How to Easily Manage Multiple Insurance Organizations in One Platform

Managing multiple insurance branches and teams doesn’t have to be a logistical nightmare. Forward-thinking insurers are leveraging insurtech platforms to bring all their organizations under one centralized, powerful hub.

With the Openkoda insurtech platform, you can seamlessly create and manage organizations, personalize interfaces, and assign user roles with precision. In this step-by-step guide, we’ll show you how to create new organizations and easily manage them within one platform.

Why You Need One Platform to Manage Multiple Insurance Organizations

1. Increased efficiency & time savings

Manually managing multiple insurance companies can be time-consuming and inefficient. A centralized platform eliminates the need to log into multiple systems, reducing redundant tasks and manual data entry. This streamlines operations and allows agents to focus on customer interactions rather than administrative tasks.

2. Better decision-making & policy comparisons

With all policy details, pricing, and coverage options in one place, agents can quickly compare different insurance providers. This enables them to make more informed recommendations to clients, ensuring they get the best coverage based on their needs and budget.

3. Improved customer service

A single platform provides instant access to customer information, making it easier to efficiently process inquiries, claims, and policy renewals. Faster response times lead to higher customer satisfaction and retention, as customers appreciate fast and accurate service.

4. Improved compliance and accuracy

Manually managing multiple insurers increases the risk of errors and regulatory issues. A centralized system standardizes data entry, ensures accuracy, and helps maintain compliance with industry regulations. This reduces the risk of errors and legal complications.

5. Scalability & business growth

As an agency grows and partners with more insurance providers, a centralized platform allows for seamless integration without disrupting existing workflows. This flexibility makes it easier to scale operations, expand offerings, and maintain efficiency as the business evolves.

6. Cost savings & automation

Using multiple software solutions can be costly and inefficient. A single management platform reduces software costs, automates repetitive tasks, and minimizes the need for additional administrative staff. This results in significant cost savings while improving operational efficiency.

7. Simplified reporting & analytics

With all insurance data in one place, organizations can create insightful reports and analyses. This helps track performance, identify trends, and optimize business strategies based on data-driven decisions.

How to Manage Multiple Insurance Organizations in One Platform: Step-by-Step Guide

Now that you understand the benefits of managing multiple insurance companies from a single platform, let’s dive into a step-by-step tutorial on how to set up new insurance organizations using the insurtech platform Openkoda and effortlessly customize dashboards for seamless management.

Follow the steps below, or watch our video tutorial:

Step 1: Create New Organizations

Managing multiple insurance entities requires a structured approach.

Openkoda simplifies the process of setting up and organizing businesses. It makes it easier for insurers to oversee different branches or agencies.

In order to create new organizations, follow these steps:

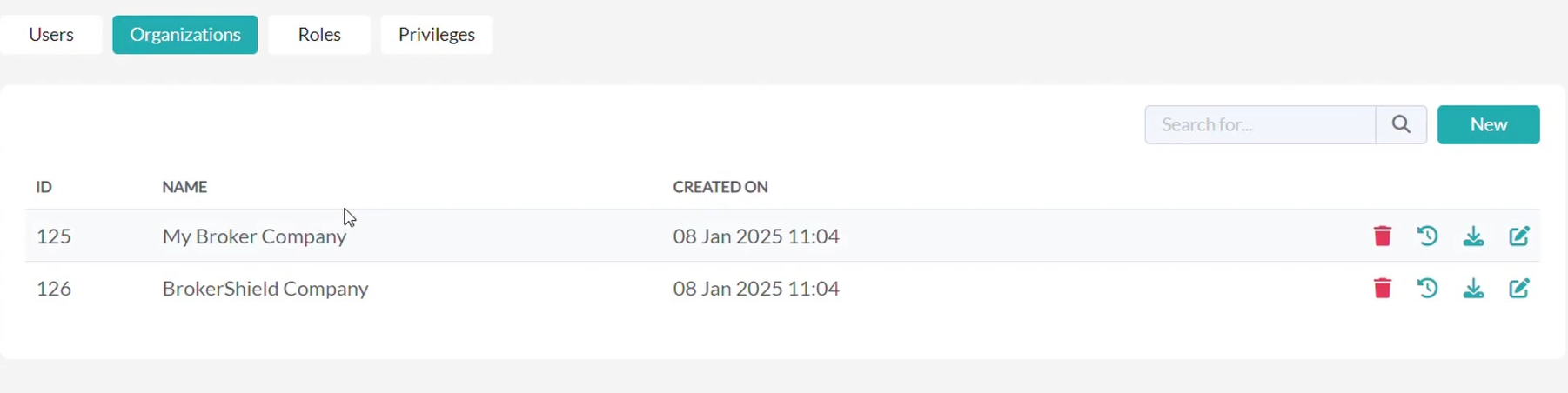

- Navigate to Organization Settings and select “Add New“.

- Enter the name of your organization. In this example, we will add BrokerShield Company and My Broker Company.

- Once added, a complete list of organizations will be displayed.

- From this list, you can edit, delete, or manage each organization with just a few clicks.

The ability to manage multiple organizations in one place provides insurers with improved visibility and control over their operations.

2. Personalize the Interface

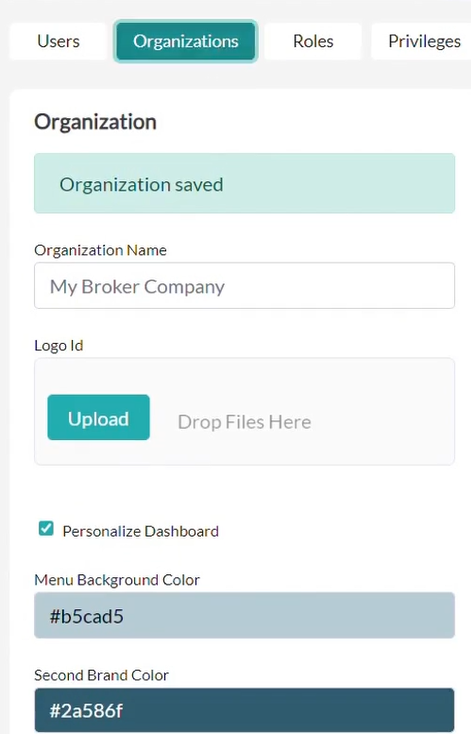

Each insurance organization has its own identity, and maintaining brand consistency is important for both internal teams and clients.

Openkoda provides full customization capabilities, allowing insurers to tailor the interface to their needs and preferences.

You are able to modify logos, color schemes, and themes to reflect the organization’s brand.

You can also customize dashboards and menu layouts to align with workflow preferences and configure the navigation structure to improve user experience and accessibility. Learn how to do it in this video tutorial.

By enabling organizations to tailor their interfaces, Openkoda helps increase recognition, improve usability, and create a more efficient work environment.

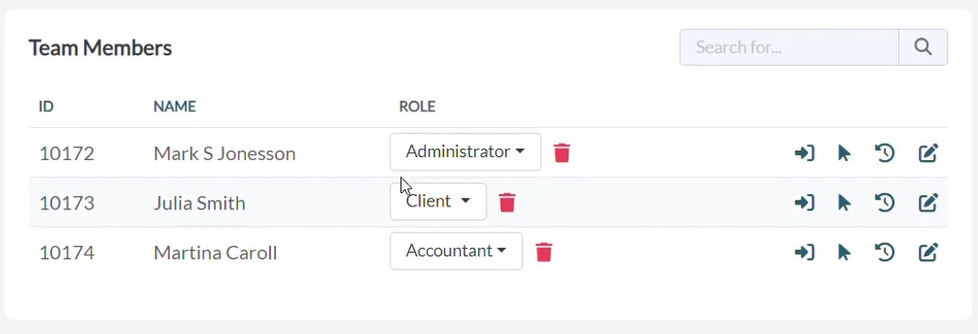

3. Add and Manage Users

Scalability is crucial for insurers, especially as teams grow and roles diversify.

Openkoda allows organizations to add and manage an unlimited number of users while maintaining structured access controls.

