How to Build Your Own Embedded Insurance for Device Protection

As an innovative insurer, you’re always looking for new ways to meet your customers where they are – and embedded insurance is one of the most powerful tools at your disposal.

Embedded insurance is an opportunity to improve customer engagement, create new revenue streams, and stay ahead of the curve in a rapidly evolving insurance market. By integrating device insurance directly into digital touchpoints (such as product checkout, registration flows, or partner applications), you can offer protection at the exact moment it’s needed. It’s fast, frictionless, and perfectly tailored to today’s digital-first customers.

In this guide, we’ll walk you through building a fully customizable, embeddable device insurance quote form — complete with dynamic pricing, validation, real-time database integration, and automation. Whether you’re launching embedded insurance through a partner ecosystem or your own platform, this is a proven foundation to accelerate innovation.

Why Embedded Insurance is a Game-Changer

Offer Coverage at the Moment of Need

Embedded insurance lets you deliver device protection exactly when the customer is thinking about it. This leads to faster decisions, increased conversion and customer satisfaction.

Enable Real-Time Personalization

Modern insurance solutions like embedded insurance are built for personalization, offering tailored coverage options that adapt to each customer’s needs in real time. From smartphones to laptops, customers want insurance that feels relevant without spending time comparing insurance options. With embedded logic that dynamically adapts to their inputs (like device value or policy variant), you offer personalized pricing and protection options tailored to a specific buyer.

Launch Fast, Iterate Often

With insurtech platforms like Openkoda, you can launch embedded insurance faster. You can introduce new products, adjust pricing rules, or update quote forms without waiting months of development or heavy IT involvement.

Whether you’re deploying through partners, e-commerce sites, or your own digital platform, Openkoda enables insurers to test, iterate, and optimize embedded experiences in a flexible way.

New Revenue Streams and Cross-Selling Opportunities

For businesses, offering personalized embedded insurance unlocks new revenue streams and cross-selling opportunities.

By integrating insurance options directly into the purchasing process, companies can generate additional income with minimal effort, such as offering device protection along with electronics.

This approach makes it easy to upsell related services that are relevant to the customer’s purchase.

Curious how to implement all this in your own digital flow? Book your personalized demo and see embedded insurance for devices in action.

How to Build an Embeddable Device Insurance Quote Form: A Step-by-Step Framework Using Openkoda

Whether you’re integrating into a partner platform or your own digital journey, this guide shows you how to build and launch your own embedded insurance solutions in days – not months.

Follow the steps below or watch our video tutorial:

