Prebuilt

Fully functional from day one within the Openkoda platform.

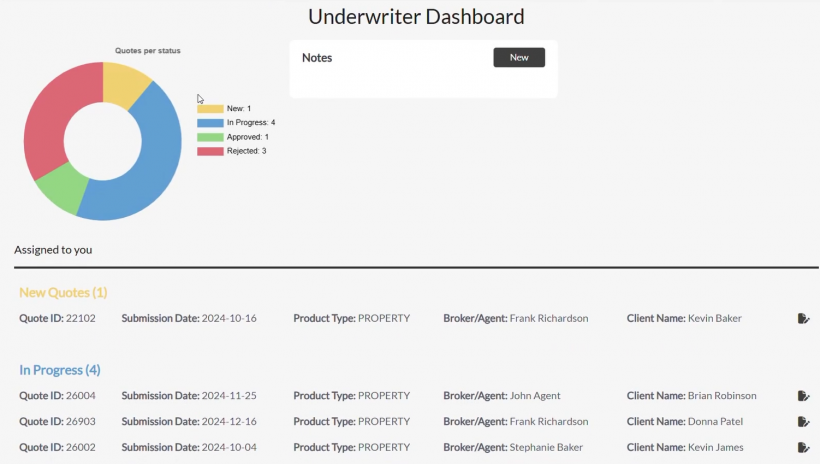

Accelerate underwriting decisions with a customizable dashboard that unifies data, automates workflows, and streamlines every step in one place.

Open-Source Unlimited Users GenAI No Vendor Lock-In

Fully functional from day one within the Openkoda platform.

Every tab, field, rule, and workflow can be modified.

Adaptable to personal, commercial, and specialty lines.

Track quotes through their entire lifecycle with powerful filters and instant access to full details. No more jumping between systems.

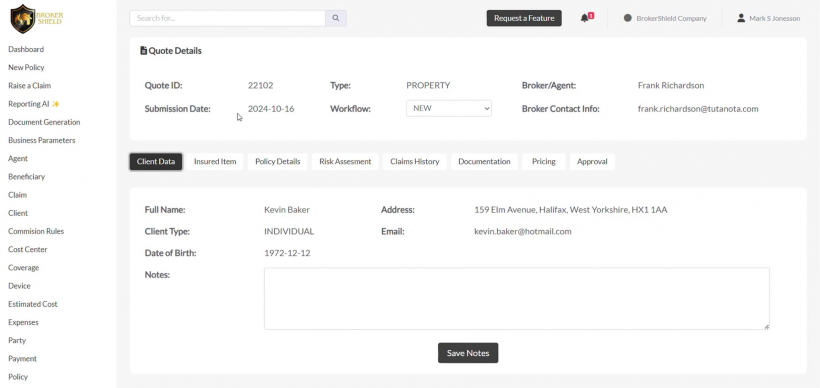

View broker contact info, client data, insured item details, and claims history. Get a complete underwriting view at a glance.

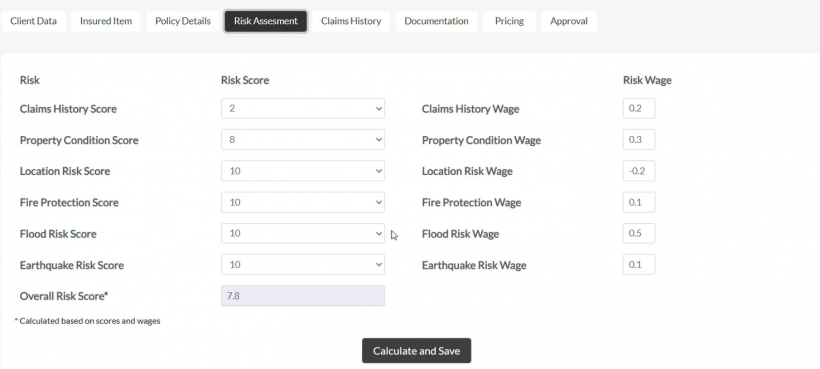

Easily apply and test your own risk scoring models, pricing logic, and calculations directly in the dashboard.

Review uploaded files and trigger document requests directly from the dashboard. Eliminate manual follow-ups and inbox clutter.

