AI in insurance industry is moving fast – from cautious pilots to technologies that can genuinely reshape how insurers operate.

What was once experimental is now slowly becoming a competitive edge, separating insurers who scale automation and intelligence from those who fall behind.

This article cuts through the noise to look at where AI is delivering value today, where expectations run ahead of reality, and what comes next.

AI in Insurance Sector: Key Takeaways

These key takeaways capture the most important signals around how AI is being adopted across the insurance sector today:

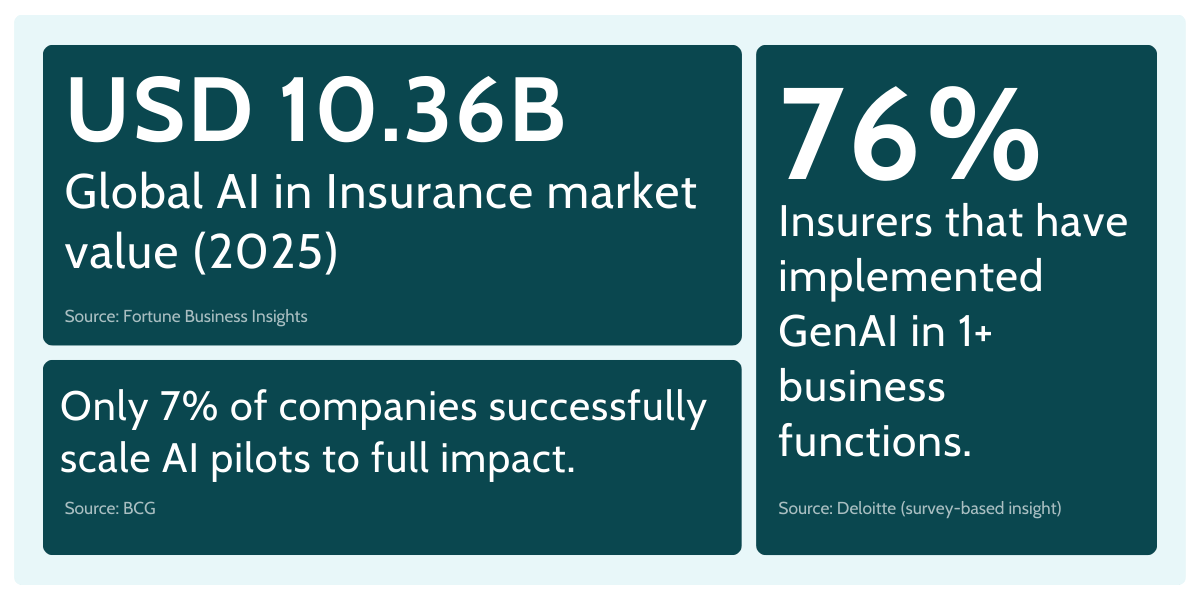

- AI in Insurance Market: Valued at ≈ USD 10.36–18.64 billion in 2025 depending on source and methodology (FortuneBusinessInsights)

- Global Insurance Artificial Intelligence Market Size: grows from ~$0.98B (2018) to $10.82B (2025) and $176.58B (2035). The implied/model CAGR is ~41.0% (2018–2025) and ~32.1% (2026–2035). (AlliedMarketResearch)

- Regional Insurance AI Systems Concentration: North America is consistently reported as the largest region—e.g., ~37.9% of 2025 revenue in one estimate and ~44.4% of 2024 revenue in another—while Asia‑Pacific is repeatedly identified as the fastest-growing region. (DimensionMarketResearch)

