Driving Insurance Innovation: Key Trends and Strategies

The pressure to innovate in the insurance industry has never been greater.

From advanced technologies like AI to changing customer expectations, insurers and insurtechs are rethinking how products are built, delivered, and experienced.

In this article, we explore the key trends, strategies, and potential pitfalls shaping the future of insurance innovation.

Innovation is booming and delivering solid returns for insurers

Insurance is not typically considered a bastion of innovation, despite a long track record of creating new and exciting markets around emerging risks and consumer demands.

From AI-powered underwriting engines to hyper-personalized policy offerings, the landscape is shifting fast. But this isn’t innovation for innovation’s sake.

It’s targeted, strategic, and increasingly driven by real business outcomes: cost savings, faster claims processing, more accurate risk assessments, and, ultimately, higher customer satisfaction and retention.

The C-suite is already taking note of the key role innovation will play in delivering long-term value: data from a recent survey show that while executive teams focused on short-term cash management, innovation now ranks as one of their top two priorities.

What’s fueling this momentum?

Part of it is necessity.

Customer expectations have shifted dramatically. The rise of embedded insurance, on-demand coverage, and usage-based models has pushed even traditional insurers to modernize quickly or risk irrelevance.

But another driver is the maturity of the technology itself.

AI models are more accurate, scalable infrastructure is more accessible, and API-driven ecosystems make integration smoother than ever – in other words, access to cutting-edge and high-performance tech is no longer reserved for only the biggest players out there.

For insurers, this is a moment of opportunity.

Key Insurance Tech Trends To Keep Track Of in 2025

To stay competitive in a rapidly evolving market, insurers need to keep a close eye on the technologies reshaping the industry.

Here are the key tech developments every insurance leader should be watching.

Generative AI: Only a Buzzword or a Real Value?

Generative AI has exploded into the mainstream, sparking curiosity, experimentation—and some skepticism.

While some still view it as a passing trend or a shiny toy for tech enthusiasts, the insurance industry is already uncovering real, practical benefits.

We’re seeing some tech-savvy insurers leverage it to automate underwriting documentation, generate personalized policy summaries, and even assist customers through AI-driven virtual agents.

From Insight to Action: Closing the Loop

While the visions and promises for the future of artificial intelligence sure looks promising, many generative AI use cases these days stop at producing summaries or recommendations—valuable, yes, but not transformative on their own.

What’s changing in 2025 is the push toward artificial intelligence systems that not only interpret data but also trigger workflows.

