How to Implement a Dynamic Pricing & Real-Time Premium Calculation in Insurance Systems

Insurance pricing is getting a long-overdue upgrade—real-time, data-driven, and smarter than ever.

The insurance industry is finally undergoing a major transformation, driven by digitalization, evolving customer expectations, and the increasing need for agility. Traditional pricing models, which rely on fixed rate tables and manual adjustments, are becoming obsolete in the face of rapidly changing risks, competitive market dynamics, and personalized customer demands.

Dynamic pricing in insurance offers a modern, data-driven approach that enables insurers to calculate premiums in real time.

It also provides the flexibility to quickly and efficiently test new insurance products, allowing insurers to adapt pricing strategies on the fly to meet market demands and evolving customer needs.

In this post, we’ll explore what dynamic pricing is and its key benefits. In the second part, we’ll demonstrate how this system works in practice, showing you step by step its implementation and configuration using an insurtech platform.

What is Dynamic Pricing in Insurance?

Dynamic pricing in insurance refers to a real-time, automated approach to calculating premiums based on multiple variables such as customer data, external market conditions, and evolving risk assessments. Instead of relying on rigid pricing models that require IT intervention for updates, a dynamic pricing engine enables instant modifications through a user-friendly interface.

This approach allows insurers to quickly react to changes such as inflation, regulatory shifts, market demands, or competitor pricing strategies.

It also enables hyper-personalization, where policies are tailored to individual customers based on their unique risk profiles.

Additionally, dynamic pricing supports embedded insurance, where coverage is seamlessly integrated into other products and services — such as travel bookings or online purchases — ensuring that customers receive the right coverage at the right price.

Real-Time Premium Calculation

Real-time premium calculation is a specific function within a dynamic pricing system that ensures insurance premiums are calculated instantly as new data is received.

It allows insurers to provide instant and accurate quotes, real-time adjustments, and on-the-fly premium updates without requiring manual intervention.

You will see this in action in later in this article.

Benefits of Dynamic Pricing and Real-Time Premium Calculation in Insurance Systems

1. Faster Product Innovation & Market Adaptation

The insurance landscape is changing rapidly, with emerging risks such as climate change, the gig economy, and new regulatory requirements demanding constant adaptation.

Insurers that rely on traditional pricing models often struggle to keep up, as implementing new premium structures typically requires long development cycles and IT dependency.

With a dynamic pricing system, insurers can launch new products faster, test different pricing models in real time, and quickly adjust premium calculation rules based on market demands

This allows them to remain competitive and capitalize on emerging opportunities without delays.

2. Flexible Quoting System for Real-Time Adjustments

A traditional quoting system can be a major obstacle for insurers looking to adapt to changing customer expectations and risk factors

Insurers often require IT teams to modify pricing rules, which slows down their ability to respond to changes as quickly as needed.

A flexible insurance quoting system allows business teams to adjust pricing instantly through a user-friendly interface.

This ensures that insurance quotes remain accurate and competitive in real time.

3. Eliminating Long Development Cycles

One of the biggest challenges in traditional insurance pricing is the reliance on IT teams to implement even minor pricing adjustments. Updating premium calculation rules with a developer involvement leads to long waits and missed opportunities.

By using a customizable premium calculation engine, insurers can modify pricing rules without requiring IT support. As a result, the time to roll out price updates is significantly reduced.

This streamlined approach allows insurers to react instantly to market changes, ensuring that their pricing strategies remain competitive and relevant.

4. Personalized Pricing & Enhanced Customer Experience

Modern customers expect tailored insurance policies that reflect their individual needs and risk profiles

Static pricing models fail to provide this level of personalization, often resulting in generic, one-size-fits-all premiums that do not accurately reflect customer behavior.

A real-time insurance pricing engine enables insurers to personalize policies by leveraging customer AI and data-driven insurance insights.

Premiums can be adjusted dynamically based on factors such as driving habits, lifestyle choices, or purchasing behavior, creating a more transparent and customer-friendly pricing experience.

This not only increases customer satisfaction but also improves retention rates.