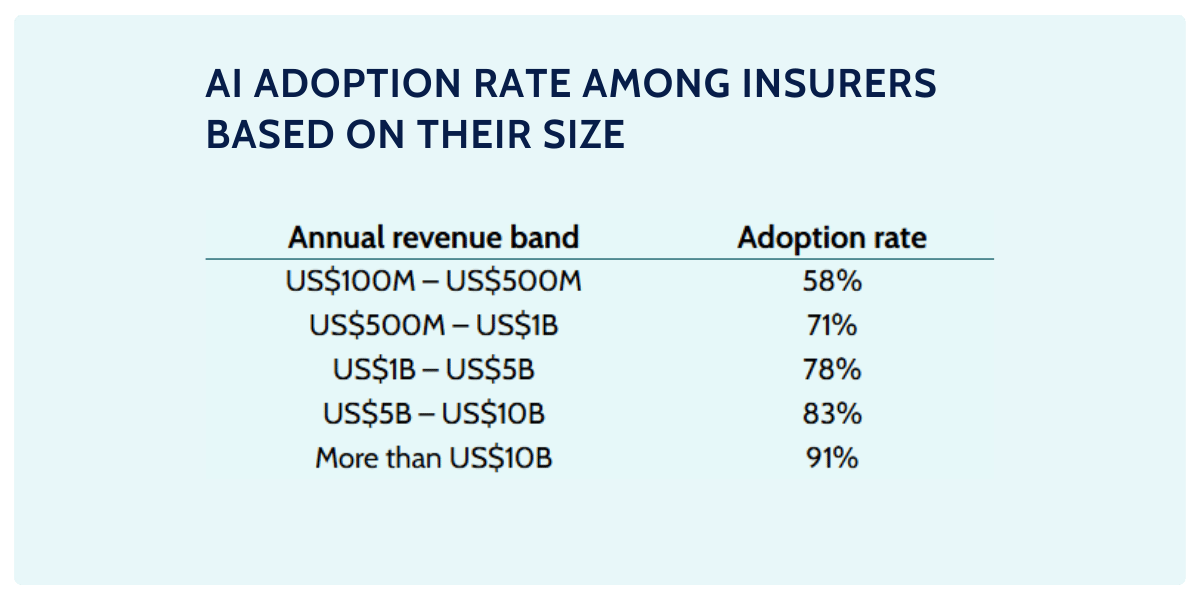

- AI in Insurance Industry adoption is broad, but scaling is the bottleneck: in a 200‑executive US insurer survey, 76% reported having implemented gen AI in at least one function, with adoption rising strongly with company revenue (e.g., 58% for $100M–$500M vs 91% for $10B+). Yet in a global insurance study, only 7% reported successfully bringing AI systems to scale, and about two‑thirds remained in piloting. (Deloitte)

- Adoption of ai technology in Insurance: Adoption of AI agents reported to have increased from 8% to 34% in a span of months in some surveys. (DataGrid)

- Human Job Uncertenties: Some insurers are optimizing workforce size: e.g., at least one large insurer planned to cut ~1,500–1,800 jobs in a division owing to AI automation in call centres and routine tasks. (Reuters)

Market Size and Growth Outlook (2026)

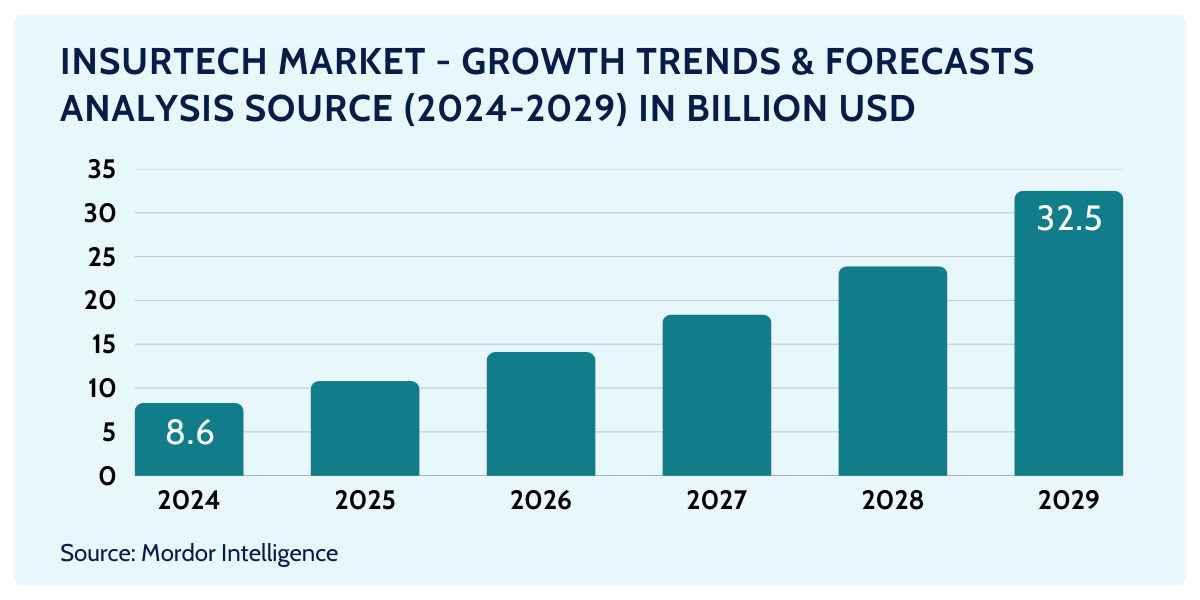

Looking at the market from a 2026 perspective, forecasts consistently point to a phase of accelerated and highly optimistic growth for artificial intelligence in the insurance industry.

