Embedded Car Insurance: How to Build It?

Embedded insurance is rapidly transforming how customers engage with car insurance providers. By integrating insurance seamlessly into existing platforms, websites, or applications, insurers can provide instant, personalized coverage exactly when customers need it most.

In this article, we’ll guide you step-by-step through creating a dynamic, embeddable quote form for car insurance that you can easily modify and integrate into your platform. But first, let’s explore why embedded insurance is particularly valuable to the car insurance sector.

Key Benefits of Embedded Insurance for Car Insurance

Convenience and Instant Access

Rather than navigating away from a site or contacting separate providers, with embedded insurance, customers can receive instant auto insurance quotes right at the point of purchase or decision. This streamlined experience dramatically reduces friction and encourages faster purchase decisions.

Increased Conversion Rates

Another critical advantage of embedded insurance is its potential for significantly improving conversion rates. When insurance coverage is presented naturally and contextually, customers are more inclined to purchase instantly, resulting in fewer abandoned transactions and increased sales.

Greater Operational Efficiency

Automated processes reduce administrative overhead, minimize human error, and streamline underwriting and policy issuance. Real-time data validation ensures accuracy, reducing claims disputes and streamlining operations.

Personalized and Flexible Offerings

Embedded insurance offers insurers the ability to customize and personalize insurance product offerings dynamically. Products and coverage levels can be updated instantly within embedded platforms, providing greater flexibility to respond to customer demands and market trends.

[Learn more: How Embedded Insurance Enables Personalized Protection]

Competitive Advantage and Customer Satisfaction

Lastly, offering embedded insurance provides companies with a clear competitive advantage. Delivering a modern, customer-centric approach to car insurance attracts tech-savvy consumers who value transparency, ease of use, and immediate service.

How to Quickly Create an Embeddable Quote Form for Car Insurance: Step-by-Step Guide

Creating a customized and embeddable car insurance quote form can significantly enhance your customers’ experience and boost conversions.

In this step-by-step guide, we’ll show you exactly how to build an interactive form for car insurance that can be embedded to your platform using Openkoda.

Follow the steps below or watch our video tutorial:

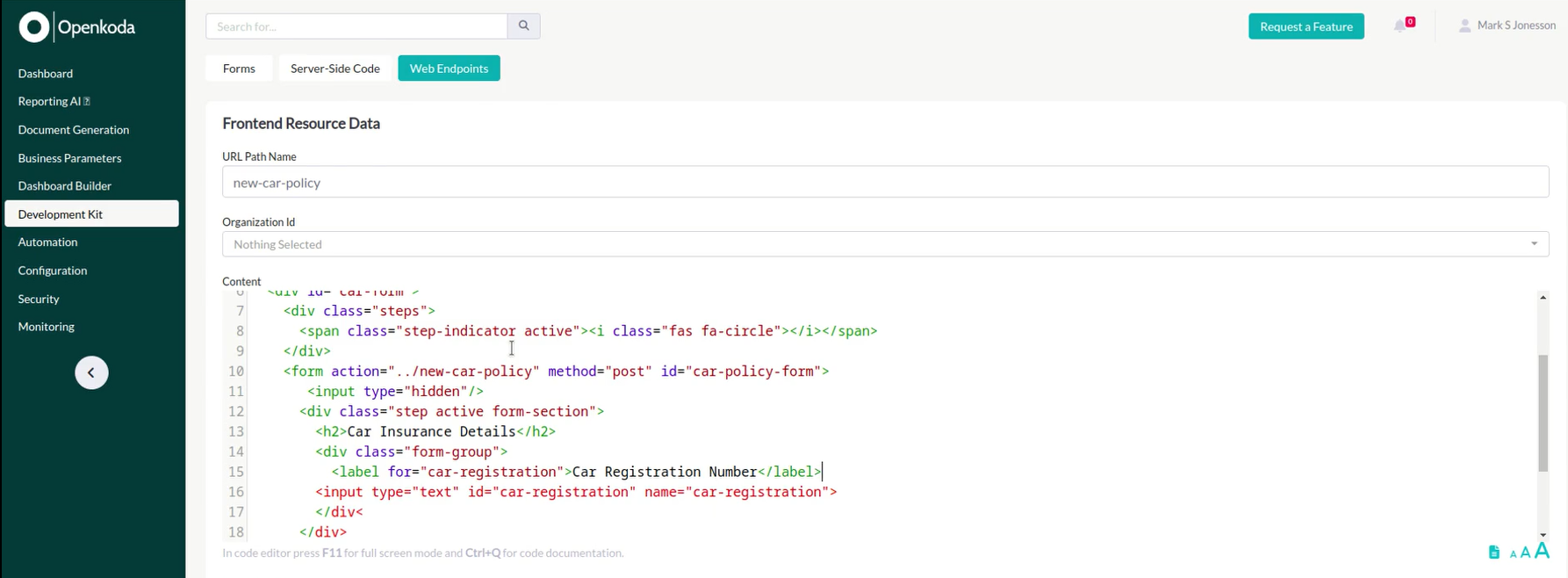

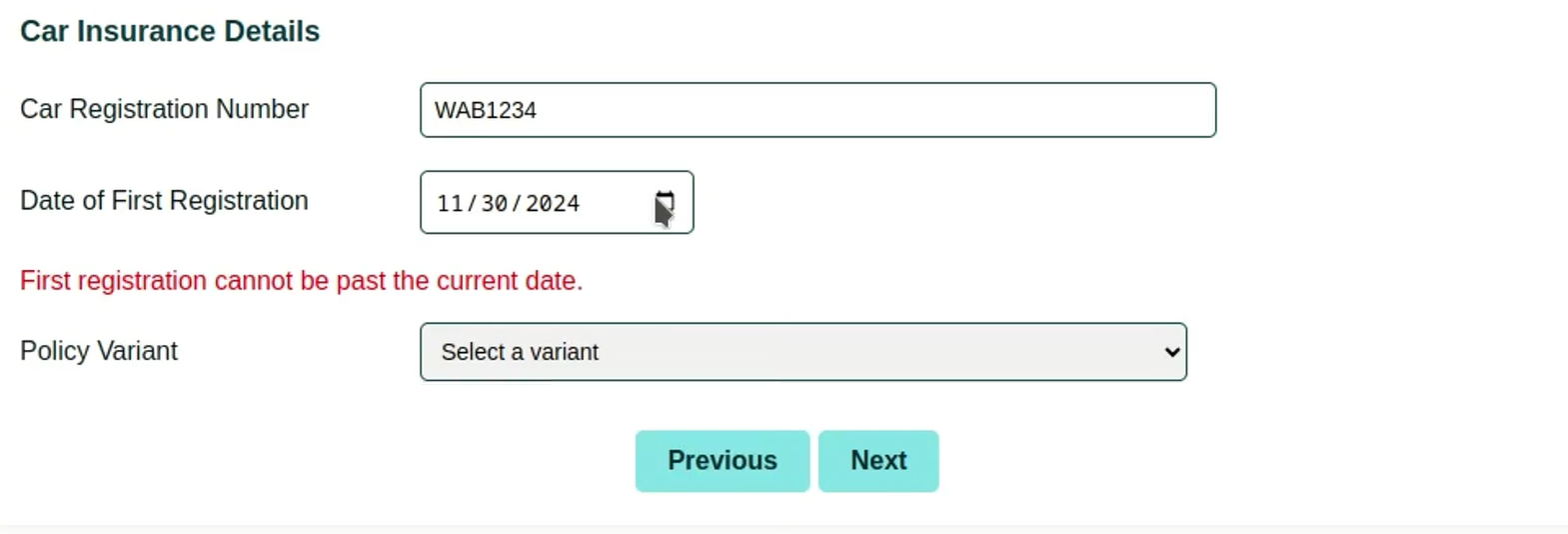

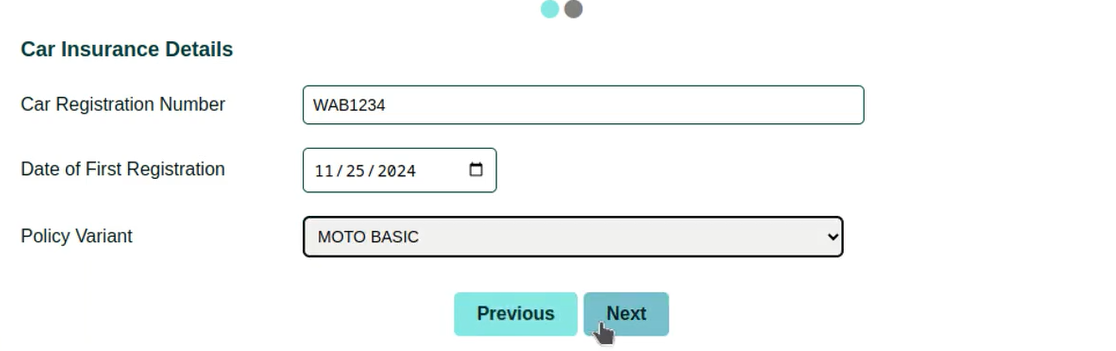

Step 1: Create Your Essential Form

Begin by laying the foundation of your form with a few essential questions.

Go to Development Kit in the Openkoda platform and add new Web Endpoint called “new-car-policy”.

These questions help gather critical data needed for an accurate car insurance quote:

- Vehicle Registration Number

- Date of First Registration

- Vehicle Model

- And any other field you might need for your policy form

Including these fields allows you to quickly collect the data needed to calculate accurate quotes for potential policyholders.

