of insurance products. It may provide standout capabilities and gives an edge over others in this bustling market space by opening doors for cross-selling and upselling opportunities when it comes true variety among available insurance services allows agencies to take advantage of occasions arise naturally.

For example, a homeowner might also need car or life insurance, increasing revenue and building loyalty through personalized packages designed for each person’s needs.

Finally, having a diverse product offering allows insurance agencies to effectively penetrate different demographic segments in the marketplace and to accurately identify and cater to the different preferences of potential customers.

This paves the way for the insurance software development of innovative niche product lines that resonate with specific audiences, providing ongoing resilience to economic fluctuations and ensuring the stability and longevity of the business.

2. Invest in digital transformation

Remaining competitive in the insurance industry now requires embracing digital transformation.

Digital transformation enhances operational efficiency, extends market reach, and provides a significant competitive edge.

Integrating modern technology and digital tools helps insurance agencies streamline processes, improve client satisfaction, and drive business growth.

One of the key aspects of digital transformation is the deployment of digital platforms that improve customer experiences, automates operational processes, and increase client engagement. Embracing technology and insurance industry trends keeps agencies relevant and opens new growth opportunities.

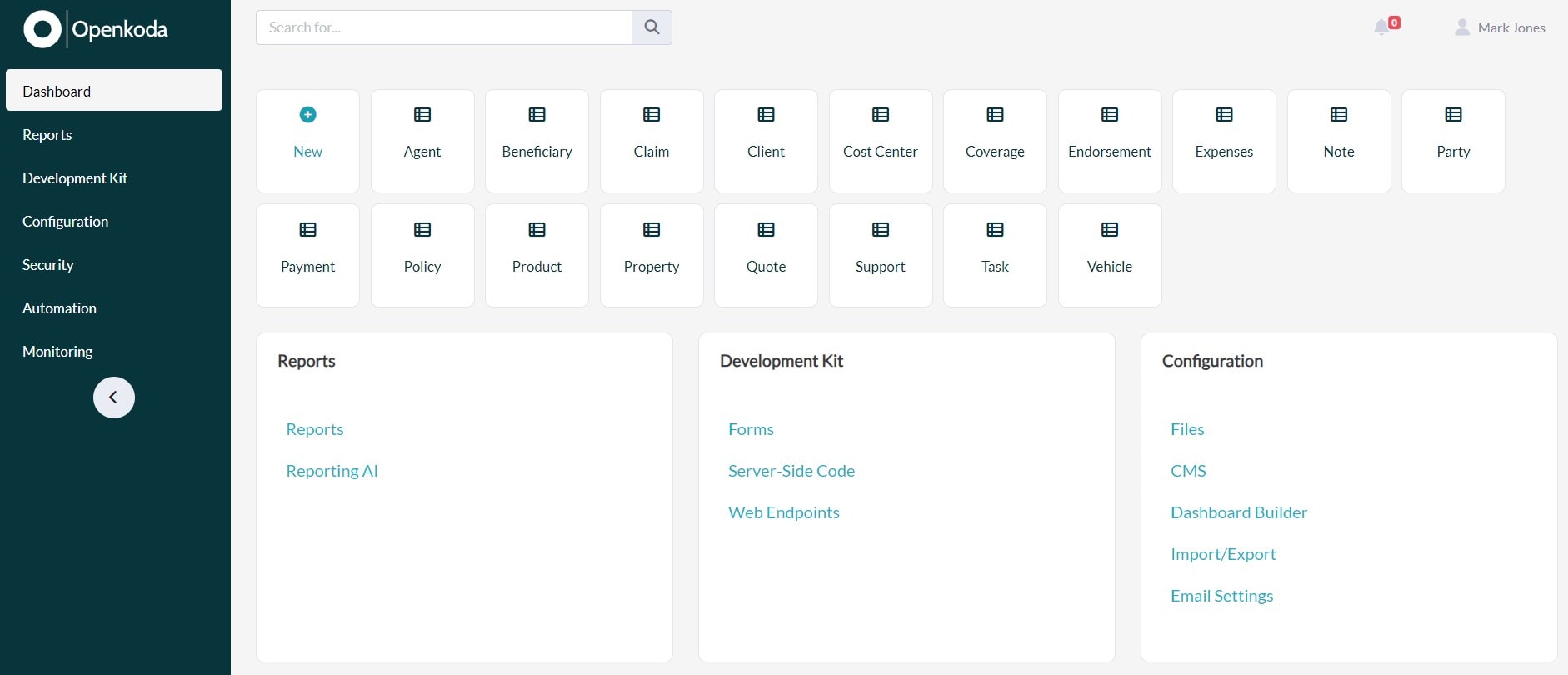

One example of a tool that can facilitate this transformation is Openkoda Insurance Policy Software.

This open source platform offers a comprehensive set of features that can help an agency digitize its operations without vendor lock-in.