5. Automation & Cost Reduction

Manual pricing adjustments are both time-consuming and expensive. They require significant human intervention, leading to errors, inefficiencies, and high operational costs.

A smart insurance pricing system automates these processes and streamlines pricing rule updates.

Such pricing automation ensures that premium calculations are consistent, accurate, and responsive to real-time data, leading to improved efficiency and cost savings.

How to Implement Dynamic Pricing Step by Step

While the benefits of dynamic insurance pricing are clear, implementing such a system requires the right technology.

Now we’ll take you through a practical demonstration of how insurers can implement and use a real-time premium calculation system for quoting using an insurtech platform to increase flexibility, efficiency, and customer satisfaction.

You’ll learn how to:

- Dynamically calculate premium values in real time

- Adjust pricing parameters without coding

- Modify core calculation logic when necessary

- Ensure seamless integration with your existing system

Follow the steps below or watch the video tutorial:

Setting Up a Flexible Insurance Quoting System with Customizable Premium Calculation using Openkoda

Step 1: Setting Up Dynamic Premium Calculation

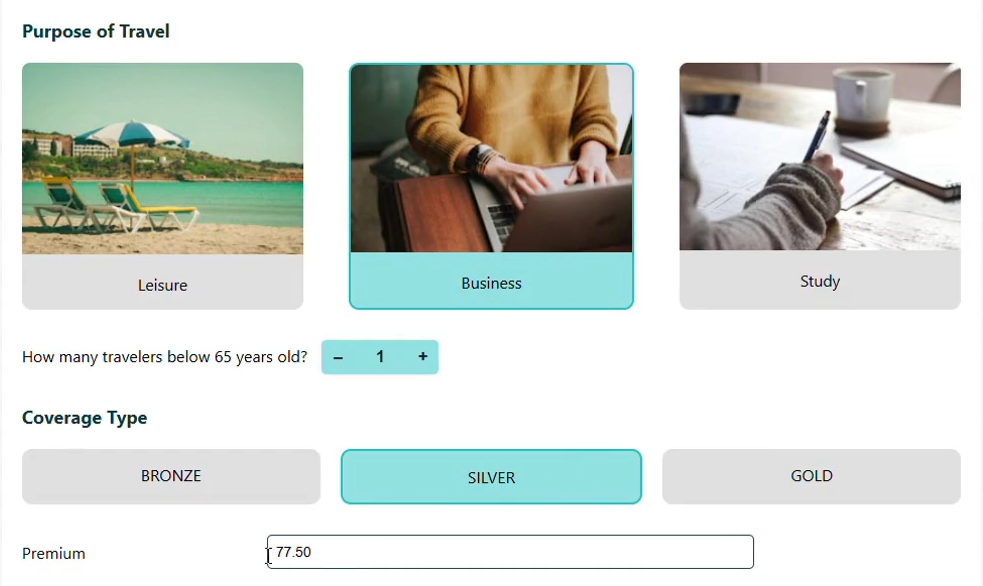

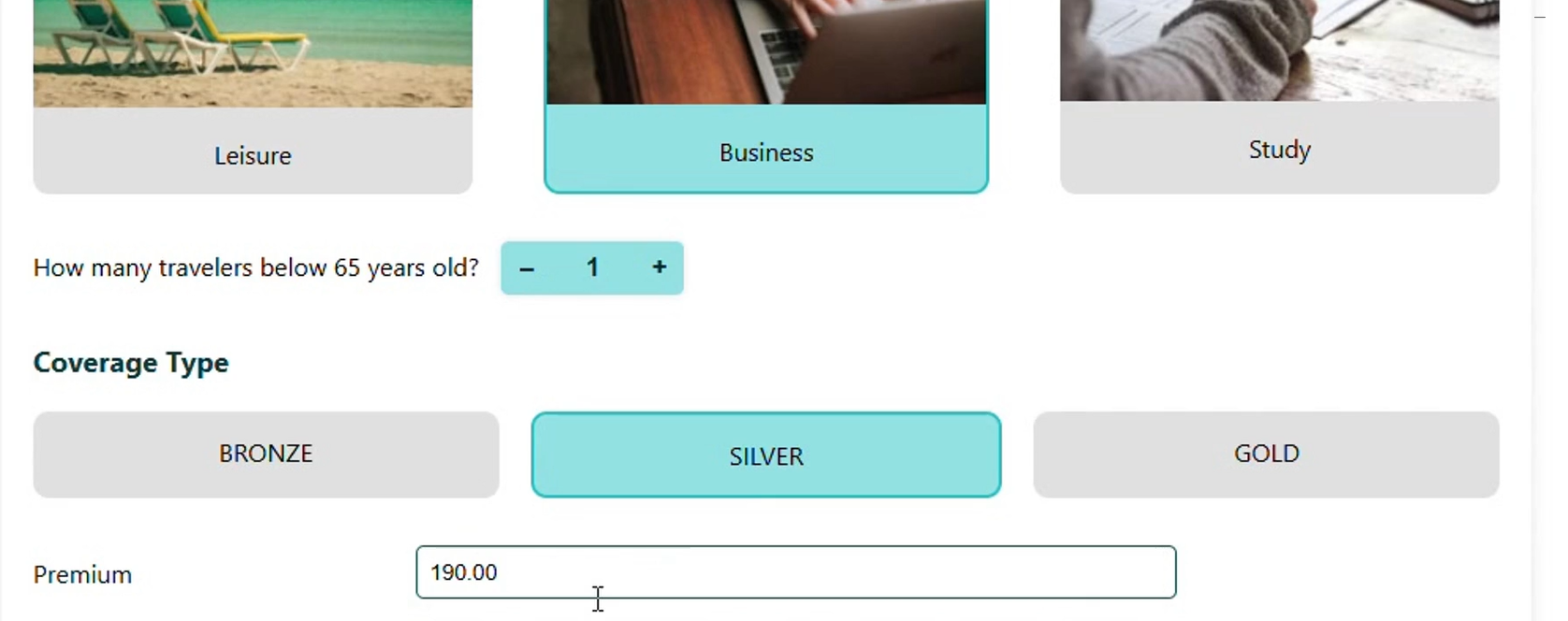

To begin, we need a form – in this case a quote form for travel insurance – where the premium value is calculated based on user input.

When a policy type is selected, the system applies business parameters and generates the corresponding premium dynamically.

This real-time premium calculation ensures that customers receive instant and accurate quotes without requiring manual input from underwriters or sales teams.