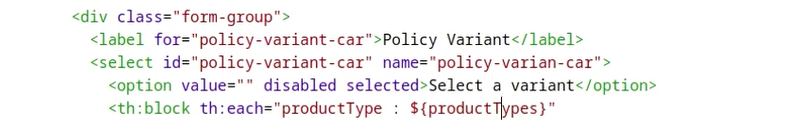

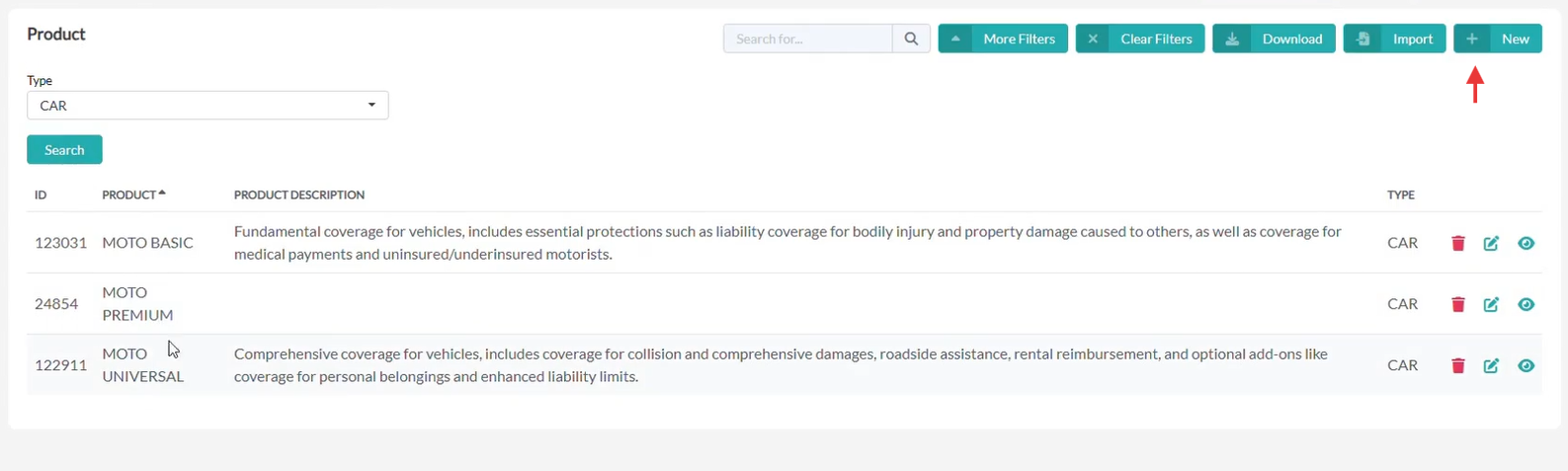

Step 2: Include Dropdown Selection for Coverage Options

Next, enhance your form by adding intuitive dropdown boxes for selecting car insurance coverage packages.

These dropdown fields dynamically pull their values directly from your Openkoda database, ensuring consistency and eliminating manual updates.

Clients can conveniently select coverage variants such as:

If you decide to introduce a new variant, such as Premium Coverage, simply update your database, and it immediately becomes available on your embedded form.

Dynamic integration with your database ensures your customers always see the latest insurance options.