Step 1: Build the Core Structure

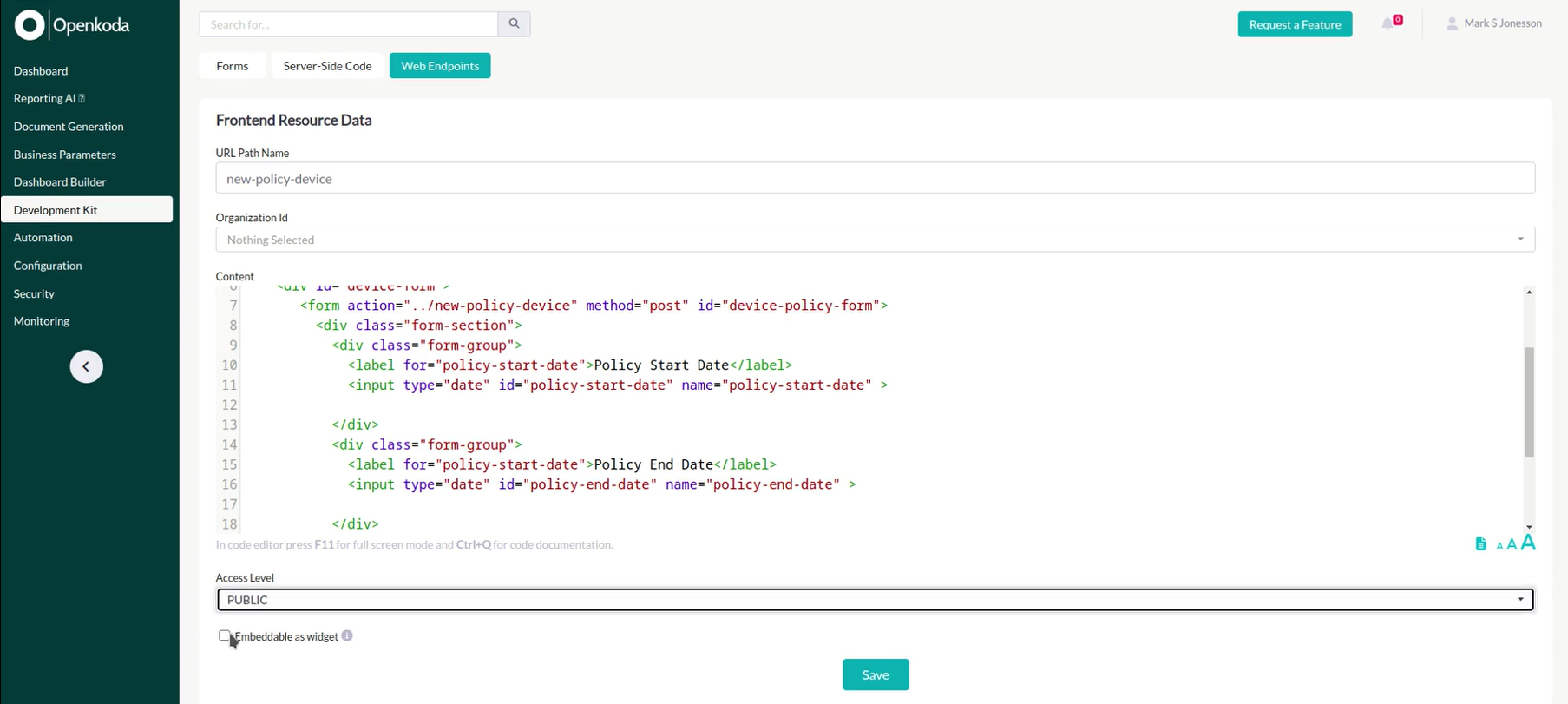

Start by creating your form in Openkoda’s Development Kit.