By automating policy management, streamlining client communications, and providing AI-driven reporting, Openkoda enables your agency to operate more efficiently and scale effectively.

Its flexibility and endless customization options ensure that it can adapt to your specific business needs, improving both client satisfaction and operational agility.

Implementing such a tool not only improves internal processes, but also positions your agency as a forward-thinking leader in the insurance industry.

Implement custom insurance software solutions

Software platforms tailored for insurance firms, such as Openkoda, are transforming the landscape of insurance agency workflows. They bring automation to a variety of policy management activities including:

- renewal processes

- client interactions

- sending out notifications and alerts

- managing emails

- running reports

By automating these tasks, there is a notable decrease in costs and an increase in operational efficiency.

Centralizing all policy-related documents in one system, combined with intelligent reminders for payments and customer interactions, simplifies daily tasks.

For instance, Openkoda has incorporated an AI Reporting Tool that swiftly creates detailed reports based on natural language inquiries which helps in making faster and more educated decisions.

Its open-source architecture along with straightforward pricing ensures agencies aren’t confined by vendor restrictions, giving them the liberty to tailor their software experience.

The integration of functions like secure user authentication protocols, administration over user roles/permissions/restrictions, as well as personalized dashboard interfaces boosts streamlined work processes contributing to heightened productivity across the board.

3. Leverage data analytics for strategic decisions

In the modern era where data analytics is pivotal, an insurance agency can use this technology to obtain a significant advantage over competitors.

Predictive modeling is especially beneficial as it allows agencies to anticipate future client actions and pinpoint customer segments that are most likely to be lucrative.

Consequently, marketing initiatives become more focused and efficient, aimed specifically at fostering profitable client relationships.

Through the power of data analytics, market segmentation transcends traditional demographic methods by incorporating insights into consumer behaviors and preferences.

This enables the creation of customized marketing messages perfectly aligned with what clients are anticipated to respond favorably to—bolstering engagement rates and improving conversions.

Using analytics to map the customer journey sheds light on critical touchpoints and potential areas where customers may lose interest or disengage altogether.

By understanding these aspects better, agencies can fine-tune their marketing techniques for improved satisfaction among clients while also driving up retention rates.

The application of dynamic pricing models informed by ongoing data not only tailors premiums accurately in line with actual risk, but mutually benefits insurers and insureds alike.

Real-time data helps insurance agencies make better decisions by quickly understanding customer behavior and market trends. This leads to better risk evaluations and more efficient operations.

[Read also: AI-Driven Insurance Analytics: Faster, Better, Smarter]

4. Build stronger relationships with clients

Maintaining client loyalty and retention is crucial for the continued success of any insurance agency.

Clear and consistent communication helps to build trust, which in turn supports client retention.

By offering exceptional customer service, an agency not only keeps its existing clients satisfied, but also attracts new ones through word-of-mouth recommendations.

When agencies proactively engage with their clients during policy renewals, suggesting improved plans or more favorable rates, they reinforce these relationships and show a sincere concern for their clients’ needs.

By customizing and personalizing interactions with customers – knowing them by name and tailoring services to meet individual needs – an insurance agency can increase satisfaction and build lasting relationships with its customers.

Implementing automated systems for communicating with customers ensures that exchanges remain frequent enough to be meaningful yet consistently high-quality in nature.

Enhancing client retention by even a marginal 5% has potential implications on profit margins, with increases possibly reaching up to 95%.

With an average industry standard at around an 84% rate of retainment within the world of insurance providers, significant opportunities are available to boost those numbers higher.

Given that attracting fresh customers may cost as much as five times more than holding onto current ones underscores how focusing on cultivating lasting client devotion offers a practical path toward achieving sustainable expansion over time.

5. Expand Market Reach

Expanding market reach is a powerful strategy for business growth and accessing niche markets.

Targeting niche markets allows agencies to create specialized offerings that resonate with specific segments, leading to deeper client relationships and higher engagement.

Mergers and acquisitions are effective strategies for rapidly increasing market share and revenue.

Partnering with an insurance agency network enhances market access and provides additional resources for growth.

6. Utilize Effective Marketing Strategies

Effective marketing strategies are crucial for building a strong brand identity and driving growth in the insurance industry.

Here are some key components to consider.

- Identifying target audiences

- Crafting compelling messaging

- Enhancing online presence for brand recognition

- Helping clients understand the uniqueness of your agency

These elements are essential for successful marketing in the insurance sector.

Measuring the effectiveness of various marketing strategies, both digital and print, is critical for optimal success. Digital marketing strategies such as social media engagement and email marketing can help agencies maintain relationships with clients and achieve client retention.

Innovative marketing tactics, including targeted advertising and content marketing, are crucial for gaining a competitive edge in the insurance industry.

Develop a comprehensive marketing plan

For sustained marketing endeavors and the expansion of a business, an all-encompassing marketing strategy is critical.

