Best Claims Management Software Solutions in 2026

As extreme weather events are growing ever more unpredictable, and new risks seem to emerge overnight, insurers are continuing to modernise their claims processing operations.

Today’s best claims management solutions blend cloud scalability and customizability with AI-driven insights, turning mountains of claims data into faster decisions and happier policyholders.

In this guide, we unpack the platforms that are currently at the top, explain their key features, and help you match each system to your own operational goals.

Claims Management Software Explained

Claims management software is a digital solution used by insurance companies to handle, process, and track insurance claims throughout their lifecycle – one of the key processes in the day-to-day operations of every insurer.

It helps automate and organize tasks such as claim intake, assessment, documentation, communication, and settlement.

The traditional approach to claims processing often involved spreadsheets, siloed systems, and manual paperwork.

This not only made the process slow and error-prone but also left little room for visibility and scalability.

In contrast, today’s claims management software is built to centralize data, automate workflows, and support seamless communication between claims adjusters, underwriters, policyholders, and third-party providers.

Why does this matter in 2026?

Because the volume, velocity, and variety of claims keep rising.

Global spend on claims-processing software is projected to jump from about $42 billion in 2025 to roughly $45.7 billion this year, with double-digit growth still ahead as carriers double-down on digitization.

What’s more, these days claims management software often goes beyond simple file-tracking and document management – in 2026 insurers can embed AI that flags potential fraud, auto-routes tasks to the next specialist and even pre-fills damage estimates using computer-vision models, making their claims management solutions real power tools for the whole organization.

Key Features of Insurance Claims Management Software

Before we dive into vendor-by-vendor comparisons, it helps to ground ourselves in the capabilities that separate a modern claims platform from the legacy stacks many carriers are still retiring.

Below are six functions you’ll see referenced again and again in 2026 product brochures – and, more importantly, in board-room ROI discussions.

- Automated Workflow Management

Streamlines claims handling by automating routine tasks such as claim routing, notifications, document generation, and approvals – reducing manual work and shortening resolution times. - First Notice of Loss (FNOL) Capture

Enables fast, accurate claim initiation through digital channels such as online portals, mobile apps, or integrated systems – often enhanced with real-time validation and prefilled fields. - Integrated Document Management

Centralizes the storage and retrieval of documents, images, forms, and communication, making it easier for teams to collaborate and stay compliant throughout the claims process. - Analytics and Reporting Tools

Offers dashboards and insights that help insurers monitor KPIs, identify trends, and improve performance. Some systems, like Openkoda’s Reporting AI, go a step further by allowing users to generate custom SQL queries using natural language, thanks to embedded generative AI. - System Customizability and Business Rule Automation

Enables insurers to adapt the platform to their specific processes – whether by configuring claim workflows, defining decision rules, or setting up automated actions for different claim scenarios, all without deep coding expertise. - Open Integrations and API Support

A robust claims platform should seamlessly connect with the insurer’s broader software ecosystem. API support ensures real-time data exchange with policy administration systems, CRM tools, payment gateways, fraud detection engines, and more.

Best Claims Management Solutions in 2026

With insurers under increasing pressure to improve operational efficiency, reduce cycle times, and meet rising customer expectations, choosing the right claims management software is more important than ever.

The market in 2026 offers a strong mix of established platforms and flexible newcomers – each catering to different needs, from enterprise-level insurers to agile insurtechs.

Here are some of the best claims management solutions currently on the market for you to choose from:

Openkoda Claims Management

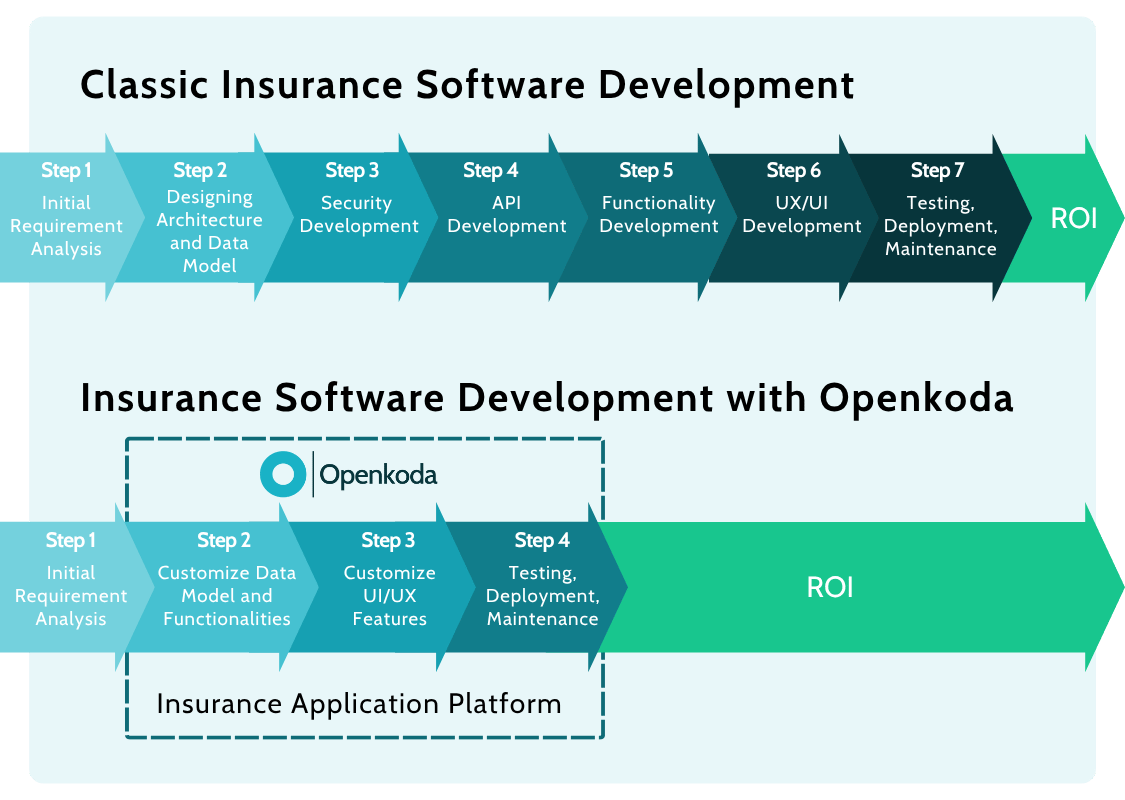

Openkoda is an insurtech platform designed to help insurers build and customize their own claims management systems with speed and control.

Because its core is built upon an open source tech stack including Java, insurers own the code outright, can modify it at will, and avoid completely the user-based pricing – ideal for rapidly growing organizations, TPAs, and vendors that need access.

Deployment is equally flexible: run it as a multi-tenant SaaS, host it on your preferred public cloud, or drop it into an on-prem Kubernetes cluster.

With domain-specific templates – including insurance claims management, policy management, embedded insurance, and insurance automation accelerators – Openkoda lets organizations deploy operational platforms fast, then tailor everything, from workflows to user interfaces, to their unique needs.

Thanks to these pre-build components Openkoda claims a 60 % reduction in delivery time versus green-field custom builds.

Key Features

- Pre‑built claims management and insurance policy application modules, delivering up to 60 % faster development cycles.

- Reporting AI – An advanced reporting tool that can generate SQL queries from natural language prompts that can later be used in visualized dashboards, and shareable reports designed for insurance teams.

- API‑first, event‑driven architecture offering REST/GraphQL connectivity and easy integration across legacy systems and third-party tools.

- Rich business process automation – dynamic workflows, seamless data exchange, event listeners, notifications, job scheduling, and document generation (PDF/Word/Excel).

- Role‑based security, audit trails, multi‑tenancy support, and GDPR‑ready compliance features out of the box.

- No per‑user licensing – the platform supports unlimited users under fixed pricing, helping insurers scale without surprises.

Best For

- Insurers or insurtechs who need custom and flexible workflows aligned with niche or evolving business models.

- Teams prioritizing faster time to market and wanting to build systems tailored to their process rather than adopting monolithic vendor templates.

- Companies that prefer transparency in pricing and want to avoid per‑user license fees as they grow.

Duck Creek Claims

Duck Creek Claims is a comprehensive, cloud-native claims management platform that helps insurers streamline operations and reduce manual processes from FNOL all the way to settlement.

With seamless integrations, real-time claims data, and low-code configurability, it’s built to boost operational efficiency and lift customer satisfaction

It’s designed to modernize legacy systems, automate repetitive tasks, and let insurers focus on higher-value work – making the claims process faster, more accurate, and more transparent for both staff and policyholders

Key Features

- Automated workflows for claim intake, evaluation, and settlement, which help reduce reliance on manual processes and improve consistency across the claims lifecycle.