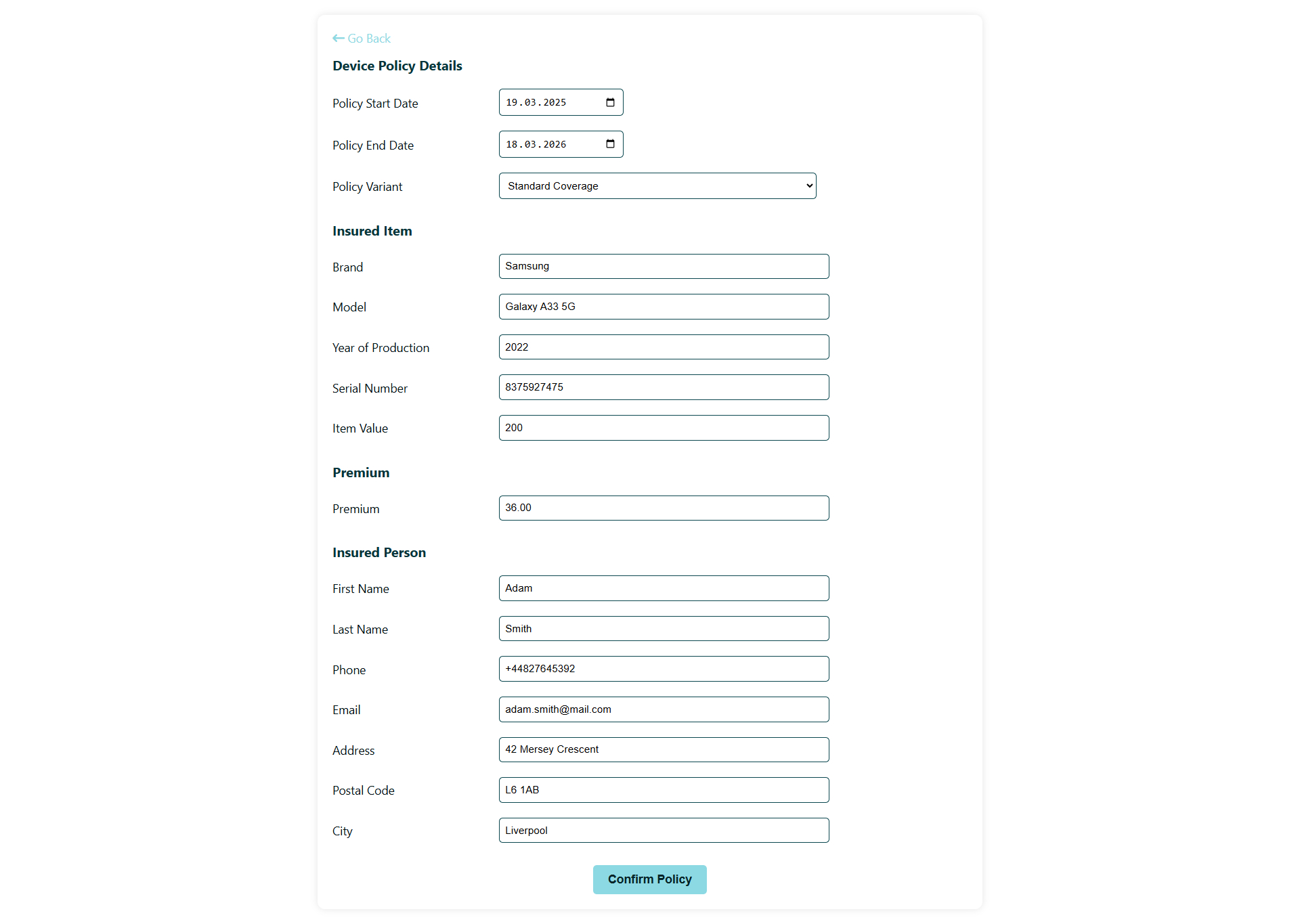

Use a Web Endpoint like “new-policy- device” and add essential fields to capture core customer input:

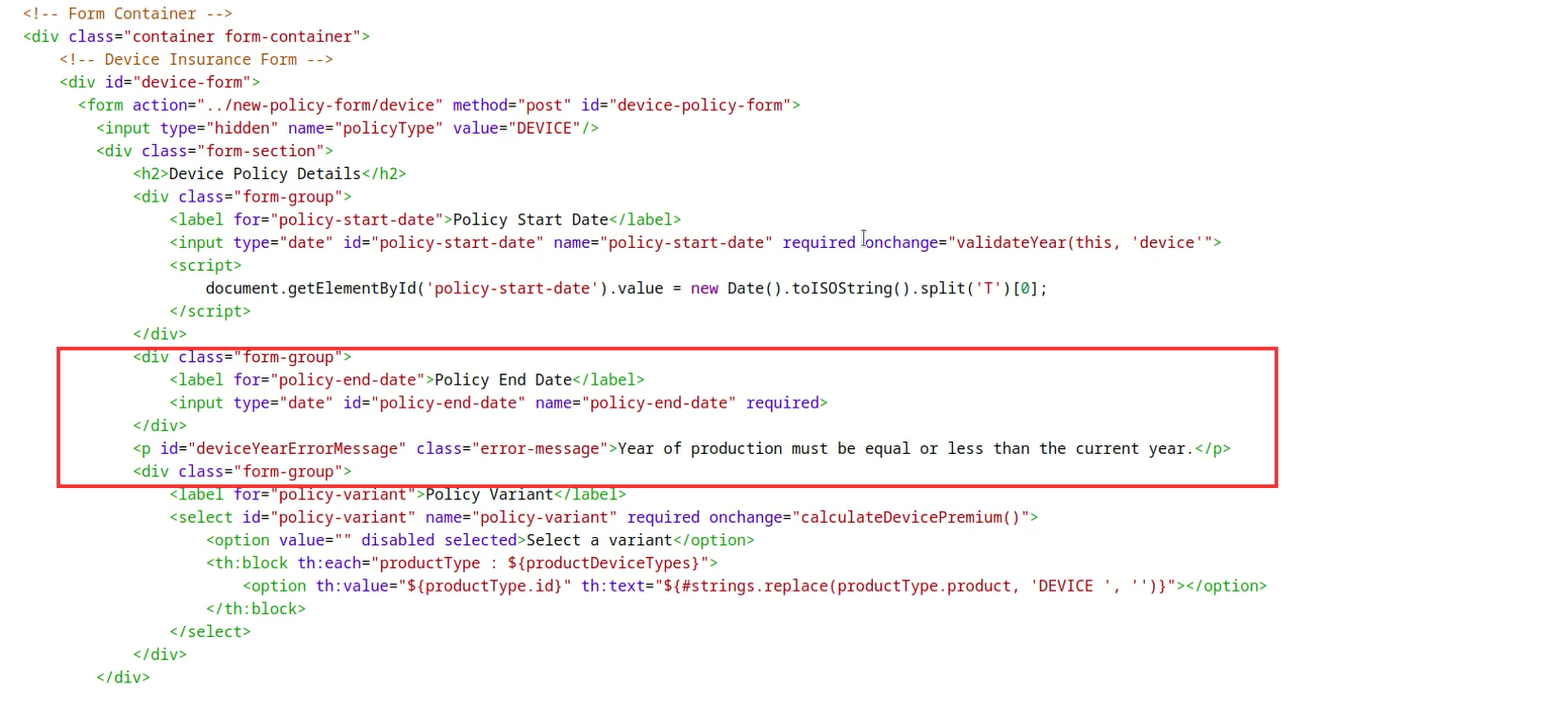

- Policy Start Date

- Policy End Date

- Brand

- Model

- Year of production

- And any other data you need

These data points form the foundation for accurate underwriting and premium estimation.