Let’s add new users and assign them roles:

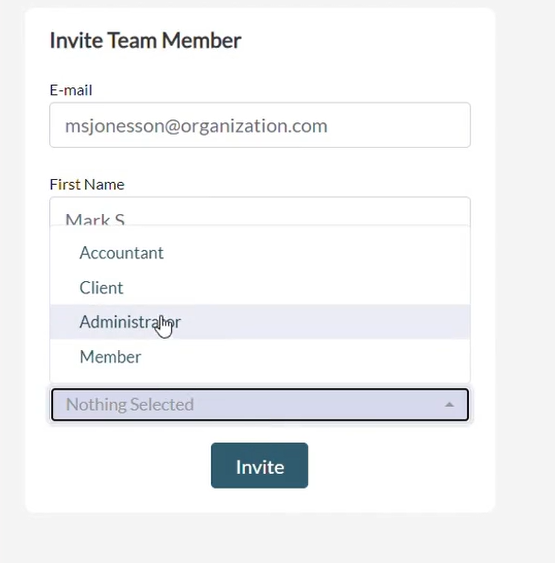

- Navigate to your organization setting and go to “Invite Team Member”

- Enter the user’s email address and assign a role.

- Openkoda provides predefined roles such as Accountant, Client, Administrator, Member, or you can create custom roles with specific permissions.

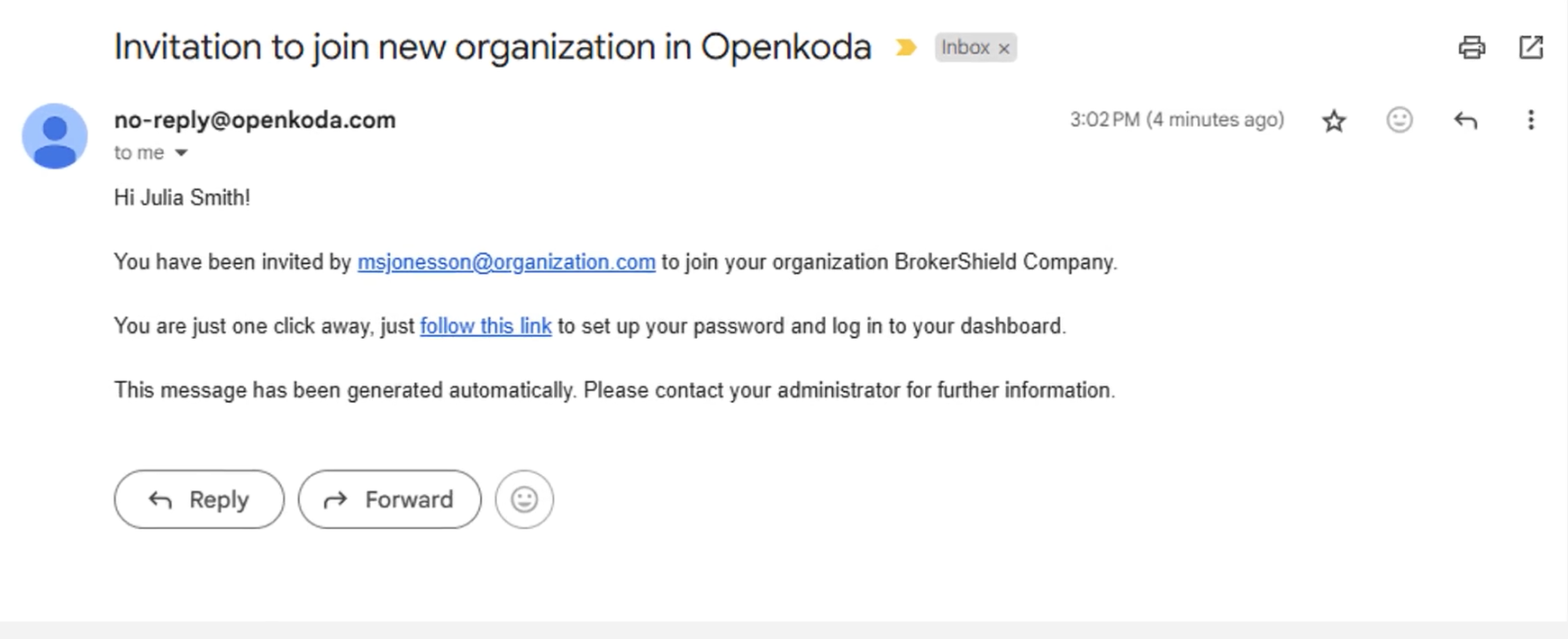

- The user will receive an email invitation to join the organization.

