Generative AI Use Cases in Insurance Industry

Generative AI is rapidly reshaping how insurers think about automation, productivity, and customer experience across the entire insurance value chain.

From underwriting and claims to reporting and customer communications, the technology promises significant gains – but early adoption has shown that success depends less on ambition and more on execution.

This article explores where generative AI is truly delivering value in insurance today, what early pilots have taught the industry, and how insurers can adopt the technology in a practical, responsible way.

Generative AI Solutions in the Insurance Sector: Promises and Disappointments

The hype around generative AI and gen AI in business is enormous.

When large language models burst onto the scene, many insurance organizations and industry leaders assumed that the technology could overhaul entire workflows—from underwriting to claims adjudication—almost overnight.

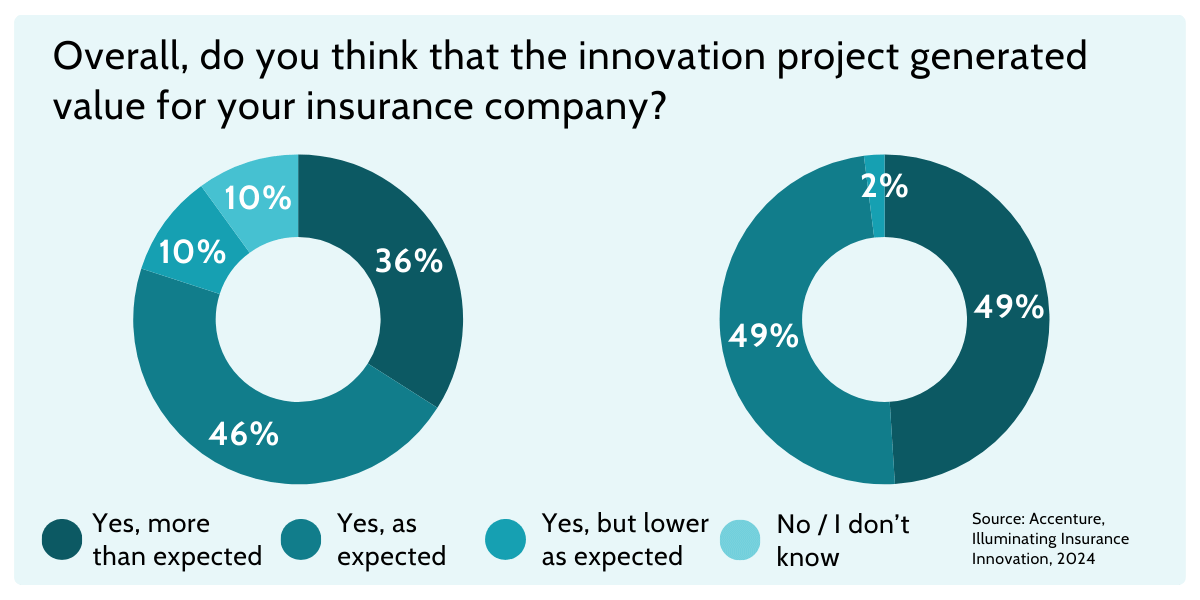

However, real-world data suggests a more sobering picture.

A lot of “best-performing” AI automation tools look impressive in demos, but the biggest pattern emerging from early AI pilot programs across companies is much simpler: the teams that get real ROI start small.

According to research referenced across multiple industry analyses, a very high proportion of enterprise generative AI pilots have struggled to deliver meaningful financial returns or move beyond the pilot stage. For example, one influential study found that roughly 95 % of generative AI pilots failed to deliver measurable ROI for companies, often because the initiatives were not well integrated into existing business processes or did not align with core performance metrics.

This doesn’t mean the technology is fundamentally flawed – far from it.

The lessons lie in how you deploy it.

What early AI pilots taught us: automate one small task first

A recurring theme from early generative AI experiments, especially among insurance industry leaders, is this: it’s far more effective to start with a narrowly scoped task than to try replacing whole workflows with generative AI.

Many organizations made the mistake of adopting AI tools as catch-all solutions. They gave teams generic bots or copilots and expected broad efficiency gains. But without integration into the workflow, clear governance, and measurable outcomes, these initiatives often stalled or delivered “interesting demos” rather than operational impact.

A better approach is: automate a single bottleneck. For example, rather than replacing the whole support workflow, you might use AI only to:

- They target a specific, repetitive pain point where automation can reduce time and errors.

- They embed AI outputs within existing technology and workflow frameworks.

- They maintain human oversight, especially in regulated sectors like insurance.

For example, an insurance organization might initially pilot an AI solution to automate a tiny portion of the claims process—such as document classification or template drafting—rather than attempting to automate the entire claims lifecycle. That narrow focus yields faster insight, clearer measurement of impact, and shorter time to value.