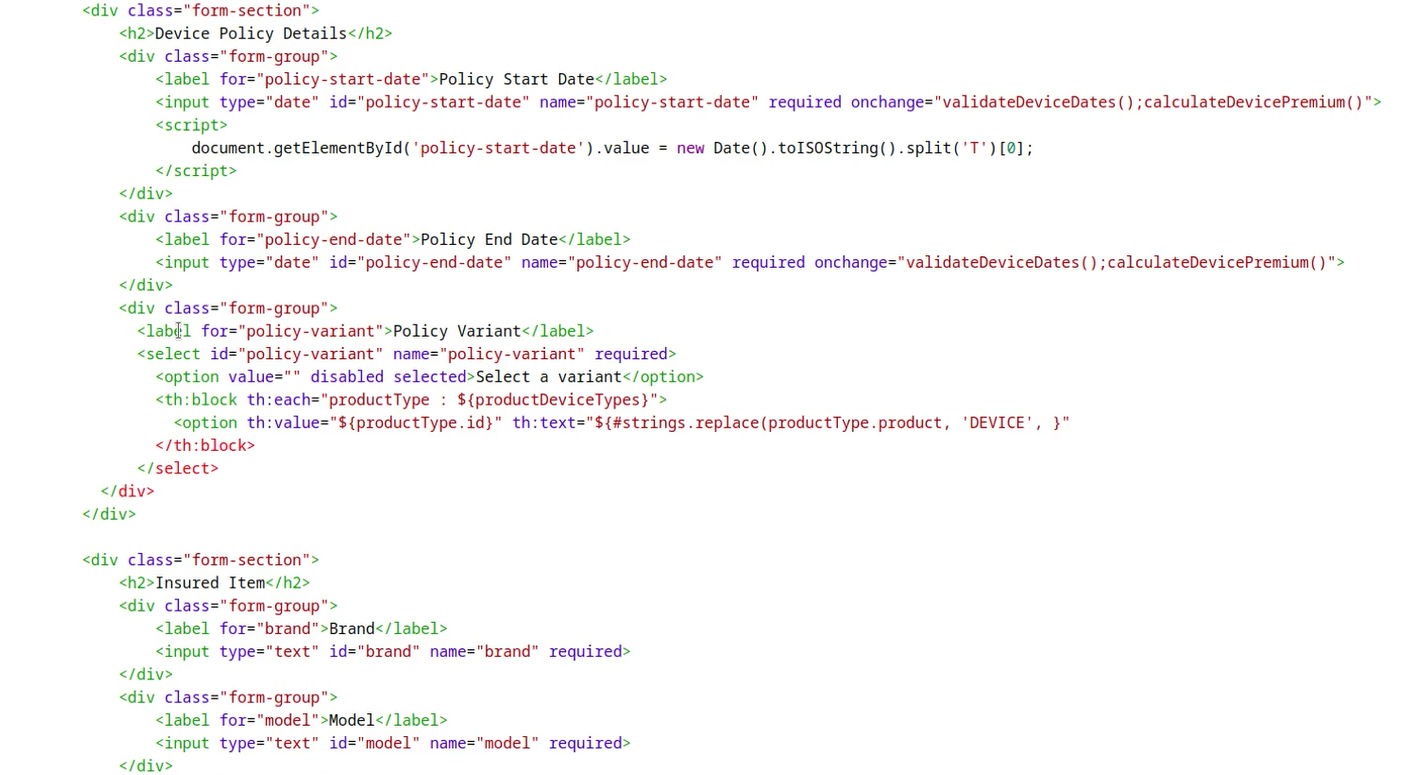

Step 2: Add Dynamic Coverage Options

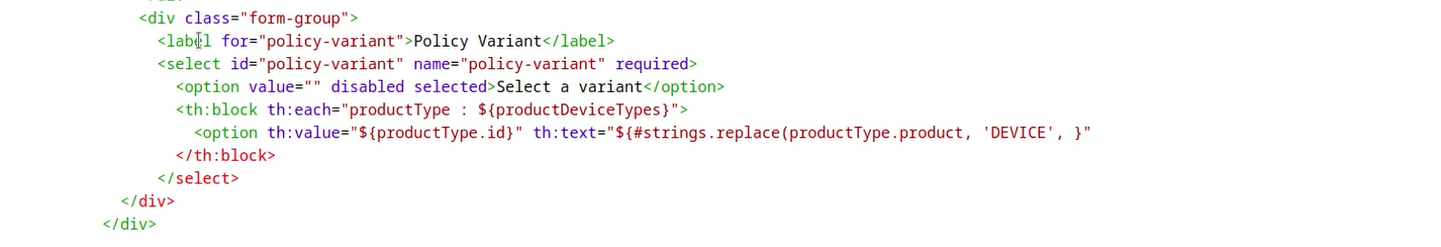

Now extend the form by adding a dropdown field that pulls policy variants directly from your database.

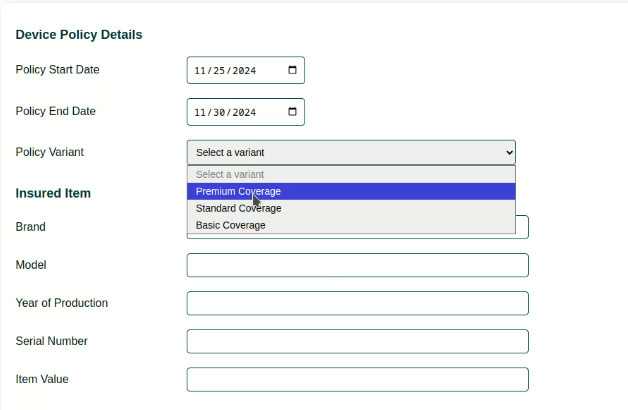

In this example, customers might choose from:

- Standard Coverage

- Extended Protection

- Premium Device Plan

If you want to introduce a new product variant next soon, you just need to update your product list.

For instance, let’s add a Premium product directly in Openkoda.

The dropdown options are dynamically populated from your Openkoda database, so any changes you make appear instantly in the form without any manual updates and with no code redeploy needed.

Curious how flexible this is in real deployments? Book your personalized demo to see live editing in action.

