Insurance Rules Engine

An insurance rules engine lets business users define and execute business rules that drive underwriting, pricing, and claims decisions.

It orchestrates complex decision logic – without deep programming knowledge – so teams can modify business rules quickly and safely. The result is faster updates, consistent decisions, and better operational efficiency.

Insurance Rules Engine: Definition

A business rules engine is software that applies and automates your organization’s business rules – the if/then logic that governs decisions – without changing core application code.

In insurance, a business rules engine evaluates data and triggers outcomes across underwriting, risk assessment, rating, eligibility, and claims processing. The result is faster, consistent decisions that are traceable and easy to audit.

Business Rules Engine: Example

In an auto quote, a business rules engine takes simple inputs – driver age, violations, ZIP, vehicle – and runs quick eligibility checks. For example, it flags very young drivers for review, but a 22-year-old with two violations may still pass while triggering a surcharge for risk assessment.

Next, it calculates the premium using dynamic pricing: base rate + territory factor + violation surcharge − any discounts (like autopay). The engine also records which rules fired, so decisions are easy to audit and explain.

If a loss occurs later, the same engine switches to claims processing rules. A minor glass claim, for instance, can be auto-routed to express repair with a preferred vendor—fast resolution, lower cost, clear traceability.

Rules Engines in Insurance Operations

A business rules engine brings consistency and speed to everyday business decisions – from quoting to claims.

Instead of burying business logic in code, it lets business users create, test, and deploy policies and procedures in hours.

Centralizing and managing business rules this way improves auditability and boosts operational efficiency, because the engine can execute business rules the same way every time, across channels and teams.

Common Use Cases (Underwriting, Rating, Eligibility, Claims Triage, Compliance)

- Underwriting & Eligibility: A business rules engine evaluates risk factors (industry, location, loss history) and returns approve/decline/refer outcomes with clear explanations.

- Rating & Pricing: Dynamic tables and factors calculate premiums in real time, so you can adjust pricing without a code release and keep margins steady.

- Claims Triage & Fraud: Rules route losses to the right path—fast-track glass repairs, desk adjuster, or SIU review—while flagging anomalies for investigation.

- Compliance & Governance: Versioned rules enforce state filings, forms, and notices, ensuring decisions stay compliant and traceable.

Rules Engine vs. Hardcoded Logic

Hardcoded logic slows change and hides reasoning.

A business rules engine decouples decisions from application code so business users can manage business rules, run simulations, and push updates safely.

The result: faster iteration, fewer IT bottlenecks, and higher operational efficiency as the engine executes business rules consistently across quoting, servicing, and claims.

Implementing a Rules Engine in Your Stack

A business rules engine sits between your apps and data, turning complex decision logic into explicit rules that your business operations can control.

It makes complex decision making processes faster, more transparent, and easier to change – without a code release – so you can modify business rules as markets or regulations shift.

- Data Sources & Integrations (policy admin, rating, CRM, payments): Connect systems to the business rules engine via APIs or events; pass normalized data (quote, policy, claim) and let the engine execute business rules—approve/decline, refer, price tier, document request—then return outcomes with explanations for downstream systems and agents.

- Rule Management, Versioning & Testing: Centralize rule management so business users can safely modify business rules in a sandbox, run simulations/A-B tests, and promote versions with approvals and audit trails. Faster, safer changes reduce rework and improve response times—lifting customer satisfaction.

- Performance & Scalability Considerations: Ensure the business rules engine handles high throughput and low latency for real-time decision logic. Use caching of reference tables, horizontal scaling, and clear fallbacks to keep decisions fast and reliable during peaks and product launches.

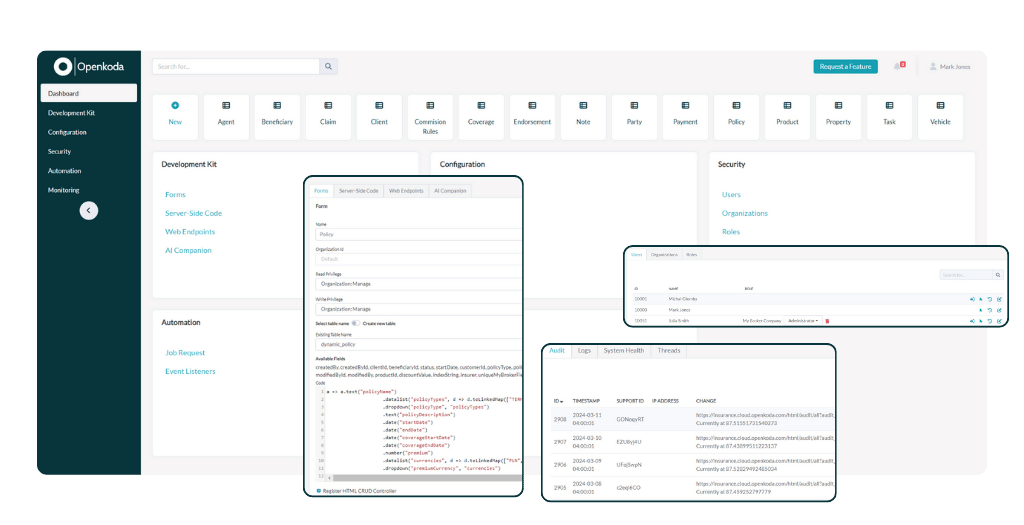

Fully Customizable Business Rules Engine with Openkoda

In insurance, you need a business rules engine that matches how you underwrite, rate, and triage—not one that forces generic flows.

Openkoda provides an open, customizable foundation where configurable rules drive underwriting and claims so decisions stay fast, auditable, and aligned to your playbook – even as products change or regulations shift.

Openkoda plugs into your existing systems through open, auto-generated REST APIs and event-driven hooks, making it easy to pass data to and from rating, policy admin, CRM, and payments without brittle middleware. That means your business rules engine can read/write the right data at the right time across your stack.

Because the platform is open-source and code-owned, teams can modify decision logic and introduce complex rules without waiting on vendor roadmaps – or having deep programming knowledge for every change.

Prefer not to staff every specialist in-house?

The Openkoda team can handle the technical implementation – from integrations to rule modeling – so you don’t have to worry about it, while your analysts own the day-to-day logic in the business rules engine.