- Triage and assignment tools that support rules-based and data-informed claim routing to appropriate adjusters or teams based on various factors.

- Real-time dashboards and reporting, giving insurers access to up-to-date claims data for tracking performance metrics and identifying operational trends.

Best For

- Insurers focused on improving operational efficiency by reducing manual tasks and standardizing claims processes.

- Organizations looking to leverage claims data for operational insights and resource management.

- Teams aiming to deliver better customer satisfaction through timely updates and clear communication.

FileHandler

FileHandler, also known as FileHandler Enterprise, is a legacy claims management software that insurance providers and third-party administrators (TPAs) have used for decades.

It supports the entire claims cycle – from first notice of loss (FNOL) through case resolution and final payments – within a single platform, helping reduce claims cycle time and simplify the oversight of claim activities

Key Features

- Full claims lifecycle management – Supports FNOL intake, assignment, evaluation, payments, and closure in one unified system

- Workflow automation based on business rules – Users can configure automatic tasks, notifications, and case routing to reduce manual interventions and accelerate claims processing

- Case, document, and claims data management – Centralizes documentation, attachments, audit logs, and communication history in a structured repository for compliance and tracking

Best For

- Third-party administrators (TPAs), self-insured organizations, and legacy insurance providers looking for a stable, proven system to manage claims with structured workflows.

- Companies aiming to reduce claims cycle time by eliminating manual steps and introducing rule-based automation.

Guidewire ClaimCenter

Guidewire ClaimCenter is a widely adopted claims management software designed for property and casualty (P&C) insurance providers managing personal, commercial, and workers’ compensation lines.

Unlike more lightweight or general-purpose platforms, it offers a highly structured architecture designed to support complex claims operations.

What sets ClaimCenter apart is its native integration with Guidewire’s broader InsuranceSuite – including policy, billing, and underwriting modules.

Key Features

- Seamless integration with Guidewire PolicyCenter and BillingCenter for full-suite insurance lifecycle management.

- Modular add-ons like Guidewire Predict and Explore for real-time analytics, severity forecasting, and benchmarking.

- Advanced claims segmentation and triage, enabling complex business rules and prioritization models.

Best For

- Enterprise P&C carriers with complex claims processes across multiple lines of business.

- Legacy insurers modernizing infrastructure while needing deep integration with other core systems.

Origami Risk

Origami Risk offers a unified, cloud-native SaaS platform that combines claims administration with policy, billing, risk, and analytics modules.

What sets Origami apart is the platform’s seamless convergence of claims management with broader risk and policy administration capabilities.

That unified data model enables insurers to manage claims lifecycle end‑to‑end while accessing rich analytics and workflow automation – all without switching environments.

Key Features

- Unified SaaS platform combining policy, billing, claims, and analytics on a single multitenant system, avoiding disparate point solutions

- Low‑code configurability: insurers and administrators can modify workflows, data fields, rules, and processes without custom coding.

- Legacy data migration support: tools and expert services assist insurers in consolidating historical claims data into the Origami platform.

Best For

- Insurers, TPAs, MGAs, and risk pools that require a single system for claims, policy, billing, and analytics operations.

- Firms transitioning from legacy stacks who need configurability without heavy development and support for data migrations.

Snapsheet Claims Platform

Last but not least we have Snapsheet Claims Platform. It is a cloud-native, modular system that focuses on simplifying auto and property claims workflows – from virtual appraisals to payment delivery.

Originally known for its innovation in virtual auto appraisals, Snapsheet has expanded its capabilities to serve insurers handling residential and commercial property claims with the same digital-first mindset.

For property insurers looking to streamline claims across multiple vendors and adjusters without building a complex system from scratch, Snapsheet offers a clean, API-ready alternative.

Key Features

- No-code workflow editor lets business users define and manage automations for claim intake, assignment, communication, and task routing—without writing code.

- Multi-channel communication via SMS, email, and portals to keep claimants informed throughout the property claims process.

- End-to-end claims and payment automation, including routing for contractor approval and repair estimate validation.

Best For

- Insurers and MGAs focused on streamlining property claims operations, especially in residential and small commercial lines.

- Digital-first insurance startups aiming to implement a fully online, touchless property claims experience.