Top 10 Insurance Software Development Companies in 2025

As the insurance market evolves, partnering with the right development company to build innovative, tailored solutions has become more critical than ever.

With countless options available, how can you ensure your choice drives success and avoids costly mistakes?

This guide not only showcases the top insurance software development companies but also provides some practical tips to help you choose the ideal partner for your needs.

Contents

- Custom Insurance Software Development: Why Bespoke Approach is Worth it

- Best Insurance Software Development Services Companies

- Openkoda

- Stratoflow

- Guidewire Software

- Applied Systems

- Cognizant

- Itexus

- Duck Creek Technologies

- Sapiens International Corporation

- Vertafore

- Insurity

- How to Choose the Right Insurance Software Development Company for You?

- How to Start?

Custom Insurance Software Development: Why Bespoke Approach is Worth it

In today’s highly competitive insurance industry, the demand for innovative solutions has never been greater—especially as companies race to enhance their operations with AI.

However, innovation alone isn’t enough.

Relying on outdated legacy systems can hinder growth, as these systems often lack the flexibility needed to meet modern market demands.

Fortunately, there’s a solution.

Choosing a custom software solution from an insurance software development company ensures a custom fit for your unique business needs.

Custom insurance software allows businesses to design systems that streamline processes, boost operational efficiency, and deliver an exceptional customer experience—all while future-proofing their technology against rapid industry changes.

The custom approach also offers unparalleled flexibility, allowing insurers to build solutions that perfectly align with their operations.

Unlike off-the-shelf products, custom insurance software is designed to address specific pain points, such as automating claims management or streamlining policy issuance.

But delivering best-in-class insurance software requires working with experienced professionals who understand the intricacies of the industry.

The Value of Choosing the Right Development Partner

Selecting the best insurance software development company is a critical step in ensuring the success of your bespoke project.

The right partner will bring industry-specific expertise, understanding the complexities of insurance processes and the nuances of regulatory compliance. A knowledgeable team can uncover hidden inefficiencies, propose innovative solutions to modern challenges, lower operational costs, and ensure seamless integration with existing systems.

Collaborating with experienced professionals minimizes risks, such as missed deadlines, cost overruns, or poorly implemented features.

If you’re wondering where to find such industry leaders, the following list of top custom insurance software development companies will point you in the right direction.

Best Insurance Software Development Services Companies

We hear you—finding the right partner for your custom insurance software development project is crucial to achieving success.

With so many options available, it’s essential to choose a company with proven expertise in the insurance sector and a track record of delivering innovative, high-quality solutions.

To help you out, here’s a list of the best insurance software development companies that provide top-tier insurance software development services.

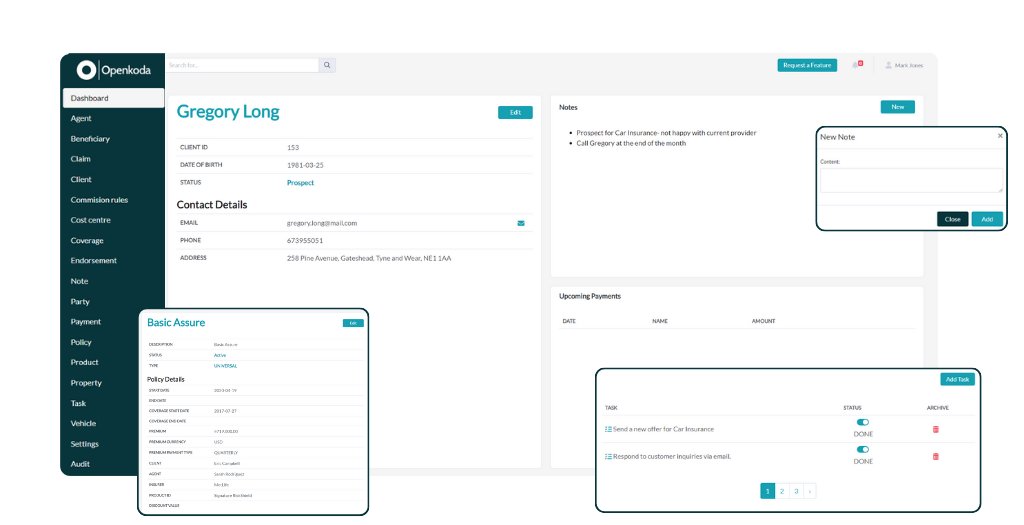

Openkoda

Openkoda is an open source enterprise platform designed to accelerate the development of insurance software solutions.