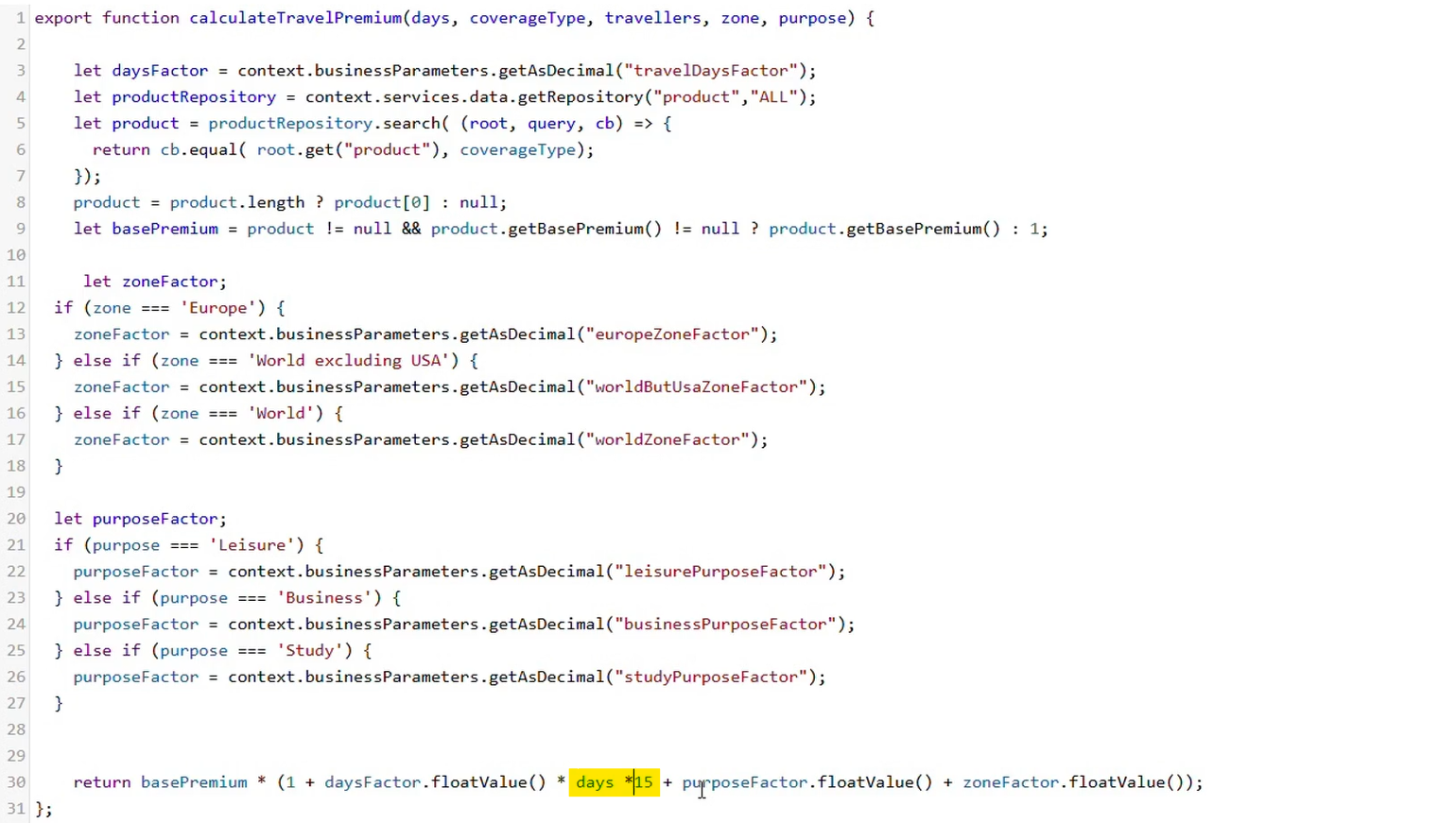

Step 2: Understanding the Server-Side Calculation Logic

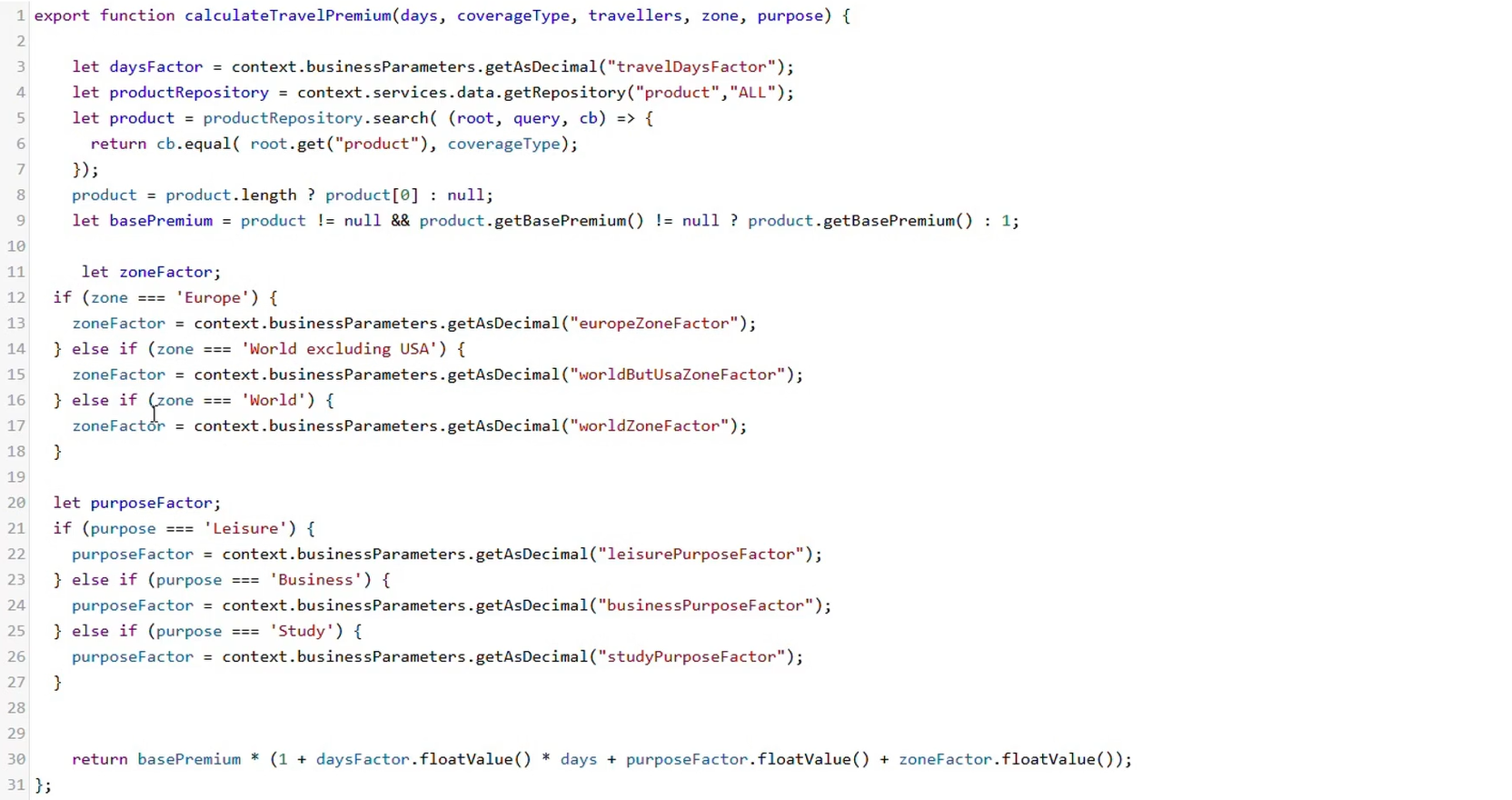

The premium value displayed in the form is not just a simple lookup—it’s calculated based on a set of business rules processed on the server.

Let’s take a look at the backend logic that handles these calculations. We won’t be making any changes to the code, it’s just for you to have a look to understand what’s behind the system.

Here, the system processes form inputs, applies the relevant business parameters, and calculates the final premium.

By centralizing the logic on the server, updates can be applied across all quoting instances, ensuring consistency.