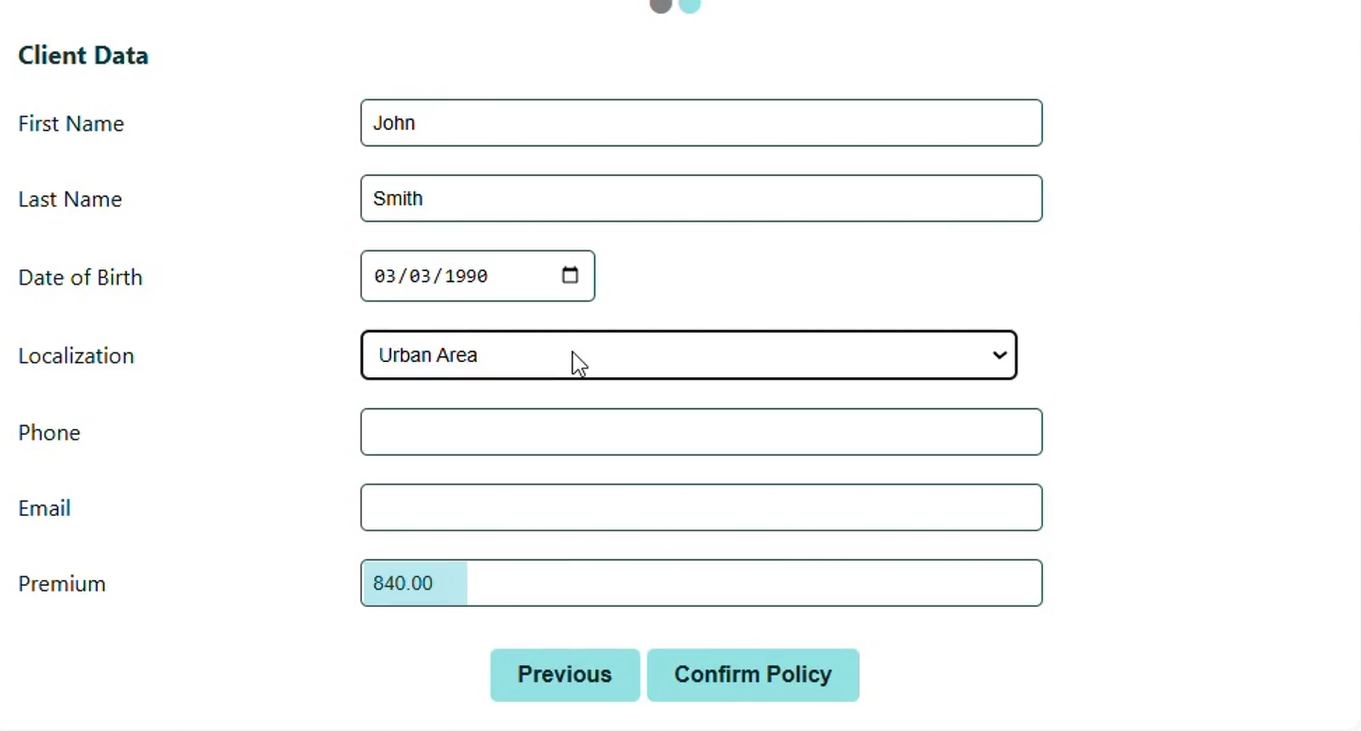

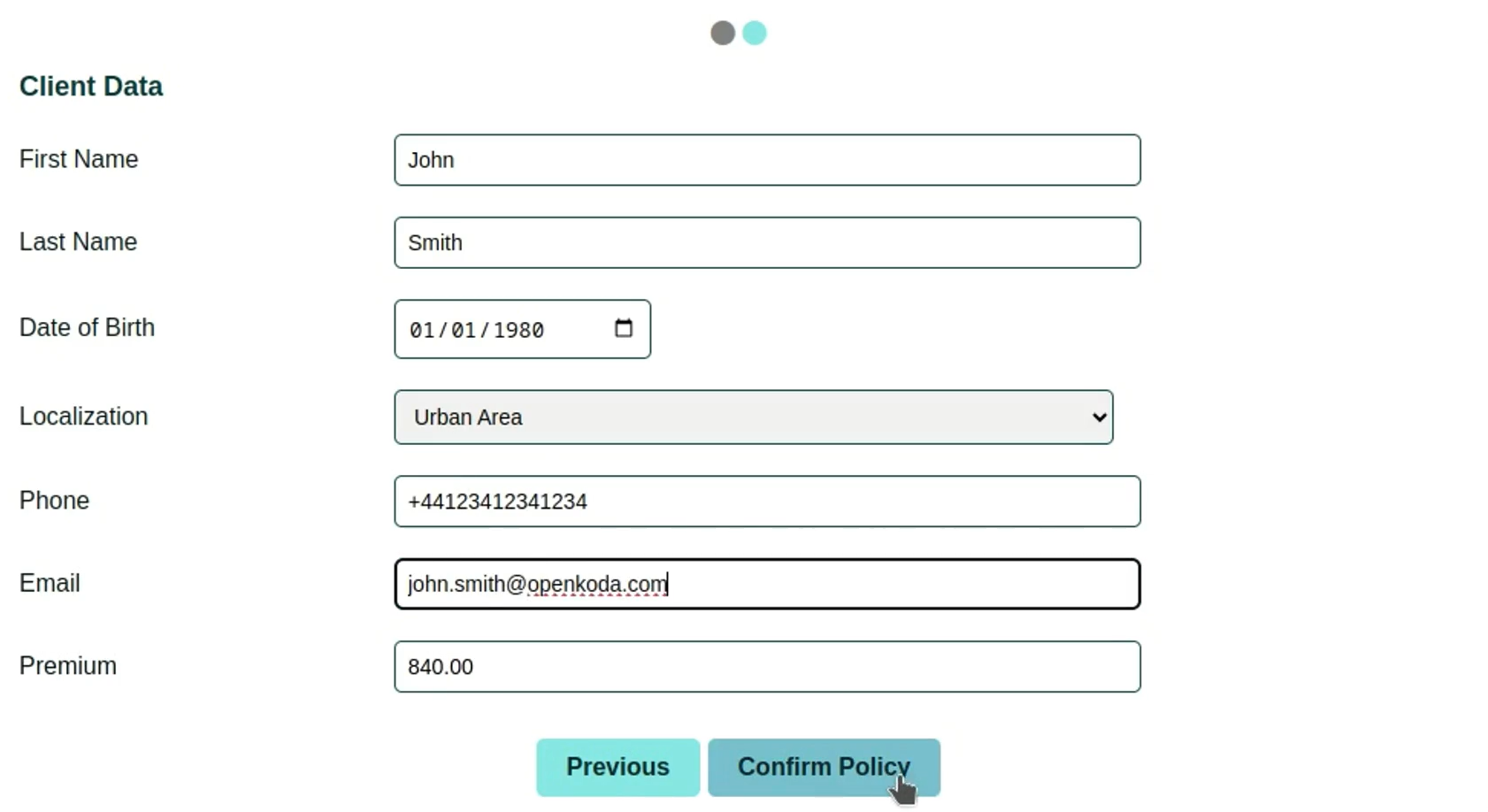

Step 3: Add Dynamic Premium Calculation

Your form should provide instant, accurate pricing to encourage quick buying decisions. To do this, add dynamic premium calculation logic.

The form will use predefined formulas considering factors like:

- First registration date

- Driver’s age

- Selected coverage type

- Location

This logic calculates the premium instantly, providing transparency and enhancing customer trust. Users can see how changes in their input immediately reflect in premium pricing.