By contrast, trying to automate everything—from customer onboarding to risk scoring—with a single platform often results in stalled pilots and frustrated stakeholders.

[Read also: Insurance Industry and Insurtech Trends for 2026]

Generative AI in Insurance: Key Examples that Actually Work

While many discussions around generative AI in insurance remain theoretical, some use cases are already proving their value in real operational environments.

Let’s highlight some practical examples where insurers are applying generative AI in focused, well-defined ways to improve efficiency, accuracy, and day-to-day decision-making.

“Micro-automation” Inside Core Platforms

One of the most effective ways to apply generative AI in insurance is through micro-automation – small, task-specific capabilities embedded within core operational platforms that reduce friction and accelerate workflows.

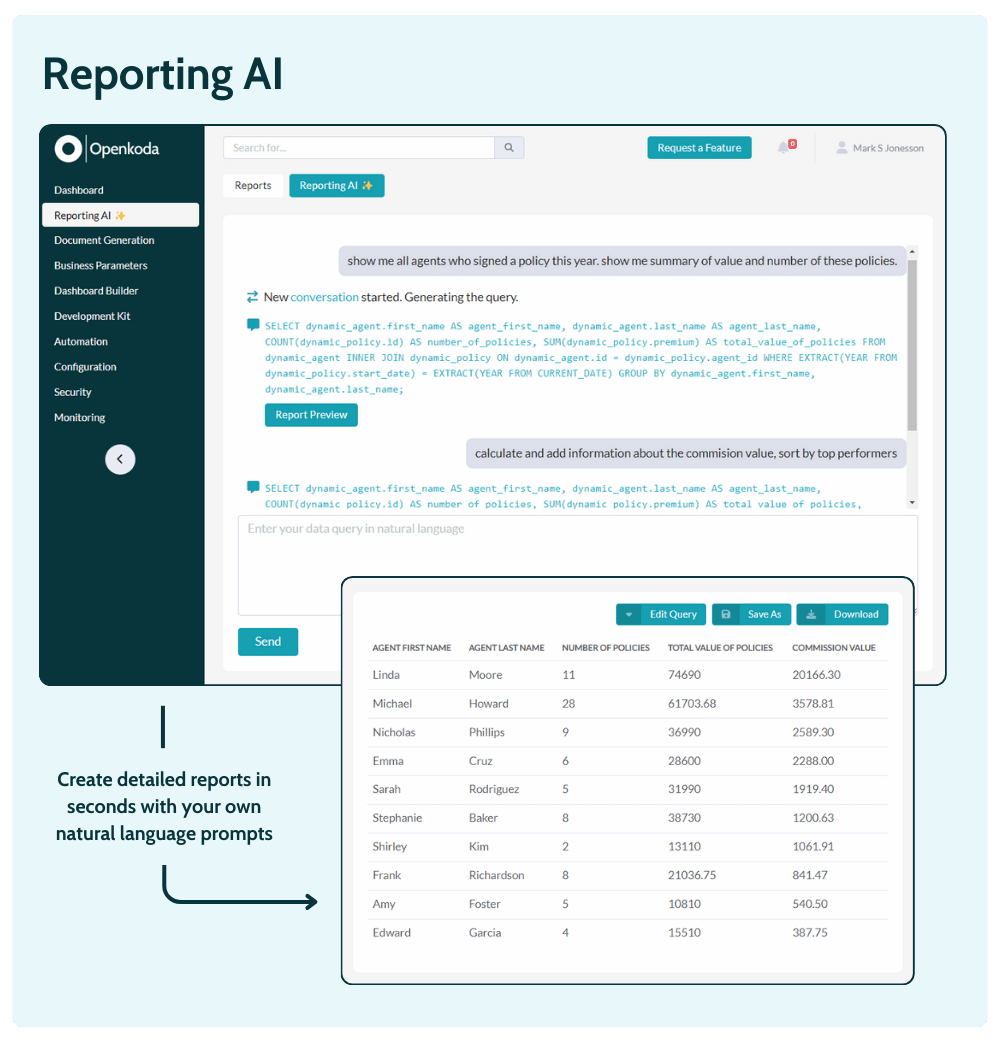

A great illustration of this approach is Openkoda’s Reporting AI, a feature built into the Openkoda insurance platform that uses natural language processing to translate plain-language questions into SQL queries and automated reports.

Users simply describe the data insights they need — for example “show me total premium written by region this quarter” — and the AI system generates the corresponding database query, retrieves the results, and presents them in a readable format.

This reduces reliance on technical analysts, accelerates decision-making, and empowers business users to extract insights from complex datasets without writing code.

By focusing on this narrow but high-impact task rather than trying to automate entire data engineering pipelines, Openkoda demonstrates how generative AI solutions can augment productivity within an insurance core platform without overcomplicating workflows.