Apply discounts, surcharges, and factors. Rules ensure compliance with your underwriting policies.

Approve or reject quotes directly from the dashboard, with audit trails, notes, and optional broker/client notifications.

Openkoda’s underwriting solutions are 100% configurable. Every field, formula and tab is up to you.

Whether you underwrite commercial fleets or specialty lines, you can tailor the dashboard to match your products, team roles, and approval workflows.

The Underwriter Dashboard gives you the power of an automated insurance underwriting system, but with none of the limitations of off-the-shelf tools.

Whether your workflow is simple or complex, Openkoda lets you:

This dashboard is ideal for insurers who want:

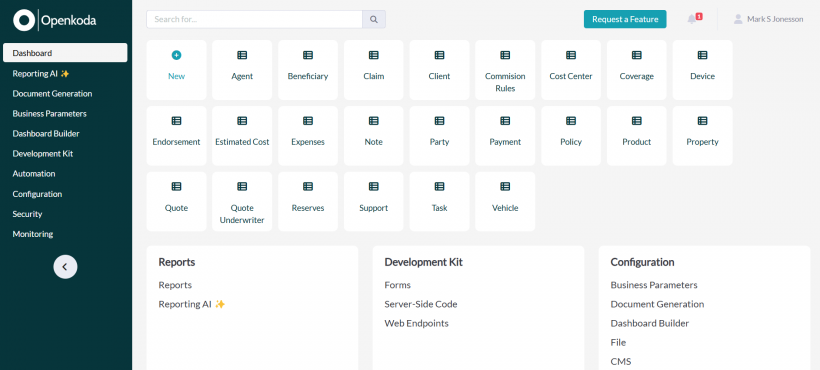

Openkoda is the insurtech platform behind this dashboard that enables you to launch insurance applications faster. It delivers enterprise-grade insurance software templates that come with essential features built-in: from role-based access to reporting and dashboards. You get a powerful foundation for rapid development, full access to the codebase, and the freedom to extend and tailor every part of the solution to meet your business needs.

Need a broker portal? A policy admin tool? Claims intake for specialty lines? You can build all of it faster and control how it evolves.

The Underwriter Dashboard is just one example of what’s possible. It’s live, proven, and ready to use with zero technical blockers to full customization.

Access your personalized underwriter dashboard instantly.

See all incoming quote requests organized by status — stay focused on what needs attention.

Review all details in one place: client info, insured item, policy terms, documents, and more.

Modify coverage limits, apply custom risk logic, and send document requests with one click.

Apply surcharges or discounts, validate pricing rules, and approve or reject the quote directly from the dashboard.

Every update is logged — ensuring full transparency, compliance, and team accountability.

An underwriting system is specialized software designed to streamline and manage the underwriting process by evaluating risk, processing applications, and supporting underwriters with data-driven decisions. These systems are used in industries like insurance, health insurance, and lending, helping companies assess borrowers’ information, enforce internal policies, and ensure compliance while offering consistent and accurate decisions.

Underwriting automation delivers significant cost savings, increases efficiency, and improves customer satisfaction. By replacing manual processes with automated underwriting solutions, companies in the insurance and lending industry can reduce processing time, enhance the accuracy of risk assessments, and leverage advanced analytics and machine learning to make smarter decisions. Automation also allows underwriters to focus on complex cases while an automated system handles high-volume, repetitive tasks — leading to better customer experience and faster delivery of insurance policies.

An automated underwriting system (AUS) is a software platform that evaluates insurance policies and other financial forms using predefined rules, machine learning, and advanced analytics. This automated system quickly processes relevant data, performs credit risk assessments, and determines eligibility based on a complete view of the applicant. AUS tools are widely used by lenders, life insurers, and health insurance providers to accelerate decisions, reduce expenses, and improve accuracy across the underwriting process.

The key difference between manual and automated underwriting lies in speed, scalability, and reliance on technology. Manual underwriting involves human underwriters reviewing applications, assessing risk, and making decisions based on documents and expertise – a time-consuming process prone to inconsistencies. In contrast, automated underwriting uses software to instantly analyze borrower’s information, apply internal policies, and determine outcomes in real time. While manual methods offer nuanced judgment, automated underwriting systems deliver faster processing, greater efficiency, and scalable solutions ideal for the digital age.