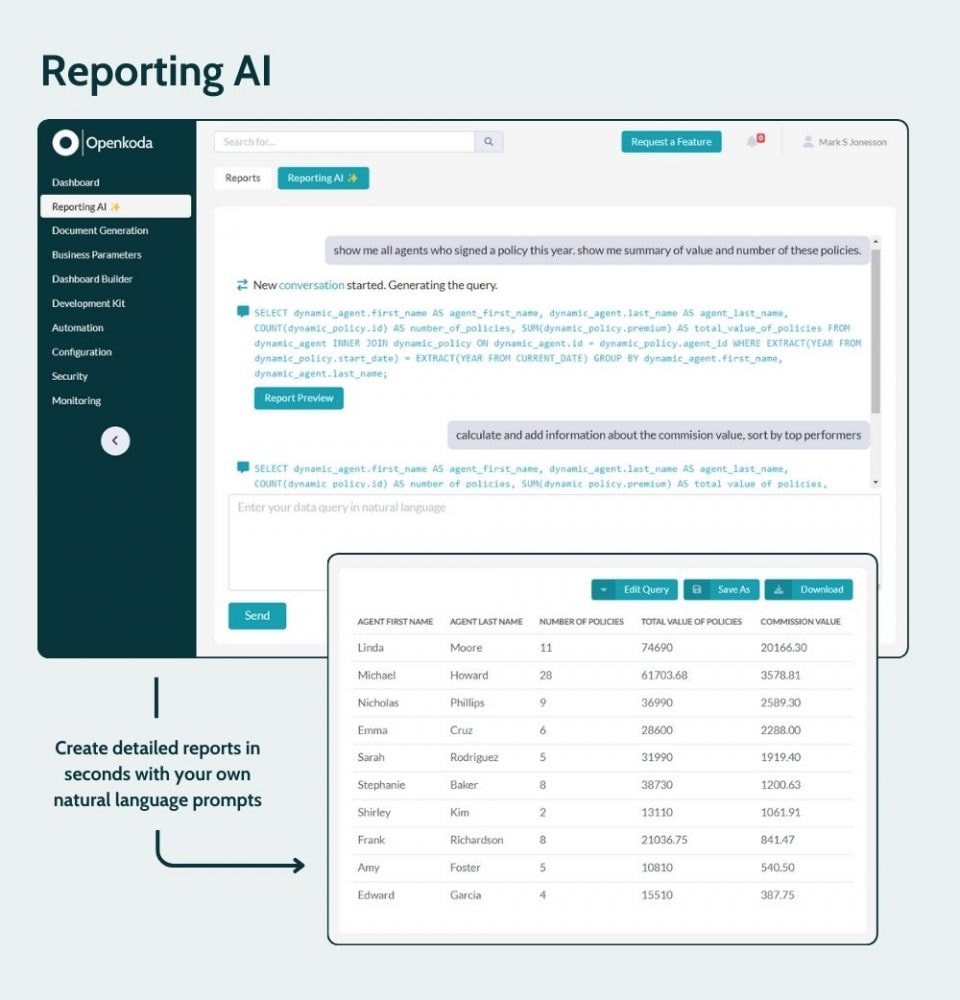

For instance, a model identifying potential fraud in a claim can automatically flag it for review or initiate follow-up procedures. An AI reporting tool can, based on your database schema, generate usable SQL quarries without needing any prior SQL experience on the user part.

Key here is to sieve through the hype and focus on the aspects of the insurance sector that can really be impactful.

Being AI Ready: Model Context Protocol

So, how to go about building custom insurance software ready for artificial intelligence?

The Model Context Protocol (MCP) is a new interesting open standard that connects AI assistants to the systems where business data lives—like document repositories, internal tools, and software environments.

While AI models are becoming smarter, they often operate in isolation.

They can’t deliver accurate, helpful responses if they don’t have access to real-time, relevant data.

MCP solves this problem by creating a simple, universal way to connect AI systems with enterprise data sources. It replaces complex, one-off integrations with a consistent and secure protocol.

For insurers, this means AI tools can work directly with claims systems, policy management software, or underwriting dashboards—making outputs more accurate and context-aware.

Accommodating for New Emerging Risks: Need for Specialized Products

Climate volatility. Cybersecurity breaches. Autonomous vehicles. AI liability.

The nature of risk is changing fast, and traditional insurance products often don’t fit the bill. That’s where specialized insurance products come in.