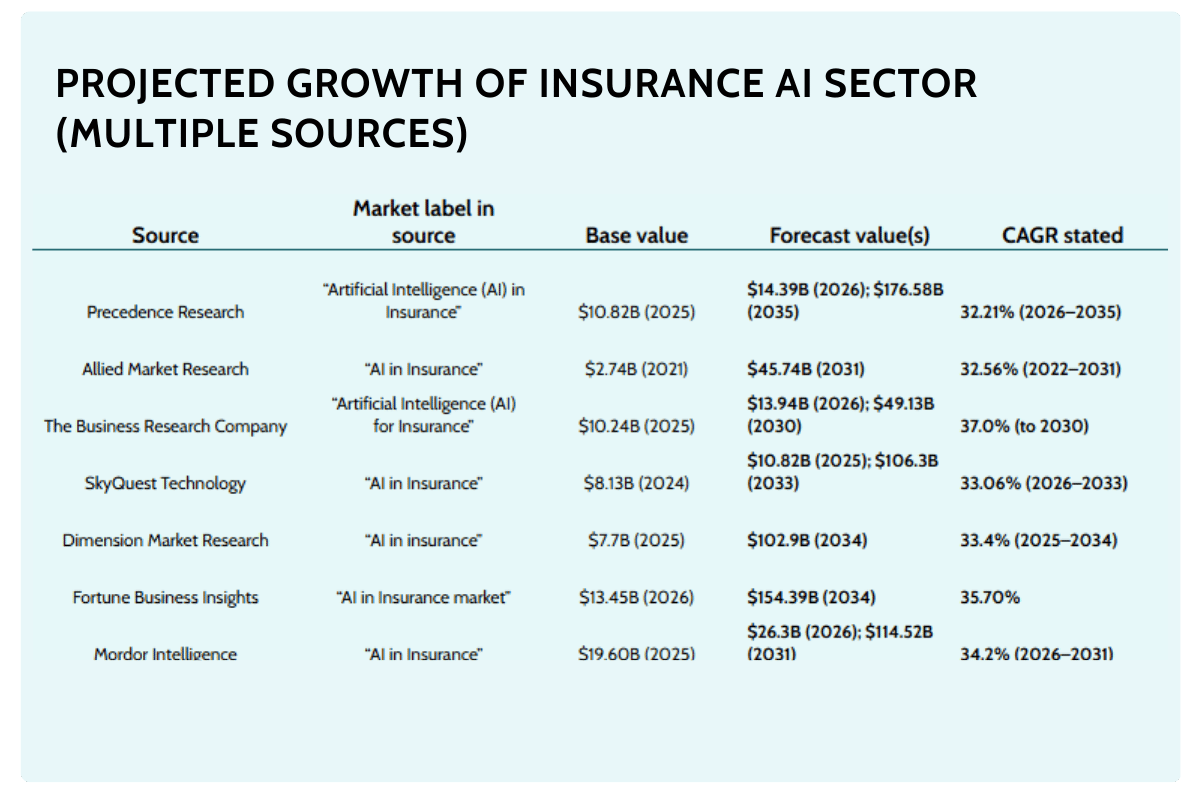

Multiple research firms estimate that the global AI-in-insurance market will already exceed $10–14 billion in 2026, with figures such as $14.39B (Precedence Research), $13.94B (The Business Research Company), $15.43B (Fortune Business Insights), and $26.3B (Mordor Intelligence) illustrating both strong momentum and a broad consensus on scale.

What is particularly notable is not just the projected market size, but the growth assumptions behind it – many of these forecasts rely on CAGRs above 30%, with some reaching 35–37%, signaling exceptionally high expectations for the value AI is expected to generate.