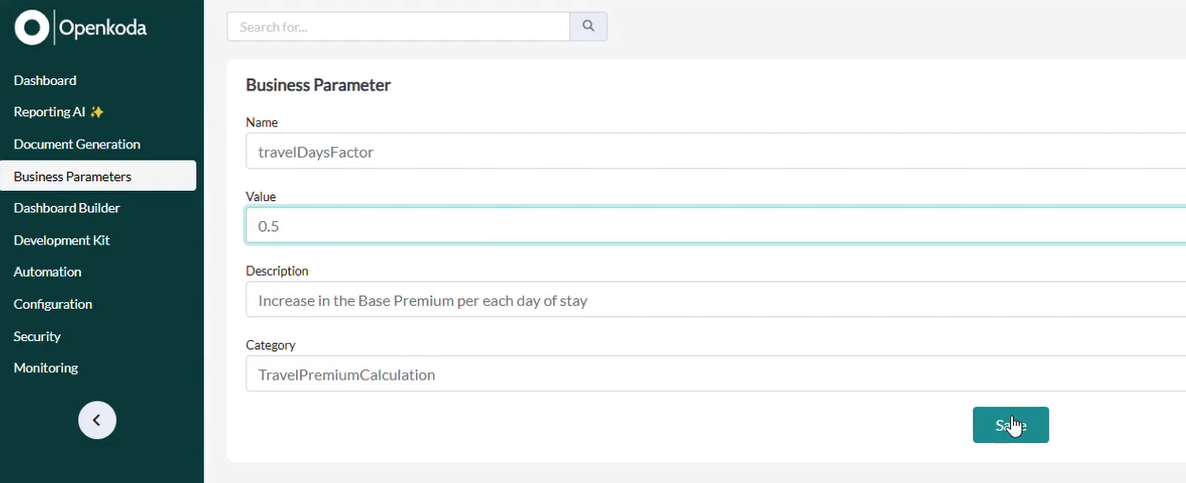

Step 3: Adjusting Business Parameters Without Code

One of the key advantages of this system – the ability to modify business parameters without coding.

For example, let’s say we need to increase premiums across a certain policy type. Instead of modifying the code, we simply update the business parameter here:

Once updated, the new premium calculation is instantly reflected in the form:

As you can see, the premium value increased from 72.50 to 190.

This feature allows insurers to quickly adapt pricing to market conditions without waiting for a development team to implement changes.

Step 4: Customizing the Premium Calculation Logic

While parameter adjustments are useful for quick changes, sometimes an entirely new calculation logic is required.

The Openkoda insurtech platform allows insurers to modify premium calculations at the code. So in case you need to make major modifications, it is possible using a development kit.

By updating the formula, insurers can introduce new risk factors, pricing models, or discount structures based on business needs.

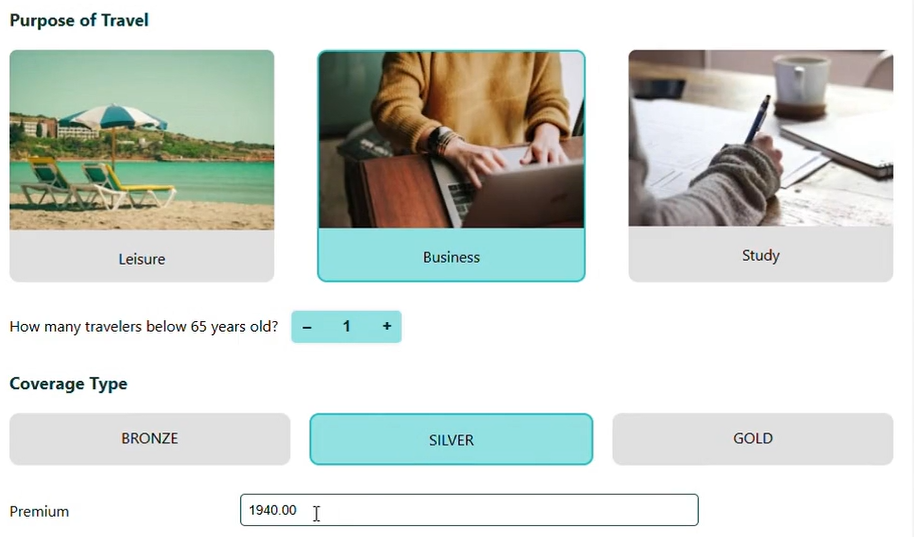

Step 5: Testing the New Premium Calculation

Once the new logic has been implemented, let’s check the quoting form. We can see the premium has been updated based on our newly implemented logic.

With this seamless integration, insurers can iterate on their pricing models without disrupting operations.

Conclusion: A Fully Customizable Quoting System

Openkoda’s dynamic pricing tool gives insurers full control over their quoting system, eliminating the delays associated with traditional software development for insurance.

Let’s summarize the key benefits of a flexible quoting system with dynamic pricing:

- Modify business parameters instantly – Adjust pricing factors without coding

- Customize premium calculations – Implement new pricing models on demand

- Ensure consistency – Apply updates across all quoting instances with ease

- Reduce development dependency – Make changes without waiting in backlog queues

- Test new insurance products quickly and with no risk – Experiment with new pricing structures and offerings before full deployment

Interested in building a smarter quoting system and seeing dynamic pricing in action? Explore the Openkoda Insurtech platform today and book a personal demo.