According to the data introduced by the customer, the premium values change dynamically in real time.

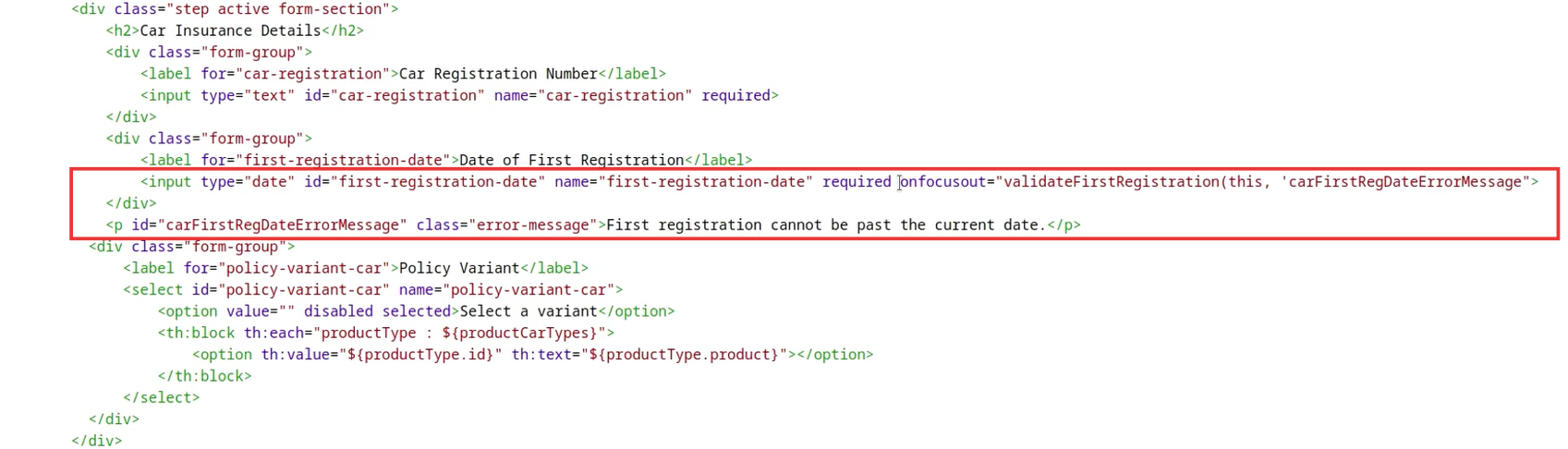

Step 4: Implement Form Validation Rules

Validation is key to ensuring data accuracy and smooth processing. Adding validation rules to your form prevents errors by checking inputs in real-time.

For example, the system verifies:

- Correct date entry (such as vehicle registration date)

- Mandatory fields completed before submission

- Proper formatting of entered data

Clear notifications guide users if they enter invalid data, ensuring accuracy and reducing administrative workload.