- Administrators can edit user roles, review activity logs, or remove users as needed.

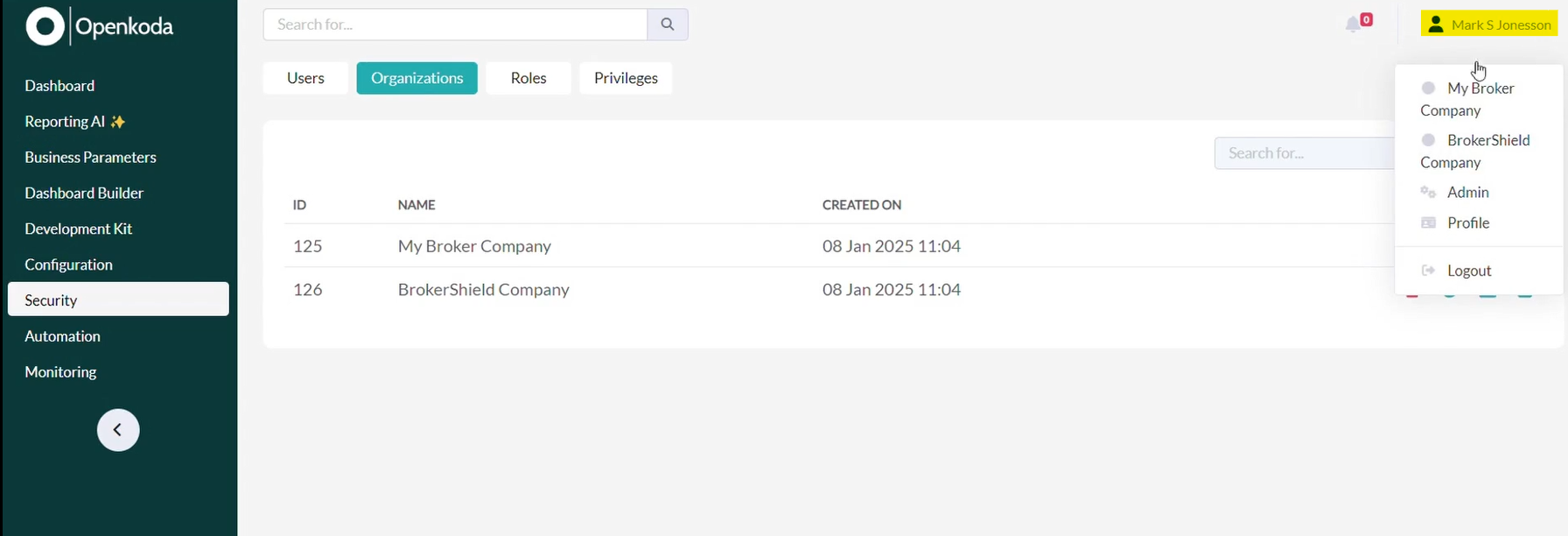

4. Navigate Between Organizations

Managing multiple branches or agencies often requires switching between organizations quickly. Openkoda simplifies this process by providing a one-click organization switcher.

Just click on the organization name in the top right menu and select the organization you want to manage.

You can instantly transition between dashboards, maintaining access to relevant data and functions.

Each organization in Openkoda maintains its own interface, dashboards, and workflows. It ensures that users always have access to the relevant tools and data.

Take Control of Your Insurance Operations with Openkoda

With Openkoda, managing multiple insurance organizations in one platform becomes significantly more efficient. Insurers can streamline operations, maintain control over user access, and customize the platform to fit their unique business needs.

Explore how Openkoda features can streamline your operations and provide the ideal solution for insurance businesses seeking innovative software and book a personal demo with us.