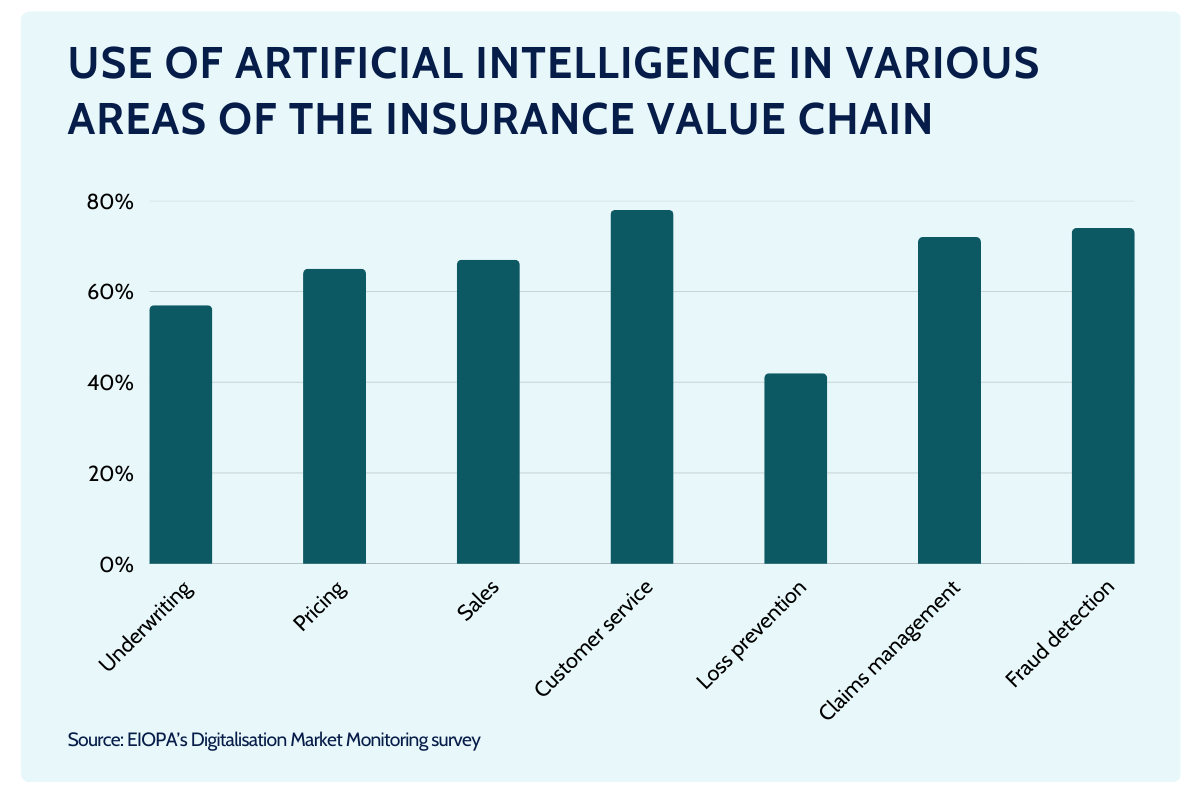

This confidence reflects more than short-term efficiency gains – it points to structural change across the entire insurance value chain, from underwriting and pricing to claims handling, fraud detection, and customer service.

Such aggressive growth assumptions suggest that AI solutions are more often than not vieved as core capabilities that will define competitiveness in the coming decade.

As AI models mature and become more deeply embedded in operational and decision-making processes, the market expectations indicate a belief that insurers who scale AI effectively will fundamentally outperform those who do not.

