Takaful: Complete Guide to Islamic Insurance

Insurance is one of the cornerstones of modern financial systems, yet for Muslims seeking solutions that align with Shariah principles, traditional models often pose ethical challenges.

This is where takaful comes in – a cooperative approach to risk management built on mutual support and fairness.

In this guide, we’ll explore how takaful works, its key principles, and the role of technology in helping takaful providers meet modern customer expectations.

What Is Takaful?

At its core, takaful is an Islamic alternative to conventional insurance. It’s based on the idea of mutual cooperation, where participants contribute to a shared pool of funds that is later used to support members who suffer a loss.

Instead of a commercial contract between insurer and policyholder, takaful functions more like a pact among community members to protect one another.

The concept isn’t new.

Its roots can be traced back to early Islamic trade routes, where merchants pooled resources to compensate each other in case of theft, accidents, or disasters during long journeys. Over time, this practice was formalized and evolved into what we now recognize as takaful.

Today, takaful is gaining traction not only in Muslim-majority countries but also in international markets.

The growing demand comes from both individuals seeking Shariah-compliant financial products and regulators encouraging diversity in financial services.

Takaful offers a way to align modern risk management practices with religious values – without sacrificing financial stability or trust.

Understanding the Islamic Model of Insurance

The structure of an Islamic insurance company is fundamentally different from that of a commercial insurer.

While traditional commercial insurance is built around profit-making contracts between the company and its policyholders, takaful operates on the principle of cooperative insurance. Participants contribute to a common pool with the understanding that funds are used to support one another in times of need, not to generate profit from uncertainty.

This distinction is crucial under Islamic law.

Conventional insurance often involves elements such as riba (interest), gharar (excessive uncertainty), or maysir (gambling), which are prohibited in Shariah. The Islamic insurance model avoids these elements by emphasizing transparency, fairness, and shared responsibility. Instead of paying premiums to an insurer who assumes all the risk, participants collectively bear that risk — aligning with the ethical framework of Shariah.

Operationally, this means a takaful provider doesn’t simply act as the risk carrier.

The Islamic insurance company plays more of a steward role, managing the contributions and ensuring compliance with both regulatory standards and religious principles. Surpluses, if they arise, are distributed back to the participants rather than retained as profit, further reinforcing the cooperative nature of the system.

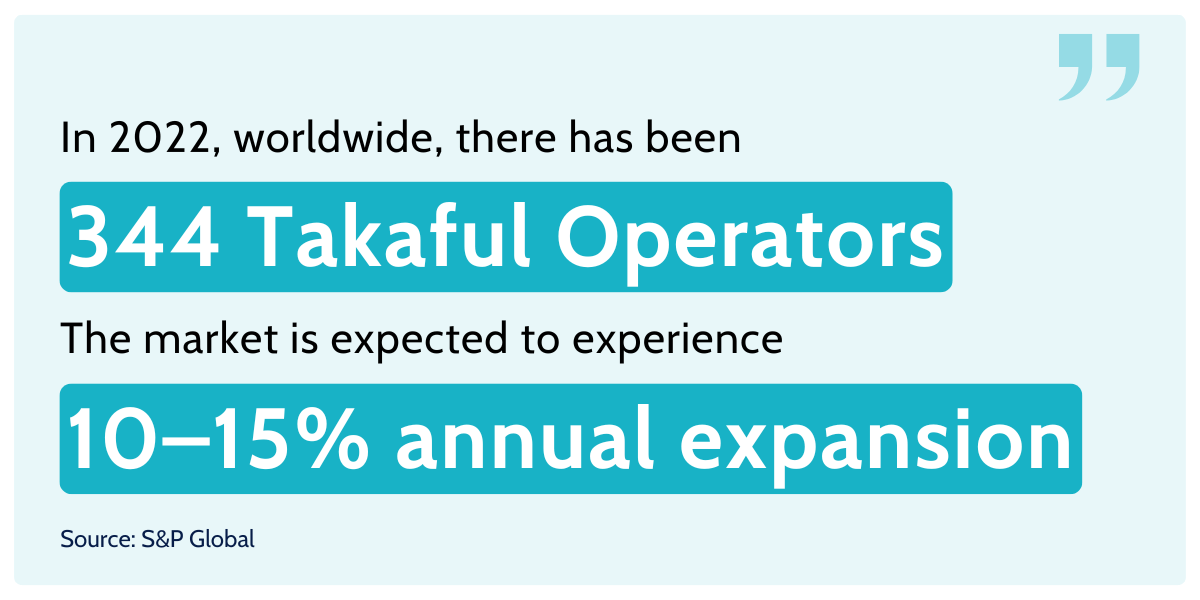

The global takaful insurance market is experiencing rapid growth, driven by rising demand for Sharia-compliant financial solutions and supportive regulatory frameworks.