It offers a suite of pre-built application templates tailored for the insurance industry, including modules for policy management, claims management software, and embedded insurance.

If you want to build, say, document management or customer relationship management software, with Openkoda you don’t have to start from scratch and build the most basic functionality such as role-based user authentication and simple dashboards – these elements are already there.

You can get right to work on the elements that really matter to your business, saving you both time and money.

When you choose our platform, our team of experienced software developers can provide professional insurance software development services to tailor these solutions to your organization’s unique needs.

Our team will work closely with your organization to customize the platform, integrate specific workflows, compliance requirements, and branding elements.

This personalized approach ensures that the software seamlessly aligns with the insurer’s operations and strategic goals.

Our team uses an open source platform that gives insurers full ownership of the code base, eliminating vendor lock-in and providing greater control over their software infrastructure.

In summary, Openkoda’s insurance software development team provides a versatile and robust platform for insurers and insurtechs looking to develop custom software solutions faster and more efficiently than with a traditional approach.

Key Strengths

- Ready-Made Application Templates: Openkoda platform offers pre-built insurance application templates, including policy management, document management software, claims processing, and embedded insurance modules, enabling rapid development deployment.

- Customizability: The system provides professional development services to tailor templates to the unique workflows, compliance requirements, and branding of each insurer.

- Open-Source Platform: Openkoda platform ensures full ownership of the codebase, eliminating vendor lock-in and giving insurers greater control over their software infrastructure.

- Scalability: Designed to handle large volumes of data and support business growth without performance issues.