Cybersecurity and Volatile Climate: Key Risks to Watch out For

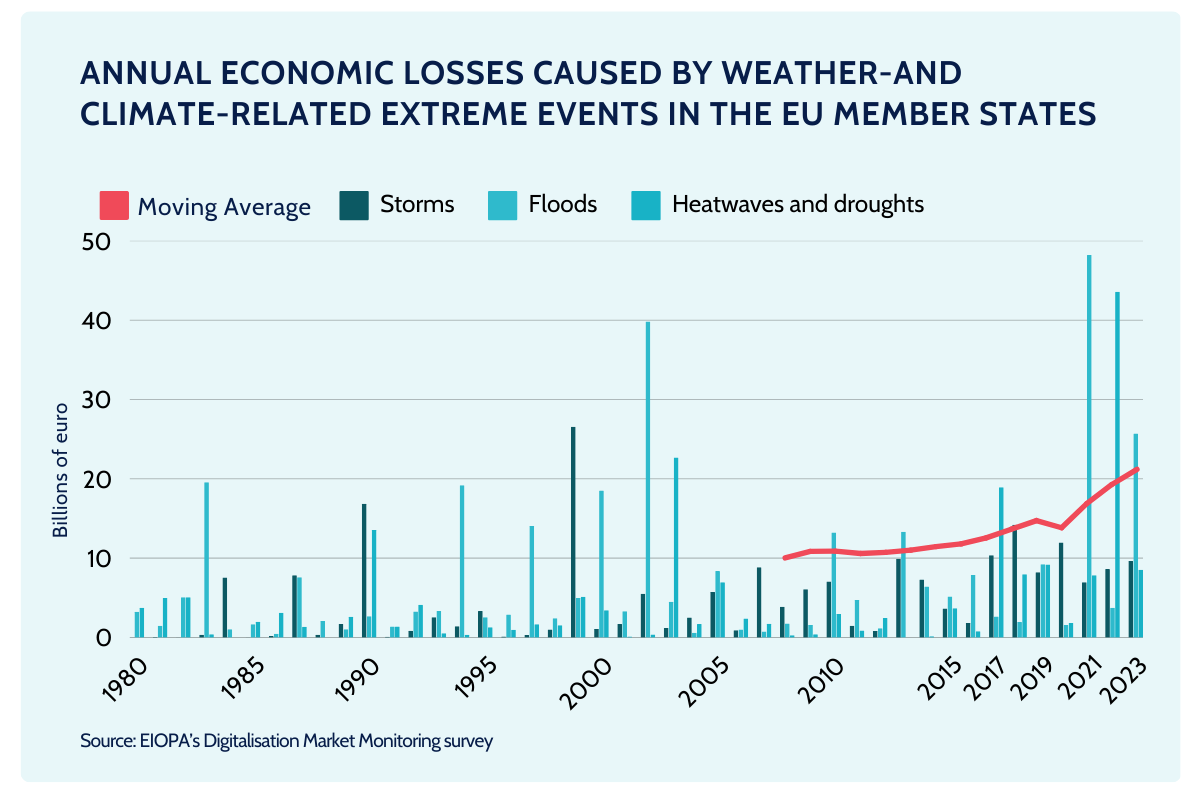

Two of the most urgent and costly risk categories in 2025 are cyber threats and climate-related events. Both continue to grow in frequency, severity, and impact—and both demand more advanced, tech-enabled insurance responses.

Cybercrime remains a top-tier concern.

In 2024, global cybercrime costs were projected to reach an astonishing $9.5 trillion USD annually. At the same time, the average cost of a data breach rose to $4.88 million—an all-time high—driven by increasingly sophisticated attacks and widespread regulatory pressures. For insurers, this means developing more precise cyber risk models, offering adaptive coverage, and incorporating real-time monitoring tools to reduce exposure.

Meanwhile, climate-driven losses have soared. Insured losses from natural catastrophes reached $140 billion globally in 2024, up from $106 billion the previous year—making it one of the most expensive years on record.

The takeaway is clear: These are not hypothetical risks.

They are current, accelerating, and materially impacting both the top and bottom lines of insurance market.

Success in this environment requires building products that are dynamic, data-informed, and specific to the nature of each risk.

Specialized Insurance Products to Cater to Niches

With the complexity and diversity of risks rising, there is a growing demand for niche, innovative insurance products tailored to specific industries, business models, or emerging scenarios.

Specialized insurance products—built around the unique needs of defined markets—are quickly gaining traction.

How specialized are we talking?

Think things like drone fleet operations, autonomous logistics, on demand insurance, or parametric weather-triggered payouts for agriculture.

To meet these demands, insurers must move beyond rigid core systems.

Developing such specialized products requires working with flexible, highly customizable software platforms that allow teams to adapt coverage logic, rating engines, and workflows to specific business needs.

[Read also: Top 10 AI Reporting Tools in 2025]

Core System Modernization: Overhauling Outdated Software

One of the biggest barriers to innovation initiatives in insurance industry?

Many insurers are still running on decades-old infrastructure that hampers agility, slows down integration with new technologies, and creates a heavy maintenance burden. In 2025, this is no longer sustainable.