Currently valued at around $34–36 billion in 2024, the market is projected to more than double by 2033–2034, reaching as high as $115–200 billion depending on the forecast.

Notably, the industry has expanded to over 340 takaful and retakaful operators worldwide, a significant leap from just over 270 a decade ago.

This combination of double-digit growth potential and regional dominance underscores the strategic importance of the takaful segment within global insurance markets.

Takaful Key Principles

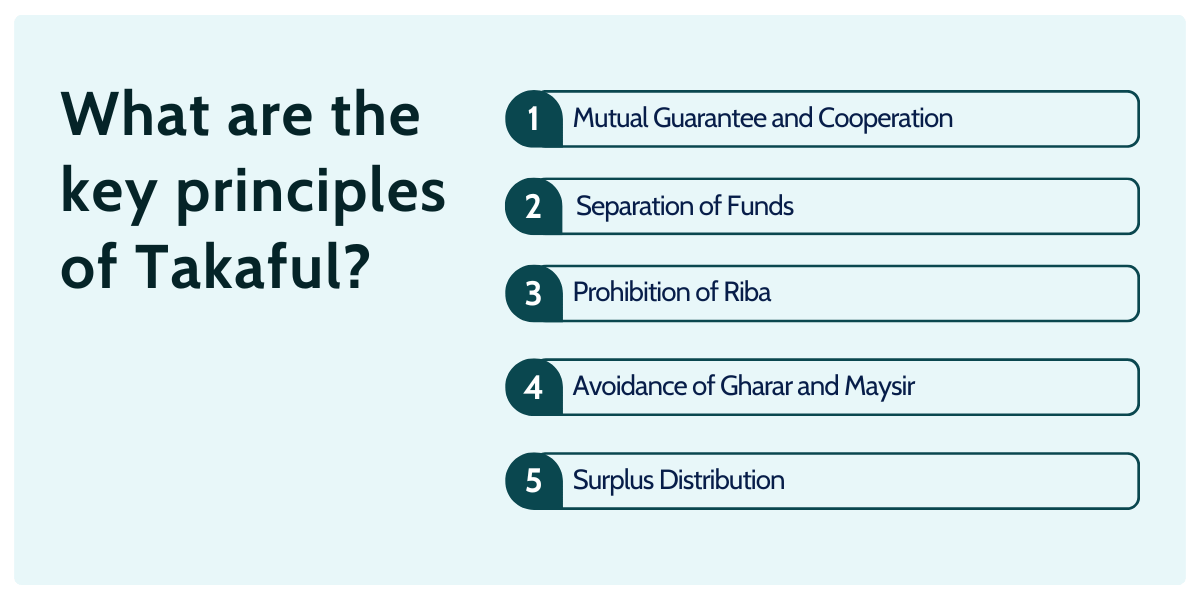

Every takaful insurance arrangement is guided by a set of Islamic principles designed to ensure compliance with Shariah. These principles provide the framework for how a takaful company should operate, from fund management to profit-sharing. They also align takaful with the broader ecosystem of Islamic banking and Islamic finance, creating a consistent ethical approach across financial services.

Over the years, bodies like the Islamic Fiqh Council have outlined clear guidelines for what makes a takaful model valid under Shariah. While interpretations may vary slightly by region, the fundamentals remain the same and are shared across most Islamic insurance companies worldwide.

Mutual Guarantee and Cooperation

The foundation of takaful lies in solidarity. Participants agree to support one another financially, transforming insurance into a form of cooperative insurance rather than a profit-driven contract.

Separation of Funds

A takaful company manages two distinct pools of money: the participants’ fund (used for claims) and the operator’s fund (used for managing the business). This ensures transparency and prevents conflicts of interest.

Prohibition of Riba (Interest)

Just as in Islamic banking, charging or earning interest is not allowed. Contributions and investments must avoid any involvement with riba, which is considered exploitative.

Avoidance of Gharar and Maysir

Excessive uncertainty (gharar) and gambling (maysir) are strictly prohibited in Islamic finance.

Takaful contracts are structured to reduce ambiguity and ensure all terms are clearly understood by participants.

Surplus Distribution

Unlike conventional insurance, if there is a surplus after claims and expenses, it is either reinvested for the benefit of all or distributed back to participants. This reflects the cooperative spirit and fairness expected from an Islamic insurance company.

Software for Takaful Insurance Company

Running a takaful operation comes with unique challenges that go beyond those faced by a conventional insurance business. A takaful operator must not only manage risk and compliance but also ensure that the Takaful insurance system is aligned with Shariah principles.

