A modern insurance rating engine turns product logic into instant, consistent pricing decisions.

It pulls together rules, actuarial factors, and third-party data so quotes reflect real risk and current market conditions.

Built as API-first pricing software, it plugs neatly into your core systems to boost operational efficiency without slowing product teams down.

Insurance Rating Engine: Definition

An insurance rating engine is the centralized service that calculates premiums and fees based on rating rules, algorithms, and data sources.

For property and casualty insurers, the rating engine evaluates exposures, applies eligibility and modifiers, and returns a price decision to quote/bind or policy issuance workflows.

Because it’s typically API-driven, the rating engine can be called from web quote forms, agent portals, PAS, and underwriting workbenches—keeping pricing consistent everywhere.

Under the hood, a rating engine combines reference tables (limits, deductibles, territory factors), actuarial formulas, and external data (e.g., geocoding, hazard scores) with product-specific rules.

Business users, not just developers, should be able to adjust factors, versions, and effective dates so pricing keeps pace with changing market conditions. This is why modern engines are packaged as configurable pricing software rather than hard-coded logic: they enhance operational efficiency by separating rating logic from application code while still integrating tightly with core systems like PAS, billing, and claims.

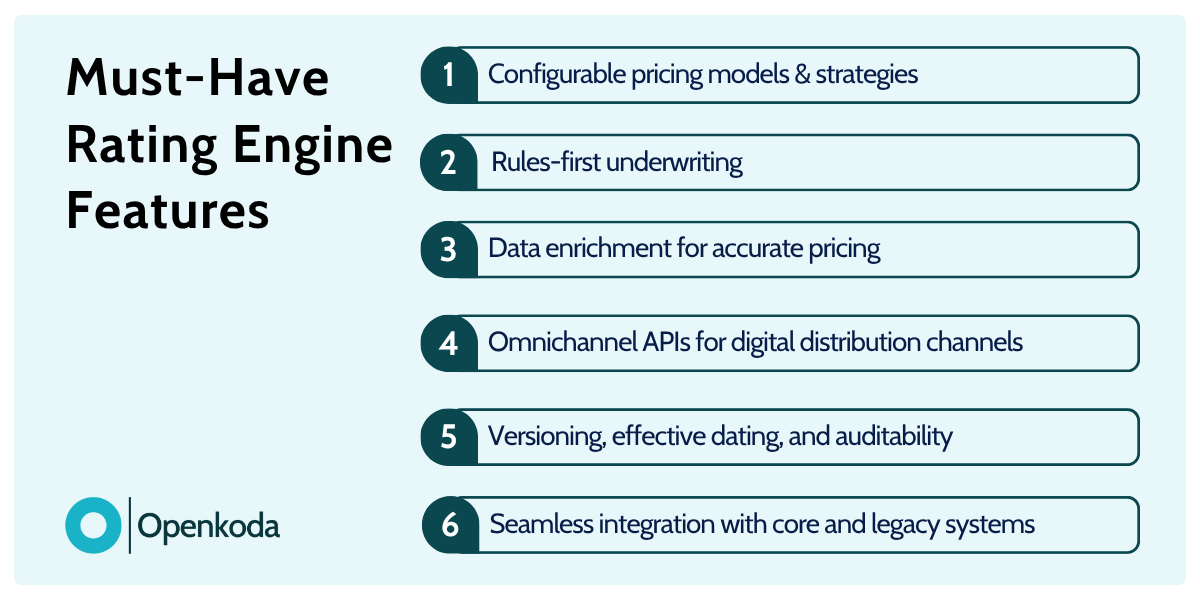

Must-Have Rating Engine Features

Let’s focus on what to look for in a modern rating engine.

The goal is simple: support evolving pricing strategies, apply underwriting rules consistently, and return accurate pricing across every channel—without breaking your legacy systems.

- Configurable pricing models & strategies: Let business users adjust base rates, factors, and relativities so the rating engine can update pricing models quickly without code.

- Rules-first underwriting: Centralize eligibility, referral, and decline logic so the rating engine screens risks consistently before it prices them.

- Data enrichment for accurate pricing: Integrate geocoding, hazard, credit, and telematics so the rating engine returns more accurate pricing in real time.

- Omnichannel APIs for digital distribution channels: Lightweight endpoints that let portals, agents, partners, and embedded flows call the rating engine reliably.

- Versioning, effective dating, and auditability: Run multiple rule sets in parallel, control go-live dates, and keep a clear trail for governance and filings.