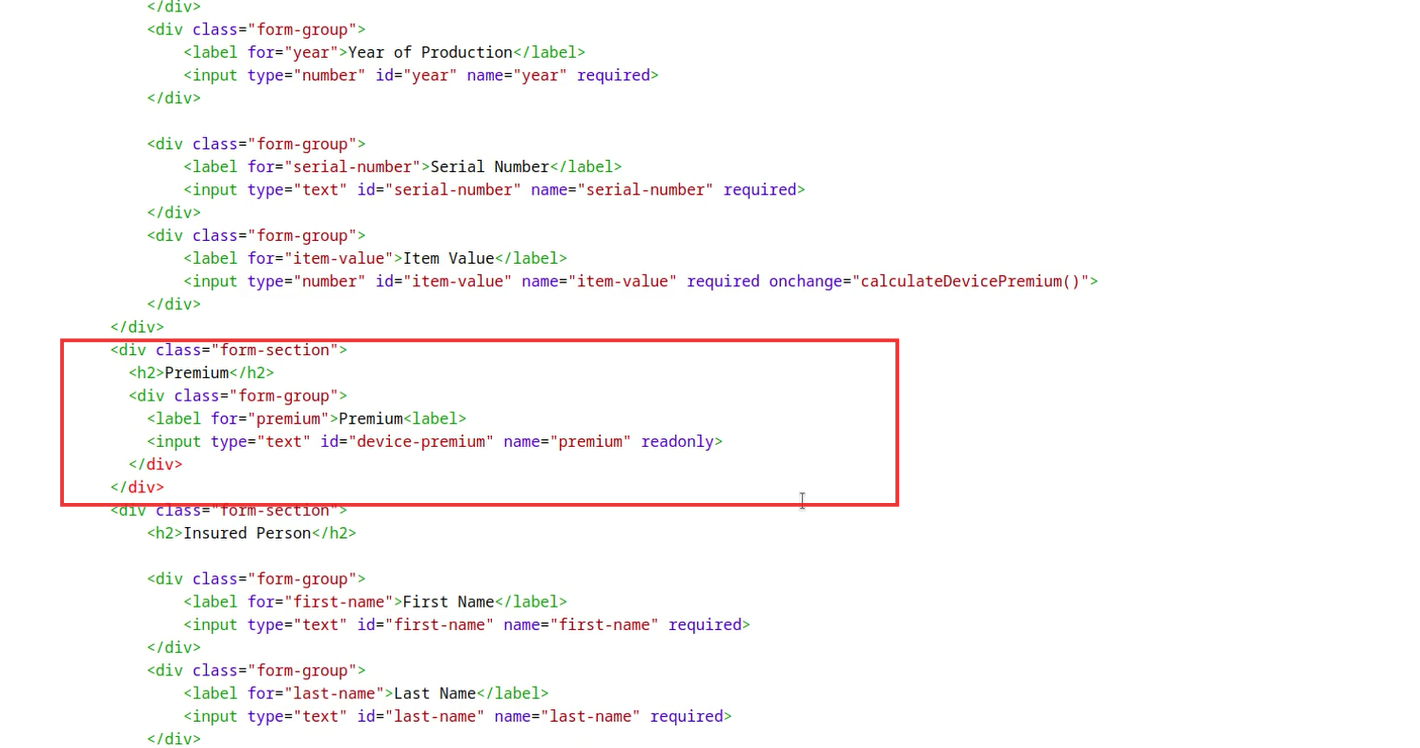

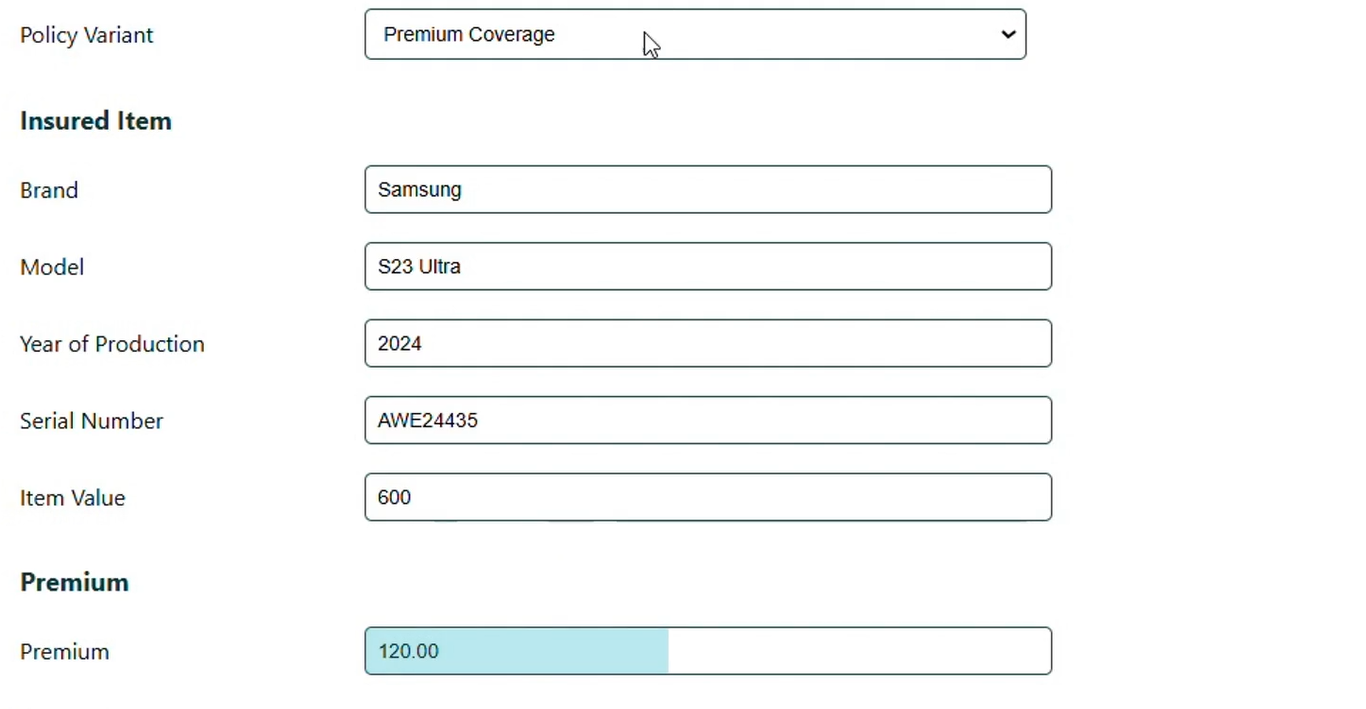

Step 3: Enable Real-Time Premium Calculation

To improve transparency and customer trust, it’s essential to show real-time dynamic premium calculations based on user input.

Use Openkoda’s backend logic to create a dynamic calculation that factors in:

- Device value

- Year of production

- Selected policy variant

As users adjust their inputs, the estimated premium updates automatically, helping them understand how pricing changes and encouraging faster purchasing decisions.

In this example, if you change the policy variant or the policy’s start and end dates, the premium amount will automatically update.

[Watch also: How to Implement Quoting System with Flexible Pricing Calculation Rules]

Step 4: Ensure Accuracy with Built-In Validation

Next, let’s apply validation rules to guarantee clean, complete and error-free data.

For example:

- Confirm valid year of production

- Require all key fields before submission

- Enforce formatting (e.g., numeric-only inputs)

Customers get real-time guidance, while your system receives accurate, ready-to-process data.

Step 5: Automate the Confirmation Email

When a user submits the form, Openkoda automatically triggers a confirmation email. This can include:

- Submitted details

- Custom messaging

- A unique link to complete the purchase

You can easily configure and personalize the email within Openkoda’s CMS. Learn how to automate and personalize emails.