Technologies like low-code platforms, microservices, and event-driven architectures are helping insurers decouple their systems and gain the flexibility needed to innovate.

Notably, insurers are looking for solutions that allow them to reduce vendor lock-in, improve data flow between departments, and launch new products faster.

Ultimately, core modernization isn’t just about improving software—it’s about future-proofing your business.

With scalable, resilient systems in place, insurers can respond to market changes more effectively and gain a competitive advantage without being held back by technical debt.

[Read also: Top 10 Insurance Software Development Companies in 2025]

Your Go-to Insurtech Product Innovation Strategy

Turning bold ideas into successful tailored solutions doesn’t happen by chance.

In today’s fast-moving market, innovation must be structured, intentional, and aligned with both business operations and customer expectations.

Based on our experiences, we’ve outlined three key steps to building that strategy—designed to help you manage uncertainty, deliver value, and scale innovation effectively.

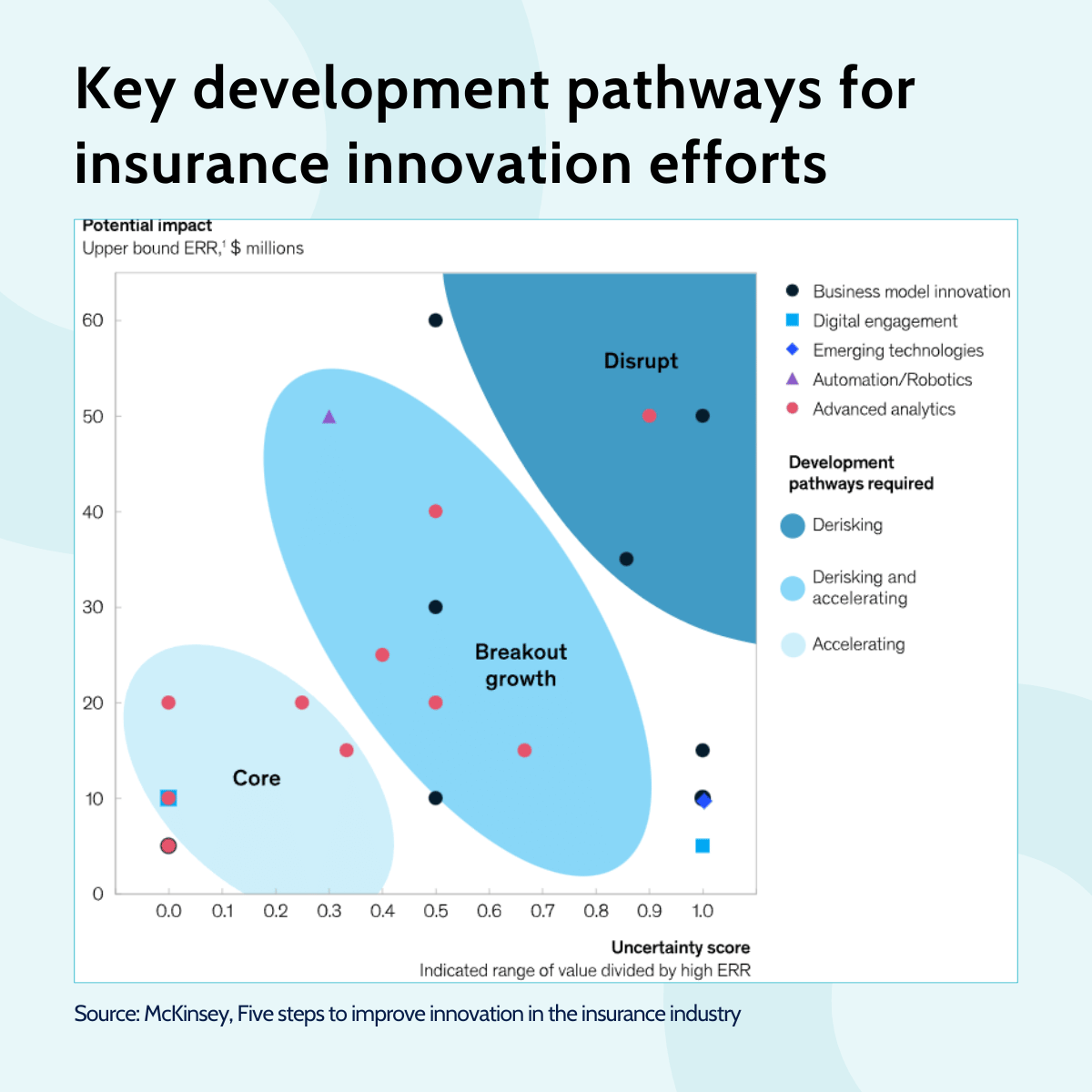

Step #1: Develop Distinct Product-Development Pathways

Not all innovation efforts are created equal. Depending on the goal, risk level, and internal readiness, product development initiatives should follow distinct strategic pathways.

Each pathway has a specific set of characteristics:

- Derisking: This approach involves exploring innovative ideas that may compete with core offerings. The delivery path is uncertain, and success depends on rigorous testing and iteration. These efforts typically require strong executive sponsorship and a high tolerance for ambiguity.

- Derisking and Accelerating: This hybrid pathway is best suited for high-potential opportunities that involve new technologies or capabilities unfamiliar to the company. The solution path is still unknown, and success hinges on cross-business unit collaboration and coordinated change management.

- Accelerating: For ideas that already have some proof points—perhaps tested in other markets or lines of business—this pathway focuses on scaling known solutions. Challenges here often lie in integration, cross-functional alignment, and infrastructure limitations.

By identifying which pathway a product fits into early on, insurers can better tailor their development approach, manage expectations, and improve their odds of successful execution.