AI in Insurance Market Size by Year and Region (USD billions) – 2026 Forecast

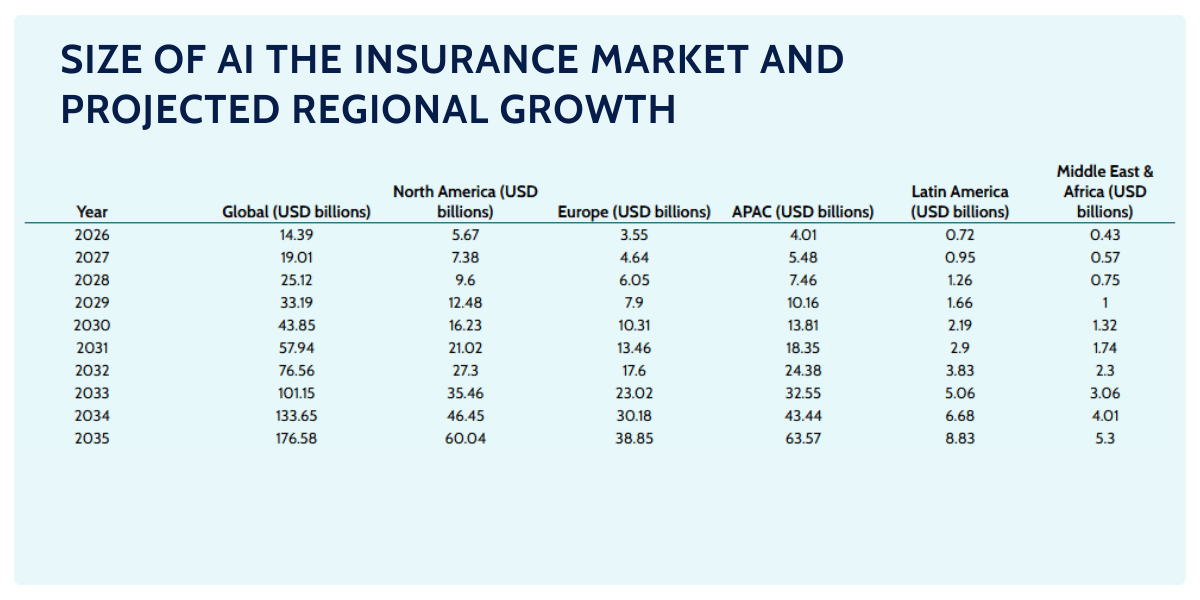

The 2026 regional outlook for artificial intelligence in the insurance industry highlights both clear market leadership and a broad-based global expansion. In absolute terms, North America stands out decisively, with AI-related insurance spending projected at around $5.67 billion in 2026, growing to an estimated $16.23 billion by 2030 and reaching approximately $60.04 billion by 2035. Europe and APAC also show strong long-term momentum: Europe is forecast to increase from $3.55 billion in 2026 to $10.31 billion in 2030 and $38.85 billion by 2035, while APAC is expected to expand from $4.01 billion to $13.81 billion and further to $63.57 billion over the same period, underscoring that advanced AI systems are already becoming a strategic priority across mature and fast-growing insurance markets alike. (AlliedMarketResearch)

What makes these projections particularly interesting, however, is the growth trajectory beyond the dominant regions.

While Latin America ($0.72B) and the Middle East & Africa ($0.43B) start from a much smaller base in 2026, their year-over-year increases are steep, signaling rapid adoption of AI tools as insurers modernize core processes and leapfrog legacy constraints. By 2030, global market size is expected to nearly triple to $43.85 billion, and by 2035 reach an estimated $176.58 billion, with every region contributing to this expansion.

AI Adoption and deployment patterns by insurer size and function

The data clearly shows that AI adoption in the insurance industry strongly correlates with insurer size.

Among carriers with annual revenues above $10B, as many as 91% are already adopting or actively deploying artificial intelligence, compared to 58% in the $100M–$500M segment (Deloitte).

This gap is hardly surprising.

Larger insurance carriers typically operate at greater scale and complexity, making them both more exposed to operational inefficiencies and better positioned to invest in advanced technology. They also tend to have richer historical datasets, stronger in-house IT capabilities, and clearer ROI justification.

Looking at deployment patterns by function, the numbers suggest that AI is no longer confined to innovation labs but is spreading across the entire value chain.

Value realization: cost savings, productivity, and performance metrics

AI is transforming core functions in insurance, including:

- Underwriting dashboards

- Claims management

- Fraud detection

- Customer service & chatbots

- Insurance document automation

- Risk profiling & pricing

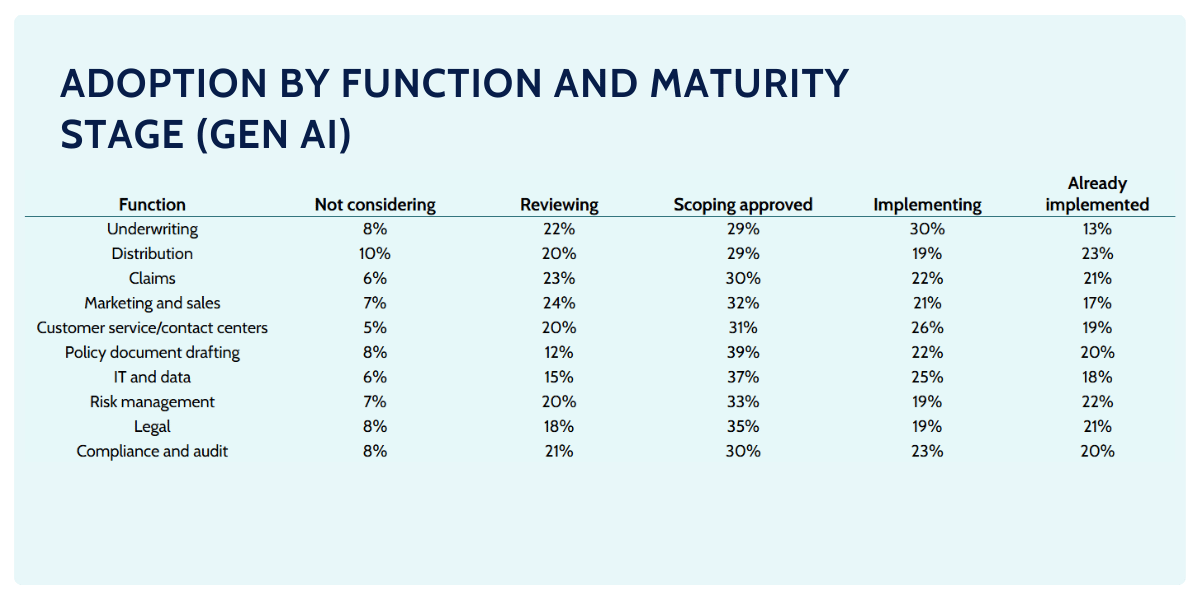

By 2026, some of the most active areas include underwriting, claims, and policy document drafting, where over 40% of insurers are already implementing or have AI solutions in production.

Claims processing in particular stands out, with 21% of insurers having already implemented AI and another 22% actively rolling it out – reflecting the high potential for automation, fraud detection, and cycle-time reduction.

According to the Deloitte study, similar momentum can be seen in IT and data (43% implementing or implemented) as well as customer service and contact centers (45% combined), where AI-driven triage, document understanding, and conversational interfaces are delivering tangible efficiency gains.

Claims Processing: Using AI technology for Unstructured Data processing

A consistent theme across the insurance industry is that claims processing represents the clearest and fastest path to measurable value from AI technology.

Claims operations sit at the intersection of high volume, strict timelines, and cost sensitivity – making them an ideal candidate for automation and augmentation. Every day, insurers handle large numbers of claims that follow similar workflows, rely heavily on unstructured inputs, and require rapid decision-making, all of which align naturally with modern AI capabilities. As a result, claims processing has emerged as the first area where AI investments can be directly linked to tangible business outcomes.

What makes claims processing particularly suitable for AI is the sheer amount of unstructured customer data involved – documents, emails, photos, invoices, medical reports, and repair estimates. AI technology excels at extracting, classifying, and interpreting this information at scale, reducing manual handling and minimizing delays caused by data bottlenecks.

Insurers applying these capabilities are seeing meaningful operational efficiency gains, including shorter claim cycle times, lower handling costs, and improved consistency in decision-making. In practice, this means faster settlements for customers and more predictable workloads for claims teams, reinforcing why claims processing is widely viewed as the most mature and value-driven use case for AI adoption today.

A domain-level transformation example includes quantified impacts in a claims domain:

- Aviva reportedly deployed 80+ AI models in claims, cutting liability assessment time for complex cases by 23 days, improving routing accuracy by 30%, reducing customer complaints by 65%, and saving £60M+ ($82M) in 2024 in motor claims. (McKinsey)

Vendor case-study metrics (useful but not always independently audited):

- Tractable reports that Admiral Seguros processed 12,000 touchless claims processing in 2021; 90% of estimates needed no human appraisers and 98% of claims completed in <15 minutes.

- Lemonade states in its annual report that its claims bot can pay claims “in as little as two seconds.

Artificial Intelligence in Underwriting: Speed and Decision Quality

Unlike claims, high-quality metrics for AI-driven underwriting are less frequently disclosed, but available evidence suggests that the upside can be substantial when AI is applied at true domain scale.

In the insurance industry, meaningful gains tend to emerge not from isolated pilots, but from redesigning the underwriting process end to end – combining workflow automation, data integration, governance, and regulatory compliance into a single operating model. When underwriting is treated as a core domain rather than a collection of disconnected use cases, insurers can unlock improvements that directly impact profitability and risk management.

This domain-based approach is increasingly associated with double-digit bottom-line effects across the insurance sector, particularly when reusable AI components are designed to scale across multiple functions.

A concrete example comes from AIG, where a GenAI underwriting pilot reportedly improved underwriting data collection and accuracy from roughly 75% to over 90%, while significantly reducing processing time, according to CEO remarks. (CIO Dive).