- Seamless integration with core and legacy systems: Adapters and event hooks so the rating engine plugs into PAS, billing, claims—helps with insurance legacy systems modernization conducted in phased.

Key Benefits of a Centralized Rating Engines

Bringing pricing logic into a single insurance rating engine pays off fast. It sharpens decision-making in the casualty insurance industry, accommodates specialty insurance needs, and keeps every channel aligned. Most importantly, a centralized rating engine gives teams full control over how prices are set and changed.

- Higher pricing accuracy: One source of truth for factors, rules, and data improves pricing accuracy and auditability—no more drift between portals, agents, and back office.

- Faster market entry and iteration: Launch new products, territories, or filings quickly; a centralized rating engine lets you test and promote changes for faster market entry without code-heavy releases.

- Improved loss ratios: By pairing underwriting insurance rules engine with richer data in the rating engine, carriers target risk more precisely—leading to better selection and improved loss ratios.

- Built for specialty insurance: Complex endorsements, bespoke limits, and niche exposures are easier to manage when the rating engine centralizes variations across specialty insurance lines.

- Full control for product and actuarial teams: Effective dating, versioning, and approvals keep changes governed so experts maintain full control—not scattered spreadsheets or code forks.

- Connect seamlessly across the stack: API-first design and adapters help the rating engine connect seamlessly to portals, PAS, billing, and data providers, reducing integration friction and keeping channels in sync.

Integrating Insurance Rating Engine With Your Existing Stack

A smooth integration starts where pricing meets operations: your policy administration system. Treat the insurance rating engine as a stateless, versioned service that’s callable from quote, bind, and endorsement workflows.

Next, align data contracts. Define each required data point (risk attributes, territory, limits, perils) and how it’s validated, enriched, and audited across channels. Decide what lives in the rating layer (calculations, eligibility) versus the policy administration layer (documents, issuance, accounting), and make those boundaries explicit.

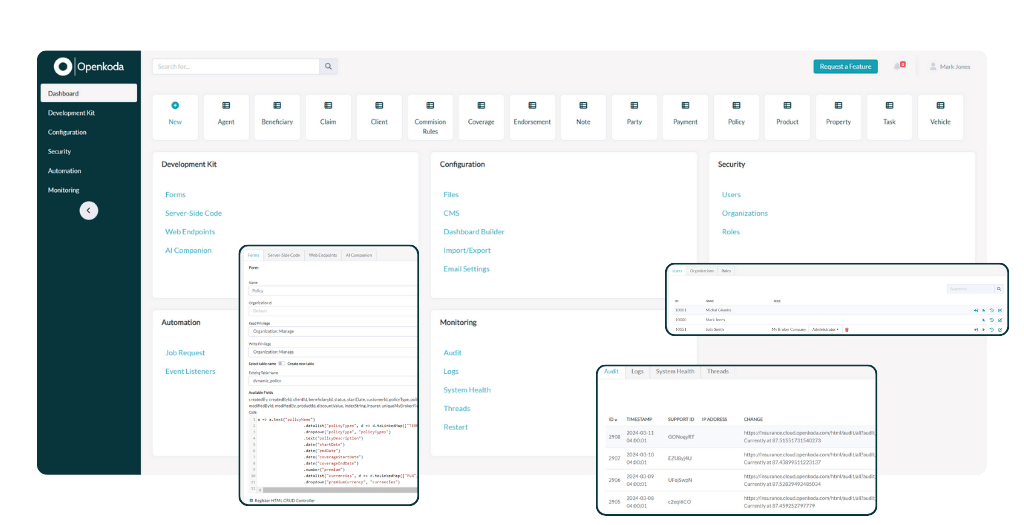

If you need a flexible way to wire pricing into your stack without heavy refactors, platforms like Openkoda can help accelerate the integration.

Openkoda provides API-first connectors and mapping utilities for common policy administration systems, plus versioned pricing rule management with approvals so product and actuarial teams can promote changes safely.

It can run alongside legacy cores or greenfield services, letting you keep full control of code and data while speeding up rating delivery and integration work.

Conclusion

A modern insurance rating engine centralizes pricing logic so decisions stay consistent across channels and products.

Paired with modern technology solutions, it supports easy configuration by business users and integrates cleanly with core platforms.

This combination boosts accuracy and governance while allowing insurers to launch faster, adapt to market shifts, and stay in control.