Bordereau Insurance

What Is a Bordereau?

A bordereau is a detailed and structured report used by an insurance company to share detailed information about policies, premiums, or claims with another party, most often within reinsurance contracts.

In practice, it acts as a standardized snapshot of portfolio performance, outlining items such as insurance premiums, sums insured, claims activity, and overall risk exposure.

Within the reinsurance industry, bordereau reporting is essential. It enables reinsurers to understand what risks they are backing, supports ongoing risk management, and ensures transparency throughout the lifecycle of reinsurance contracts.

The Origins of Bordereau

The term bordereau comes from French, where it originally meant a slip or summary list.

The term gradually entered the insurance vocabulary in continental Europe during the 18th and 19th centuries, alongside the early development of cross-border insurance and maritime risk sharing.

Its widespread adoption came with the rise of the reinsurance industry, particularly in London and continental European markets, where insurers needed a reliable way to communicate portfolio details to multiple counterparties.

As reinsurance contracts became more sophisticated, covering entire books of business rather than individual risks, simple narrative reporting was no longer sufficient.

Bordereaux evolved into standardized reporting tools, designed to present consistent, repeatable datasets covering premiums, exposures, and claims. Over time, they became a cornerstone of bordereau reporting, supporting transparency, auditability, and effective risk management across increasingly complex international insurance networks.

Real-world Examples in Insurance Industry

Today, bordereaux are embedded in everyday operations across global insurance and reinsurance workflows. They are not theoretical documents, but working tools used to monitor portfolios and manage financial and underwriting risk. Common examples include:

- Reinsurance portfolio reporting: Insurers submit periodic bordereaux to reinsurers showing written premiums, policy limits, and accumulated risk exposure, enabling accurate capital allocation and monitoring.

- Delegated authority oversight: When underwriting is delegated to MGAs, bordereaux provide insurers with ongoing visibility into pricing, coverage terms, and premium development, supporting control and governance.

These practical uses set the stage for understanding the different types of bordereau, each focused on a specific aspect of insurance operations.

Types of Bordereau

While the term bordereau is often used generically, in practice there are several distinct types, each serving a specific purpose within the insurance industry.

An insurance company may produce different bordereaux depending on what needs to be reported, to whom, and at what point in the relationship.

Importantly, not every reinsurance contract requires the same level or type of reporting.

These variations exist to meet the practical needs of insurance professionals, from underwriters and finance teams to claims specialists, working with different data sets across a defined reporting period. The most common formats focus on risk, premiums, and claims, with each playing a unique role in managing reinsurance contracts and financial transparency.

Risk Bordereau

A risk bordereau provides a detailed overview of the risks included in a ceded portfolio. It typically lists individual policies or risks, along with key attributes such as location, limits, coverage type, and exposure values. This format allows reinsurers to clearly understand what they are backing and how the overall portfolio is constructed.

For insurers, the risk bordereau supports underwriting control and portfolio analysis. For reinsurers, it is a foundational input for accumulation monitoring and exposure management, especially in lines where geographic or concentration risk matters.

Premium Bordereau

A premium bordereau focuses on the financial side of the portfolio, detailing written, earned, and sometimes unearned insurance premiums over a specific reporting period. It is the backbone of premium bordereau reporting, ensuring that ceded premiums align with the terms set out in reinsurance contracts.

This type of bordereau is critical for accurate accounting and settlements between parties. It enables both insurers and reinsurers to reconcile cash flows, calculate commissions, and track premium development over time.

Claims Bordereau

A claims bordereau captures loss activity within the reinsured portfolio.

It includes information on reported and paid claims, reserves, and claims expenses outstanding, offering a clear view of loss performance.

For all parties involved, this transparency is essential.

Claims bordereaux allow insurers and reinsurers to monitor loss trends, assess reserve adequacy, and support informed decision-making throughout the lifecycle of the reinsurance relationship.

The Operational Reality: Challenges in Bordereau Processing

In theory, a bordereau is a clear and structured reporting mechanism. In reality, bordereau processing remains one of the more complex aspects of insurance reporting. Many insurance company teams still rely on spreadsheets, emails, and manual validation, even as portfolios and reporting demands grow across the insurance industry.

One challenge lies in consistency.

A bordereau is often discussed in its singular form, yet in practice it represents a constantly evolving stream of data covering multiple insurance policies, reporting periods, and partners. Whether it is a premium bordereau, a loss bordereau, or a hybrid format, each version may differ slightly in structure, definitions, or level of detail. This makes scalable data management difficult, especially when tracking premium revenue, claims paid, and historical loss data over time.

The situation becomes even more complex when bordereaux are used to support transferring risk through reinsurance. Reinsurers depend on accurate, timely loss data to assess exposure and performance, while insurers must ensure alignment across underwriting, finance, and claims teams.

