Insurance Broker Portal

An insurance broker portal is a secure, multi-carrier workspace for placing and servicing policies.

It lets brokers submit applications, compare quotes, track status, and manage documents end-to-end. With automation and integrations, it reduces email, speeds time to bind, and improves client experience.

What Is an Insurance Broker Portal?

A broker portal is a secure online workspace where brokers get access to carrier and wholesaler systems to serve clients. It’s a web app (and usually works on a mobile device) that brings quoting, renewals, and servicing into one place.

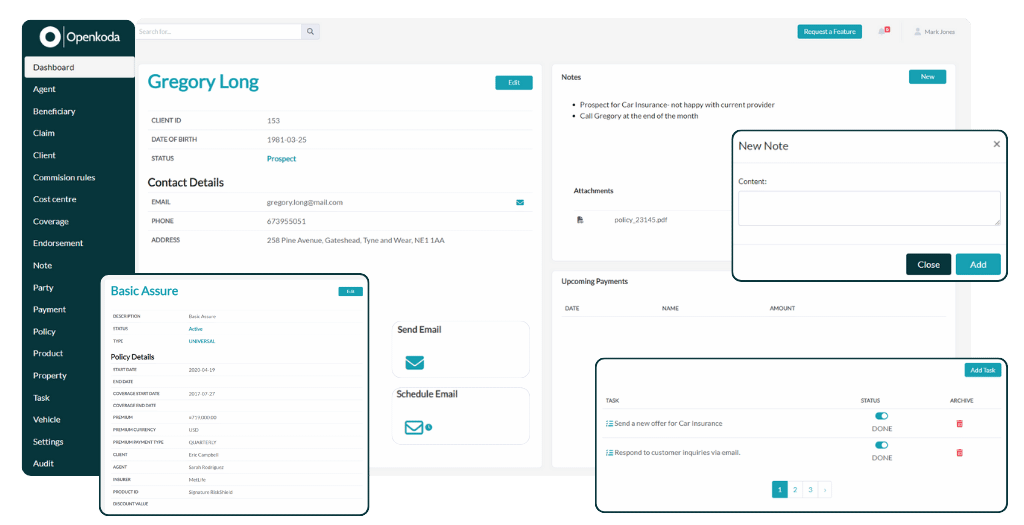

From a single account, brokers can compare plans, track applications, store user guides, contact information and other resources, and pull the tools they need – without juggling email threads or spreadsheets.

The portal also centralizes paperwork of the insurance business.

Brokers can upload or retrieve documents, download statements, and share status updates with clients in a few clicks. In short, a broker portal streamlines day-to-day insurance work so brokers spend more time advising and less time chasing data.

How Insurance Broker Portals Work

Brokers log in, search a client record, and start a workflow – quote, bind, endorse, or renew.

The broker portal connects to rating engines and policy administration, so eligibility, plans, pricing, and forms are current.

Role-based access ensures the right tools, documents, and statements show up for each broker, whether they’re at a desk or on a mobile device.

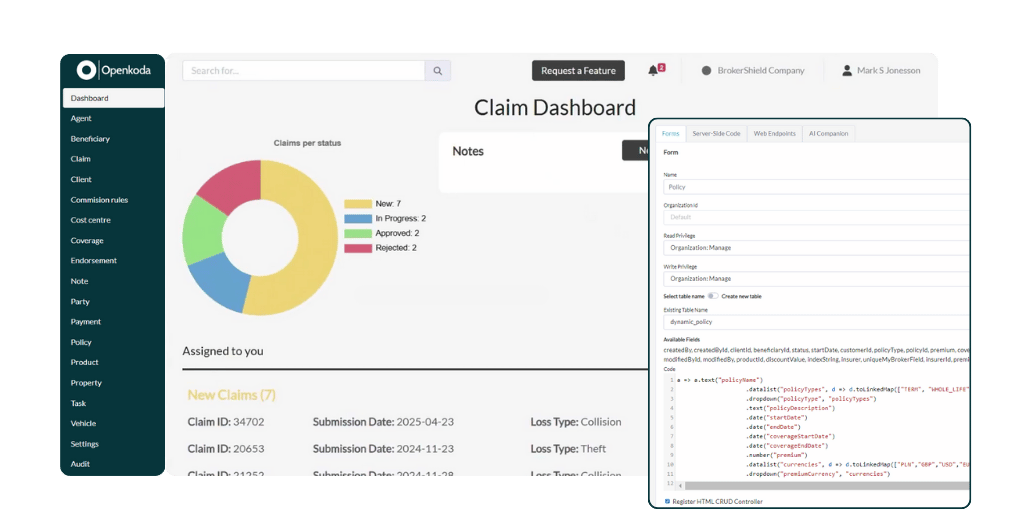

Broker Portal Key Features

A broker portal should make daily work simple, fast, and consistent. Here are the essentials:

- Single account login & roles: One place to manage books, with permissions that fit your team.

- Quote, enroll, and renew for individuals & groups: Compare options and move clients from quote to bind without rekeying.

- Document management: Generate forms, collect signatures, and store files where brokers and clients can find them.

- Client & insurance policy management: Search, update details, track service requests – all inside the broker portal.

- Billing, commissions, and statements: View premiums, payouts, and downloadable statements in one view.

- Pipeline & tasks: See what’s next at a glance; assign follow-ups to keep clients and groups on track.

Insurance Broker Portal Details

In an insurance business, a broker portal brings quoting, servicing, and renewals into one secure place.

It gives brokers access to real-time rates, forms, and client data, all tied to a single account.

Who Uses a Broker Portal?

Independent brokers, producer teams, and wholesalers use it for day-to-day work. Service reps and back-office staff also rely on the same account records for consistent handoffs. Role-based access ensures each user sees the right books, products, and actions.

What Tasks Can Brokers Do?

Create quotes, compare plans, and move from proposal to bind.

They also use portals to update client details, upload evidence, request endorsements, generate documents, share them with clients, and have parties sign electronically – keeping every step linked to the same account.

When Do Carriers/Wholesalers Implement One?

When distribution is growing, service is inconsistent, or multiple systems slow teams down. A portal provides unified access, faster cycle times, and better oversight across the insurance business, especially during product launches or market expansions.

Building Custom Insurance Broker Portals

The biggest challenge with broker portals isn’t “having a portal” – it’s aligning it to your specific book of business: product lines, underwriting rules, workflows, and compliance.

A custom, API-first approach lets the portal mirror how your brokerage actually works – today and as you scale. Openkoda fits that approach.

Openkoda is a powerful insurtech platform designed to speed up the development of insurance applications and products by delivering an extendable enterprise-ready core that can be customized to fit unique need of insurance brokers, MGAs and other players in the insurance sector.

Beyond speed, Openkoda emphasizes open-source foundations, unlimited users, and no vendor lock-in – giving you long-term control over your portal.

Why it matters: instead of starting from scratch, you can assemble a broker portal from insurance-specific building blocks – policy management, claims tools, and embedded insurance flows – to hit the market faster.

Bottom line: with Openkoda you keep strategic control – own the code, customize freely, and evolve your broker portal as your distribution, products, and partners change.