This type of targeted automation helps customer support teams, underwriting units, and analytics groups get timely answers while keeping governance and control in human hands.

[Read also: Top 10 AI Reporting Tools in 2026]

Document and email drafting from structured data

Another practical application of generative AI in the insurance industry lies in automating the creation of routine documents and communications — tasks that are repetitive, time-consuming, and prone to inconsistencies when done manually.

Many insurance organizations still rely on manual drafting of letters, policy documents, renewal notices, claim acknowledgments, and customer follow-ups.

With generative AI solutions, insurers can generate this content automatically by feeding structured data (like policyholder details, coverage terms, claim status, or payment schedules) into an AI model trained on approved templates and communication standards.

For example, an AI system can produce personalized renewal notices or claim update emails that are consistent in tone and compliant with internal and regulatory guidelines, then route them for review by customer service representatives or legal teams before distribution. This not only accelerates turnaround times but also helps maintain quality and reduce human error, freeing up time for those teams to focus on more complex customer interactions.

Natural language processing and artificial intelligence makes it possible to interpret structured inputs and produce fluid, context-aware text that aligns with brand voice and compliance requirements.

That’s how:

- Humans still approve the final output

- The AI saves time on repetitive writing

- The organization keeps control through templates and tone rules

Enhanced Underwriting

Underwriting is one of the areas where insurance generative AI delivers value fastest—provided it’s used to support decisions, not replace them. Instead of positioning generative AI technology as an autonomous risk engine, insurers are successfully using it to enhance how underwriters work with information.

Modern underwriting relies on a mix of structured and unstructured data: application forms, historical claims data, inspection notes, third-party reports, and free-text disclosures. Generative AI can quickly summarize, normalize, and contextualize this information so underwriters can focus on judgment rather than data wrangling.

Typical high-impact use cases include:

- Summarizing long risk descriptions or broker submissions into standardized risk profiles

- Highlighting inconsistencies between application data and historical claims

- Generating underwriting notes or recommendations based on predefined risk rules

By augmenting risk assessment rather than automating it end-to-end, generative AI in insurance improves speed and consistency while keeping accountability firmly with human experts—an approach that resonates strongly across the insurance industry.

Data extraction + validation from incoming documents

Another area where artificial intelligence proves its worth is the unglamorous but essential task of extracting data from documents. Every insurer deals with large volumes of PDFs, scans, images, and emails—repair invoices, medical reports, estimates, statements—that feed into underwriting and claims management software.

Here, generative AI is used not to “decide outcomes,” but to:

- Extract key fields from documents (amounts, dates, identifiers)

- Validate extracted data against existing systems

- Flag missing, inconsistent, or suspicious entries for review

Because these workflows combine structured and unstructured data, traditional automation often falls short. Generative models, however, can interpret context and language while still operating within clear validation rules.

The result is faster intake, fewer manual errors, and smoother claims automation—all without removing humans from the loop.

This approach scales well and reduces operational friction, especially in high-volume lines of business where document handling is a major bottleneck.

Streamlined Claims Processing

Last but not least we’ve got claims processing.

Claims processing is one of the most operationally complex areas in the insurance industry, and it is also where policyholders most directly experience the quality of service.

For this reason, successful insurance generative AI initiatives in claims tend to focus on removing friction from day-to-day work rather than attempting full automation of decision-making. The goal is to speed up handling, improve consistency, and support human adjusters—while keeping control and accountability firmly in place.

In practice, generative AI technology is increasingly used to analyze and summarize claims data spread across multiple systems and documents.

When a claim changes hands or escalates, AI can generate concise summaries of the claim history, key events, and outstanding issues, allowing adjusters to quickly understand the context without reviewing dozens of records. This significantly reduces handling time and helps teams maintain continuity, especially in high-volume environments.

Generative AI is also improving outbound and inbound customer communications during the claims process. By drafting clear, consistent claim acknowledgments, status updates, or explanations of next steps, AI systems help insurers respond faster to customer inquiries while maintaining a professional and compliant tone. Customer service representatives can review and approve these messages rather than writing them from scratch, which improves efficiency and reduces the risk of inconsistent messaging.

When applied in this focused way, generative AI in insurance supports smarter claims management without overstepping into automated decision-making. The result is a smoother claims experience, faster resolution times, and higher customer satisfaction—demonstrating how artificial intelligence can deliver real value when aligned with operational realities.

So… which AI automation tools are “best-performing”?

In the insurance sector, the best-performing generative AI solutions are rarely the most complex or the most hyped.

In practice, the “best” tools are usually the ones that:

- They integrate into existing systems such as CRM platforms, policy administration systems, claims management tools, BI solutions, or customer service software. This avoids disruptive technology replacements and ensures that generative AI supports existing workflows instead of fragmenting them.