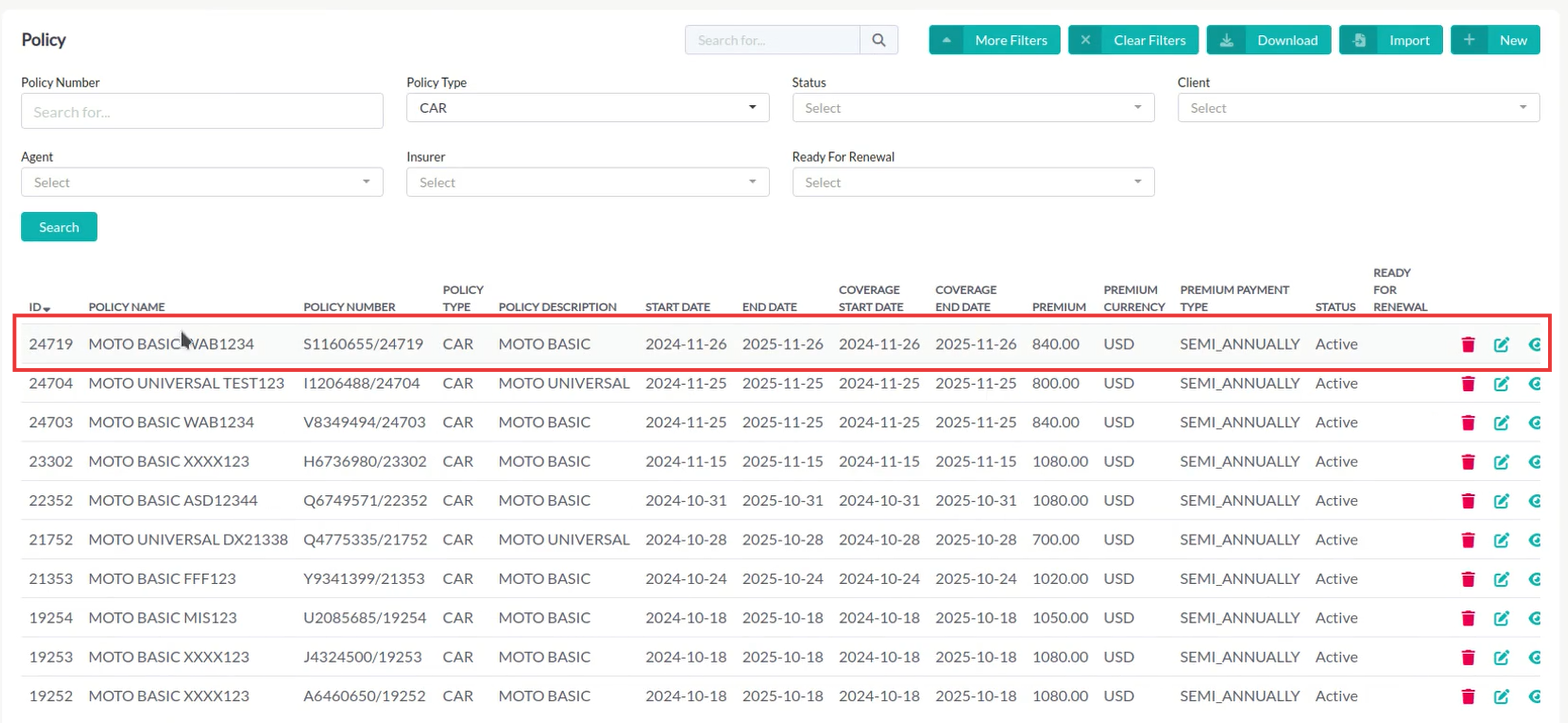

Step 5: Securely Store Customer and Policy Data

Upon submission and confirmation, each policy quote is securely and instantly stored in your database.