Segmenting your audience to group prospective clients with similar traits boosts the precision of targeting efforts

When it comes to content production, zero in on crafting materials that speak directly to the needs and preferences of your target demographic through blog articles, videos, and postings across various social media platforms.

To ensure broad coverage and heightened interaction during campaign roll-out, employ a diverse array of digital promotion techniques including email marketing as well as advertising on social networks. It’s vital to track the effectiveness of these campaigns using analytics tools.

This data provides valuable insights into successful strategies as well as those requiring optimization.

Engage with community and networking events

Participation in local community events and leveraging networking opportunities can significantly boost an agency’s profile, thus drawing the interest of new clients.

Such engagement also fortifies bonds within the community and offers a stage to demonstrate the agency’s dedication.

Build a strong brand identity

A strong brand identity fosters client loyalty and maintains a competitive advantage.

A unique selling proposition (USP) helps insurance agencies stand out from competitors by highlighting unique features such as flexible hours or specialized expertise.

Consistent branding reinforces recognition and keeps the agency top-of-mind for clients, crucial for business growth.

Participating in local events significantly enhances brand exposure and community connection for insurance agents.

Using specific colors and clear fonts in branding materials conveys trust and professionalism, strengthening the agency’s corporate identity. A strong brand identity boosts client retention, motivates employees, and contributes to revenue growth.

7. Invest in employee development

Developing the skills of employees is vital for maintaining excellence in service and promoting growth within an organization.

In the ever-changing insurance industry, continuing education enables insurance professionals to handle intricate policy details and embrace new technologies.

Establishing a culture that values continuous learning positions companies to effectively address new challenges and seize opportunities as they arise.

Equipping staff with access to educational materials such as ebooks, seminars, and training programs fosters professional advancement while cultivating potential leaders within the company.

When employees are proficiently trained, they become more confident, motivated, and efficient, directly improving client retention rates along with increasing referrals.

Fostering employee development stands as a key strategy for sustainable growth by preparing personnel to navigate shifting products and regulatory landscapes in the insurance sector.

[Read also: Data-Driven Insurance: Opportunities and Common Issues]

8. Streamline operational processes

Automation streamlines operational processes, allowing for faster task completion while maintaining high-quality standards.

Automation improves operational efficiency and enhances customer satisfaction by freeing agents to focus on complex issues requiring personal attention.

Automated systems can assist in compliance by tracking regulatory changes and ensuring adherence to industry standards.

Effective insurance agency management software, like Openkoda, streamlines operations, improves customer service, and increases efficiency for a successful insurance agent. The software should offer features like customer management, policy administration, claims tracking, and analytics.

Optimizing workflows through automation enhances operational efficiency and fosters improved customer satisfaction.

Summary

In our journey through the top insurance agency growth strategies, we’ve explored various ways to achieve a competitive edge. From diversifying your insurance offerings to leveraging data analytics, embracing digital transformation, and building a strong brand identity, each strategy plays a crucial role in driving business growth. Enhancing customer experience with digital platforms, fostering client loyalty, expanding market reach, and utilizing effective marketing strategies further strengthen your agency’s capabilities.

Investing in employee development, setting and tracking SMART goals, and streamlining operational processes are additional pillars that support sustainable growth. By implementing these strategies, your insurance agency can not only boost revenue and client satisfaction, but also establish a strong foothold in the competitive insurance market. Ready to transform your agency into a beacon of success? The time to act is now.

FAQ

Why is diversifying insurance offerings important for an agency’s growth?

Diversifying insurance offerings is crucial for growth as it allows you to meet diverse client needs, enhances client retention, and opens doors for cross-selling and upselling.

Embrace this strategy to elevate your agency’s success!

How can data analytics benefit an insurance agency?

By leveraging data analytics, an insurance agency can achieve precise segmentation of the market and tailor its marketing strategies to individual needs. This leads not only to better decision-making, but also enhances operational efficiency.

Adopting these tools is key for your agency’s expansion and maintaining a competitive edge in the industry!

What role does digital transformation play in the insurance industry?

Digital transformation is crucial for the insurance industry as it boosts operational efficiency, expands market reach, and elevates customer satisfaction through streamlined processes and advanced technology.

Embrace this change to stay competitive and meet evolving customer needs!

How can an insurance agency foster client loyalty and retention?

To nurture loyalty and ensure the retention of your clients, prioritize consistent communication and deliver outstanding service. Tailor your interactions to each client’s needs and consider implementing loyalty programs.

By employing these tactics, you can develop robust relationships with your clientele that will encourage their continued patronage.

Why is it important for insurance agencies to invest in employee development?

Focusing on the growth of your team is essential, as it improves service quality, equips employees to handle sophisticated policies effectively, and enables them to embrace emerging technologies. These advancements are instrumental in maintaining client loyalty and stimulating word-of-mouth recommendations.

When you make a commitment to your staff’s development, you’re laying the groundwork for sustained success!