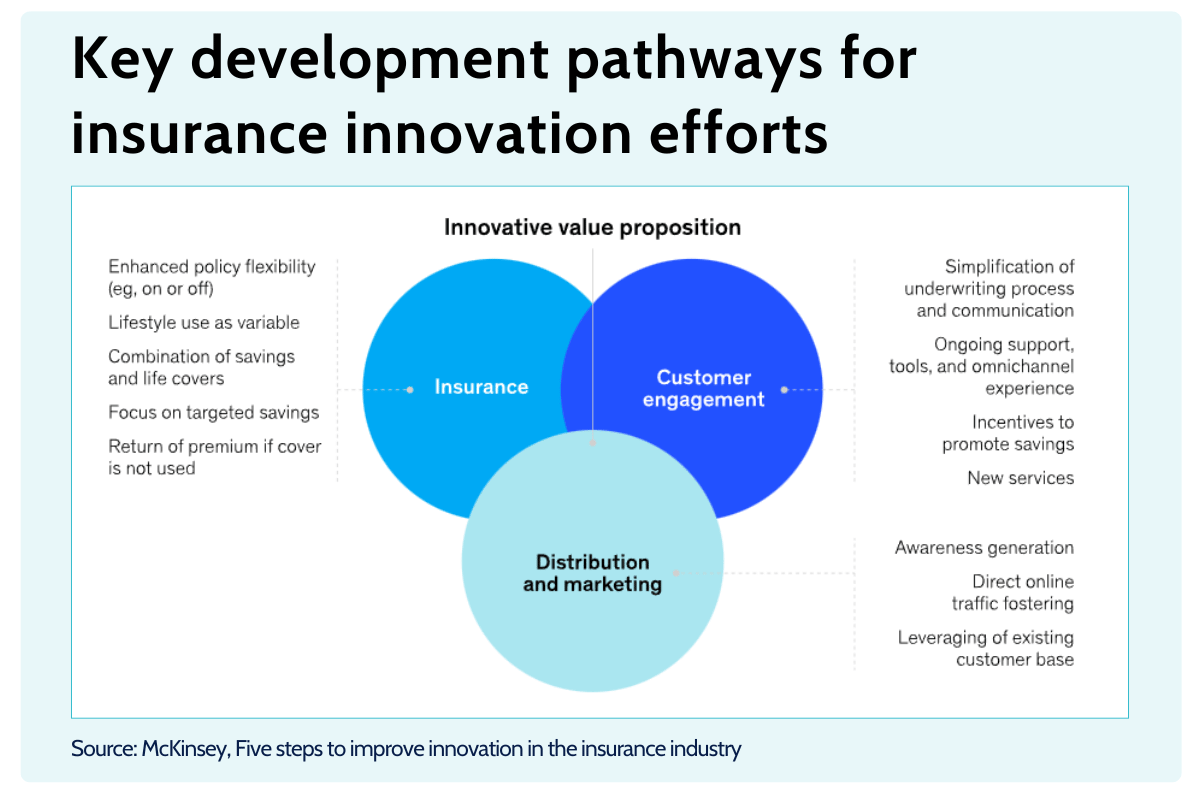

Step #2: Design Unique Value Propositions for Your Users

Innovation only works when it delivers clear value to the user.

Successful insurance products today are those that offer distinctive benefits at various stages of the value chain—not just in coverage terms, but in how they’re discovered, purchased, and experienced.

The key is to step beyond generic features and focus on what truly sets your offering apart. What specific problem are you solving better than anyone else?

Whether it’s simplicity, speed, transparency, or flexibility—owning a unique angle is crucial for adoption and long-term success.

Step #3: Build Upon an Extensible and Customizable Core

Innovation is not sustainable on rigid infrastructure.

To support continuous experimentation and fast product launches, insurers need a modern, extensible core that allows for real-time changes, smooth integrations, and modular development.

This means moving away from monolithic legacy systems and embracing platforms that support configuration, not just customization—giving product teams the freedom to test, iterate, and scale without being tied to long development cycles or external dependencies.

Importantly, we are not talking only about adjusting the front-end, we are focusing on customizing underlying product logic—from pricing and rules engines to insurance automation and data exchange layers.

This flexibility is especially critical when wanting to build specialized insurance products faster, especially where off-the-shelf systems fall short.

To see how such a process might work in practice, check out this short demo video of developing a quoting system with flexible pricing calculation rules:

Key Threats: What Can Derail Your Innovation Strategy

Even the most forward-thinking insurance innovation strategies can stumble if certain risks aren’t actively managed.

As insurers pursue new products, technologies, and business models, it’s critical to be aware of the hidden—and often underestimated—issues that can undermine progress.

Vendor-Lock In: Innovation’s Silent Roadblock