The case illustrates how AI, when embedded deeply into underwriting operations rather than layered on top, can deliver both efficiency and decision-quality gains without compromising regulatory discipline.

Fraud detection: precision proxies and measurable savings

Fraud detection consistently emerges as one of the largest and most mature application areas for AI across the insurance market, reflecting both its financial impact and its suitability for automation.

Market research and industry surveys regularly rank fraud detection among the top AI use cases, with one widely cited benchmark attributing approximately 41% of AI adoption in insurance to fraud detection and credit analysis combined. This prominence is driven by the fact that fraud sits deep within core insurance operations, where even small accuracy improvements can translate into meaningful financial results at scale.

From an implementation perspective, fraud detection benefits from advances in generative AI capabilities and large language models, particularly in analyzing unstructured evidence such as claims narratives, emails, and supporting documents.

When combined with strong data governance, these models enable insurers to build “precision proxies” – risk signals that do not prove fraud outright but reliably flag anomalies for human review. This approach aligns well with regulatory expectations in the insurance industry, as it augments investigator judgment rather than replacing it, while still delivering measurable efficiency gains.

A few exampl;es of real-life deployment and case studies:

- A case-study summary for Shift Technology reports that 68% of alerts raised in 2022 were accepted for investigation (precision proxy) and that the solution identifies >$5B in claims fraud annually (vendor-reported). (GoodData)

- A deployment note on Diot-Siaci adopting Shift’s fraud solution claims “twice the accuracy” and a 75% success rate in identifying claims fraud. (Actuidata)

The economic case for AI-driven fraud detection is often compelling. An illustrative (older) example describes an AI fraud system with an upfront cost of approximately ¥200M (~$1.8M) plus ongoing maintenance, expected to generate annual savings of around ¥140M (~$1.25M).

At that level, payback is achieved in under two years, highlighting a recurring pattern seen across the market: fraud detection investments tend to offer relatively fast ROI compared with more transformational AI initiatives, even though actual outcomes vary by insurer, data quality, and operational maturity.

[Read also: Pet Insurance Statistics, Facts and Trends (2026)]