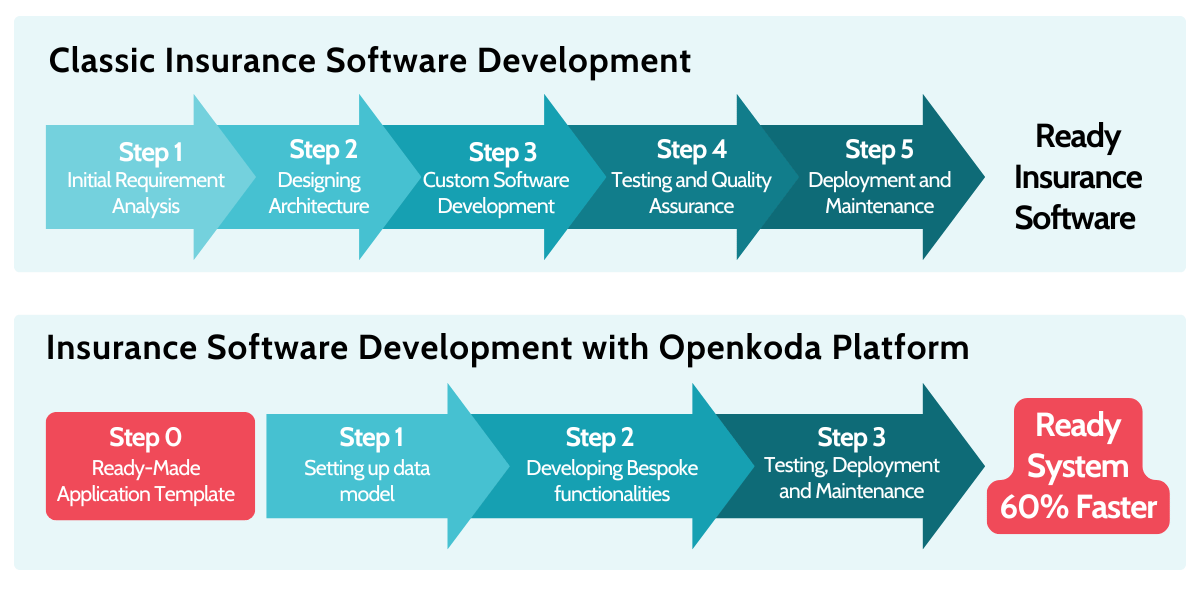

- Rapid Development Cycle: Thanks to prebuilt insurance components, Openkoda development team can deliver ready products up to 60% faster compared to competition, ensuring quick time-to-market for insurance providers.

- Focus on Insurer Needs: Openkoda’s team offers solutions specifically designed for insurance companies, addressing their unique challenges and opportunities.

- Experience in Fintech and Insurance: Openkoda’s developers have over 10 years of experience in working on high-performance systems for insurtech and fintech companies worldwide.

Stratoflow

Stratoflow is one of the top insurance software development companies that specializes in delivering customized insurance software solutions for companies looking to streamline operations and improve customer experience.

Their approach focuses on providing insurance software development services that combine advanced technology with a deep understanding of the insurance industry.

Stratoflow works closely with insurance firms to identify unique challenges and create customized solutions that improve operational efficiency while adapting to the dynamic demands of the market.

The company’s core strength lies in developing high-performance, scalable systems designed to meet the rigorous demands of the insurance industry.

Stratoflow’s solutions are capable of managing complex workflows, processing large data sets and supporting real-time analytics. These capabilities enable insurers to streamline processes, maintain superior performance, and make data-driven decisions.

As Openkoda’s strategic partner, Stratoflow leverages the platform’s powerful capabilities to accelerate the creation of custom insurance software solutions.

Openkoda’s pre-built application templates for policy management, claims processing and embedded insurance applications enable Stratoflow to deliver customized solutions faster and more efficiently than traditional methods.

By combining their powerful engineering expertise with Openkoda’s innovative platform, Stratoflow is setting a new standard in insurance software development services.

Key Strengths

- High-Performance Software: Stratoflow insurance software development company specializes in developing robust and scalable solutions that handle complex workflows, large datasets, and real-time processing efficiently.

- Expertise in Insurance Software Development: Provides tailored insurance software development services, including policy administration, claims management, and customer relationship tools.

- Strategic Partnership with Openkoda:

Leverages Openkoda’s platform to accelerate delivery timelines and ensure rapid deployment of custom insurance software solutions. - Customizable Solutions:

Develops software tailored to the specific needs of insurers, ensuring seamless integration with existing systems and alignment with business objectives.

Guidewire Software

Founded in 2001 and headquartered in San Mateo, California, Guidewire Software, Inc. specializes in providing insurance software solutions to the property and casualty (P&C) insurance industry.

The company’s primary offerings include InsuranceSuite, which includes PolicyCenter, BillingCenter, and ClaimCenter applications.

These tools help insurers efficiently manage policies, billing processes, and claims. Guidewire also offers InsuranceNow, a cloud-based platform that integrates policy, billing, document management systems and claims management capabilities.

In addition, the company provides analytics and artificial intelligence applications to help insurers make better decisions and optimize operations.

Key Strengths

- Comprehensive Product Suite: Guidewire’s InsuranceSuite offers a unified platform that addresses core insurance operations, including policy administration, billing, and claims management.

- Cloud-Based Solutions: With offerings like InsuranceNow, Guidewire provides cloud-based services that enhance scalability and flexibility for insurers.

- Focus on P&C Insurance: The company’s exclusive focus on the P&C insurance sector allows it to tailor its products and services to meet the specific needs of this market.

Applied Systems

Applied Systems is a leading provider of insurance software development services, offering innovative solutions to improve the operations of insurance companies.

The company’s product suite includes agency and broker management systems, such as Applied Epic and Applied TAM, which streamline policy administration, billing and claims processes.