This means software cannot simply replicate what a standard insurer uses — it has to be tailored to the cooperative and ethical nature of takaful.

One of the key challenges is handling the takaful fund, which belongs collectively to the takaful participants.

The system needs to clearly separate this fund from the operator’s own finances, track contributions, and manage disbursements for future claims in a transparent way. At the same time, it should support the distribution of any surpluses back to participants, rather than automatically counting them as company profit.

There’s also the issue of managing the lifecycle of an insurance policy within a takaful model.

Policies need to reflect both modern standards of customer service and compliance with Islamic requirements, ensuring clarity and fairness at every step. The right software makes this easier by automating fund accounting, claims processing, and reporting – while still giving the operator flexibility to adapt to regional regulations and interpretations of Shariah.

Key Features of Takaful Insurance Systems

For a takaful insurance company, technology needs to do more than replicate what exists in conventional insurance. The system has to balance operational efficiency with compliance to Islamic values, while still offering customers a seamless experience. Good software supports the unique structure of takaful plans and makes it easier for operators to manage funds, policies, and participant relations transparently.

Key features include:

- Fund segregation tools – separating the participants’ takaful fund from the operator’s accounts.

- Shariah-compliant investment modules – ensuring money is only invested in sectors aligned with Islamic values.

- Flexible insurance policy management – allowing customization of takaful plans while maintaining transparency.

- Surplus distribution mechanisms – tracking and allocating surpluses back to participants fairly.

- Regulatory and Shariah compliance reporting – built-in checks to help a takaful insurance company demonstrate adherence to both local regulations and Islamic finance principles.

Speeding up Custom Takaful Software Development

When a takaful operator considers software, time to market, compliance, flexibility, and ownership all matter more than ever.

The operator is balancing not only business concerns (claims handling, fund management, policy lifecycle) but also Shariah principles: fund separation, surplus distribution, transparent calculation of future claims, etc.

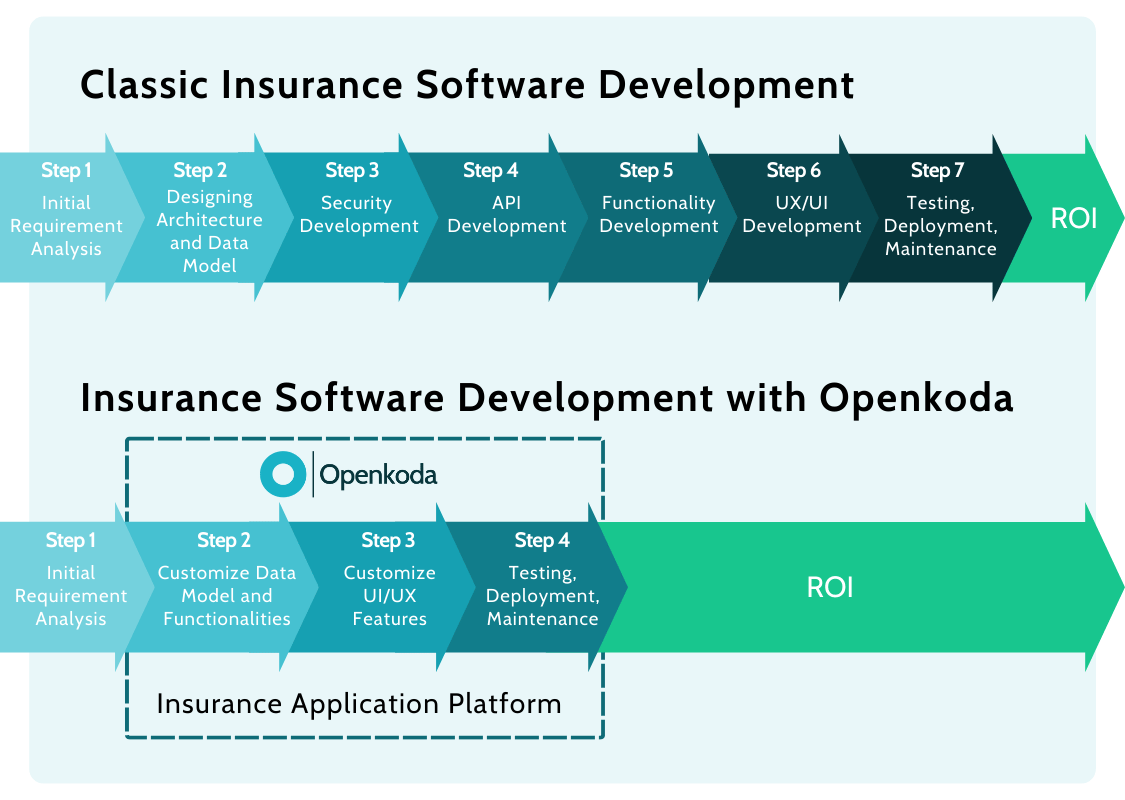

Traditional custom software development can be slow, expensive, and rigid — especially when starting from scratch or modernizing legacy systems.