As insurers turn to external platforms and third-party technologies to accelerate product development and digital transformation, they also expose themselves to a growing risk: vendor lock-in.

This dependency can become a major problem when you need to move quickly—launching a new product, integrating a partner, or changing a core process. If your systems aren’t open and flexible, even small changes can become expensive and time-consuming.

Vendor lock-in isn’t just a technical issue—it’s a strategic one.

It can limit innovation, slow time to market, and reduce your control over critical systems.

The solution?

Choose platforms that offer open architecture, full customizability, and easy integration. Avoid solutions that restrict your options or force you to rely on proprietary tools. True innovation requires freedom to adapt, evolve, and move at your own pace.

Budgets Overruns: The Hidden Cost of Innovation Drift

Another frequent threat to innovation is financial overreach.

It starts with a great idea and a clear goal—but along the way, the scope grows, priorities shift, and costs spiral out of control.

This is especially risky when modernizing core systems or working across multiple departments.

Without clear boundaries and strong project management, innovation projects can lose focus and burn through budgets without delivering real results.

To prevent this, develop your software around a couple key principles such as: setting up measurable milestones, focusing initially on minimum viable product development, tight feedback loops, and a clear definition of success.

[Read also: 7 Key Insurtech Trends For 2025]

Closing Thoughts

Innovation in insurance is no longer optional—it’s a key driver of growth, efficiency, and long-term success.

From adopting generative AI to creating specialized products and building on flexible platforms, the opportunities are real and within reach. But to succeed, insurers must be strategic.

That means choosing the right pathways, focusing on what customers truly value, and staying alert to hidden risks like vendor lock-in or budget drift.