In addition, Applied Systems delivers custom insurance software designed to meet the unique needs of insurance companies, enabling them to improve efficiency and customer service.

Key Strengths

- Comprehensive Product Suite: Applied Systems offers a wide range of solutions, including agency management systems, cloud services, and data analytics tools, addressing various aspects of the insurance business.

- Focus on Insurance Industry: Specializing exclusively in insurance software development services, Applied Systems ensures that their products are designed to meet the specific requirements of the insurance sector.

Cognizant

Cognizant is a global professional services company that provides insurance software solutions to help insurance companies improve their operations and customer experience.

The company’s offerings include digital transformation services, insurance mobile app development, platform modernization and data analytics that enable insurers to streamline processes, improve risk management and customer engagement and adapt to evolving market demands.

Key Strengths

- Comprehensive Services: Offers end-to-end insurance solutions, including digital transformation, platform modernization, and data analytics.

- Industry Expertise: Deep understanding of insurance industry challenges and requirements.

- Global Reach: Serves insurance companies worldwide, providing scalable solutions.

- Innovation Focus: Invests in emerging technologies to deliver advanced insurance software solutions.

- Client-Centric Approach: Tailors solutions to meet specific needs of each insurance company.

Itexus

Itexus is a custom software development company specializing in financial technology (fintech) solutions.

Established in 2013, the company has developed a diverse portfolio of advanced and scalable web and mobile applications for startups, midsize companies, and established enterprises.

Their services include the development of claims management systems, policy administration platforms, underwriting and quoting software, risk management tools, and fraud analysis applications.

By integrating these solutions, Itexus aims to automate manual processes, reduce human errors, and improve overall operational efficiency for insurance companies.

Key Strengths

- Tailored Solutions: Develops custom insurance software to meet specific business requirements.

- Technological Expertise: Utilizes advanced technologies to optimize insurance operations.

- Industry Focus: Specializes in insurance software solutions, ensuring deep industry knowledge.

Duck Creek Technologies

Duck Creek Technologies is a leading provider of insurance software development solutions, offering a comprehensive suite of products designed to streamline the operations of insurance companies.

The company’s offerings include policy administration, billing, claims management, and analytics, all designed to improve efficiency and customer satisfaction.

Duck Creek’s cloud-based platform enables insurers to quickly adapt to market changes and deliver personalized services to policyholders.

Key Strengths

- Comprehensive Suite: Provides integrated solutions covering policy, billing, claims, and analytics.

- Cloud-Based Platform: Offers scalable and flexible cloud solutions for insurance software development.

- Customer-Centric Approach: Focuses on enhancing customer satisfaction through personalized services.

- Rapid Deployment: Enables quick adaptation to market changes with configurable software.

- Global Reach: Serves a diverse range of insurance companies worldwide.

Sapiens International Corporation

Sapiens International Corporation is a global provider of insurance software solutions, offering a comprehensive suite of products designed to improve the operations of insurance companies.

Its offerings include policy administration, billing, customer relationship management, claims management software and analytics.

Sapiens’ cloud-based platform enables insurers to quickly adapt to market changes and deliver personalized services to policyholders.

Key Strengths

- Comprehensive Product Suite: Sapiens offers a wide range of solutions, including policy administration, billing, claims management, and analytics, addressing various aspects of the insurance business.

- Cloud-Based Solutions: Their cloud services provide insurance companies with scalable and secure platforms, enabling remote access and reducing the need for on-premises infrastructure.

- Commitment to Innovation: The company invests in research and development to continuously enhance their offerings, integrating advanced technologies to keep pace with the evolving needs of the insurance industry.

Vertafore

Vertafore is a leading provider of insurance software solutions, serving carriers, agencies, managing general agents (MGAs), and independent agents. Their offerings are designed to streamline operations, enhance efficiency, and foster stronger relationships within the insurance distribution channel.

For MGAs, Vertafore offers specialized management systems tailored to complex underwriting, diverse lines of business, and unique distribution models.