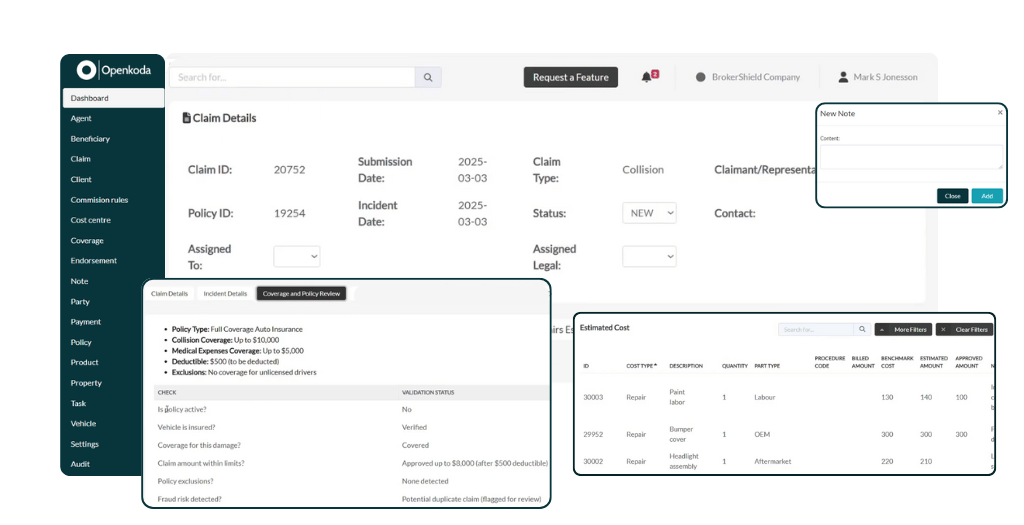

Openkoda offers a compelling alternative for takaful / Islamic insurance companies.

It’s an open-source insurtech/business-application platform that gives teams a strong foundation of insurance-specific building blocks, while retaining full control and room for customization.

Concretely, Openkoda helps in three areas that matter most to takaful:

- Business-rule agility: Configure contribution formulas, surplus allocation logic, and provisioning for future claims through customizable modules. When your Shariah board refines an opinion or a regulator updates guidance, you adjust rules—not rebuild the system.

- Transparent fund accounting: Model distinct ledgers for the participants’ fund and the operator’s fund, with clear audit trails across underwriting, claims, and surplus distribution.

- On-premises or private deployment: Keep data and logic inside your chosen environment. For many takaful operators, this simplifies compliance, board oversight, and data-sovereignty requirements.

Just as important is the day-to-day developer experience.

Openkoda’s open architecture (standard tech stack, readable codebase) means your team can extend modules, integrate core banking/finance systems, or plug in Shariah-compliant investment providers without wrestling with vendor lock-in.

How does this work in practice?

Let’s take a look.

Example: Launching a New Family Takaful Plan with Openkoda

A takaful team wants to introduce a family plan in two regions with slightly different Shariah and regulatory interpretations, and they look into the Openkoda Takaful Core Administration System.

First, they clone an existing product template and refine it: contribution tiers are adjusted, surplus-sharing rules are encoded to match the board’s decision, and the participants’ fund parameters are linked to the plan so accounting stays transparent from day one.

Next, they set regional parameters – claims thresholds, documentation checklists, and review queues – without changing the underlying workflow engine. Both regions share the same process backbone, but each has its own ruleset and reporting pack that the compliance team can audit at any time.

Finally, they publish clean APIs to agency portals and partner platforms.

Role-based access ensures intermediaries only see what they should, while audit logs capture every change to product rules and claims decisions.

Because the stack runs on-premises, the operator keeps full control over data residency and system updates.

The net effect: faster time-to-market, easier governance, and a participant experience that feels modern – without compromising the distinct mechanics that make takaful work.

[Read also: Top 5 Insurance Core Systems in 2025]

Closing Thoughts

Takaful is, at its heart, a cooperative way to manage risk – participants pool their contributions to protect one another rather than transferring risk to a profit-seeking insurer.

It differs from traditional insurance through its Shariah-aligned structure: prohibition of riba and excessive uncertainty, clear separation of participant and operator funds, and the possibility of surplus returning to participants.

The operator acts as a steward and manager, not the ultimate risk bearer. For customers and regulators alike, that translates into a model built on transparency, mutuality, and ethical accountability.