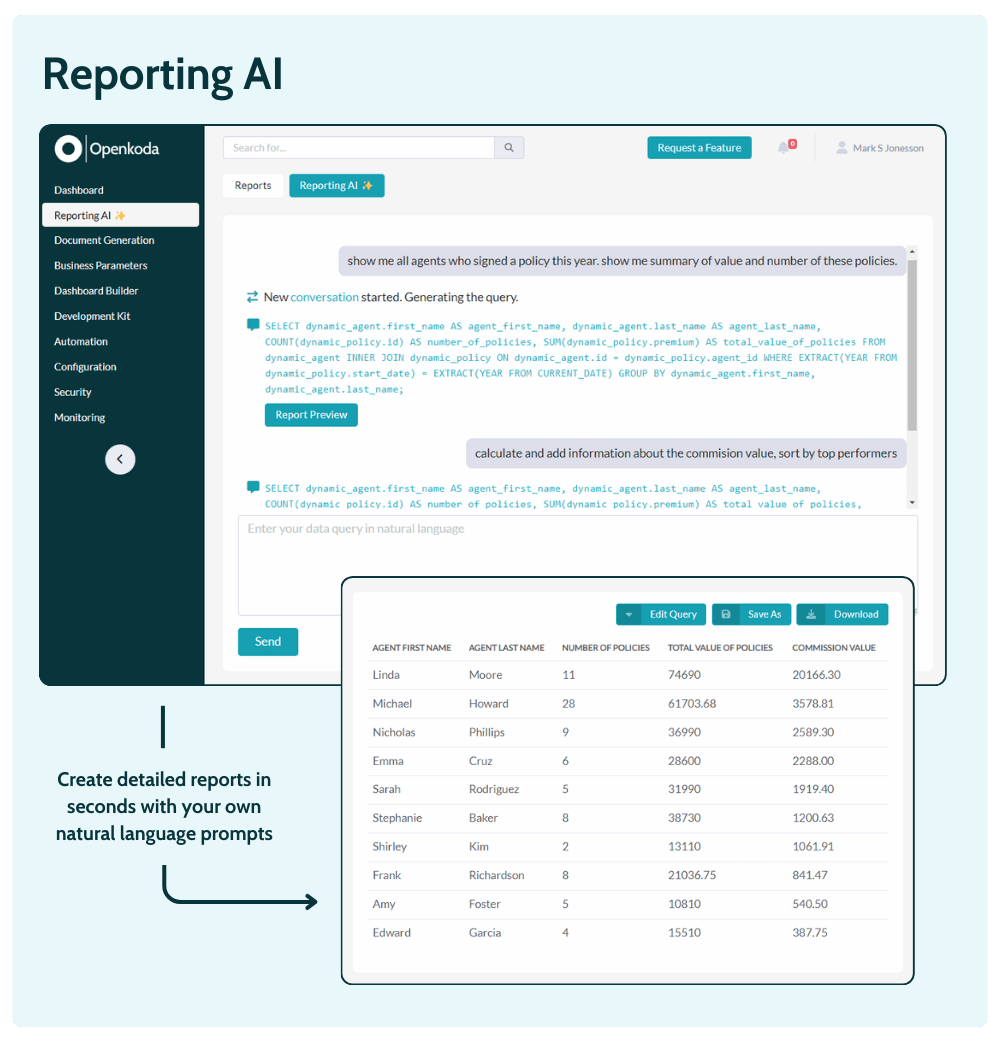

SQL Insurance Reporting: When Gen AI Can Speed Up Report Creation by Up to 90%

For many insurance companies, reporting remains a surprisingly manual and time-consuming part of daily operations – even in otherwise modern data environments. Business users often depend on technical teams to translate questions into SQL, iterate on queries, and validate results before a report is ready for decision-making.

This is another area where AI in insurance is starting to deliver very tangible value.

By applying generative AI directly to the reporting layer, insurers can dramatically shorten the distance between a business question and a usable answer.

Openkoda’s Reporting AI functionality is a good example of how this shift is playing out in practice. Instead of writing SQL manually, users can describe what they need in natural language, and the system generates accurate SQL queries against the underlying data model. This leverages AI’s ability to understand both business intent and technical structure, allowing insurers to create or modify reports in minutes rather than days.

In real-world scenarios, this approach can speed up report creation by up to 90%, directly helping teams enhance operational efficiency without sacrificing control or transparency.

Beyond speed, the real impact comes from streamlining processes across analytics, compliance, and management reporting. Faster access to consistent, query-level insights enables teams to react more quickly to trends, monitor performance in near real time, and support informed decisions across underwriting, claims, finance, and operations.

Practical artificial intelligence ROI expectations and constraints

A CEO perspective survey summarized in KPMG reporting indicates that 58% of insurance CEOs expected gen AI to take 3–5 years to provide ROI, highlighting that payback can be slower than pilot enthusiasm suggests – especially when governance, data foundations, and operating-model changes are required.

Investment and funding in insurtech and AI startups

Investment and funding trends in insurtech and AI startups offer a clear signal of where the insurance industry expects future value to emerge.

Capital flows into AI-driven ventures reflect growing confidence that advanced analytics, automation, and generative technologies can address long-standing inefficiencies across underwriting, claims, distribution, and operations.

[Read also: Life Insurance Statistics and Trends (2026)]

AI-centered share of InsurTech investment

In 2024, AI-centered InsurTechs raised $2.01B across 119 deals; they also accounted for 34.6% of all 2024 deals, and had higher average deal sizes than non-AI-centered companies. (AJG)

In Q2 2025 commentary, cumulative InsurTech funding since 2012 was noted as about $60B, with around $15B (~25%) going to AI-related technologies (cumulative, not annual). (AJG)

In Q4 2025, 77.9% of quarterly funding went to AI-centered companies (quarterly share).

Adoption by function and maturity stage (gen AI)

In a survey of 200 US insurance executives, 76% reported that their organization had implemented generative AI in one or more business functions, with stronger adoption among larger insurers by revenue.

Even with broad experimentation, scale is scarce. Boston Consulting Group reports that only 7% of insurers surveyed successfully brought AI systems to scale and about two‑thirds remain in piloting, framing scaling as an organizational/process challenge more than a modeling challenge.

[Read also: Car Insurance Statistics and Facts (2026)]

Closing Thoughts

Taken together, the data shows that while ROI from early AI pilots in the insurance industry has sometimes been mixed or slower to materialize than expected, this should not be mistaken for a lack of long-term potential.

As AI deployments mature and move beyond isolated experiments, areas such as claims processing, SQL-based reporting and data access, and the underwriting process are already demonstrating clearer, more repeatable value.

The next phase for insurers will be less about proving that AI works, and more about applying it deliberately at scale – where it can consistently improve efficiency, decision quality, and competitive positioning across the business.