- They include guardrails, audit trails, and human approval steps, which are critical when using gen AI tools in underwriting, claims, or customer communications. These controls reduce compliance and reputational risks while allowing insurers to benefit from automation.

- They focus on one repeatable task with measurable impact, such as report generation, document drafting, data extraction, or triage. Narrowly scoped use cases that boost human expertise and not replace it make it easier to track ROI and refine models before scaling.

When evaluating generative AI tools, insurers are better served by starting with the use case – not the technology.

Identifying where friction exists today (for example, reporting delays or manual document handling) and selecting a tool that can deliver a production-ready micro-automation is far more effective than rolling out broad, generic AI platforms.

Once these foundations are proven, expanding into more advanced generative AI solutions becomes both safer and more sustainable.

[Read also: Life Insurance Statistics and Trends (2026)]

The Future of Insurance Generative AI

Over the next few years, insurance companies will increasingly leverage generative AI not as a single “big bang” transformation, but as a portfolio of tightly governed capabilities spread across underwriting, claims, service, and analytics.

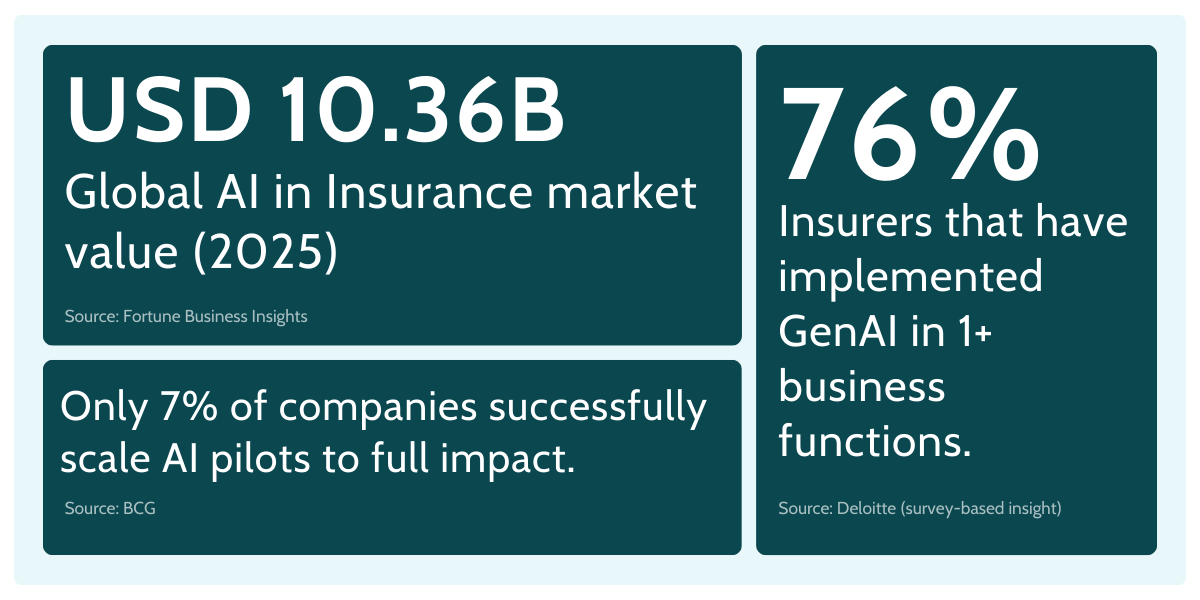

The opportunity is significant: McKinsey estimates $50B–$70B in insurance-industry revenue impact from gen AI productivity gains across business functions.

Yet a persistent pattern is also clear—many insurers are still struggling to move from pilots to scaled, repeatable value. BCG reports that only 7% of insurers surveyed have successfully brought AI systems to scale, with about two-thirds still in the piloting stage.

Bain estimates that, at full potential, generative AI could drive a 20%–25% decrease in P&C claims loss-adjusting expenses, largely by helping handlers locate and connect information faster.

This direction fits the broader shift toward claims assistance: using claims data to speed up investigation, documentation, and customer-facing updates – while keeping decision authority with humans.

Some of the most visible benefits of generative AI in insurance are emerging in customer interactions, where clarity and tone matter. At the same time, using AI in communications raises potential risks (hallucinations, incorrect coverage wording, inconsistent guidance), especially when models draw on sensitive customer data. This is why insurers are investing in guardrails: approved templates, grounding in policy language, review workflows, and audit trails.

The direction is promising – but it’s also disciplined.

The future belongs to insurers who treat generative AI as a capability to be engineered responsibly: narrow use cases first, strong governance around customer data, and steady expansion once measurable outcomes are proven.