ACORD Form

ACORD forms are the insurance industry’s standard documents for collecting, sharing, and verifying policy information across carriers, brokers, and agents.

They keep data consistent – from applications to certificates of insurance – so everyone speaks the same language. Below, we’ll clarify what ACORD forms are, where to find them, and how to use them efficiently.

What is an ACORD Form?

An ACORD form is a set of standardized forms the insurance industry uses to collect and share consistent information. ACORD stands for stands for Association for Cooperative Operations Research and Development.

Carriers, insurance agents, and policyholders rely on them so everyone reads data the same way – across liability insurance, property insurance, and other lines. In practice, an ACORD form reduces rework and speeds up approvals because each insurance company knows exactly where to find key fields.

One of the most familiar examples is the ACORD certificate (often ACORD 25), which summarizes active insurance coverage for a third party.

But ACORD also publishes standard forms for applications, changes, cancellations, and more.

Why Are Certificates of Insurance Necessary?

An ACORD certificate proves you have the required insurance coverage – most often liability insurance – for a job, lease, or vendor contract.

It’s a quick snapshot that a counterparty can review without digging into your full policy.

Because the ACORD certificate follows a uniform layout, reviewers can spot limits, dates, and parties at a glance. Faster checks, fewer surprises.

Does Every COI Need to Be ACORD Approved?

Not always.

While many organizations prefer the ACORD certificate because it’s a trusted standardized form, some insurance companies issue their own certificates or digital equivalents.

That said, using ACORD’s standard forms usually speeds acceptance.

Most risk, legal, and procurement teams – including those focused on commercial property insurance – recognize them immediately.

Where Can I find ACORD Forms?

Start with your insurance agent or your insurance company portal; they can issue the needed ACORD form for your situation.

You can also obtain licensed ACORD forms through ACORD membership or approved vendors – ask your agent which path fits your use case.

How Do I Get a Certificate of Insurance for ACORD?

Ask your agent or carrier to issue an ACORD form – most often the ACORD 25 certificate of insurance.

In the insurance industry, this is the standard way to provide proof that your policies are active, especially your liability insurance coverage.

Share the certificate holder’s name and address, any contract wording, and required limits. Your insurer will pull the key information from your policies (limits, effective/expiration dates, policy numbers) and generate the ACORD form, usually delivered by email or through a portal. Because everyone recognizes the layout, reviewers can confirm details quickly – leading to increased efficiency for vendor onboarding, leases, and project approvals.

ACORD Form Examples

An ACORD form standardizes how you present proof of insurance so reviewers can verify you’re properly insured at a glance – whether that’s property insurance, liability insurance, or a certificate of insurance request.

Here are some of the most common types of ACORD forms:

- ACORD 25 — Certificate of Liability Insurance: One-page certificate of insurance widely used to show active general liability (and other liability lines) to third parties.

- ACORD 28 — Evidence of Commercial Property Insurance: Used to prove commercial property insurance to lenders, landlords, or other certificate holders.

- ACORD 27 — Evidence of Property Insurance (personal lines): Shows evidence of personal property coverage (e.g., for a mortgagee).

- ACORD 1 — Property Loss Notice: Standard notice to report a property loss event to the carrier.

- ACORD 2 — Automobile Loss Notice: For documenting car accident information and reporting auto losses to the insurer.

- ACORD 3 — General Liability Notice of Occurrence/Claim: Notifies the carrier of a potential or actual general liability claim.

- ACORD 90 — Personal Auto Application: Standard application for personal auto lines.

- ACORD 125 — Commercial Insurance Application: Core app used with line-specific supplements.

- ACORD 126 — Commercial General Liability Section: CGL supplement to the 125.

- ACORD 130 — Workers Compensation Application: WC application used with the 125.

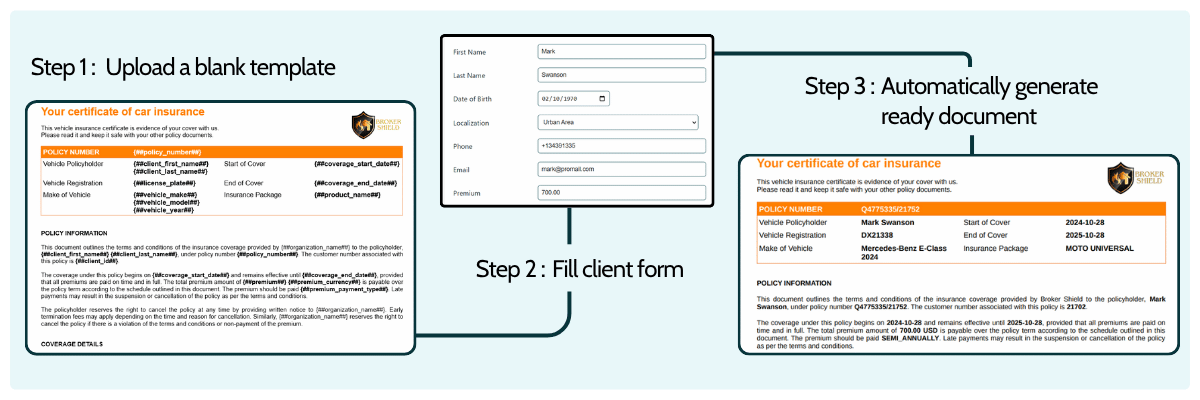

Customizable ACORD Forms Templates

In the insurance industry, producing standardized documents at scale is a daily task – especially when a ACORD form must reflect different products, jurisdictions, and certificate holder requirements.

Manual edits slow teams down and introduce errors. A template-driven approach keeps the ACORD form consistent while letting you adapt content to real-world workflows.

With Openkoda, document generation is built around data, rules, and approvals.

Templates pull structured fields (policy, quote, claim) into placeholders, apply business logic for conditional sections, and output PDFs ready to send or e-sign. Role-based reviews, versioning, and an audit trail help teams update wording quickly when regulations change, without disrupting operations.