Openkoda ensures all data is safeguarded, structured, and easy to retrieve for underwriting, reporting, or policy management.

Your policy management dashboard conveniently displays all collected information, simplifying ongoing management and analysis.

Step 6: Automate the Confirmation Email

Enhance customer engagement and speed up conversions by sending automatic confirmation emails once the form is submitted.

Your embedded car insurance form can trigger an immediate email containing:

- Confirmation of details submitted

- A direct, personalized link to complete the purchase

- Relevant policy information

This automation significantly improves client satisfaction by streamlining their buying experience, driving increased sales.

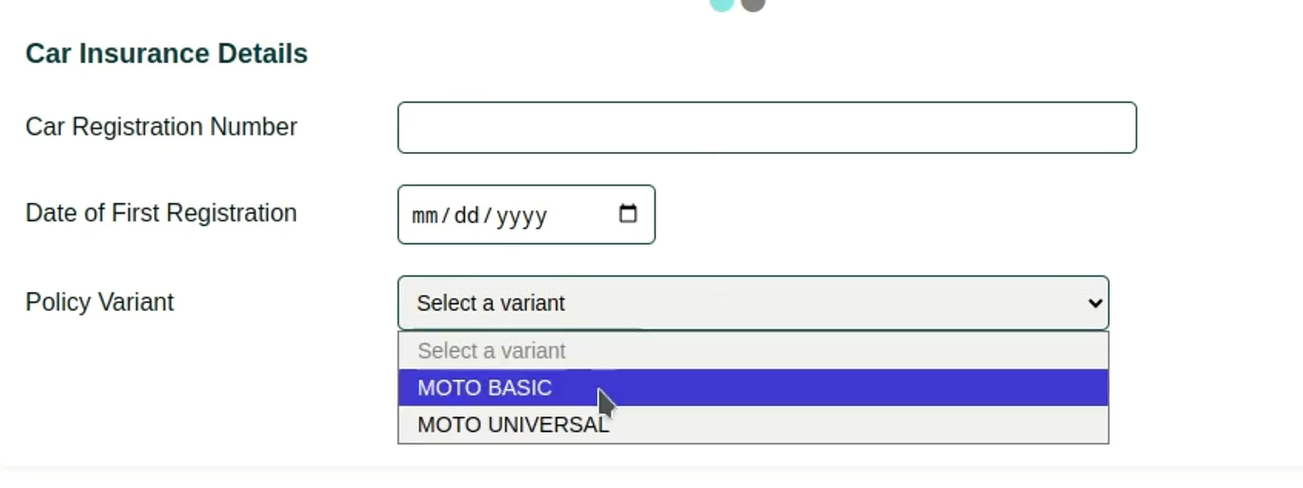

Step 7: Finalize and Embed Your Quote Form

Now your fully interactive, intuitive, and accurate car insurance quote form is ready to integrate into your website!

Your embedded form features:

- Instant premium calculation

- Real-time validation checks

- Automated email confirmations

- Dynamic database integration for updates

This powerful, user-friendly solution dramatically reduces development time and helps insurers quickly adapt to customer demands, ultimately increasing conversions and customer satisfaction.

This is the final two-step embedded insurance form:

Embed Your Car Insurance Quote Form with Openkoda

With Openkoda, creating an embeddable car insurance quote form takes only minutes. The result? Improved client experience, enhanced operational efficiency, and increased potential for conversions.

Want to see Openkoda in action or learn how we can tailor a solution to your unique business needs?

Book a personalized demo and transform your insurance quoting experience with our flexible, powerful software solution for the insurance industry.

Related Posts

- How to Implement a Dynamic Pricing & Real-Time Premium Calculation in Insurance Systems

- How to Build an Embeddable Quote Form for Travel Insurance

- How to Automate Insurance Policy Renewal Reminders?

- How to Easily Manage Multiple Insurance Organizations in One Platform

- How to Personalize Your Openkoda Interface to Match Your Brand