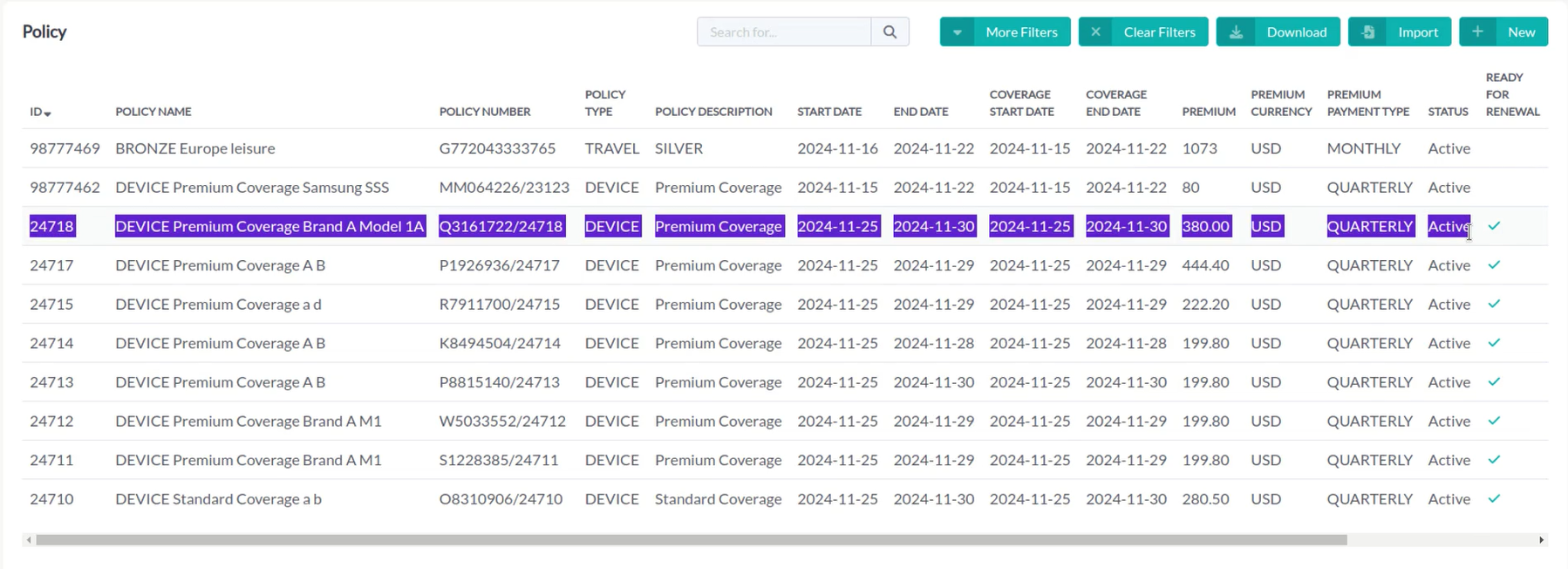

Step 6: Secure Data Storage and Policy Management

All submitted data is securely stored in your policy management application. Your team can:

- Access customer and policy details instantly

- Manage policies (edit, delete, download, import, export)

- Filter and analyze records for reporting or underwriting

- Automate downstream workflows like policy issuance or renewals

This structured storage ensures compliance, operational efficiency, and long-term scalability.

Step 7: Secure Data Storage and Policy Management

Now your interactive, intuitive, and accurate device insurance quote form is ready to integrate into your website.

Your embedded form features:

- Instant premium calculation

- Real-time validation checks

- Automated email confirmations

- Dynamic database integration for updates

This powerful, user-friendly solution dramatically reduces development time and helps insurers quickly adapt to customer demands, ultimately increasing conversions and customer satisfaction.

Build Fast, Customize & Innovate Without Limits.

With the Openkoda Insurtech platform, you can embed your insurance products anywhere – from mobile apps to e-commerce sites – while maintaining control over policy logic and pricing strategies, and adapting instantly to market trends and customer behavior. If you’re exploring ways to launch or expand your embedded device insurance offering, Openkoda is built to help you do it — quickly, securely, and at scale.

Ready to launch embedded insurance tailored to your product ecosystem? Book your personalized demo to see your use case live in action.

Related Posts

- How to Automate Payment Reminders: The Insurer’s Guide

- How to Automate Insurance Policy Renewal Reminders?

- Embedded Car Insurance: How to Build It?

- Step-by-Step Guide to Creating a Custom Insurance Business Dashboard

- How to Implement a Dynamic Pricing & Real-Time Premium Calculation in Insurance Systems