A key component of Vertafore’s strategy is their open architecture, which facilitates seamless integration with third-party applications through Application Programming Interfaces (APIs).

Key Strengths

- Tailored Solutions: Provides software customized to your specific business requirements.

- Workflow Automation: Automates routine tasks, freeing up your team to focus on strategic initiatives.

- Data-Driven Insights: Offers analytics tools to help you make informed decisions.

- Scalable Platforms: Solutions grow with your business, ensuring long-term value.

- Industry Expertise: Deep understanding of insurance industry challenges and requirements.

Insurity

Insurity is a prominent provider of cloud-based software solutions tailored for the property and casualty (P&C) insurance industry.

Their offerings are designed to enhance operational efficiency, accelerate product deployment, and support data-driven decision-making for insurers, managing general agents (MGAs), and brokers.

A cornerstone of Insurity’s portfolio is the Insurity Platform, an end-to-end system encompassing policy administration, billing, claims management, and analytics.

This cloud-native platform is highly configurable, enabling organizations to swiftly adapt to market changes and introduce new products in as little as 30 days.

Key Strengths

- Comprehensive Suite: Offers integrated solutions covering policy, billing, claims, and analytics.

- Cloud-Based Platform: Provides scalable and secure cloud solutions for insurance software development.

- Customization: Tailors software to meet the specific needs of each insurance company.

[Read also:AI-Driven Insurance Analytics: Faster, Better, Smarter]

How to Choose the Right Insurance Software Development Company for You?

The insurance software development market is diverse, offering a wide range of companies with varying levels of expertise and specialization.

With so many options, it’s crucial to identify a partner that understands your unique needs and can deliver tailored solutions that drive innovation and growth.

Platforms like Clutch are a great starting point when searching for the right partner. Clutch provides verified client reviews, detailed case studies, and performance ratings that help you compare insurance software development companies.

Key Factors to Look for in a Development Partner

- Industry Expertise: Experience in handling insurance-specific challenges like compliance and claims processing.

- Technical Skills: Proficiency in modern technologies like AI, IoT, and blockchain.

- Proven Track Record: A portfolio of successful projects in the insurance domain.

- Customization: Ability to deliver tailored solutions that fit your unique needs.

- Communication: Regular updates, clear roadmaps, and transparency in all aspects.

- Post-Development Support: Reliable maintenance and updates after deployment.

Selecting the wrong development company can lead to significant challenges, including misaligned solutions that fail to meet your goals, integration issues with existing systems, or products that quickly become obsolete.

With tens or even hundred of thousands of dollars in development budgets failed projects of

That’s why thorough research is so incredibly important.

The right insurance software development company will combine technical expertise with a deep understanding of the industry.

[Read also: Data-Driven Insurance: Opportunities and Common Issues]

How to Start?

If you have chosen your ideal custom insurance software development company, start your collaboration by establishing a clear understanding of your business needs and goals.

Begin by identifying the challenges you aim to address, such as modernizing legacy insurance systems, automating insurance processes, improving customer experiences or just staying up to date with latest insurance industry trends.

Create a list of essential features and functionalities to effectively communicate your vision to potential partners.

Providing relevant documents, workflows, and pain points early in the process will enable the development team to design tailored solutions.

Finally, set clear expectations and milestones for the project, including a detailed scope of work and timeline.

A transparent agreement on deliverables and ongoing communication will lay the groundwork for a successful partnership.

If you’re ready to explore how Openkoda can help you build custom insurance software, get in touch with us today!

Let’s schedule a personalized demo to showcase our capabilities and discuss how we can address your unique needs with innovative, tailored solutions.

Related Posts

- Custom Insurance Software Development: Streamlining Processes for Faster Deployment

- Data-Driven Insurance: Opportunities and Common Issues

- AI-Driven Insurance Analytics: Faster, Better, Smarter

- 5 Key Insurance Industry Trends for 2025

- Digital Transformation in Insurance Industry: Key Strategies & Trends