Common operational challenges include:

- Inconsistent data formats: Different bordereau templates and structures make aggregation and comparison difficult across partners and reporting cycles.

- Manual data entry and validation: Spreadsheet-based bordereau workflows increase the risk of errors, delays, and reconciliation issues.

- Limited visibility into claims development: Tracking changes in claims paid and reserves over time is harder when bordereau versions are not centrally managed.

- Delayed reporting cycles: Slow bordereau production can impact financial close processes and reinsurance settlements.

- Poor integration with core systems: When bordereaux are disconnected from policy, billing, and claims platforms, maintaining accurate, auditable reporting becomes a constant struggle.

These operational realities explain why modern insurers increasingly look for more robust, system-driven approaches to bordereau management.

Openkoda: Supporting Faster Bordereau Processing

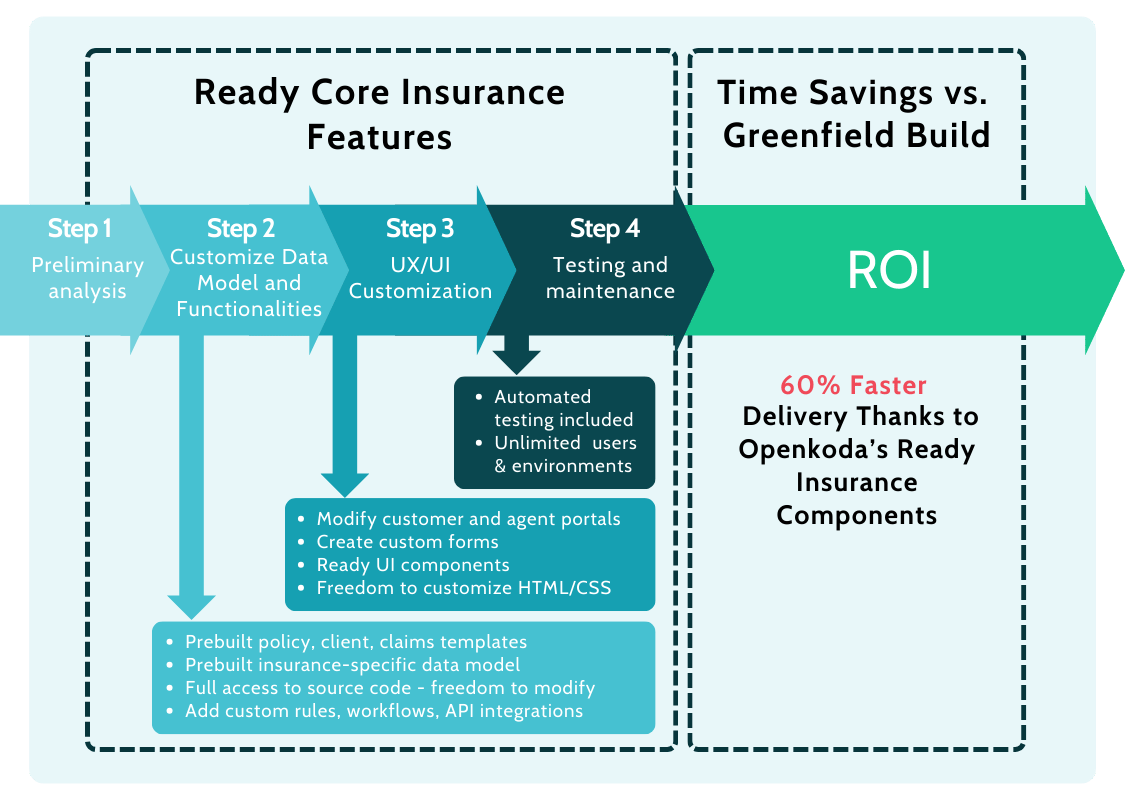

These challenges are precisely where modern insurance software plays a vital role.

Openkoda provides a flexible software core that insurers and reinsurers can use to manage bordereaux as part of a broader, integrated data architecture, rather than as isolated spreadsheets or one-off files.

By connecting bordereau workflows directly to policy, billing, and claims data, Openkoda makes it possible to generate a single report or multiple tailored outputs from the same trusted data source. This allows teams to produce a detailed report covering premiums collected, claims development, and exposure metrics, while maintaining consistency across stakeholders. Insurers can effectively monitor portfolios written in primary insurance and reinsurance alike, with full traceability back to source systems.

Just as importantly, Openkoda helps insurers ensure compliance with contractual and regulatory requirements. Standardized, auditable reporting reduces operational risk, supports oversight of potential liabilities, and gives finance, underwriting, and risk teams confidence in the numbers they rely on, every reporting cycle.

The Bottom Line

When done well, bordereau reporting transforms raw data into actionable insight, enabling better decisions across underwriting, finance, and risk management.

For the insurance industry, the ability to reliably produce and analyze bordereaux is no longer optional- it is essential to operating at scale and with confidence.